What’s the Long-Term Forecast for Natural Gas Prices?

US natural gas prices have fallen for the third time in the last five trading sessions. Prices are following the long-term bearish trend and trading close to 16-year lows.

Feb. 24 2016, Published 9:10 a.m. ET

Natural gas price trends

US natural gas prices have fallen for the third time in the last five trading sessions. Prices are following the long-term bearish trend and trading close to 16-year lows. Rising natural gas production and inventories could swing natural gas prices.

Support and resistance

Record natural gas production and record natural gas inventory will put pressure on natural gas prices in the short term as well as the long term. Gas prices could see key support at $1.60 per MMBtu (million British thermal units). Prices tested this level in 1995.

In contrast, record low US natural gas rig count and declining investments in oil and gas exploration and production could boost natural gas prices. The next resistance for natural gas prices is seen at $2.40 per MMBtu. Prices tested this mark in January 2016.

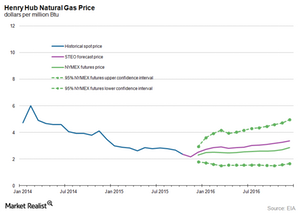

Long-term natural gas price forecast

Below are some of the forecasts for natural gas prices.

- Economist Intelligence Unit estimates that US natural gas prices could average around $3.60 per MMBtu by 2020.

- The World Bank forecasts that US natural gas prices could trade around $3.90 per MMBtu by 2020.

- The IMF (International Monetary Fund) estimates that US natural gas prices could average about $3.10 per MMBtu during the same period.

- The EIA (U.S. Energy Information Administration) forecasts that gas prices could average around $2.71 per MMBtu and $3.32 per MMBtu in 2016 and 2017, respectively.

The catastrophic fall in natural gas prices will impact the margins of gas producers such as Gulfport Energy (GPOR), Cabot Oil & Gas (COG), Anadarko Petroleum (APC), Comstock Resources, Devon Energy (DVN), Comstock Resources (CRK), and Memorial Resource Development (MRD). The natural gas output mix of these companies is more than 40% of their production portfolio.

The volatility in the natural gas market affects ETFs and ETNs such as the Guggenheim S&P 500 Equal Weight Energy ETF (RYE), the VelocityShares 3x Long Natural Gas ETN (UGAZ), and the PowerShares DB Energy ETF (DBE).