Analyzing Libya and Nigeria’s Crude Oil Production

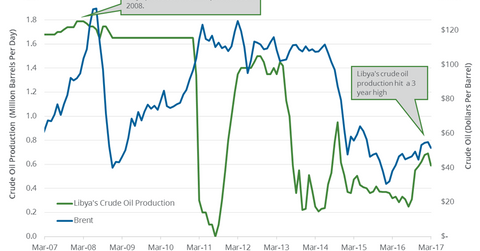

Libya’s crude oil production hit ~814,000 bpd in early May 2017. Bloomberg estimates that production is at the highest level since October 2014.

May 23 2017, Updated 10:38 a.m. ET

Libya’s crude oil production

Libya’s crude oil production hit ~814,000 bpd (barrels per day) in early May 2017, according to National Oil Corporation. Bloomberg estimates that production is at the highest level since October 2014. The restart of production at the Sharara and El Feel fields led to the rise in Libya’s crude oil production. The rise in Libya’s crude oil production could pressure crude oil (IXC) (IEZ) (SCO) prices. Lower crude oil prices have a negative impact on oil producer’s earnings such as Marathon Oil (MRO), Swift Energy (SFY), Warren Resources (WRES), and Continental Resources (CLR).

Nigeria’s crude oil production

The EIA (U.S. Energy Information Administration) estimates that Nigeria’s crude oil production rose by 80,000 bpd to 1.38 MMbpd (million barrels per day) in April 2017—compared to the previous month. Production rose 6.5% month-over-month, but fell 12.1% year-over-year. Nigeria’s crude oil production is expected to average 2.2 MMbpd in 2017, according to market surveys.

Libya, Nigeria, and OPEC’s meeting

Libya and Nigeria were exempt from the production cut deal on November 30, 2016. If they were exempt from the production cut on May 25, 2017, the countries would ramp up production in 2017. It would have a negative impact on oil (XLE) (XOP) (UCO) prices. The rise in production from the US, Brazil, Libya, and Nigeria could delay re-balancing in the oil market.

Goldman Sachs thinks that any rise in Libyan and Nigerian production could cap oil prices in 2017. Read Are Hedge Funds Turning Bearish on Crude Oil? for more on crude oil price forecasts.

In the next part, we’ll discuss Iran and Iraq’s plan in OPEC’s meeting.