Alexion Pharmaceuticals Inc

Latest Alexion Pharmaceuticals Inc News and Updates

Alexion Pharmaceuticals Adds Metabolic Drug Kanuma to Portfolio

Kanuma was acquired by Alexion Pharmaceuticals on completion of the acquisition of Synageva Pharmaceuticals in June 2015.

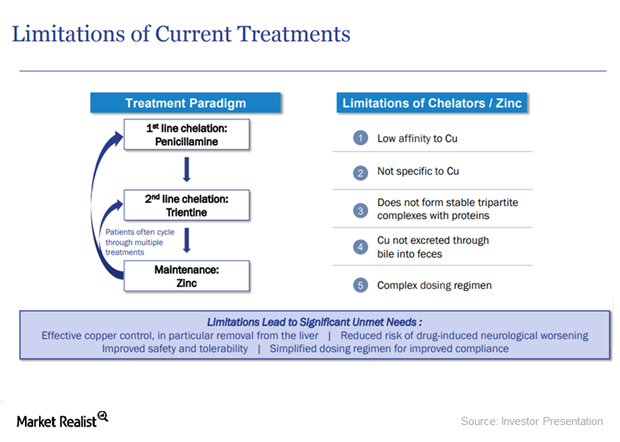

WTX101: A Superior Treatment for Wilson Disease

WTX101 has a unique action mechanism. The drug has the potential to become the standard of care for Wilson disease patients.

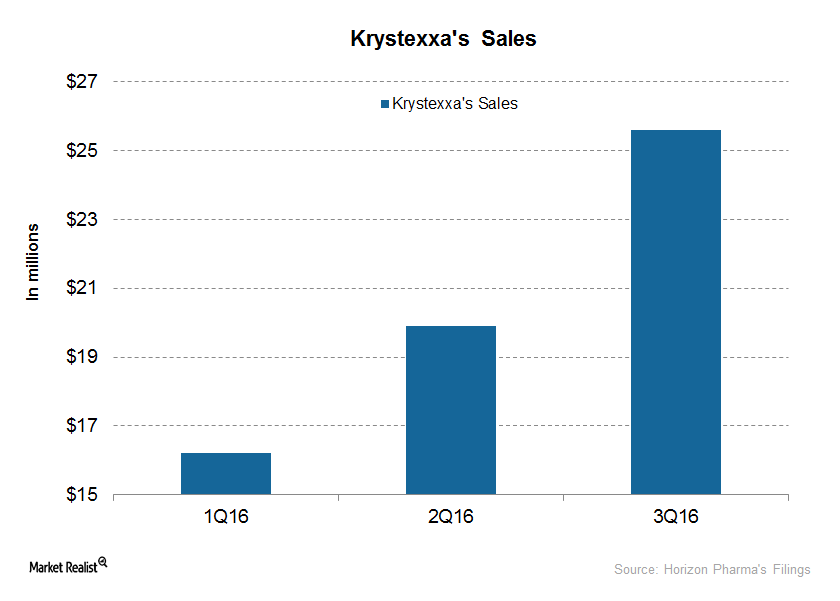

Revenue Drivers for Krystexxa, Horizon’s Orphan Biologic Drug

Horizon plans to drive Krystexxa through increased awareness and outreach, investing in its marketing and medical education as well as commercial infrastructure.

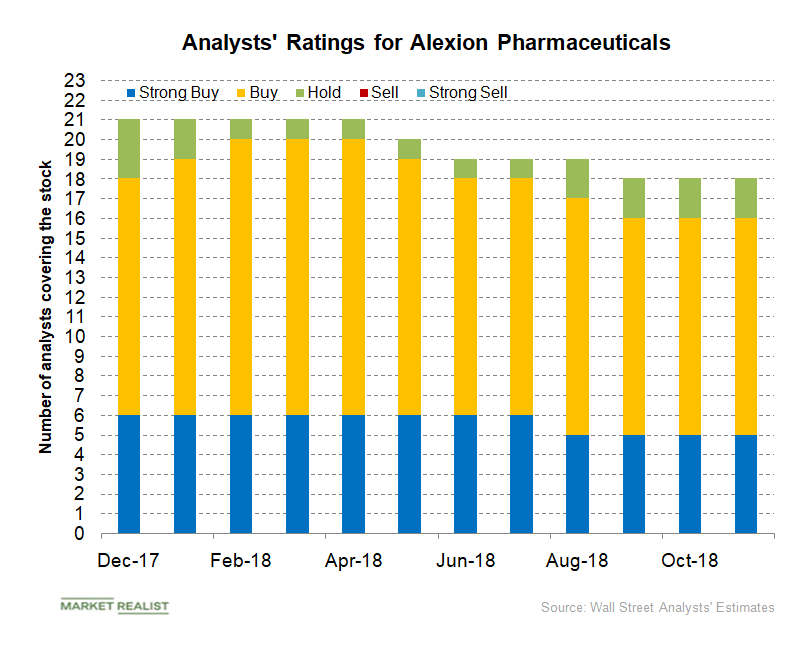

How Analysts View Alexion Stock

In November 2018, of the total 18 analysts covering Alexion Pharmaceuticals (ALXN), 16 analysts have given the stock a “buy” or higher rating, and two analysts have given it a “hold” rating.

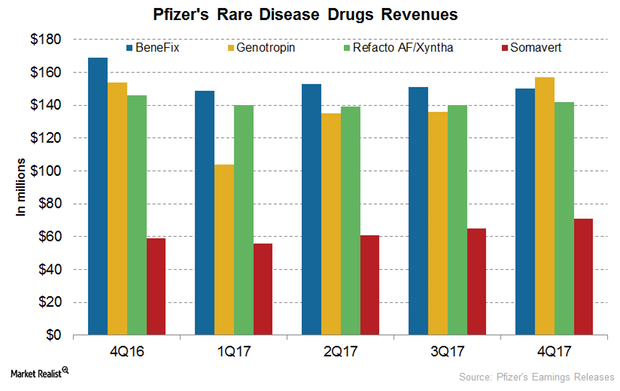

Inside Pfizer’s Rare Disease Segment Performance in 2017

In 4Q17, Pfizer’s BeneFix reported revenues of $150 million, which represents a ~11% decline YoY and a ~1% decline quarter-over-quarter.

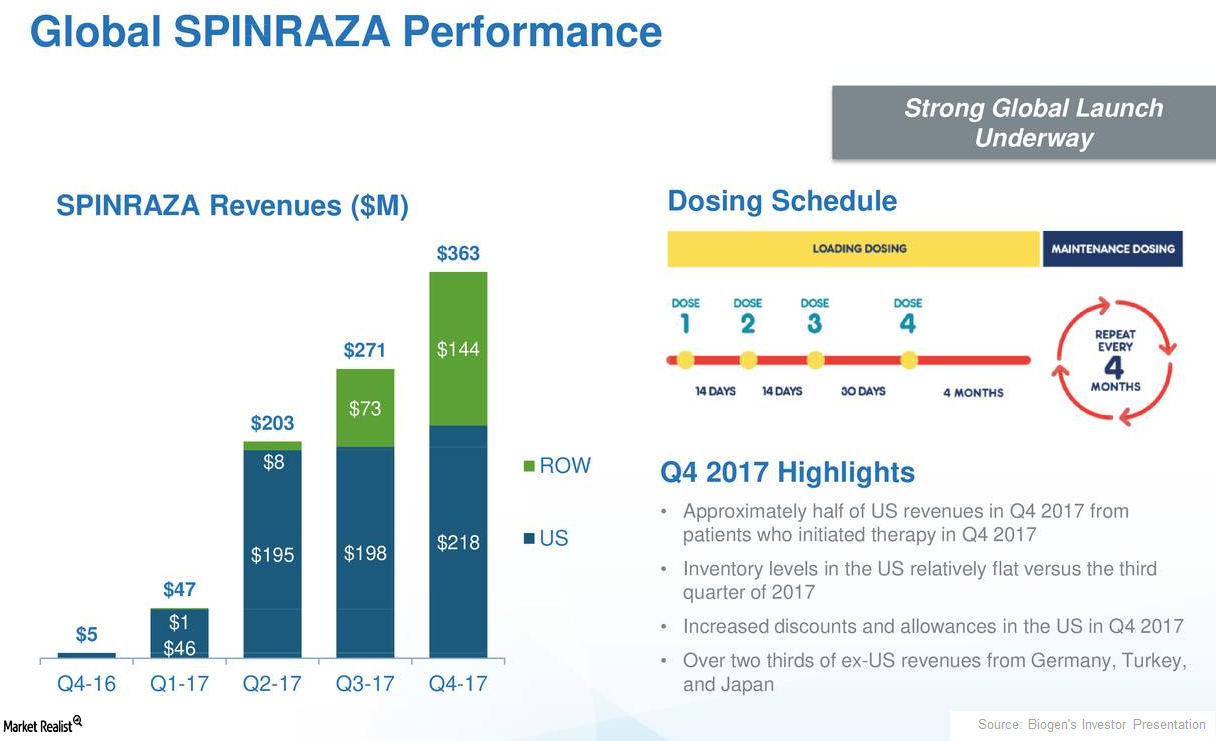

How Biogen’s Spinraza Is Positioned for 2018

In 4Q17, Biogen’s (BIIB) Spinraza generated revenues of $363 million, which reflected 34% quarter-over-quarter growth.

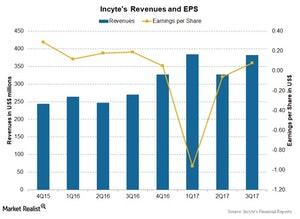

How’s Incyte’s Valuation in January 2018?

Analysts expect Incyte Corporation’s revenue to rise ~26.7% to $413.8 million in 4Q17 compared to $326.5 million in 4Q16.

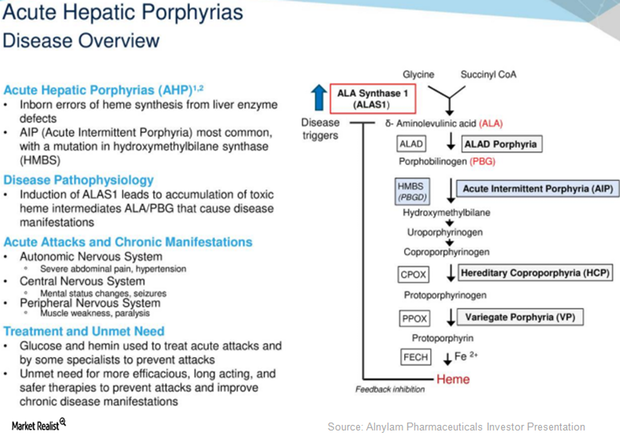

Givosiran May Become Major Growth Driver for Alnylam Pharmaceuticals

On September 7, 2017, Alnylam Pharmaceuticals (ALNY) announced that it had reached an agreement with the US Food and Drug Administration (or FDA) related to the design of the phase three program for investigational RNAi therapeutic Givosiran.

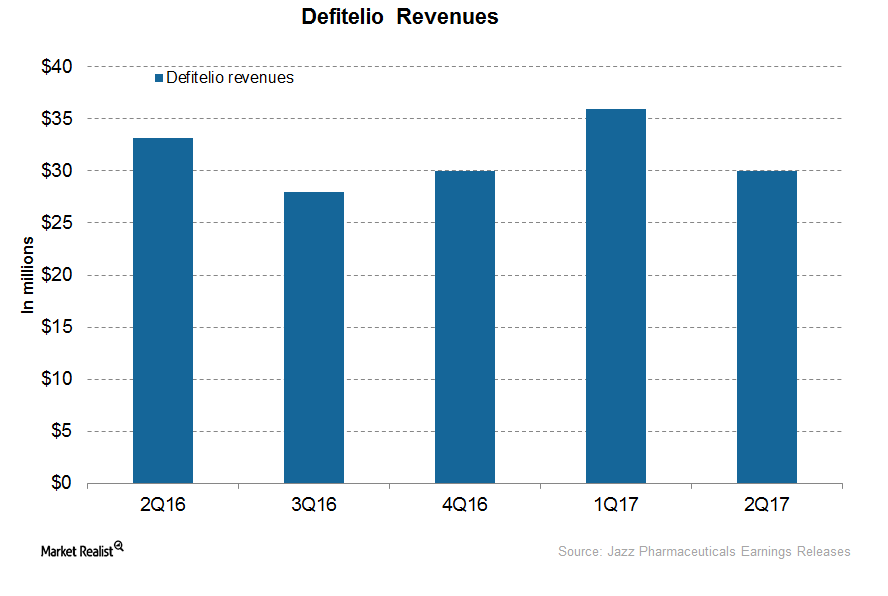

How Is Jazz’s Defitelio Positioned after 2Q17?

In 2Q17, Jazz Pharmaceuticals’ (JAZZ) Defitelio generated revenues of ~$30 million, which represents a ~10% fall YoY and a ~17% fall QoQ.

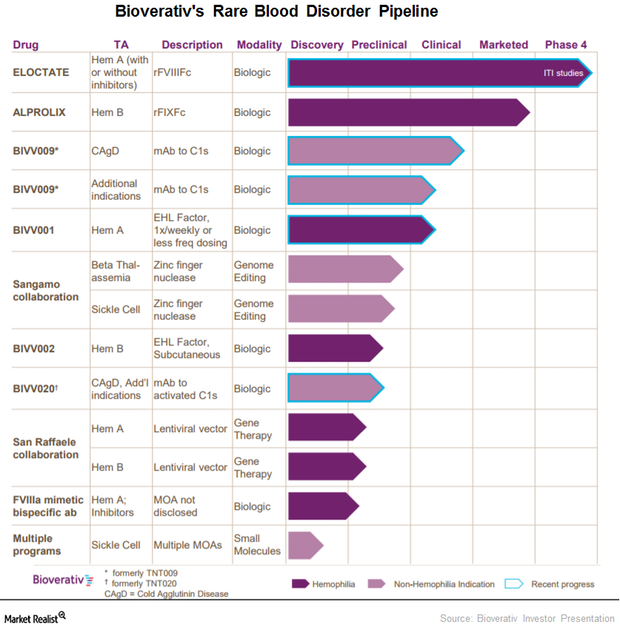

This Part of Bioverativ’s Pipeline Could Be a Major Long-Term Growth Driver

In June 2017, the FDA accepted Bioverativ’s investigative new drug application for BIVV001, a drug designed to treat prophylaxis from bleeding associated with hemophilia A.

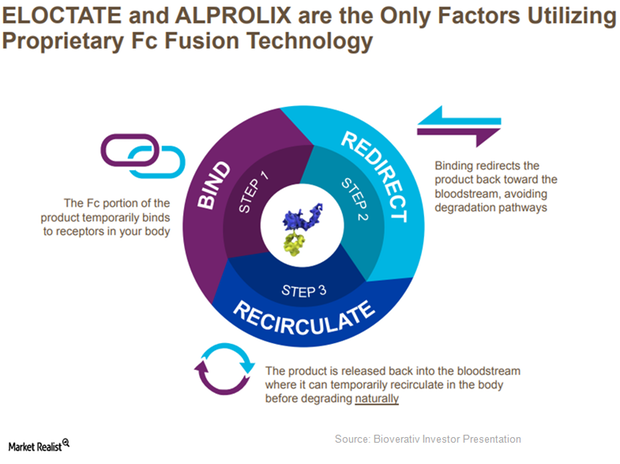

Alprolix and Eloctate Increasingly Used for Prophylaxis in 2017

Since demand from the target population for prophylaxis is rising rapidly, Bioverativ’s Alprolix and Eloctate are expected to see solid demand trends in 2017.

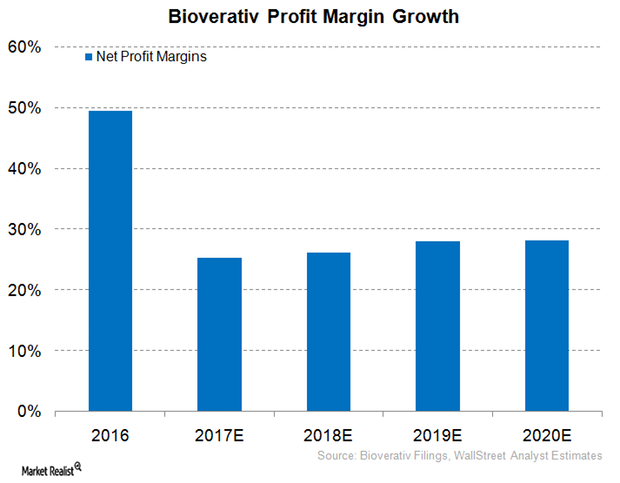

Bioverativ Expected to Report Healthy Profit Margins in 2017

Bioverativ (BIVV) expects its 2017 GAAP and non-GAAP operating margins to fall 38.0%–42.0% and 43.0%–47.0%, respectively.

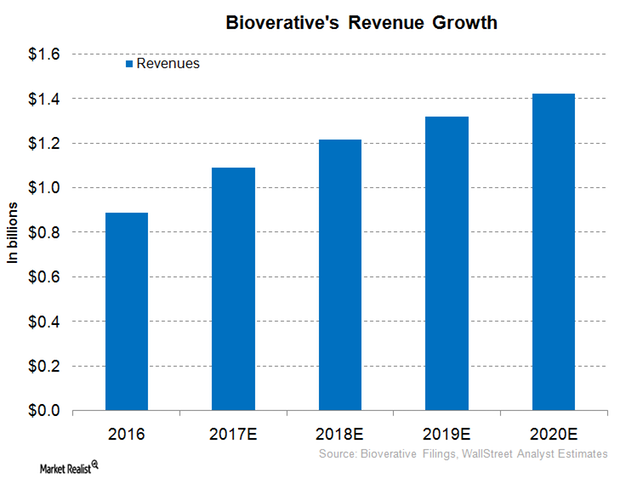

Bioverativ Expected to Report Robust Revenue Growth in 2017

In 1Q17, Bioverativ reported revenues close to $259.0 million, driven by its focus on a commercial strategy for its hemophilia products and optimal cost management.

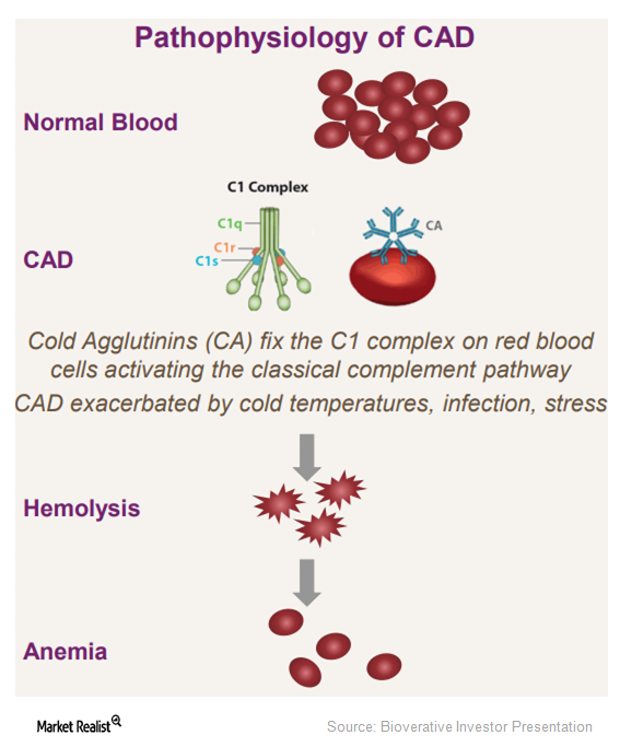

Bioverativ–True North Therapeutics: Stronger Research Pipeline

The acquisition of True North Therapeutics has paved the way for Bioverativ’s (BIVV) entry into cold agglutinin disease (or CAD).

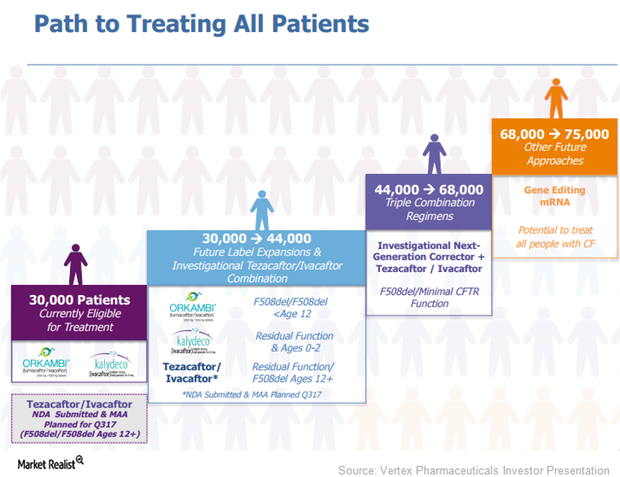

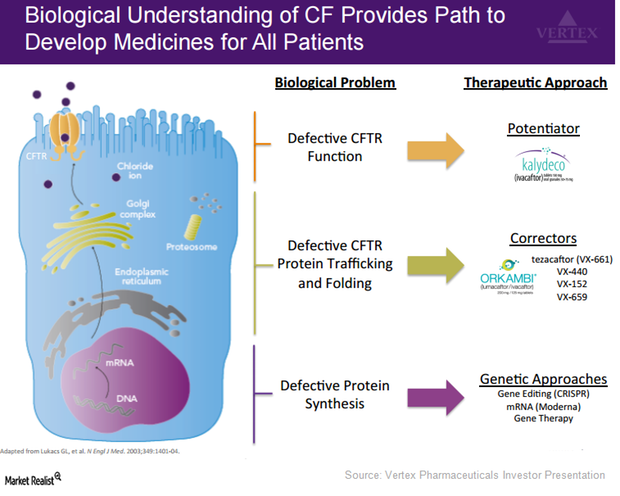

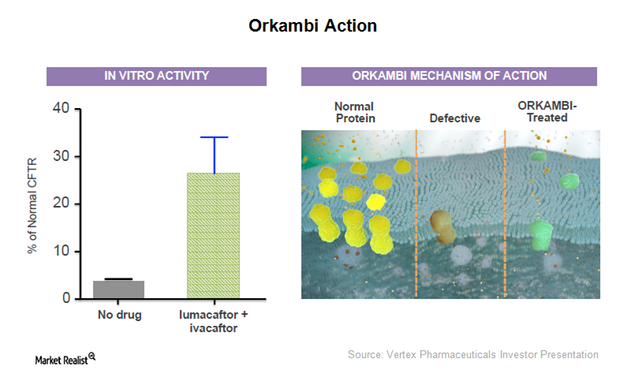

Vertex Pharmaceuticals Cystic Fibrosis Market Could Expand

Vertex Pharmaceuticals’ (VRTX) drugs, Orkambi (lumacaftor/ivacaftor) and Kalydeco (ivacaftor), are capable of treating around 30,000 cystic fibrosis (or CF) patients.

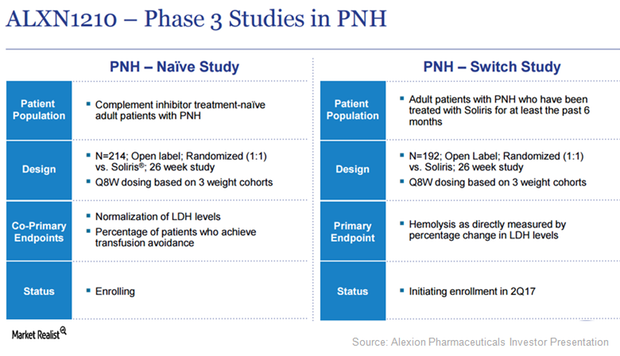

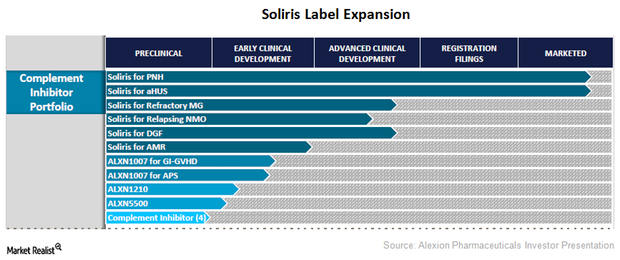

ALXN1210 Is Expected to Boost Alexion Pharmaceuticals’ Revenue

Alexion Pharmaceuticals has planned five clinical trials in 2017 to test the potential of investigational next-generation C5 antibody, ALXN1210, as a treatment option for complement-mediated diseases.

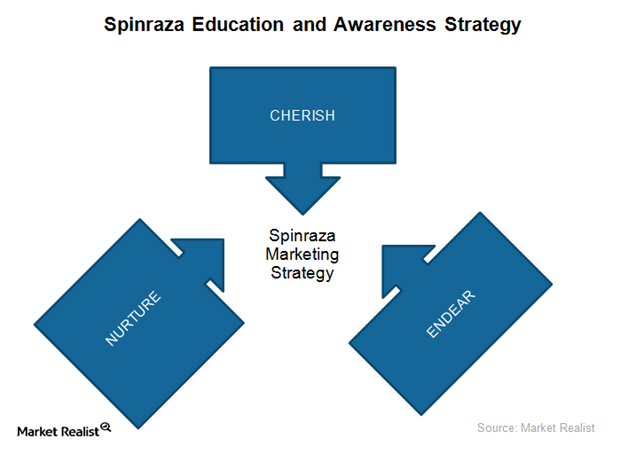

Biogen’s Targeted Marketing Strategy for Spinraza in 1Q17

To promote the use of Spinraza for SMA, Biogen (BIIB) has been actively educating and creating awareness for the drug among physician and patient communities.

Vertex Has Adopted Multiple Approaches to Treat Cystic Fibrosis

Vertex Pharmaceuticals (VRTX) is aiming to increase the number of patients eligible to be treated with its drugs to include the entire CF patient population.

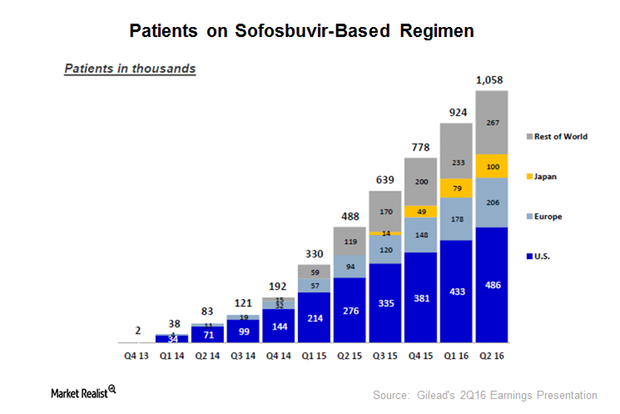

How Gilead Dominates the HCV Space

In January 2012, Gilead Sciences (GILD) acquired Pharmasset and got access to sofosbuvir. In December 2013, the FDA approved sofosbuvir under the brand name Sovaldi.

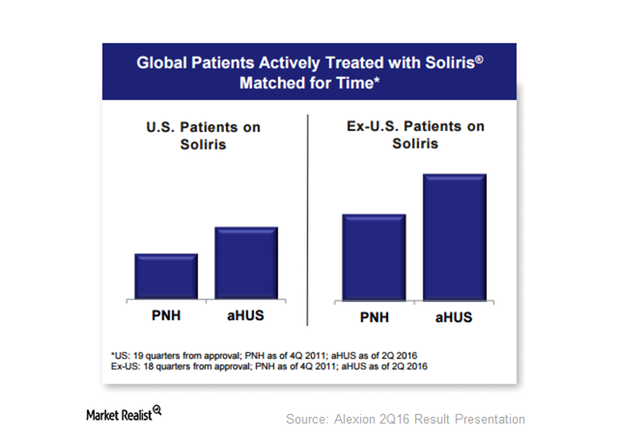

How Significant Is Alexion’s Opportunity with Soliris?

Alexion (ALXN) has been serving the atypical hemolytic uremic syndrome, or aHUS, market for the past five years.

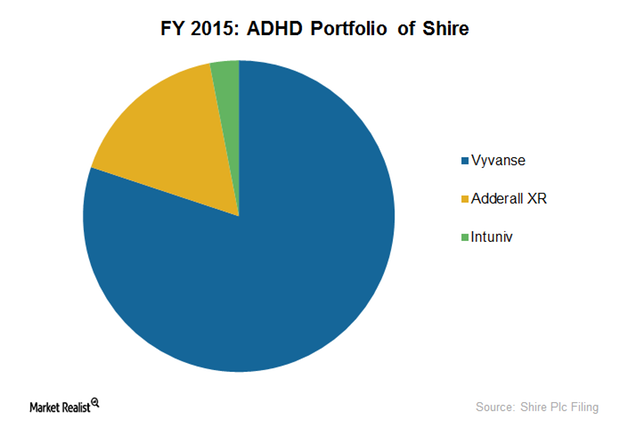

How Vyvanse Could Fuel Shire’s ADHD Portfolio Sales

Vyvanse is Shire’s leading ADHD drug, constituting 80% of the company’s ADHD portfolio. In fiscal 2015, Vyvanse earned the company $1.7 billion.

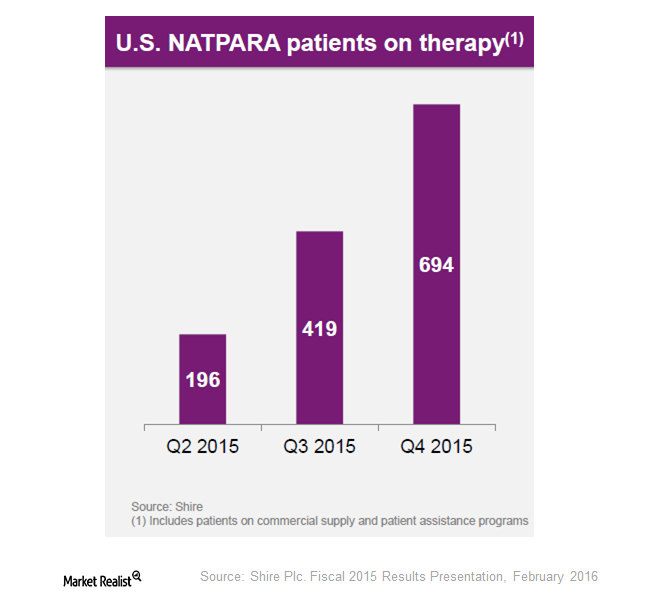

Shire’s Acquisition Gives It Natpara and Gattex

Gattex is the first and only analog of glucagon-like peptide-2 (or GLP-2) indicated for short bowel syndrome. The drug is known as Gattex in the United States and Revestive in Europe.

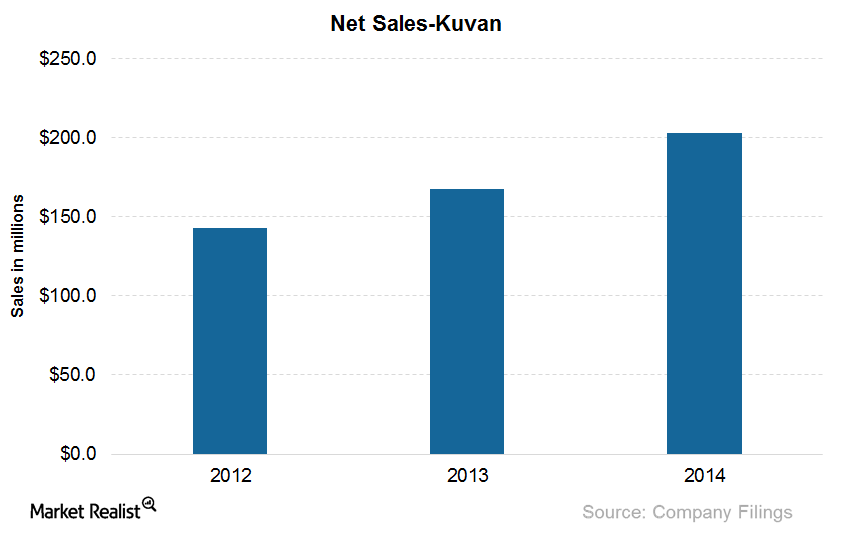

What Are BioMarin’s Products for Treating Phenylketonuria?

Kuvan, with the active ingredient sapropterin dihydrochloride, is effective in reducing blood phenylalanine levels in PKU (or phenylketonuria) patients.

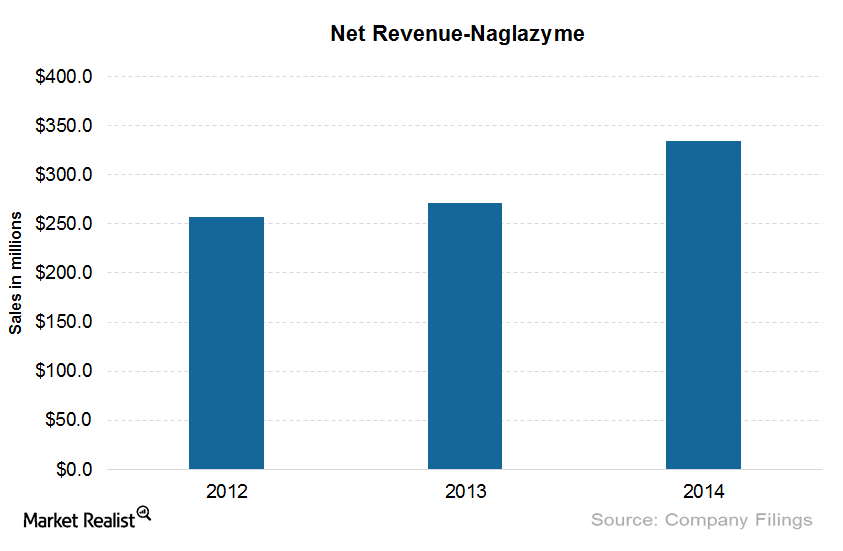

Naglazyme: One of the Costliest Drugs in the United States

The wholesale cost per patient for Naglazyme is around $485,747 per year. The drug has been effective in improving walking and stair-climbing capacity.

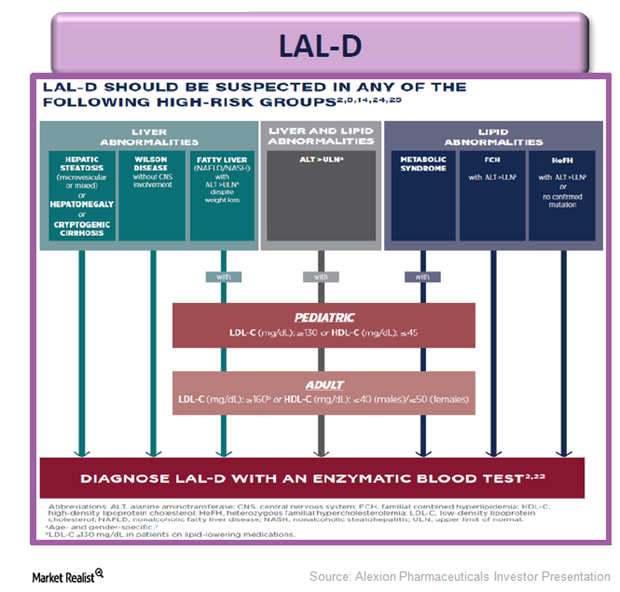

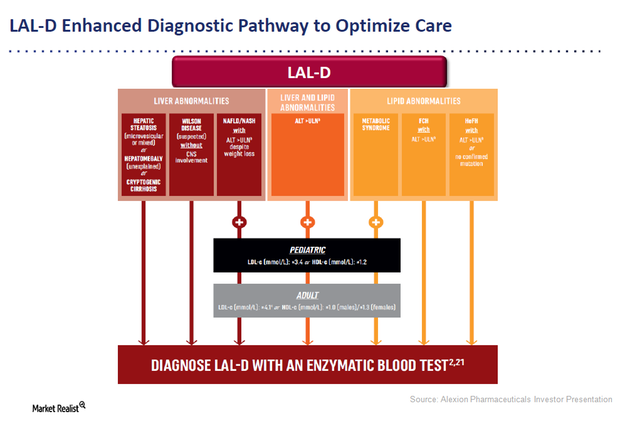

Kanuma: An Innovative Enzyme Replacement Therapy for LAL-D

Alexion Pharmaceuticals’ Kanuma is an innovative enzyme replacement therapy for patients suffering with lysosomal acid lipase deficiency (or LAL-D).

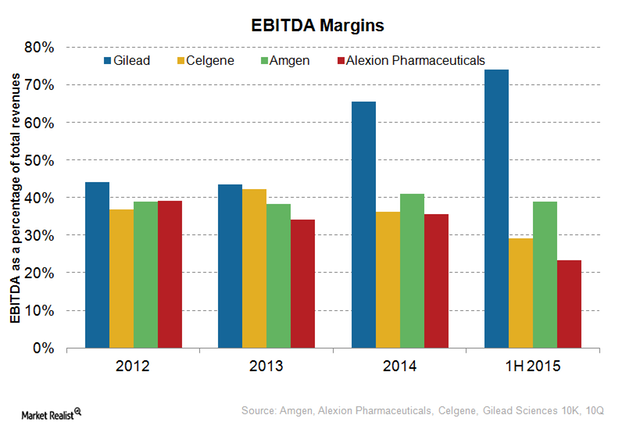

Alexion Pharmaceuticals’ Cost Structure and EBITDA Margins

Mature biotechnology companies generally earn EBITDA margins of about 30% to 40%.

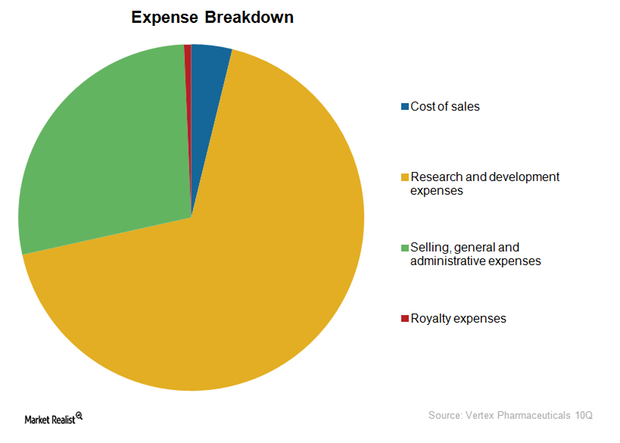

Vertex Pharmaceuticals’ Cost Structure and EBITDA Margins

While mature biotechnology companies with drugs in multiple disease segments earn an average of 30%–40% EBITDA, margins of companies targeting only rare diseases can vary due to unique business models.

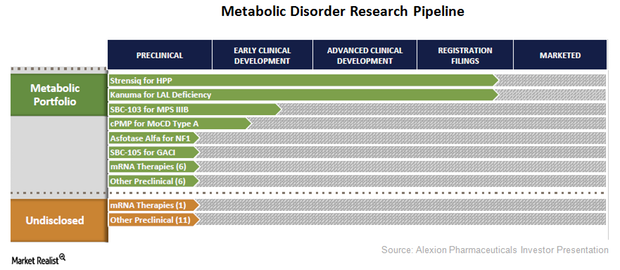

Alexion Pharmaceuticals Diversifies Its Research Pipeline

Alexion Pharmaceuticals (ALXN) has strengthened its drug pipeline by diversifying its research programs across the metabolic disorder segment.

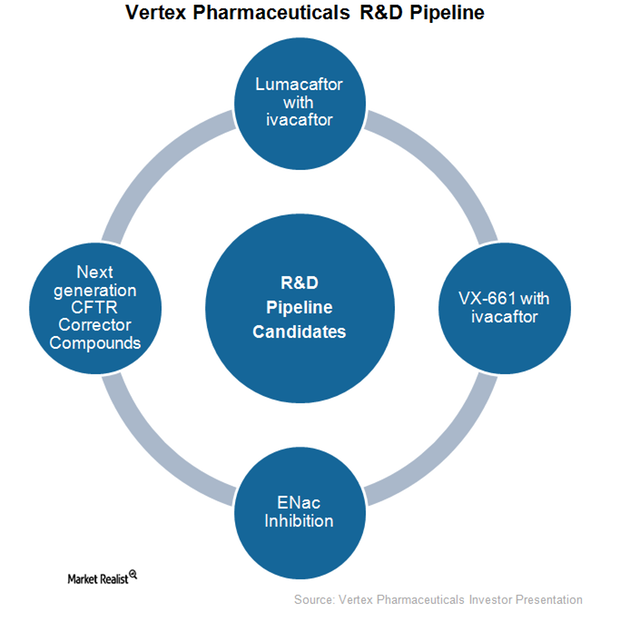

Vertex Has Strong Research and Development Pipeline

As part of its research and development, Vertex Pharmaceuticals (VRTX) has been actively exploring new cystic fibrosis (or CF) drugs as well as other indications for its existing drug Kalydeco.

Alexion Pharmaceuticals Expands Soliris Labels

Alexion Pharmaceuticals is actively involved in expanding the approved labels for its flagship product Soliris.

Vertex Pharmaceuticals’ New Drug Orkambi Receives FDA Approval

On July 2, 2015, the FDA (U.S. Food and Drug Administration) approved Orkambi, a combination drug of lumacaftor and ivacaftor, for treating cystic fibrosis (or CF) patients.