Berkshire Hathaway Inc

Berkshire Hathaway is a conglomerate holding company that was founded in 1839 by Oliver Chace. Berkshire Hathaway owns several companies such as GEICO, Duracell, and Helzberg Diamonds among others.

In 1970, Warren Buffett became chairman and the largest shareholder of Berkshire Hathaway and has been at the helm ever since.

Location: Omaha, Neb.

Industry: Insurance – Diversified

Sector: Financial Services

CEO: Warren Buffet

Valuation: $700 billion

Latest Berkshire Hathaway Inc News and Updates

Berkshire Hathaway Acquires Alleghany — Details on the $11.6 Billion Deal

Warren Buffett’s Berkshire Hathaway has scooped up Alleghany Corporation in a deal worth $11.6 billion. Here’s what to know about the transaction.

Nu Holdings IPO Forecast: Will Buffett Be Lucky This Time With Nubank?

Nu Holdings, which is the parent company for Nubank, has lowered the IPO price. What’s the forecast for Nu stock and is it a good buy?

Warren Buffett Is Selling Stocks—Here's What He's Shedding

Everyone wants to know what Warren Buffett has in his portfolio. Here's what Buffett is selling right now.

How Did Charlie Munger Get Rich and Make His Billions?

Charlie Munger is a billionaire investor, but how did he earn his wealth? Here's a look into how he got rich.

NetJets Expands in Big Deal, Publicly Traded Parent Company Wins Too

Private jet company NetJets just finalized a major deal. Is the luxurious airway publicly traded?

Warren Buffett’s Top 4 High Conviction Stocks: Overview for Investors

Berkshire Hathaway still appears to be concentrating its holdings. Here are Warren Buffett’s top four high conviction stocks.

Should You Buy AON Stock Like Warren Buffett or Wait?

Berkshire Hathaway, which is led by the legendary value investor Warren Buffett, has disclosed a new stake in Aon. Should you buy the stock?

Berkshire Hathaway 13F: Stocks Warren Buffett Is Buying in 2021

Berkshire Hathaway is expected to release its first-quarter 13F this weekend. What stocks is Warren Buffett buying and selling in 2021?

How Berkshire Hathaway Vice Chairman Greg Abel Makes His Millions

Greg Abel, the vice chairman at Berkshire Hathaway, earns nearly $20 million annually. He's also on the shortlist to take over from Warren Buffett.

Inside Scoop on Berkshire Hathaway’s Top Holdings in 2021

Berkshire Hathaway has gained around $17 billion across just five stocks this year. What are Berkshire Hathaway’s top holdings in 2021?

How to Invest in Berkshire Hathaway and Whether You Should

Here’s how to invest in Berkshire Hathaway—billionaire CEO Warren Buffett’s company. What do analysts say? Is Berkshire Hathaway a buy?

The Parent of All Parents: Here's What Berkshire Hathaway Actually Does

A holding company seems enigmatic, but Berkshire Hathaway's role is clear cut. So, what does Berkshire Hathaway actually do?

Here Is Warren Buffet's Net Worth in 2020

Warren Buffett is one of the wealthiest people in the world and one of its most famous investors with a net worth in the billions.

Warren Buffett, Berkshire Hathaway, and the Lost Decade

Several observers have criticized Warren Buffett, arguably the best value investor of all time, for Berkshire Hathaway’s recent underperformance.

Warren Buffett Goes Light on Tech Stocks, Loses $20 Billion Net Worth

Warren Buffett has only invested sparingly in the technology sector. His notable tech stock holdings are Apple (NASDAQ:AAPL) and Amazon (NASDAQ:AMZN).

Bill Ackman Rolled the Dice, Profited from US Stock Market Crash

Bill Ackman made the correct bets when US stock markets crashed in the first quarter. He has been outperforming SPY by a wide margin this year.

Why Did Warren Buffett Sell Airline Stocks in April?

Warren Buffett said that he sold all of his holdings in airline stocks in April. He has been on a selling spree despite the crash in US stock markets.

Are Bill Ackman’s Investment Strategies Successful?

In the first quarter of 2020, activist hedge fund manager Bill Ackman made a windfall profit of $2 billion. He was short on the market in March 2020.

Q1 13F: How Bill Ackman Played the US Stock Market Crash

So far in 2020, Bill Ackman’s timing has been impeccable. He made over $2 billion by shorting stocks as US stock markets crashed in the first quarter.

Gold Prices: Undervaluation, Smart Money Piles Up

Since March, gold prices are on a tear due to uncertainty surrounding COVID-19. The SPDR Gold Shares has seen gains of 16.2% since March 18.

Warren Buffett: Airline Stocks Were Finally a ‘Death Trap’

Over the weekend, Berkshire Hathaway held its annual shareholder meeting. Warren Buffett revealed that the company has fully exited airline stocks.

UBS Survey Shows HNI Clients Await a Stock Market Crash

A UBS survey of HNI clients with investable assets over $1 million showed that 61% expect stocks to fall 5%–20%. Another 16% see a bear market.

How Does the Oil Price Crash Impact Warren Buffett?

For the first time, WTI crude prices fell into the negative zone during trade on Monday. Warren Buffett invested in Occidental Petroleum last year.

Was 2019 a “Nightmare” for Warren Buffett and Berkshire?

Warren Buffett underperformed the stock markets last year. Berkshire Hathaway’s returns versus the S&P 500 were the worst since 2009.

Warren Buffett Has Loads of Cash and No Takers

Berkshire Hathaway’s huge cash pile might stay in place for a while. Warren Buffett was outbid by Apollo Global Management in his efforts to buy Tech Data.

What Berkshire Hathaway Really Does, Says Buffett

Berkshire Hathaway is a huge conglomerate with diverse operations. The company’s operations are complex, so let’s take an easy-to-understand approach.

What Warren Buffett Might Say about Tesla’s Q3 Earnings

Warren Buffett has been somewhat critical of Tesla CEO Elon Musk. Tesla released its third-quarter earnings on Wednesday, which shattered the estimates.

Berkshire Hathaway: Apple Is a Shining Star in 2019

Berkshire Hathaway stock has underperformed the S&P 500 this year. However, Apple is outperforming the markets. Buffett has been optimistic about Apple.

Warren Buffett Isn’t Always Right on Apple Stock

Warren Buffett has admired Apple in the past. As a value investor, Buffett was expected to add more shares when Apple stock fell in the fourth quarter.

Is Warren Buffett’s Nightmare Scenario Coming True?

Warren Buffett’s Berkshire Hathaway’s cash pile has grown steadily. At the end of Q2, the company had more than $122 billion in cash and cash equivalents.

Trade War: Are Trump and Xi Jinping Taking Buffett’s Advice?

Over the last few days, the trade war de-escalated. President Trump said that the US-China trade talks are resuming “at a different level.”

Berkshire Hathaway 13F: Warren Buffett Played It Safe

There weren’t any real surprises in Berkshire Hathaway’s 13F for the second quarter. In some ways, the 13F replicated the first quarter.

Ackman Makes Berkshire Bet: What It Means for Investors

According to the regulatory filing from Bill Ackman’s Pershing Square Capital, the fund has taken a new stake in Berkshire Hathaway (BRK.B).

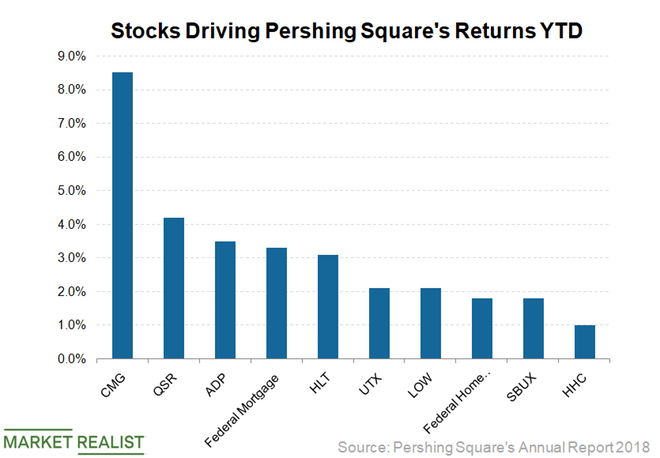

Bill Ackman Thanks Warren Buffett for His Fund’s Comeback in 2019

Bill Ackman has made a huge comeback in 2019.

Buffett versus Dalio on Gold: Whose Advice Should You Take?

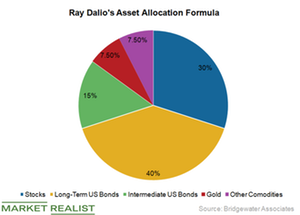

When it comes to investing in stocks, Berkshire Hathway’s (BRK.A) chair, Warren Buffett, and Bridgewater’s founder, Ray Dalio, have similar advice.

How Will Berkshire Deploy Its Cash Pile of over $100 Billion?

Berkshire Hathaway (BRK.B) was sitting on liquidity of $118 billion at the end of the first quarter.

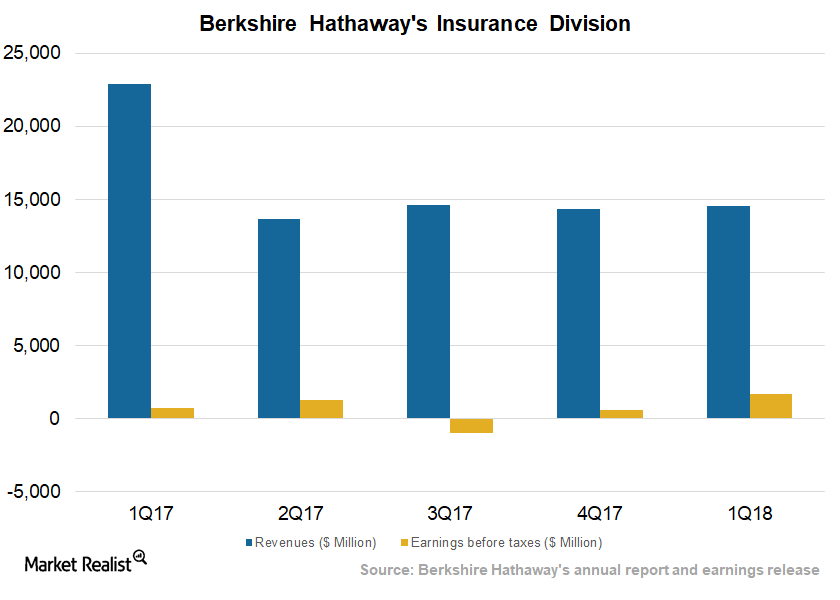

Berkshire’s Insurance Segment Benefits From Fewer Claims

In 1Q18, Berkshire Hathaway’s (BRK.B) insurance revenue fell YoY (year-over-year) to $14.6 billion from $22.9 billion.

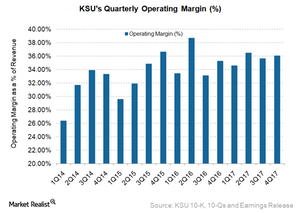

How Kansas City Southern Delivered on 4Q17 Operating Margins

In 4Q17, Kansas City Southern (KSU) reported an improvement of 80 basis points in its operating margin, which rose to 36% from 35.2% in 4Q16.

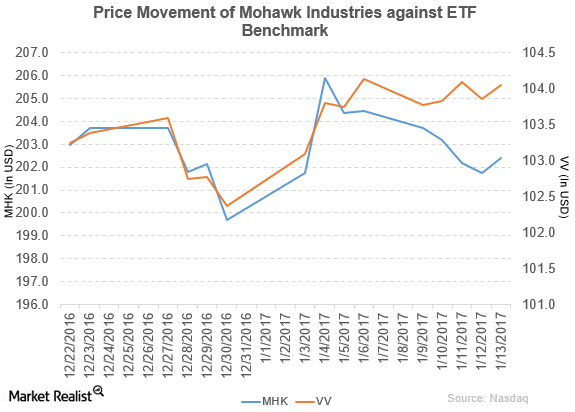

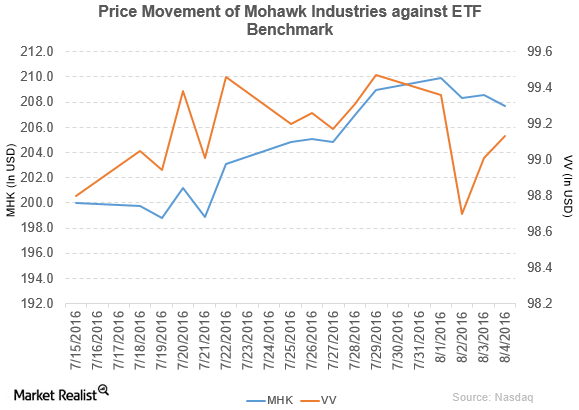

Moody’s Upgrades Mohawk Industries’s Notes to ‘Baa1’

Mohawk Industries (MHK) reported fiscal 3Q16 net sales of ~$2.3 billion—a rise of 6.5%, compared to net sales of ~$2.2 billion in fiscal 3Q15.

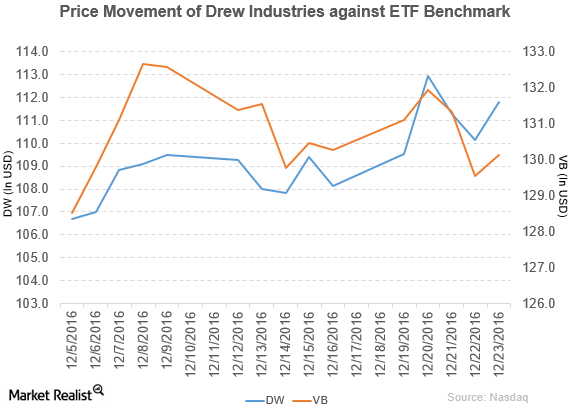

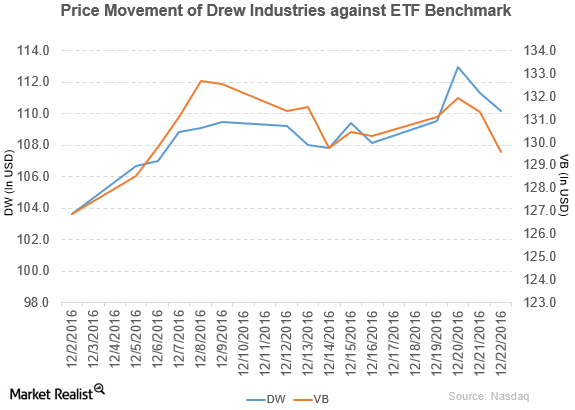

Drew Industries Announces Change of Name and Ticker Symbol

Drew Industries (DW) rose 3.4% to close at $111.80 per share during the third week of December 2016.

Why Sidoti Rated Drew Industries a ‘Buy’

Drew Industries (DW) has a market cap of $2.7 billion. It fell 1.0% to close at $110.15 per share on December 22, 2016.

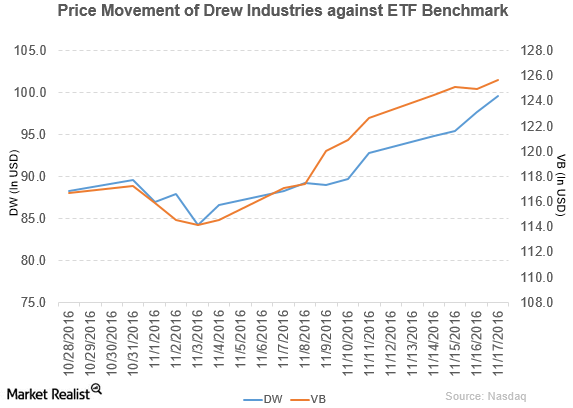

Drew Industries Declares Dividend of $0.50 Per Share

Drew Industries rose 1.9% to close at $99.60 per share on November 17. The stock’s weekly, monthly, and YTD price movements were 11.0%, 7.4%, and 65.5%.

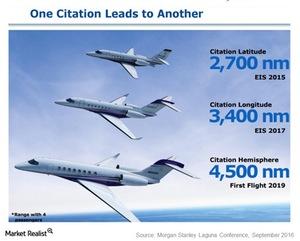

NetJets Orders Secure Textron Aviation amid Business Jet Weakness

Textron Aviation increase its sales in the last two quarters after gaining traction for its new Latitude business jets. It has secured 150 orders from NetJets.

Mohawk Industries’ Earnings Results in Fiscal 2Q16

Mohawk Industries (MHK) has a market cap of $15.3 billion. It fell by 0.42% to close at $207.70 per share on August 4, 2016.

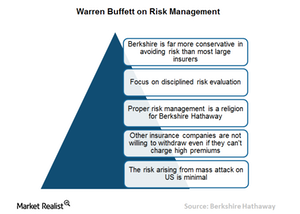

Why Buffett Thinks Risk Management Should Be a Disciplined Affair

Berkshire Hathaway has reported an underwriting profit for 13 straight years, showing a pre-tax gain of $26.2 billion for the period. Buffett states that this was due to Berkshire’s insurance manager’s daily focus on disciplined risk evaluation.