Yum Brands Inc

Latest Yum Brands Inc News and Updates

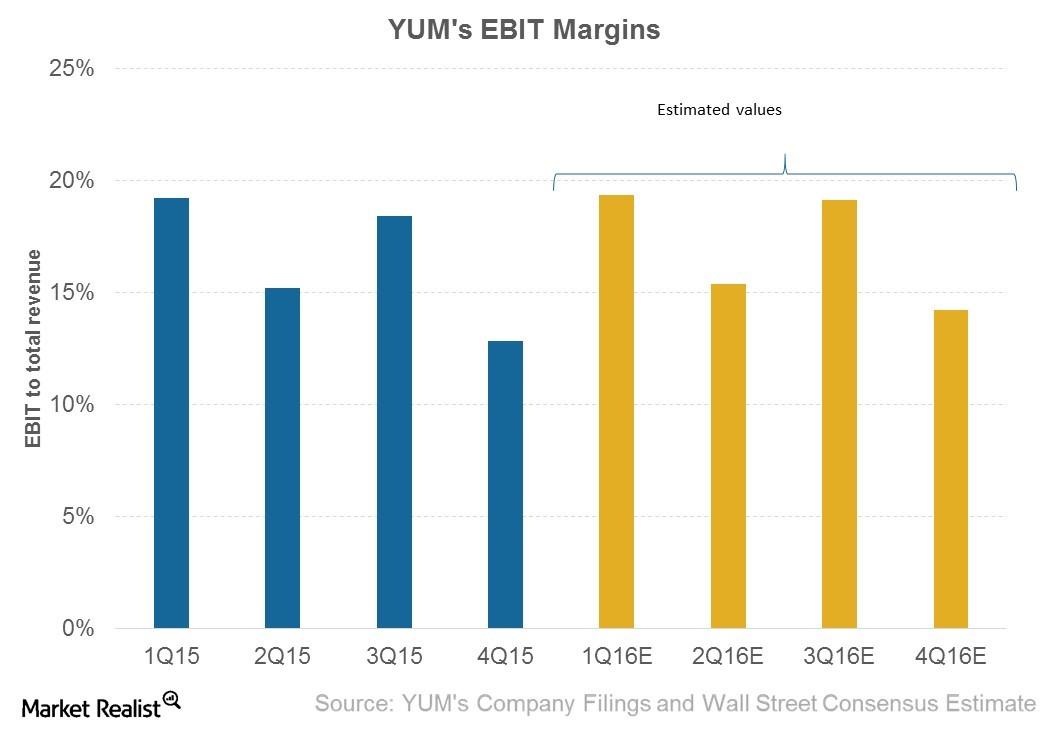

Could Yum! Brands’ Margins Increase in 1Q16?

With positive same-store sales growth expected in all three of YUM’s divisions, analysts are expecting the leverage to improve the company’s margins.

Why Analysts Say ‘Hold’ for Domino’s Stock ahead of Q1 Earnings

As of April 21, 2017, Domino’s Pizza (DPZ) was trading at $179.3. Domino’s stock price might have factored in the estimates we discussed in our previous articles.

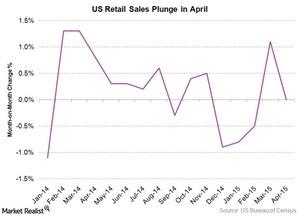

US Retail Sales Flat in April on Rising Oil Prices, Yet XRT Up 1%

Retail sales in the United States in April didn’t see any growth over March’s sales figures. But the jobless claims reading brought some positive news for the consumer sector.

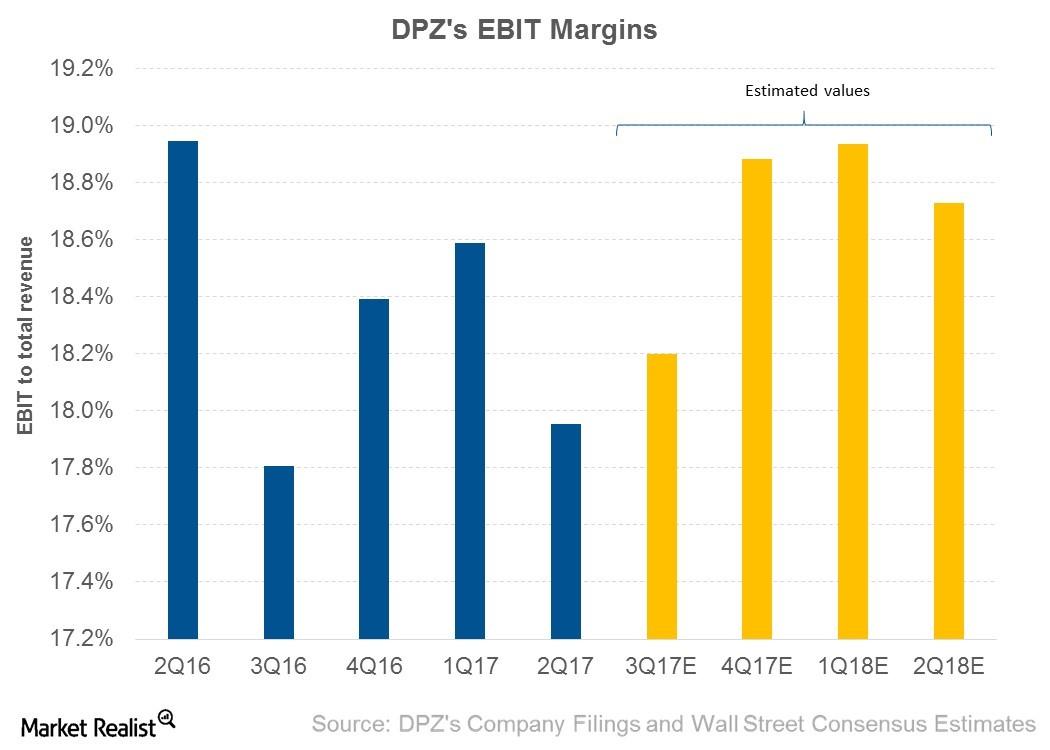

Why Did Domino’s EBIT Margin Decline in 2Q17?

For 2Q17, Domino’s (DPZ) posted EBIT (earnings before interest and tax) of $113.27 million, which represents an EBIT margin of 18.0%, compared with 18.9% in 2Q16.

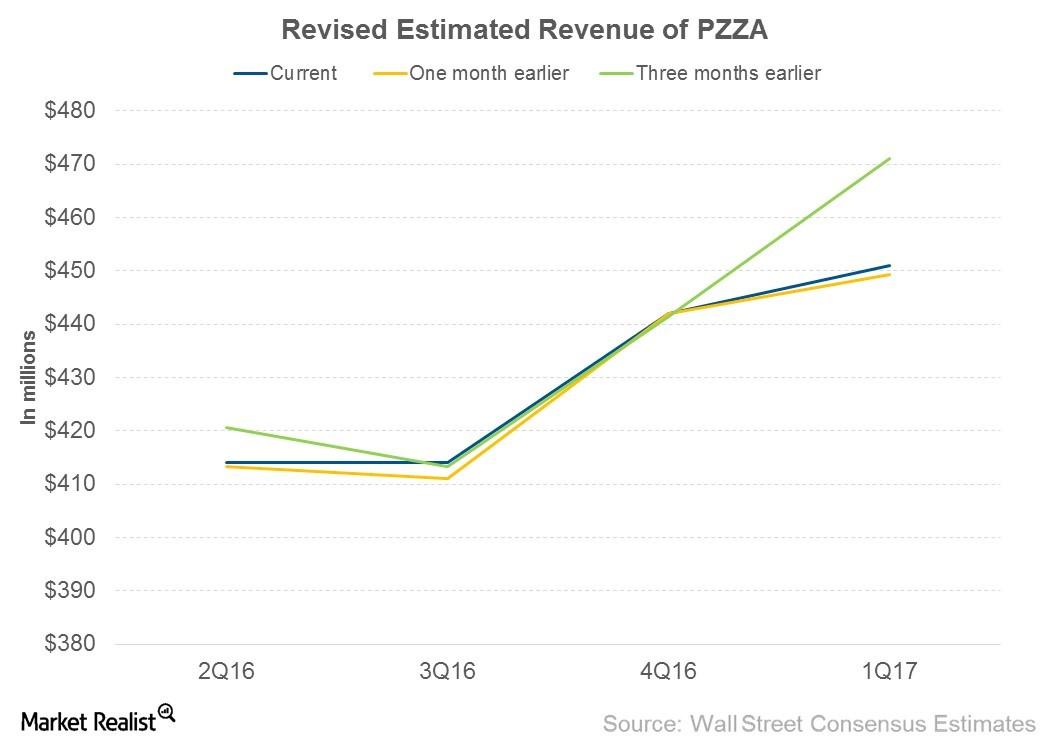

Why Have Analysts Raised their Revenue Estimates for Papa John’s?

In 1Q16, PZZA’s domestic company-owned restaurants generated nearly 48% of Papa John’s revenue, while domestic commissaries and others generated 39.4%.

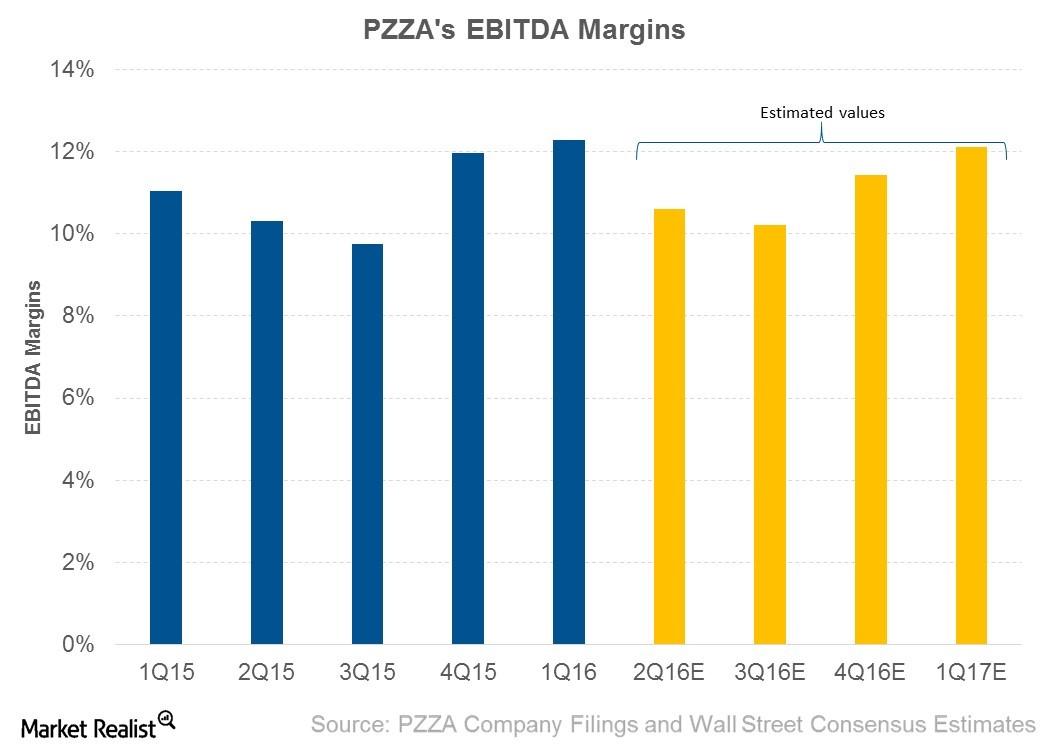

Why Are Analysts Expecting Papa John’s EBITDA Margins to Expand in 2Q16?

Analysts expect Papa John’s (PZZA) to post EBITDA of $43.9 million in 2Q16. This represents an EBITDA margin of 10.6%, compared to 10.3% in 2Q15.

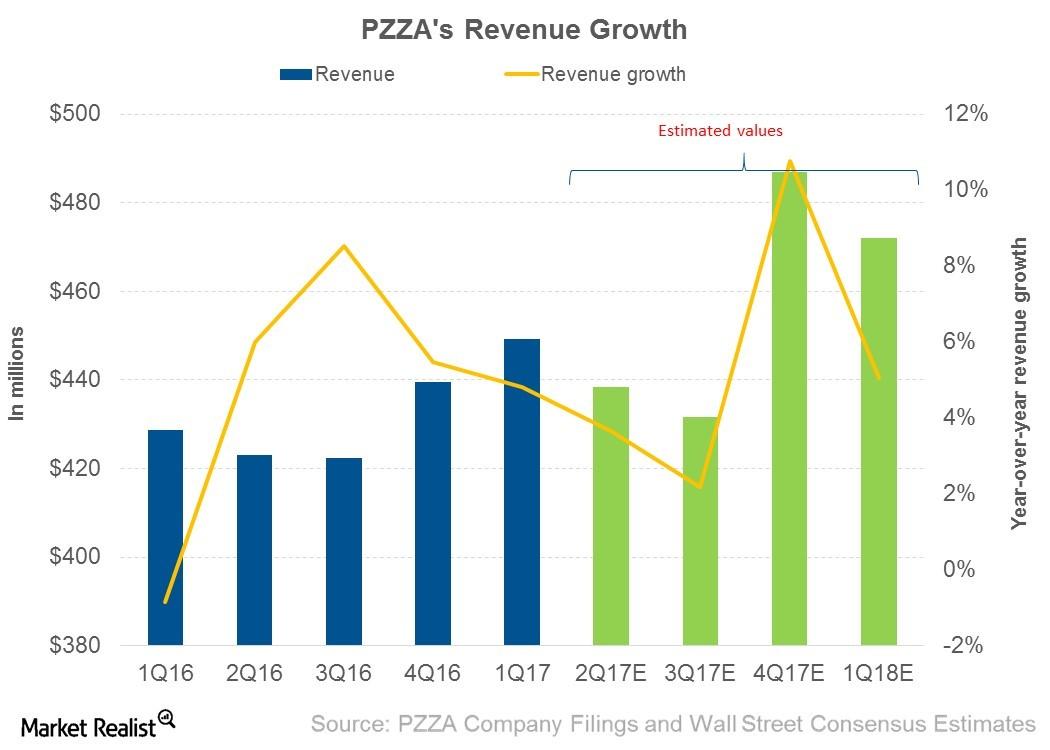

Papa John’s Revenue Estimates for the Next 4 Quarters

For the next four quarters, analysts expect Papa John’s (PZZA) to post revenue of $1.83 billion, which represents growth of 5.5%.

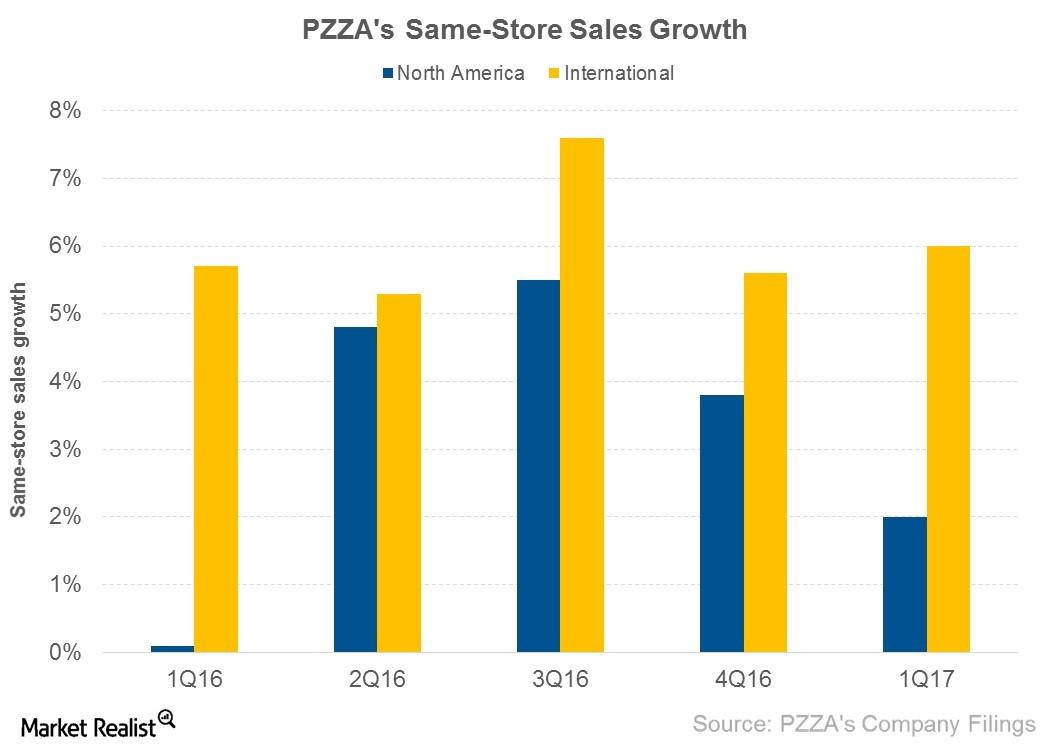

Factors That Drove Papa John’s Same-Store Sales Growth in 1Q17

In 1Q17, Papa John’s (PZZA) restaurants in North America posted SSSG of 2%. Company-owned restaurants posted SSSG of 3%, and franchised restaurants posted SSSG of 1.7%.

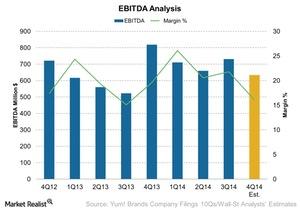

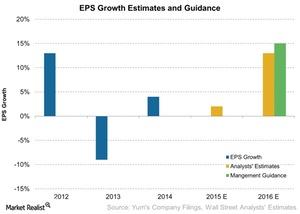

Why Yum! Brands Is Expected To Report Lower EBITDA

Wall Street analysts’ estimated EBITDA for the fourth quarter is $633 million—compared to $918 million in the same quarter last year.

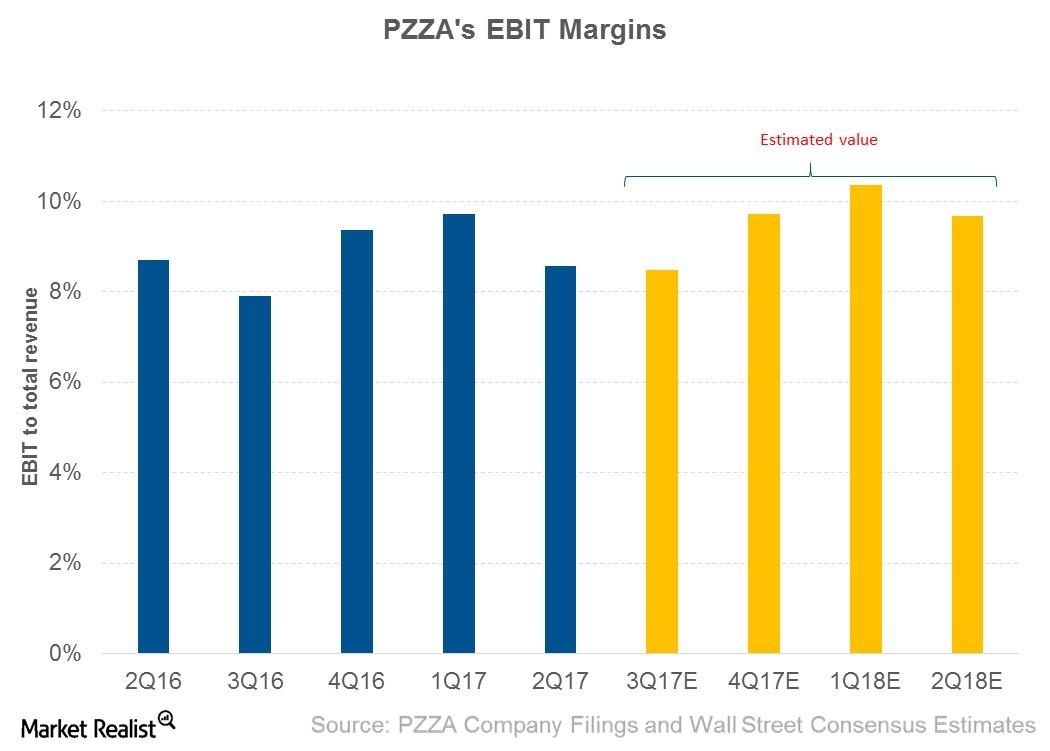

Why Papa John’s Earnings Margin Narrowed in 2Q17

Performance in 2Q17 In 2Q17, Papa John’s International (PZZA) posted EBIT (earnings before interest and tax) of $37.2 million, which represents an EBIT margin of 8.6%. In comparison, the company posted an EBIT margin of 8.7% in 2Q16. Why Papa John’s margins narrowed Papa John’s EBIT margins were impacted by a rise in the cost of […]

Why Investors Are Confident in YUM ahead of Its 3Q16 Results

Yum! Brands develops, operates, franchises, and licenses the Pizza Hut, KFC, and Taco Bell brands. It’s set to announce its 3Q16 results on October 5, 2016.

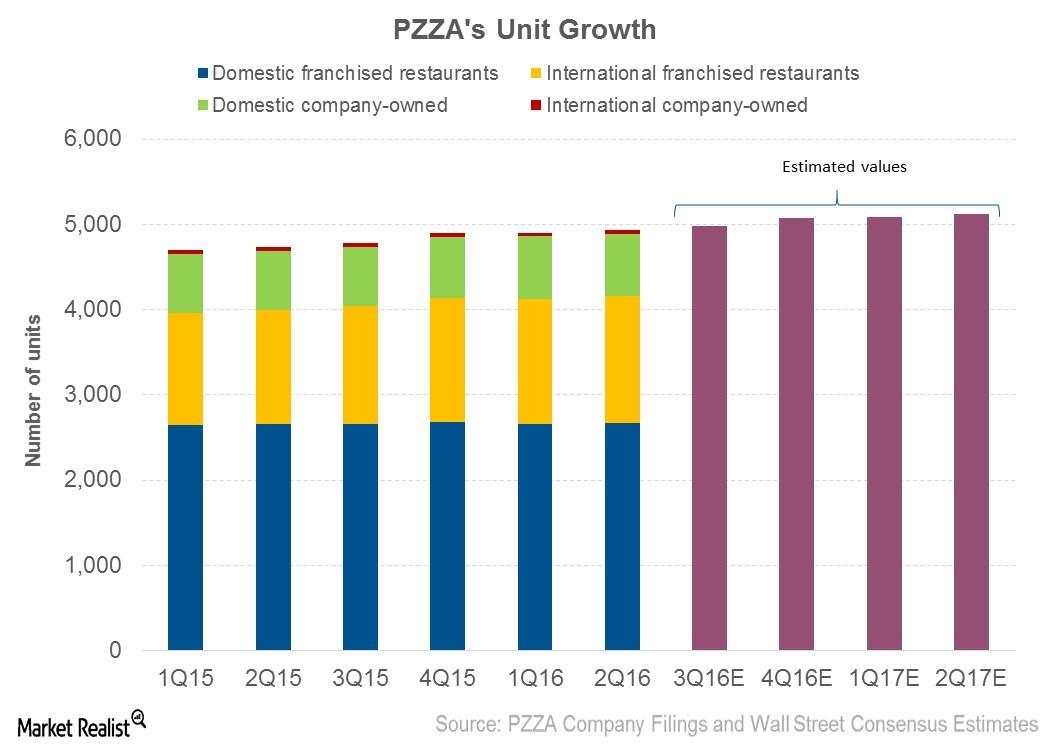

Franchising Dominates Papa John’s Expansion Plans

With 42 units added in the first two quarters of 2016, Papa John’s has maintained its 2016 guidance for unit growth at 180–200 units.

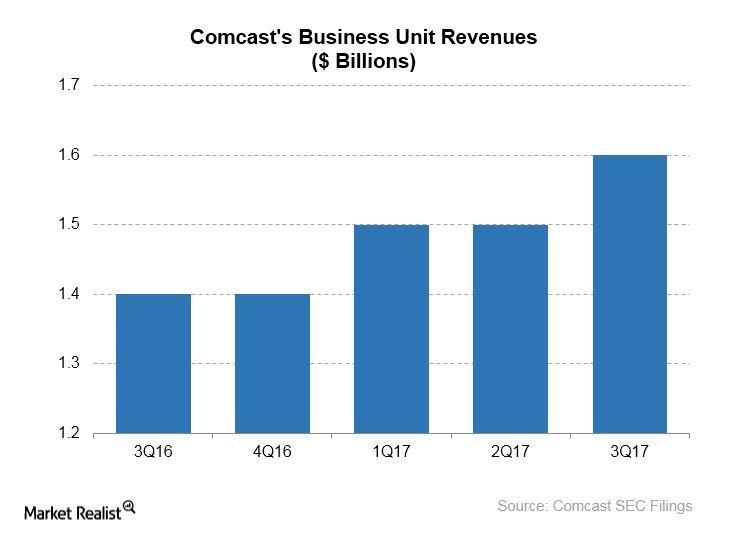

Comcast Moves To Boost Growth In Business Unit

In 3Q17, Comcast’s Business Services segment generated revenues of $1.6 billion, which rose 12.6% year-over-year.

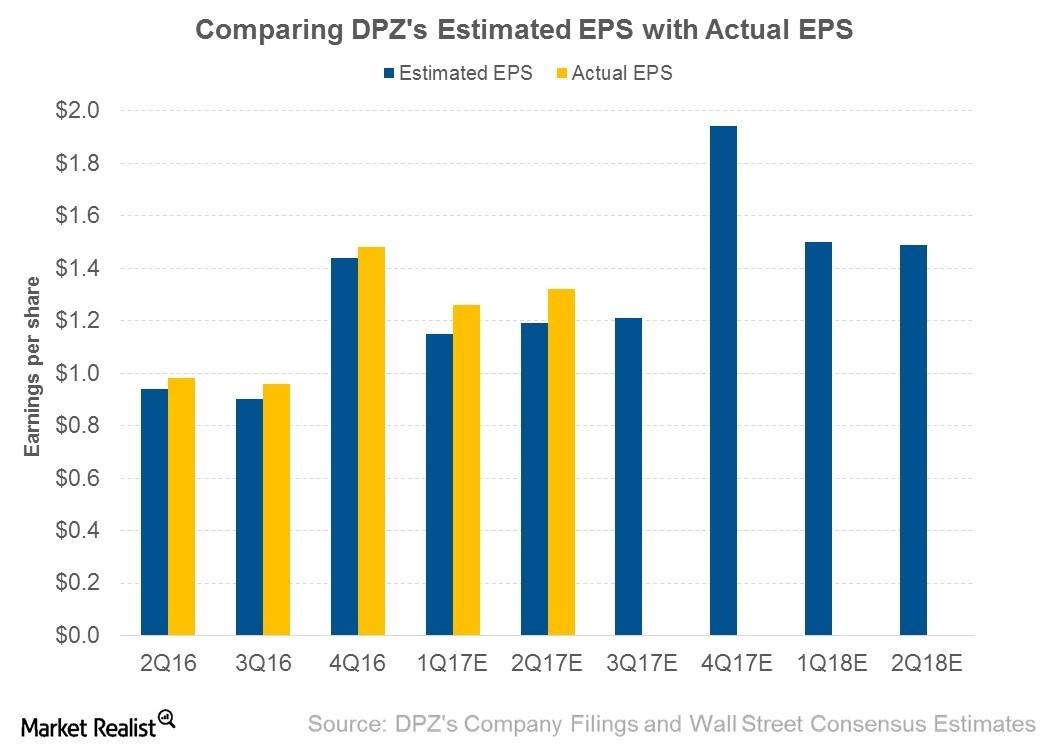

Could Domino’s Earnings Rise in the Next 4 Quarters?

Earnings expectations For the next four quarters, analysts expect Domino’s Pizza (DPZ) to post EPS (earnings per share) of $6.14, which represents a growth of 22.3% from the EPS of $5.02 seen in the four quarters prior. EPS growth Domino’s EPS growth is expected to be driven by higher revenue, EBIT (earnings before interest and tax) […]

When Will Yum! Complete the Separation of Its China Division?

On October 20, Yum! announced that it will separate its China division from the rest of its business. It’s expected to complete this by the end of 2016.

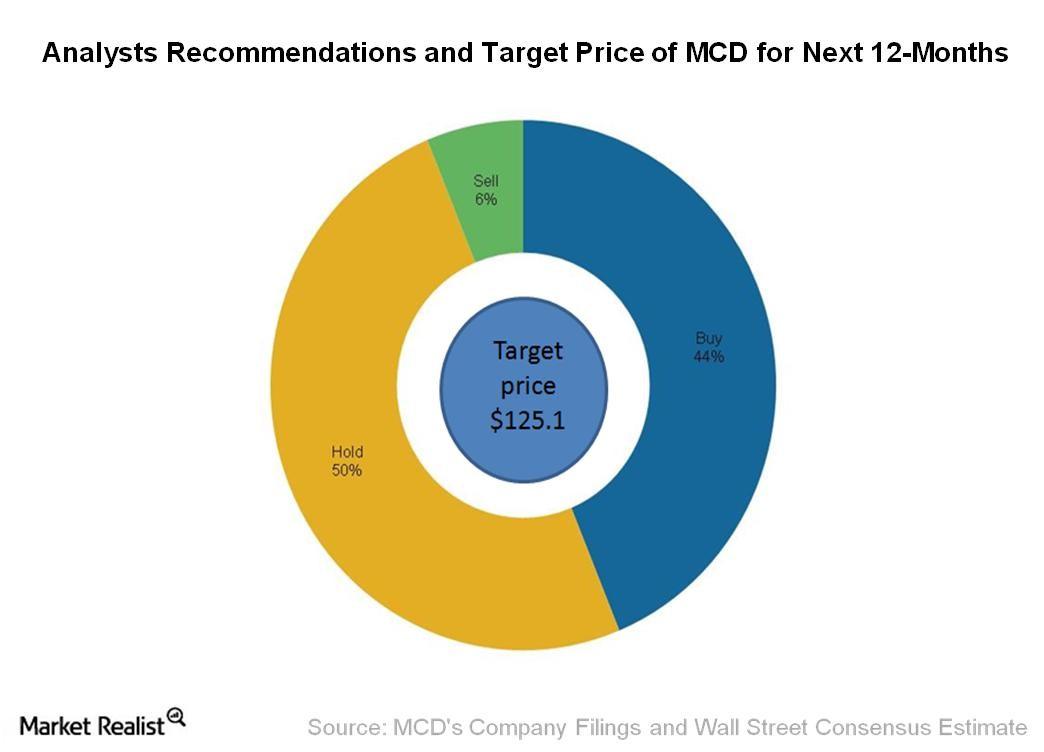

Analysts Revised the Price Target after McDonald’s Earnings

Wall Street analysts set a price target of $125.1 for the next 12 months with a return potential of 5% from the closing price of $119.2 on January 25.

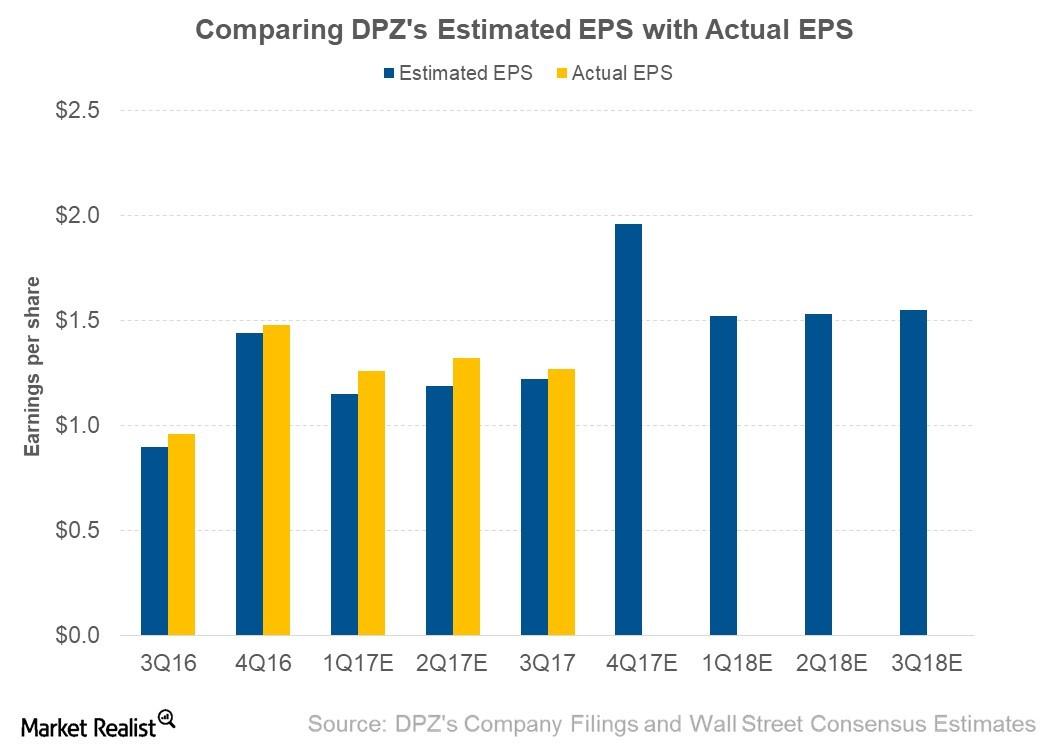

This Likely Drove Domino’s 3Q17 EPS

For 3Q17, Domino’s Pizza (DPZ) posted adjusted EPS (earnings per share) of $1.27, which represents a 32.3% YoY (year-over-year) rise from $0.96 in 3Q16.

BYND Leads Alt-Meat Market, Faces New Competitors

On Friday, investment bank UBS started coverage on Beyond Meat Stock (BYND). At 10:08 AM ET today, the stock was trading 4.4% lower at $76.5.

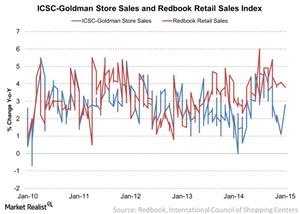

Retail Sales Reports From ICSC-Goldman And Johnson Redbook

The ICSC-Goldman and Johnson Redbook indices both report consumer spending data each week, but people consider the ICSC-Goldman index to be more consistent.

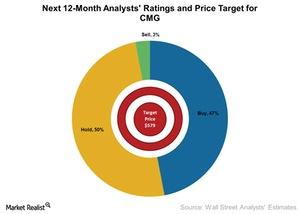

Must Know: Analysts’ Price Target for Chipotle Mexican Grill

About 47% of analysts have “buy” recommendations on Chipotle, 50% of analysts have “hold” recommendations, and 3% have “sell” recommendations on the company. Overall, the stock has a “buy” rating.Consumer Why Yum! Brands’ division in China is important

Yum! Brands’ (YUM) division in China includes its business in mainland China. It’s the combined revenues from all the brands—KFC, Pizza Hut, East Dawning, and the Little Sheep.Consumer Analyzing Burger King’s shifting business model focus in 2Q14

Franchise revenues include royalties and franchise fees. Royalties are calculated as a percentage of franchise restaurant revenues, which are driven by same-store sales.

McDonald’s Risks, Strengths, and Weaknesses

The restaurant industry is susceptible to a wide array of risks of macro and micro factors. As a huge global brand, McDonald’s faces several risks.Earnings Report Starbucks’ strategy: Aggressive unit growth

Unit growth is a key driver that Starbucks is aggressively pursuing to grow the company’s sales. In the last 12 months, Starbucks has added 1,599 net new restaurants, or 8% growth in units.Consumer Why Tim Hortons introduced a mobile app and loyalty cards

Along with introducing new products like those we discussed in the previous part of this series, Tim Hortons (THI) is also testing different revenue channels and payment methods.

Analyzing Shake Shack’s Fine-Casual Concept

Shake Shack is conceptualized as a “new fine-casual” restaurant format. The fine-casual restaurant is a hybrid of the fine dining and fast-casual dining formats.Consumer Must-know: Yum! Brands’ segments by business models

For six months ending June 2014, China’s division reported revenue of $3 billion, or 52% of Yum! revenues. China only represents 15% of the more than 40,000 Yum! restaurant units.Consumer Why Yum! Brands’ division in India has been successful

Yum! Brands’ (YUM) division in India includes its businesses in India, Nepal, Bangladesh, and Sri Lanka. As of June 2014, the company had 714 restaurant units in India.

McDonald’s Global Presence and the Three-Legged Stool

McDonald’s, the world’s largest fast food chain, has over 38,000 restaurants across 120 countries. In 2018, it had approximately $21.0 billion in sales.

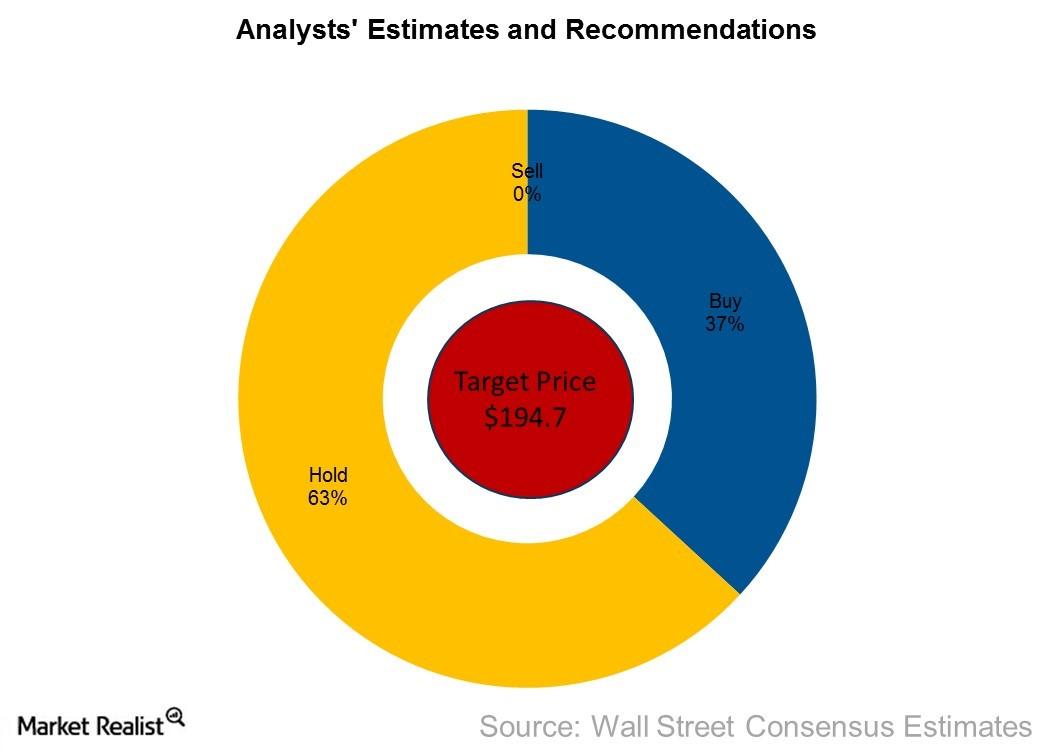

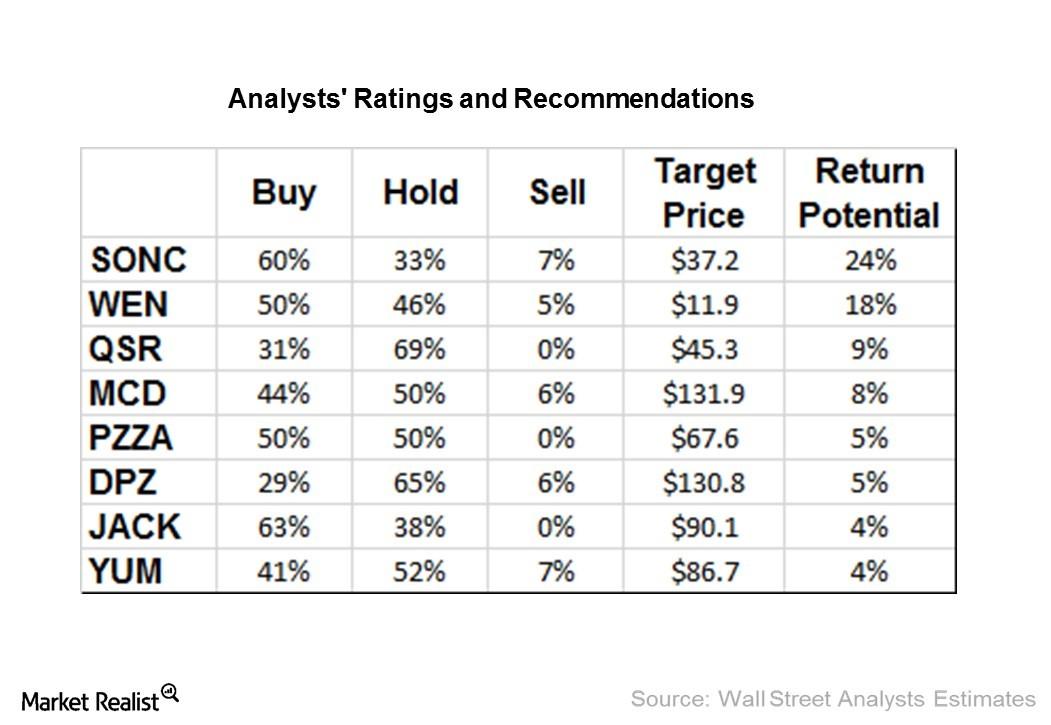

The Word on the Street: What Analysts Are Recommending for Fast-Food and Pizza Companies after 1Q16

JACK, PZZA, and QSR are the most favored stocks in our group of eight fast-food restaurants, with no analyst recommending a “sell” for their stocks.Consumer Domino’s management guidance on food costs, capex, and more

Management anticipates the effective tax rate to be in the range of 37% to 38% for the “foreseeable future.” Corporate tax rates in the U.S. are high, and force some companies to move their headquarters to countries offering lower tax rates.

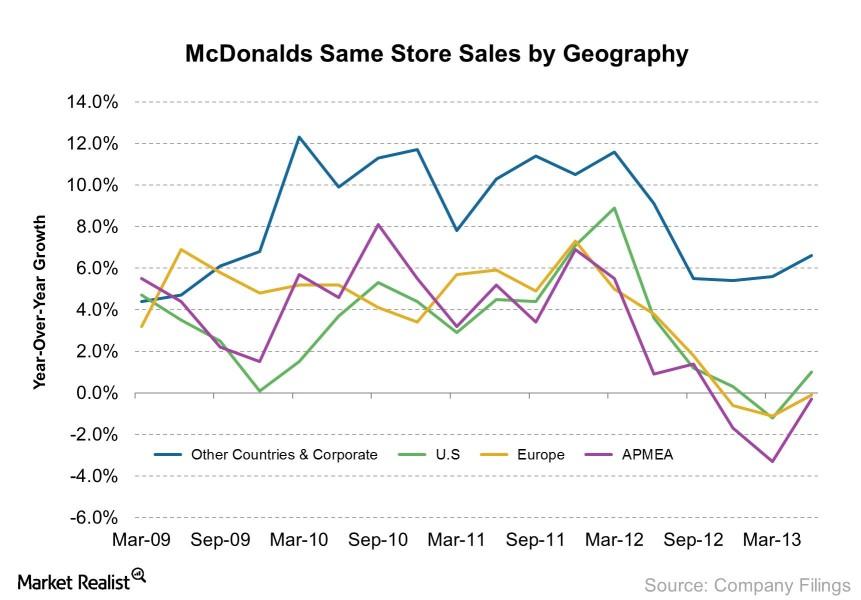

Downward trend: McDonald’s November Same-Store Sales

McDonald’s November same-store sales indicate a continued slide in all segments. Tensions between Russia and Ukraine are partially to blame.Consumer Why Burger King is improving its traffic through product innovation

Burger King (BKW) introduced premium products internationally that should complement its menu. It launched a Hashbrown Whopper in Korea, a Barbecue Bacon Whopper in the U.S., and a Mexican Whopper in Spain.

Must-Know: What Is PEG Ratio and How Is It Used?

Investors use a bunch of metrics to determine if a stock is attractive. One such metric is the PEG or the price-to-earnings-to-growth ratio.

An Investor’s Guide to Chipotle and Its Customers

Chipotle Mexican Grill (CMG) operates more than 1,700 fast-casual restaurants. Here’s everything you need to know about the business.

Wedbush Initiated Coverage on Papa John’s with a ‘Buy’ Rating

On Wednesday, Nick Setyan of Wedbush initiated his coverage on Papa John’s with a “buy” rating. He also gave a target price of $95.

Must-Know: McDonald’s Has Got Tough Competition

McDonald’s (MCD) competition includes large international and national food chains as well as regional and local retailers of food products.

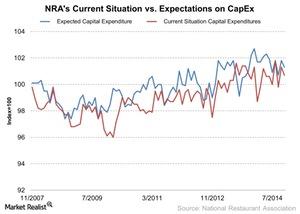

Restaurant Industry Outlook On Capital Expenditures

Restaurants make capital expenditures for various reasons. They do it to open new stores, purchase new equipment, and remodel existing stores.

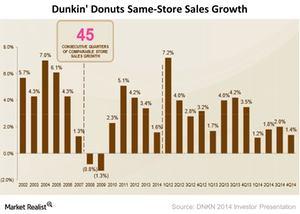

How Is Dunkin’ Donuts Doing in Same-Store Sales Growth?

Overall same-store sales growth for Dunkin’ Donuts has been declining. The company had negative same-store sales growth in 2008 and 2009.Consumer Why McDonald’s same-store sales declined across all segments

During the earnings call, management stated that McDonald’s “hasn’t changed at the same rate as its customers’ eating out expectations” in its priority markets.

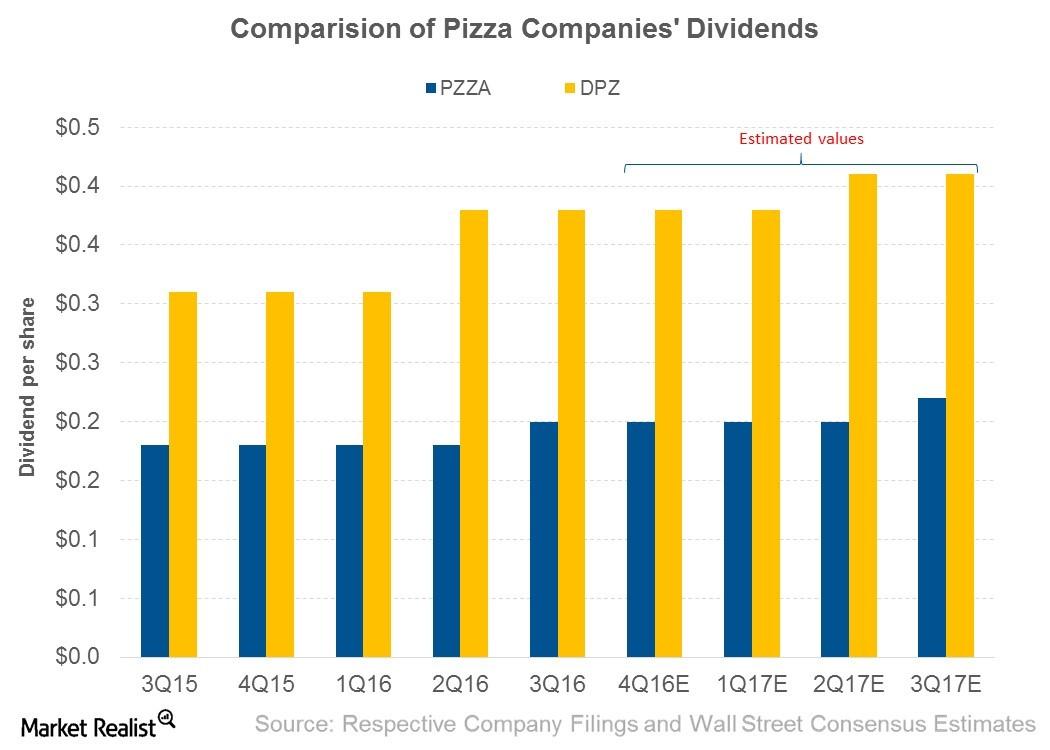

Comparing Domino’s and Papa John’s Dividend Policies

Importance of dividends Dividends help smooth out return volatility for shareholders. Both Domino’s Pizza (DPZ) and Papa John’s (PZZA) have a strong history of returning cash to shareholders. . 3Q16 dividends In 3Q16, Domino’s Pizza paid dividends of $0.38, which represents a growth of 22.6% from $0.31 in fiscal 3Q15. For the next four quarters, […]

Are McDonald’s higher sales in Europe part of a larger trend?

In this series, we uncover the key indicators investors should know to help them stay calm and position themselves correctly in the restaurant market. Investing is an art and a science. There is no secret formula.

McDonald’s Supply Chain: A Must-Know for Investors

With over 38,000 restaurants, McDonald’s doesn’t make any of its products. Instead, it contracts with suppliers to meet its massive requirements.

Investors Should Consider Domino’s Pizza before Its Q2 Earnings

Domino’s Pizza (NYSE:DPZ) will likely report its second-quarter earnings on July 16. Should you buy the stock before its earnings?

Domino’s Pizza Stock Rises following Positive Business Update

Domino’s Pizza announced that in the first two months of the second quarter, its US SSSG grew by 14.0%, while its international SSSG rose by 1.0%.

Domino’s Pizza’s Q1 Results Might Drive Its Stock Price

The COVID-19 outbreak has created a meltdown in the global financial markets. However, Domino’s Pizza (NYSE:DPZ) has continued its impressive performance.

Is Domino’s Pizza a Safe Bet amid the Lockdown?

President Trump extended the lockdown to April 30 amid the COVID-19 pandemic. Will Domino’s Pizza (NYSE:DPZ) benefit from the extension?

Domino’s Pizza Stock Rose Due to Earnings Beat

Today, Domino’s Pizza reported its fourth-quarter earnings. The company reported revenues of $1.15 billion, which beat analysts’ estimates of $1.13 billion.

What Does Wendy’s Future Look Like?

Innovation, consumer-facing technological development, and brand building with its franchisees are going to be the three crucial aspects of Wendy’s future.Consumer Why fuel prices affect restaurants

Higher fuel costs put pressure on operating costs, and can squeeze profit margins. The demand side also takes a hit. When gas prices are high, consumers tend to economize on transit by eliminating unnecessary trips.