American High-Income Trust

Latest American High-Income Trust News and Updates

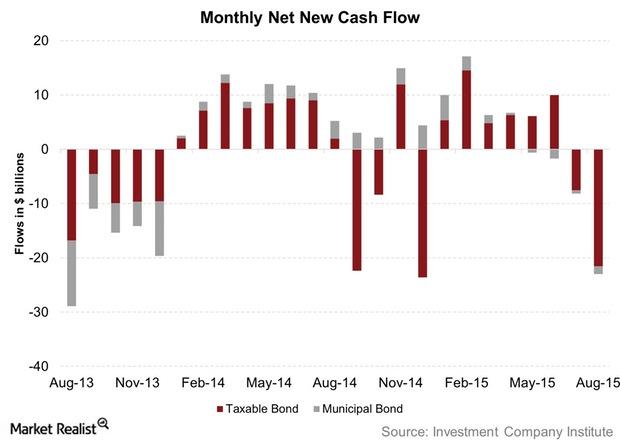

What Bond Mutual Fund Investors Can Do in a Liquidity Squeeze

Things look fine for now Previously in this series, we discussed how mutual funds have a notably larger holding of corporate bonds at present than they had before the financial crisis of 2008. We’ve also talked about how regulatory changes could impact the role of banks as market makers. At the same time, the role […]

Bill Gross Talks about Compressed ‘Carry’ in Financial Markets

In his latest monthly investment outlook for June 2016, bond market veteran Bill Gross talked about “carry” in financial markets.

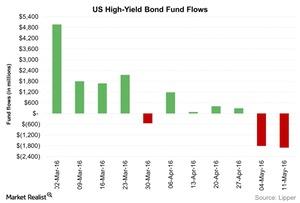

How Did High Yield Bond Fund Outflows Do Last Week?

Investor flows into high yield bond funds were negative last week for the second consecutive week. Net outflows from high yield bond funds totaled $1.9 billion.