What Bond Mutual Fund Investors Can Do in a Liquidity Squeeze

Things look fine for now Previously in this series, we discussed how mutual funds have a notably larger holding of corporate bonds at present than they had before the financial crisis of 2008. We’ve also talked about how regulatory changes could impact the role of banks as market makers. At the same time, the role […]

Dec. 4 2020, Updated 10:42 a.m. ET

Things look fine for now

Previously in this series, we discussed how mutual funds have a notably larger holding of corporate bonds at present than they had before the financial crisis of 2008. We’ve also talked about how regulatory changes could impact the role of banks as market makers.

At the same time, the role of bond mutual funds as credit providers to the bond market—specifically, to corporate bonds—has expanded tremendously. However, large-scale redemptions can get mutual funds with investments in relatively illiquid securities into trouble, thus creating a spiral of declining prices and increasing redemptions. Combine this with the fact that events like a rate hike can, and mostly will, reduce the liquidity of bonds in the market, and the situation poses a significant risk to bond mutual fund investors.

This all leads to one big question: What can investors do in such a scenario?

Plan of action

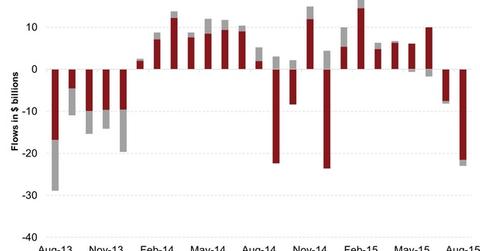

The graph above shows flows into taxable and municipal bonds. Note that in both July and August, bond funds witnessed outflows, possibly due to expectations of a rate hike in September 2015. Generally speaking, expectations of a rate hike in the future can result in similar, even sharper outflows than what the graph shows.

So if you’re in it for the long term, the one and only thing you can do is stay calm. This advice is specifically for investors who treat their fixed income investments as an asset, with no promise of returns—not as a deposit that they can withdraw any time they want.

For investors whose nerves get the better of them when asset prices turn south, you might consider trying to move from high-yield bonds into either Treasuries (VFIIX) or investment-grade corporate bonds (PTTAX), which are invested into higher-rated papers. If you want to remain invested, you might want to prepare yourself for some volatility and be sure that your portfolio is free of investments that can be difficult to sell in a liquidity crunch.

High-yield securities are traditionally considered less liquid than other types of bonds. Funds like the American Funds American High-Income Trust Class A (AHITX) and T. Rowe Price High Yield Fund Advisor Class (PAHIX) invest 20–30% of their assets in securities rated CCC and below. Securities rated at this scale may not find many takers in a liquidity squeeze.

On the other hand, funds like the PIMCO High Yield Fund Class A (PHDAX) and the Prudential Short Duration High Yield Income Fund Class A (HYSAX), which invests in bonds issued by companies like MGM Resorts International (MGM), NRG Energy (NRG), and Alcatel-Lucent SA (ALU), have less than 8% of their assets invested into this segment.

You might also consider keeping your investment advisor engaged by discussing your concerns about the liquidity of your investments related not just to corporate bands but to investment-grade bonds and Treasuries.

On the Market Realist end, we’ll continue to keep you updated with developments on mutual funds on our Mutual Funds page.