Tsakos Energy Navigation Ltd

Latest Tsakos Energy Navigation Ltd News and Updates

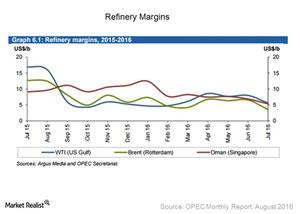

Oil Supply and Refinery Margins Concern Crude Tankers

Refinery margins have fallen throughout most of the world. US Gulf refinery margins for WTI crude lost more than $2 compared to last month’s level.

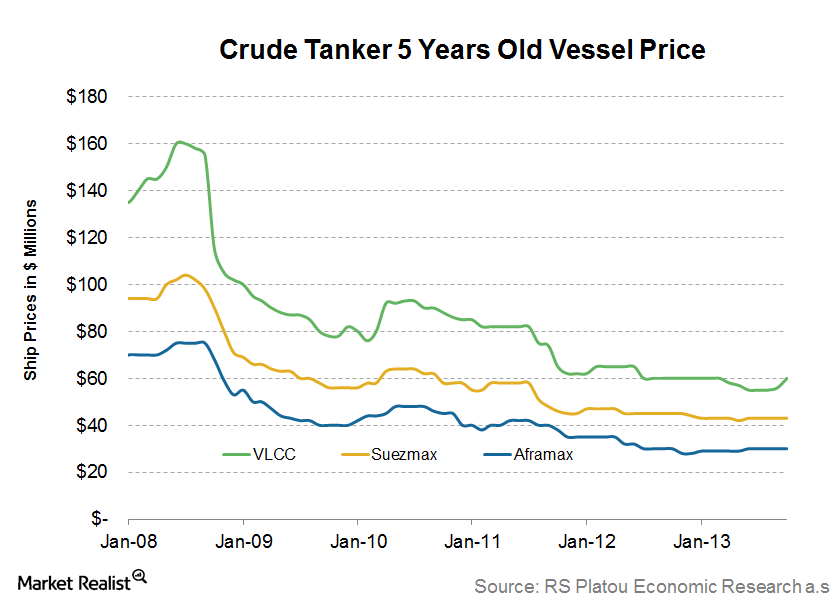

Why current secondhand oil tanker values suggest a mixed outlook

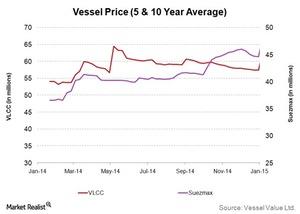

While the VLCC data is positive, the picture for the crude tanker business remains mixed. This could portray a short-to-medium-term negative outlook.

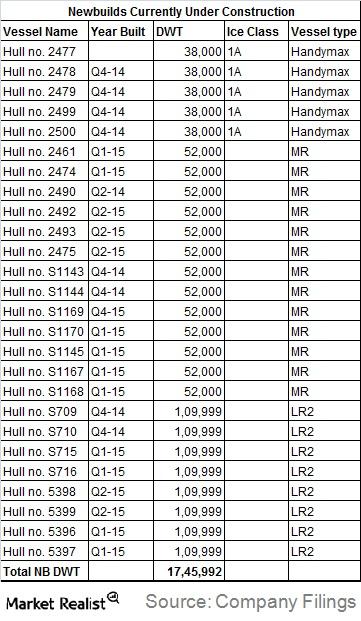

Scorpio Tankers adopts a shift in charter mix

For the third quarter of 2014, the charter hire expense increased $1.1 million to $32.9 million, from $31.9 million in the year ago quarter.

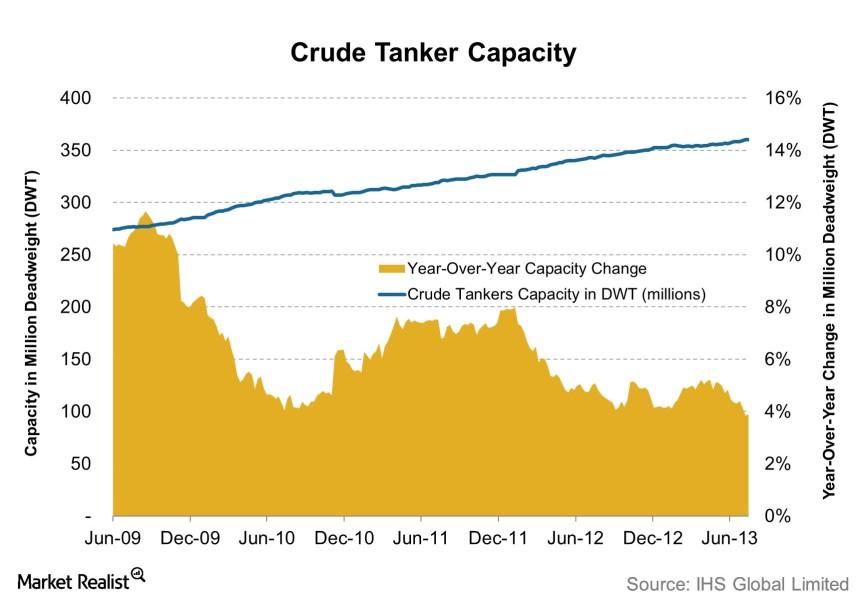

Weekly tanker digest: Have fundamentals changed? (Part 4)

Continued from Part 3 The importance of capacity Capacity, in a commoditized industry like shipping, is an important metric that directly impacts companies’ top line, or revenue performance. When capacity grows faster than demand, competition will rise among individual shipping firms as they try to use idle ships and cover fixed costs. This will lower day […]

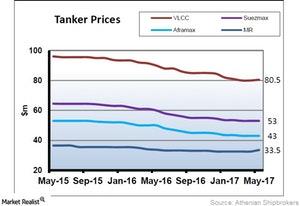

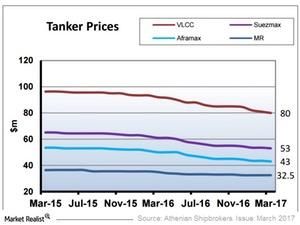

VLCC Prices Rose First Time in 2017

Newbuild VLCC (very large crude carrier) prices rose in May 2017, and this is the first time we’ve seen a rise in prices this year.Energy & Utilities Why Frontline is on the verge of bankruptcy

Industry analysts suggest that investors should avoid Frontline because of the bankruptcy risk. Currently, the company is facing bankruptcy. This is led by the $190 million bond that’s due in April 2015.Energy & Utilities 5-year-old and 10-year-old VLCC prices stay at consistent levels

Since secondhand vessels can be delivered within a few months, they tend to reflect industry participants’ expectations for medium-term fundamentals and rates, unlike newbuilds, for which two years of delivery time is mandatory.

5- and 10-year VLCC and Suezmax weekly prices on the run-up

Weekly vessel values have been on the rise, with positive week-over-week and significant year-over-year growth.

China’s June Data Impact the Crude Tanker Industry

China (FXI) released its key economic data for June—import and export data, auto sales data, and the manufacturing index.

China’s April Trade Data and the Crude Oil Tanker Industry

China, which has the second-largest economy in the world, has a significant impact on the crude tanker industry.

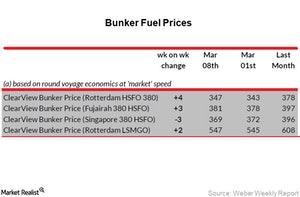

Analyzing Bunker Fuel Prices in Week 12

On March 22, 2018, the average bunker fuel price was $423 per ton—compared to $413 per ton on March 15.

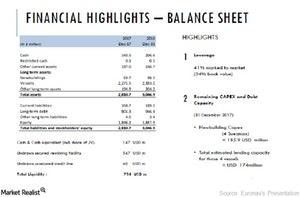

Analyzing Euronav’s Balance Sheet on December 31

Euronav had a liquidity of $754 million at the end of the fourth quarter. Euronav has been working to strengthen its liquidity position.

China’s December Trade Data Impact the Crude Tanker Industry

China (FXI) released key economic data for December 2017—import and export data, auto sales data, and the manufacturing index.

What Current Tanker Prices Tell Us about the Tanker Industry

Newbuild vessel prices fell in March 2017. We saw in our last month’s series that newbuild vessel prices also fell in February.

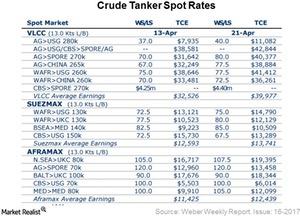

VLCC, Suezmax, and Aframax Rates Rose in Week 16

According to the Weber Weekly Report, VLCC rates on the benchmark route rose from $32,439 per day on April 13, 2017, to $38,884 per day on April 21, 2017.

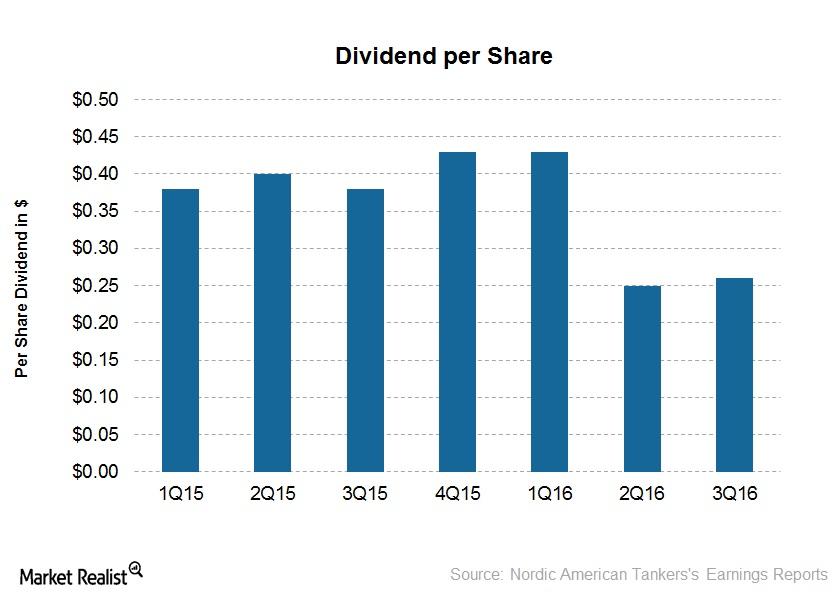

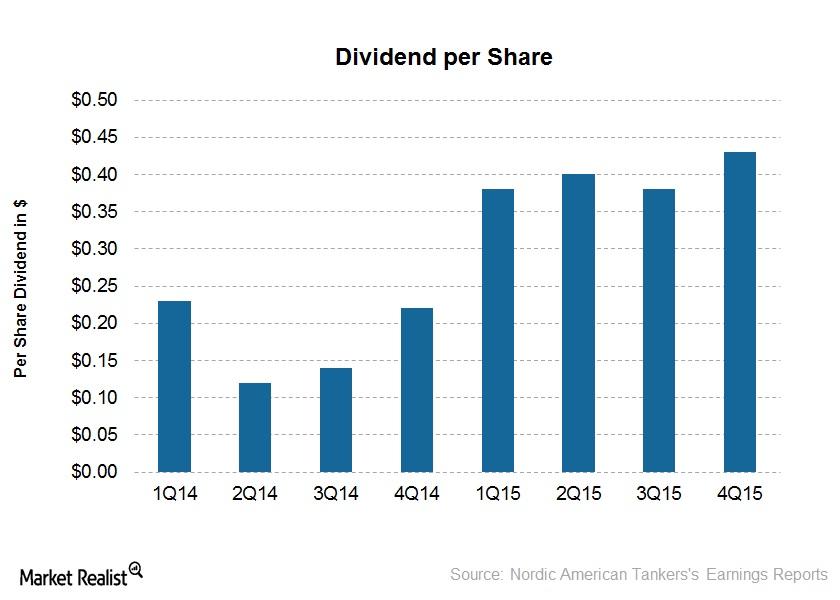

Nordic American Tankers’ Long Dividend History Continued

Nordic American Tankers has a long history of paying dividends—77 consecutive quarters to date. It declared a cash dividend of $0.26 per share on October 27.

NAT’s Dividends: 74 Straight Quarters of Payouts to Investors

Nordic American Tankers’ (NAT) dividend yield has ranged from 6.3%–10.36% in the past four quarters. NAT had a dividend yield of 14.17% as of February 11, 2016, one of the highest dividend yields in the industry.

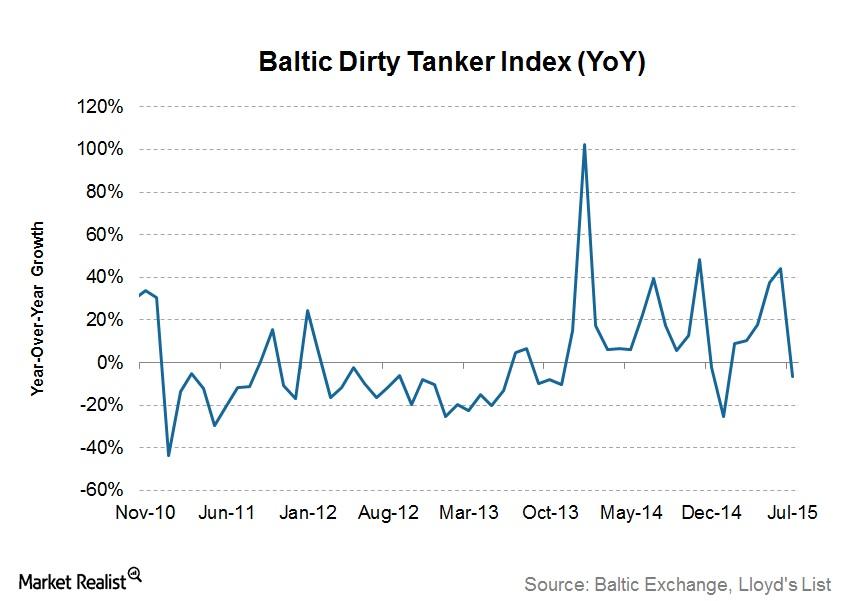

Free Fall of Baltic Dirty Tanker Index: Something to Worry About?

On July 1, the Baltic Dirty Tanker Index was at 952 points, the highest in July. Then the index took a free fall and hit 752 points on July 31 and 673 on August 12.

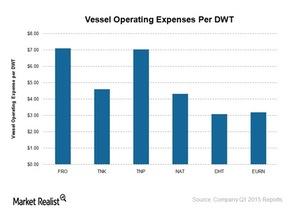

Comparing Tanker Companies’ Operating Expenses per DWT

Vessel operating expenses mainly include crewing, repair and maintenance, and insurance expense, but not fuel cost (DBO).

5- and 10-year VLCC Prices Higher in February

Five-year VLCC prices in February increased to $80.9 million from $80.7 million in January. Ten-year VLCC prices fell to $52.2 million from $52.8 million.