Russian and US Crude Oil Exports Are Important for Oil Bears

US crude oil exports fell by 1,264,000 bpd or 60% to 869,000 bpd on October 27–November 3, 2017. Exports rose by 459,000 bpd from the same period in 2016.

Nov. 15 2017, Published 8:15 a.m. ET

US crude oil exports fell

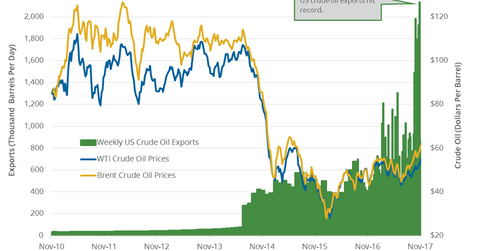

US crude oil exports fell by 1,264,000 bpd or 60% to 869,000 bpd on October 27–November 3, 2017. Exports rose by 459,000 bpd or 112% from the same period in 2016. Meanwhile, US crude oil exports hit a record 2,133,000 bpd for the week ending October 27, 2017. Exports rose due to the oil export ban being lifted, a rise in US crude oil production, and a wider spread between Brent and WTI (West Texas Intermediate) oil prices.

Near record US crude oil exports benefit WTI crude oil (USO) (DWT) (UWT) prices. High oil prices benefit oil producers (PXI) (FENY) like Anadarko Petroleum (APC), Occidental Petroleum (OXY), and Cobalt International Energy (CIE).

Russia’s crude oil exports

According to Russia’s energy ministry, the country’s crude oil exports rose 12.8% in October 2017—compared to the previous month. So far, crude oil exports have risen 2.62% in 2017.

A rise in Russia’s crude oil exports could increase global crude oil supplies and weigh on oil prices (BNO) (USL). Lower oil prices have a negative impact on oil producers (IEO) (FXN) like Rosneft, BP (BP), Lukoil, Total SA (TOT), ExxonMobil (XOM), and Petro China (PTR).

Russia and ongoing production cuts

Russia (RSX) agreed to cut the output by 300,000 bpd as part of the production cuts. Russia’s crude oil output has fallen by 317,000 bpd or 2.8% as of October 2017 from 11,247,000 bpd in October 2016. Russia’s crude oil exports rose despite ongoing production cuts.

Impact

High exports from the US would add to global crude oil supplies and weigh on Brent oil prices (BNO). Higher exports from Russia and the US could offset some of the impacts from the production cuts and weigh on oil (DBO) (USL) prices.

In the next part, we’ll discuss the IEA’s monthly oil market report.