Will the API’s Crude Oil Inventories Pressure Crude Oil Prices?

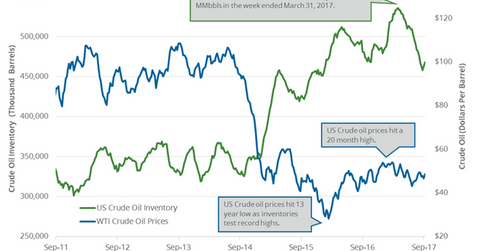

A market survey estimates that US crude oil inventories would have risen by 2.9 MMbbls (million barrels) on September 8–15, 2017.

Sept. 19 2017, Published 10:31 a.m. ET

Crude oil prices

November WTI (West Texas Intermediate) crude oil (USO) (UCO) (DBO) futures contracts rose 0.7% and were trading at $50.73 per barrel in electronic trade at 5:50 AM EST on September 19, 2017.

The E-Mini S&P 500 (SPY) December futures contracts rose 0.1% to 2,504.75 in electronic trading at 5:50 AM EST.

WTI crude oil prices have fallen 12% YTD (year-to-date). Moves in crude oil prices impact ETFs and oil and gas producers. The YTD returns of the top five crude oil ETFs, ranked by assets under management, are mentioned below:

- The United States Oil ETF (USO) has fallen 13.2% YTD.

- The iPath S&P GSCI Crude Oil Total Return ETN (OIL) has fallen 17.2% YTD.

- The ProShares Ultra Bloomberg Crude Oil (UCO) has fallen 27.2% YTD.

- The VelocityShares 3x Long Crude Oil ETN (UWT) has fallen 44.2% YTD.

- The PowerShares DB Oil ETF (DBO) has fallen 10.95% YTD.

API’s crude oil inventories

The API (American Petroleum Institute) will release its crude oil and gasoline inventory report on September 19, 2017. According to a market survey, US crude oil inventories would have risen by 2.9 MMbbls (million barrels) on September 8–15, 2017. A market survey estimates that US gasoline and distillate inventories would have fallen by 2 MMbbls and 1.1 MMbbls on September 8–15, 2017.

In its report the previous week, the API estimated that US crude oil inventories rose by 6.1 MMbbls on September 1–8, 2017. The API also estimated that US gasoline and distillate inventories fell by 7.8 MMbbls and 1.8 MMbbls on September 1–8, 2017. The EIA reported that US crude oil inventories rose by 5.8 MMbbls to 468.2 MMbbls on September 1–8. US gasoline and distillate inventories fell by 8.4 MMbbls and 3.2 MMbbls, respectively, on September 1–8.

Impact

US crude oil inventories have risen for two consecutive weeks. Any rise in US crude oil inventories could pressure crude oil (DIG) (BNO) (IEZ) prices. However, a fall in US gasoline and distillate inventories would support gasoline, diesel, and crude oil prices.

In the next part, we’ll look at how Libya’s crude oil production drives oil prices.