QEP Resources Inc

Latest QEP Resources Inc News and Updates

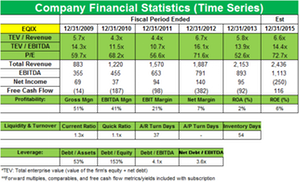

JANA sells stake in Equinix

JANA Partners sold a significant stake in Equinix (EQIX) during the fourth quarter. The position accounted for 3.38% of the fund’s third-quarter portfolio.

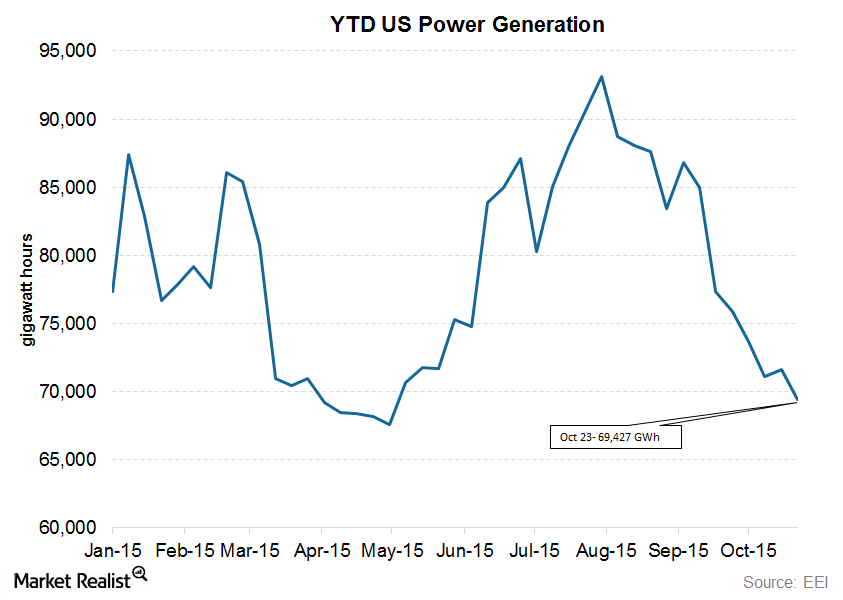

US Power Generation Down Again: An Analysis of Trends

An increase in US power generation numbers is expected for the week ended October 30, 2015.

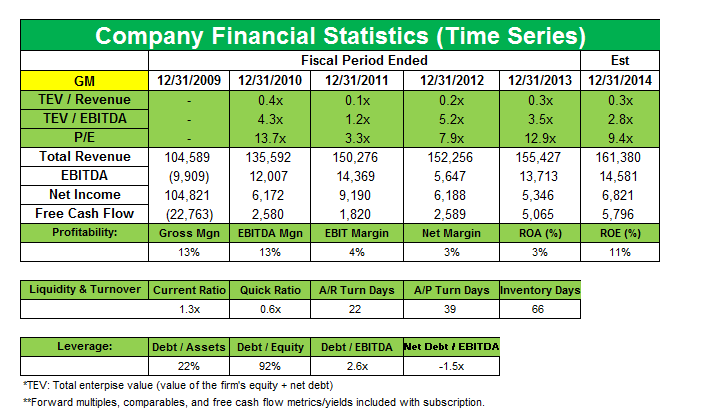

Why did JANA Partners boost its position in General Motors?

JANA Partners enhanced its position in from 0.17% to 4.23% last quarter General Motors.

Energy Calendar for Oil and Gas Traders: May 1–5

The energy sector contributed to ~6.3% of the S&P 500 (SPY) (SPX-INDEX) on April 28, 2017. Oil and gas are major parts of the energy sector.

Hedge Funds’ Net Long Positions in US Crude Oil Rose Again

Hedge funds increased their net bullish positions in US crude oil futures and options rose by 36,834 contracts to 215,488 contracts on July 11–18, 2017.

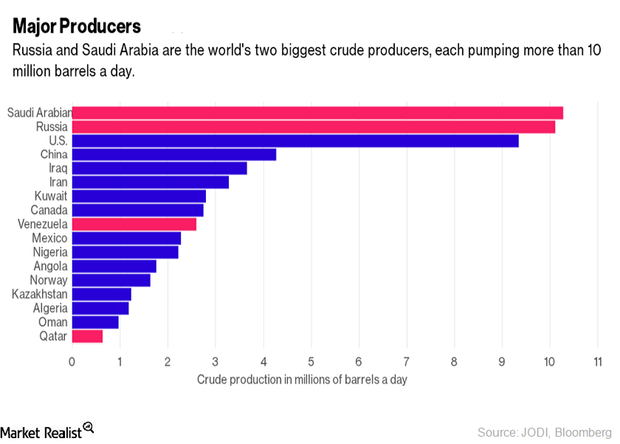

Decoding the Major Oil Producers’ Meeting in Algeria

OPEC producers’ meeting was held from September 26–28, 2016. Crude oil prices rose 12% in August 2016 due to speculation about the meeting’s outcome.

Hedge Funds’ Net Long Positions in US Natural Gas

Hedge funds decreased their net bullish positions in US natural gas futures and options 1.9% to 186,799 on June 12–19.

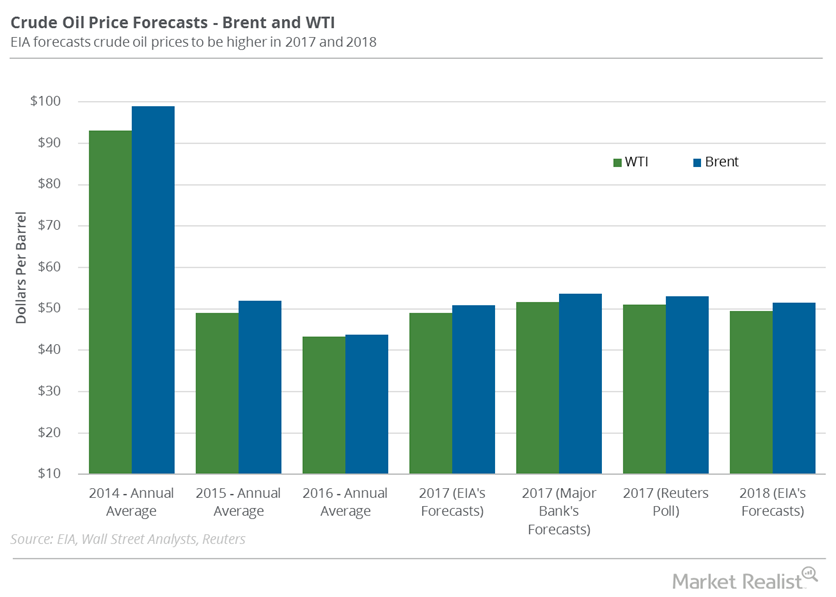

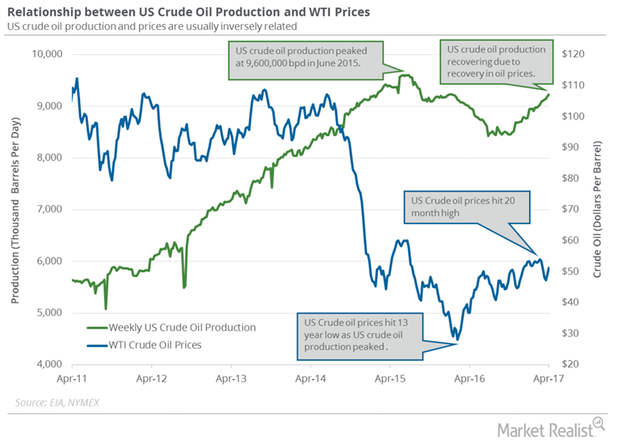

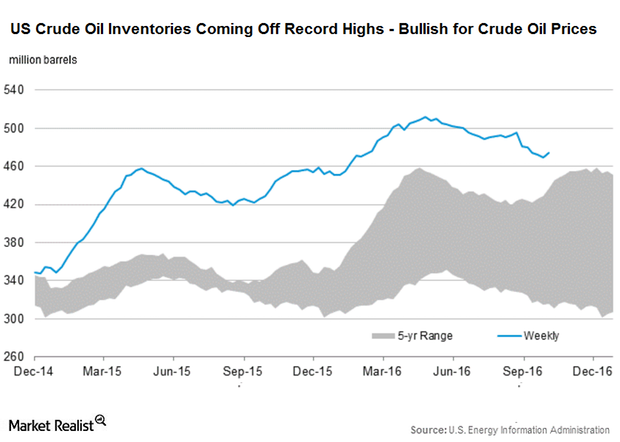

EIA Raises Estimates for US Crude Oil Production in 2018

The EIA (U.S. Energy Information Administration) reported that US crude oil production rose by 36,000 bpd (barrels per day) to 9,235,000 bpd between March 31 and April 7, 2017.

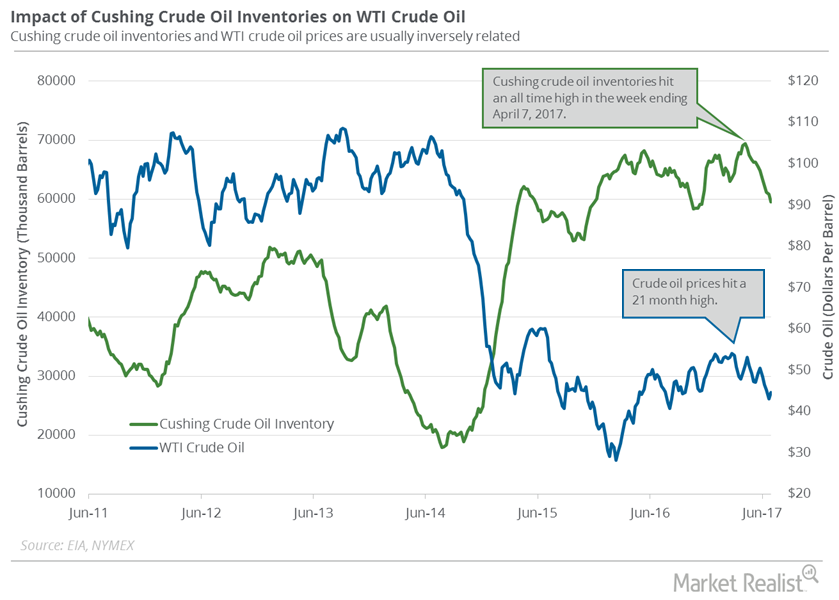

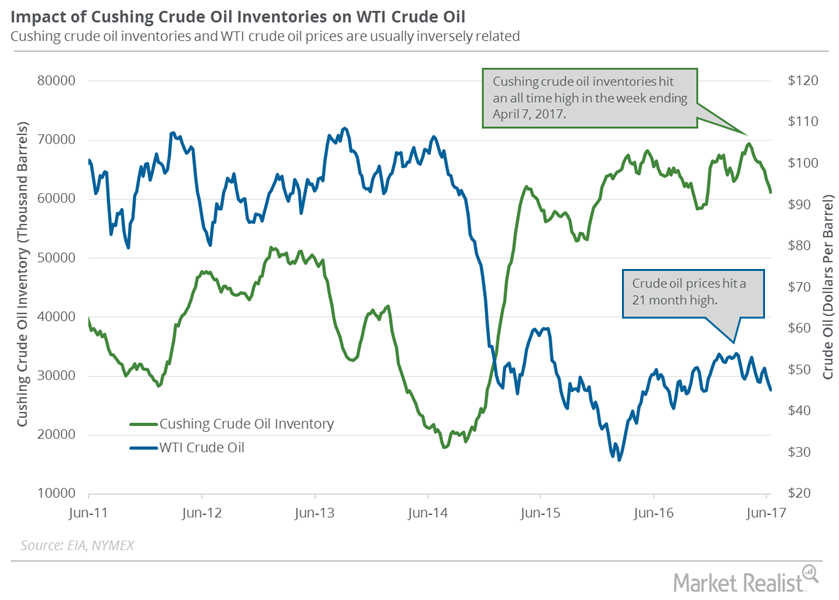

Cushing Inventories: Lowest Level since November 2016

Cushing inventories could have fallen on June 30–July 7, 2017. Crude oil inventories at Cushing have fallen for the seventh straight week.

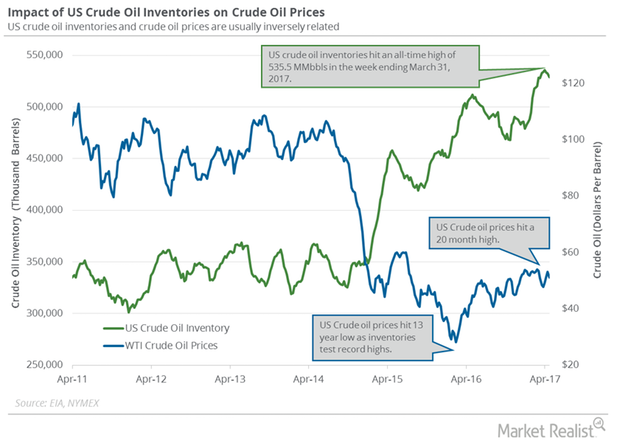

US Crude Oil Prices Are Trading Near a 2016 High!

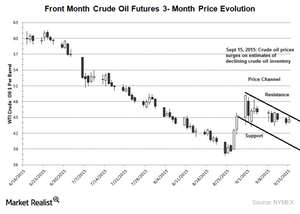

November WTI (West Texas Intermediate) crude oil futures contracts rose 0.5% and settled at $50.44 per barrel on October 13.

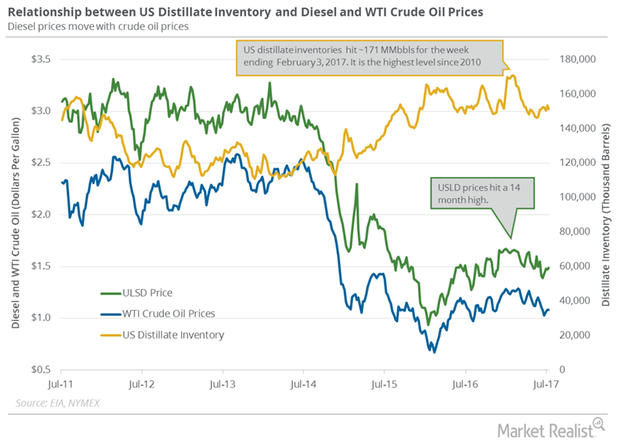

US Distillate Inventories Fell for the Fourth Time in 5 Weeks

The EIA reported that US distillate inventories fell by 1.9 MMbbls (million barrels) to 149.5 MMbbls on July 14–21, 2017.

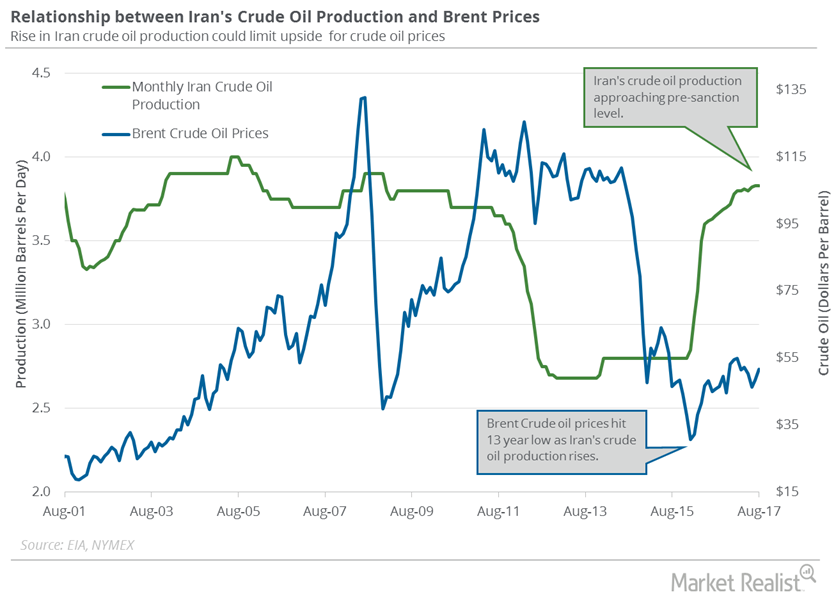

Iran’s Crude Oil Production Was Flat in August 2017

The EIA estimates that Iran’s crude oil production was flat at 3.8 MMbpd (million barrels per day) in August 2017—compared to July 2017.

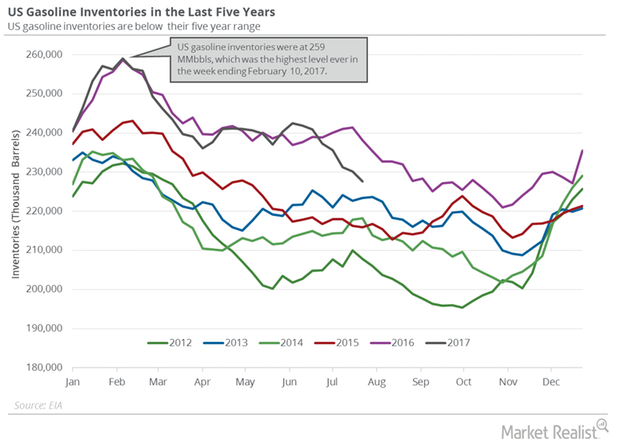

Analyzing US Crude Oil and Gasoline Inventories

The API estimates that US gasoline inventories rose by 1.5 MMbbls (million barrels) on July 28–August 4, 2017.

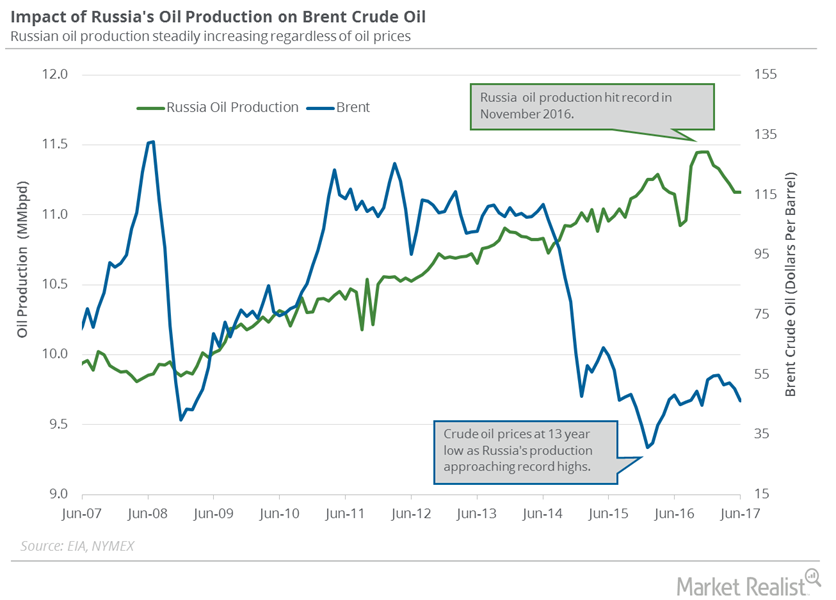

Russia’s Crude Oil Production Was Flat Again

The Russian Energy Ministry estimates that Russia’s crude oil production was flat at 10.95 MMbpd in July 2017—compared to the previous month.

Cushing Inventories Fell for the Ninth Time in 10 Weeks

The EIA (U.S. Energy Information Administration) will release weekly data on crude oil and gasoline inventories on June 28, 2017.

Why Did Oil Prices Rise This Morning?

Oil prices rose early today because of the oil workers’ strike in Kuwait. Here’s what you need to know.

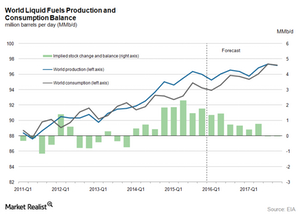

Crude Oil Supply and Demand Gap: Will It Narrow or Widen?

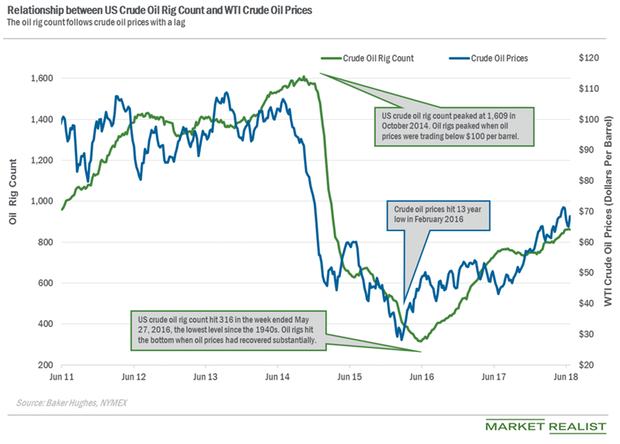

The consensus of slowing US crude oil production will continue to narrow the supply and demand gap as long as demand stays steady.

Crude Oil Prices Are Trading in a Downward Trending Range

October WTI crude oil futures rose for the first time after falling for two consecutive days. Slowing US crude oil production is driving crude oil prices.

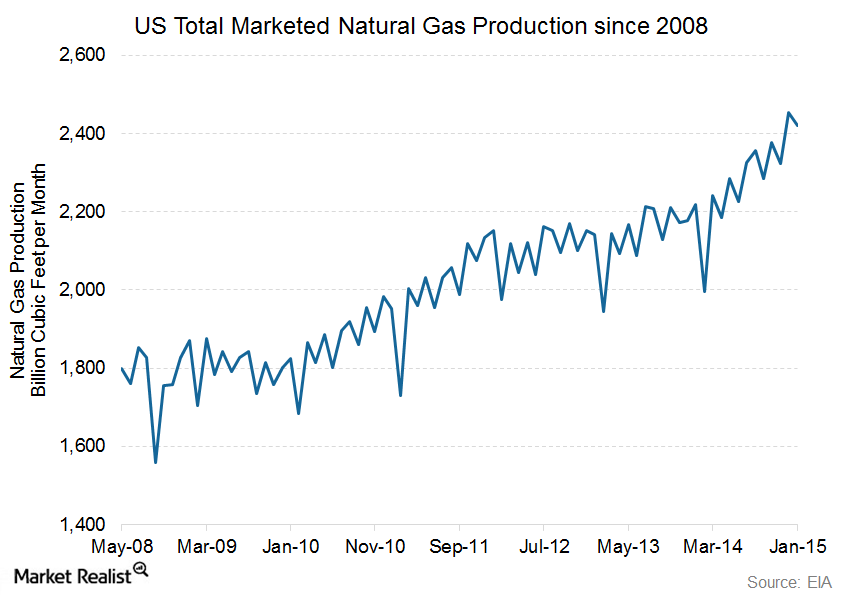

EIA Reports a Slight Decline in Natural Gas Production

Continued production growth set a grim scenario for natural gas prices. High production levels are bearish for natural gas prices.