Frontline Ltd

Latest Frontline Ltd News and Updates

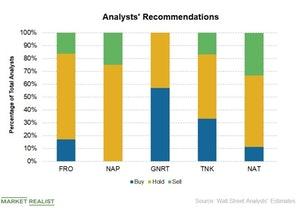

Analysts’ Recommendations for Crude Tanker Stocks

In Week 28, analysts made no target price revisions or recommendation changes for crude tanker companies.

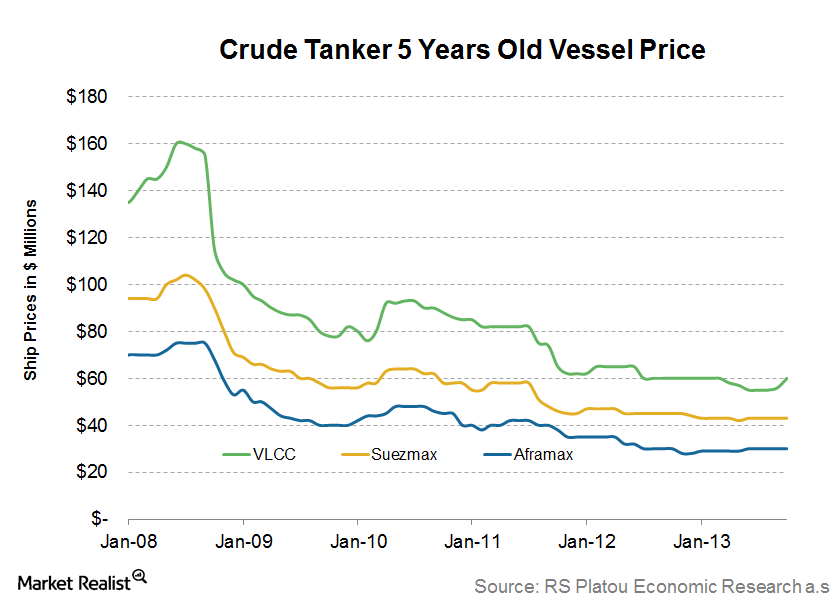

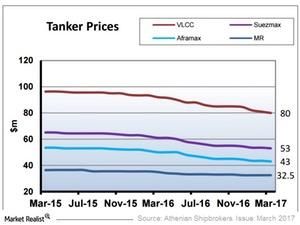

Why current secondhand oil tanker values suggest a mixed outlook

While the VLCC data is positive, the picture for the crude tanker business remains mixed. This could portray a short-to-medium-term negative outlook.

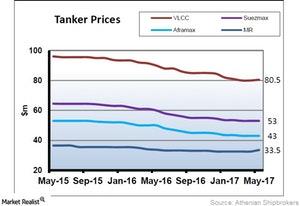

VLCC Prices Rose First Time in 2017

Newbuild VLCC (very large crude carrier) prices rose in May 2017, and this is the first time we’ve seen a rise in prices this year.

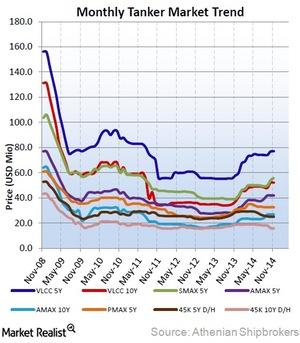

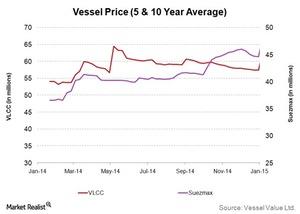

Five-year and ten-year VLCC prices increase

With faster deliveries and employment of vessels, secondhand vessels tend to reflect industry participants’ expectations for medium-term fundamentals.Energy & Utilities 5-year-old and 10-year-old VLCC prices stay at consistent levels

Since secondhand vessels can be delivered within a few months, they tend to reflect industry participants’ expectations for medium-term fundamentals and rates, unlike newbuilds, for which two years of delivery time is mandatory.

5- and 10-year VLCC and Suezmax weekly prices on the run-up

Weekly vessel values have been on the rise, with positive week-over-week and significant year-over-year growth.

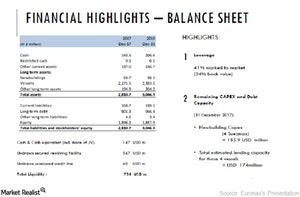

Euronav and Gener8 Maritime Partners’ Merger

On December 21, 2017, Euronav (EURN) and Gener8 Maritime Partners (GNRT) announced a stock-for-stock merger.

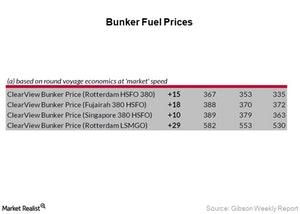

Oil Price Reach 3-Year High: What about Bunker Fuel Prices?

On January 4, 2018, the average bunker fuel price was $431 per ton—compared to $413 per ton on December 21, 2017.

What Current Tanker Prices Tell Us about the Tanker Industry

Newbuild vessel prices fell in March 2017. We saw in our last month’s series that newbuild vessel prices also fell in February.

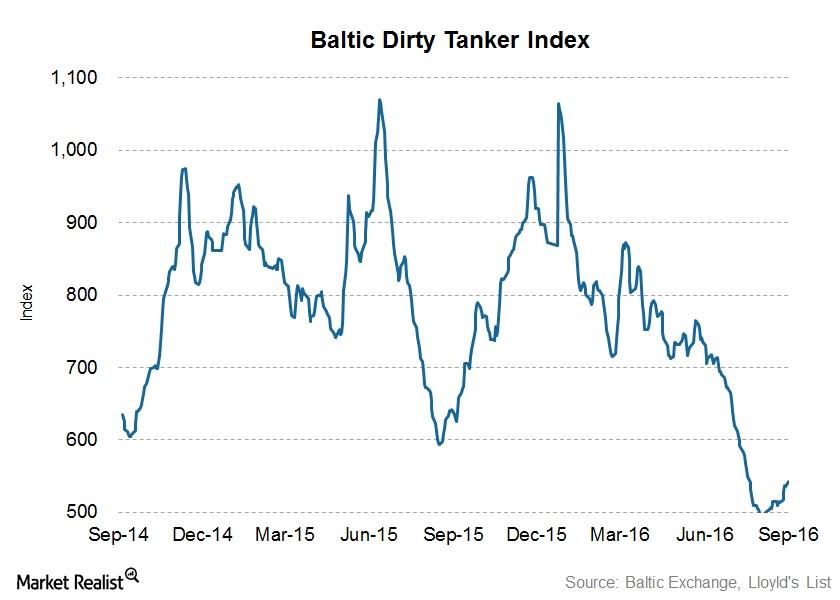

Performance of Baltic Dirty Tanker Index in Focus

The BDTI (Baltic Dirty Tanker Index) stood at 554 on September 12, 2016. For the week ended September 9 (Week 36), the BDTI rose to 542 from 516 at the beginning of the week.

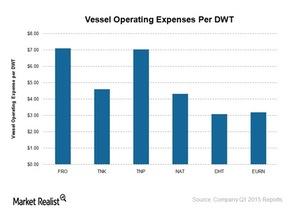

Comparing Tanker Companies’ Operating Expenses per DWT

Vessel operating expenses mainly include crewing, repair and maintenance, and insurance expense, but not fuel cost (DBO).

5- and 10-year VLCC Prices Higher in February

Five-year VLCC prices in February increased to $80.9 million from $80.7 million in January. Ten-year VLCC prices fell to $52.2 million from $52.8 million.