Visa Inc

Latest Visa Inc News and Updates

A Lawsuit Against Pornhub and Parent Company MindGeek, Also Includes Visa — Here's Why

A lawsuit has opened up against Pornhub and its parent company MindGeek. Some might be surprised to see that Visa is being sued too. Here's Visa's involvement explained

Revisiting PayPal–Amazon Payment Partnership Talks

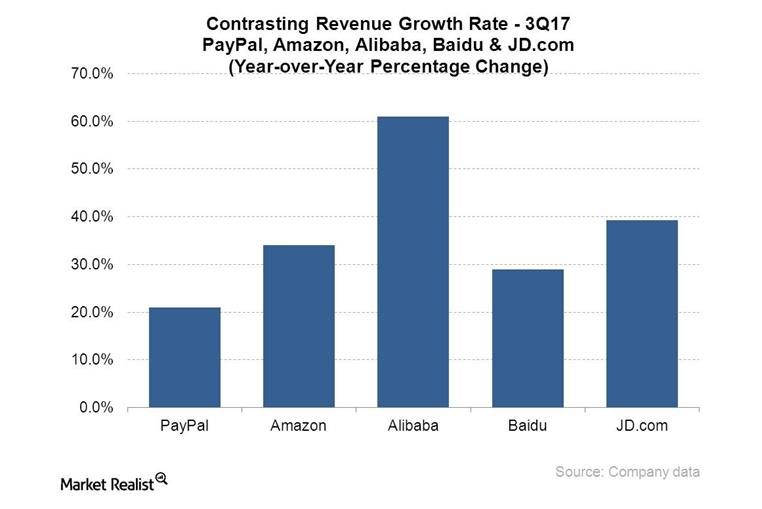

PayPal’s (PYPL) chief financial officer, John Rainey, mentioned partnering with Amazon (AMZN) during a recent Credit Suisse technology event. He didn’t clarify whether the companies were still in active talks.

Understanding PayPal’s Choice Transition

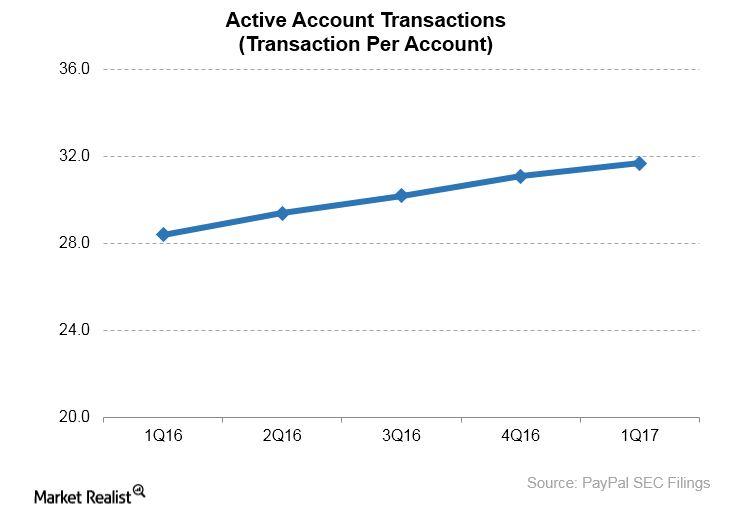

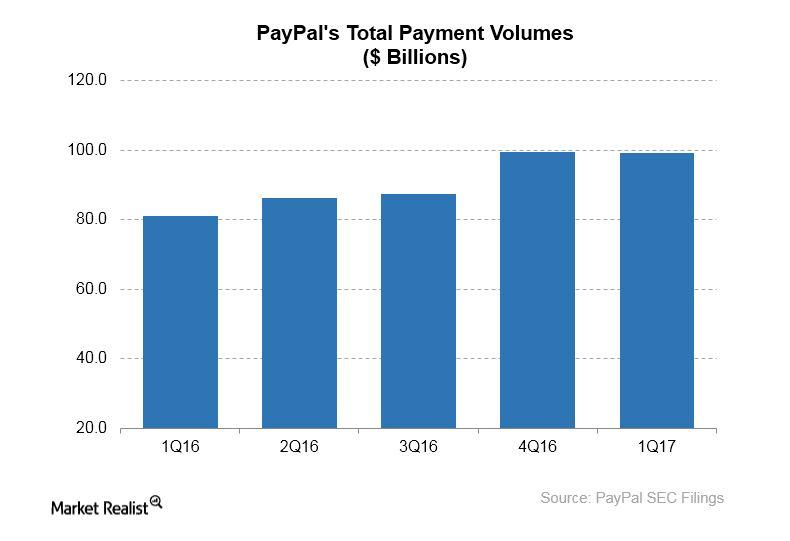

PayPal reported that its payment transaction per active account increased 12.0% year-over-year in 1Q17.

Is IBM Plotting to Put PayPal Out of Business?

IBM (IBM) announced in February 2017 that it was teaming up with Visa (V) to enable people to pay for goods and services through virtually any connected device.

S&P 500 Index Nears Record High amid Earnings Season

The S&P 500 Index, represented by the SPDR S&P 500 ETF (SPY), rose 0.3% on October 23, nearing the all-time high it saw in July.

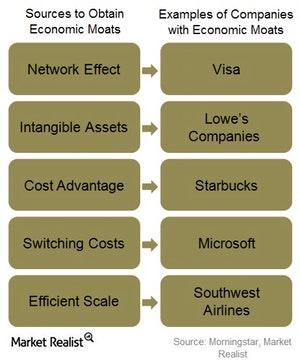

The Idea behind Economic Moats

“How Moats Translate into Sustainable Competitive Advantages” is a five-part moat investing education series that explores the primary sources of economic moats. she

Why PayPal Stock Is an Attractive Pick for Investors

On Thursday, PayPal stock rose 2.6% and closed at $168.05 after an analyst upgrade. At the last closing price, PayPal’s market cap was $197.3 billion.

Is AXP Stock a ‘Sell’ after Its Q1 Earnings?

Today at 7:02 AM ET, AXP stock rose 1.1% to $84.10 in the pre-market session. The company reported its first-quarter earnings results on April 24.

Bitcoin Year in Review and 2020 Forecast

I wouldn’t call 2019 a sea of tranquility for Bitcoin. But at least it wasn’t as much of a roller-coaster ride as the two preceding years.

Goldman Sachs’ Best Stock Picks for 2020

Strategists at Goldman Sachs (GS) project Netflix (NFLX), T-Mobile (TMUS), and Coca-Cola (KO) to be among the best stock picks for 2020.

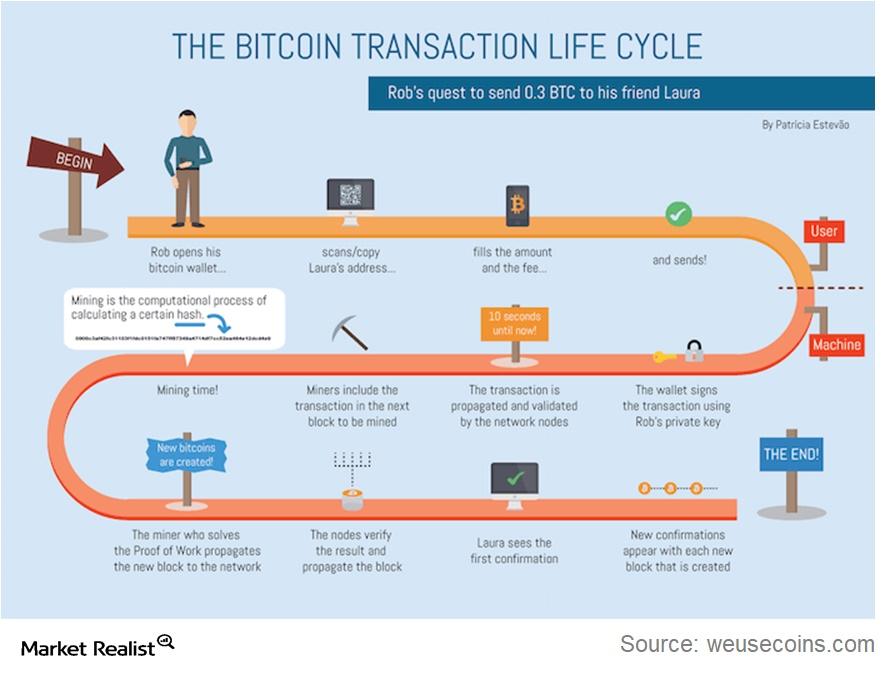

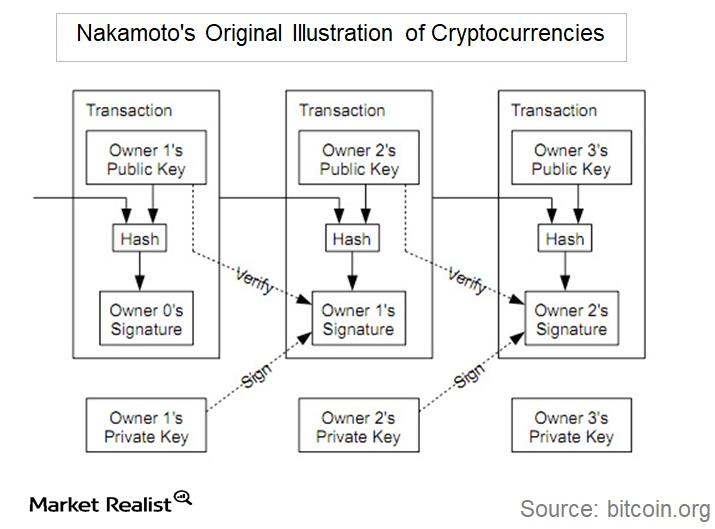

How to Transact in Bitcoin and Other Cryptocurrencies

If you have purchased bitcoin currency, and it’s now in your digital wallet, there will likely be a time that you’ll want to conduct a transaction with it.

US GDP Shatters Expectations, Pessimists Run for Cover

The US GDP increased at an impressive rate of 1.9% for the third quarter. The growth beat the expectations of around 1.6% for the quarter.

Tech Stocks Drive the S&P 500 to Record Highs

This year, the SPDR S&P 500 ETF (SPY) and Technology Select Sector SPDR ETF (XLK) have risen 19.2% and 35.5%, respectively. What’s driven this rally?

Dow Jones Futures Are Flat: Watch Out for Data!

Dow Jones Futures are pointing to a flat opening for the day. The flash PMI data and other economic data releases might impact markets today.

Verizon and Wells Fargo Are Getting on the Blockchain

Verizon (VZ) and Wells Fargo (WFC) are taking steps to integrate blockchain technology into their business models. Here’s why.

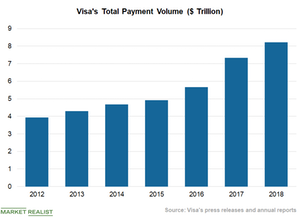

Digitization and Tech Investment Drove Visa’s Payment Volume

Visa’s (V) fourth-quarter results benefited from the growing global trend of cashless transactions.

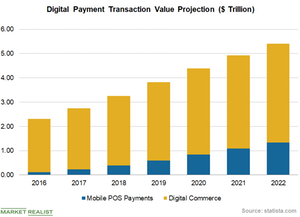

Rising Digital Payments to Support Mastercard’s Long-Term Growth

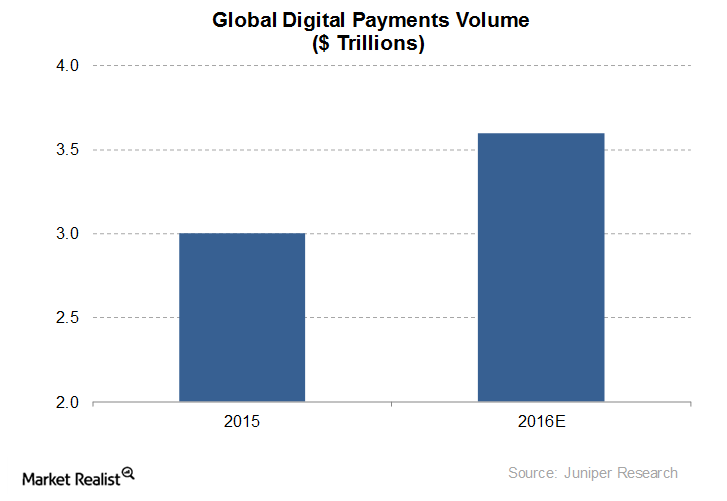

Statista projects that the total value of global digital payment transactions could increase to ~$5.41 trillion in 2022 from ~$2.75 trillion in 2017.

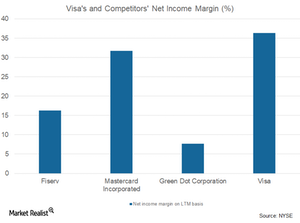

Inside Visa’s Operating Expenses

Visa (V) saw a rise of 13% in total operating expenses on a YoY (year-over-year) basis in fiscal 1Q18. It incurred $1.5 billion in expenses in fiscal 1Q18 compared to $1.4 billion a year earlier.

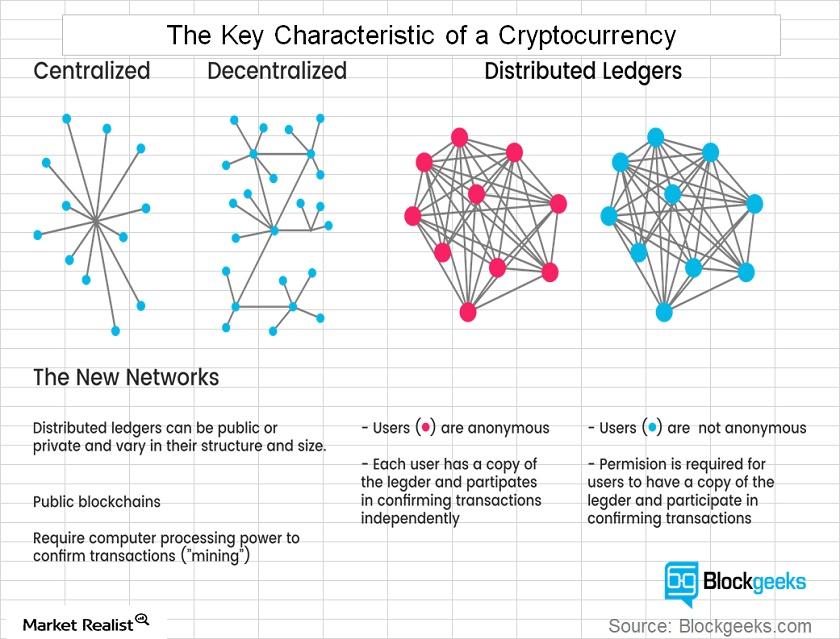

Breaking down Bitcoin and Cryptocurrencies: Key Characteristics

In the case of bitcoin, the safety of the system is linked with the bitcoin algorithm, which miners keep solving to generate new coins and maintain the system.

How the First Bitcoin Was Created

Satoshi Nakamoto is considered to be the founder of bitcoin, but the actual identity of Satoshi Nakamoto is not known.

Analyzing Visa’s Assets and Liabilities

As of September 30, 2016, Visa (V) has reported a total asset balance of $64.03 billion. As of June 30, 2017, the company managed to report a total asset balance of $64.00 billion.

Why PayPal Favors a 2-Sided Network

PayPal (PYPL) processed $99.3 billion in payment volumes in 1Q17, up 23% year-over-year.

A Look at PayPal’s Notable Achievements

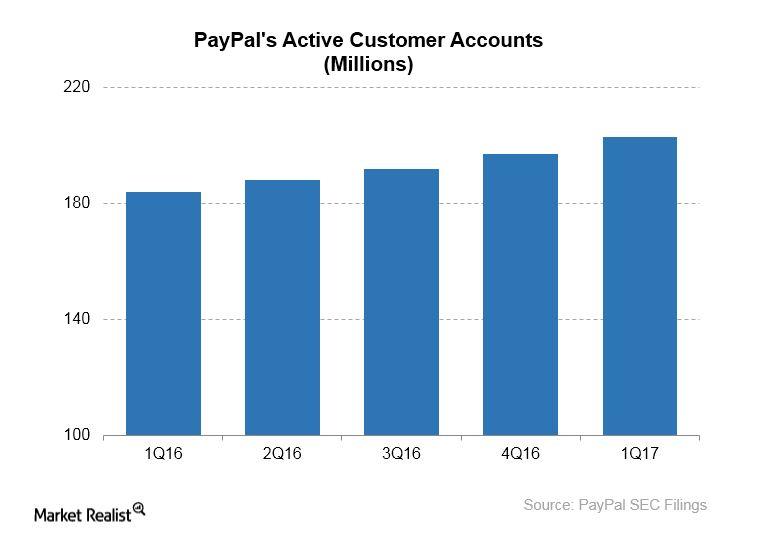

PayPal concluded 1Q17 with ~203 million active registered accounts, up from 197 million in 4Q16 and 184 million a year earlier.

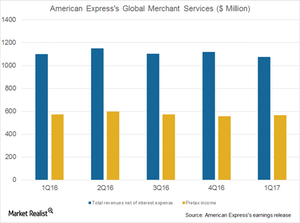

Inside American Express’s Global Merchant Services Segment

American Express’s (AXP) Global Merchant Services segment is expected to see a marginal increase in its net income in 2Q17.

American Express to Ride on Partnerships, Digitization

American Express (or Amex) (AXP) has entered into digital partnerships with Airbnb, Facebook (FB), and Uber in order to offset the revenue loss from Costco (COST).

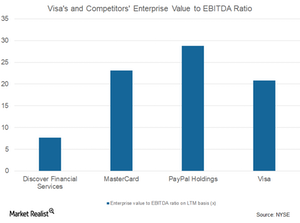

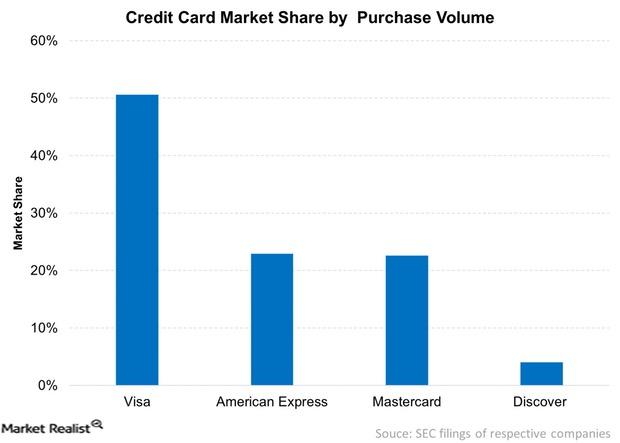

How Visa Created a Network Effect

Visa (V) boasts a significant advantage in terms of its worldwide acceptance. This availability lent to the network effect’s being the source of the company’s moat.

Will Payment Processors Keep Seeing the US Dollar Impact in 2017?

Payment processors are now seeing improved performances on increased spending, new technologies, expansion into global markets, and the stable US dollar.

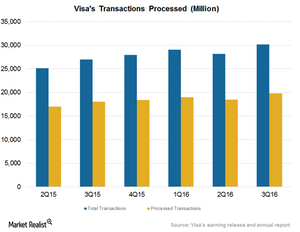

International Use to Boost Visa’s Fiscal 4Q16 Processed Transactions

Visa (V) reported total transactions of $30.2 billion in fiscal 3Q16, compared to $27 billion in fiscal 3Q15—a growth of 11.8% year-over-year.

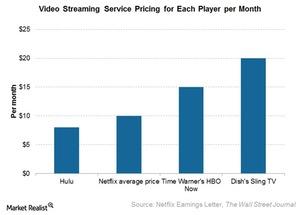

Hulu: Its Strategic Significance for Disney

Disney expects the equity loss from its investment in Hulu to accelerate since Hulu is increasing its investment in acquiring original content from media companies and producing original programming.

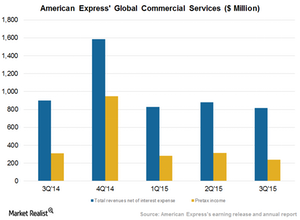

American Express Is Focusing on Its Global Commercial Services

American Express’s Global Commercial Services’ total revenues net of interest expense fell by 9% to $817 million in 3Q15, forming 10% of its total revenues.

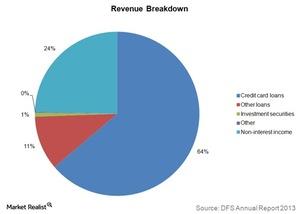

What investors should know about Discover Financial Services

Discover Financial Services (DFS) is a direct bank and electronic payment services company in the US. It offers an array of banking products.

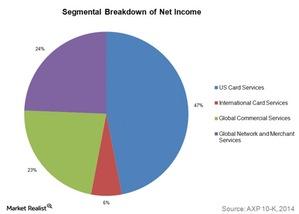

American Express and Its Four Operating Segments

Of the four American Express segments, the Global Network and Merchant Services segment has shown the highest growth over the last two years.

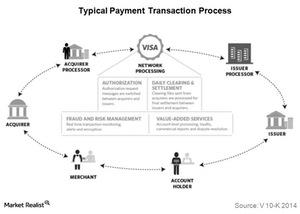

What Happens When You Swipe a Visa Card?

Visa’s open-loop payments network connects and manages the exchange of information between issuers and acquirers.

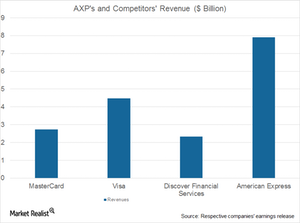

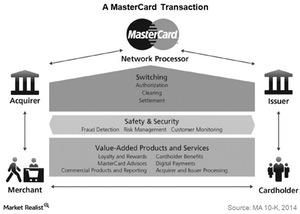

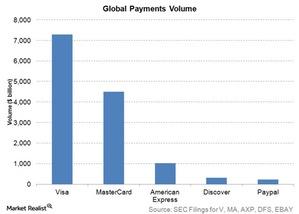

MasterCard: The World’s Second Largest Payment Processing Company

MasterCard enables consumers and businesses to use electronic modes of payment instead of cash and checks. MasterCard’s payment network is the second largest in the world, behind industry leader Visa.

MasterCard Operates in an Intensely Competitive Payments Industry

Cash and checks constitute ~85% of the retail payment transactions worldwide. However, electronic payment methods are increasingly replacing cash and check payments globally.

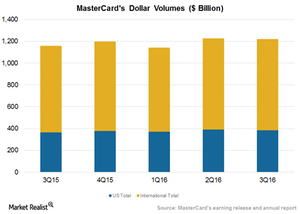

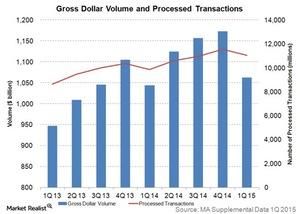

Why Growth in MasterCard’s Gross Dollar Volume is Important

The US accounts for 32% of MasterCard’s total gross dollar volume. The Asia-Pacific, Middle East, and Africa contribute 31%, and Europe accounts for 27% of the total volume.

MasterCard Does Not Look Overvalued Compared to Historical Levels

MasterCard focuses on growth in its core business of credit, debit, prepaid offerings, and processed transactions. It seeks to diversify its customer base, including smaller merchants and consumers who still use cash and checks.