Hedge Funds’ Net Long Bullish Positions Hit a 10-Month Low

The Commodity Futures Trading Commission reported that hedge funds decreased their net long positions in US crude oil futures and options on June 13–20.

Nov. 20 2020, Updated 1:42 p.m. ET

Hedge funds

On June 23, 2017, the US Commodity Futures Trading Commission released its weekly “Commitments of Traders” report. It reported that hedge funds decreased their net long positions in US crude oil futures and options by 60,556 contracts or 31% to 134,742 contracts on June 13–20, 2017. It’s the lowest level since August 2016.

It suggests that hedge funds are bearish on crude oil (IXC) (ERY) (ERX) prices even after OPEC’s successful meeting. Moves in crude oil prices impact oil and gas producers’ earnings like Hess (HES), Warren Resources (WRES), and QEP Resources (QEP).

Crude oil price forecasts

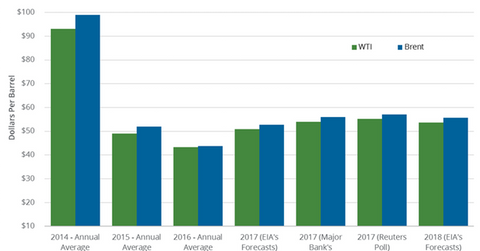

A market survey from 31 banks suggests that WTI crude oil prices will average $53 per barrel and $58 per barrel in 2017 and 2018, respectively.

A market survey from 33 banks suggests that Brent crude oil prices will average $55 per barrel and $60 per barrel in 2017 and 2018, respectively. BNP Paribas and DNB Markets predict that Brent crude oil prices will hit $60 per barrel in 2017 despite oversupply concerns. WTI and Brent crude oil prices averaged $43.3 per barrel and $43.7 per barrel in 2016, respectively.

On June 26, 2017, Pioneer Natural Resources (PXD) stated that US crude oil prices could trade below $60 per barrel until 2021 due to high global crude oil inventories. Higher crude oil production from the US, Libya, and Nigeria could also pressure crude oil prices in 2017 and 2018.

Read Dennis Gartman: Is the Pain Done for Crude Oil Futures? and Crude Oil Prices Could Collapse despite OPEC’s Production Cut for more on crude oil prices.

Read Will US Natural Gas and Crude Oil Follow the Same Trend? for more on natural gas prices.