Teekay Corp

Latest Teekay Corp News and Updates

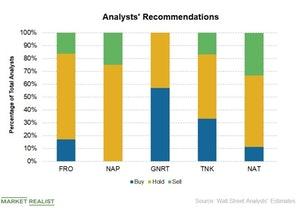

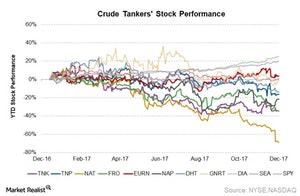

Analysts’ Recommendations for Crude Tanker Stocks

In Week 28, analysts made no target price revisions or recommendation changes for crude tanker companies.

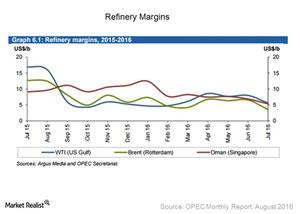

Oil Supply and Refinery Margins Concern Crude Tankers

Refinery margins have fallen throughout most of the world. US Gulf refinery margins for WTI crude lost more than $2 compared to last month’s level.

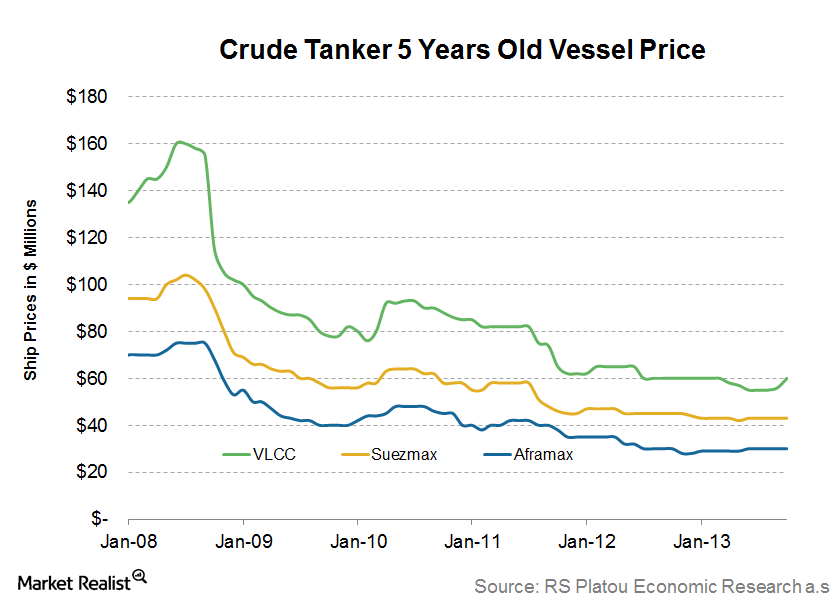

Why current secondhand oil tanker values suggest a mixed outlook

While the VLCC data is positive, the picture for the crude tanker business remains mixed. This could portray a short-to-medium-term negative outlook.

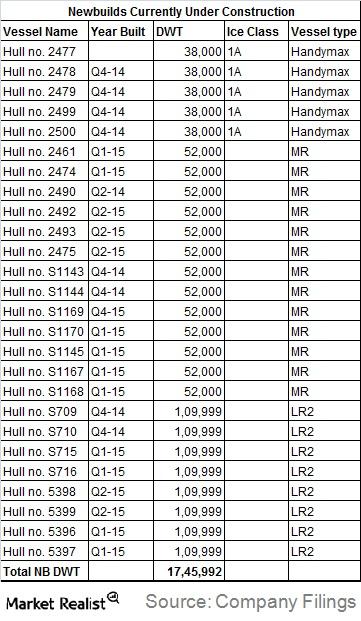

Scorpio Tankers adopts a shift in charter mix

For the third quarter of 2014, the charter hire expense increased $1.1 million to $32.9 million, from $31.9 million in the year ago quarter.

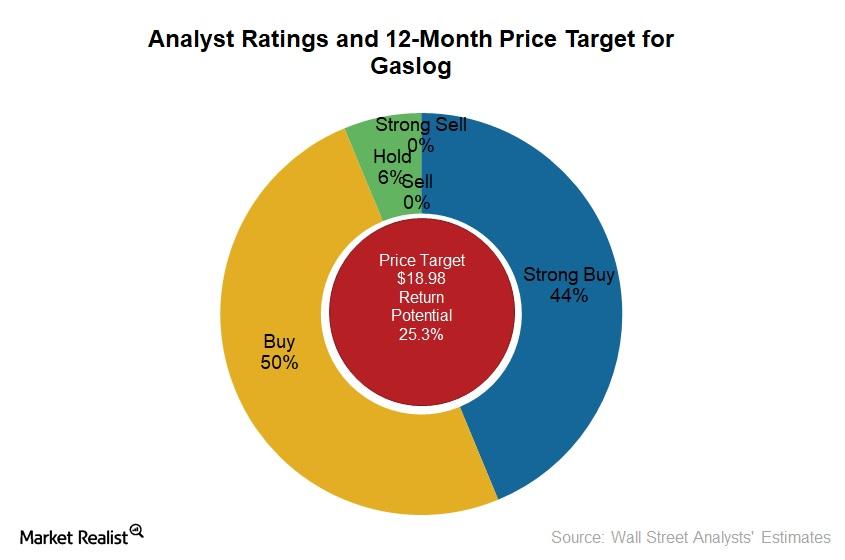

Morgan Stanley Upgrades GasLog

In June 2017, Morgan Stanley upgraded GasLog (GLOG) to “overweight” from “equal weight.”

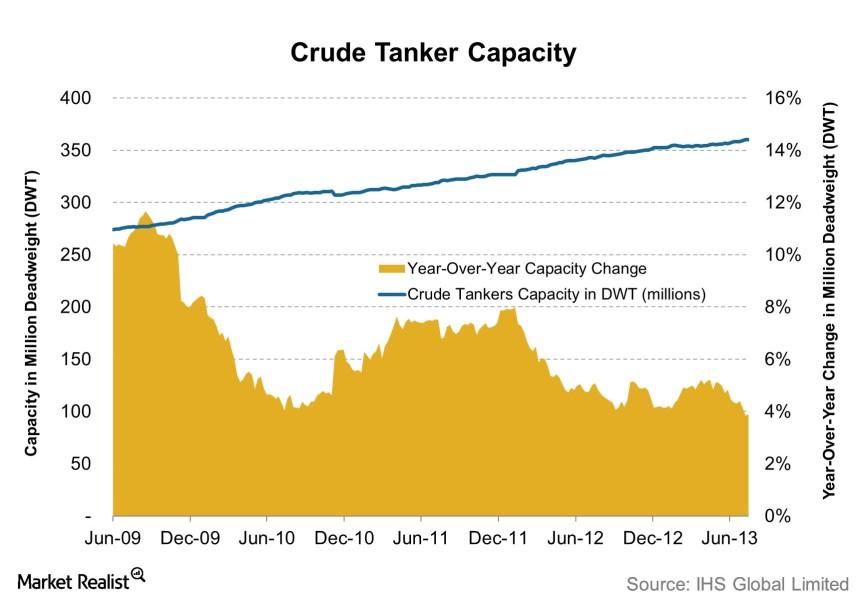

Weekly tanker digest: Have fundamentals changed? (Part 4)

Continued from Part 3 The importance of capacity Capacity, in a commoditized industry like shipping, is an important metric that directly impacts companies’ top line, or revenue performance. When capacity grows faster than demand, competition will rise among individual shipping firms as they try to use idle ships and cover fixed costs. This will lower day […]

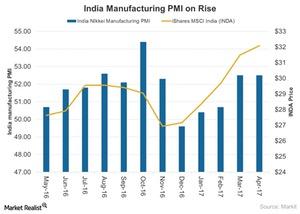

Improved Manufacturing in India, But Recovery?

The Nikkei India Manufacturing PMI for April 2017 matched its reading for the previous month.

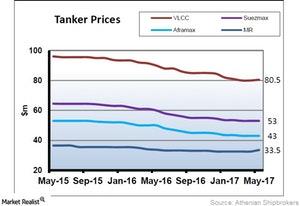

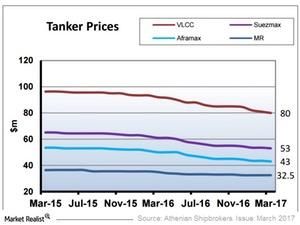

VLCC Prices Rose First Time in 2017

Newbuild VLCC (very large crude carrier) prices rose in May 2017, and this is the first time we’ve seen a rise in prices this year.

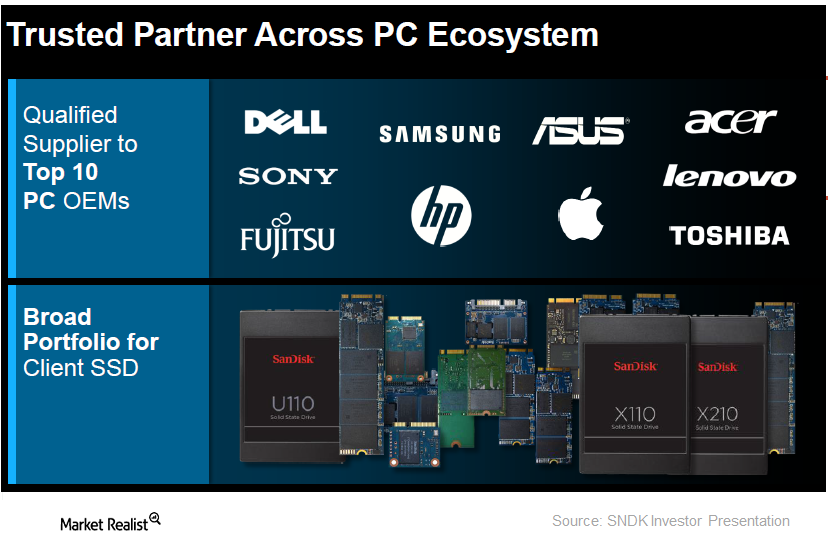

JAT Capital Eliminates Exposure to SanDisk Corporation

JAT Capital sold its position in SanDisk Corporation (SNDK) in 4Q14. The position had represented 1.2% of the fund’s third-quarter portfolio.

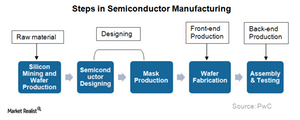

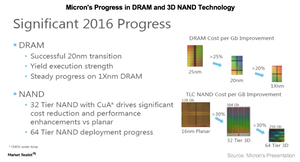

What Makes Micron a Key Player in Semiconductor Manufacturing?

Semiconductor manufacturing is complex and involves design, fabrication, assembly, and testing. Building a fab requires investments of $3–4 billion.Energy & Utilities Why Frontline is on the verge of bankruptcy

Industry analysts suggest that investors should avoid Frontline because of the bankruptcy risk. Currently, the company is facing bankruptcy. This is led by the $190 million bond that’s due in April 2015.

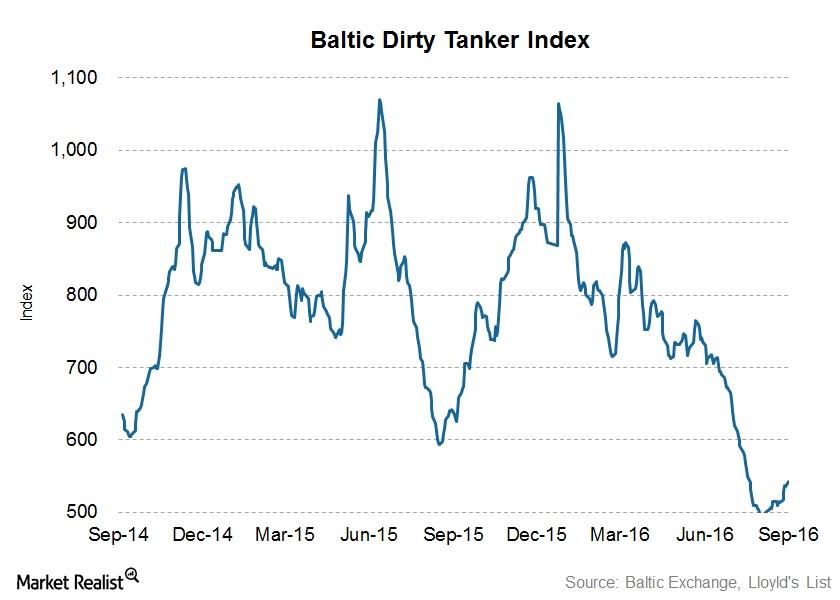

Crude Tanker Stocks and the BDTI Index in Week 39

In week 39, the week ending September 29, the BDTI rose to 776 from 772. In week 38, the index rose by 28 points. It rose for the fifth consecutive week.

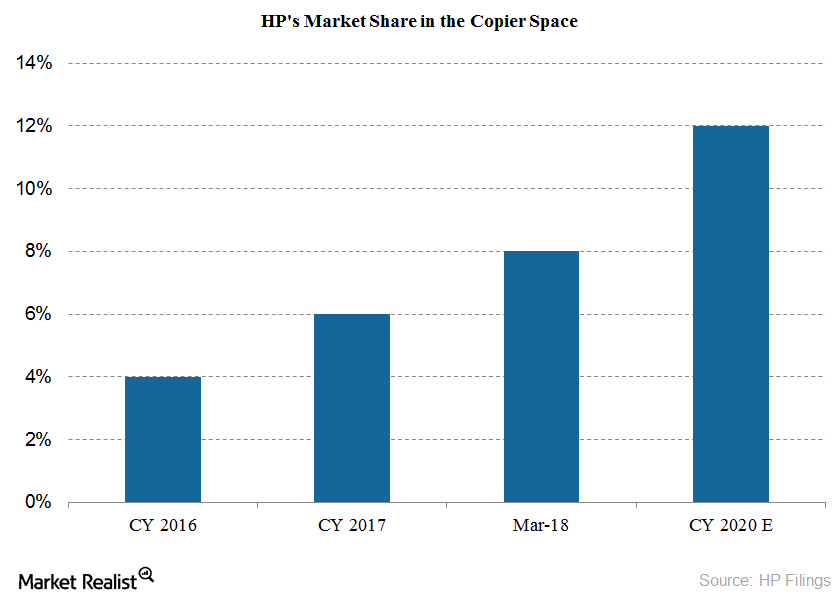

How HP Views the A3 Copier Market

In September 2016, HP (HPQ) announced its intention to acquire Samsung’s (SSNLF) Printing business for $1.1 billion.

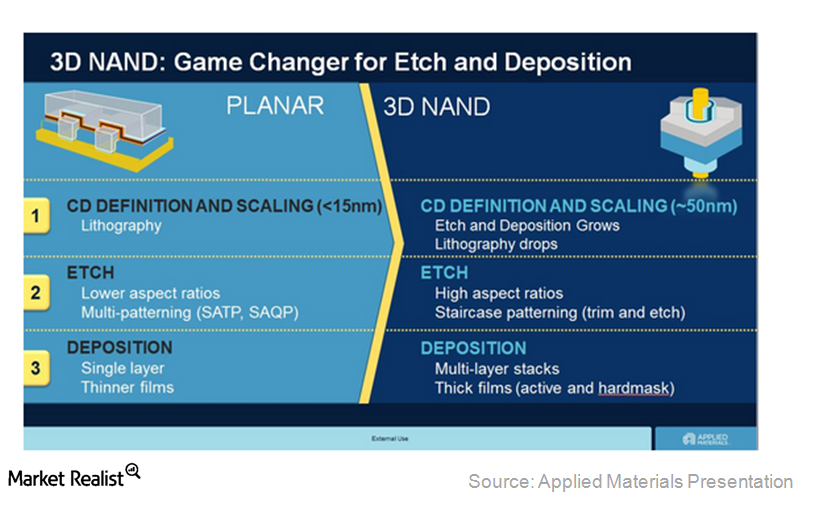

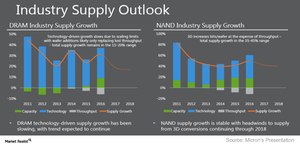

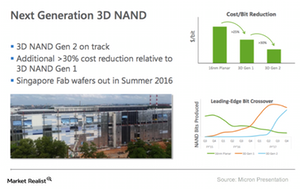

Why 3D NAND should drive Applied Materials’s growth

The market share for 3D NAND is expected to reach 20% in 2015, and this technology is expected to account for the majority of total flash shipments by 2017.

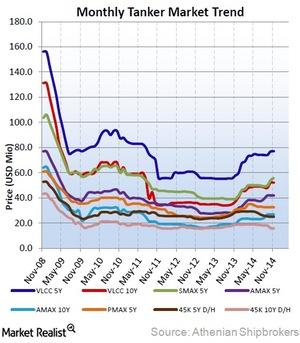

Five-year and ten-year VLCC prices increase

With faster deliveries and employment of vessels, secondhand vessels tend to reflect industry participants’ expectations for medium-term fundamentals.Energy & Utilities 5-year-old and 10-year-old VLCC prices stay at consistent levels

Since secondhand vessels can be delivered within a few months, they tend to reflect industry participants’ expectations for medium-term fundamentals and rates, unlike newbuilds, for which two years of delivery time is mandatory.

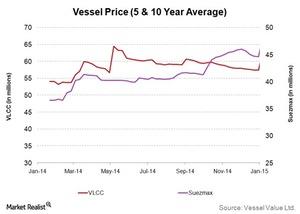

5- and 10-year VLCC and Suezmax weekly prices on the run-up

Weekly vessel values have been on the rise, with positive week-over-week and significant year-over-year growth.

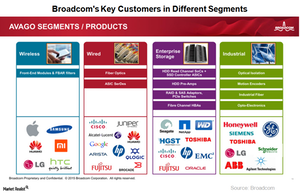

Why the Technology Industry Opposed the Broadcom–Qualcomm Deal

Broadcom (AVGO) failed to crack the technology industry’s biggest acquisition of Qualcomm for $117 billion due to intervention by President Trump.

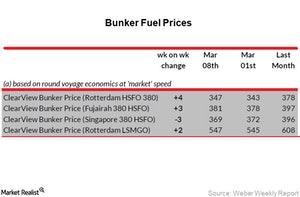

Analyzing Bunker Fuel Prices in Week 12

On March 22, 2018, the average bunker fuel price was $423 per ton—compared to $413 per ton on March 15.

Euronav and Gener8 Maritime Partners’ Merger

On December 21, 2017, Euronav (EURN) and Gener8 Maritime Partners (GNRT) announced a stock-for-stock merger.

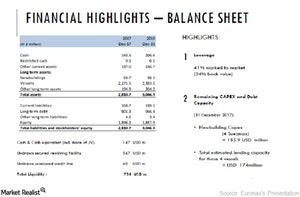

Analyzing Euronav’s Balance Sheet on December 31

Euronav had a liquidity of $754 million at the end of the fourth quarter. Euronav has been working to strengthen its liquidity position.

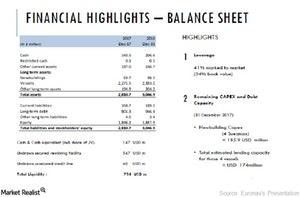

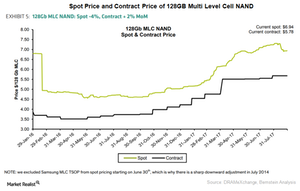

What Is Micron’s NAND Strategy for Fiscal 2018?

At the end of fiscal 1Q18, 3D NAND accounted for 80% of Micron’s total NAND output. The company expects to increase this mix to 95% by the end of fiscal 2018.

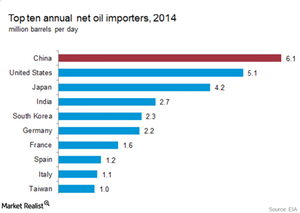

China’s December Trade Data Impact the Crude Tanker Industry

China (FXI) released key economic data for December 2017—import and export data, auto sales data, and the manufacturing index.

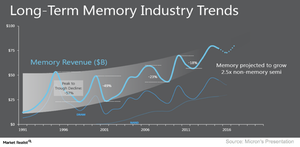

Changing Memory Industry Dynamics to Positively Impact Micron’s Growth

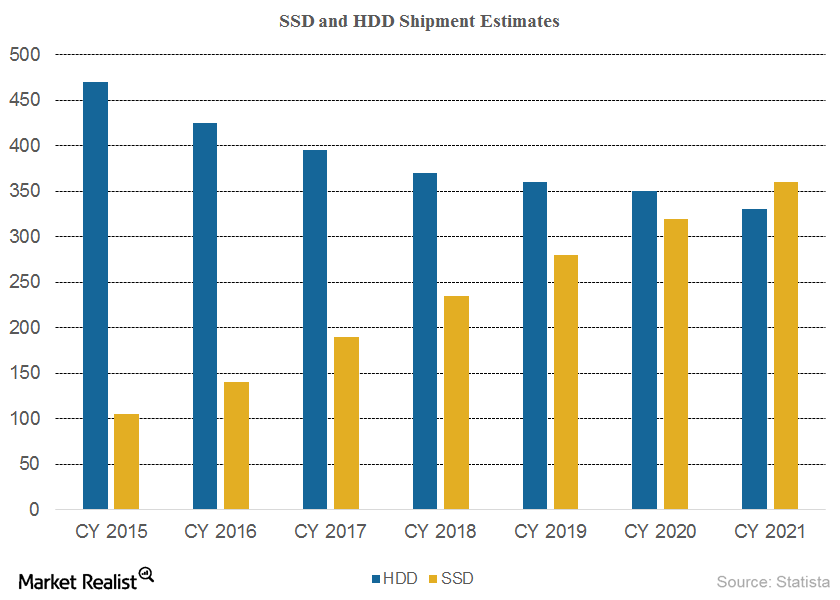

Micron expects the SSD (solid-state drive) attach rate to increase to ~50% in 2018 and 75% in 2020.

What Analysts Project for Global HDD and SSD Shipments

According to Statista, HDD (hard disk drive) shipments are expected to fall 7% YoY (year-over-year) in 2017 to 395 million units from 425 million units in 2016.

Micron’s Strategy in the NAND Market

Micron expects the NAND industry supply to grow 30%–40%, with its NAND supply expected to grow at the higher end of the industry supply range.

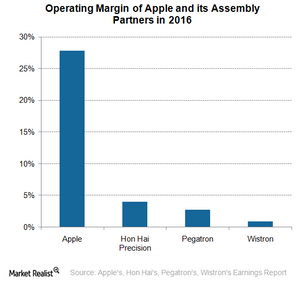

How Might Apple’s iPhone 8 Impact Foxconn?

Taiwanese manufacturer, Hon Hai Precision Industry, also known as Foxconn, is expected to be a major beneficiary of the iPhone 8 super-cycle.

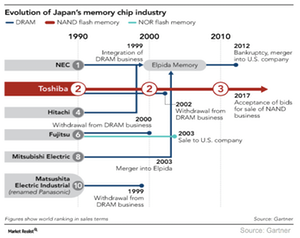

AVGO’s Bid for Toshiba’s Memory Business Surrounded by Hurdles

Broadcom (AVGO) is bidding for Toshiba’s (TOSBF) NAND (negative-AND) Flash business in order to expand in the network storage market.

What Current Tanker Prices Tell Us about the Tanker Industry

Newbuild vessel prices fell in March 2017. We saw in our last month’s series that newbuild vessel prices also fell in February.

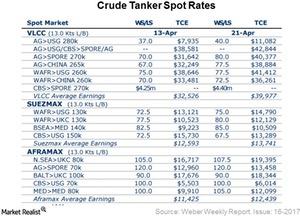

VLCC, Suezmax, and Aframax Rates Rose in Week 16

According to the Weber Weekly Report, VLCC rates on the benchmark route rose from $32,439 per day on April 13, 2017, to $38,884 per day on April 21, 2017.

How Micron Technology Could Benefit from an Early Transition to 3D NAND

Micron Technology’s chief financial officer, Ernie Maddock, stated that a company transitioning to 3D NAND would see negative bit growth in the first half as it puts planar capacity offline.

Micron Technology’s 3D NAND Roadmap for 2017

Micron Technology (MU) plans to spend ~$1.8 billion in capex on ramping up the 64-tier 3D NAND and developing the third-generation 3D NAND.

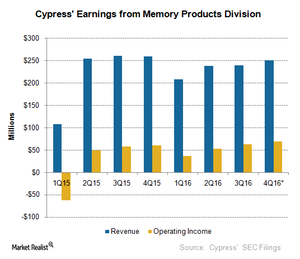

Cypress Depends on Memory Business to Improve Profits

Cypress Semiconductor (CY) is becoming a complete embedded solutions provider.

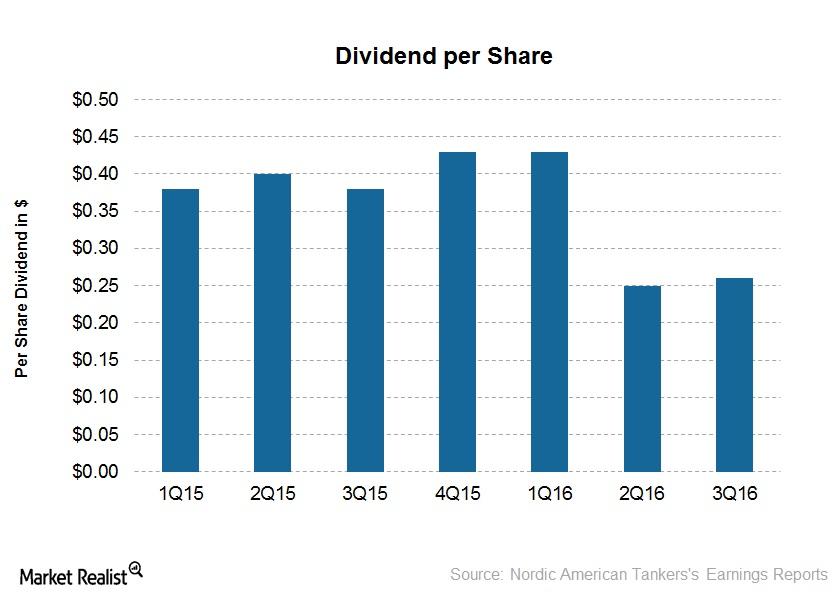

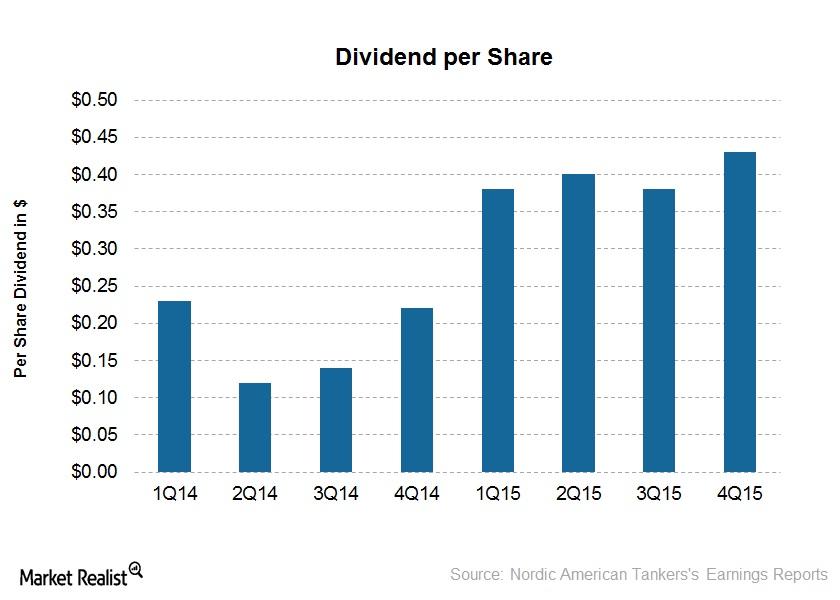

Nordic American Tankers’ Long Dividend History Continued

Nordic American Tankers has a long history of paying dividends—77 consecutive quarters to date. It declared a cash dividend of $0.26 per share on October 27.

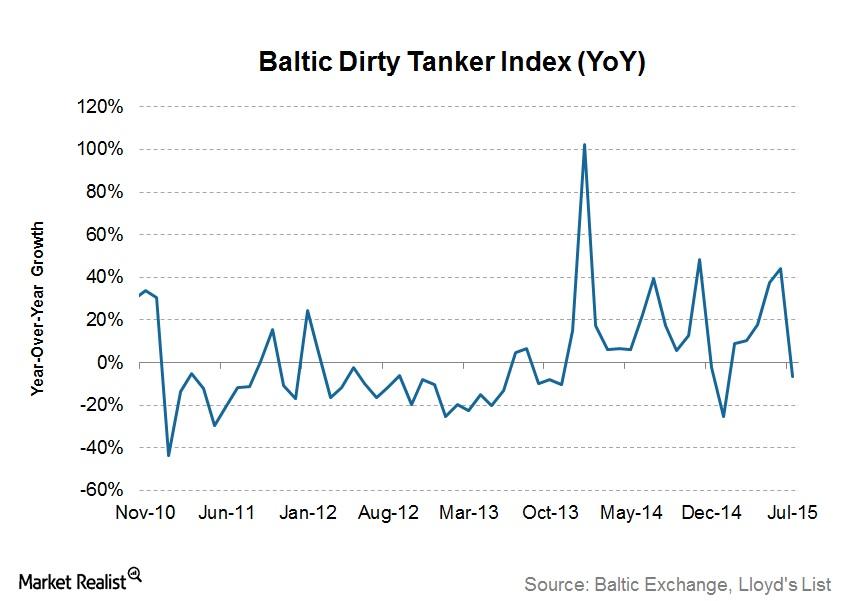

Performance of Baltic Dirty Tanker Index in Focus

The BDTI (Baltic Dirty Tanker Index) stood at 554 on September 12, 2016. For the week ended September 9 (Week 36), the BDTI rose to 542 from 516 at the beginning of the week.

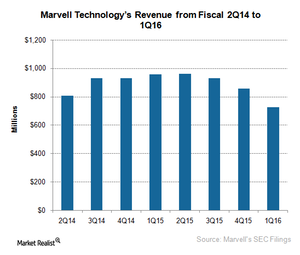

What’s the Root Cause of Marvell’s Problems?

Let’s dig into the cause of Marvell’s accounting issues, see how one thing led to another, and look at how its new management plans to untangle the chaos.

What the Investments of Micron and Other Suppliers in 3D NAND Capacity Could Mean

Micron is moving a step further and developing 3D NAND Generation 2 technology. It expects to bring this into production in fiscal 2Q17.

NAT’s Dividends: 74 Straight Quarters of Payouts to Investors

Nordic American Tankers’ (NAT) dividend yield has ranged from 6.3%–10.36% in the past four quarters. NAT had a dividend yield of 14.17% as of February 11, 2016, one of the highest dividend yields in the industry.

China’s Crude Oil Imports: Bright Spot in 2016 Oil Market?

Market estimates from Bloomberg suggest that China’s crude oil imports in 2016 may rise by 8% to 7.2 MMbpd (million barrels per day).

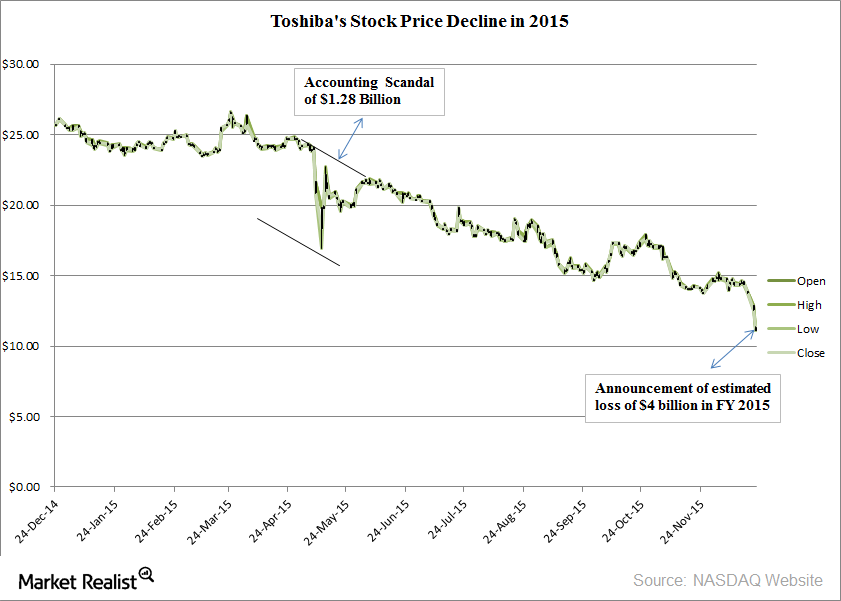

Toshiba to Implement Measures to Prevent Recurrence of Fraud

Toshiba is looking to start an evaluation system for the CEO and president of the company, in which 120 senior managers will hold a vote of confidence in January 2016.

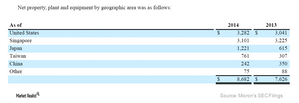

Micron’s Manufacturing Base in the US and Overseas

Micron controls costs by developing a manufacturing base in countries where manufacturing costs are low, but it manufactures most of its chips in the US.

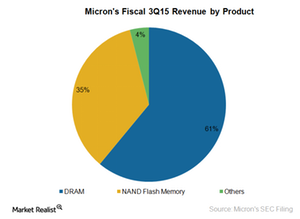

Micron’s Product Portfolio at a Glance: Must-Knows

Micron expanded its product portfolio from 64-kilobit DRAM chips in 1980 to NAND Flash Memory devices in 2004, to SSDs in 2007, to NOR Flash Memory in 2011.

Free Fall of Baltic Dirty Tanker Index: Something to Worry About?

On July 1, the Baltic Dirty Tanker Index was at 952 points, the highest in July. Then the index took a free fall and hit 752 points on July 31 and 673 on August 12.

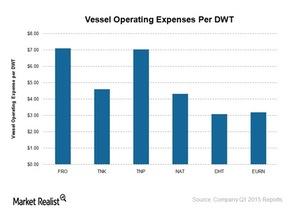

Comparing Tanker Companies’ Operating Expenses per DWT

Vessel operating expenses mainly include crewing, repair and maintenance, and insurance expense, but not fuel cost (DBO).

5- and 10-year VLCC Prices Higher in February

Five-year VLCC prices in February increased to $80.9 million from $80.7 million in January. Ten-year VLCC prices fell to $52.2 million from $52.8 million.Energy & Utilities Liquefaction capacity is key to liquefied natural gas carriers

Whether more proposals will get approval and more liquefaction capacity will come online will depend on the economic feasibility of the liquefaction plants.Energy & Utilities A guide to liquefied natural gas carriers and key shipping costs

While there are a few different types of LNG vessels, the two dominant containment systems, Moss (nicknamed “dinosaur egg”) and Membrane systems are employed today.Energy & Utilities Investing in liquefied natural gas carriers: The future of natural gas

Global energy demand will continue to increase, driven by population growth and improved standards of living. At the same time, emphasis on sustainability becomes more critical.