PIMCO Total Return Fund

Latest PIMCO Total Return Fund News and Updates

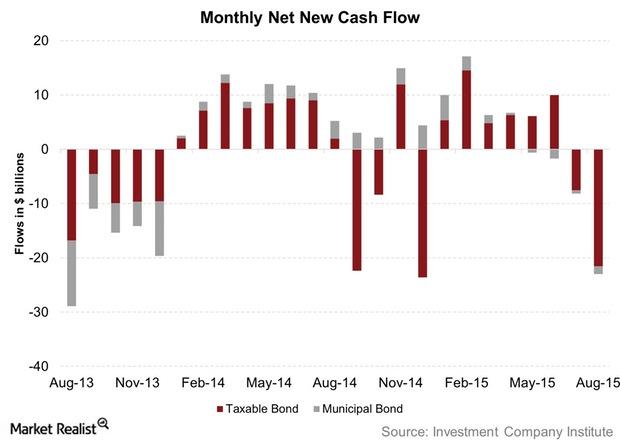

What Bond Mutual Fund Investors Can Do in a Liquidity Squeeze

Things look fine for now Previously in this series, we discussed how mutual funds have a notably larger holding of corporate bonds at present than they had before the financial crisis of 2008. We’ve also talked about how regulatory changes could impact the role of banks as market makers. At the same time, the role […]

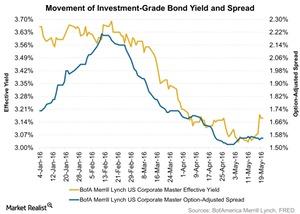

High-Grade Bond Yields Rise on Better Odds of a Rate Hike

Last week, investment-grade bond yields jumped 12 basis points and ended at 3.16%, the highest level since April 5, 2016.