Gordon Kristopher

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Gordon Kristopher

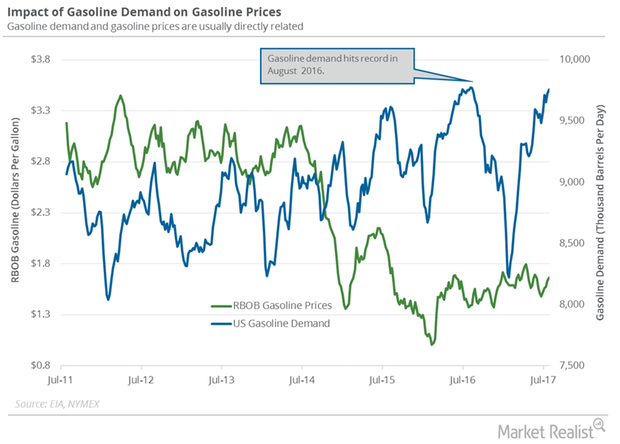

US Gasoline Demand Could Fall in 2018

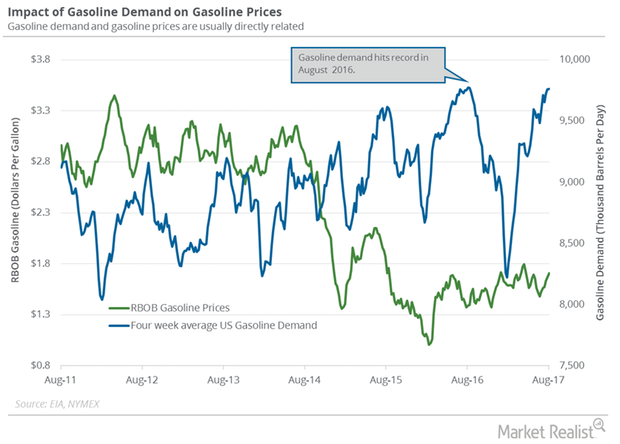

The EIA estimates that weekly US gasoline demand rose by 456,000 bpd (barrels per day) to 9.6 MMbpd (million barrels per day) on September 1–8, 2017.

Hedge Funds Are Turning Bearish on US Crude Oil

Hedge funds reduced their net long positions in US crude oil futures and options by 12,094 contracts to 157,891 contracts on September 5–12, 2017.

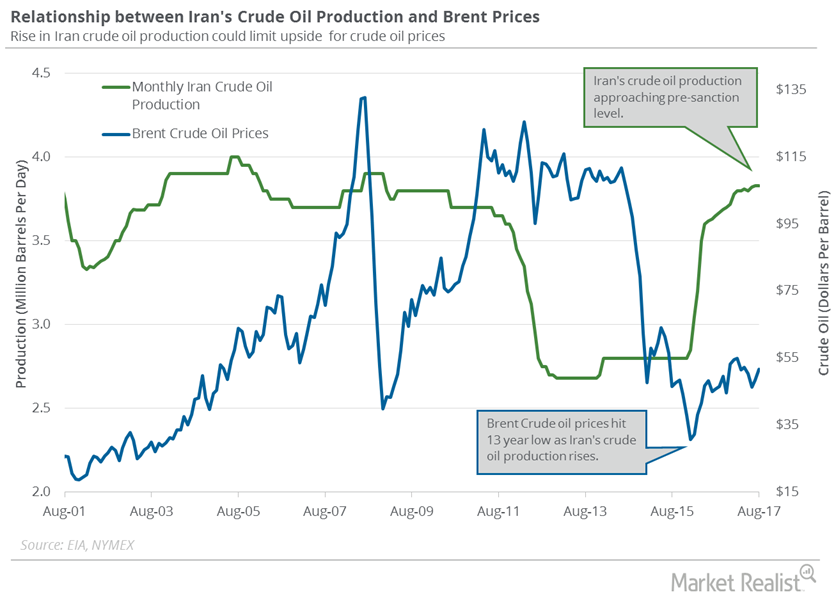

Iran’s Crude Oil Production Was Flat in August 2017

The EIA estimates that Iran’s crude oil production was flat at 3.8 MMbpd (million barrels per day) in August 2017—compared to July 2017.

OPEC’s Crude Oil Production and Exports Impact Crude Oil Prices

The EIA estimates that OPEC’s crude oil production fell by 150,000 bpd to 32.77 MMbpd (million barrels per day) in August 2017—compared to July 2017.

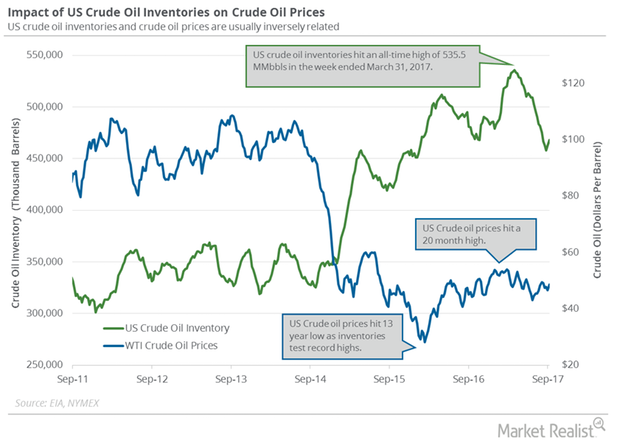

Will the API’s Crude Oil Inventories Pressure Crude Oil Prices?

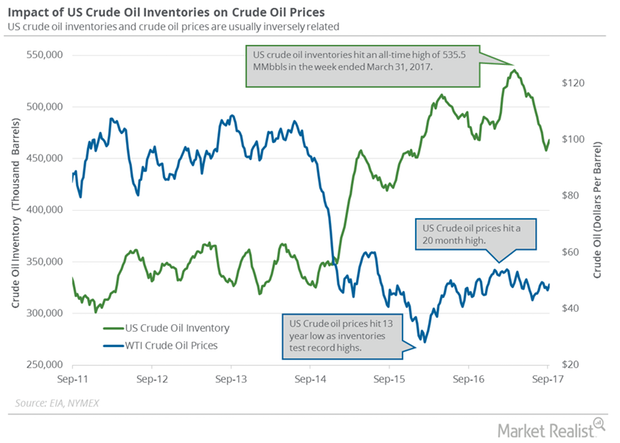

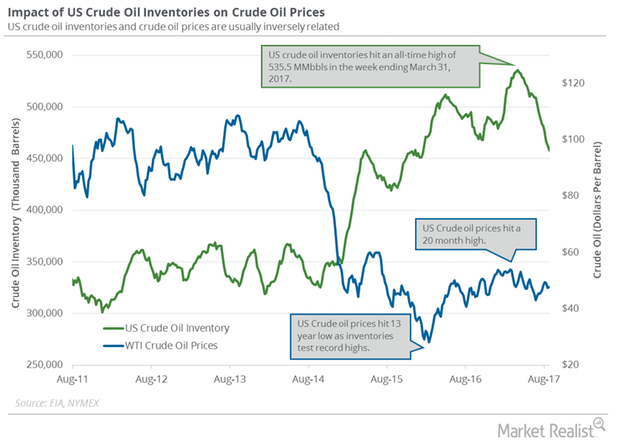

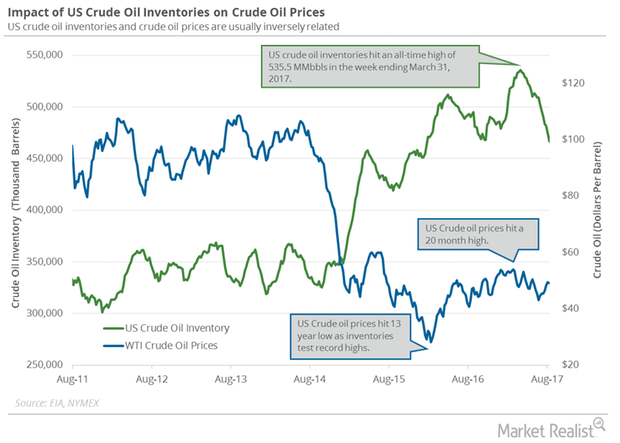

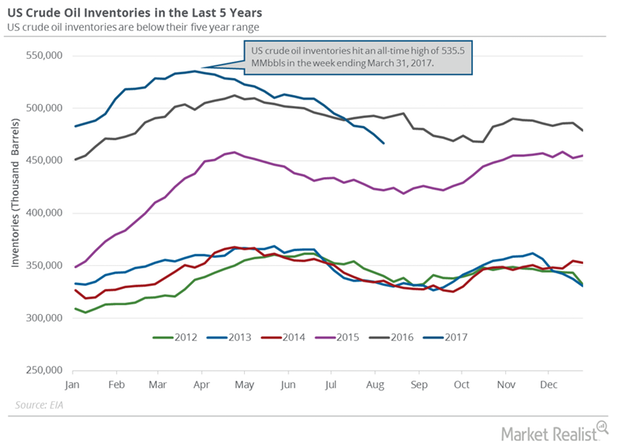

A market survey estimates that US crude oil inventories would have risen by 2.9 MMbbls (million barrels) on September 8–15, 2017.

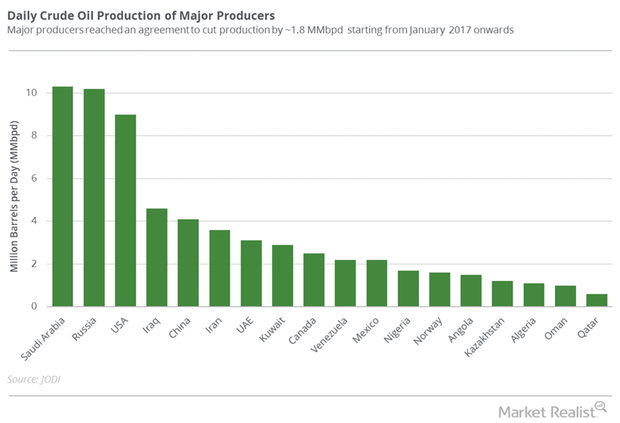

Will Major Oil Producers Extend the Output Cut Deal past March?

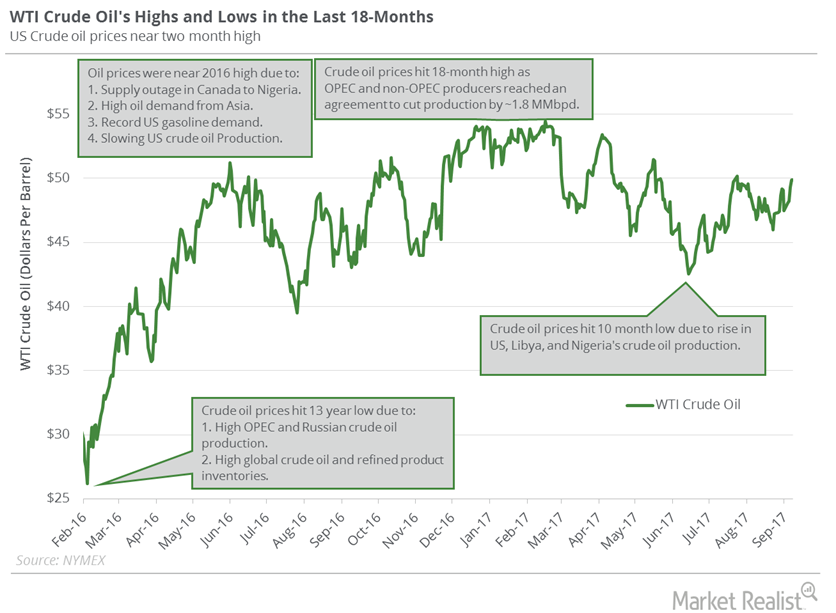

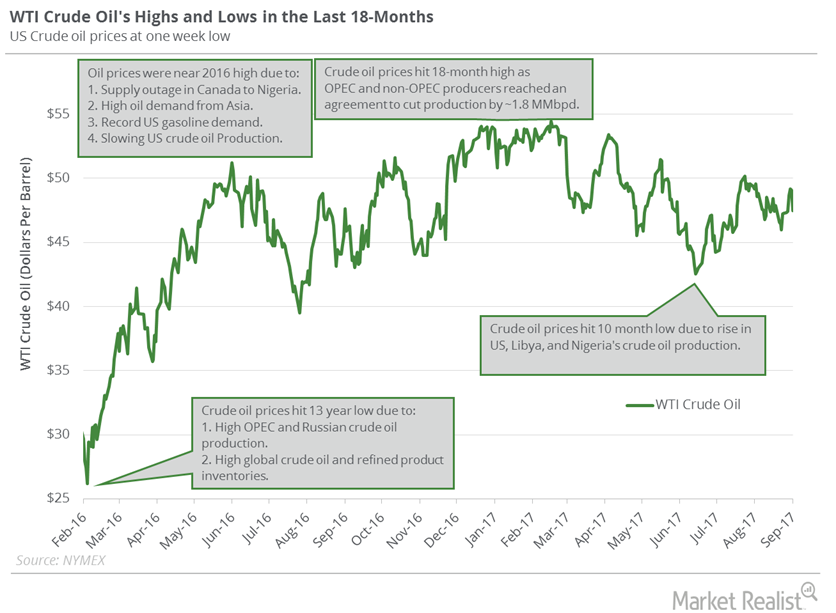

October WTI (West Texas Intermediate) crude oil (USO)(UCO)(DIG) futures contracts rose 0.16% and were trading at $49.98 per barrel in electronic trading at 2:10 AM EST on September 18.

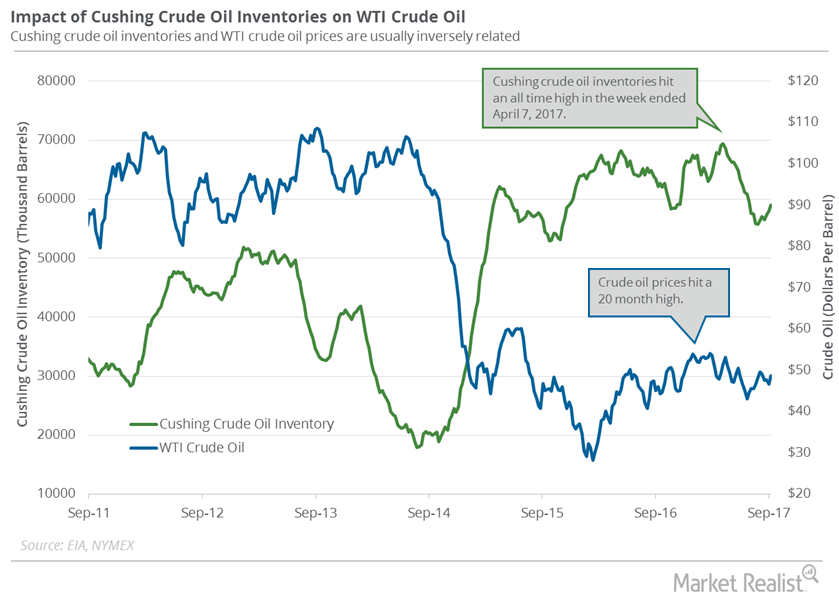

Cushing Inventories: Bullish or Bearish for Crude Oil Prices?

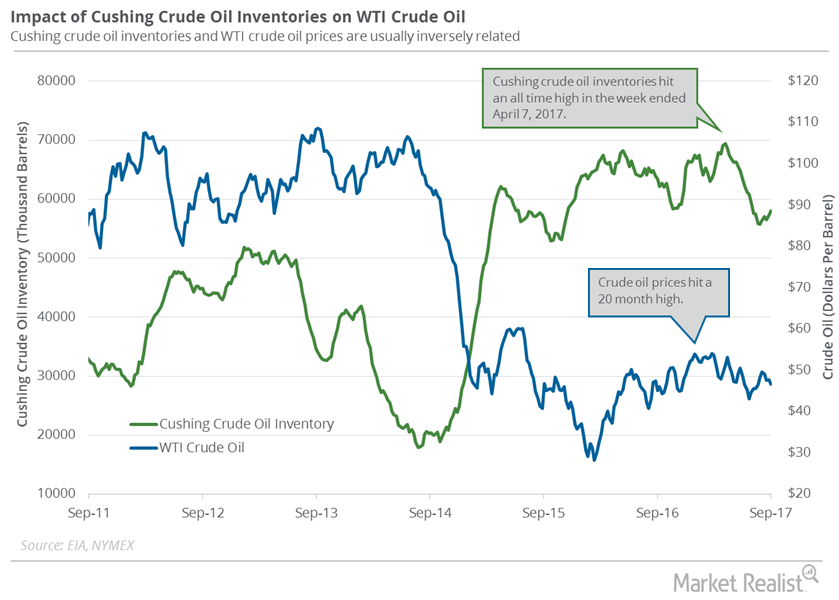

A market survey estimates that Cushing crude oil inventories has risen between September 8 and September 15.

Will US Crude Oil Futures Break $50 per Barrel?

Let’s track some important events for crude oil and natural gas traders between September 18 and September 22.

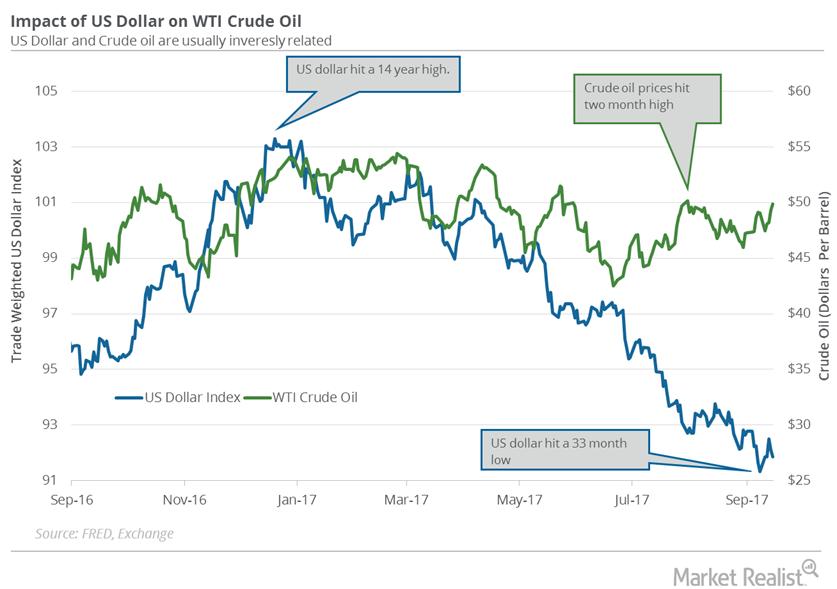

Will the FOMC Meeting Drive the US Dollar and Crude Oil Futures?

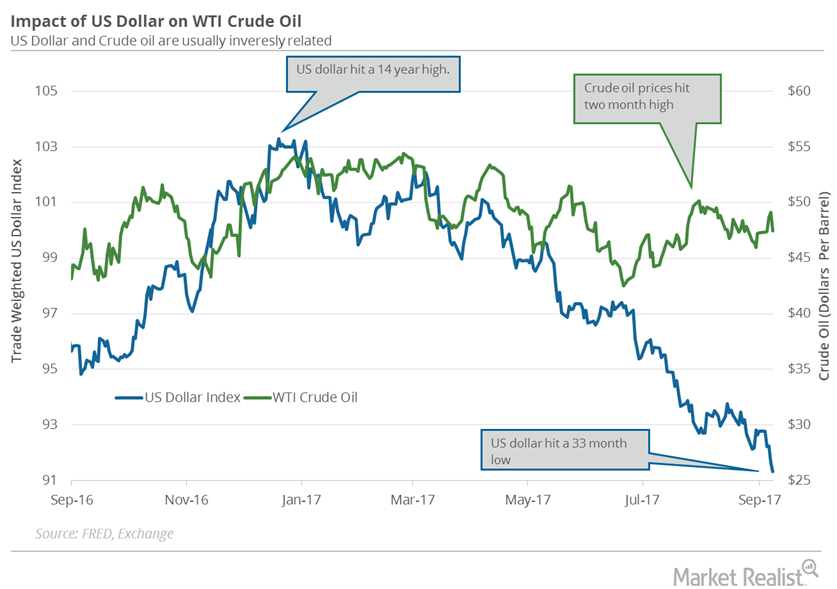

The US Dollar Index fell 0.27% to 91.86 on September 15. It’s near a 33-month low. Prices fell due to the surprise decline in US retail sales in August.

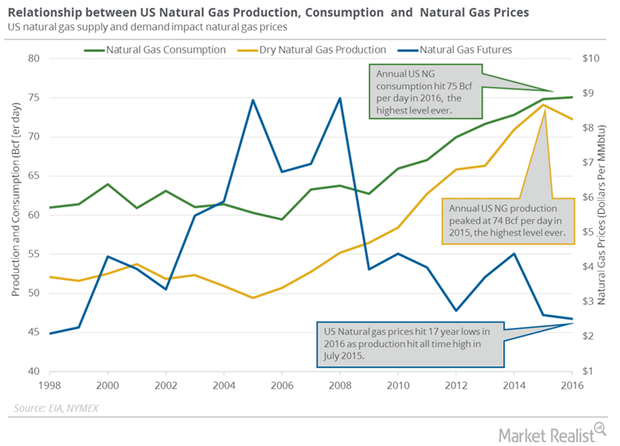

Will US Natural Gas Consumption Outweigh Production?

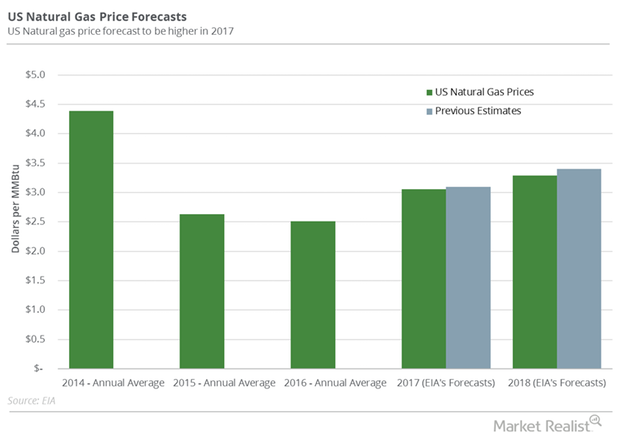

PointLogic estimates that weekly US natural gas consumption fell 6.6% to 52 Bcf per day from September 7 to 13. Consumption fell 13% year-over-year.

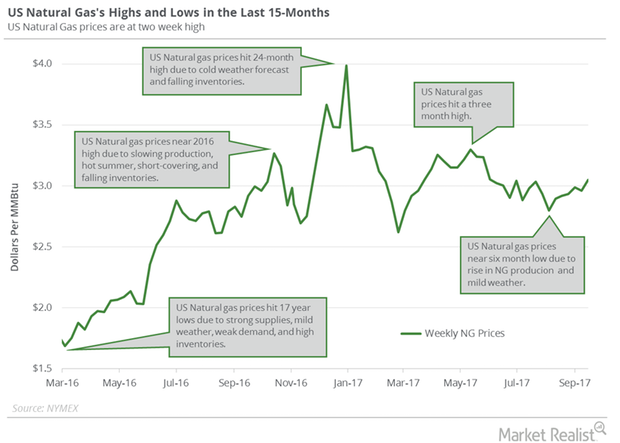

Why US Natural Gas Futures Hit a 2-Week High

US natural gas (DGAZ)(UGAZ)(UNG) futures contracts for October delivery rose 0.32% to $3.07 per MMBtu (million British thermal units) on Thursday, September 14.

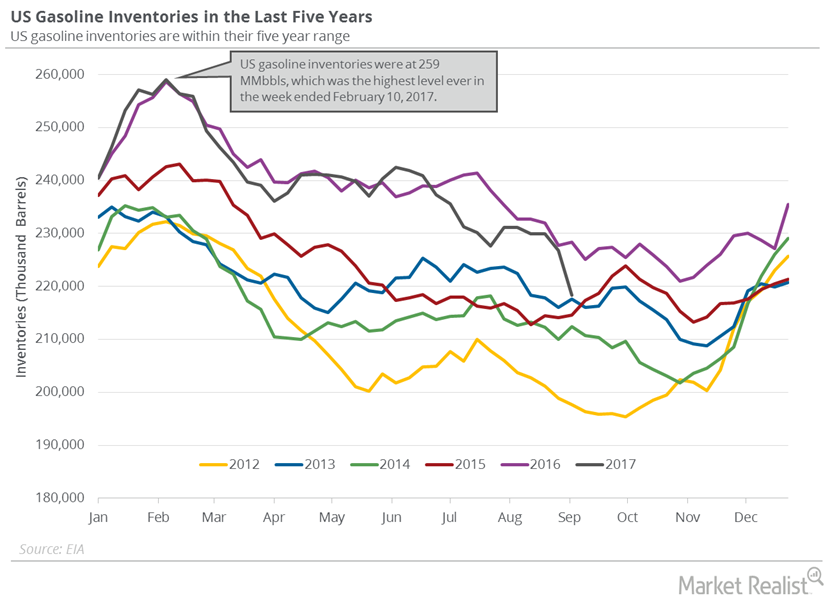

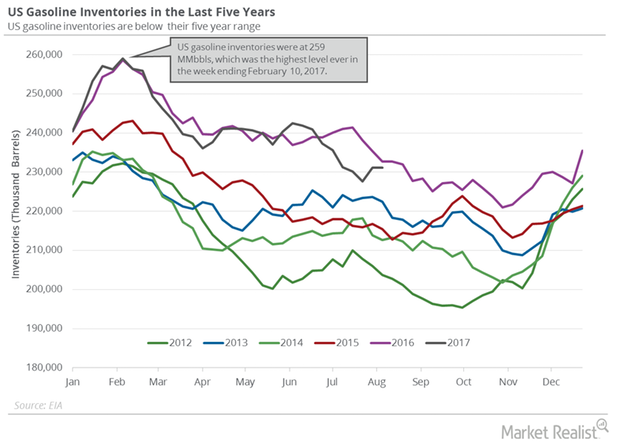

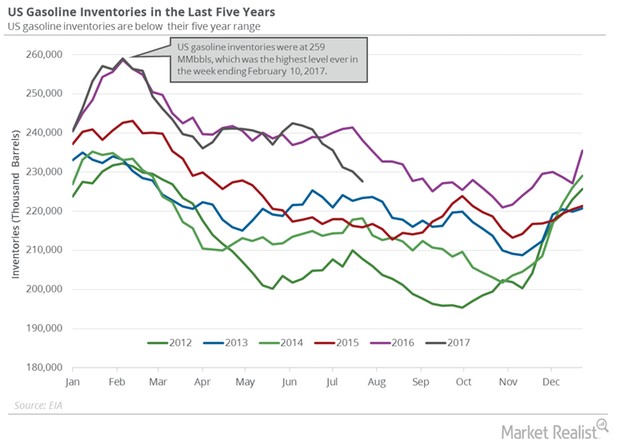

US Gasoline Inventories’ Largest Weekly Drop in 27 Years

The EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report on September 13.

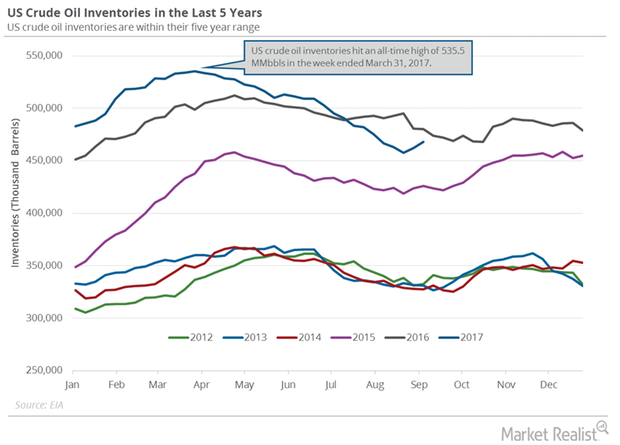

Why US Crude Oil Inventories Rose Again

On September 13, the EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report.

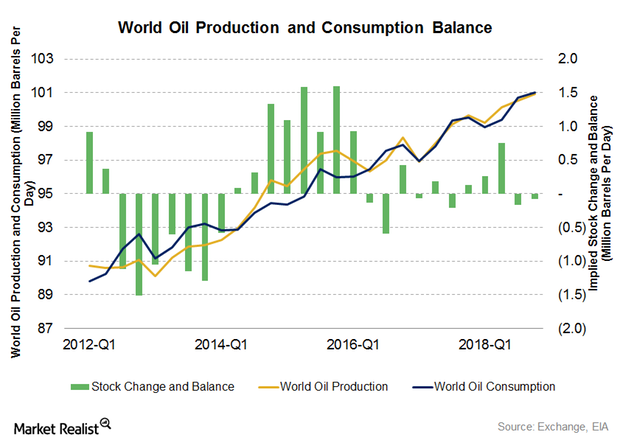

Are US Crude Oil Supply and Demand Tightening?

WTI (West Texas Intermediate) crude oil (XLE)(XOP)(USO) futures contracts for October delivery rose 2.2% to $49.3 per barrel on September 13.

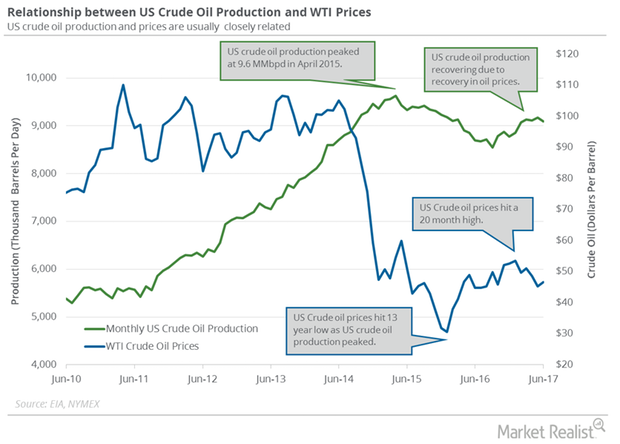

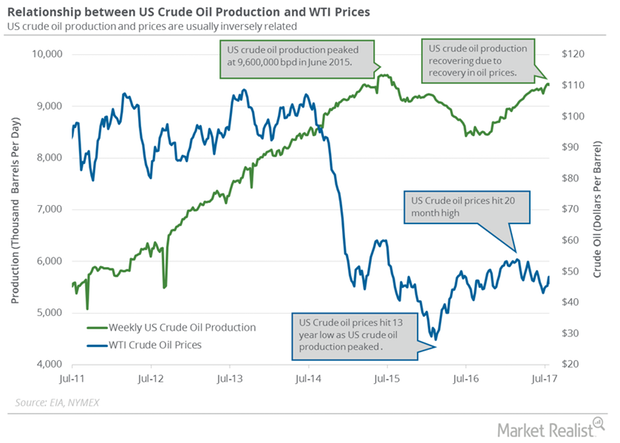

US Crude Oil Production Hit a 5-Month Low

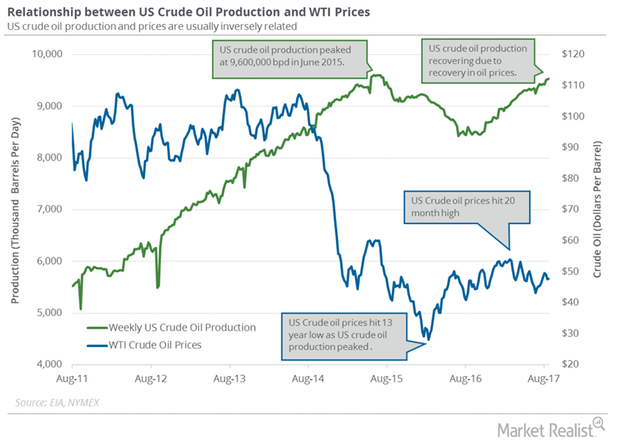

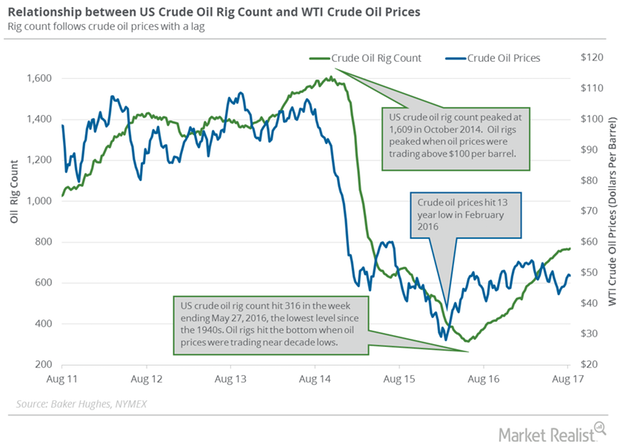

US crude oil production hit a five-month low due to slowing crude oil rigs and lower crude oil (XLE) (USO) (UCO) prices in the past few months.

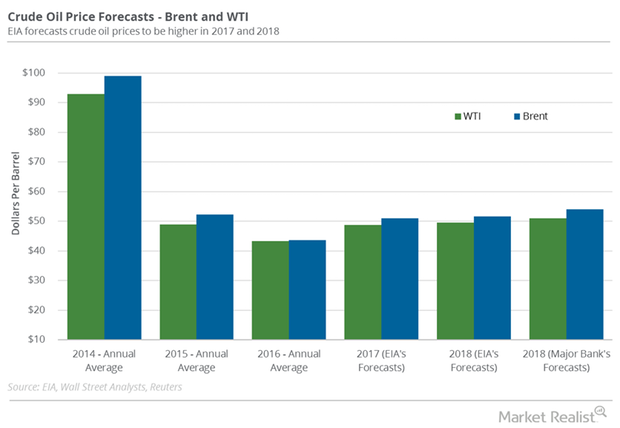

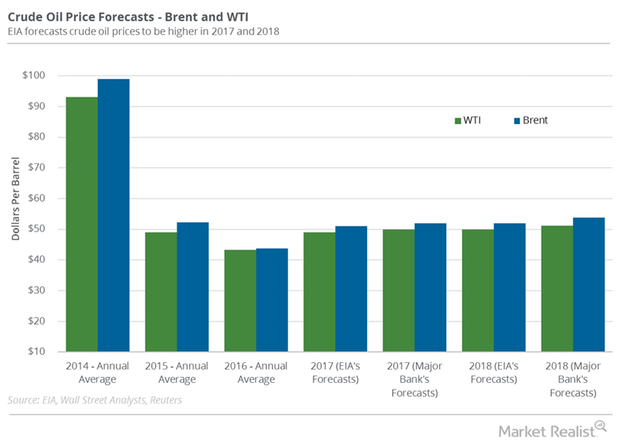

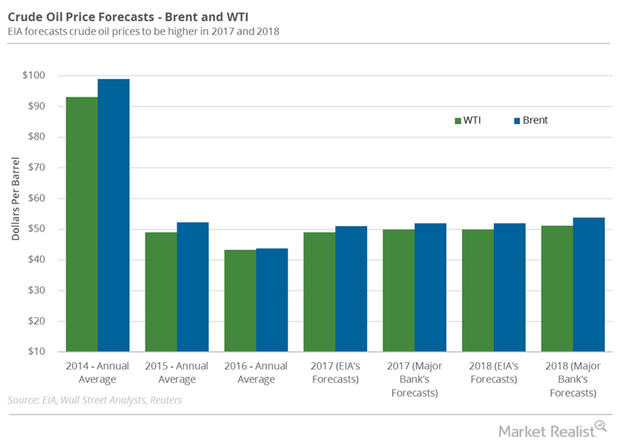

Why Were Crude Oil Price Forecasts Downgraded Again?

A Wall Street Journal survey estimates that US crude oil prices could average $51 per barrel in 2018—$2 per barrel lower than previous estimates.

Hurricanes Could Impact Global and US Crude Oil Demand

West Texas Intermediate crude oil (DBO) (DIG) (XLE) futures contracts for October delivery rose 1.2% to $48.07 per barrel on September 11, 2017.

Why Cushing Crude Inventories Rose for the 4th Time in 5 Weeks

A market survey estimates that Cushing crude oil inventories fell from September 1 to 8, 2017. Cushing crude oil inventories rose for the fourth time in the last five weeks.

What to Watch: This Week’s Key Crude Oil Price Drivers

Let’s track some important events for crude oil and natural gas traders from September 11 to 15, 2017.

Why the US Dollar Hit a 33-Month Low

The US Dollar Index fell 0.34% to 91.33 on September 8—the lowest level in the last 33 months. Prices fell due to the following factors.…

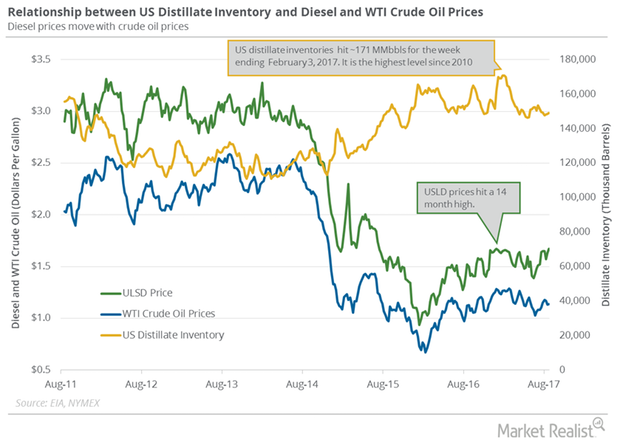

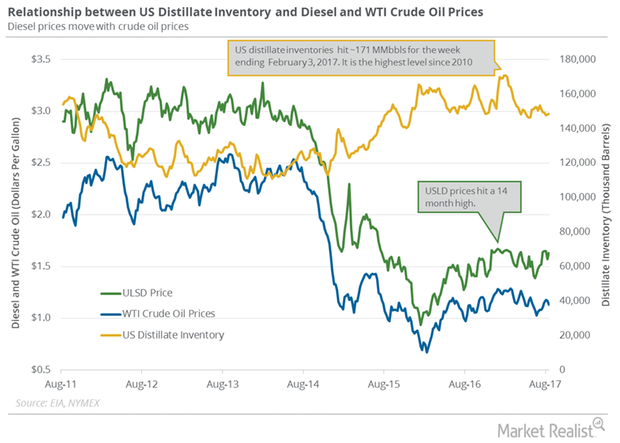

US Distillate Inventories Rise for a Third Week

US distillate inventories On August 30, 2017, the EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report. The EIA estimates that US distillate inventories rose by 0.5% to 149.1 MMbbls (million barrels) between August 18 and 25, 2017. Inventories fell by 5.6 MMbbls, or 3.6%, from the same period in 2016. Inventories […]

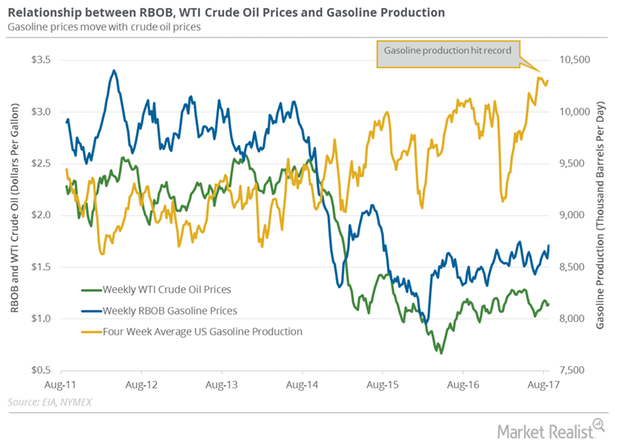

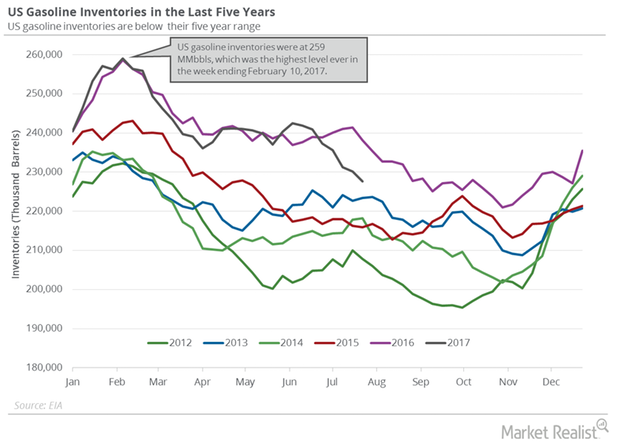

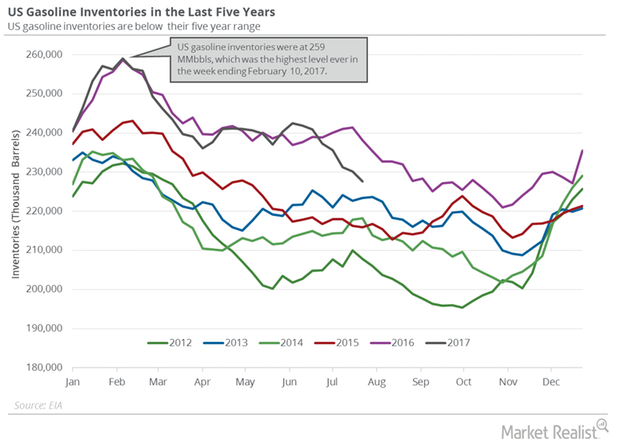

US Gasoline Futures Hit 2-Year High despite Inventory Rise

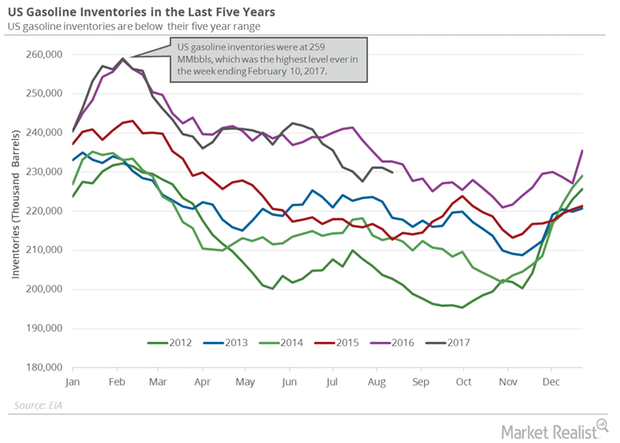

US gasoline inventories The U.S. Energy Information Administration reported that US gasoline inventories rose 35,000 barrels to 229.9 MMbbls (million barrels) between August 18 and 25, 2017. Inventories fell 2.1 MMbbls, or 0.9%, from the same period in 2016. For the third time in five weeks, inventories rose. A market survey estimated that US gasoline […]

How Hurricane Harvey May Impact US Crude Oil Production

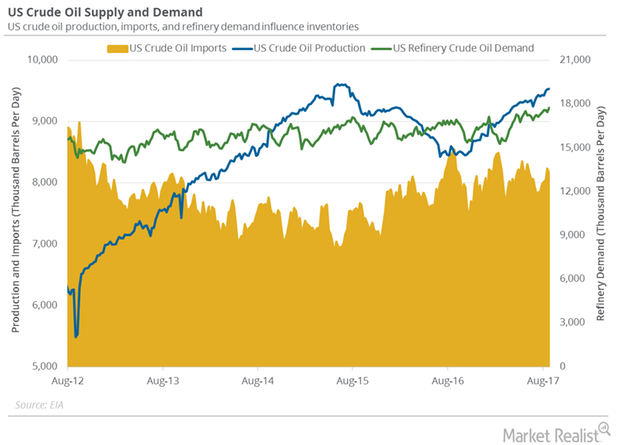

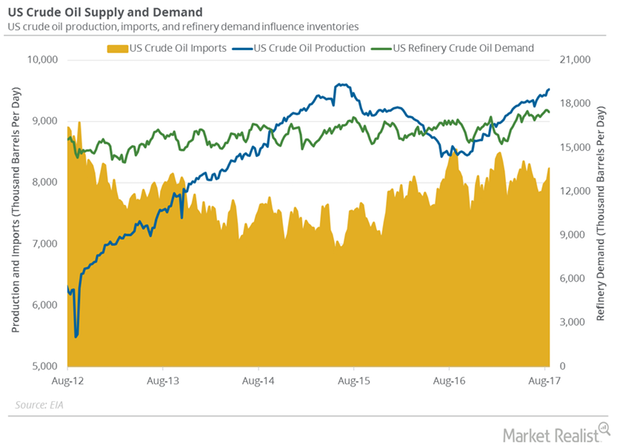

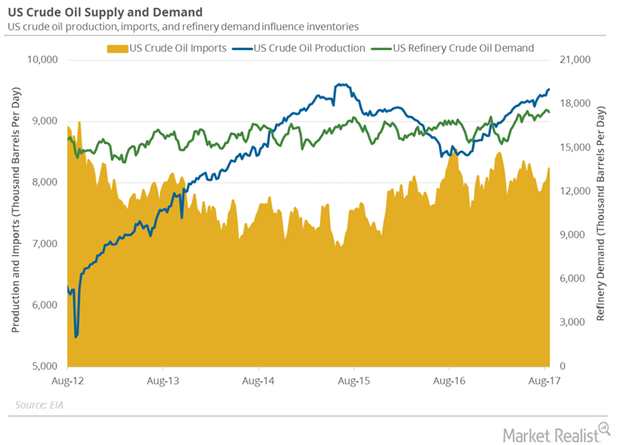

US crude oil production The EIA (U.S. Energy Information Administration) estimates that US crude oil production rose by 2,000 bpd (barrels per day) to 9,530,000 bpd between August 18 and 25, 2017. Production rose 1,042,000 bpd, or 12.3%, from the same period in 2016. It has risen for three consecutive weeks to August 25, and has reached […]

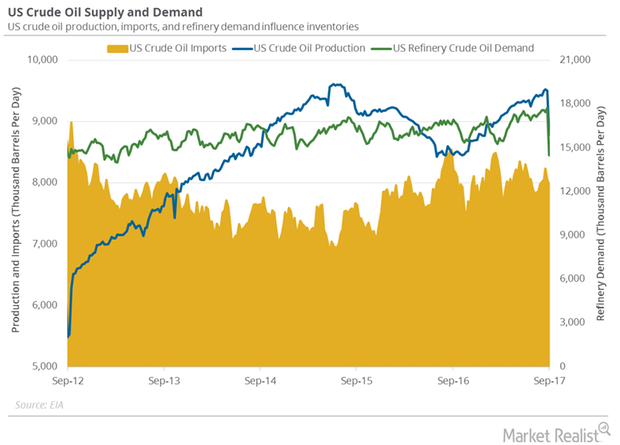

Pre-Hurricane Harvey, US Crude Oil Demand Hit a Record High

US refinery crude oil demand The EIA (U.S. Energy Information Administration) estimates that US refinery crude oil demand rose by 264,000 bpd (barrels per day) to 17,725,000 bpd between August 18 and 25, 2017, reaching the highest level since 1982. Refinery demand rose 1.5% week-over-week and rose 1,110,000 bpd, or 6.6%, year-over-year. High refinery demand is […]

Could Crude Oil Futures Rise Due to Short Covering?

In this series, we’ll review US crude oil inventories, refinery demand, production, and gasoline and distillate inventories.

Hurricane Harvey Could Impact the US Natural Gas Rig Count

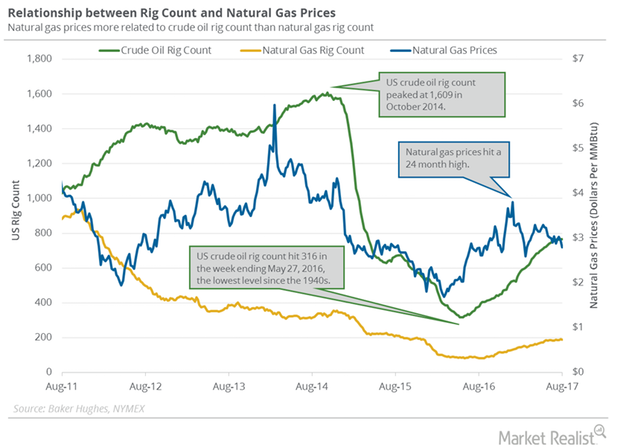

Baker Hughes reported that the US natural gas rig count fell by two to 180 on August 18–25, 2017. It’s the lowest level since May 19, 2017.

Why Hedge Funds May Be Turning Bearish on US Crude

The US Commodity Futures Trading Commission reported on Friday, August 25, that hedge funds have cut back their bullish positions in US crude futures and options.

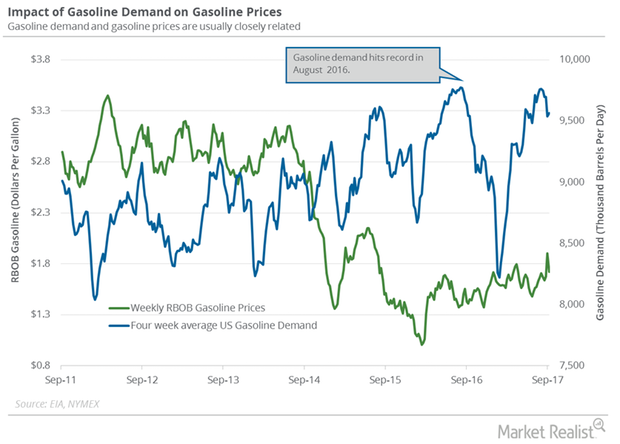

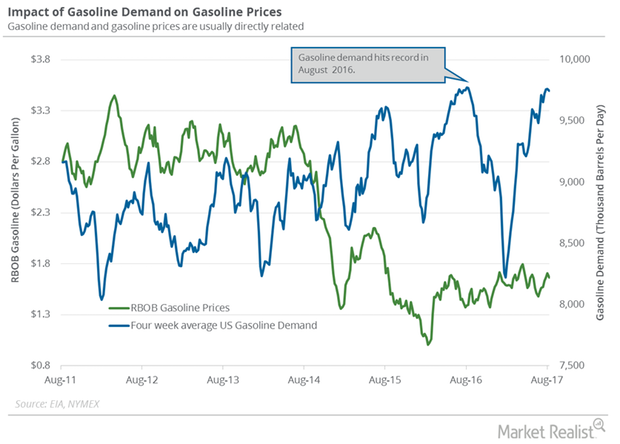

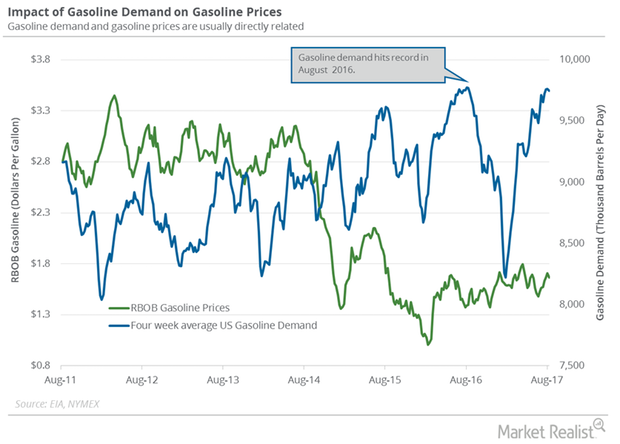

Will US Gasoline Demand Impact Gasoline and Crude Oil Futures?

The EIA estimates that weekly US gasoline demand rose 107,000 bpd (barrels per day), or 1.1%, to 9.6 MMbpd between August 11 and August 18.

Why September Gasoline Futures Hit a 2-Year High

September gasoline futures contracts rose 4% and closed at $1.78 per gallon on August 29, 2017—the highest settlement in more than two years.

Harvey and API Crude Oil Inventories: The Impact on Crude Futures

US crude oil futures contracts for October delivery fell 0.3% to $46.44 per barrel on August 29, 2017.

Will US Crude Oil Futures Rise above Key Moving Averages?

Let’s track some important events for oil and gas traders between August 28 and September 1, 2017.

How Tropical Storm Harvey Impacts US Crude Oil and Gasoline Prices

WTI (West Texas Intermediate) crude oil (SCO)(BNO)(PXI) futures contracts for October delivery rose 0.4% and were trading at $46.8 per barrel in electronic trading at 2:05 AM EST on August 29.

US Distillate Inventories Were Flat Last Week

The EIA (U.S. Energy Information Administration) estimates that US distillate inventories were flat at 148.4 MMbbls (million barrels) between August 11, 2017, and August 18, 2017.

How US Gasoline Inventories Support Crude Oil Futures

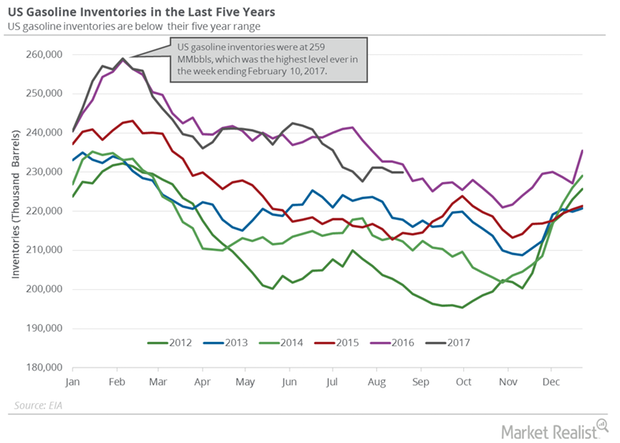

The US Energy Information Administration reported that US gasoline inventories fell by 1.2 MMbbls (million barrels) to 229.9 MMbbls (million barrels) between August 11, 2017, and August 18, 2017.

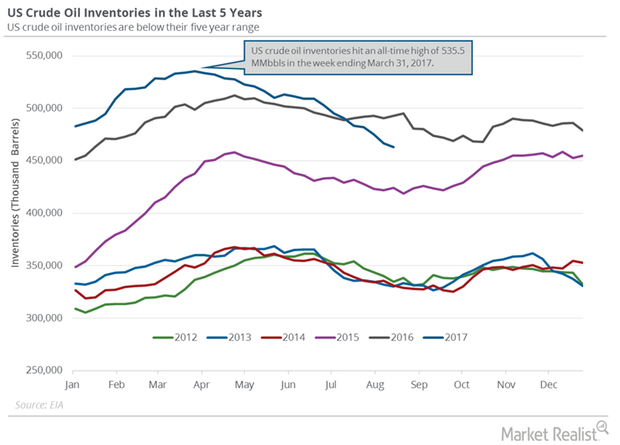

US Crude Oil Inventories Fall in Line with Market Expectations

A Reuters survey estimated that US crude oil inventories would fall 3.5 MMbbls between August 11, 2017, and August 18, 2017.

Could US Gasoline Demand Fall in the Coming Months?

The EIA estimates that US gasoline demand will fall 275.0 Mbpd (thousand barrels per day) to 9.5 MMbpd (million barrels per day) August 4–11, 2017.

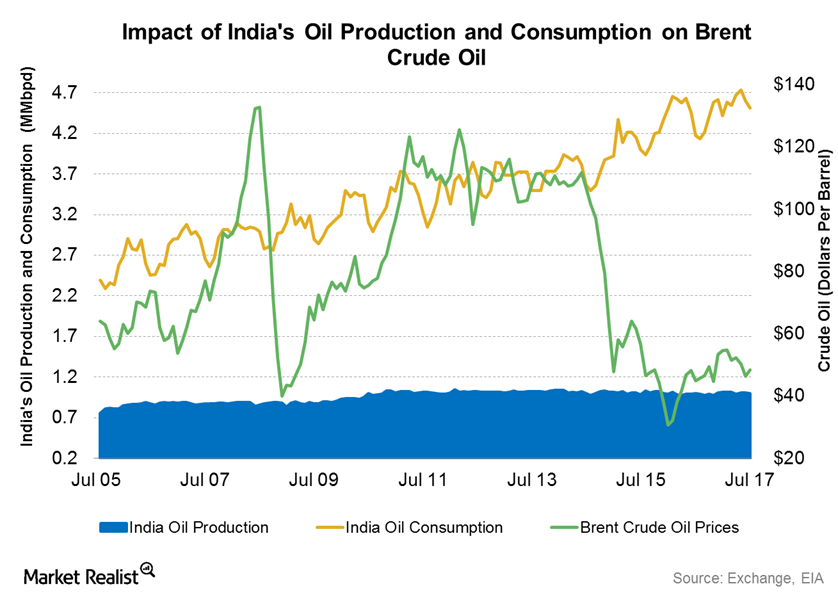

How India’s Crude Oil Imports, Production, Demand Impact Prices

India’s Petroleum Planning and Analysis Cell estimated that the country’s crude oil imports rose 0.60% to 4.2 MMbpd in July 2017 from July 2016.

Will US Crude Oil Inventories Fall Again and Drive Oil Prices?

October WTI crude oil futures contracts rose 0.60% to $47.83 per barrel on August 22, 2017, and Brent crude oil futures contracts rose 0.40% to $51.87 per barrel.

Will the US Crude Oil Rig Count Support Crude Oil Futures?

Baker Hughes released its US crude oil rig count report on August 18, 2017. It reported that the US crude oil rig count fell by five to 763 on August 11–18.

US Natural Gas Futures Could Fall in 3Q17

The CFTC reported that hedge funds decreased their net long positions on US natural gas futures and options contracts 28% to 39,569 on August 1–8, 2017.

US Gasoline Inventories Pressured Gasoline and Crude Oil Futures

The EIA reported that US gasoline inventories rose by 22,000 barrels or 0.1% to 231.1 MMbbls (million barrels) on August 4–11, 2017.

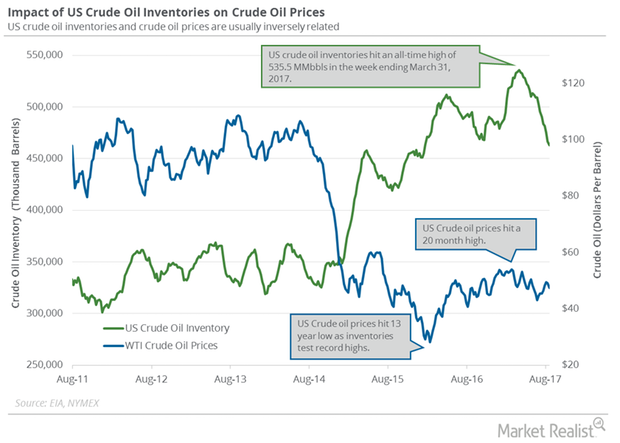

US Crude Oil Inventories: Biggest Draw since September 2016

The EIA reported that US crude oil inventories fell by 8.9 MMbbls or 1.8% to 466.4 MMbbls on August 4–11, 2017—the biggest draw since September 2016.

What to Expect from US Gasoline Demand

The EIA (U.S. Energy Information Administration) estimates that weekly US gasoline demand fell by 45,000 bpd (barrels per day), or 0.45%, to 9,797,000 bpd between July 28 and August 4, 2017.

Will US Crude Oil and Gasoline Inventories Support Oil Prices?

September WTI (West Texas Intermediate) crude oil (OIH) (SCO) (DIG) futures contracts rose 0.5% to $47.81 per barrel in electronic trading at 1:50 AM EST on August 16, 2017.

Will Global Oil Consumption Beat Production?

WTI (West Texas Intermediate) crude oil (PXI)(USL)(SCO) futures contracts for September delivery fell 0.1% and were trading at $48.78 per barrel in electronic trading at 2:00 AM EST on August 14, 2017.

US Gasoline Inventories Limit the Upside for Crude Oil Futures

US gasoline inventories rose by 3.4 MMbbls to 231.1 MMbbls on July 28–August 4, 2017. Inventories rose for the third time in the last ten weeks.

EIA Upgrades US Crude Oil Production Estimates for 2017 and 2018

The EIA released its Short-Term Energy Outlook report on August 8, 2017. It estimates that US crude oil production could average 9.35 MMbpd in 2017.

US Gasoline Demand Hit a Record: What’s Next?

The EIA estimates that weekly US gasoline demand rose by 21,000 bpd (barrels per day) to 9,842,000 bpd on July 21–28, 2017. It’s the highest level ever.

Analyzing US Crude Oil and Gasoline Inventories

The API estimates that US gasoline inventories rose by 1.5 MMbbls (million barrels) on July 28–August 4, 2017.

Crude Oil Futures Fell despite OPEC’s Meeting and API Data

September US crude oil futures contracts fell 0.4% to $49.17 per barrel on August 8. Brent crude oil futures fell 0.4% to $52.14 per barrel on the same day.