Energy Calendar for Oil and Gas Traders This Week

The energy sector contributed to ~6.6% of the S&P 500 (SPY) (SPX-INDEX) on April 7, 2017. Crude oil and natural gas are major parts of the energy sector.

Nov. 20 2020, Updated 2:20 p.m. ET

Important events on the energy calendar

The energy sector contributed to ~6.6% of the S&P 500 (SPY) (SPX-INDEX) on April 7, 2017. Crude oil and natural gas are major parts of the energy sector. Oil and gas producers’ earnings such as ConocoPhillips (COP), Warren Resources (WRES), SM Energy (SM), and QEP Resources (QEP) depend on crude oil (XLE) (DIG) (SCO) and natural gas (UNG) (BOIL) (FCG) prices. For the latest updates on crude oil prices, read Part 1 and Part 4 of this series.

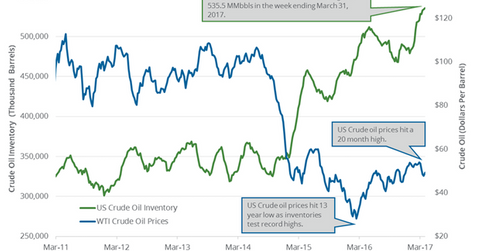

Crude oil and natural gas prices are driven by catalysts such as inventories and supply and demand data. Let’s take a look at some important events for the energy sector this week.

Tuesday, April 11:

- The API (American Petroleum Institute) will release its crude oil inventory.

Wednesday, April 12:

- The EIA (U.S. Energy Information Administration) will release its Weekly Petroleum Status report—read US Crude Oil Inventories Hit a New Record for more information on the latest report. For more on the crude oil market’s outlook in 2017, read What Can Investors Expect in the Crude Oil Market in 2017? and Decoding the World Oil Supply and Demand Gap in 2017.

- The EIA will release its This Week in Petroleum report.

Thursday, April 13:

- The EIA will release its Weekly Natural Gas Storage report—read US Natural Gas Inventories: Bullish or Bearish for Prices? for information on the latest report. Read What Can Investors Expect from the Natural Gas Market in 2017? for more on the natural gas market’s outlook in 2017.

- The EIA will provide its weekly natural gas update.

- Baker Hughes will release the US crude oil rig count.

- Baker Hughes will release the US natural gas rig count.

In the next part, we’ll take a look at the crude oil market’s highs and lows in the last 15 months.