Euronav NV

Latest Euronav NV News and Updates

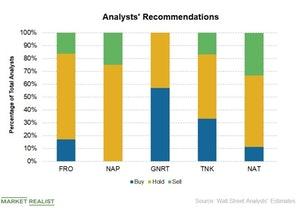

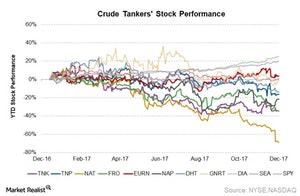

Analysts’ Recommendations for Crude Tanker Stocks

In Week 28, analysts made no target price revisions or recommendation changes for crude tanker companies.

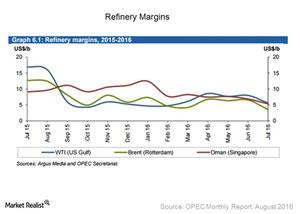

Oil Supply and Refinery Margins Concern Crude Tankers

Refinery margins have fallen throughout most of the world. US Gulf refinery margins for WTI crude lost more than $2 compared to last month’s level.

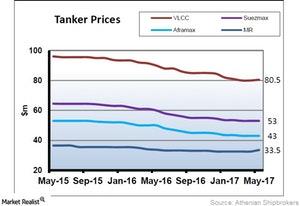

VLCC Prices Rose First Time in 2017

Newbuild VLCC (very large crude carrier) prices rose in May 2017, and this is the first time we’ve seen a rise in prices this year.

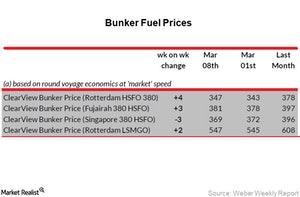

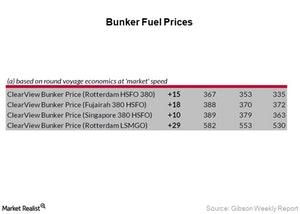

Analyzing Bunker Fuel Prices in Week 12

On March 22, 2018, the average bunker fuel price was $423 per ton—compared to $413 per ton on March 15.

Euronav and Gener8 Maritime Partners’ Merger

On December 21, 2017, Euronav (EURN) and Gener8 Maritime Partners (GNRT) announced a stock-for-stock merger.

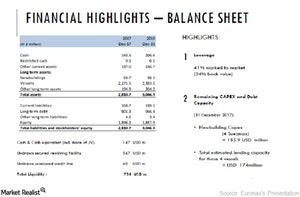

Analyzing Euronav’s Balance Sheet on December 31

Euronav had a liquidity of $754 million at the end of the fourth quarter. Euronav has been working to strengthen its liquidity position.

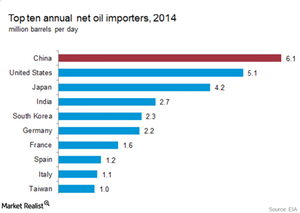

China’s December Trade Data Impact the Crude Tanker Industry

China (FXI) released key economic data for December 2017—import and export data, auto sales data, and the manufacturing index.

Oil Price Reach 3-Year High: What about Bunker Fuel Prices?

On January 4, 2018, the average bunker fuel price was $431 per ton—compared to $413 per ton on December 21, 2017.

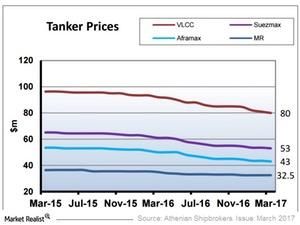

What Current Tanker Prices Tell Us about the Tanker Industry

Newbuild vessel prices fell in March 2017. We saw in our last month’s series that newbuild vessel prices also fell in February.

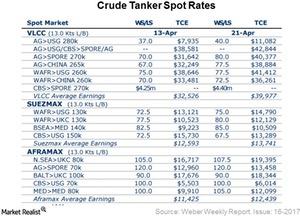

VLCC, Suezmax, and Aframax Rates Rose in Week 16

According to the Weber Weekly Report, VLCC rates on the benchmark route rose from $32,439 per day on April 13, 2017, to $38,884 per day on April 21, 2017.

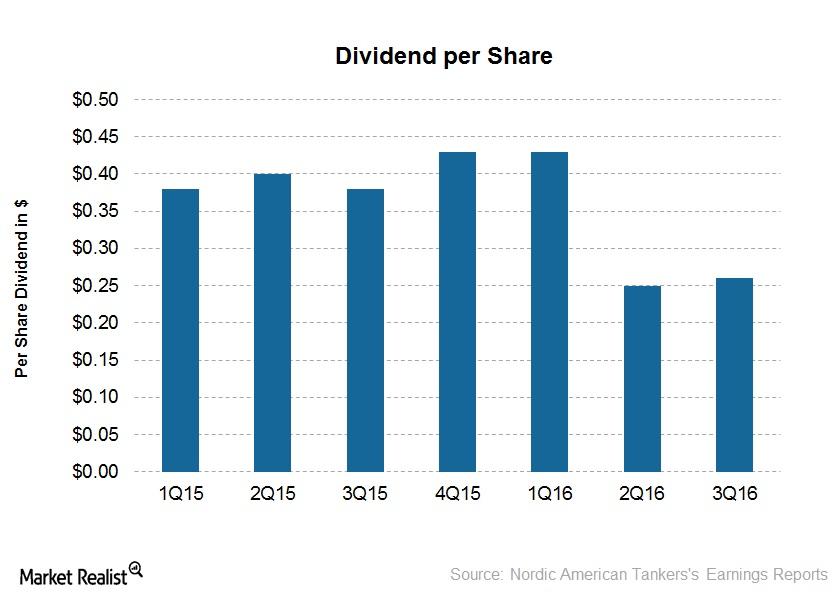

Nordic American Tankers’ Long Dividend History Continued

Nordic American Tankers has a long history of paying dividends—77 consecutive quarters to date. It declared a cash dividend of $0.26 per share on October 27.

China’s Crude Oil Imports: Bright Spot in 2016 Oil Market?

Market estimates from Bloomberg suggest that China’s crude oil imports in 2016 may rise by 8% to 7.2 MMbpd (million barrels per day).

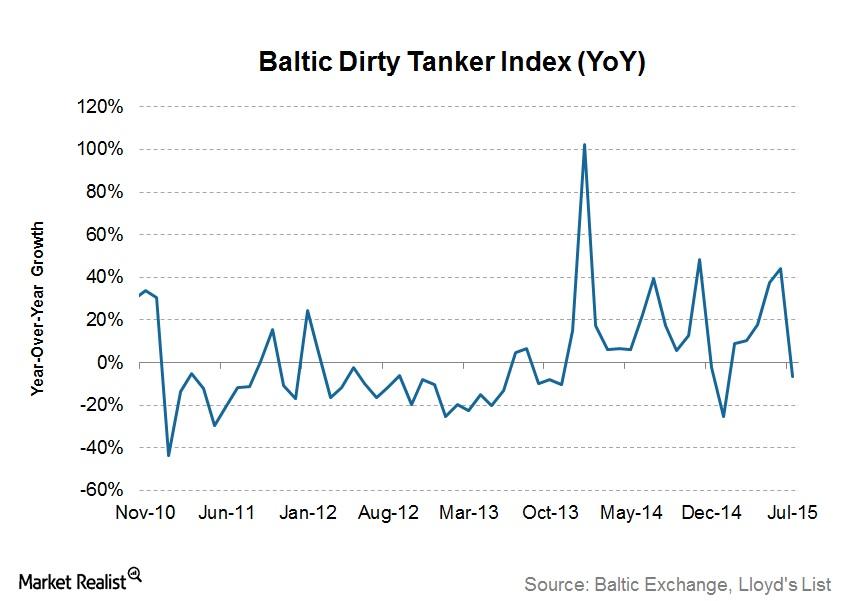

Free Fall of Baltic Dirty Tanker Index: Something to Worry About?

On July 1, the Baltic Dirty Tanker Index was at 952 points, the highest in July. Then the index took a free fall and hit 752 points on July 31 and 673 on August 12.