Warren Resources Inc

Latest Warren Resources Inc News and Updates

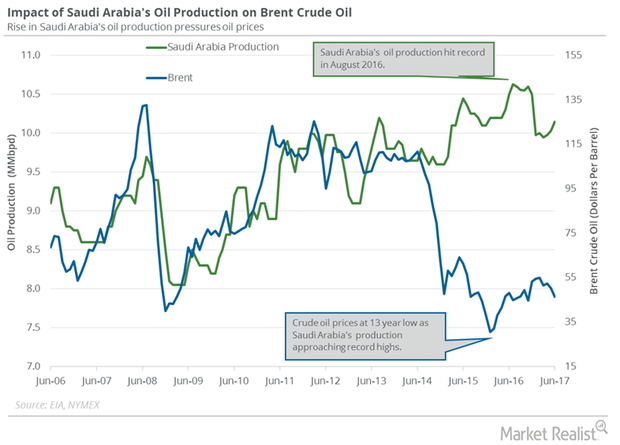

Will Saudi Arabia’s Crude Oil Export Plans Rescue Oil Prices?

Saudi Arabia is the largest crude oil producer and exporter among the OPEC (Organization of the Petroleum Exporting Countries) member countries.

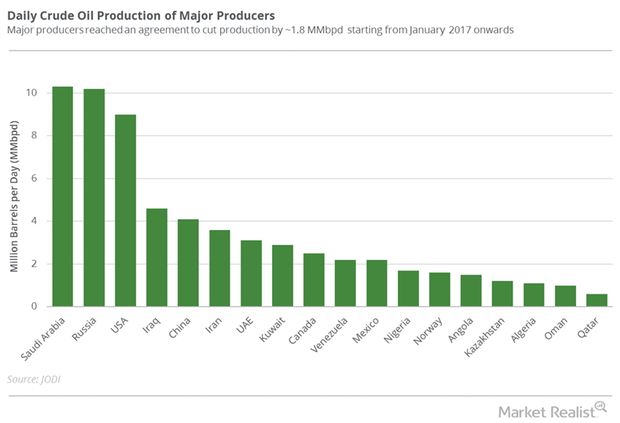

Will OPEC and Russia Announce Deeper Production Cuts?

The OPEC and non-OPEC monitoring committee meeting will be held on July 24, 2017, in Russia. The meeting will discuss production cut deal compliance.

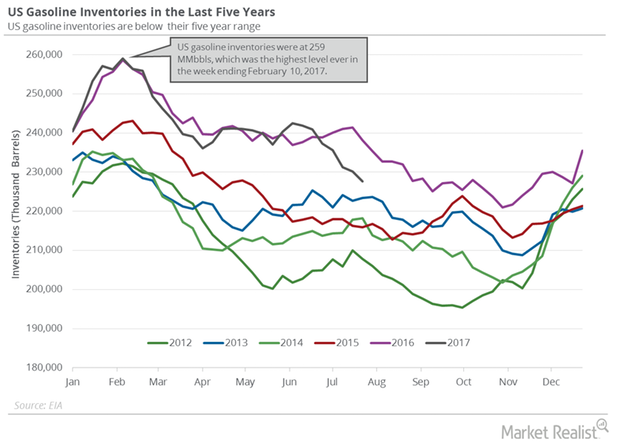

US Gasoline Inventories Limit the Upside for Crude Oil Futures

US gasoline inventories rose by 3.4 MMbbls to 231.1 MMbbls on July 28–August 4, 2017. Inventories rose for the third time in the last ten weeks.

Analyzing US Crude Oil and Gasoline Inventories

The API estimates that US gasoline inventories rose by 1.5 MMbbls (million barrels) on July 28–August 4, 2017.

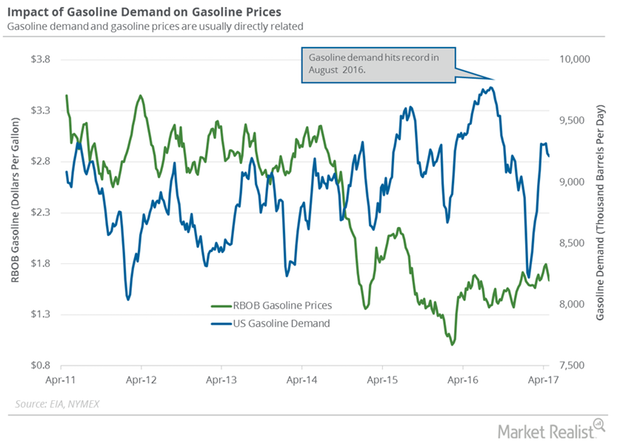

Is US Gasoline Demand Turning Bearish?

The EIA estimated that four-week average US gasoline demand fell by 22,000 bpd (barrels per day) to 9,215,000 bpd on April 21–28, 2017.

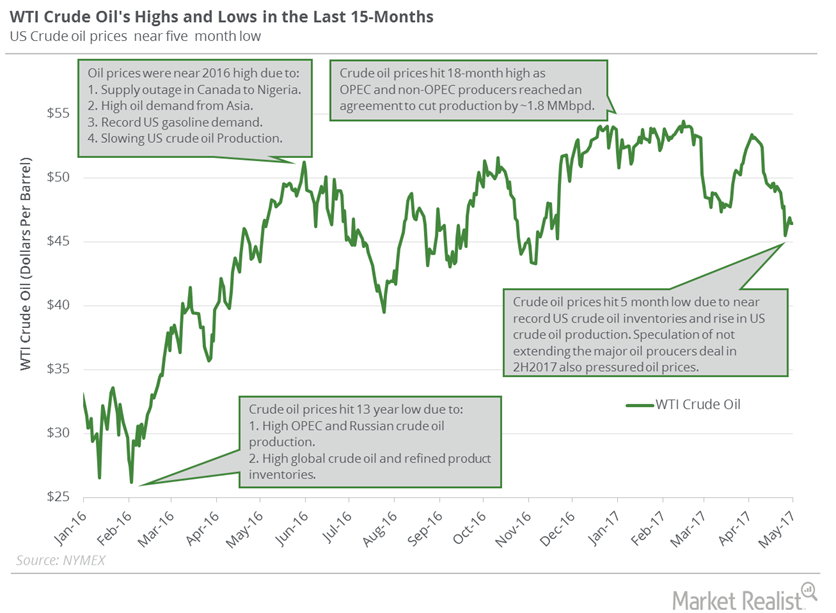

Could Crude Oil Prices Hit Lows from 2016?

WTI (West Texas Intermediate) crude oil (FXN) (SCO) (FENY) futures contracts for June delivery are near a five-month low as of May 9, 2017.