NRG Energy Inc

Latest NRG Energy Inc News and Updates

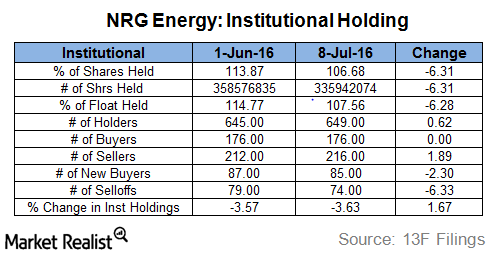

What Are Institutional Investors Doing with NRG Energy?

Institutional investors decreased their positions in NRG Energy (NRG) in June 2016.

Oaktree Capital Sheds Nearly Half Its Holdings in NRG Energy

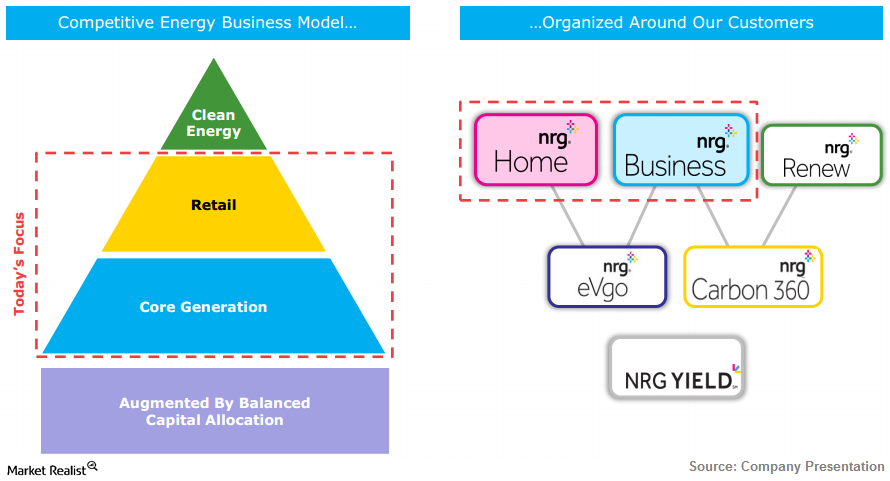

NRG Energy is a US-based integrated retail electricity and wholesale power-generation firm. The company has 2.5 million residential customers across the US.

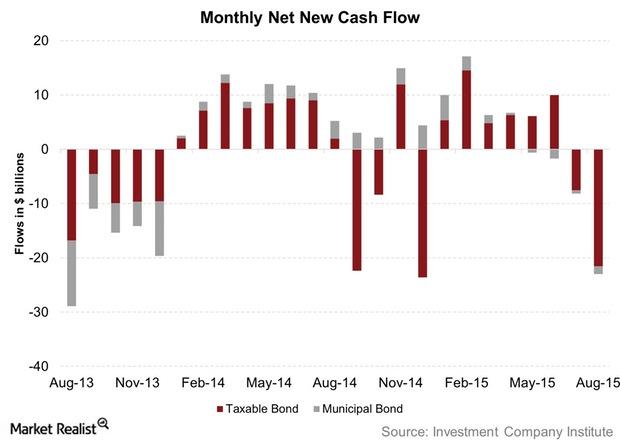

What Bond Mutual Fund Investors Can Do in a Liquidity Squeeze

Things look fine for now Previously in this series, we discussed how mutual funds have a notably larger holding of corporate bonds at present than they had before the financial crisis of 2008. We’ve also talked about how regulatory changes could impact the role of banks as market makers. At the same time, the role […]

NRG Energy’s Valuation Compared to Its Peers

Currently, NRG Energy (NRG) stock is trading at a forward PE ratio of 8.5x based on its estimated EPS in 2019.

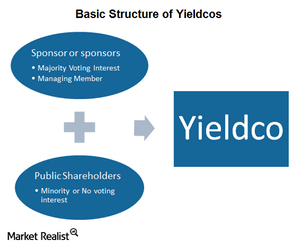

Yieldco: A Green Investment Option That Pays

While REITs started trading in 1951 and MLPs started off in 1981, the first yieldco was floated in 2005 by Seaspan Corporation, a shipping company.Energy & Utilities Why did the market punish Exelon?

Exelon Corporation’s (EXC) stock has been hammered in the last six years. In 2008, the stock was trading at ~$90 per share. Early this year, the stock was available at less than $27 per share.Energy & Utilities Must-know: Understanding Duke’s strategy

In recent years, Duke Energy (DUK) made its intent very clear. It concentrates on its regulated utilities—its core business—instead of other areas. The regulated utilities business is Duke’s strength.Energy & Utilities Why electricity demand is linked to GDP

Electricity is the backbone of a nation’s progress. All of the industries need electricity to operate—directly or indirectly. When a business flourishes, the electricity consumption increases.

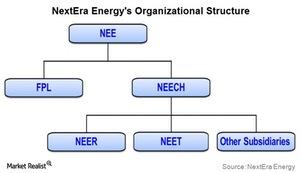

NextEra Energy plays in regulated and unregulated utility markets

NextEra Energy is a Florida-based power company. Its subsidiaries are Florida Light & Power and NextEra Energy Resources.

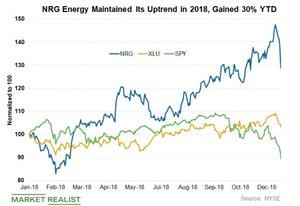

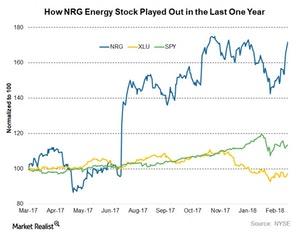

Elliott Management Exits NRG Energy in Q1: What’s Next?

Elliott Management, the activist shareholder whose involvement doubled NRG Energy (NRG) stock in the last year, has exited NRG.

NRG Energy’s Current Valuation

Currently, NRG Energy (NRG) stock is trading at an EV-to-EBITDA valuation of 12x—compared to its five-year historical valuation of around 11x.

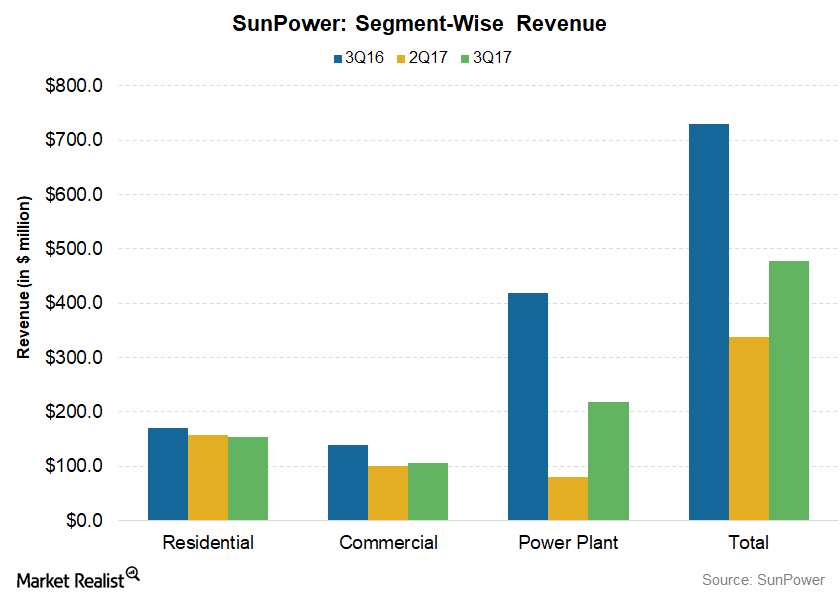

Why SunPower Reported Lower 3Q17 Revenues

SunPower (SPWR) reports its revenue under the power plant, residential, and commercial segments. The latter two segments are together called the distributed generation segments.

Cleaner Natural Gas Production Continuing to Hurt Coal Miners

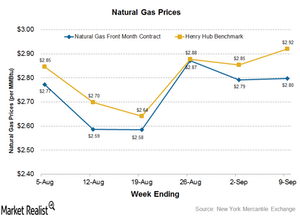

Henry Hub benchmark natural gas prices came in at $2.92 per MMBtu for the week ended September 9, 2016, compared to $2.85 per MMBtu for the previous week.

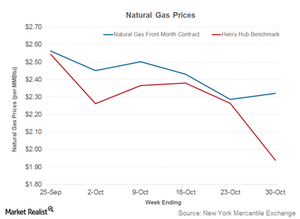

Coal under Pressure as Natural Gas Prices Remain Subdued

Natural gas prices and coal’s market share in electricity generation are related. When natural gas prices fall, coal loses market share. It becomes more economical to use natural gas for power generation.

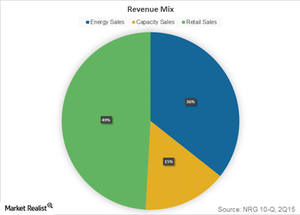

How Does NRG Energy Earn Its Revenues?

NRG Energy (NRG) earns revenues in three primary ways across its segments: energy sales, capacity sales, and retail sales.