Cobalt International Energy Inc

Latest Cobalt International Energy Inc News and Updates

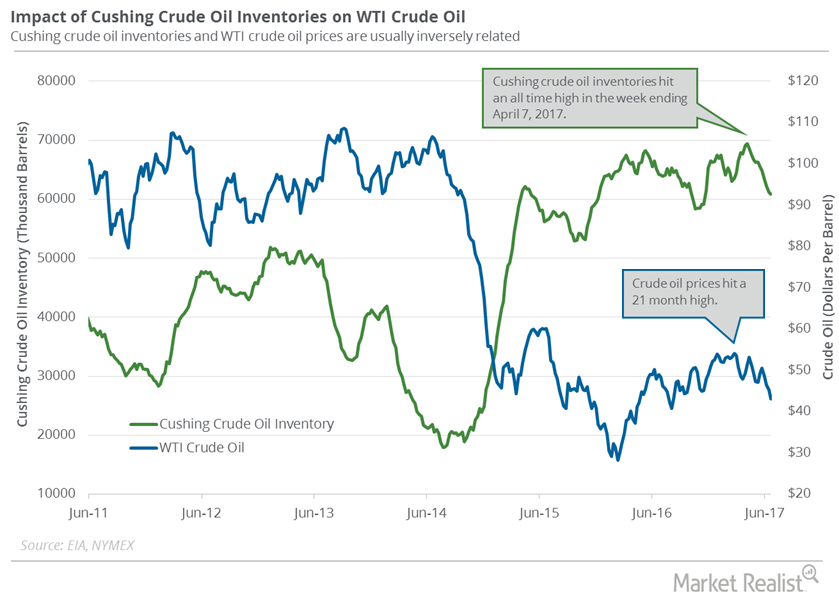

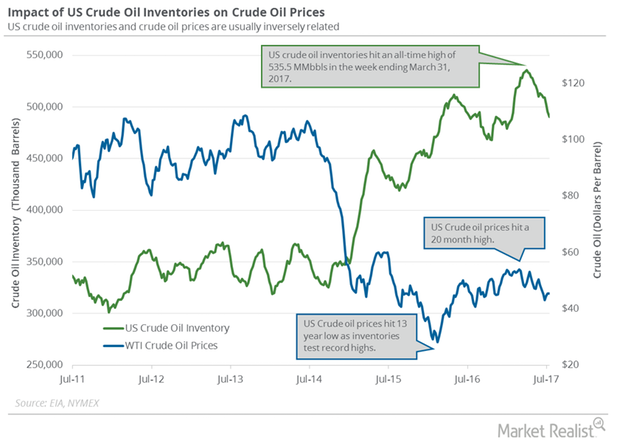

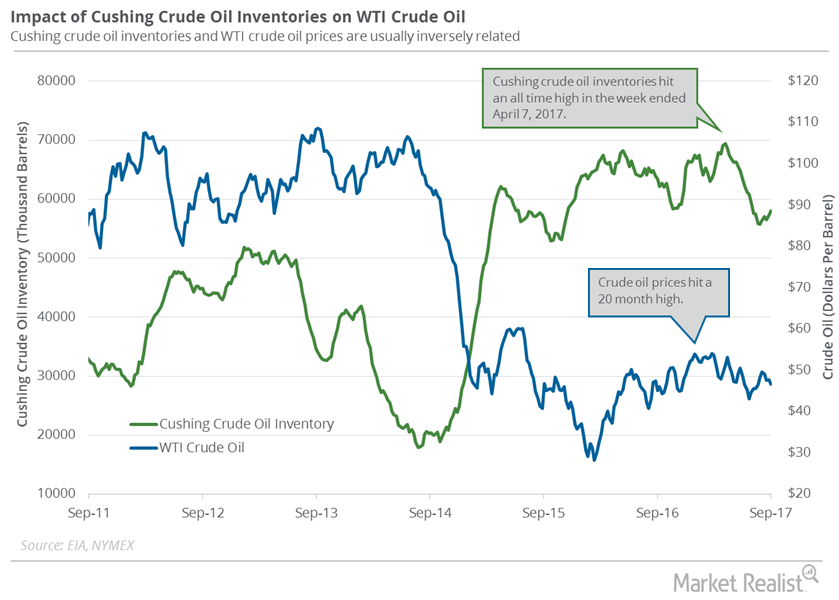

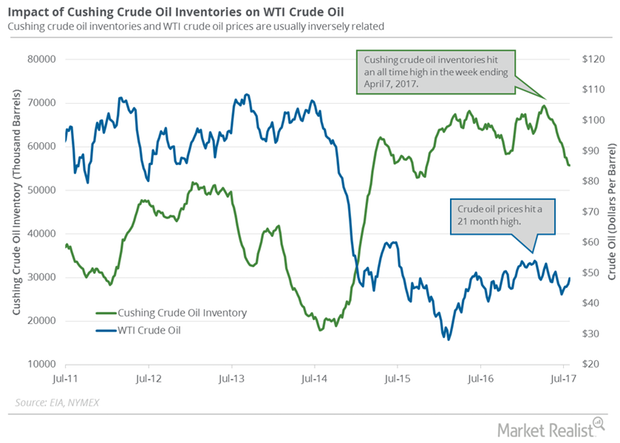

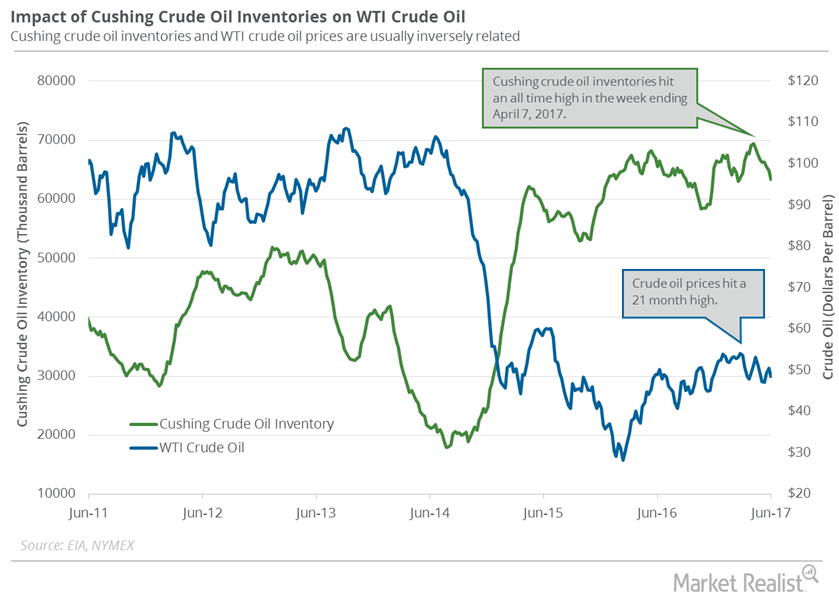

Cushing Inventories Have Fallen 10% in the Last 10 Weeks

Cushing crude oil inventories have fallen 10% in the last ten weeks. A better-than-expected fall in Cushing inventories could support US crude oil prices.

OPEC and Non-OPEC Meeting Could Drive Crude Oil Futures

August US crude oil futures contracts rose 0.4% and closed at $44.4 per barrel on July 10. Brent crude oil futures rose 0.4% to $46.8 per barrel.

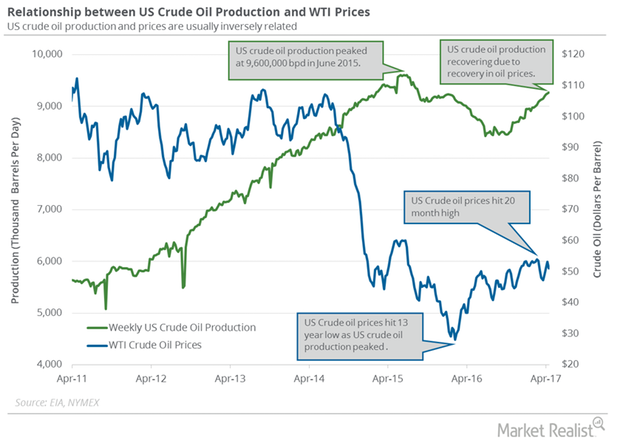

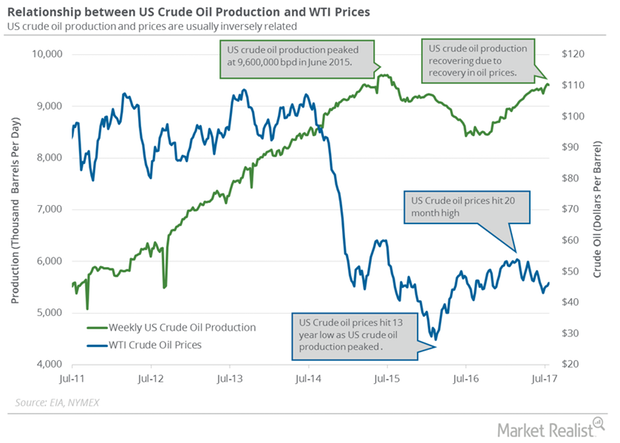

US Crude Oil Production Is near August 2015 High

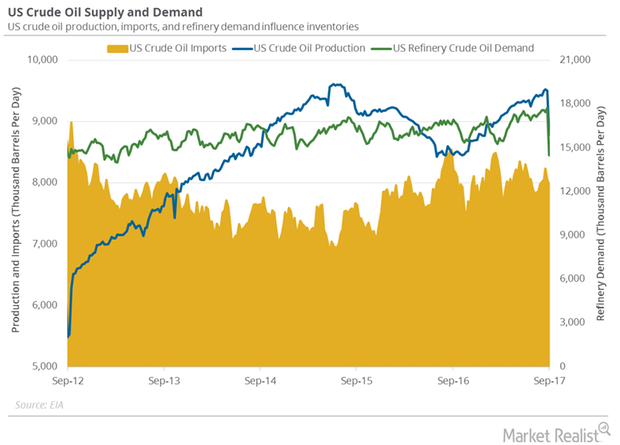

The EIA (U.S. Energy Information Administration) reported that US crude oil production rose by 13,000 bpd (barrels per day) to 9,265,000 bpd on April 14–21.

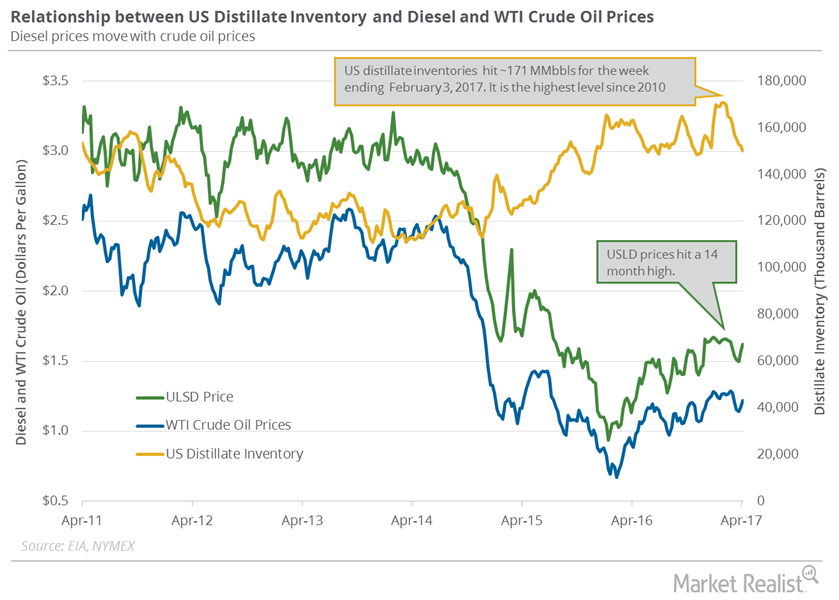

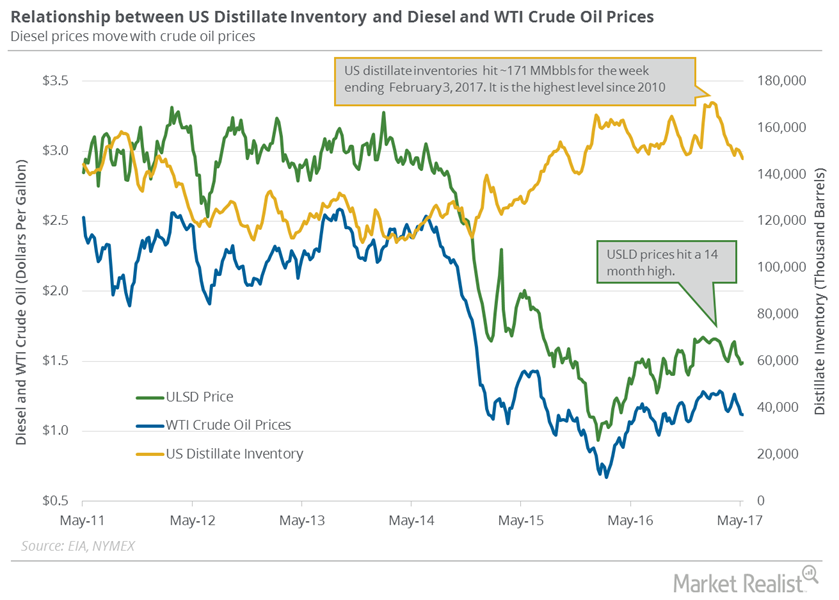

How US Distillate Inventories Affect Diesel and Oil Prices

The EIA (U.S. Energy Information Administration) reported that US distillate inventories fell by 2.2 MMbbls (million barrels) to 150.2 MMbbls between March 31 and April 7, 2017.

US Crude Oil Imports from Saudi Arabia Hit a 7-Year Low

US crude oil imports have fallen 4.5% YTD. US crude oil imports from Saudi Arabia are at a seven-year low at 524,000 bpd for the week ending July 14, 2017.

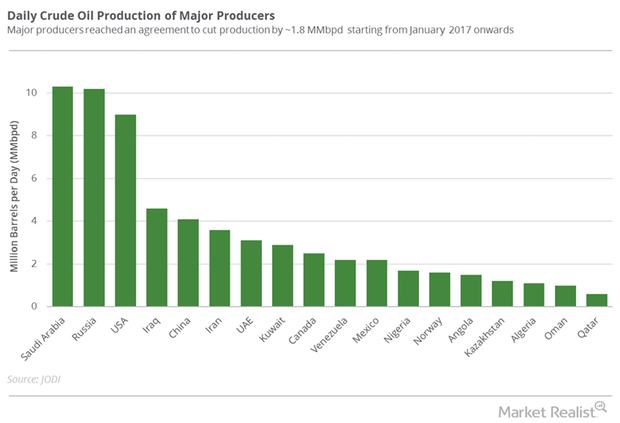

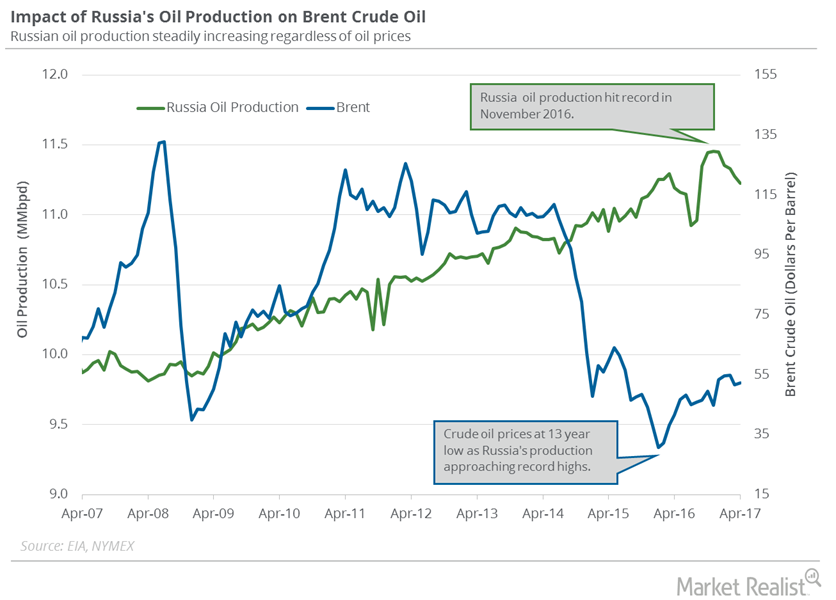

Russia Could Leave OPEC’s Production Cut Deal

Rosneft is Russia’s largest oil producer. On June 1, a Rosneft board member stated that Russia wouldn’t extend the production cut deal beyond March 2018.

US Distillate Inventories Fell for the Third Straight Week

The EIA reported that US distillate inventories fell by 1.9 MMbbls (million barrels) to 146.8 MMbbls on May 5–12, 2017.

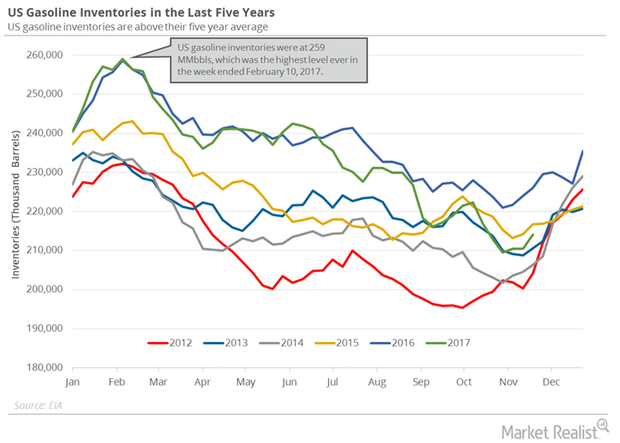

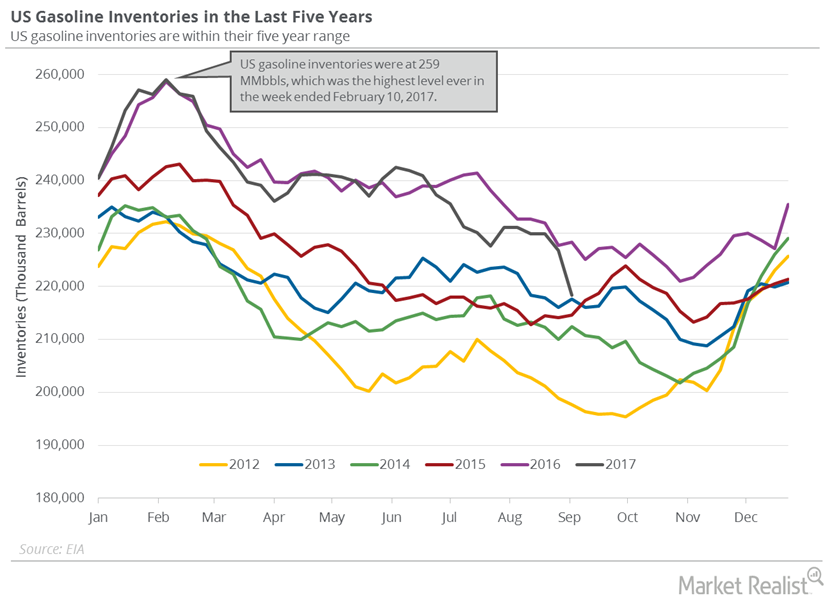

Analyzing US Gasoline Inventories and Demand

The API reported that US gasoline and distillate inventories rose by 9,200,000 barrels and 4,300,000 barrels on November 24–December 1, 2017.

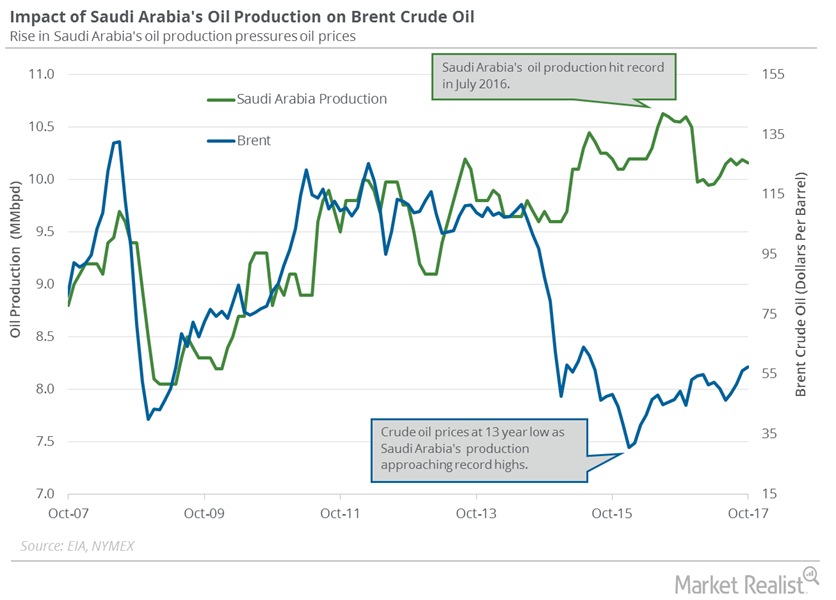

Saudi Arabia Could Help the Global Oil Market

Saudi Arabia’s crude oil exports to the US fell to 525,000 bpd in October 2017—the lowest in 30 years. Exports fell due to ongoing output cuts.

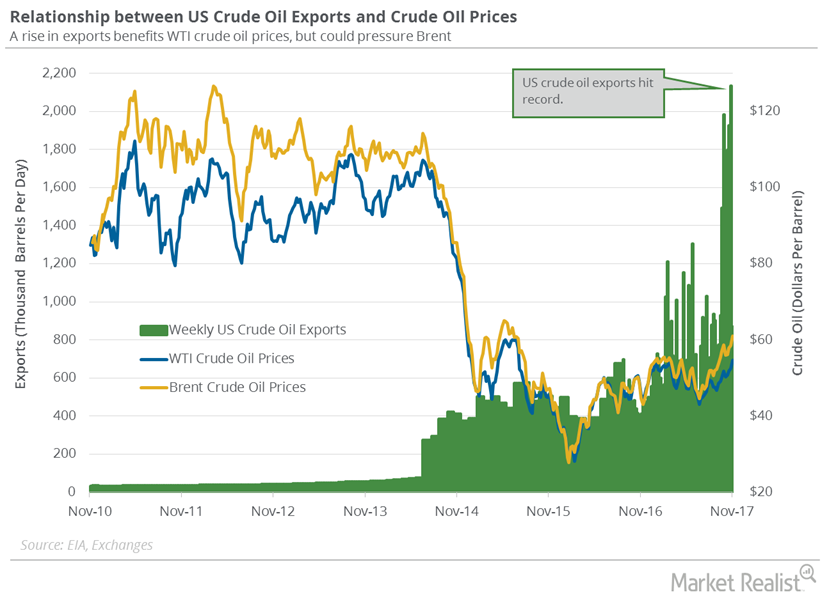

Russian and US Crude Oil Exports Are Important for Oil Bears

US crude oil exports fell by 1,264,000 bpd or 60% to 869,000 bpd on October 27–November 3, 2017. Exports rose by 459,000 bpd from the same period in 2016.

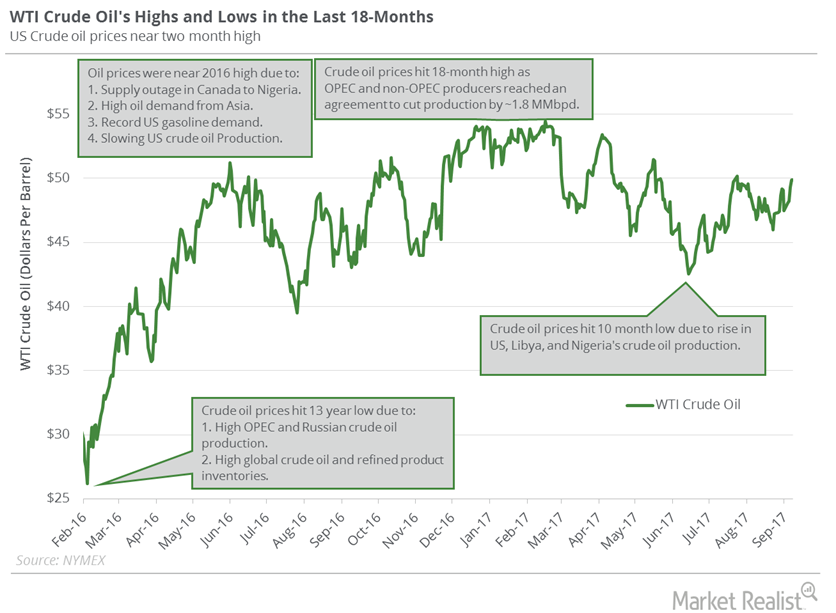

Will US Crude Oil Futures Break $50 per Barrel?

Let’s track some important events for crude oil and natural gas traders between September 18 and September 22.

US Gasoline Inventories’ Largest Weekly Drop in 27 Years

The EIA (U.S. Energy Information Administration) released its weekly crude oil inventory report on September 13.

Hurricanes Could Impact Global and US Crude Oil Demand

West Texas Intermediate crude oil (DBO) (DIG) (XLE) futures contracts for October delivery rose 1.2% to $48.07 per barrel on September 11, 2017.

Why Cushing Crude Inventories Rose for the 4th Time in 5 Weeks

A market survey estimates that Cushing crude oil inventories fell from September 1 to 8, 2017. Cushing crude oil inventories rose for the fourth time in the last five weeks.

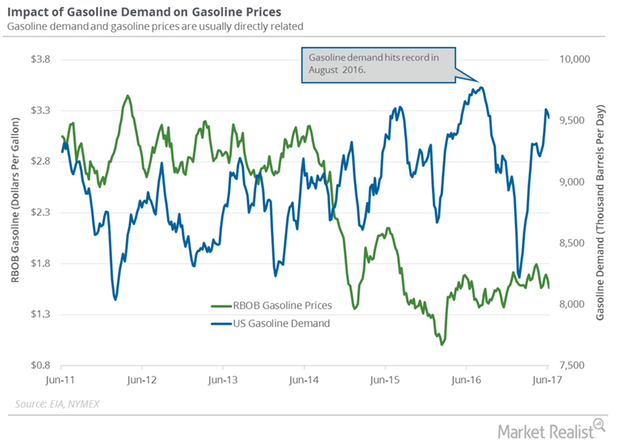

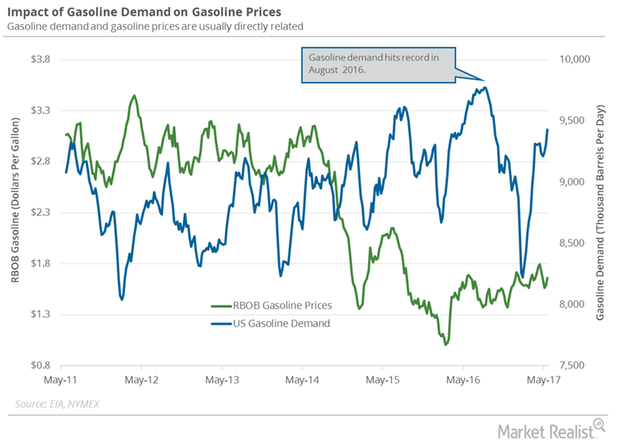

Will US Gasoline Demand Impact Gasoline and Crude Oil Futures?

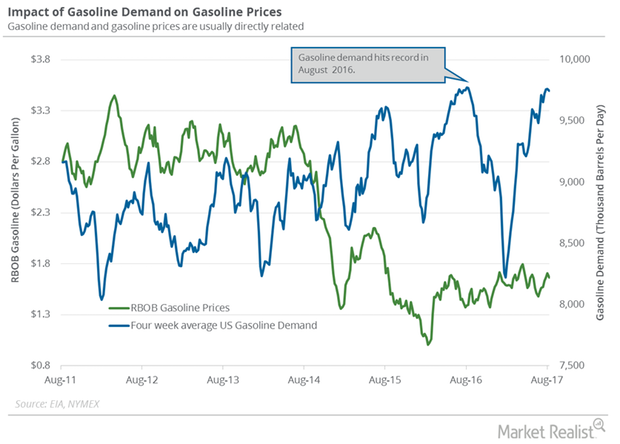

The EIA estimates that weekly US gasoline demand rose 107,000 bpd (barrels per day), or 1.1%, to 9.6 MMbpd between August 11 and August 18.

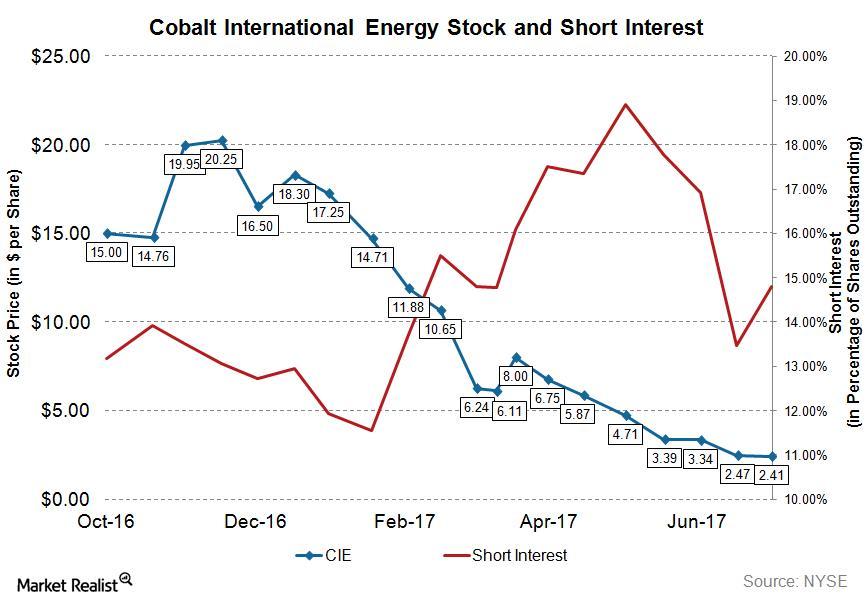

Analyzing Short Interest in Cobalt International Energy’s Stock

As of July 14, 2017, Cobalt International Energy’s (CIE) total shares shorted (or short interest) was 4.37 million, whereas its average daily volume is 1.03 million.

Cushing Inventories Fell 20% from the Peak

A preliminary market survey estimates that Cushing inventories fell on July 28–August 4, 2017. Inventories fell for the 11th consecutive week.

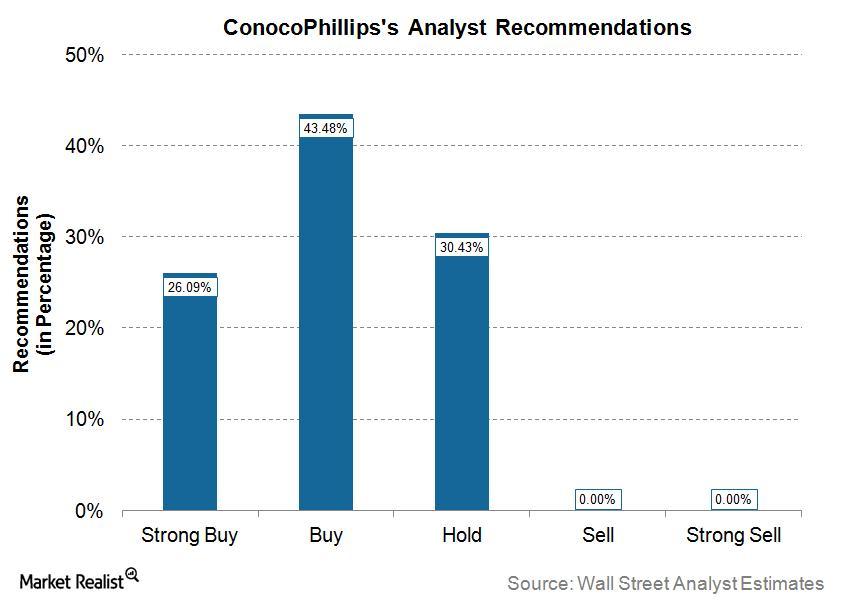

What Wall Street Analysts Are Saying about ConocoPhillips

As of July 28, 2017, 43.48% of the total Wall Street analysts covering ConocoPhillips (COP) have a “hold” recommendation on ConocoPhillips.

Will US Crude Oil Production Slow Down in 2018?

The EIA reported that US crude oil production fell by 19,000 bpd (barrels per day) to 9,410,000 bpd on July 14–21, 2017.

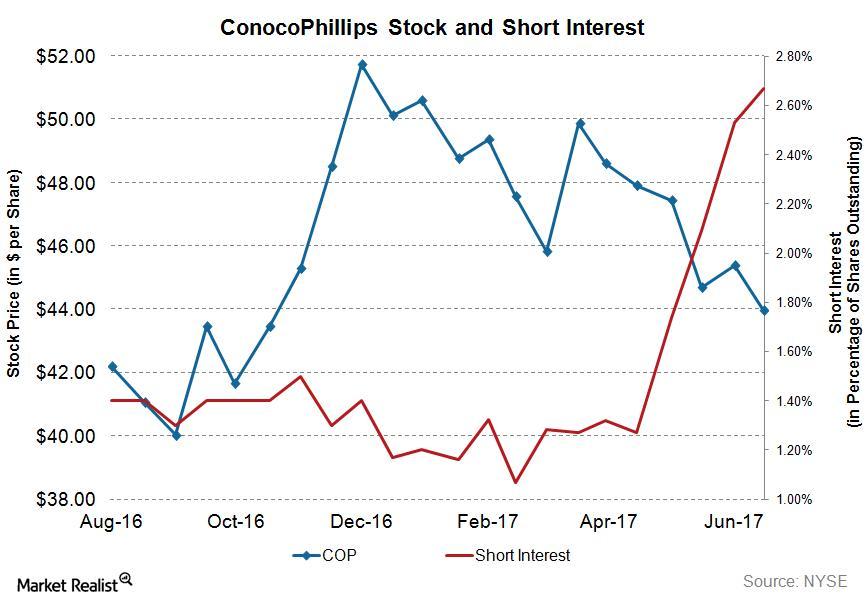

Analyzing Short Interest in ConocoPhillips Stock

On March 31, 2017, 1,282 13F filers held ConocoPhillips (COP) stock in their portfolios. However, only 19 filers featured COP in their top ten holdings.

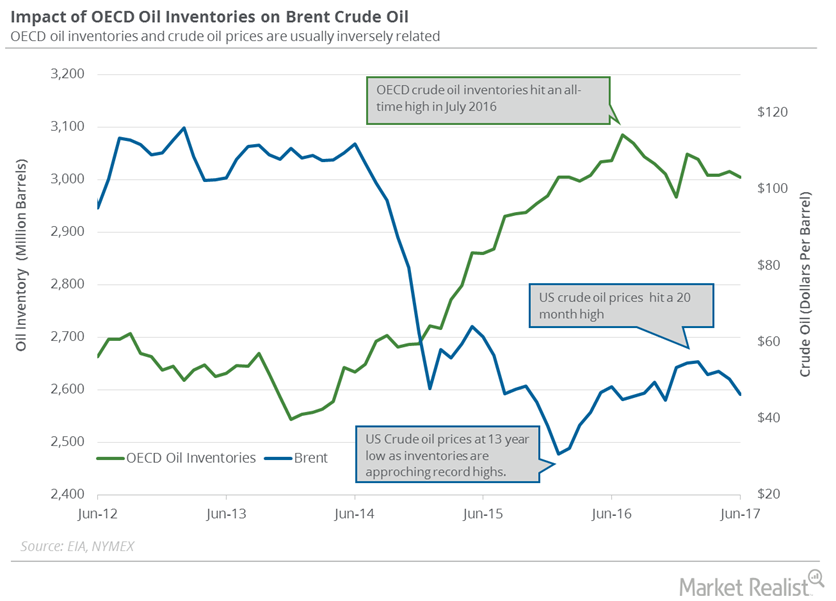

Will OECD’s Crude Oil Inventories Fall below the 5-Year Average?

The EIA estimates that OECD’s crude oil inventories fell by 10.13 MMbbls (million barrels) to 3,005 MMbbls in June 2017—compared to May 2017.

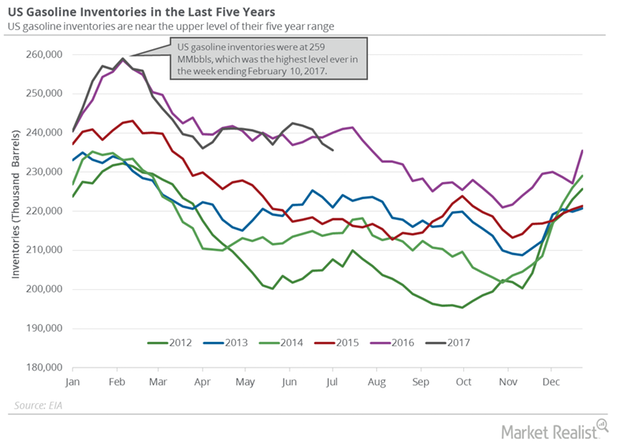

US Gasoline Inventories Support Gasoline, Crude Oil Futures

The EIA reported that US gasoline inventories fell 1.6 MMbbls (million barrels) to 235.6 MMbbls between June 30, 2017, and July 7, 2017.

US Gasoline Demand: Positive or Negative for Crude Oil?

The EIA (U.S. Energy Information Administration) estimates that weekly US gasoline demand rose by 547,000 bpd or 6% to 9,816,000 bpd on June 9–16, 2017.

Cushing Crude Oil Inventories Fell Again

A recent survey estimated that inventories at Cushing could have fallen on June 2–9, 2017. Inventories at Cushing fell for the seventh time in ten weeks.

US Gasoline Demand Could Hit a Peak This Summer

The EIA estimated that four-week average US gasoline demand rose by 124,000 bpd (barrels per day) to 9,430,000 bpd on May 12–19, 2017.

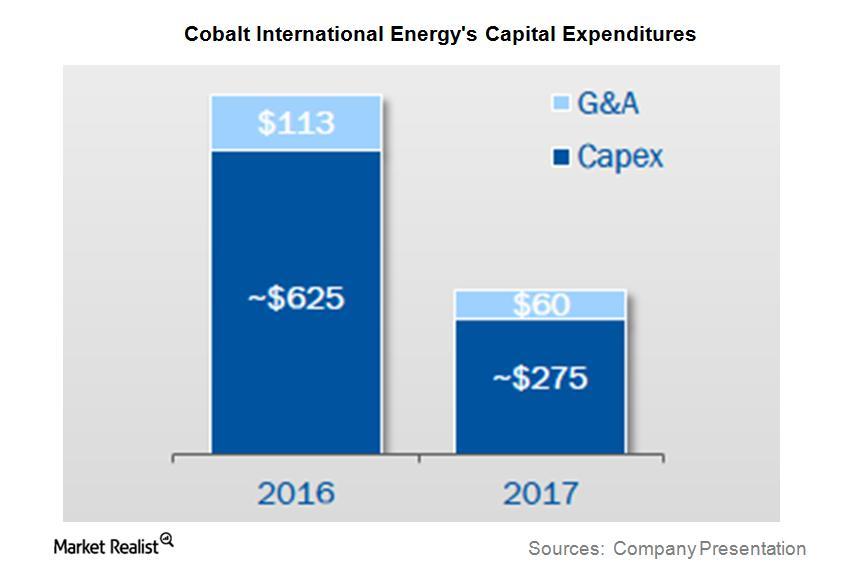

Cobalt International Energy’s Capital Expenditure Guidance

For fiscal 2017, Cobalt International Energy (CIE) plans to spend significantly lower on capex (capital expenditure), or ~56.0% less than fiscal 2016.

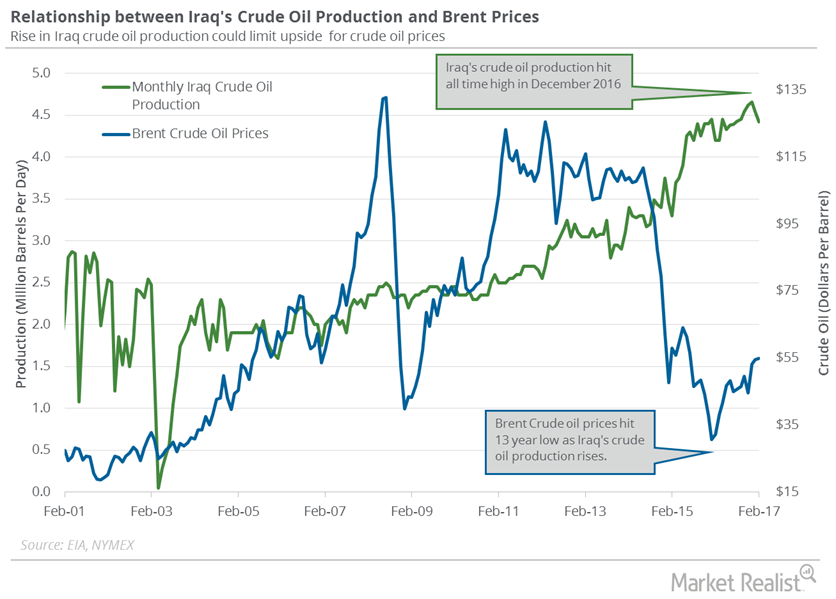

Iraq’s Crude Oil Production: More Pain for Crude Oil Bears

The EIA estimates that Iraq’s crude oil production fell by 115,000 bpd (barrels per day) to 4.42 MMbpd in February 2017—compared to the previous month.Industrials Paulson & Co. buy a new stake in Verizon Communications in 1Q14

Paulson took a new position in Verizon Communications (VZ) last quarter. The position accounts for 2.04% of Paulson’s $20 billion portfolio.