How Traders Benefit from the Crude Oil Contango Market

The EIA estimates that contango trade will be unviable until contango conditions reach $10–$12 per barrel. Citigroup suggests that if oil prices fall below $30 per barrel, it will be unviable to store crude oil at sea.

Feb. 5 2016, Published 7:19 a.m. ET

Crude oil contango market

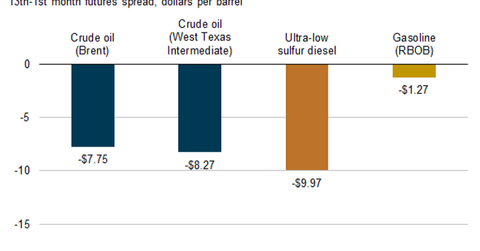

The rising crude oil inventory, as discussed in the previous part of this series, led to the opportunity to store crude oil and sell it at higher prices in the future. This opportunity is viable when the cost of buying and storing crude oil is less than the price of crude oil futures contracts. The chart below shows the difference between front-month crude oil futures contracts and 13-month futures contracts. The positive difference between the future-dated and the front-month prices is called a contango market.

Cost of storing crude oil

Crude oil traders like Vitol Group and BP (BP) take advantage of the broader contango market. These traders buy front-month crude oil futures contracts and take delivery upon their expiration. They store this crude oil in Cushing, Oklahoma, and then sell it at higher prices in six months. Industry surveys estimate that leasing costs at large tanks in Cushing were 25–35 cents per barrel per month compared to the 12-month contango price of $8.27 per barrel, as shown in the chart above. Thus, the storage cost of crude oil for 12 months could be $4.20 per barrel at most, keeping administrative fees and other pumping costs at $1 per barrel for 12 months. This means traders could make a profit of $3 per barrel.

Further, the EIA (U.S. Energy Information Administration) estimates that storing crude oil in large oil tankers for several months is expensive. It estimates that the trade will be unviable until contango conditions reach $10–$12 per barrel. Citigroup suggests that if oil prices fall below $30 per barrel, it would be unviable to store crude oil at sea.

Effect on crude oil tankers

However, long-term oversupply and the broader contango market have benefited oil tankers like Nordic American Tankers (NAT), Teekay Tankers (TNK), Frontline (FRO), Euronav (EURN), DHT Holdings (DHT), and Tsakos Energy Navigation (TNP).

The steep contango conditions in the ultra-low sulfur diesel market provide opportunity for contango traders and supertankers. Ultra-low sulfur diesel inventories in the United States have risen more than total motor gasoline inventories since the middle of June 2014.

ETFs and ETNs like the United States Oil Fund (USO), the iPath S&P GSCI Crude Oil Total Return Index ETN (OIL), the VelocityShares 3X Long Crude Oil ETN (UWTI), and the ProShares UltraShort Bloomberg Crude Oil ETF (SCO) are also influenced by the rises and falls in crude oil prices.

In the next part of this series, we’ll shift our focus to the US crude oil rig count.