David Ashworth

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From David Ashworth

How Did US Financial Markets Fare in October 2015?

The S&P 500 index, tracked by the SPDR S&P 500 ETF (SPY) and the iShares Core S&P 500 ETF (IVV), rose 8.3% in October.

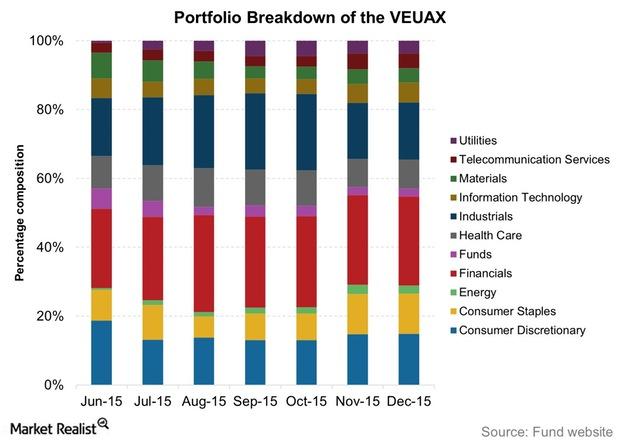

Analyzing JPMorgan Intrepid European Fund’s Allocation in 2015

The JPMorgan Intrepid European Fund’s assets were spread across 79 holdings as of December 2015.

Is It Time to Invest in International Funds?

2016 has mostly been about macro trends, thus presenting a different set of challenges for active fund managers who mostly focus on companies rather than economic and sector trends.

Lack of Rate Hike in September Leads US Stocks Down

The US Federal Reserve met on September 16 and 17 in one of the most anticipated monetary policy meetings in recent memory.

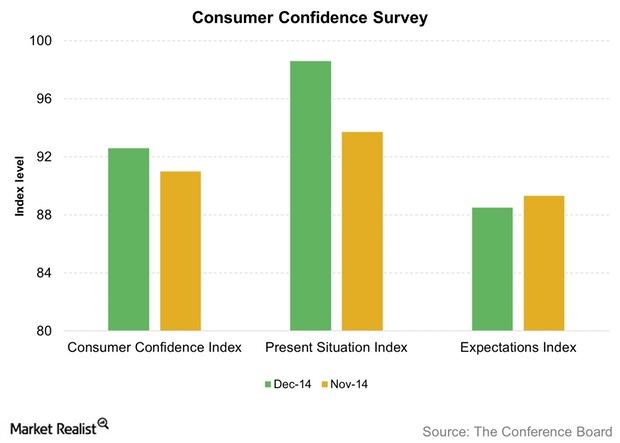

Why did consumers’ confidence rise in December?

The Board’s Consumer Confidence Index rose to 92.6 in December—compared to 91 in November. For November, the index was revised from an initially reported value of 88.7.

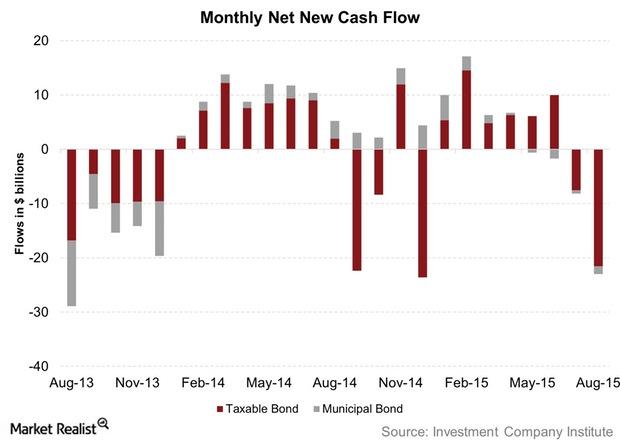

What Bond Mutual Fund Investors Can Do in a Liquidity Squeeze

Things look fine for now Previously in this series, we discussed how mutual funds have a notably larger holding of corporate bonds at present than they had before the financial crisis of 2008. We’ve also talked about how regulatory changes could impact the role of banks as market makers. At the same time, the role […]

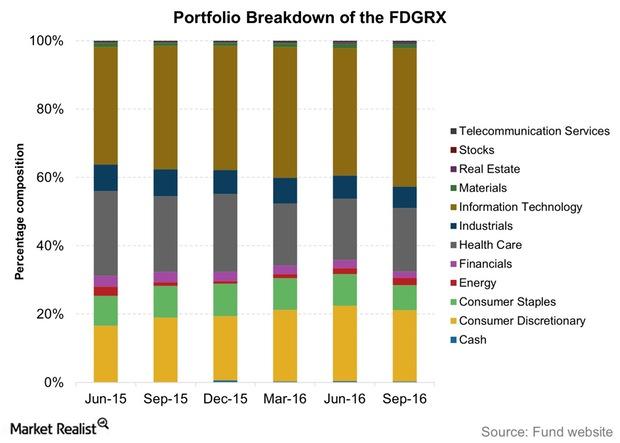

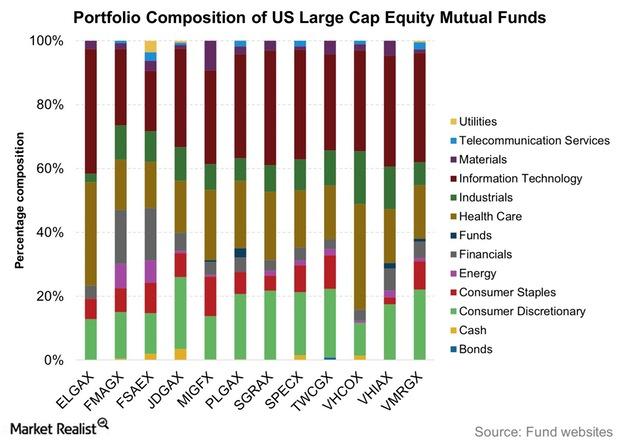

Inside the Fidelity Growth Company Fund Portfolio

FDGRX’s core sectors are information technology, consumer discretionary, and healthcare. The first two sectors make up a little over 60% of the portfolio.

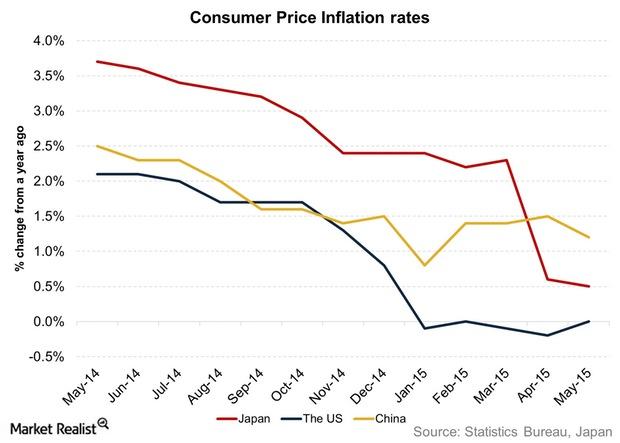

Key for Investors: Understanding Inflation and Its Implications

Inflation represents a rise in the general price level in a country or region. The higher the inflation, the lower the quantum of a particular good that can be purchased.

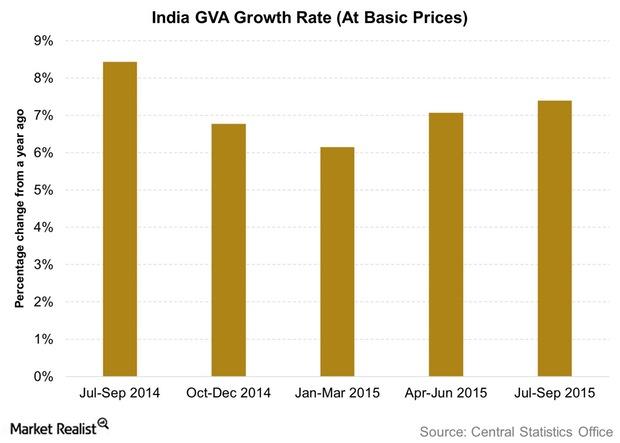

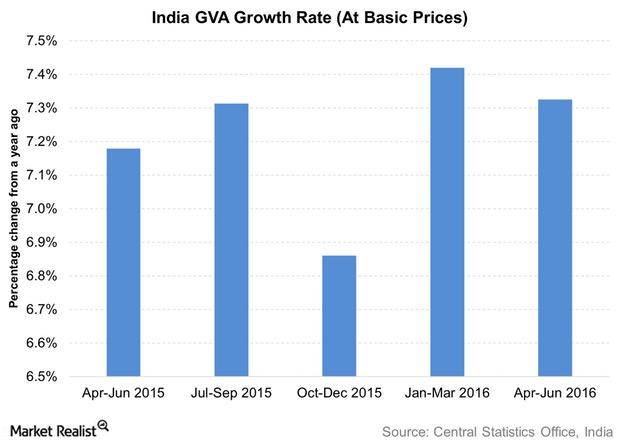

India’s Economic Growth in GVA Terms: What Does the RBI Expect?

For financial year 2016–2017, the RBI forecasts the GVA growth at a 7.6% pace. This assumes that there aren’t any significant headwinds.

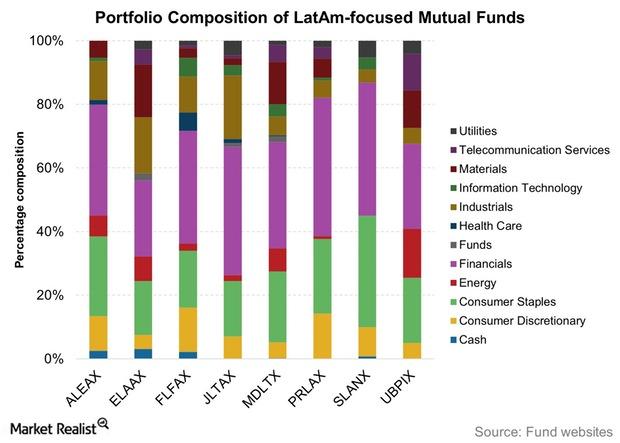

Mark Mobius Is Investing in Brazil: Should You?

In an interview with Bloomberg Markets Middle East, Mark Mobius stated that he is continuing to put money into Brazil.

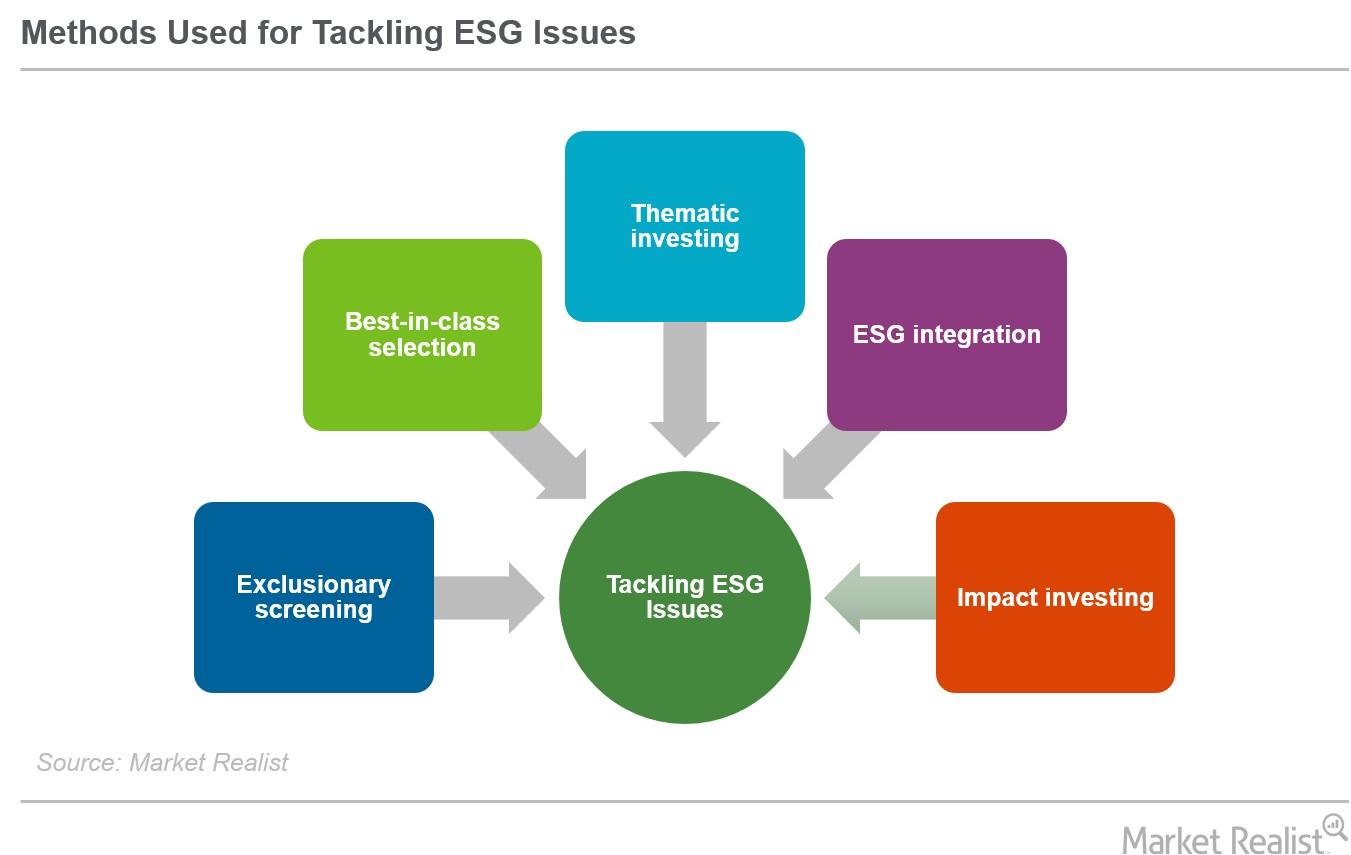

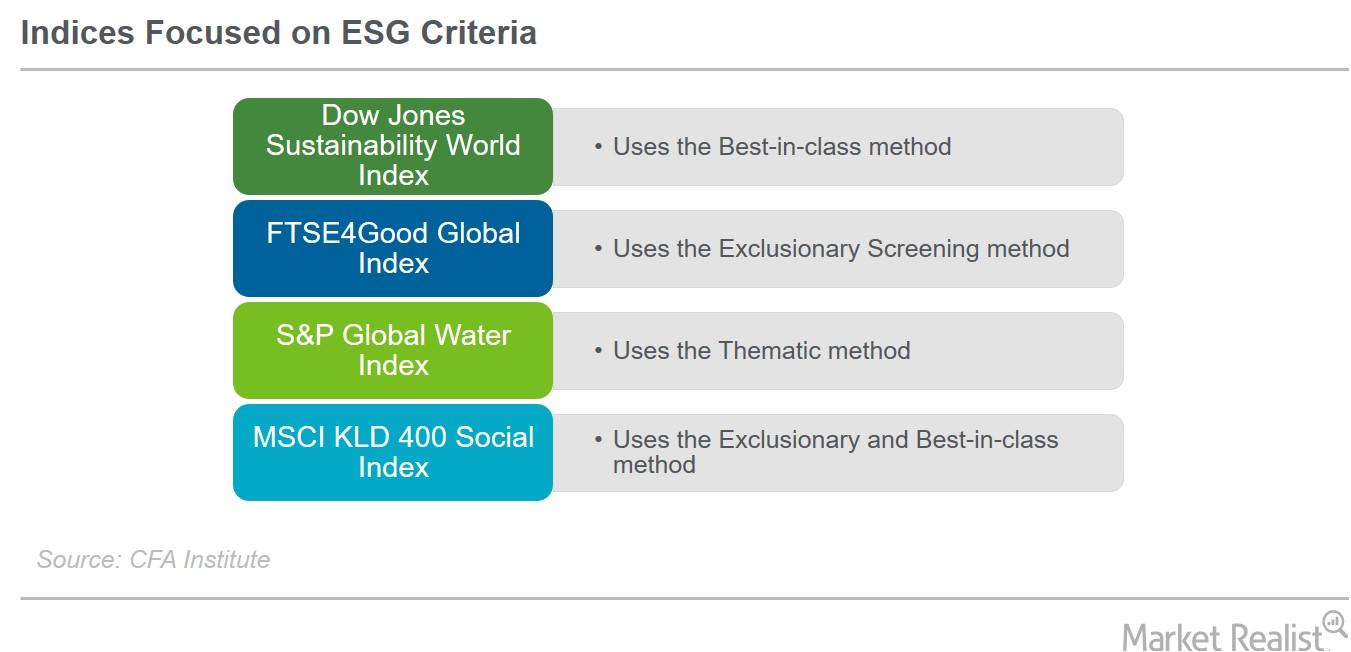

What Are the Methods Used to Tackle ESG Issues?

There are some important things to know when analyzing ESG issues. Unlike traditional analysis, there’s no particular outlined method for conducting ESG analysis.Company & Industry Overviews Discretionary Stocks Boost the Wells Fargo Growth Fund in YTD 2016

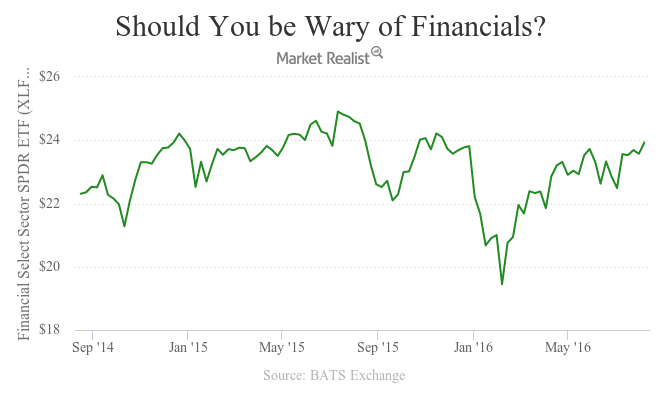

Early 2016 was not generous to the Wells Fargo Growth Fund – Class A (SGRAX), and the fund was a below-average performer until May. However, things have improved since then.

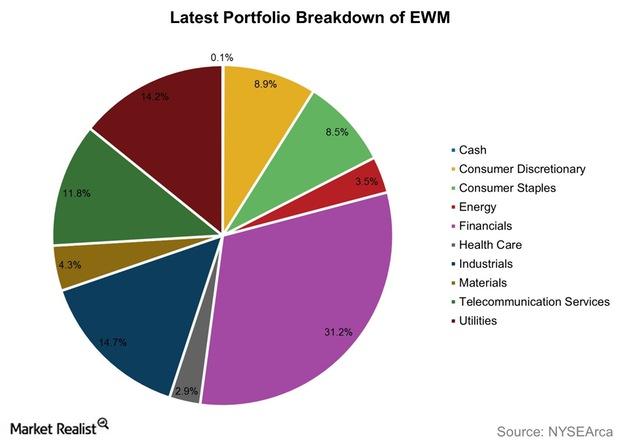

How to Invest in Malaysian Equities via ETFs

If you want to invest in Malaysian equities, then the iShares MSCI Malaysia ETF (EWM) is the fund for you.

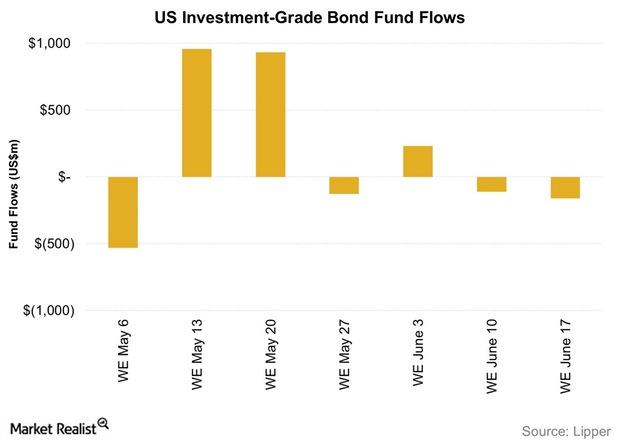

Investment-Grade Bond Funds Saw Outflows Last Week

Flows into investment-grade bond funds (LQD) were negative in the week ending June 17. This was the second consecutive week witnessing outflows.

US Large-Cap Equity Funds: Is Active or Passive Investment Best?

Except for one fund (MIGFX), no other actively managed fund that we have reviewed in this series has been able to outperform the passively managed SPY.

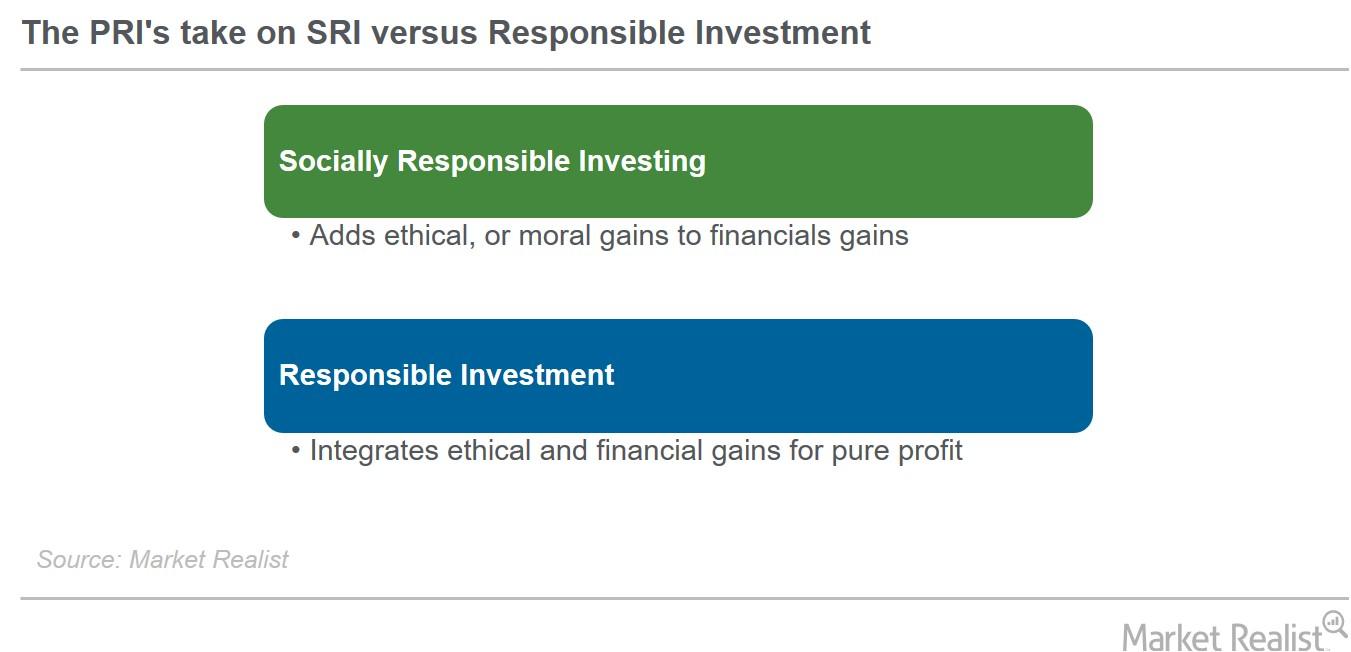

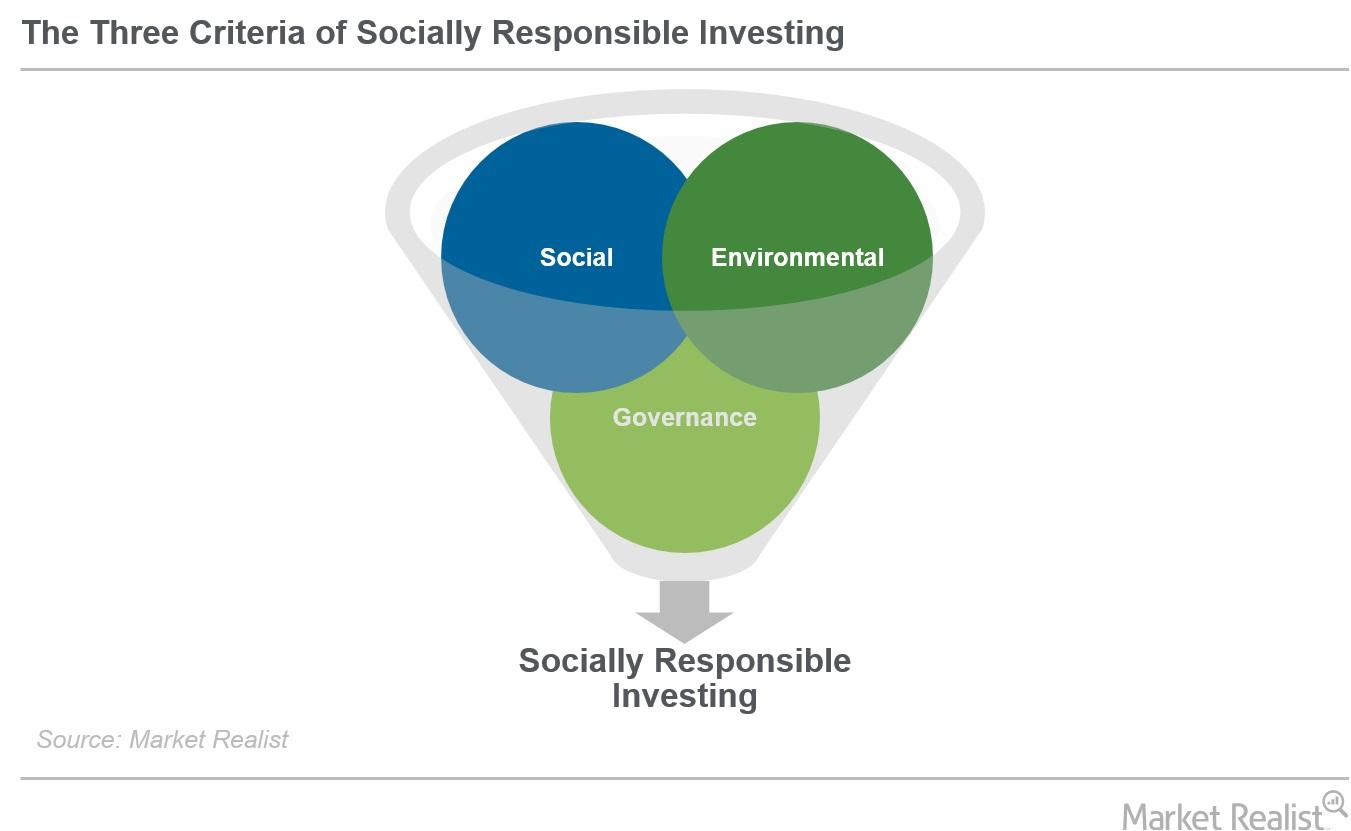

Responsible Investment versus Socially Responsible Investing

The Principles for Responsible Investment (or PRI) calls itself “the world’s leading proponent of responsible investment.”

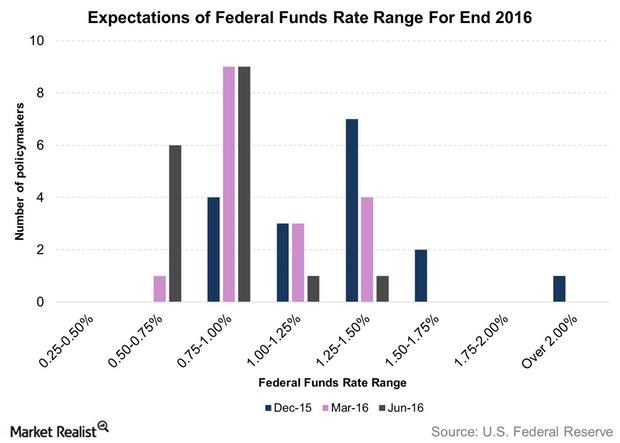

Why the Divergence on the Rate Hike Timing in the US?

As a group, policymakers seem utterly confused regarding their reading of the economic situation, inflation, and the labor market.

Mutual Funds’ Role in Socially Responsible Investing

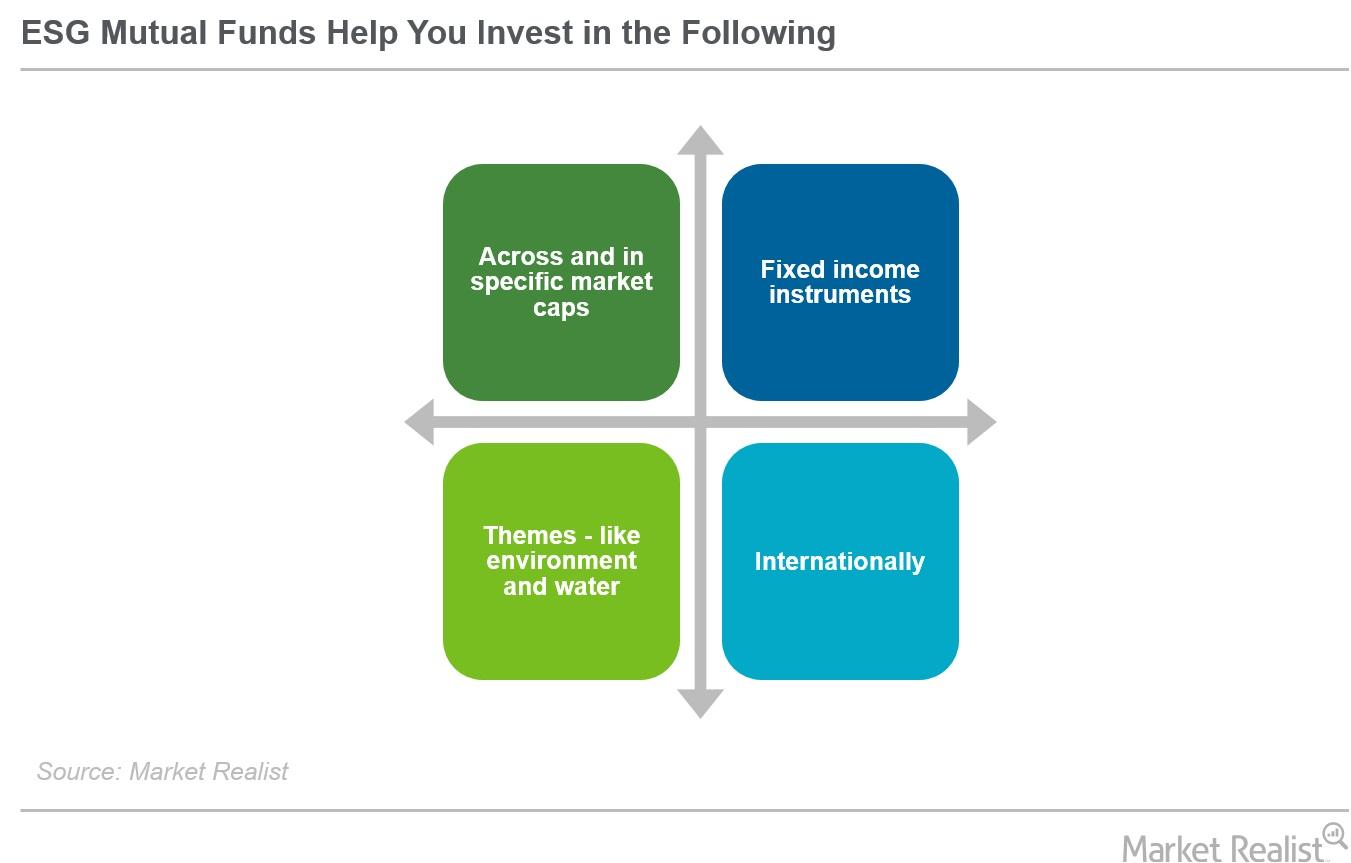

The Forum for Sustainable and Responsible Investment notes on its website, “Mutual funds are one of the most dynamic segments within the ESG investing space.”

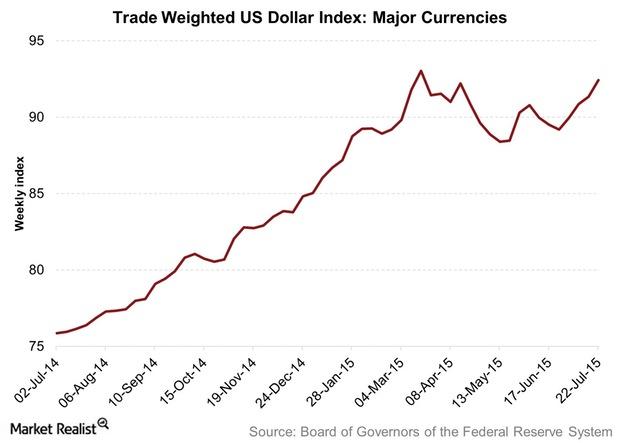

Net Exports: Why They Matter and What Drives Them

A country’s net exports measure the value of total exports less the value of its total imports. It’s positive if exports are larger in value than imports.

The Lowdown on Socially Responsible Investing

Socially responsible investing is known by several terms, including sustainable investing, green investing, and ethical investing.

Which Sectors to Avoid if Inflation Rises

Telecom services and utilities, the traditional dividend stars, have provided a fillip to US equities in 2016.

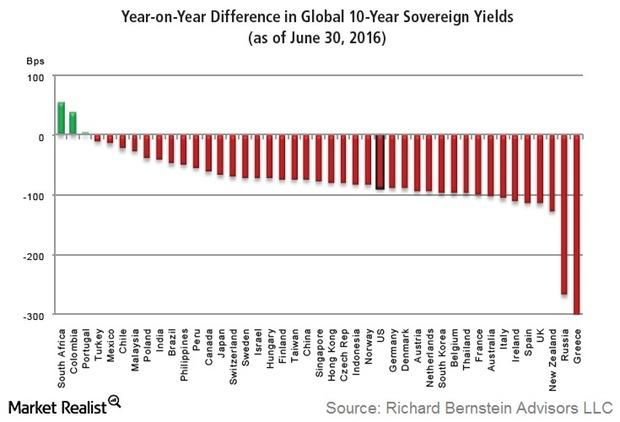

Richard Bernstein: Falling Yields Are Testimony to Risk Aversion

Bernstein asked a rhetorical question: “Could there be anything that suggests extreme risk aversion more than the increasing proportion of global sovereign bonds that have negative yields?”

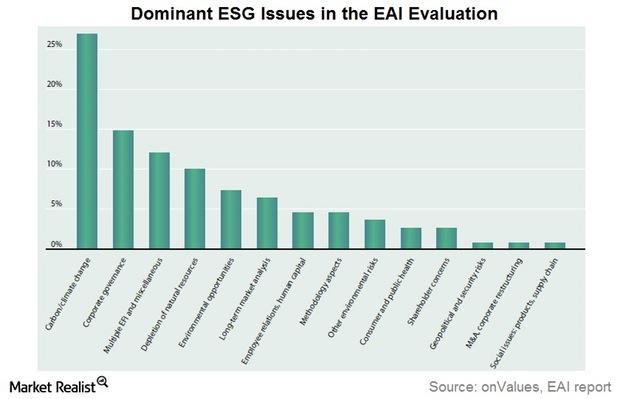

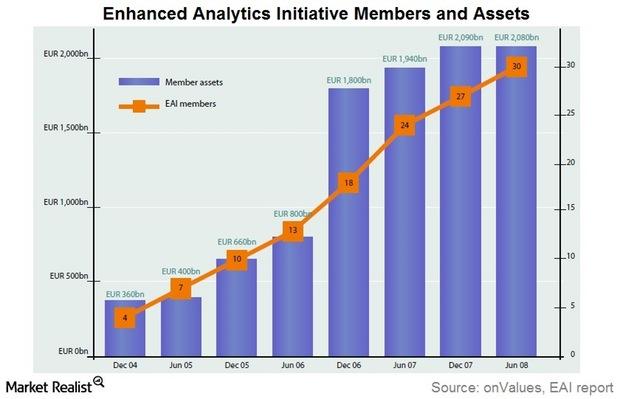

What to Take from the Enhanced Analytics Initiative

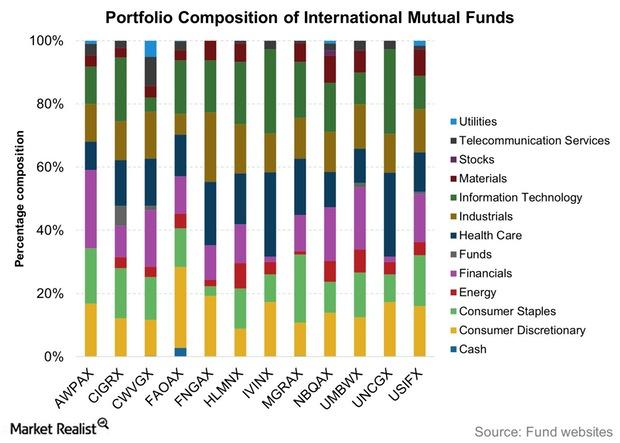

The onValues report on behalf of the Enhanced Analytics Initiative made several conclusions regarding the progress of its understanding of environmental, social, and governance criteria.Company & Industry Overviews Why Has CIGRX Delivered Below-Average Returns?

The Calamos International Growth Fund – Class A (CIGRX) seems to be cautious about its portfolio positioning for now.

Goldman Sachs Gets Bullish on Commodity Prices

Goldman Sachs has gone bullish on commodities. The finance major, which is the biggest commodities dealer (in sales), has advised clients to go overweight.

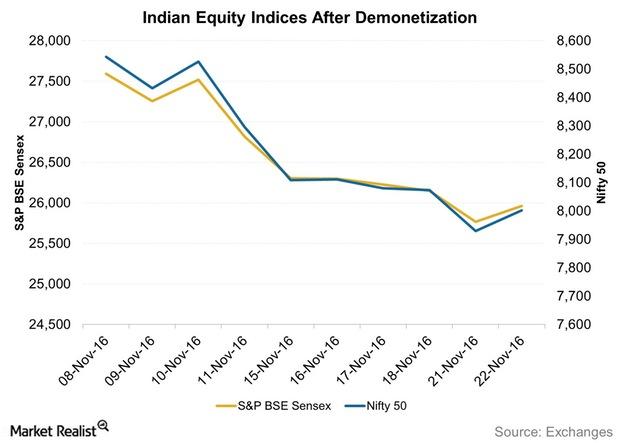

India’s Financial Markets Fell Due to Demonetization

The two benchmark equity indices—the Nifty 50 and the S&P BSE Sensex—fell each trading day since the demonetization except for November 10 and November 22.

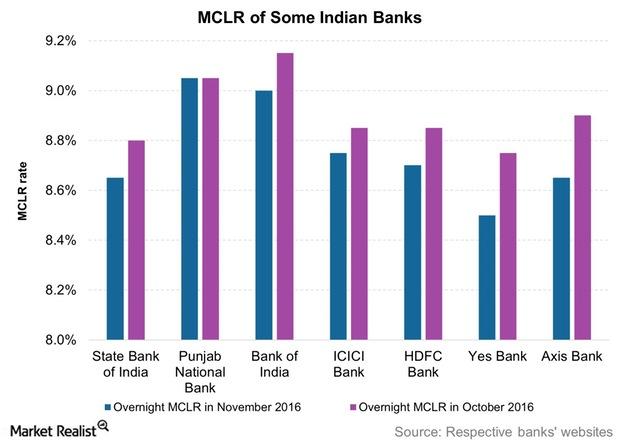

Will Demonetization in India Impact Your Loan Burden?

Banks saw a rise in term deposit accounts since the demonetization. As a result, commercial banks sharply reduced their deposit rates.

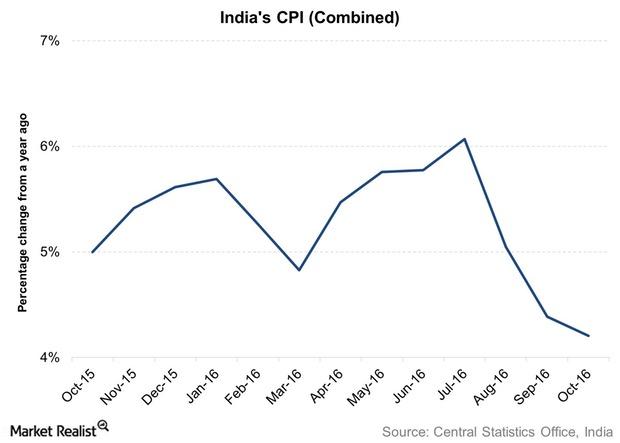

Will Demonetization Impact India’s Inflation?

The demonetization that has been in effect since November 9 is expected to have a negative impact on inflation. Consumer spending activity almost stopped.

How Could Demonetization Impact the Indian Economy?

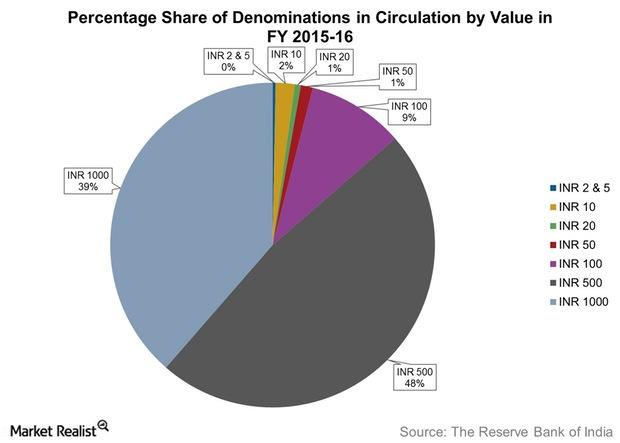

The demonetization of the 500 rupee note and the 1,000 rupee note will likely hit the Indian economy hard in the short term.

Why India Demonetized 2 Currency Notes

The 500 rupee note and the 1,000 rupee note were demonetized at midnight on November 8. The move aimed to curb black money in the financial system.

Narayana Kocherlakota on Trump and the Federal Reserve

Narayana Kocherlakota, 12th president of the Federal Reserve Bank of Minneapolis, said central banks have been able to control inflation better when left alone by the government.

Bernstein: Excess Risk Aversion Has Made Investors ‘Wallflowers’

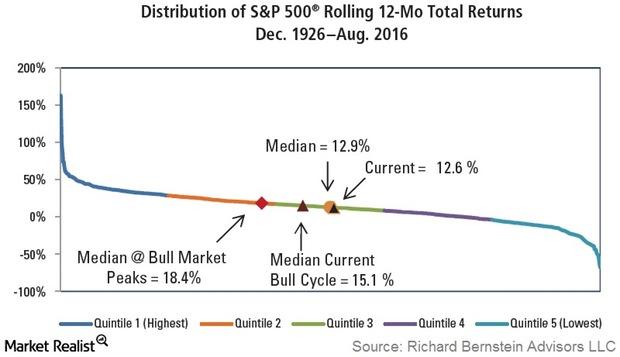

In his November Insights newsletter, Richard Bernstein stated, “It is incredible that investors have basically been wallflowers during the second longest bull market of the post-war period.”

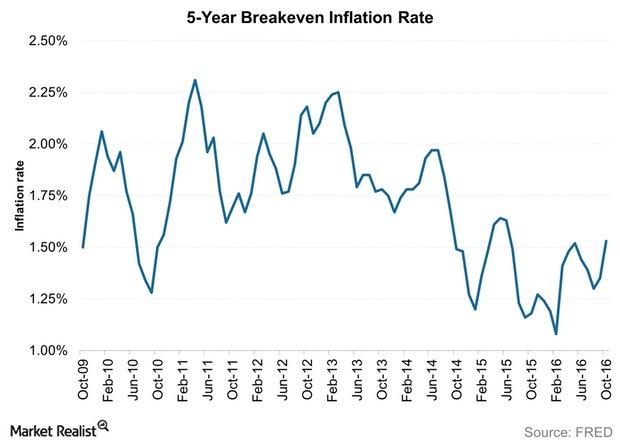

Richard Bernstein: Be Safe on Your Quest for Safety

After expressing his thoughts on the Baby Boomer generation’s having become risk-averse, Richard Bernstein moved on to the topic of the safety of “safe” investments.

Why Richard Bernstein Sees Risk in ‘Safe’ Investments

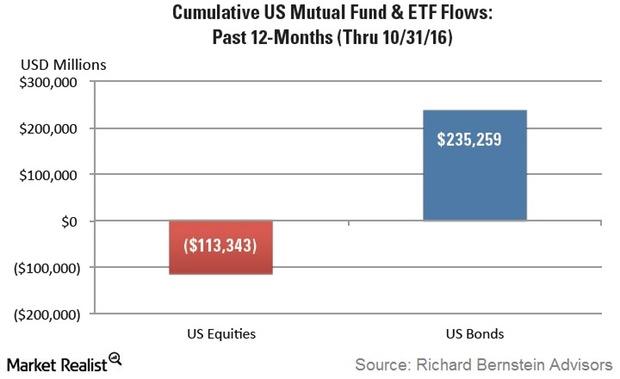

Richard Bernstein believes that investors’ flocking to fixed-income products and shunning equities has increased their risk.

Demographics Driving Conservative Investment? Bernstein Says No

After stating that the market isn’t in a low return environment, Richard Bernstein moved on to discuss the reasons cited by many for conservative asset allocation.

Bernstein on the Opportunity Cost of Underweighing Equities

In his November 2016 Insights newsletter, Richard Bernstein talked about the growing opportunity cost of investing in equities (SPHD) (VIG).

How the Next President Could Shape US Monetary Policy

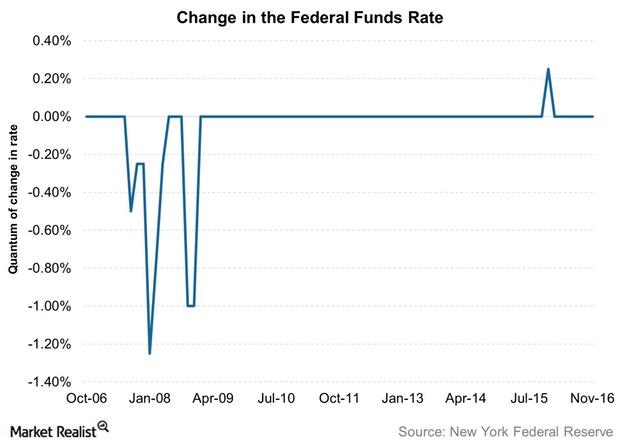

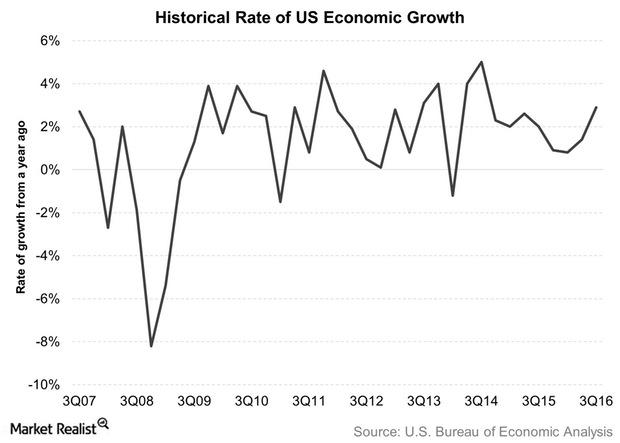

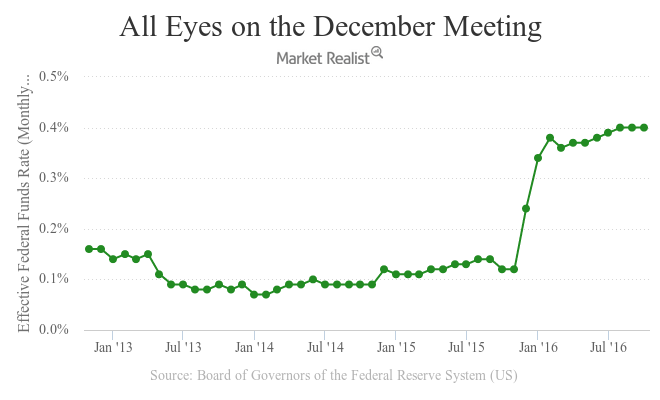

The Federal Reserve’s second last meeting of 2016 is now over, leaving only one meeting left in which the central bank can enact a rate hike.

Bill Gross: Monetary Policy on Steady but Slow Path

After the release of the FOMC’s November statement, Bill Gross said that monetary policy in the United States is steadily moving toward normalization, though its pace is slow.

A Pass on a November Hike: It’s Up to December Now

The expected occurred on November 2, 2016, when the FOMC (Federal Open Market Committee) left the federal funds rate unchanged at 0.25%–0.5%.

Investing in Environmental, Social, and Governance ETFs

Some stock indexes have taken into consideration ESG (environmental, social, and governance) criteria, applying the methods outlined in the previous article to tackle ESG issues.

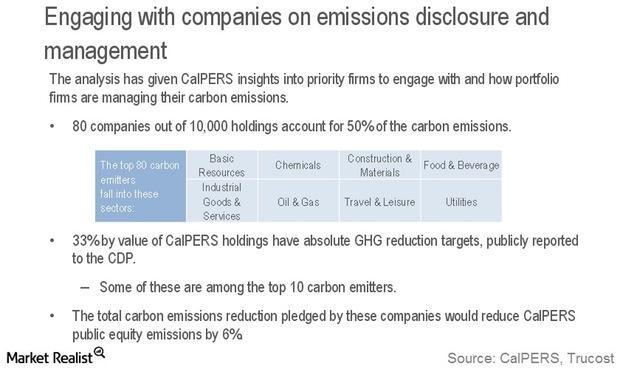

How Pension Funds Have Been Drawn to ESG

Though it might seem that considering environmental impacts while making investments is an oddity that arouses the interest of a niche group of investors, this assumption is incorrect.Macroeconomic Analysis Statoil Expects Cost Reductions in Offshore Wind

One reason that renewable energy hasn’t caught on in a big way is the cost associated with energy generation.

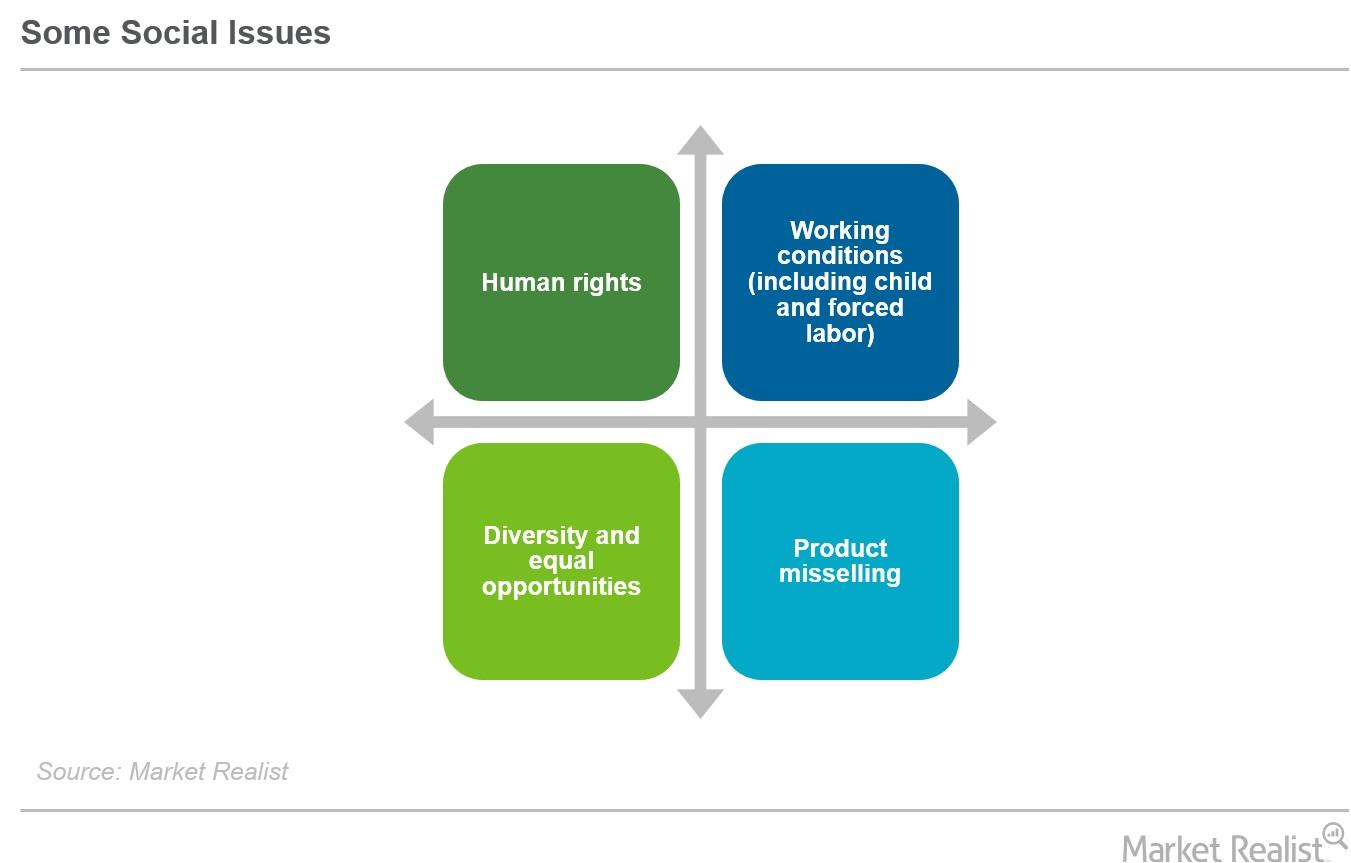

What Social Factors Do ESG Criteria Touch On?

Some issues considered under the social criterion when evaluating a company’s products and practices are human rights, human capital management, and work conditions.

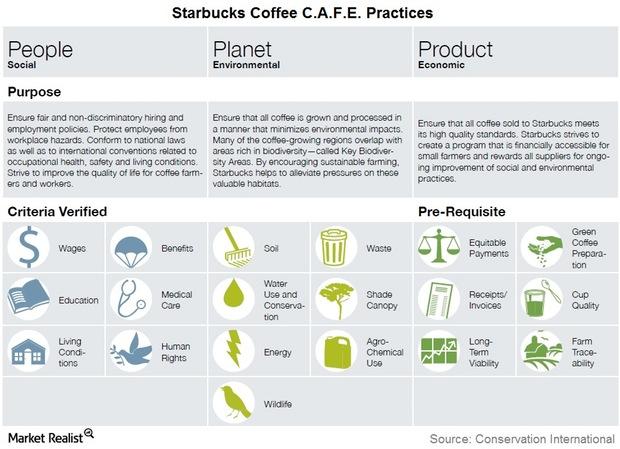

How Starbucks Brews Up Sustainable Products

A sustainable coffee effort In the previous article, we looked at industry-level and investment-level examples of how things have been on the sustainable investment front and the developments that are helping certain industries. In this article, we’ll look at a company-level example by way of Starbucks (SBUX). Starbucks employs sustainability standards called C.A.F.E. (Coffee and […]

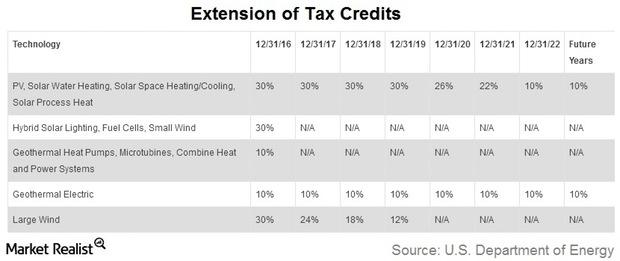

How the New US President Will Affect This Space

On December 15, 2015, the Obama administration signed a bill for the extension of tax credits to renewable energy.

What You Need to Know about the Enhanced Analytics Initiative

Established in mid-2004, the Enhanced Analytics Initiative was aimed at integrating extra-financial issues with traditional financial analysis with a long-term view.

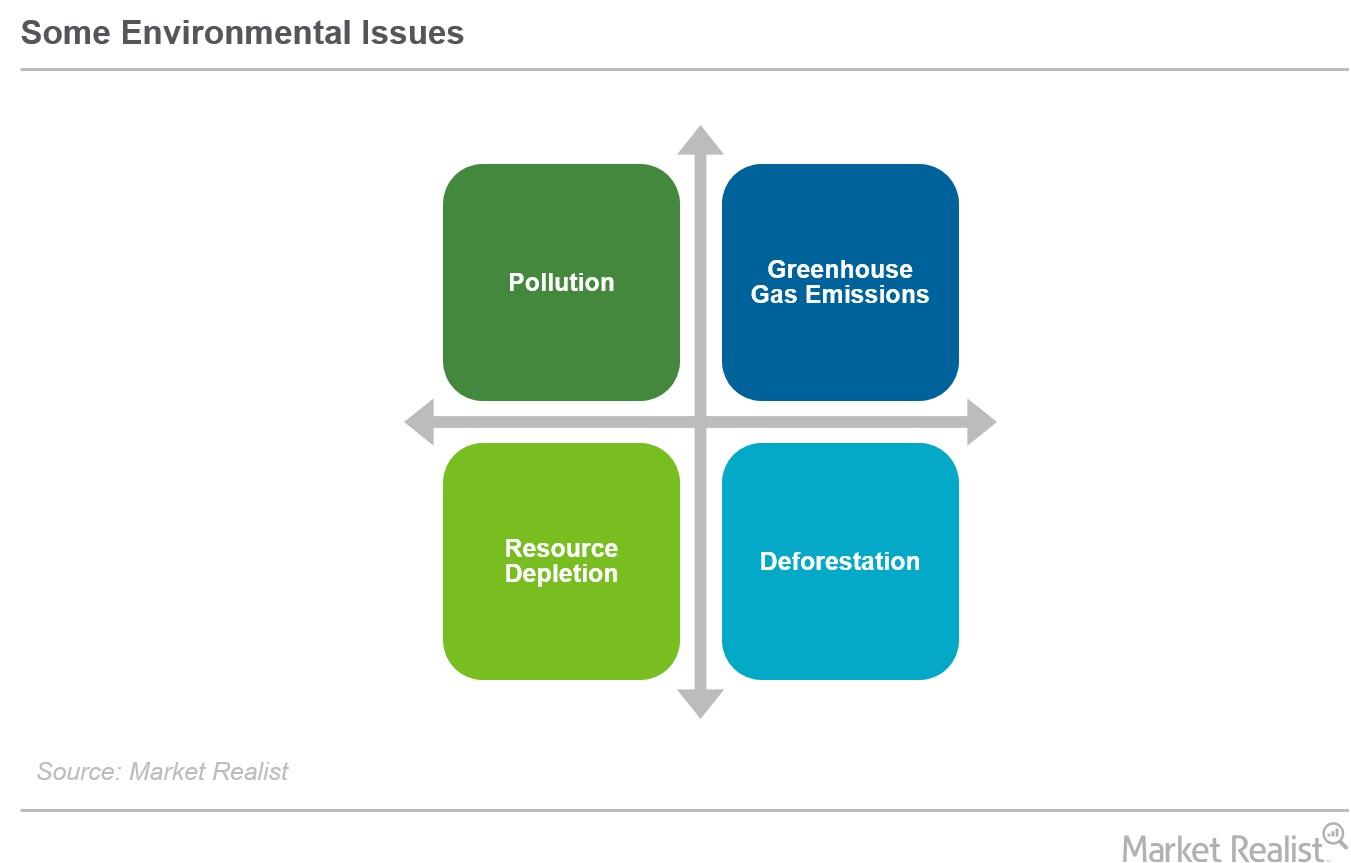

Evaluating ESG for the Effects on Environmental Issues

Some issues considered under the environmental criterion when evaluating a company’s products and practices are pollution, carbon emissions, and resource depletion.

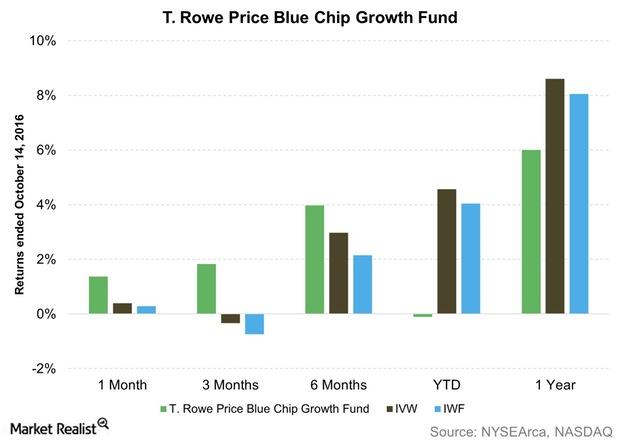

Why the T. Rowe Price Blue Chip Growth Fund Has Had a Rough 2016

TRBCX has had quite a poor run in 2016 so far. The fund places in the bottom three in the YTD period among the 12 funds in this review.

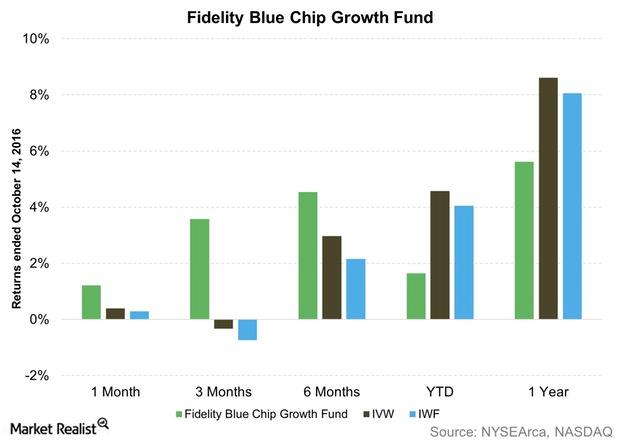

Behind the Fidelity Blue Chip Growth Fund’s Disappointing Performance in 2016

FBGRX has had a below-average 2016 so far, placing seventh in our select peer group of 12 funds in terms of point-to-point returns.

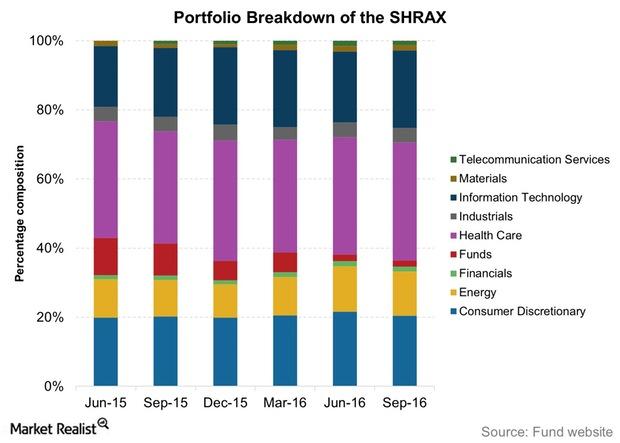

Inside the ClearBridge Aggressive Growth Fund Portfolio

The sectoral breakdown of SHRAX is unlike any other mutual fund in this review, with healthcare as its biggest holding, commanding 35% of the portfolio.