Invesco CurrencyShares Euro Trust

Latest Invesco CurrencyShares Euro Trust News and Updates

Could Rising Interest Rates Help the US Dollar?

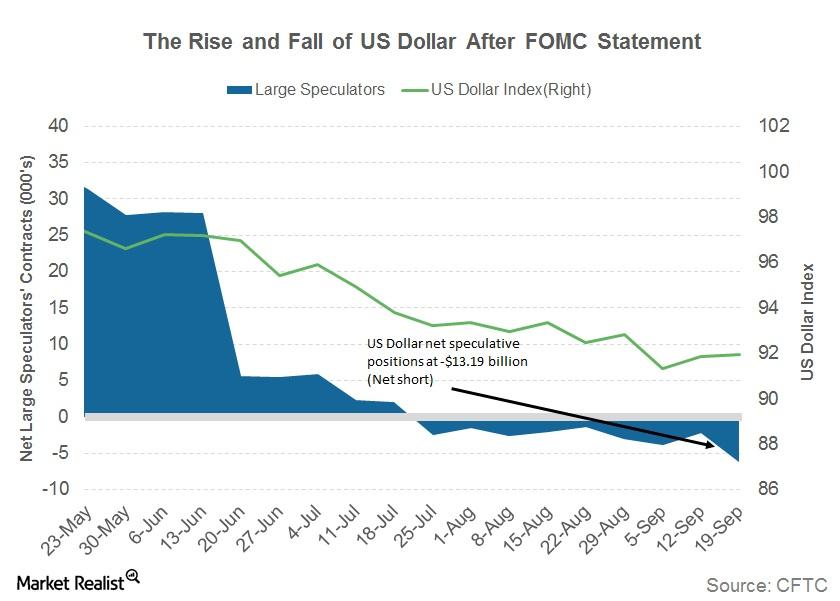

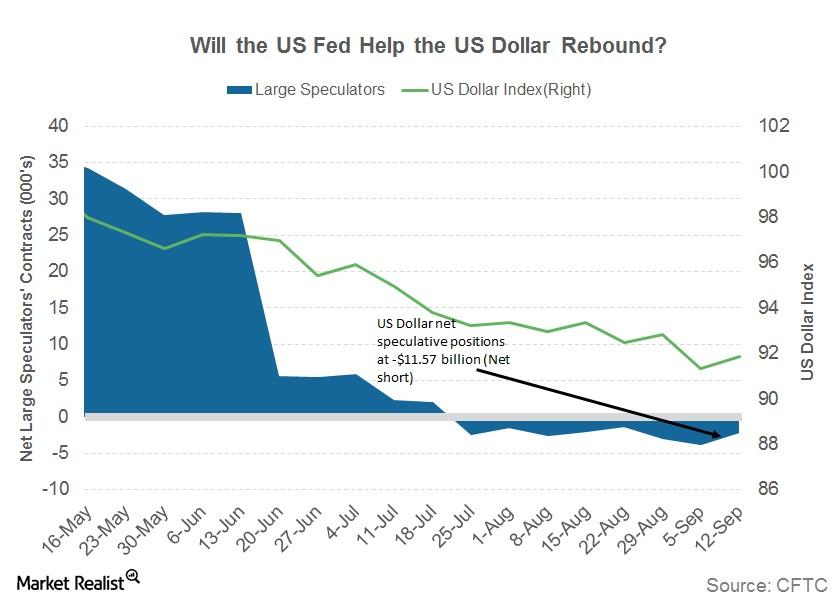

Double dose of optimism for the US dollar The US dollar (UUP) was being written off before the beginning of September, as the Fed was expected to stay on hold and other major central banks were expected to start policy normalization. However, the Fed had a surprise in store for the market. The FOMC’s (Federal Open […]

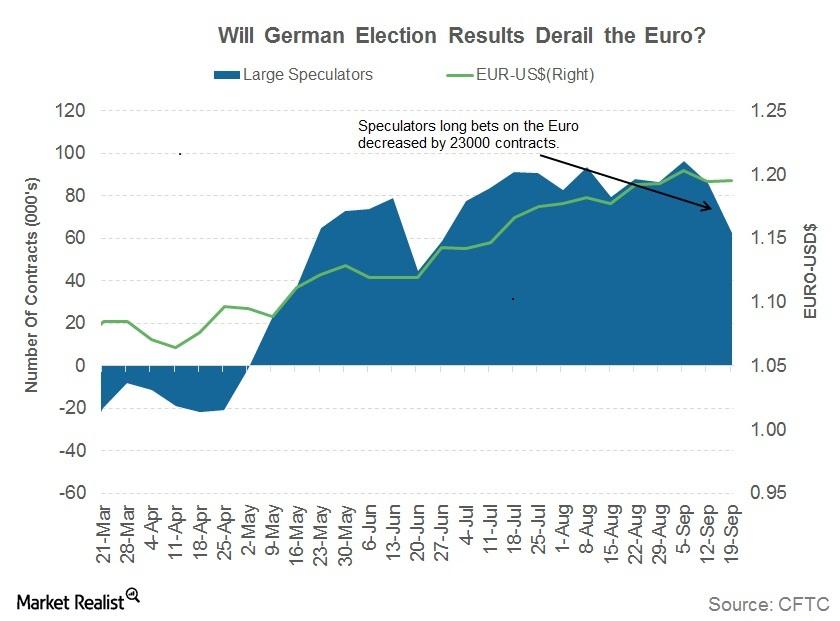

Will a Coalition Government in Germany Derail the Euro?

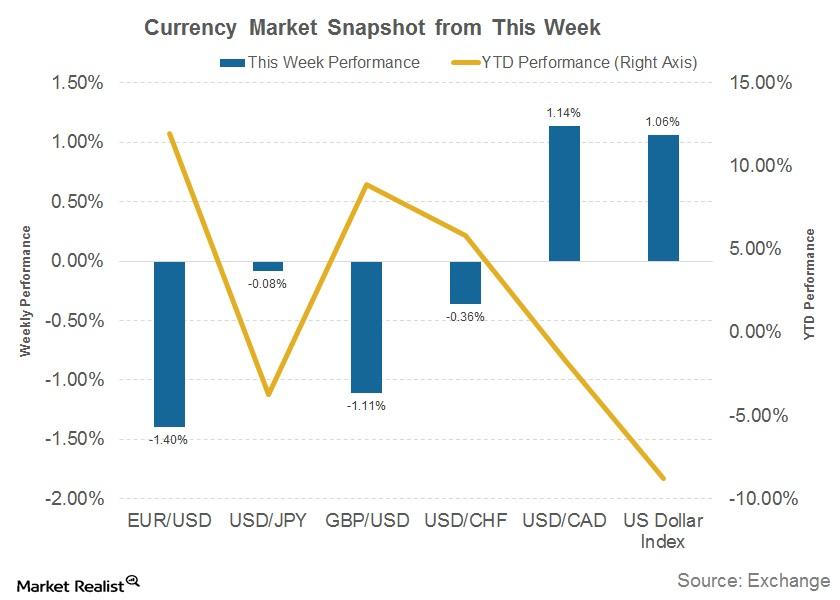

The euro-dollar (FXE) closed the week ending September 22 at 1.2 against the US dollar (UUP).

Why the US Dollar Failed to Rally despite Increased Rate Hike Odds

The US Dollar Index (UUP) failed to rally aggressively despite a hawkish surprise from the US Fed.

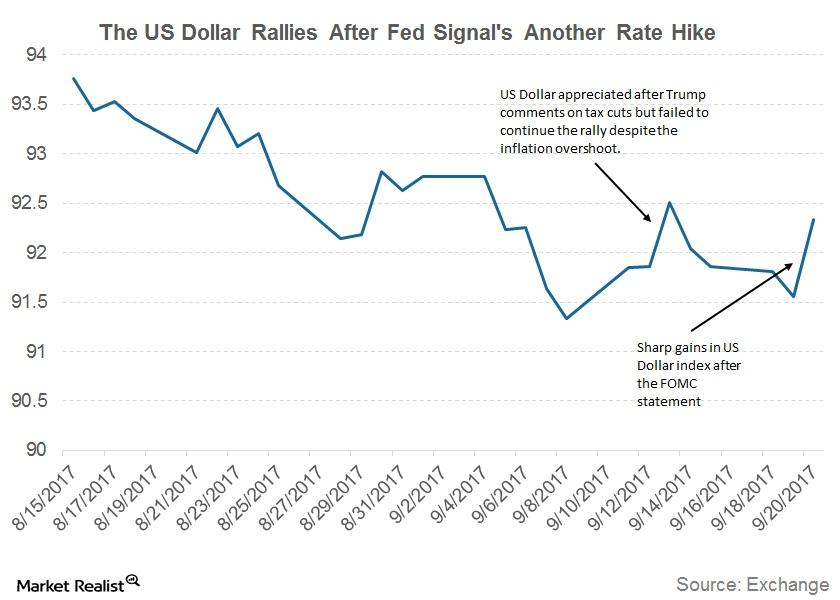

Assessing the US Dollar’s Rally after the Latest Hawkish Fed Statement

The US dollar rallied after the latest FOMC (Federal Open Market Committee) meeting statement was released on September 20.

Why the US Dollar Saw a Sharp Rebound

The US Dollar Index (UUP) witnessed a sharp recovery last week, rebounding from a two-year low of 91.0.

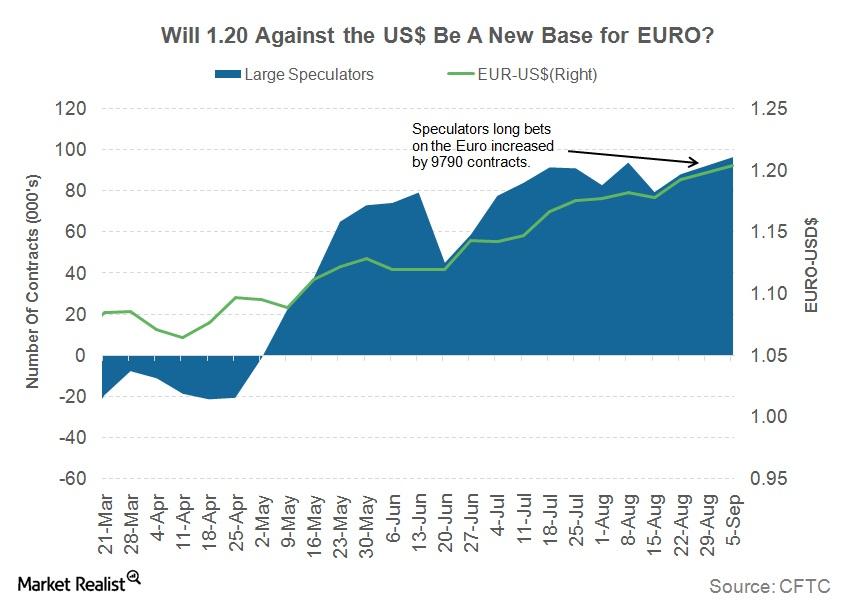

Why Was the Euro a Silent Spectator Last Week?

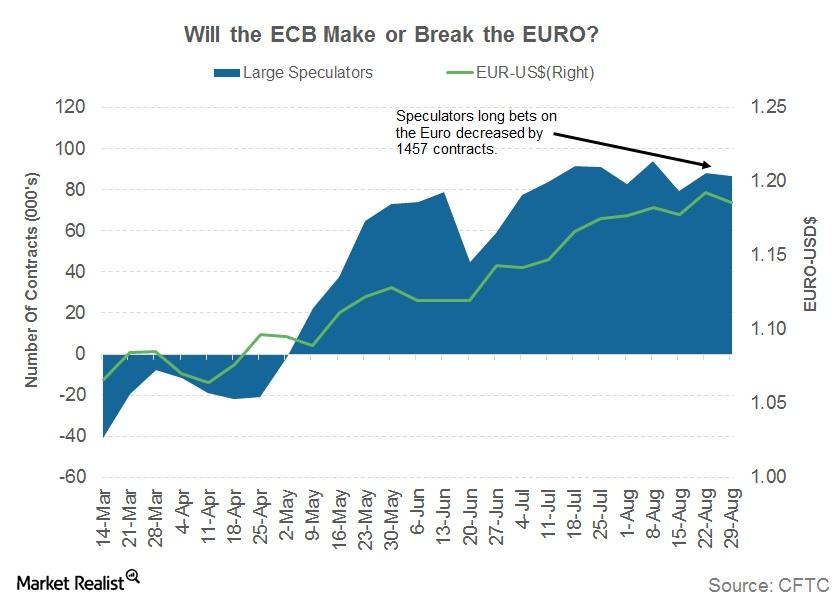

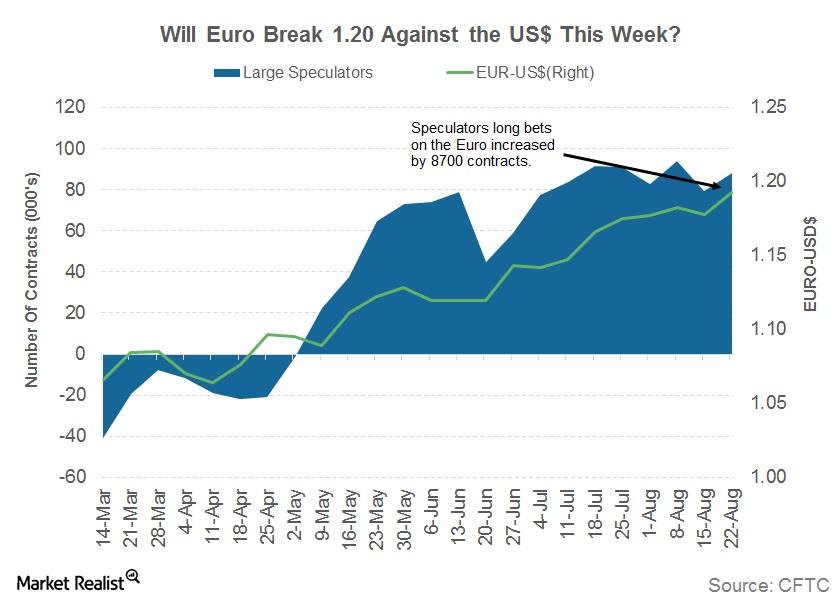

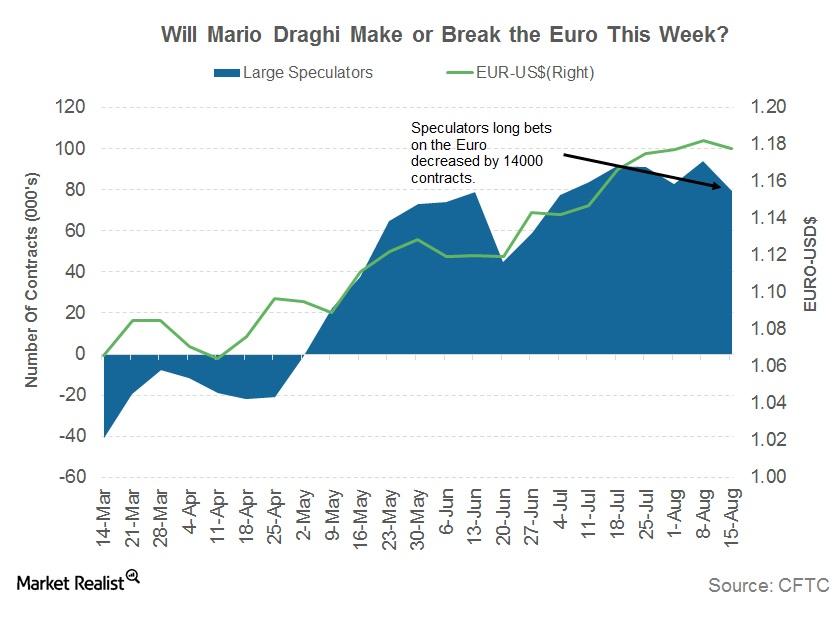

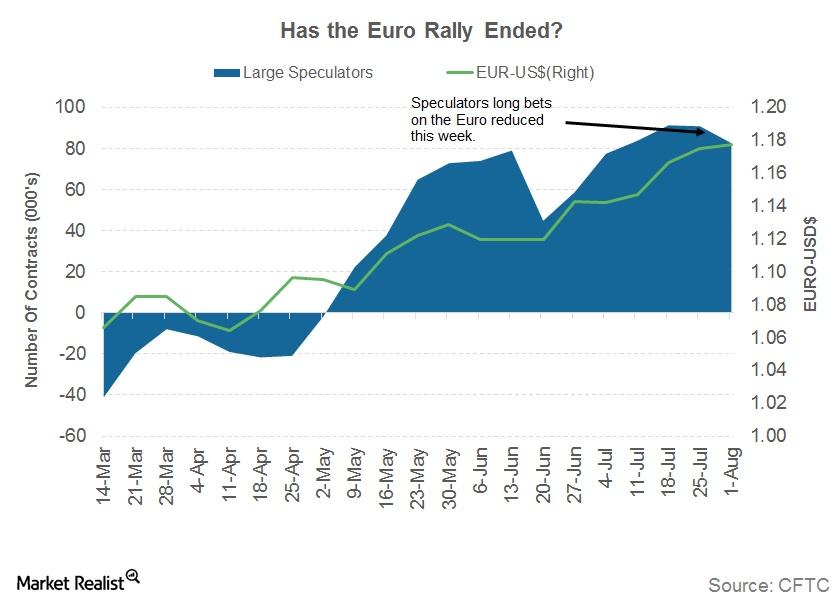

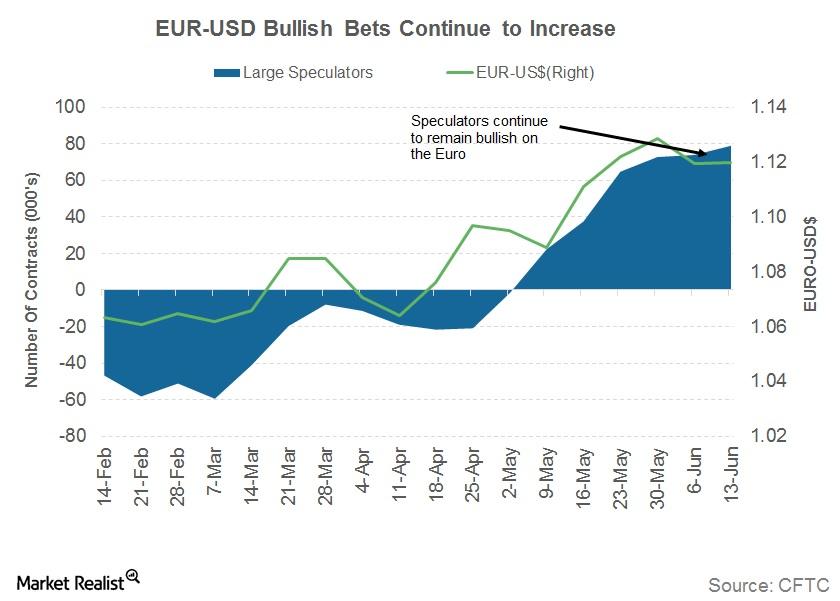

As per the latest Commitment of Traders (or COT) report, released on Friday, September 15 by the Chicago Futures Trading Commission (or CFTC), speculators turned bullish on the euro during the week.

How ECB Tapering Could Impact European Bond Markets

The European bond market’s reaction to the ECB’s (European Central Bank) September 7 statement has so far been positive.

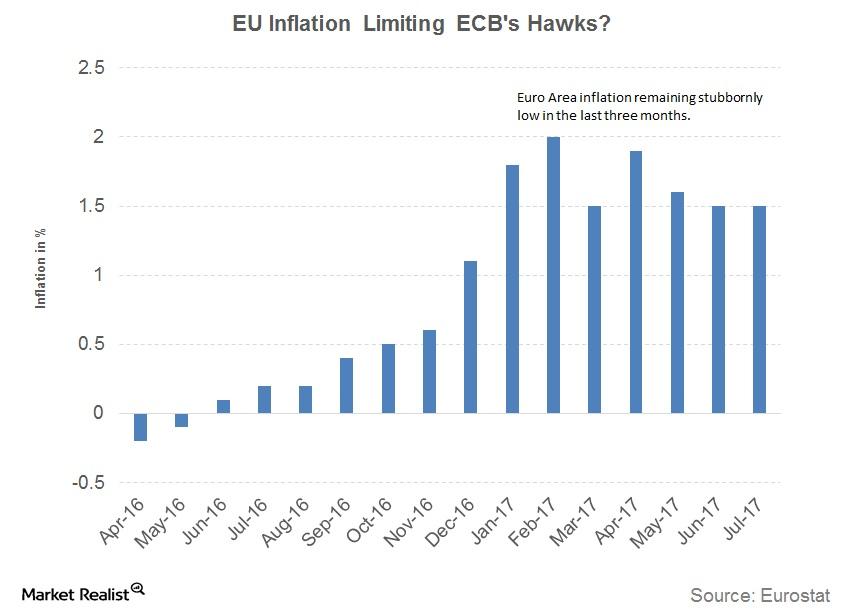

Why Did the ECB Downgrade Its Inflation Outlook?

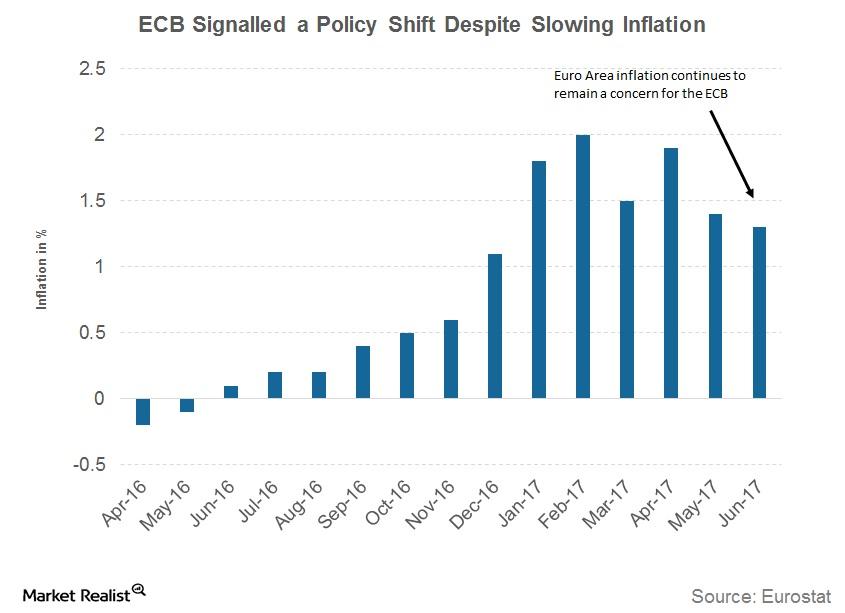

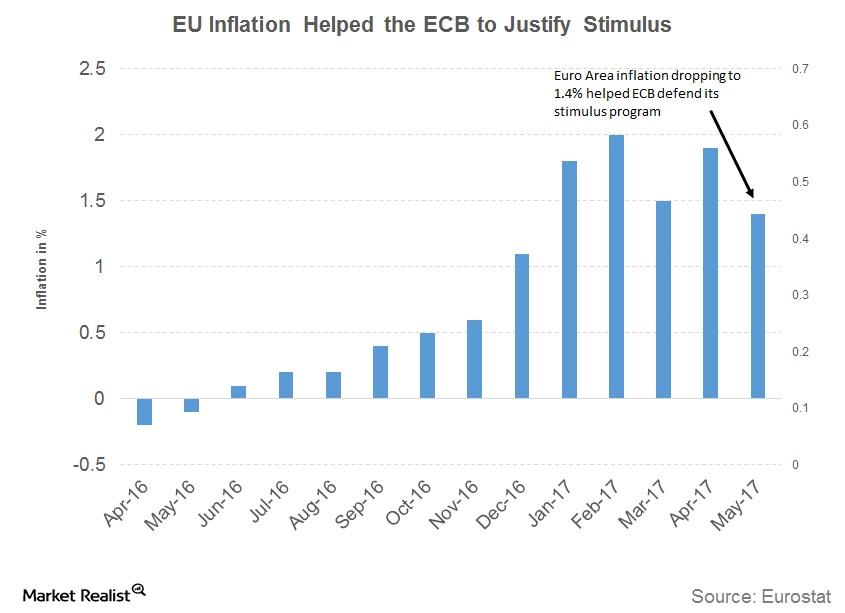

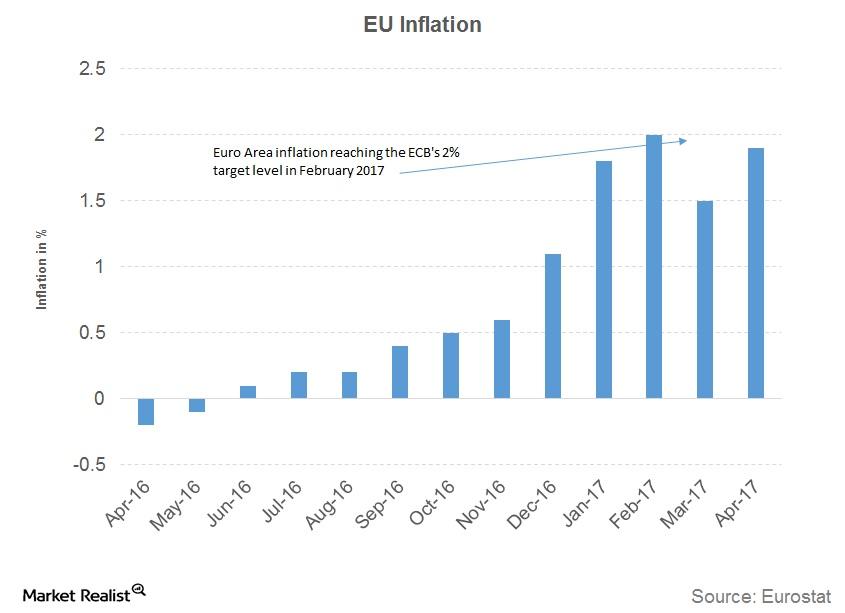

In its September 7 policy meeting, the ECB (European Central Bank) downgraded the outlook for the EU economy’s inflation.

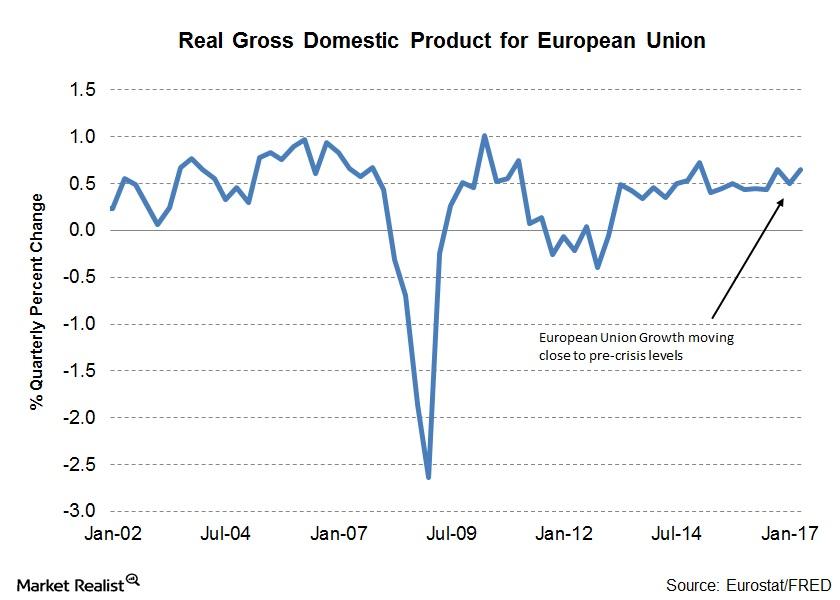

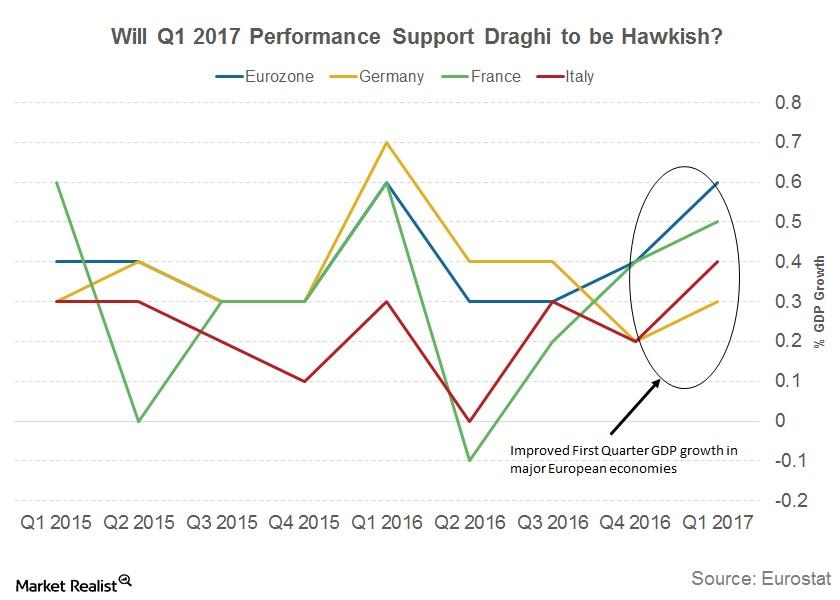

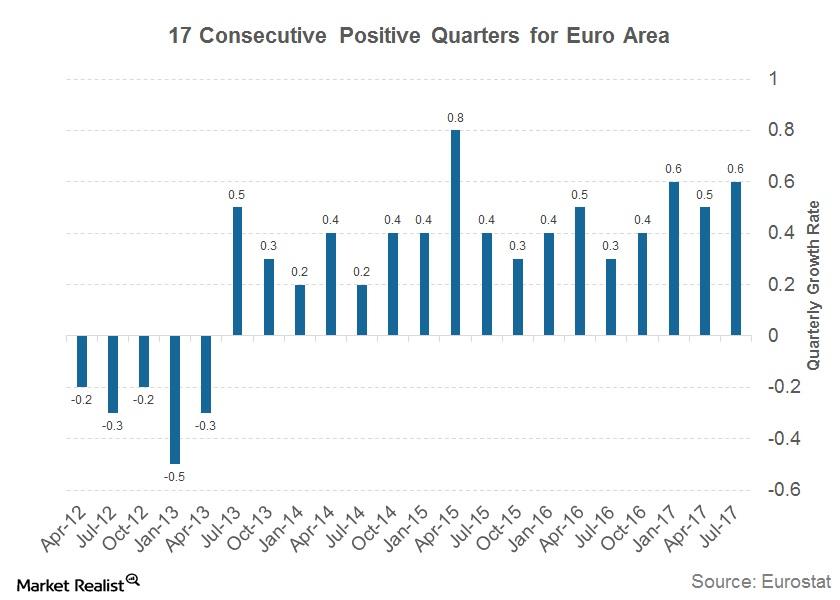

Why Strong European GDP Growth Momentum Gives Confidence to the ECB

In its September 7 meeting, the ECB (European Central Bank) governing council sounded optimistic about the strong growth momentum in the EU.

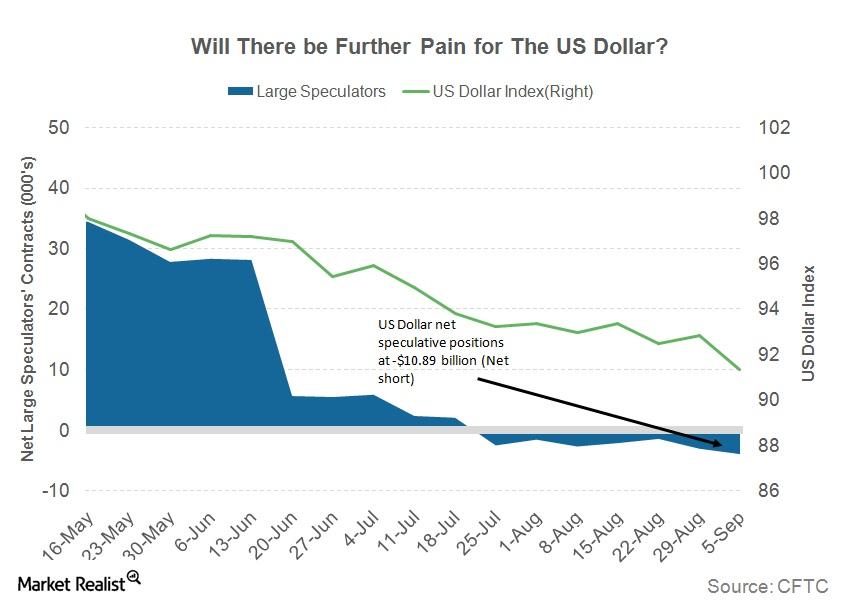

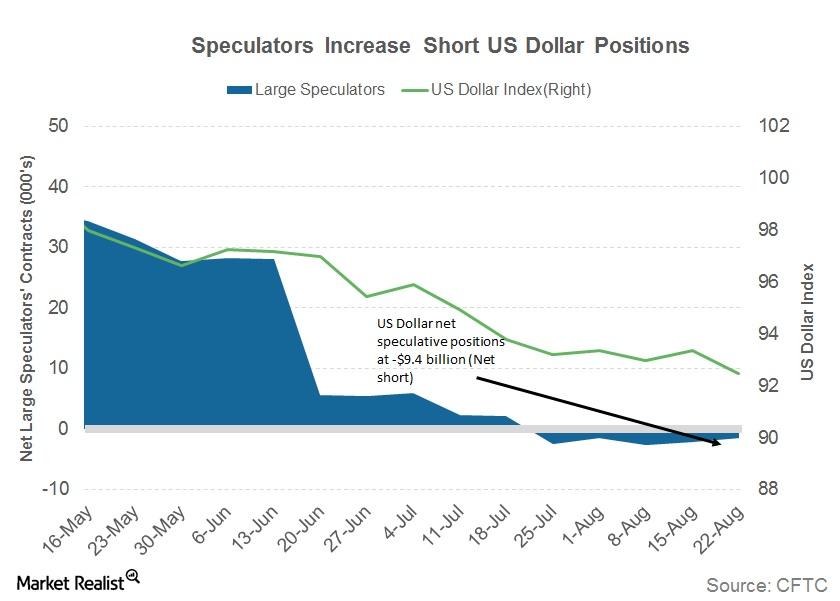

Why the US Dollar Could Be Poised for Further Losses

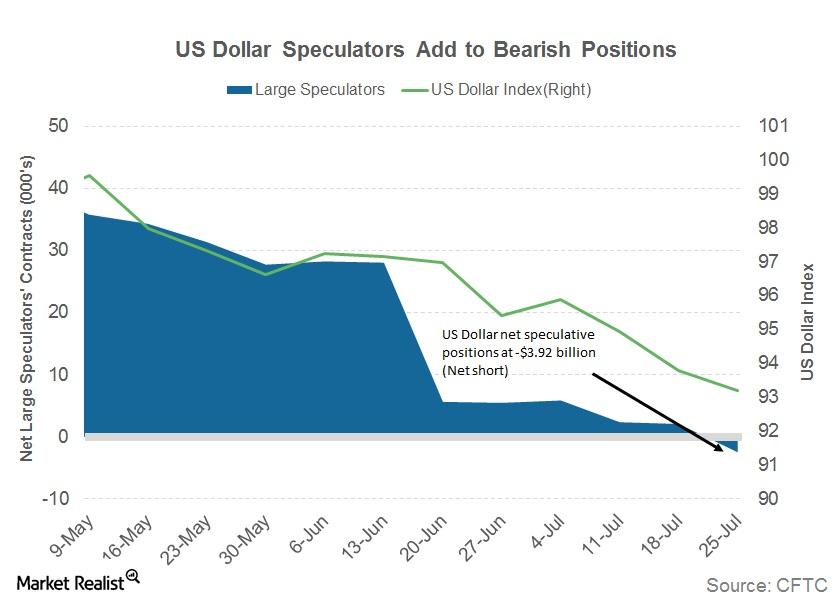

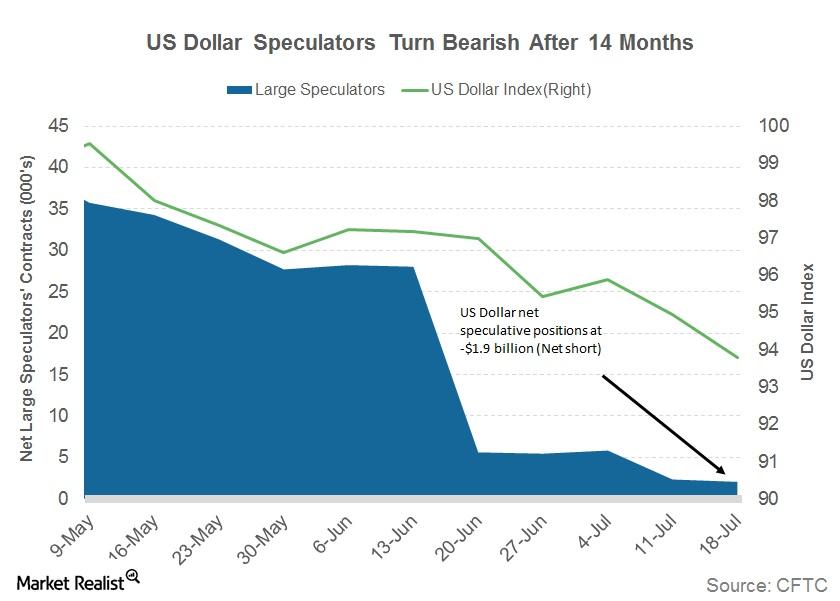

The US Dollar Index (UUP) failed to hold onto its gains from the previous week as investors were convinced that the Fed most likely wouldn’t make any changes to its monetary policy this year.

Why the Euro Rose to a 3-Year High Last Week

The euro closed the week ended September 8, 2017, at ~1.20 against the US dollar. It rose 1.48% against the US dollar as euro bulls took charge.

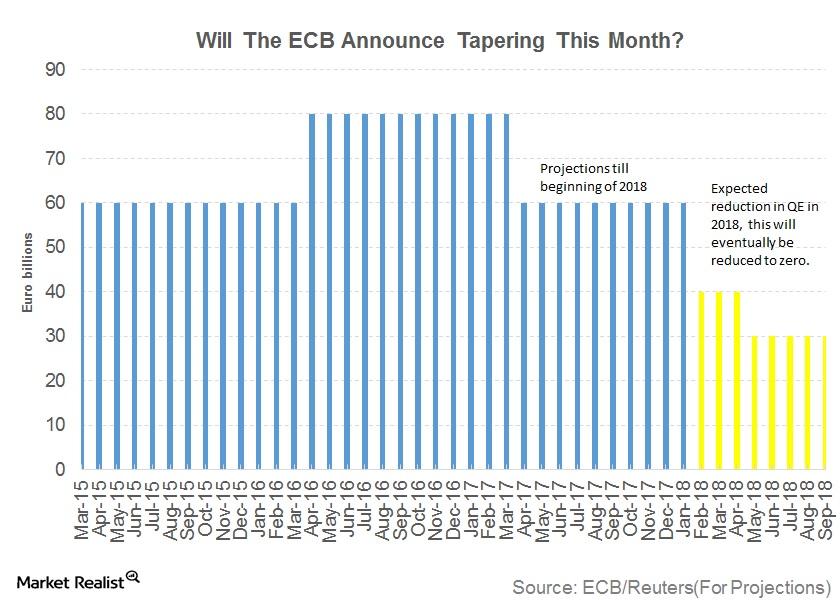

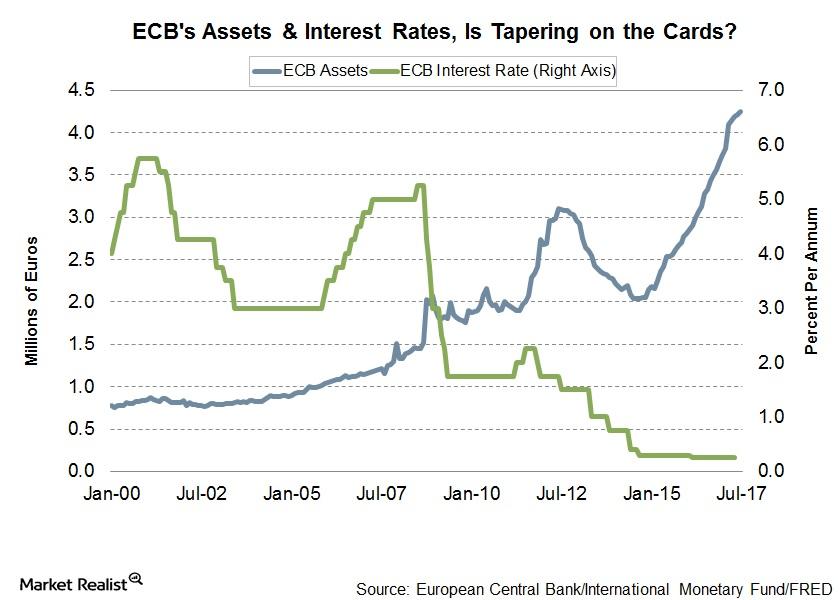

Will the ECB Surprise Markets with a Tapering Announcement?

The governing council of the European Central Bank (or ECB) is scheduled to meet on September 7 in Frankfurt, Germany. The meeting will be followed by a press conference.

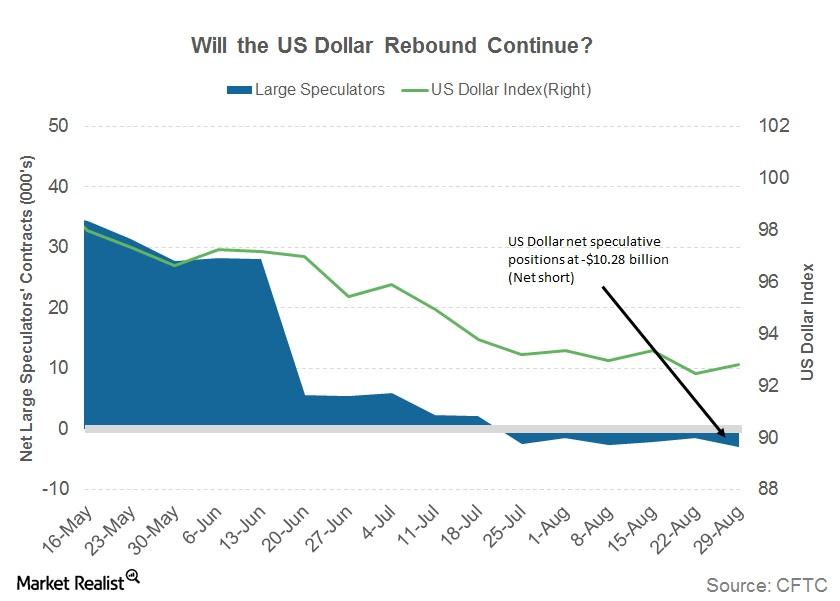

How to Make Sense of the US Dollar Rebound

The US Dollar Index (UUP) surprised the markets with its resilience despite a weak August jobs report.

Why the Euro Could Remain Volatile This Week

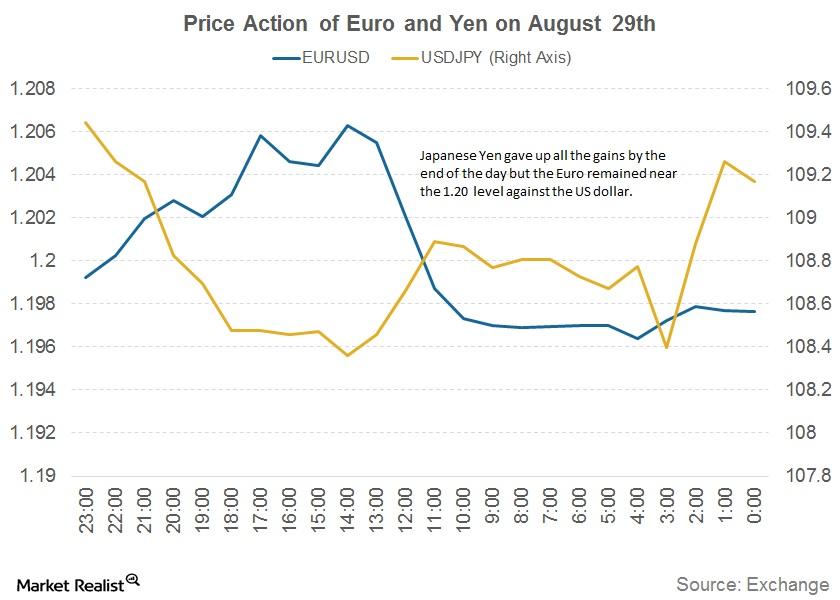

The euro (FXE) closed the week ended September 1, 2017, at 1.19 against the US dollar (UUP). It lost 0.56% against the US dollar.

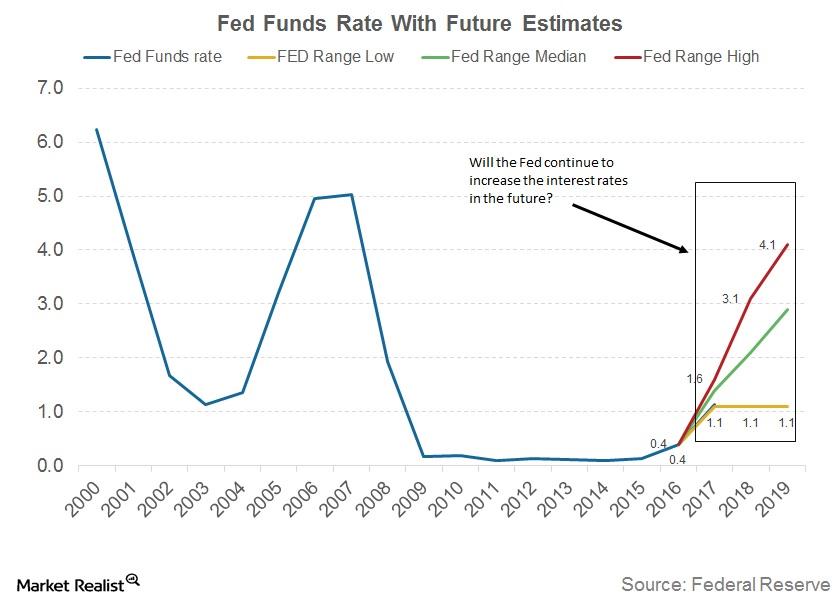

Stanley Fisher’s Solution for Low Interest Rates

Stanley Fisher, vice chair of the U.S. Federal Reserve, has shared his views on low interest rates and some solutions to get rates back to normal levels.

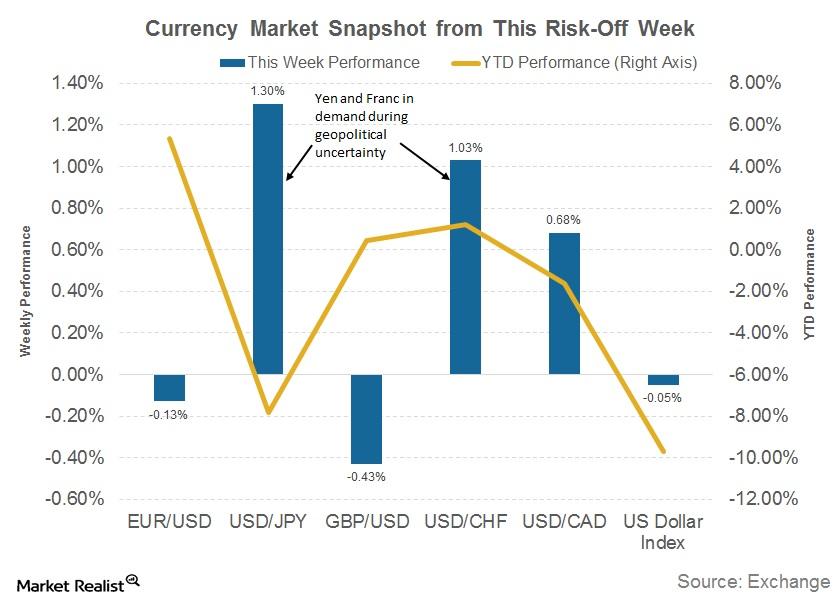

Why the Euro Is Turning Out to Be a Preferred Safe Haven

Volatility in the currency markets spiked after news of the North Korean missile launch on August 29. Demand for safe haven currencies like the Japanese yen (FXY) and Swiss franc (FXF) picked up in the Asian session.

Is the US Dollar Dying a Slow Death?

The US Dollar Index closed the week ending August 25 at 92.68—compared to 93.36 in the previous week.

Mario Draghi Didn’t Stop the Appreciating Euro

European Central Bank President Mario Draghi gave didn’t comment about removing monetary stimulus in his speech at the Jackson Hole symposium.

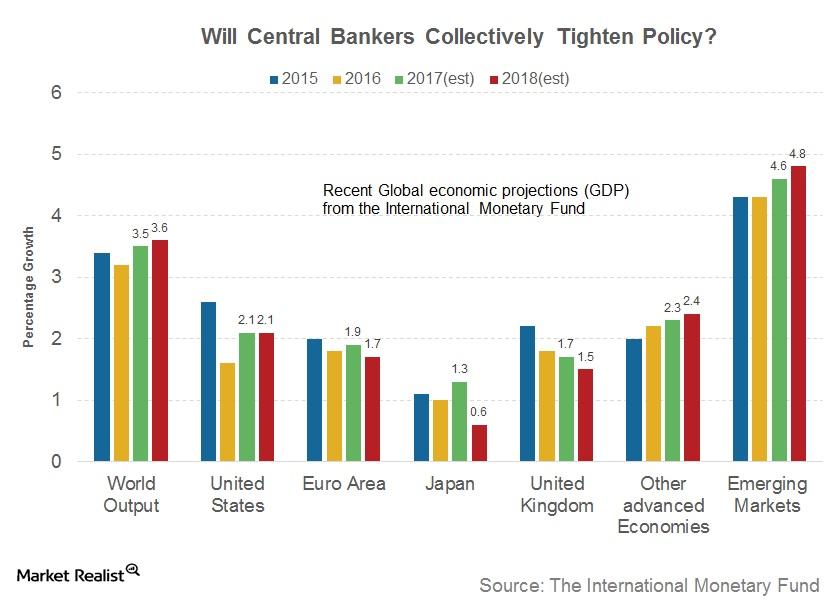

Will Jackson Hole in 2017 Be the Beginning of the End of Monetary Accommodation?

This year’s theme for the annual Jackson Hole Symposium is “Fostering a Dynamic Global Economy.”

Why Draghi Is a Person of Interest at Jackson Hole

ECB President Mario Draghi is scheduled to speak at this year’s Jackson Hole Symposium on August 25—after a hiatus of three years.

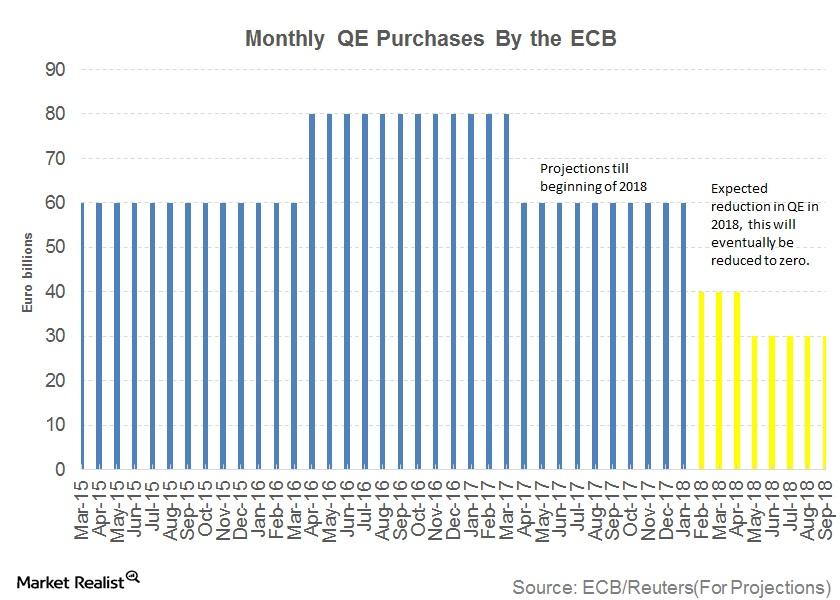

Will ECB’s Tightening Lead to Bond Market Sell-Off?

If the European economy continues to improve at the current pace, the QE program could be scaled down to 40.0 billion euros per month.

Will Draghi Lift or Drown the Euro This Week?

The euro-dollar pair (FXE) closed the week ending August 18 at 1.18 against the US Dollar (UUP).

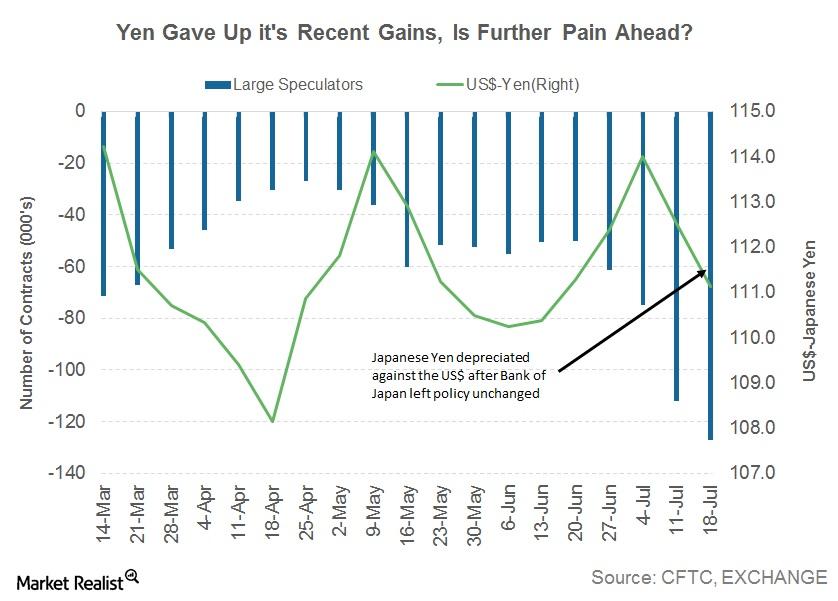

A Lesson from Currency Markets during Geopolitical Tensions

Last week’s rising geopolitical tensions between the United States and North Korea turned the tide for the yen. The Swiss franc also appreciated.

Is Strong Economic Expansion in the Eurozone Driving the ECB?

The European economy has expanded in the last 17 consecutive quarters. The Eurozone’s annual growth rate is 2.1%—the highest growth rate in the last six years.

Is the Euro Running Out of Steam?

The German DAX (DAX) was up ~1.1%, Euro Stoxx (FEZ) was up ~1.1%, and France’s CAC was up ~1.4% in the week ended August 4, 2017.

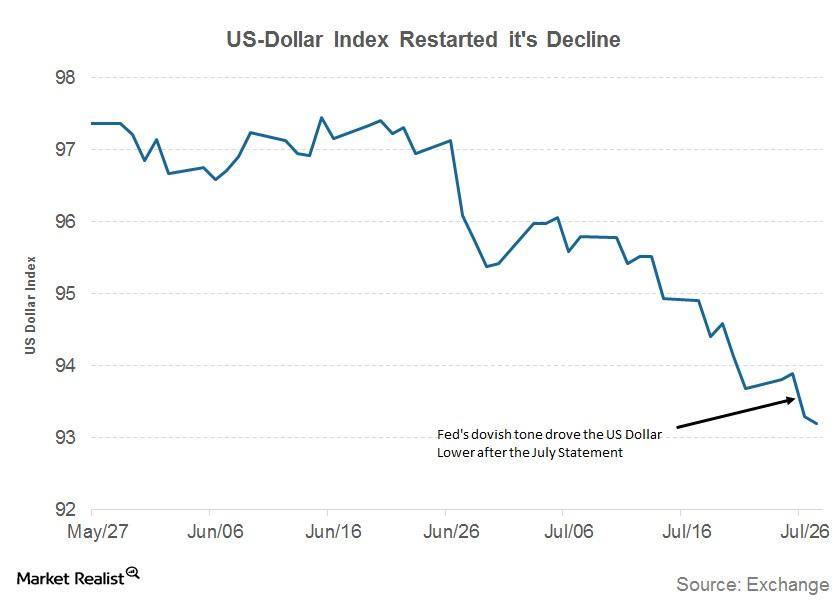

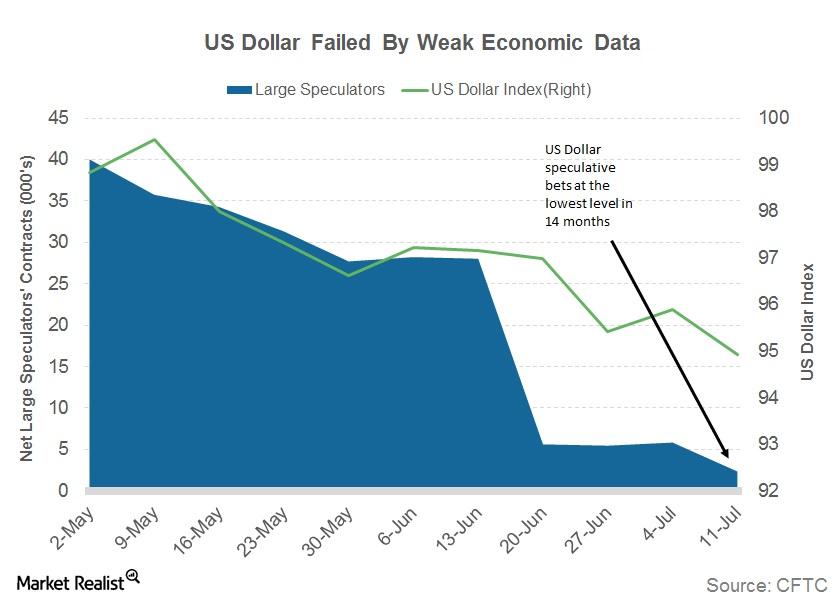

What to Expect from the US Dollar

The US Dollar Index (UUP) continued to slide in the previous week due to the FOMC’s dovish statement and weaker-than-expected economic data.

The Japanese Yen Could Keep the US Dollar Company

Another week of appreciation The Japanese yen (JYN) had another positive week, posting gains of 1.3% and closing at 111.12 against the US dollar (UUP). The previous week’s close for the currency pair was 112.53. This strength was primarily driven by the US dollar, rather than positive news from the Japanese economy. Most of the […]

This Is Why the US Dollar Could Slide Further

US Dollar index reaches a 14-month low The US Dollar Index (UUP) continued with its fall as investors preferred major peers. In the week ended July 21, the US Dollar Index closed at 93.78, falling 1.7% from the week prior. It is headed for its fifth consecutive month of loss this year. Conflicting news from […]

Why the US Dollar Took a Hit after the FOMC’s July Statement

Most of the statement released by the Federal Open Market Committee (or FOMC) following its two-day monetary policy meeting was in line with the market’s expectations.

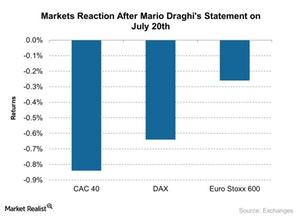

Euro Surged, Market Fell after Draghi’s Statement

When ECB president Mario Draghi announced that the interest rate remained unchanged at 0.0%, the euro fell nearly 0.30% against the US dollar.

Have Yellen and US Economy Failed the US Dollar?

The US Dollar Index (UUP) closed at 94.9, depreciating by 0.90% last week.

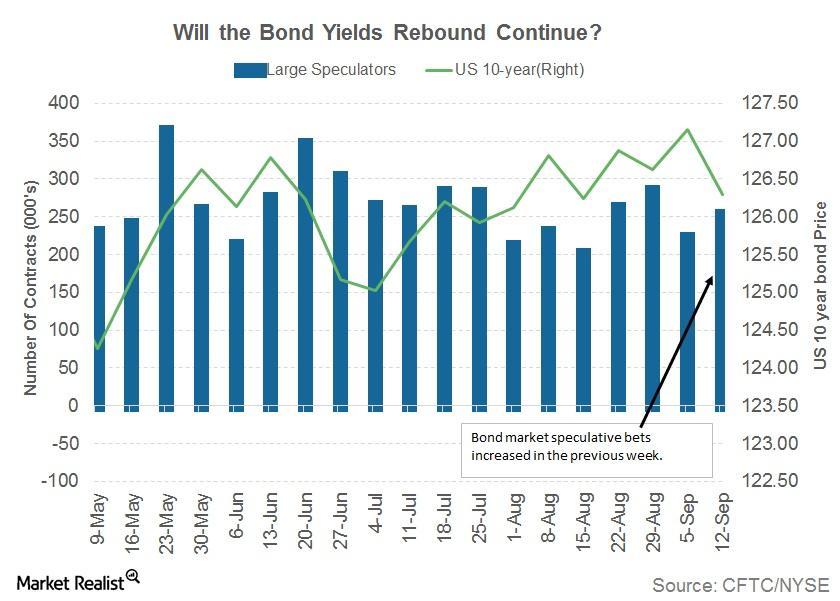

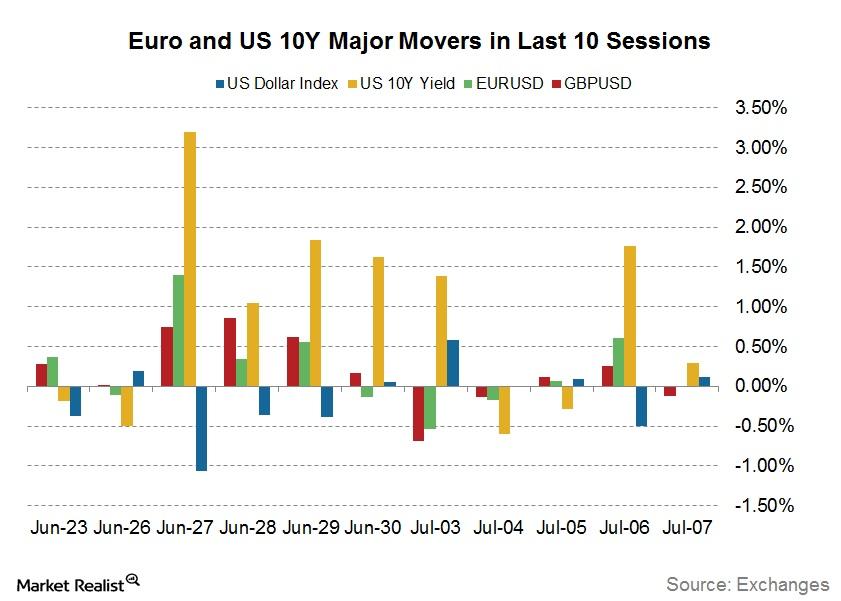

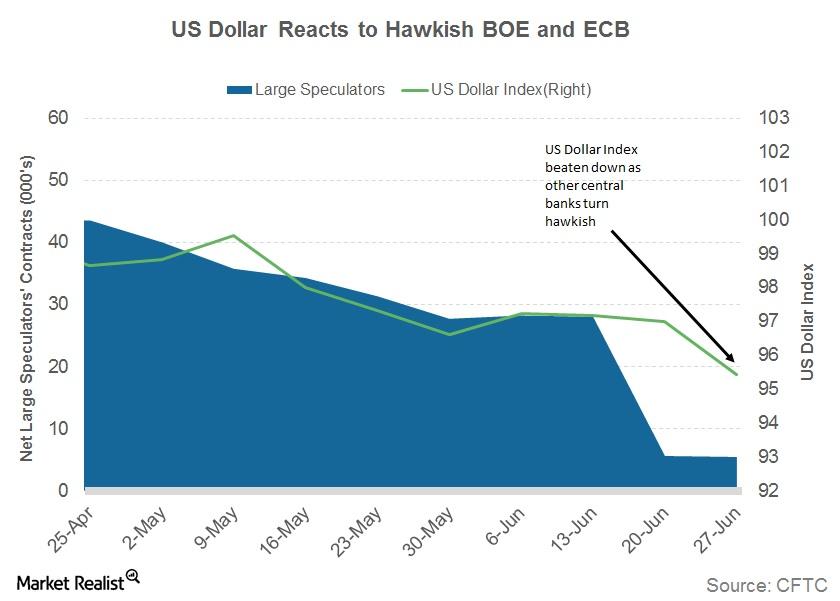

How Central Bankers Are Rattling Bonds and Currencies

Since the FOMC minutes and the hawkish turn of events at the European Central Bank and the Bank of England, bond yields across the board have been trending higher.

Confused Markets: Inside the ECB’s Struggle amid Miscommunication

The ECB (European Central Bank) in its recent monetary policy meeting on June 8 left its main refinancing rate at 0% and the interest rate at 0.25%.

Did the BOE and ECB Pressure the US Dollar This Week?

The currency markets are anticipating the June FOMC’s meeting minutes, which are expected to be hawkish.

Will Weak Data from the EU Derail the Euro?

The euro (FXE) remained confined to a narrow range against the US dollar (UUP) in the previous week.

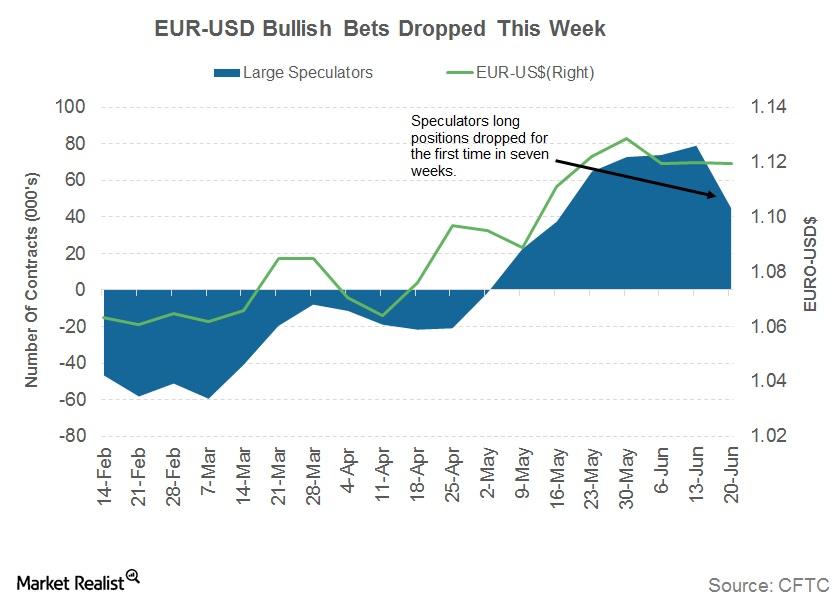

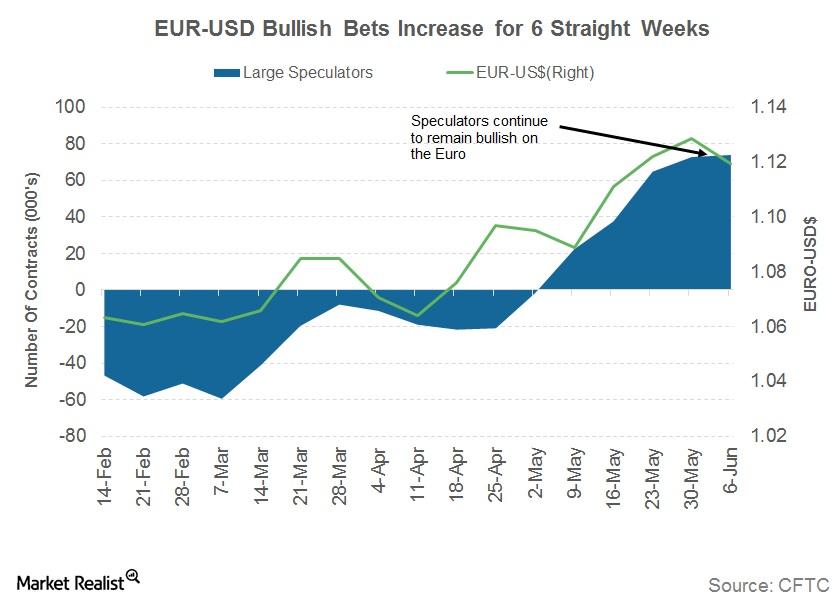

Is Long Euro the Theme for Forex Markets?

The euro (FXE) remained in a narrow trading range against the US dollar (UUP) between the levels of 1.130 and 1.115 for the last five weeks.

Has the ECB Been Successful in Taming the Euro?

The euro (FXE) closed the week at 1.1196 to the US dollar (UUP), posting a 0.76% loss compared to the previous week.

Why the ECB Closed the Door on Further Rate Cuts

The ECB (European Central Bank) left interest rates unchanged at 0% in the rate-setting meeting that was held on Thursday, June 8.

Will the ECB Stop the Surging Euro?

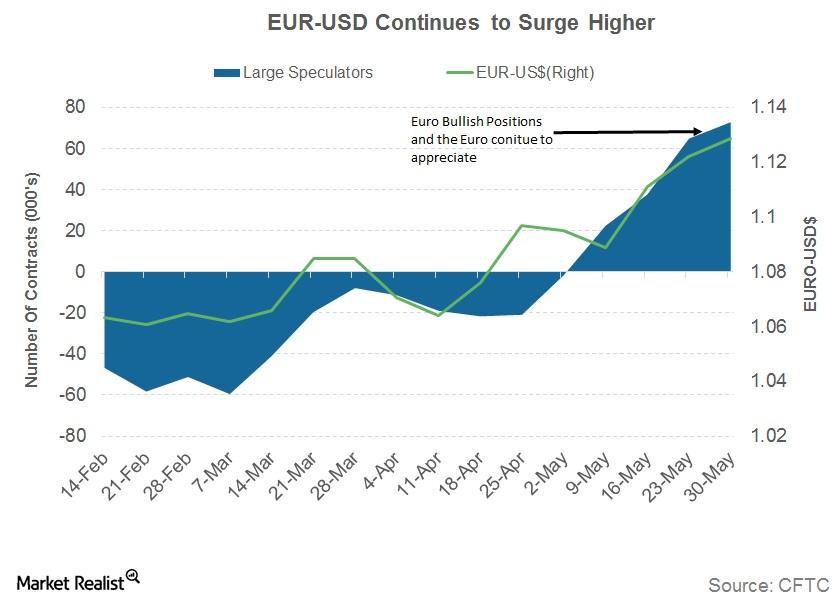

Last week (ended June 2), the euro continued to appreciate against the US dollar.

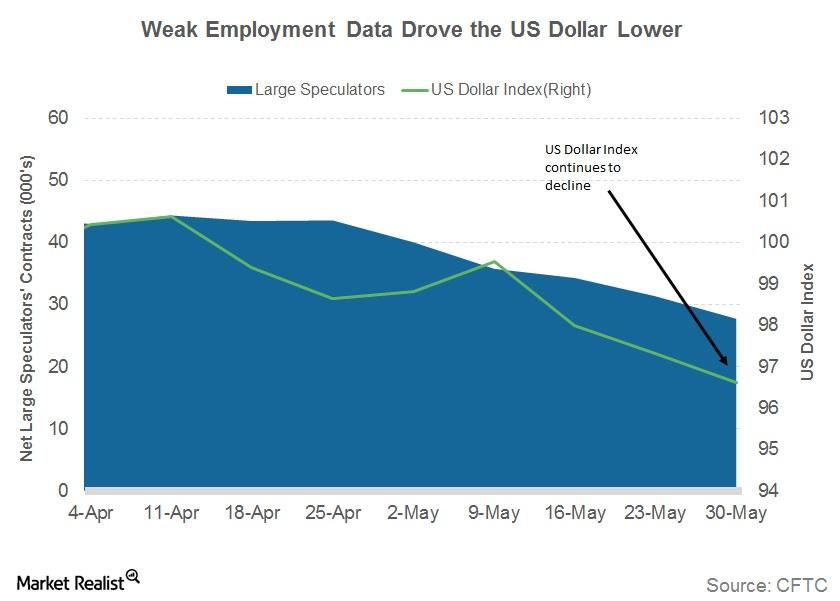

How the Weak Jobs Data Could Spell Doom for the US Dollar

The US dollar came into focus after the weak US jobs data on June 2. The payroll data was a negative surprise, with only 138,000 jobs being added in May.

What the Falling US Dollar Could Indicate for Investors

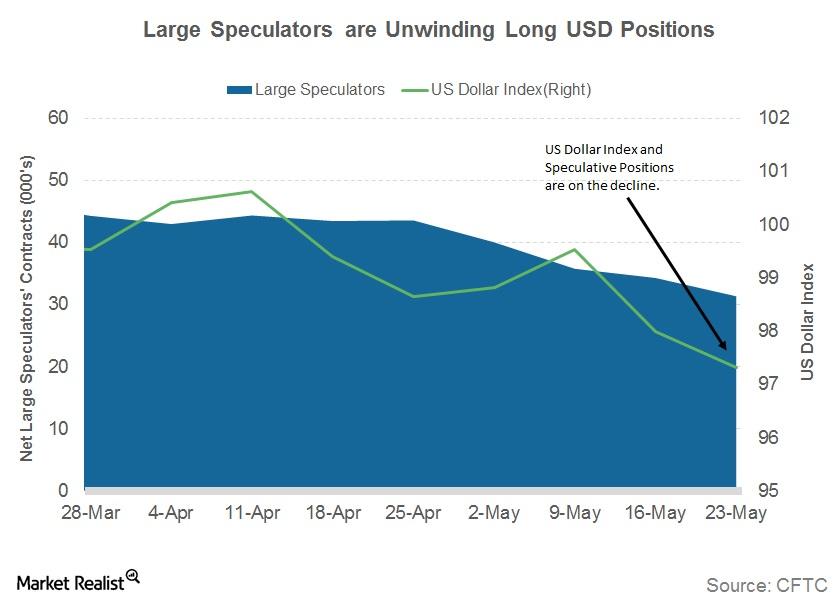

The US dollar (UUP) has continued to lose its value with respect to its trading partners. The US Dollar Index fell 1.6% in the week ended May 26, 2017.

Forex Markets: Will the Euro Dominate?

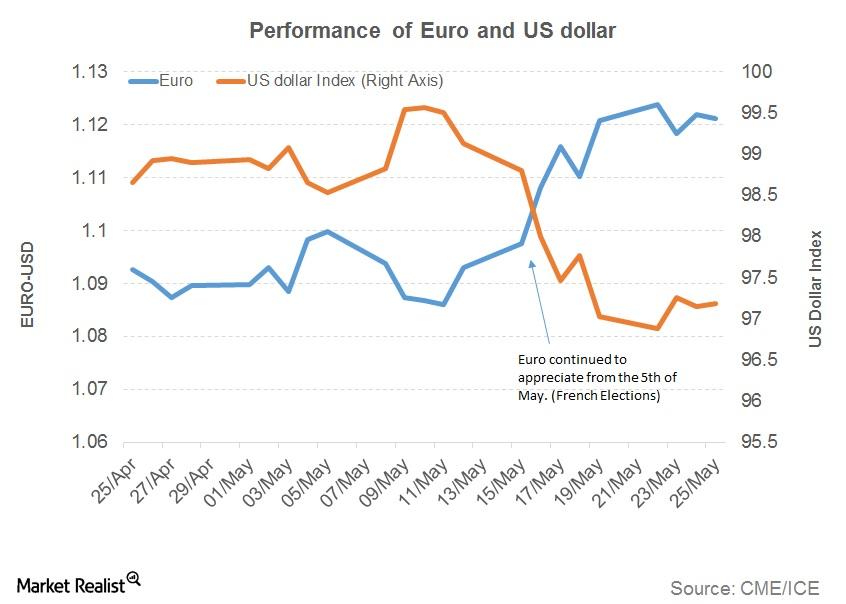

The euro-US dollar (FXE) continued to rise and claimed a new six-month peak above 1.1250 after the FOMC minutes didn’t revive the US dollar (UUP) on May 23.

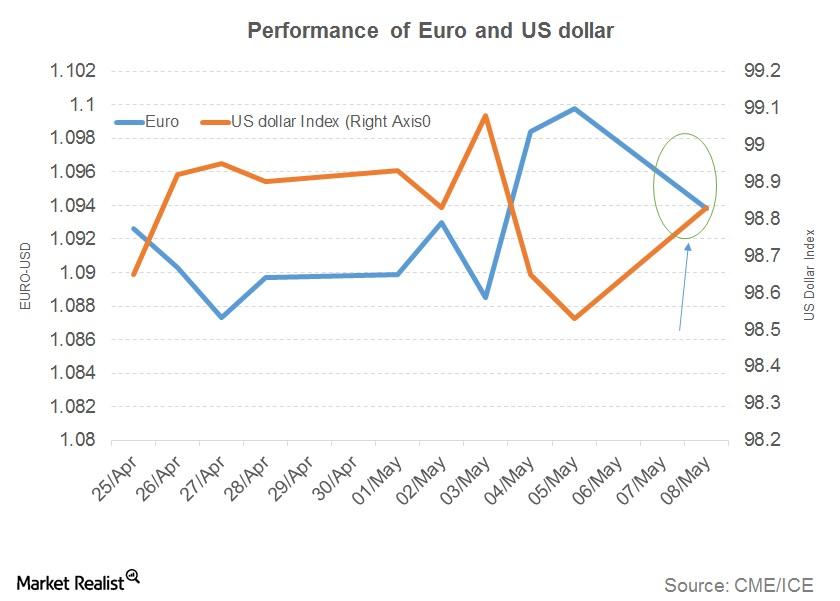

How Fixed Income, Currency Markets Reacted to the French Election

European bonds (BWX) started showing signs of celebration late May 5 as opinion polls pointed toward an Emmanuel Macron win in the French presidential election.

Why the ECB Is Struggling to Hide Its Excitement

The European Central Bank’s (or ECB) policy statement that was released on April 28 reported that the ECB left monetary policy unchanged, which was in line with expectations.