Gordon Kristopher

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Gordon Kristopher

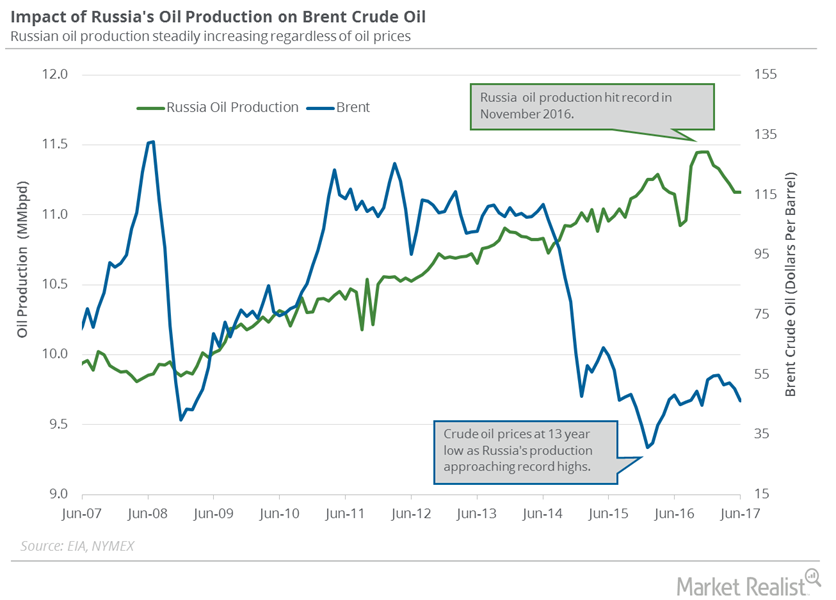

Russia’s Crude Oil Production Was Flat Again

The Russian Energy Ministry estimates that Russia’s crude oil production was flat at 10.95 MMbpd in July 2017—compared to the previous month.

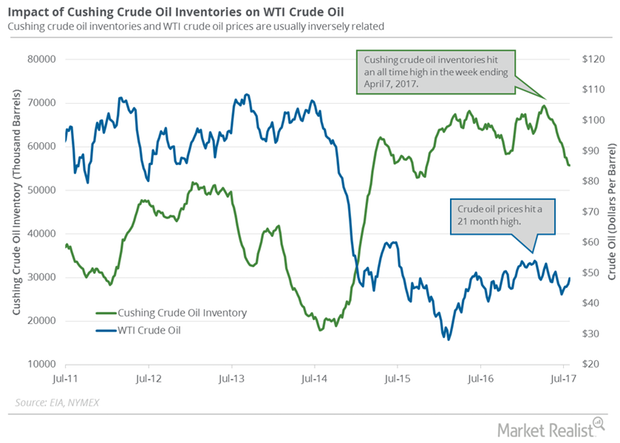

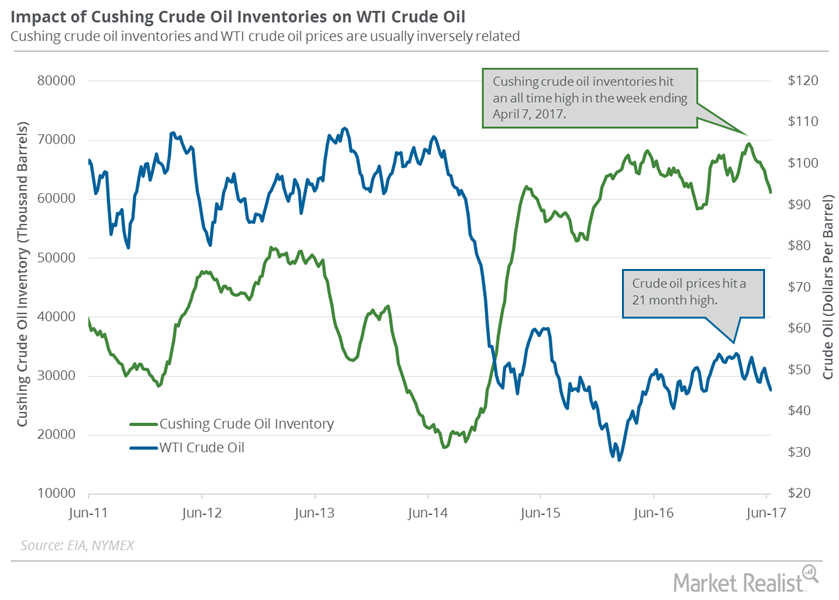

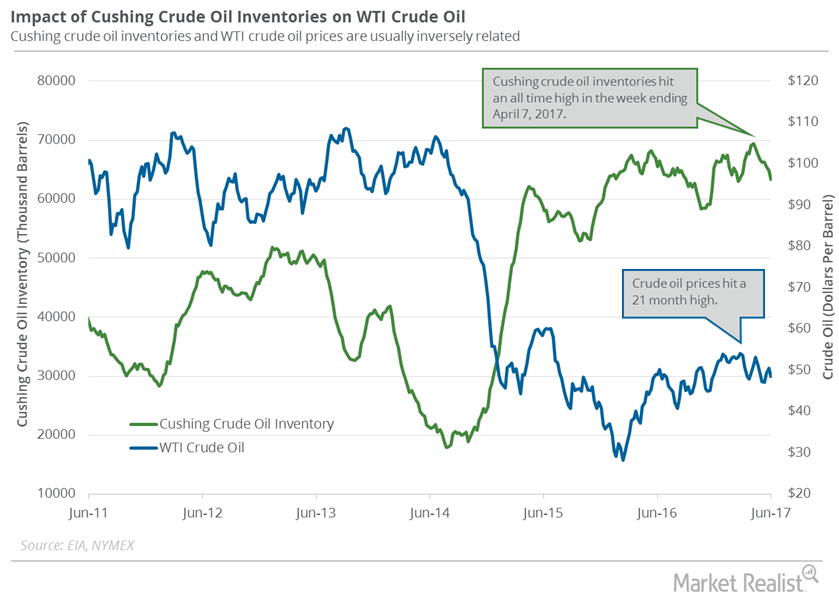

Cushing Inventories Fell 20% from the Peak

A preliminary market survey estimates that Cushing inventories fell on July 28–August 4, 2017. Inventories fell for the 11th consecutive week.

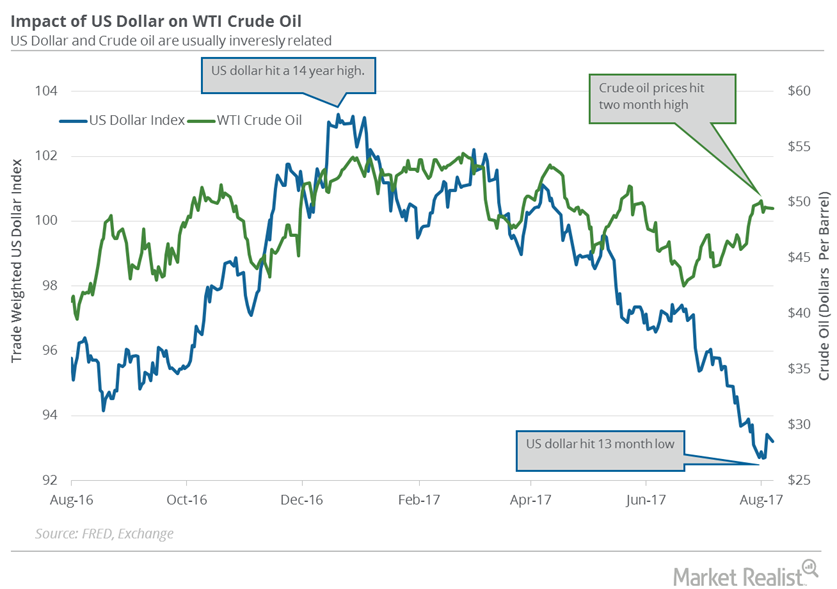

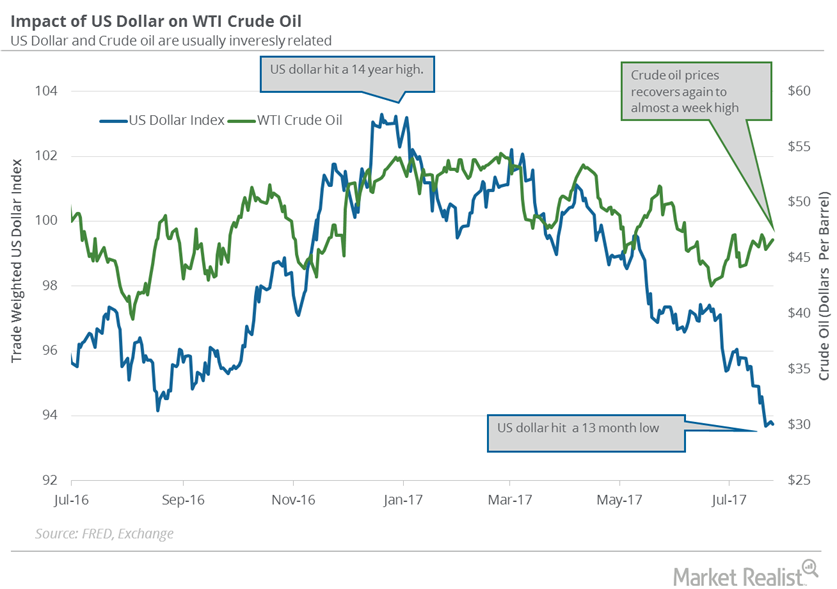

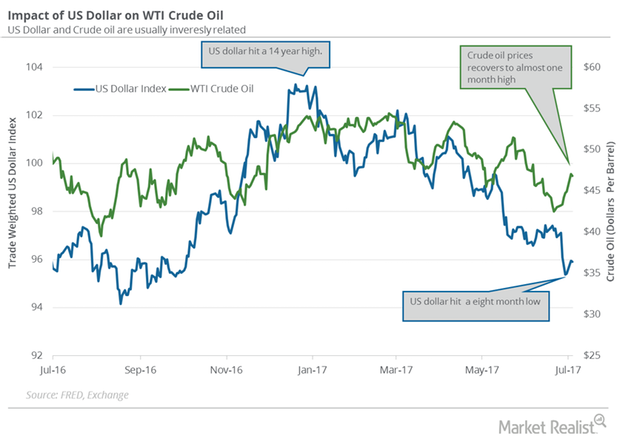

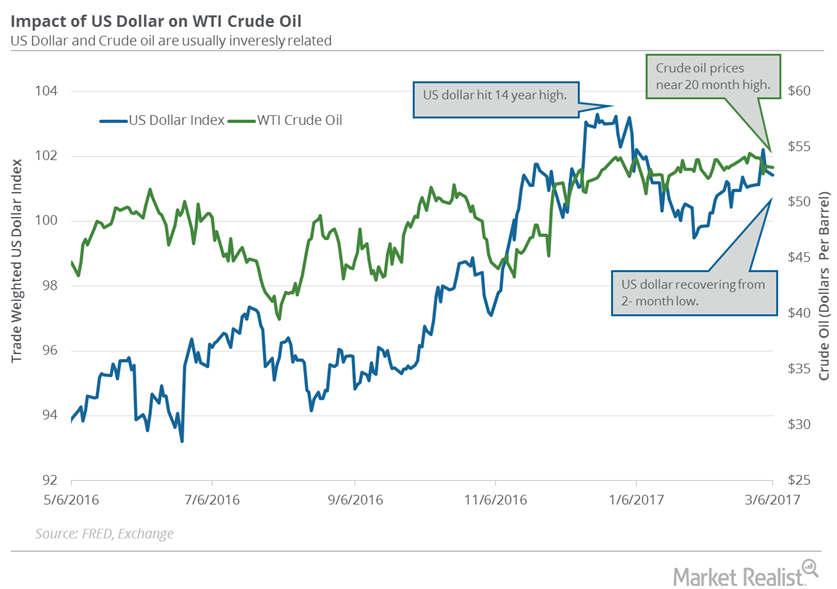

US Dollar Recovers from a 13-Month Low

The US Dollar Index rose 0.77% to 93.7 on August 4, 2017. The US dollar rose due to the better-than-expected rise in US unemployment data.

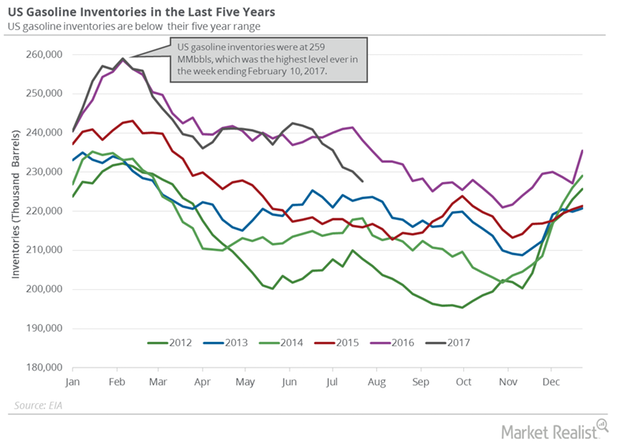

US Gasoline Inventories Fell, Supported Gasoline Oil Prices

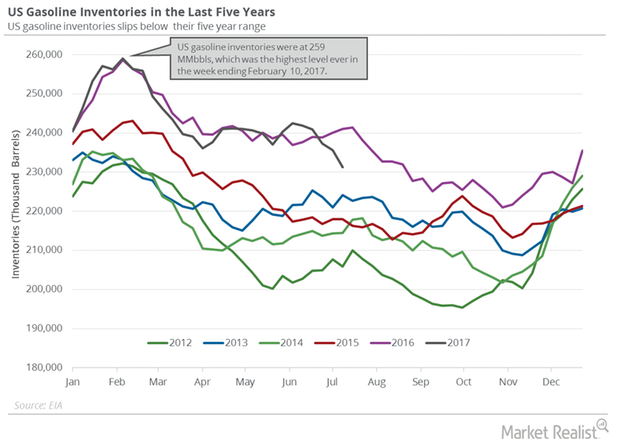

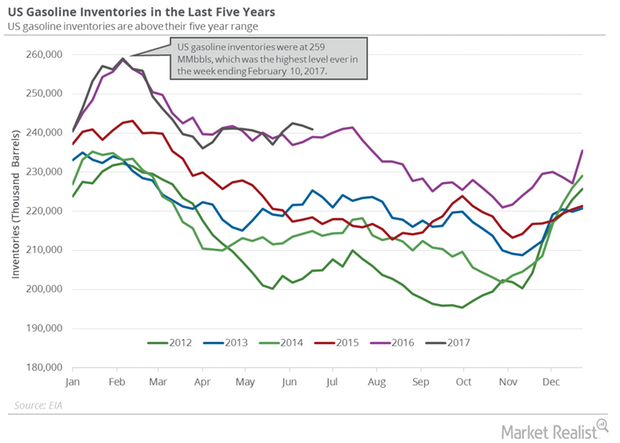

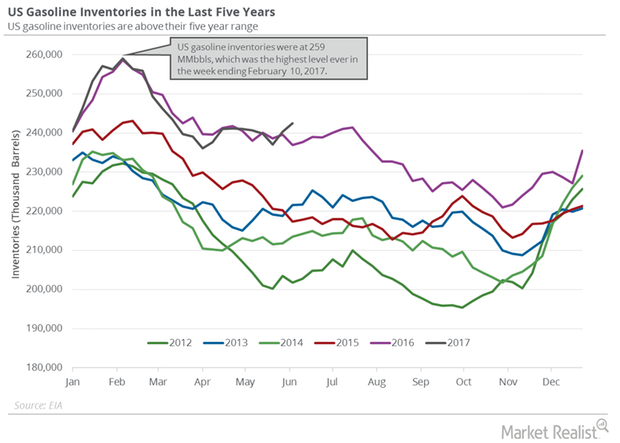

The EIA reported that US gasoline inventories fell 1.1% or by 2.5 MMbbls (million barrels) to 227.7 MMbbls on July 21–28, 2017.

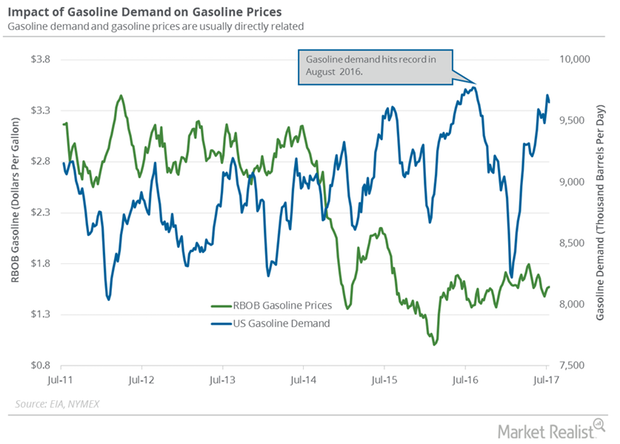

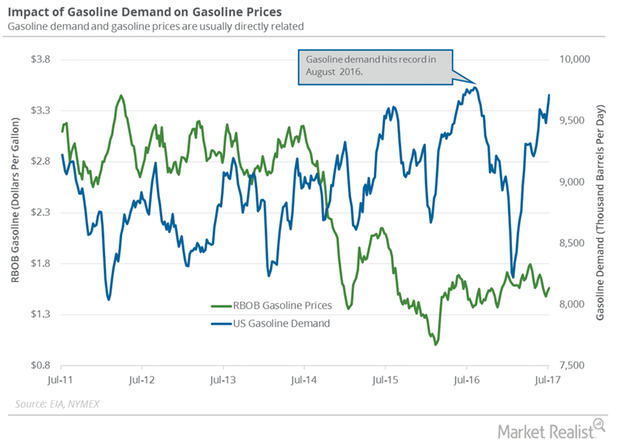

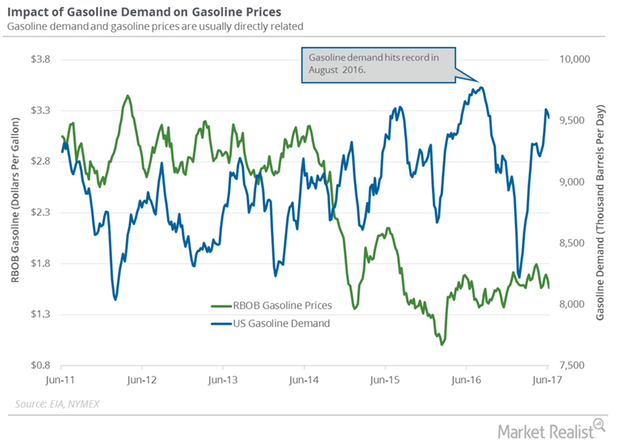

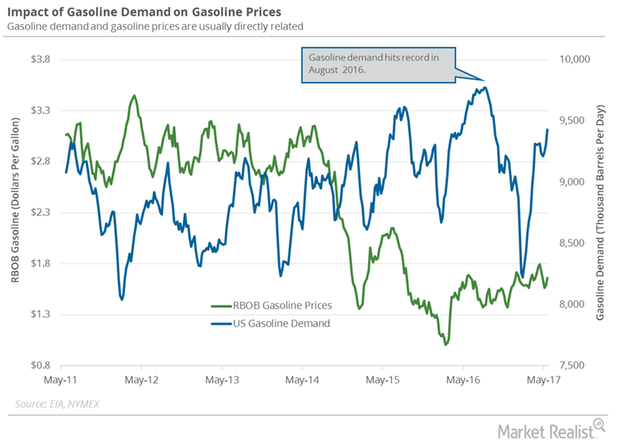

Why US Gasoline Demand Rose for 2nd Consecutive Month

The EIA (US Energy Information Administration) estimates that US gasoline demand rose 1.5% to 9.6 MMbpd (million barrels per day) in May 2017 compared to May 2016.

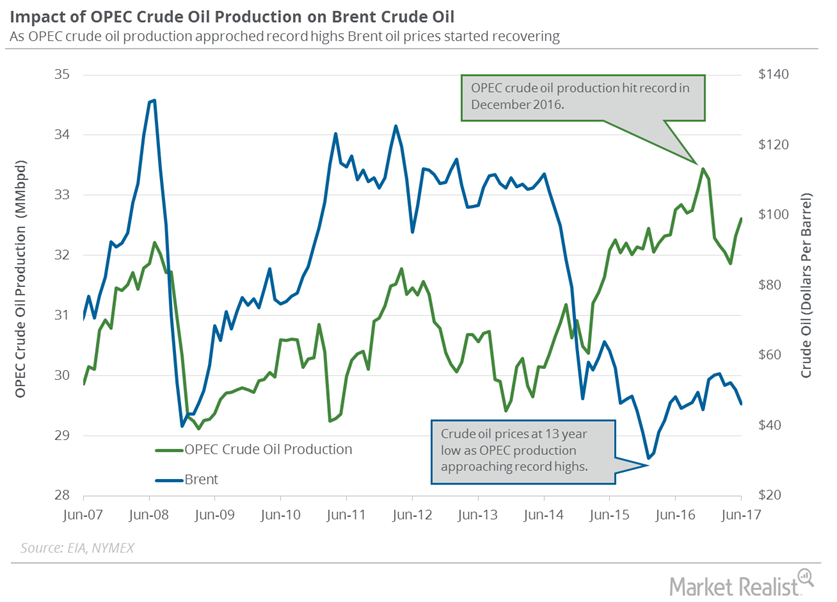

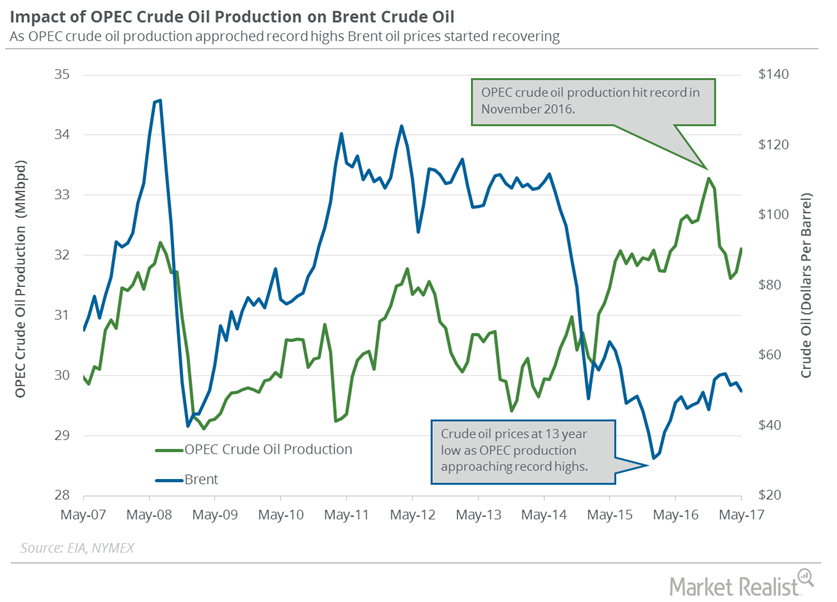

Problems for Crude Oil Bulls as OPEC Production Hits 2017 High

September US crude oil futures contracts rose 0.20% and were trading at $50.29 per barrel in electronic trading at 1:35 AM EST on August 1, 2017.

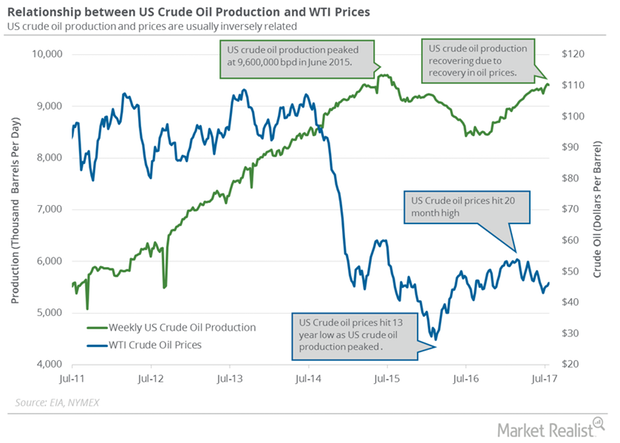

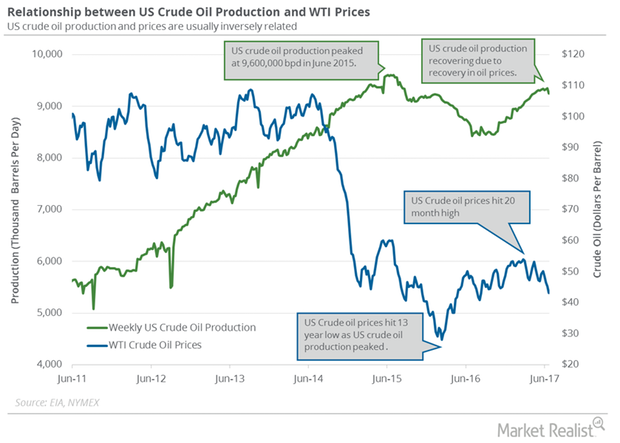

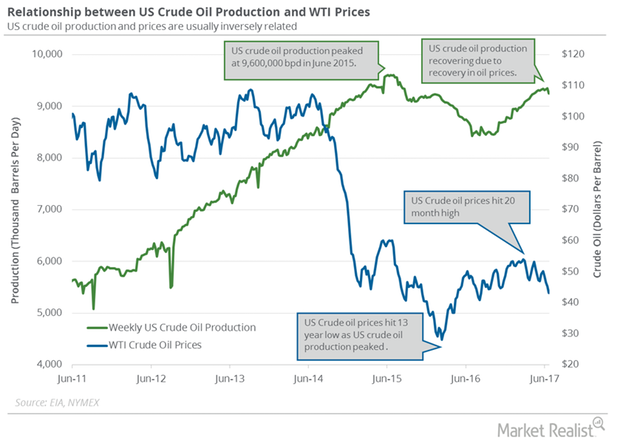

Will US Crude Oil Production Slow Down in 2018?

The EIA reported that US crude oil production fell by 19,000 bpd (barrels per day) to 9,410,000 bpd on July 14–21, 2017.

US Dollar Is near a 13-Month Low: What’s Next?

The US dollar hit 93.68 on July 21, 2017—the lowest level in 13 months. The US dollar has fallen more than 8% in 2017.

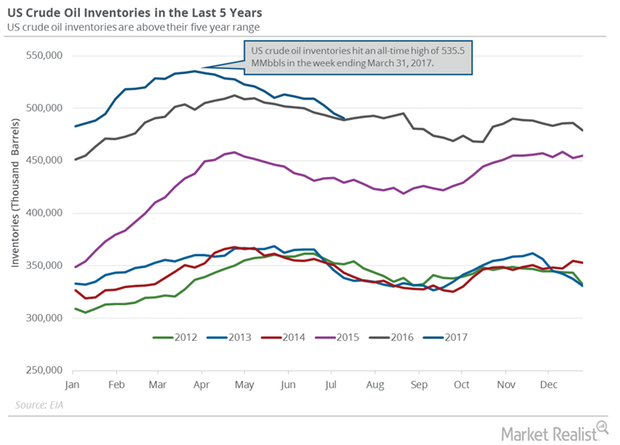

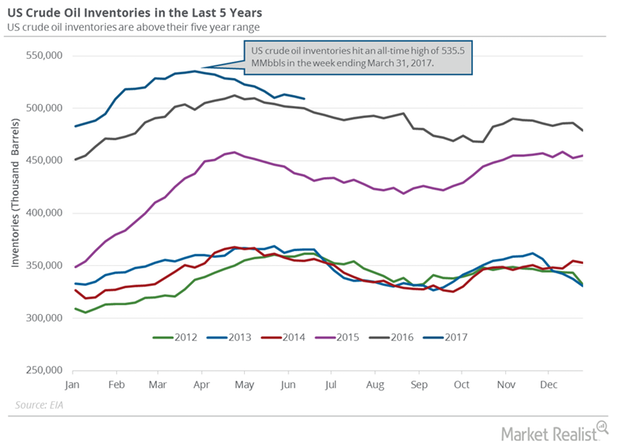

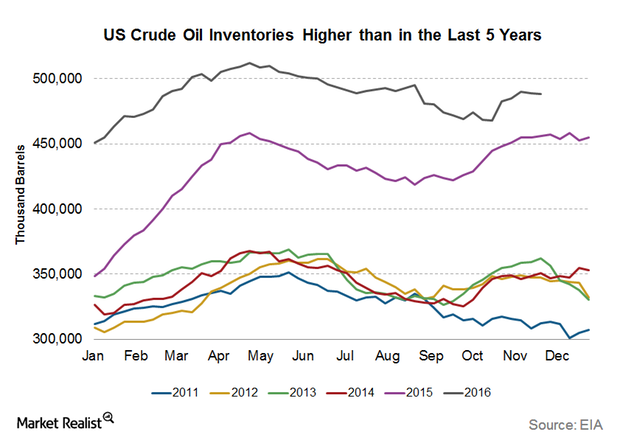

US Crude Oil Inventories Could Fall below the 5-Year Average

The EIA estimates that US crude oil inventories fell by 4.7 MMbbls (million barrels) to 490.6 MMbbls on July 7–14, 2017.

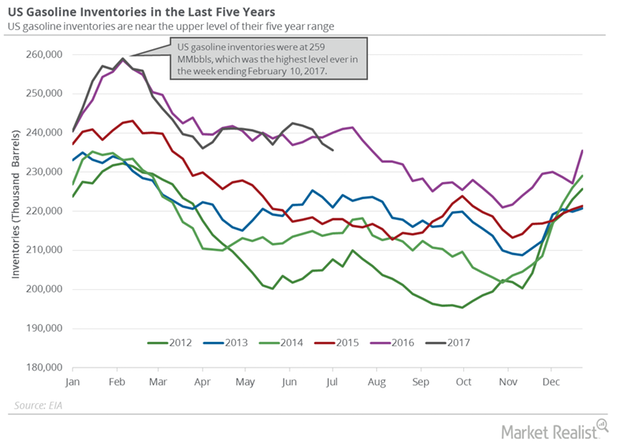

US Gasoline Inventories Drive Gasoline and Crude Oil Prices

The EIA reported that US gasoline inventories fell by 4.4 MMbbls (million barrels) to 231.2 MMbbls on July 7–14, 2017.

Near Record US Gasoline Demand: Are the Bulls Taking Control?

The EIA estimates that the four-week average for US gasoline demand rose 129,000 bpd (barrels per day) to 9.7 MMbpd (million barrels per day) from July 7 to 14, 2017.

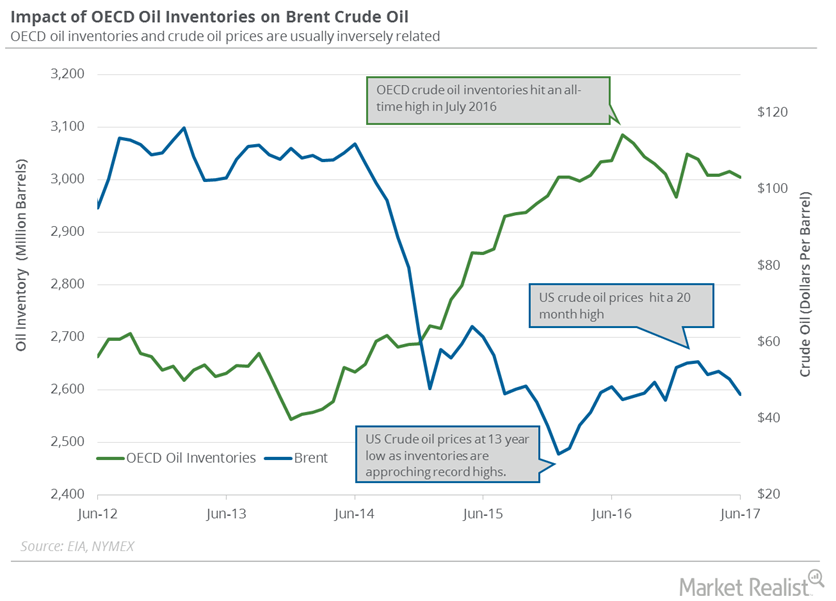

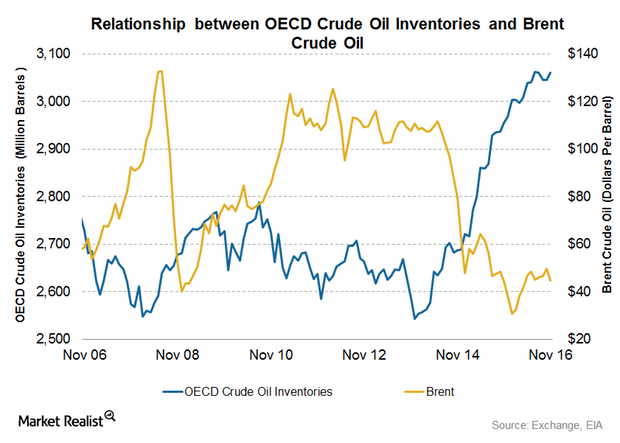

Will OECD’s Crude Oil Inventories Fall below the 5-Year Average?

The EIA estimates that OECD’s crude oil inventories fell by 10.13 MMbbls (million barrels) to 3,005 MMbbls in June 2017—compared to May 2017.

US Gasoline Inventories Support Gasoline, Crude Oil Futures

The EIA reported that US gasoline inventories fell 1.6 MMbbls (million barrels) to 235.6 MMbbls between June 30, 2017, and July 7, 2017.

Analyzing Hedge Funds’ Net Long Position on US Crude Oil

Hedge funds increased their net long positions in US crude oil futures and options by 16,345 contracts to 149,951 contracts on June 27–July 4, 2017.

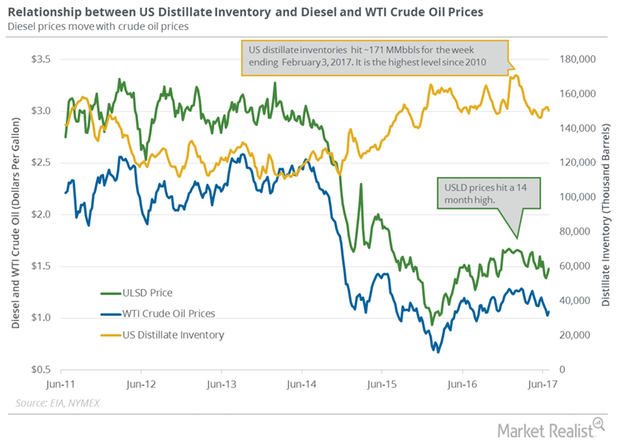

US Distillate Inventories Fell for the Second Straight Week

The EIA reported that US distillate inventories fell by 1.8 MMbbls (million barrels) or 1.2% to 150.4 MMbbls on June 23–30, 2017.

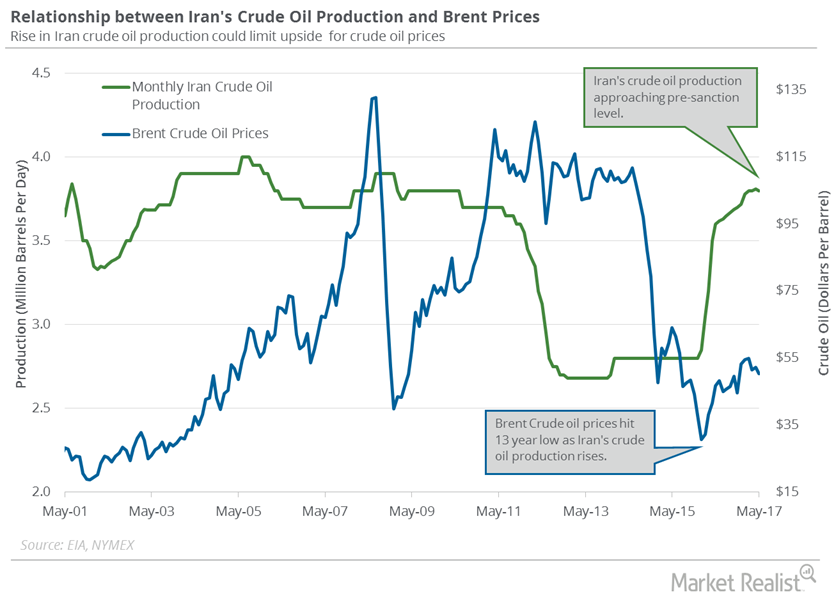

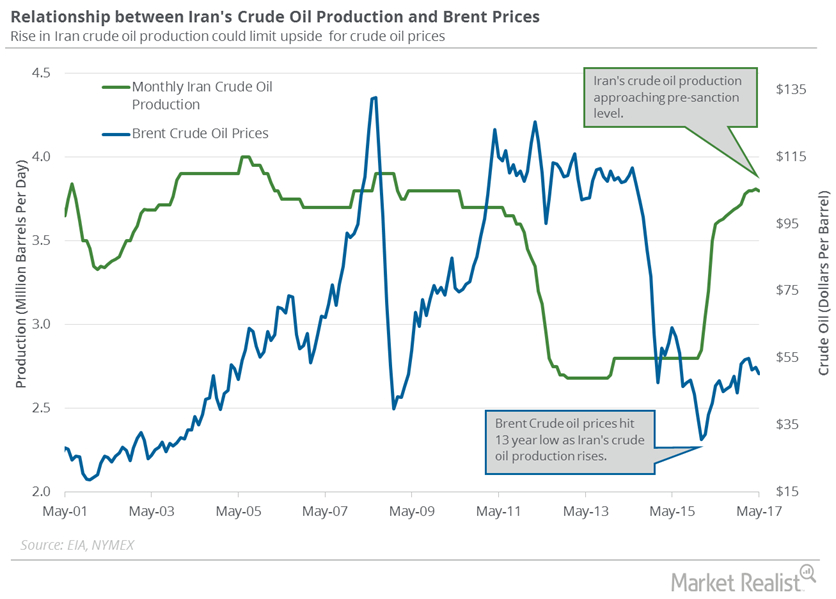

Iran’s Crude Oil Exports and Production: Crucial for Oil Prices

Iran’s crude oil exports are expected to fall 7% in July 2017, according to Reuters. Exports are expected to fall to 1.86 MMbpd in July 2017.

Will the US Dollar Continue Its Bearish Momentum This Week?

August 2017 West Texas Intermediate crude oil futures contracts fell 0.5% and were trading at $46.83 per barrel in electronic trade at 1:45 AM EST on July 4, 2017.

OPEC’s Crude Oil Production Hit a 2017 High

OPEC’s production cut compliance was at 92% in June 2017. Lower compliance from OPEC members and Russia could pressure crude oil prices.

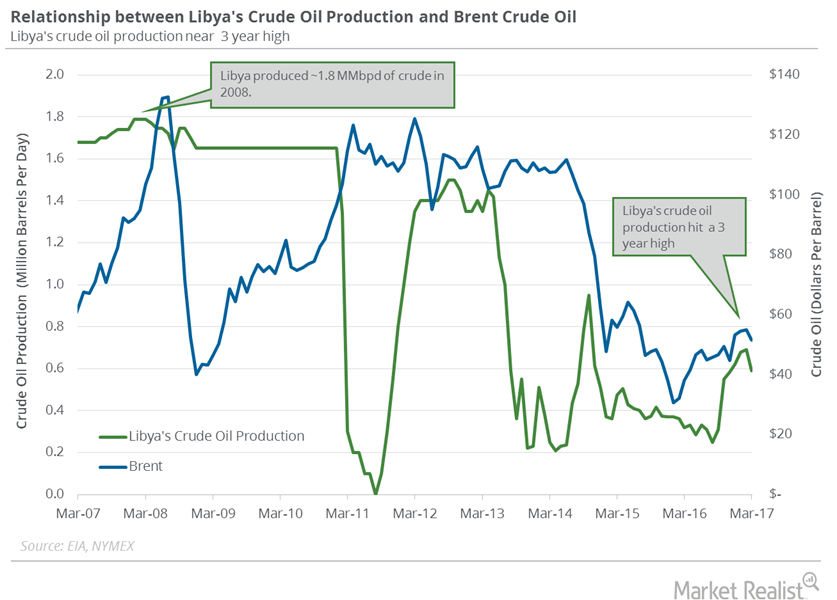

Will Libya and Iran Swing Crude Oil Prices?

Market surveys project that Libya’s crude oil production is near 1 MMbpd—the highest level in three years. High production could pressure crude oil prices.

US Crude Oil Production: Biggest Weekly Fall since July 2016

The EIA (U.S. Energy Information Administration) reported that US crude oil production fell by 100,000 bpd to 9,250,000 bpd on June 16–23, 2017.

How Long Can US Gasoline Inventories Support Crude Oil Bulls?

The EIA (U.S. Energy Information Administration) reported that US gasoline inventories fell by 0.1 MMbbls to 241 MMbbls on June 16–23, 2017.

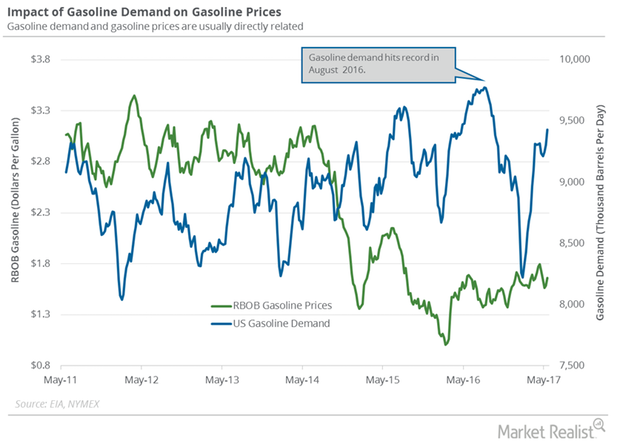

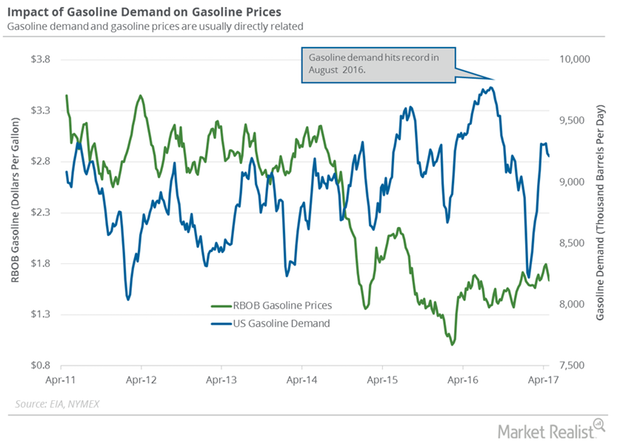

US Gasoline Demand: Positive or Negative for Crude Oil?

The EIA (U.S. Energy Information Administration) estimates that weekly US gasoline demand rose by 547,000 bpd or 6% to 9,816,000 bpd on June 9–16, 2017.

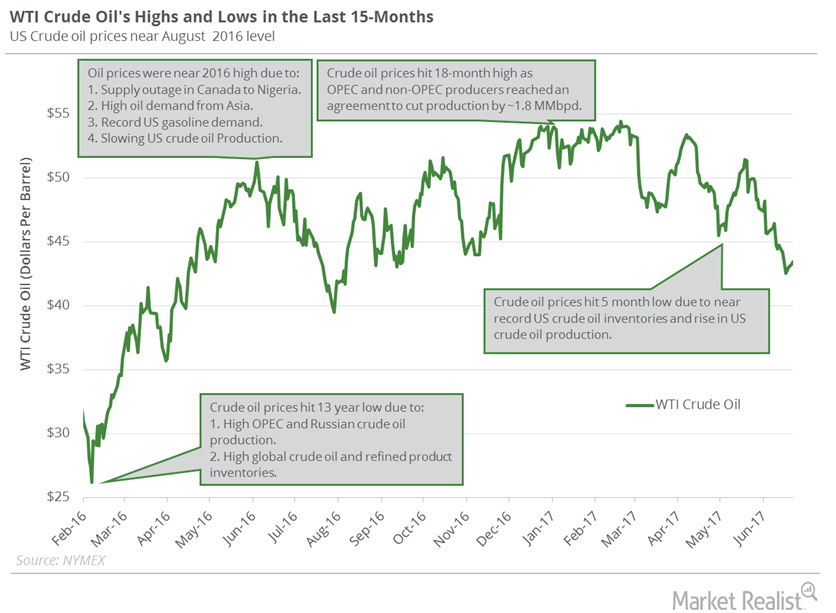

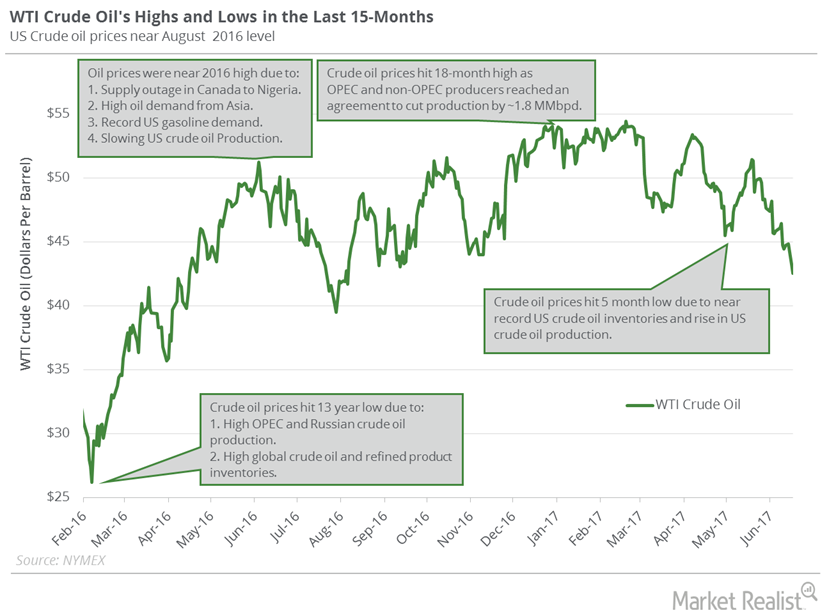

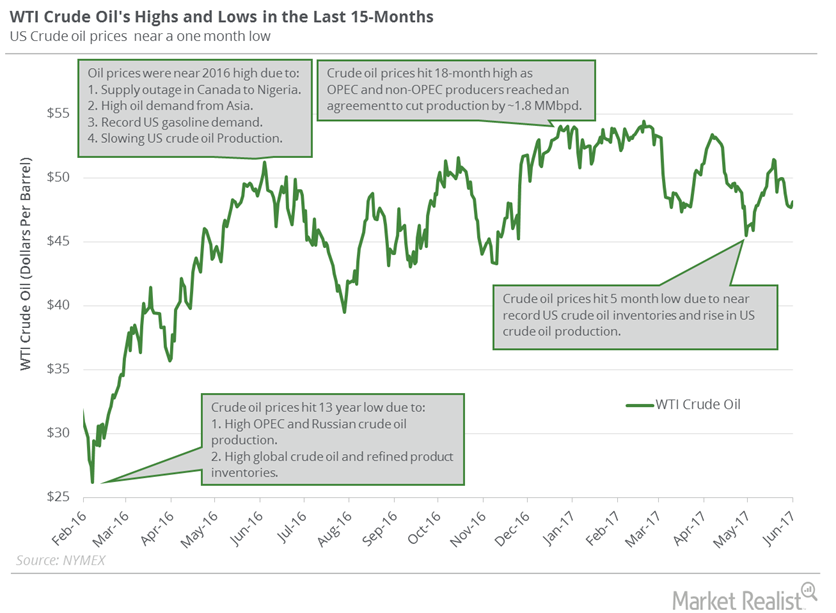

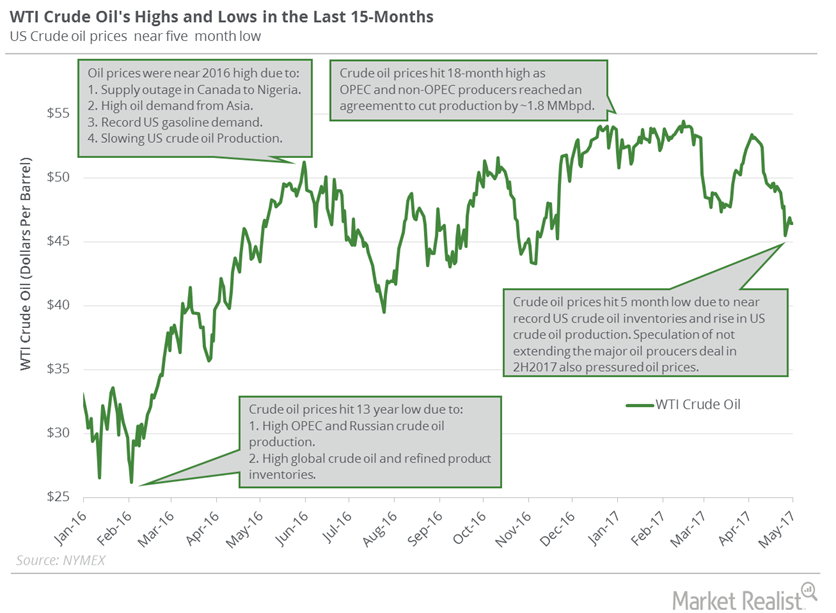

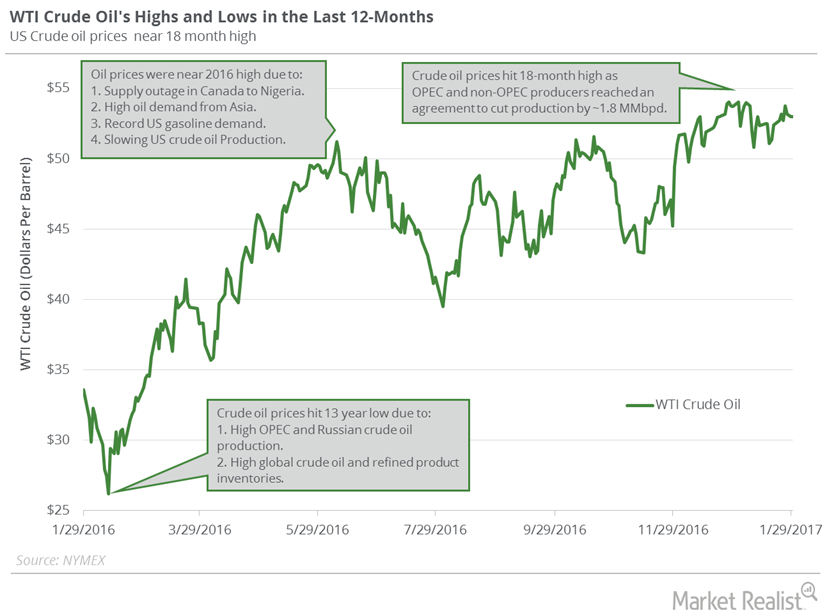

Key Support and Resistance Levels for US Crude Oil Futures

August US crude oil futures key support level is $43 per barrel. Prices tested this level three times in the last 15 months.

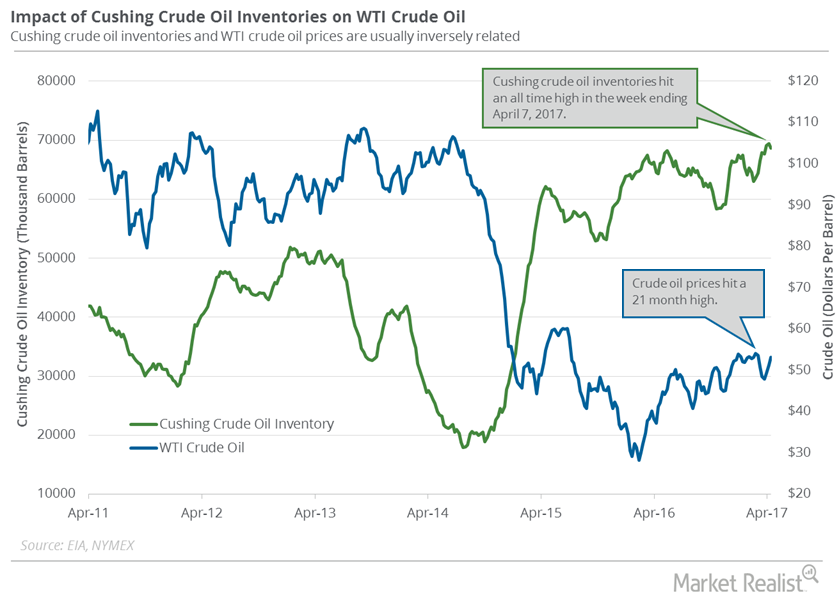

Cushing Inventories Fell for the Ninth Time in 10 Weeks

The EIA (U.S. Energy Information Administration) will release weekly data on crude oil and gasoline inventories on June 28, 2017.

US Crude Oil Prices Could Be Range Bound Next Week

August WTI (West Texas Intermediate) crude oil (XOP) (VDE) (RYE) futures contracts rose 0.5% and closed at $42.74 per barrel on June 22, 2017.

What US Crude Oil Inventories Mean for Oil

The EIA reported that US crude oil inventories fell by 2.7 MMbbls (million barrels) to 509.1 MMbbls on June 9–16, 2017.

Analyzing Iran’s Crude Oil Production and Export Plans

Iran’s crude oil production is at a seven-year high. Iran was able to scale up production after the US lifted sanctions on the country in January 2016.

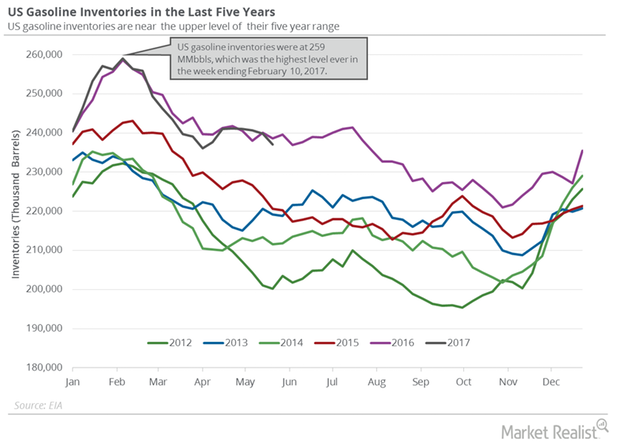

Analyzing US Gasoline Inventories and Gasoline Demand

US gasoline inventories rose by 2.1 MMbbls to 242.3 MMbbls on June 2–9, 2017. Inventories rose 0.9% week-over-week and 2.3% year-over-year.

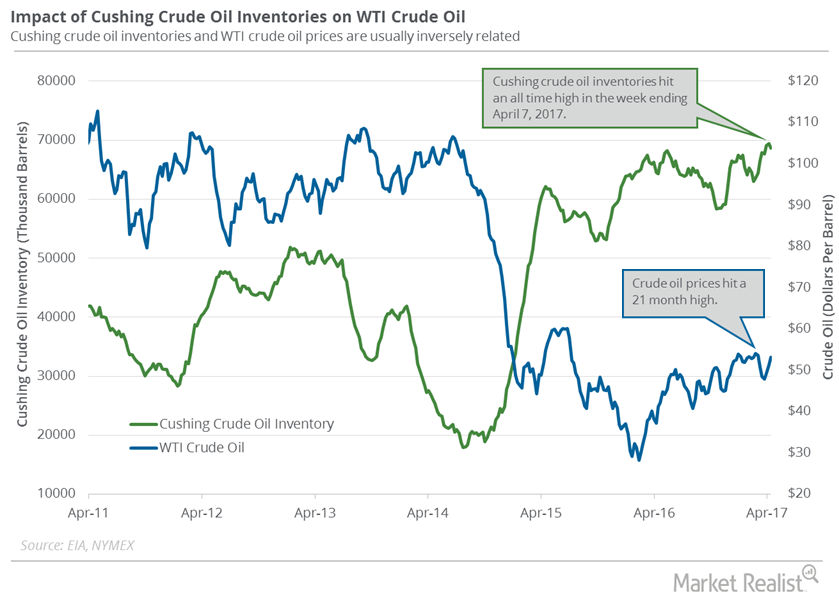

Cushing Crude Oil Inventories Fell Again

A recent survey estimated that inventories at Cushing could have fallen on June 2–9, 2017. Inventories at Cushing fell for the seventh time in ten weeks.

US Gasoline Inventories: More Concerns for Crude Oil Prices

US gasoline inventories are 7.2% below their all-time high. The expectation of a fall in gasoline inventories could support gasoline prices.

US Gasoline Consumption Rose in May

The EIA estimates that US gasoline consumption averaged 9,600,000 bpd (barrels per day) in May 2017—0.16 MMbpd higher than the same period in 2016.

What to Expect from Crude Oil Futures This Week

US crude oil (USO) (IXC) (IYE) (PXI) prices are near their one-month low. Lower crude oil prices have a negative impact on oil producers’ earnings.

US Gasoline Demand Could Hit a Peak This Summer

The EIA estimated that four-week average US gasoline demand rose by 124,000 bpd (barrels per day) to 9,430,000 bpd on May 12–19, 2017.

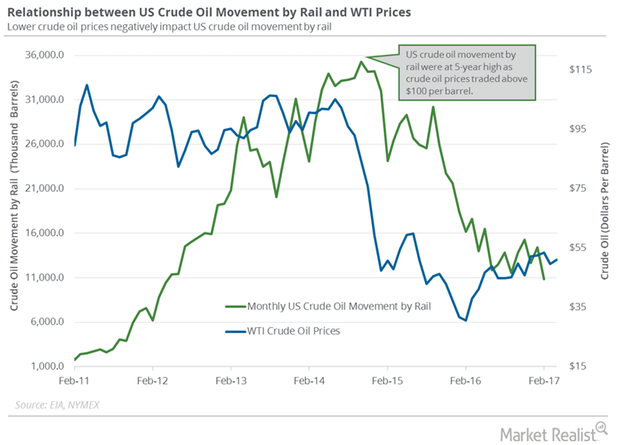

How Did Crude Oil Movement by Rail Trend in February 2017?

The US Energy Information Administration estimates that US crude oil movement by rail fell by 3,546,000 barrels to 10,850,000 barrels in February 2017.

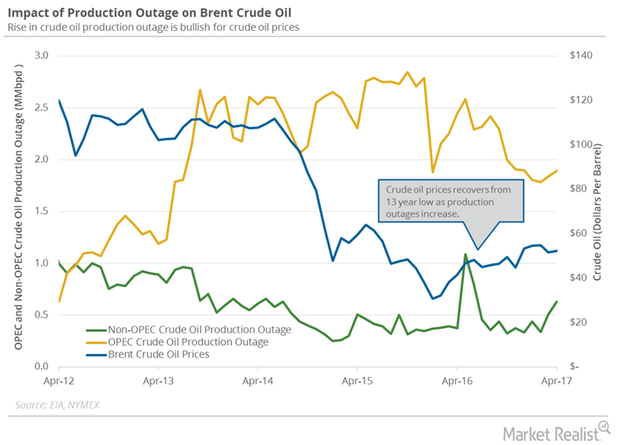

Global Crude Oil Supply Outages Could Help Crude Oil Bulls

The EIA estimated that global crude oil supply outages rose by 181,000 bpd (barrels per day) to 2.52 MMbpd in April 2017—compared to March 2017.

Analyzing Libya and Nigeria’s Crude Oil Production

Libya’s crude oil production hit ~814,000 bpd in early May 2017. Bloomberg estimates that production is at the highest level since October 2014.

WTI Crude Oil and Gasoline Futures Diverge

US gasoline futures contracts for June delivery fell 0.1% to $1.60 per gallon on May 17, 2017. Prices fell due to a lower fall in US gasoline inventories.

Is US Gasoline Demand Turning Bearish?

The EIA estimated that four-week average US gasoline demand fell by 22,000 bpd (barrels per day) to 9,215,000 bpd on April 21–28, 2017.

Could Crude Oil Prices Hit Lows from 2016?

WTI (West Texas Intermediate) crude oil (FXN) (SCO) (FENY) futures contracts for June delivery are near a five-month low as of May 9, 2017.

Cushing Crude Oil Inventories Fell for 3rd Consecutive Week

Market surveys estimate that Cushing crude oil inventories rose between April 28 and May 5, 2017.

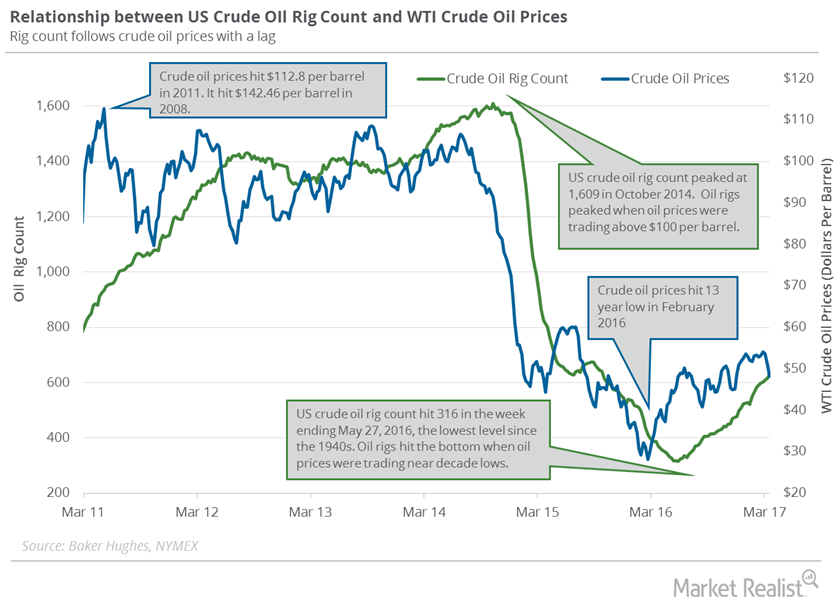

US Crude Oil Rig Count Hit a 2-Year High

Baker Hughes (BHI) released its weekly US crude oil rig count on April 28, 2017. It reported that crude oil rigs rose by nine to 697 on April 21–28, 2017.

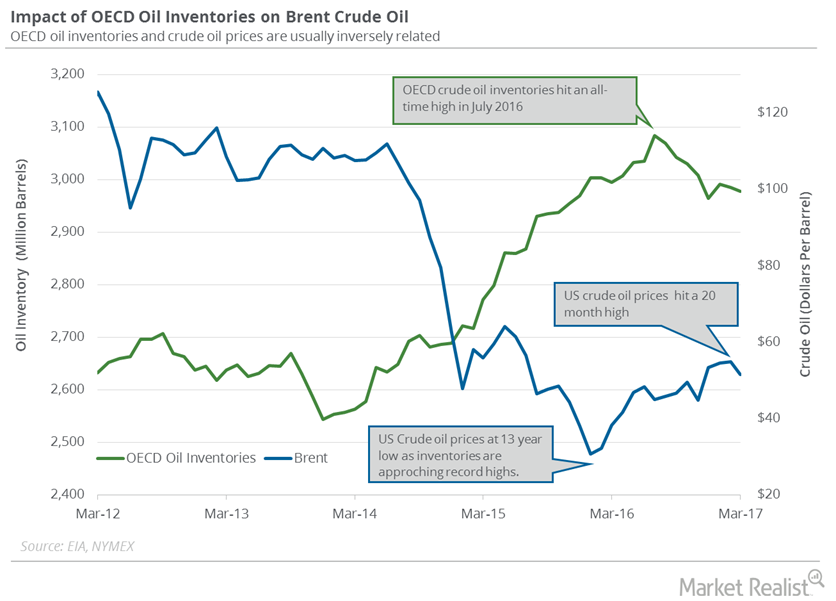

OECD’s Crude Oil Inventories Impact Crude Oil Futures

The EIA estimates that OECD’s crude oil inventories fell by 7.69 MMbbls (million barrels) to 2,977 MMbbls in March 2017—compared to the previous month.

Cushing Crude Oil Inventories Fell from an All-Time High

For the week ending April 14, 2017, the EIA reported that Cushing crude oil inventories fell by 0.8 MMbbls (million barrels) to 68.6 MMbbls.

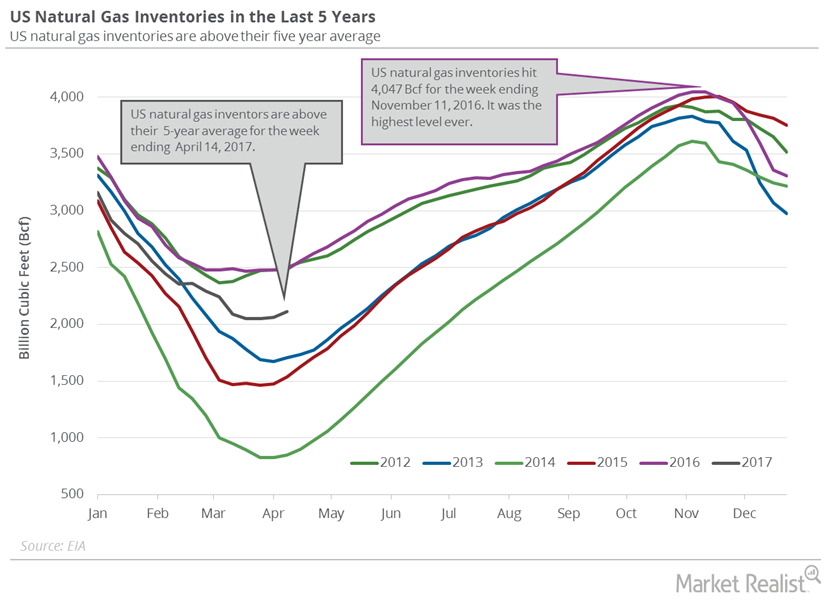

US Natural Gas Inventories Pressure Prices

The EIA reported that US natural gas inventories rose by 54 Bcf to 2,115 Bcf on April 7–14, 2017. Inventories rose 2.6% week-over-week but fell 14.8% YoY.

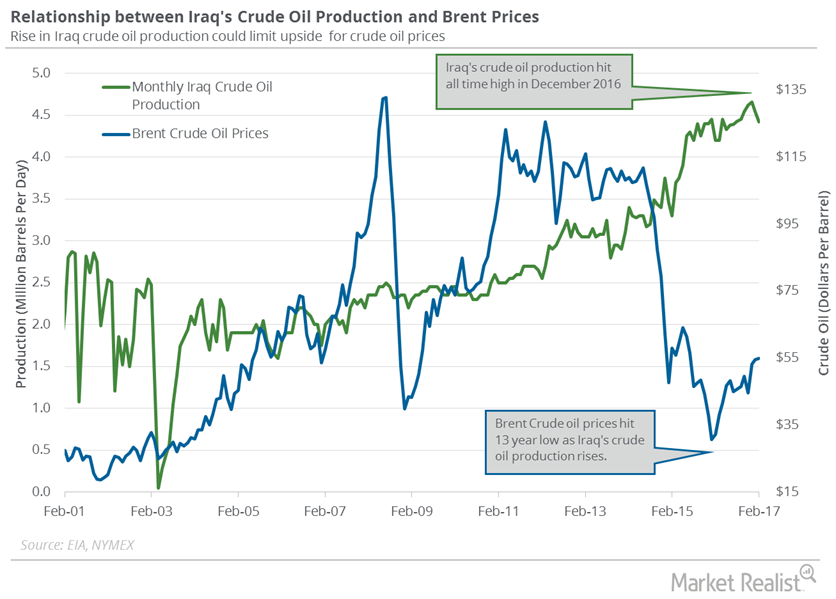

Iraq’s Crude Oil Production: More Pain for Crude Oil Bears

The EIA estimates that Iraq’s crude oil production fell by 115,000 bpd (barrels per day) to 4.42 MMbpd in February 2017—compared to the previous month.

Janet Yellen and the US Dollar Impacted Crude Oil Prices

The US dollar and crude oil (ERY) (ERX) (DIG) (XES) are usually inversely related. A weaker US dollar makes crude oil more affordable for oil importers.

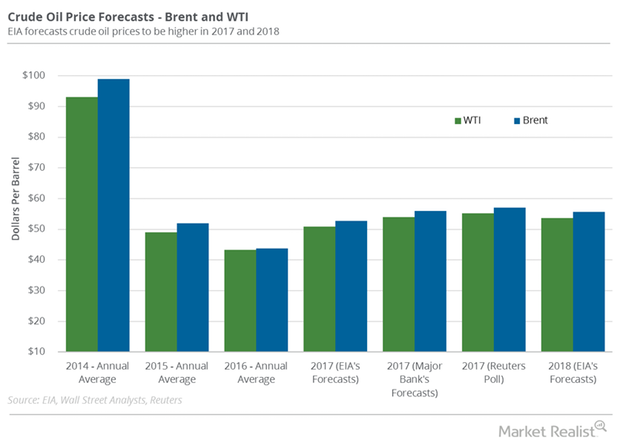

Decoding US Crude Oil Prices in the Last 12 Months

As of January 27, 2017, crude oil prices rose 103% from their 2016 lows. Higher crude oil prices have a positive impact on producers’ earnings.

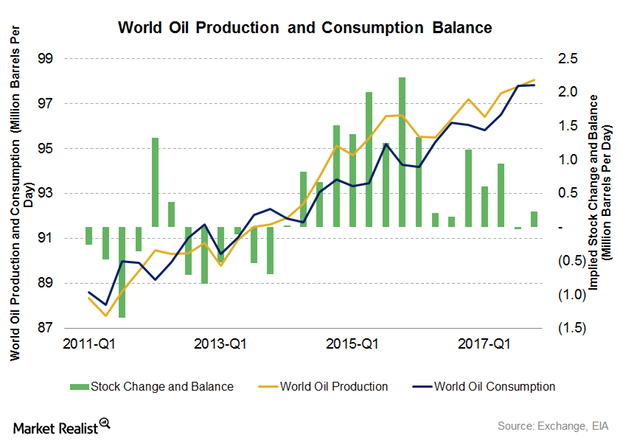

Decoding the World Oil Supply and Demand Gap in 2017

The EIA estimates that the world oil supply and demand gap averaged 780,000 bpd (barrels per day) in 1H16. It’s expected to average 650,000 bpd in 2H16.

Will OECD Crude Oil Inventories Impact Crude Oil Prices in 2017?

The EIA estimates that OECD crude oil inventories rose by 15.9 MMbbls to 3,061 MMbbls in November 2016—compared to the previous month.

US Crude Oil Inventories Supported Crude Oil Prices

The EIA (U.S. Energy Information Administration) reported that US crude oil inventories fell by 884,000 barrels to 488.1 MMbbls from November 18–25, 2016.