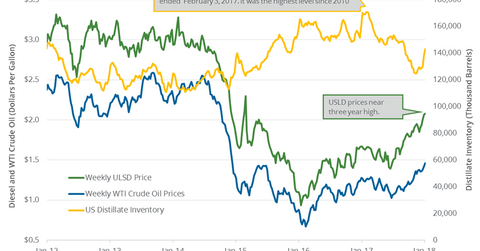

US Distillate Inventories Rose for the Seventh Time in 8 Weeks

US distillate inventories rose by 4.2 MMbbls (million barrels) to 143.1 MMbbls between December 29, 2017, and January 5, 2018.

Nov. 20 2020, Updated 12:36 p.m. ET

US distillate inventories

US distillate inventories rose by 4.2 MMbbls (million barrels) to 143.1 MMbbls between December 29, 2017, and January 5, 2018, according to the EIA. Inventories rose 3.1% week-over-week but fell by 26.9 MMbbls or 16% YoY.

Market surveys estimated that US distillate inventories could have risen by 1.5 MMbbls between December 29, 2017, and January 5, 2018. US diesel futures rose 0.7% to $2.08 per gallon on January 10, 2018. US crude oil (USO) (DBO) and diesel futures moved together on January 10, 2018.

Crude oil (SCO) prices are at the highest level since December 2014. Moves in oil (UCO) prices impact oil producers (IEZ) (VDE) like SM Energy (SM), W&T Offshore (WTI), and Goodrich Petroleum (GDP).

Similarly, volatility in diesel prices impacts US refiners (CRAK) like PBF Energy (PBF), Phillips 66 (PSX), and Valero (VLO).

US distillate production and demand

US distillate production fell by 301,000 bpd (barrels per day) to 5.3 MMbpd (million barrels per day) between December 29, 2017, and January 5, 2018, according to the EIA. Production fell 5.4% week-over-week and by 33,000 bpd or 0.6% YoY.

US distillate demand rose by 67,000 bpd to 3.7 MMbpd between December 29, 2017, and January 5, 2018. Demand rose 1.8% week-over-week and by 457,000 bpd or 14.3% YoY. The rise in demand is bullish for diesel and oil (USO) prices.

Impact

US distillate inventories rose for the seventh time in the last eight weeks. The inventories rose ~15% in the last eight weeks. Any increase in inventories has a negative impact on diesel and oil (USL) prices.

However, US distillate inventories are 2% below their five-year average, which is bullish for diesel and oil (UWT) prices. Any rise in US distillate inventories above the five-year average could be bearish for diesel and oil prices.

Read Is the Crude Oil Price Rally Sustainable in 2018? and US Natural Gas Futures Could Rise in 2018 for updates on oil and gas.