BlackRock Inc

Latest BlackRock Inc News and Updates

Republicans Are Blasting BlackRock's ESG Agenda — Scandal Explained

BlackRock Inc., the largest global asset manager, has been criticized by both climate activists and fossil-fuel proponents. Has BlackRock been involved in an ESG scandal?

BlackRock Partners With Coinbase to Offer Crypto for Institutional Investors

On Aug. 4, BlackRock and Coinbase announced their partnership to offer crypto to institutional investors. What does the deal mean for Coinbase?

BlackRock’s Crypto Portfolio: The World’s Largest Asset Manager Leaps Toward Blockchain

As the world’s largest asset manager, BlackRock is making big moves toward crypto. Here’s the latest on BlackRock’s crypto portfolio.

Larry Fink Says Institutional Investors Are Fascinated by Bitcoin, but Still Not Interested

Larry Fink’s recent comments on bitcoin provide some insights into how Wall Street views cryptocurrencies both now and in the future.

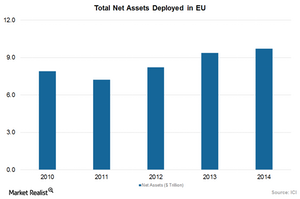

Fund Flows Continue to Rise in the European Union

Fund flows in European equities (EFA) have expanded at a slower pace since 2011. Overall, they’ve grown at an average of 10% over the past three years.

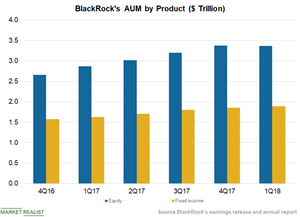

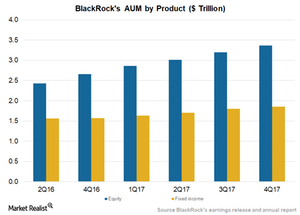

BlackRock’s Diversified Offerings Can Benefit from Rate Hikes

In the first quarter, BlackRock managed ~$1.9 trillion in fixed income offerings, up from ~$1.6 trillion in the first quarter of 2017.

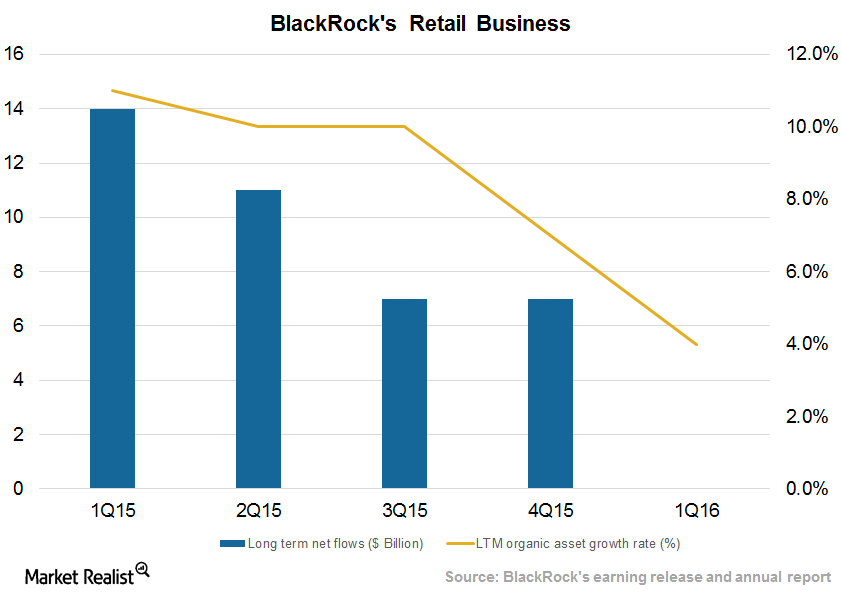

BlackRock’s Retail Continues to Attract New Clients across Classes

BlackRock’s (BLK) retail business had assets under management (or AUM) of $542 billion as of March 31, 2016.

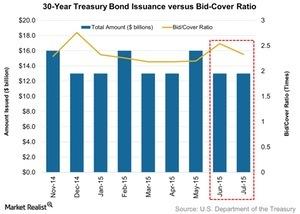

10-Year Treasury Note Market Demand Barely Moved Last Week

On July 8, ten-year Treasury notes worth $21 billion were auctioned—the same as the previous week.

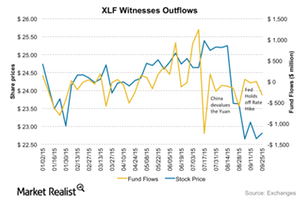

Fund Flows to XLF Have Been Declining

Exchange-traded fund investors added almost $552.6 million on average to the Financial Select Sector SPDR ETF (XLF) in the last quarter. During the week ending September 25, the ETF witnessed outflows of $318.3 million.

How Could a Trade War Impact Asset Managers?

After Trump announced that Chinese investments in US tech stocks would be restricted, the Dow Jones Industrial Average spiked downward.

Interest Rate Expectations Have Jolted Equity and Debt Alike

Asset managers (VFH) are seeking stability in order to attract funds toward either equity or debt offerings.

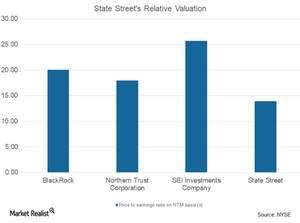

Can State Street Recover Its Discounted Valuations?

On a next 12-month basis, State Street Corporation (STT) has a PE (price-to-earnings) ratio of 13.9x. Its competitors’ average is 21.22x.

Where Are Interest Rates Going? Ray Dalio Weighs In

Ray Dalio, and Marketplace Morning Report host David Brancaccio discussed the future of the economy and the next recession. Here’s what you need to know.

Paul Singer Increased His Holdings in NXP Semiconductor in 3Q17

Paul Singer, the CEO of Elliott Management, increased his holdings in NXP Semiconductor (NXPI) in 3Q17, according to a recent 13F filing report.

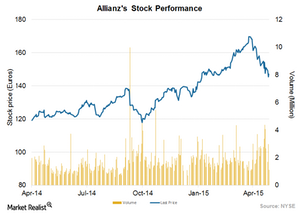

Allianz Reports 11% Revenue Growth Backed by Insurance Business

Allianz Group offer property casualty insurance, life and health insurance, and asset management products and services in over 70 countries. The company’s major operations are in Europe.

Why David Einhorn Is Betting against Amazon

On a YTD (year-to-date) basis, Amazon has returned nearly 40% as of November 3, 2017.

How Does BlackRock Make Money?

BlackRock, an investment management giant, had $7.0 trillion in AUM (assets under management) at the end of the third quarter.

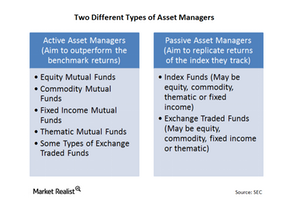

Traditional assets: Defining active and passive management

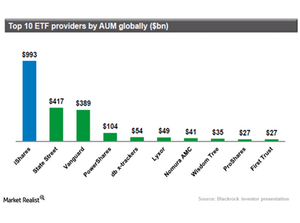

Active asset management refers to those asset managers that essentially try to outperform the average market return, a benchmark, or a hurdle rate that may have been set internally.Financials The big 3 ETF providers in the US—iShares, SPDR, and Vanguard

In the U.S., Blackrock (BLK), State Street GA (STT), and Vanguard are the top three ETF providers. They have a 40.1%, 22.3%, and 20.7% market share, respectively.

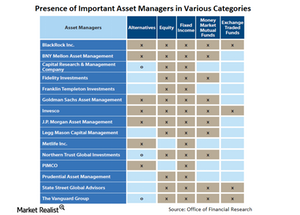

The main players in asset management

The efficient market hypothesis maintains that the market prices everything correctly and so it isn’t possible to outperform the market in the long run.

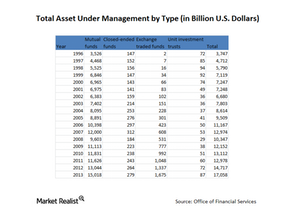

How big is the asset management industry?

Audited and verified annual figures at the end of 2013 indicate that total assets under management of US registered investment companies equalled nearly $17.1 trillion.Financials Must-know investment pledges to India from Fortune 500 CEOs

The group spoke about how these companies and India could benefit from investment flow into the country. Modi sought investment pledges from many of these CEOs, who were impressed with what India had to offer.

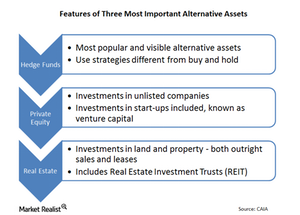

Private equity, hedge funds, and other alternative assets

Private equity is capital invested in companies that aren’t listed on stock exchanges. These alternative assets include venture capital.

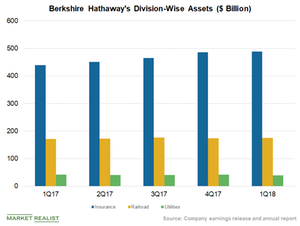

How Will Berkshire Deploy Its Cash Pile of over $100 Billion?

Berkshire Hathaway (BRK.B) was sitting on liquidity of $118 billion at the end of the first quarter.

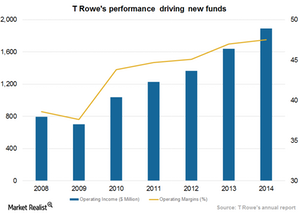

A Look at T. Rowe Price’s Assets under Management

Asset classes In its investor presentation on February 21, 2018, T. Rowe Price (TROW) stated that its core business is helped by the allocation of its AUM (assets under management) in different asset classes and its strong client base. However, the company also believes that targeting new opportunities is crucial for its core business. Of its total AUM, […]

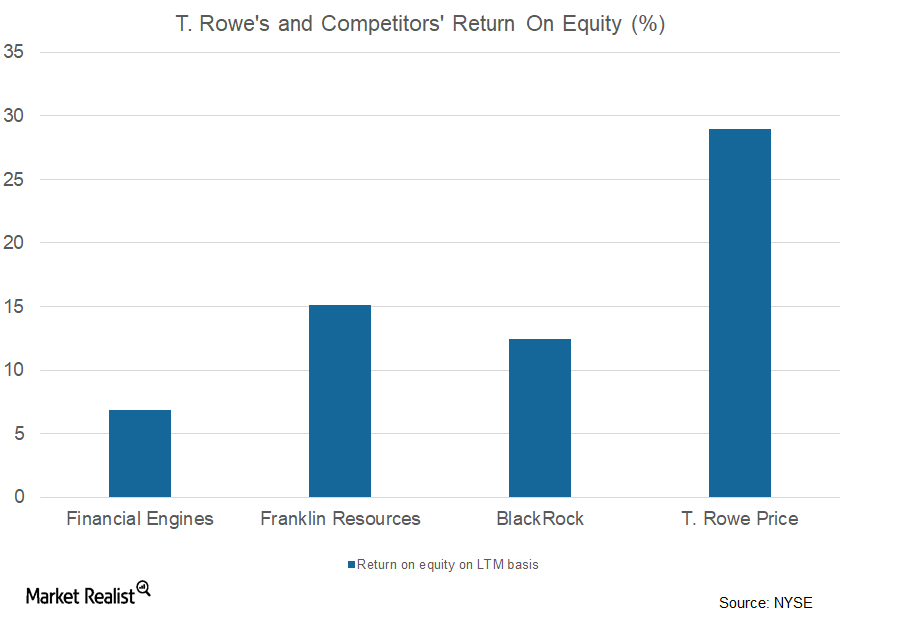

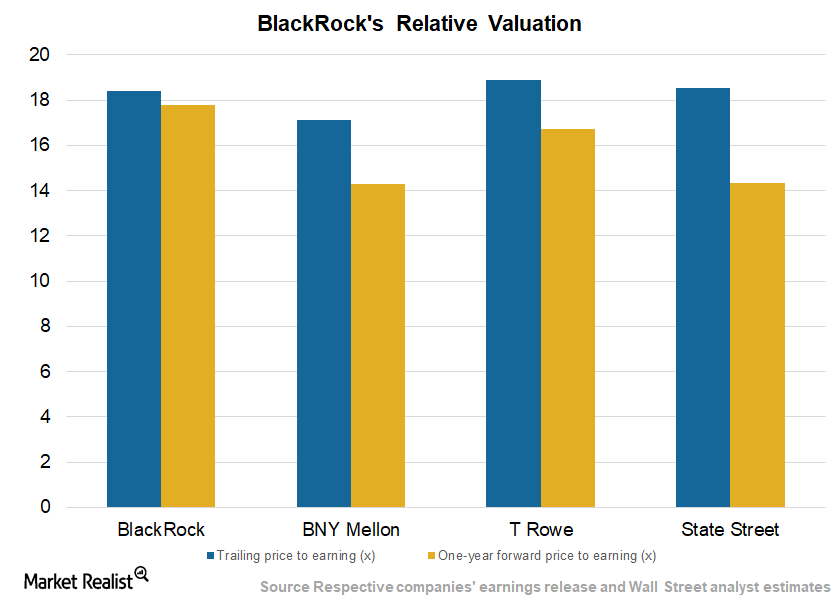

BlackRock’s Valuations Stable amid Strong Operating Performance

BlackRock is currently trading at a forward price-to-earnings ratio of 17.6x, compared with the industry average of 18.6x.

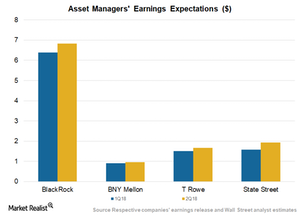

BlackRock and Competitors Look at Strong 1Q18 Numbers

Among the major asset managers, BlackRock (BLK) is expected to post sequential and year-over-year growth in earnings per share to $6.38 in 1Q18 and $6.83 in 2Q18.

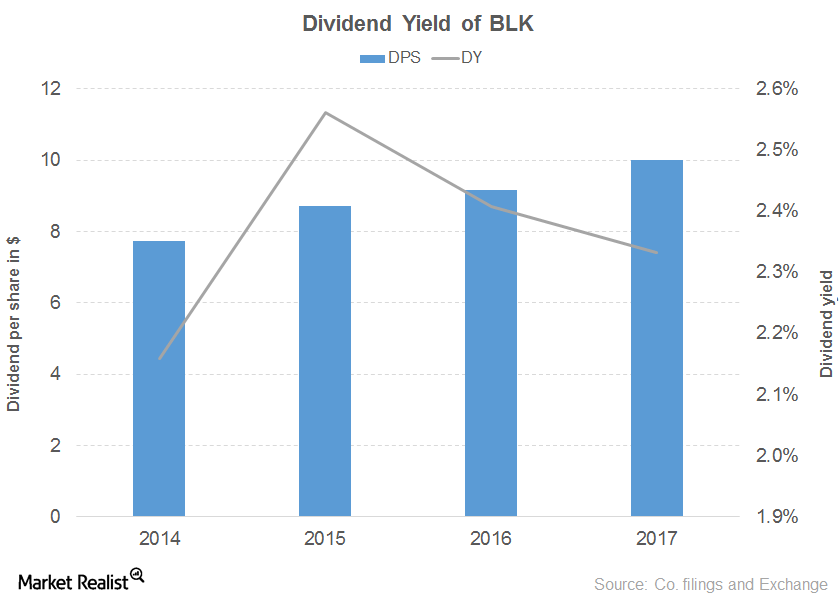

What Led to BlackRock’s Downward Sloping Dividend Yield Curve?

BlackRock posted a 7.0% revenue growth in the first half of 2017, driven by every segment except multi-asset and alternatives, which reported flat growth.

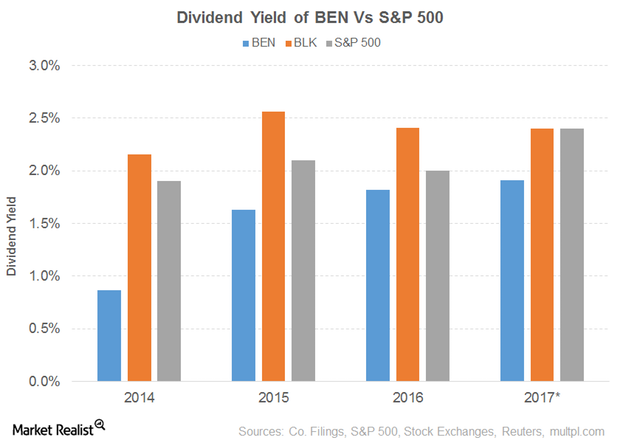

Dividend Yield of Franklin Resources

Franklin Resources (BEN) has recorded consistent growth in dividends since at least March 1982.

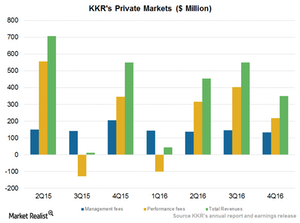

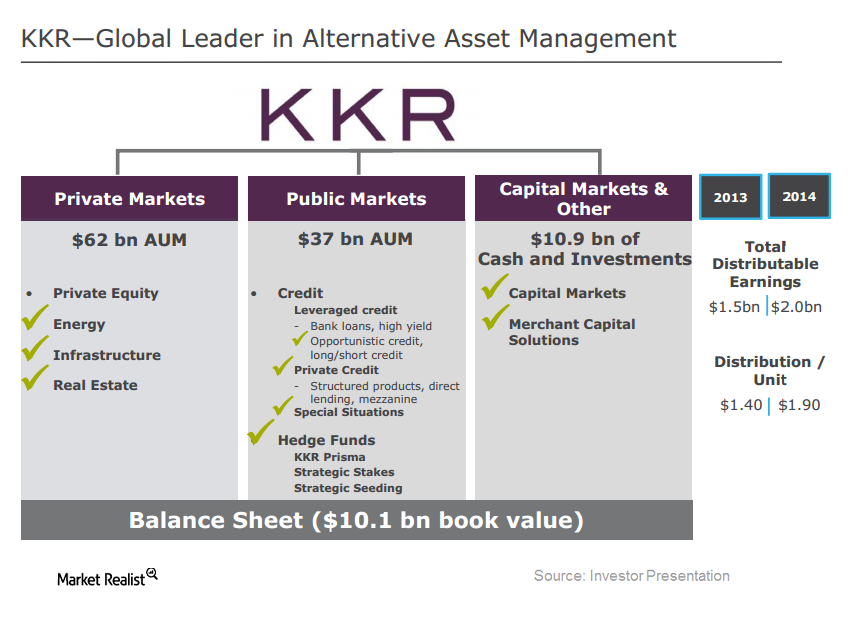

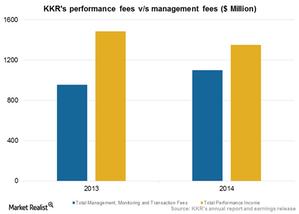

KKR Private Markets Segment Projects Deployment and Growth in 2017

KKR & Company’s (KKR) Private Markets segment contributed almost 71% of the company’s total revenues in 4Q16.

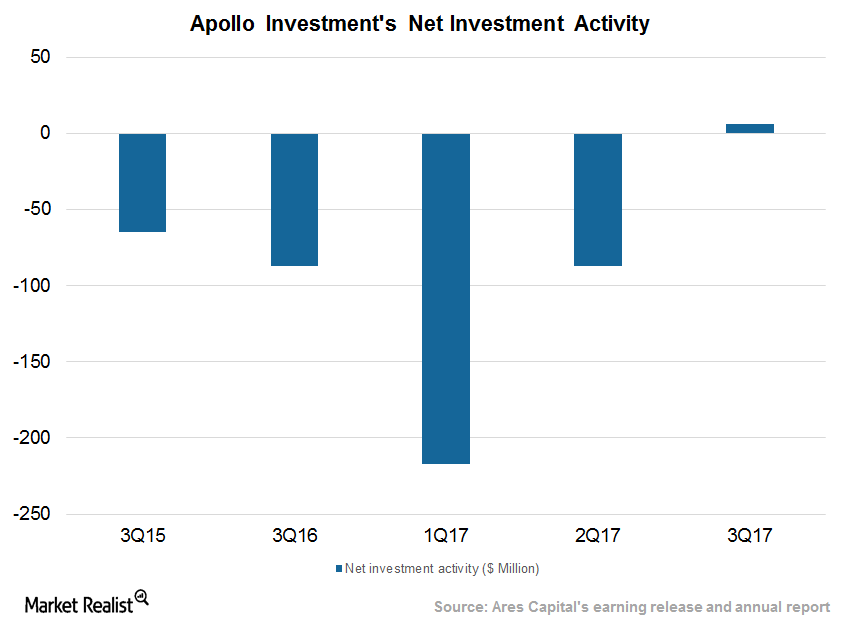

Apollo Investment Sees Net Investments Turn Positive in Fiscal 3Q17

In fiscal 3Q17, Apollo Investments (AINV) sold $17.1 million in investments and repaid $178.2 million.

Apollo Investment’s Net Exits Trend Expected to Reverse in 2017

Apollo Investment’s (AINV) total portfolio stood at ~$2.6 billion in fiscal 2Q17 compared to ~$3.2 billion in fiscal 2Q16.

KKR Private Markets Segment Rises on Performance Fees in 3Q

In 3Q16, KKR’s Private Markets segment reported revenues of $549 million in 3Q16, as compared to $12 million in 3Q15 and $453 million in 2Q16.

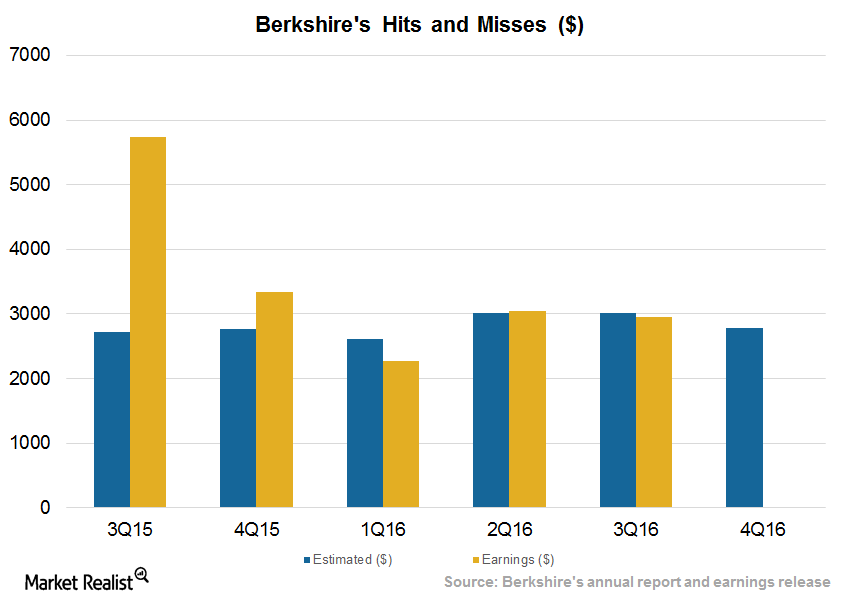

Buffett’s Berkshire Misses Estimates amid Volatile Environment

Berkshire Hathaway reported its third quarter earnings on November 5, 2016. The company missed analysts’ operating earnings per share estimates of $3,022 with reported EPS of $2,951.

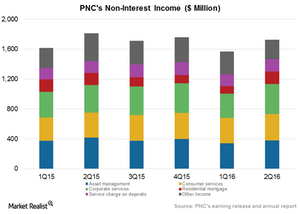

PNC Financials’ Non-Interest Income Ratio Continues to Expand

PNC Financial’s non-interest income for 2Q16 increased by 10% over the previous quarter, mainly due to higher fee income growth.

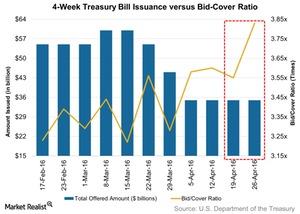

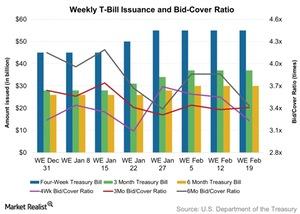

Fundamental Market Demand Rose for 4-Week Treasury Bills Auction

The US Department of the Treasury conducted the weekly auction of four-week Treasury bills (or T-bills) on April 26.

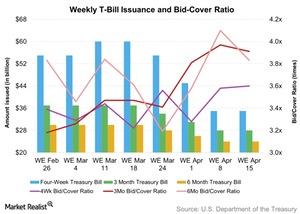

Indirect Bidders Participated in the 13-Week T-Bills Auction

The U.S. Department of the Treasury auctioned 13-week T-bills worth $28 billion on April 11. The offer amount of these bills was the same as the previous auction.

What Are TIPS and How Do They Benefit Investors?

Treasury inflation-protected securities (or TIPS) protect the value of debt securities from eroding due to a rise in inflation.

How Was Market Demand for the 13-Week Treasury Bill Auction?

The U.S. Department of the Treasury conducted the weekly auction of 13-week Treasury bills on February 16, 2016. The total issuance was worth $37 billion.

Fairholme Capital Exits Stake in KKR

For the fourth quarter of 2014, KKR reported a net loss of $0.6 million, compared to net income of $277.9 million in 4Q13.

T. Rowe Price Group: It Takes Seed Capital to Build New Funds

The length of time seed capital is held in a portfolio depends on various factors such as how long it takes to generate cash flow from unrelated investors.

KKR Capstone: An institutionalized process of creating value

KKR has institutionalized the process of creating value in its portfolio companies through KKR Capstone.

How does BlackRock compare to its peers?

How does BlackRock compare to its peers? BlackRock faces major competition from State Street and Vanguard.

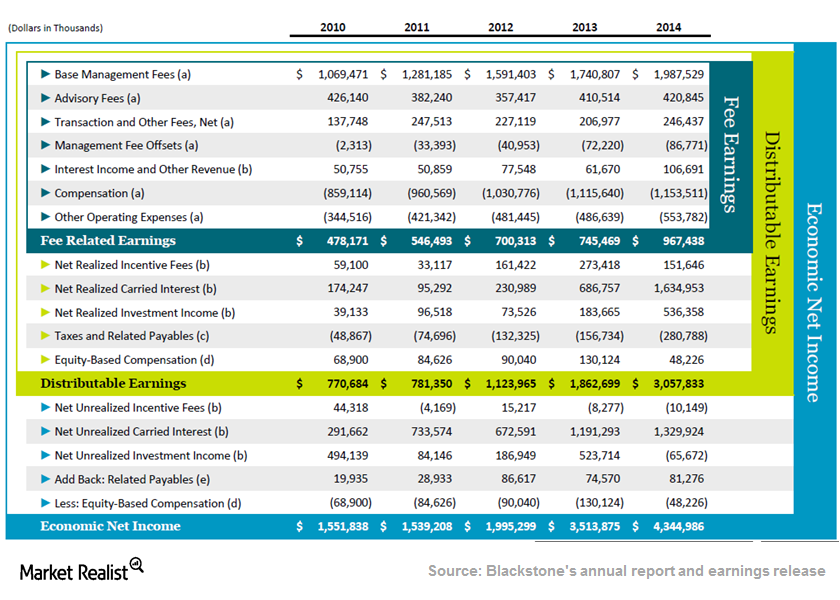

Blackstone’s revenue model

The company’s revenue model is based on charging management and performance fees for managing the portfolios in its investment advisor firms.