US Dollar Index is Weak in the Early Hours on December 15

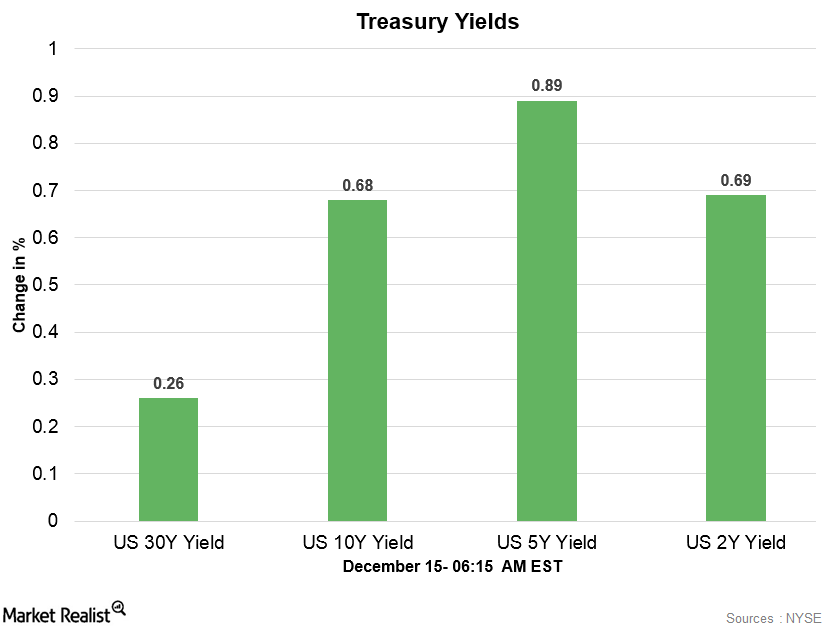

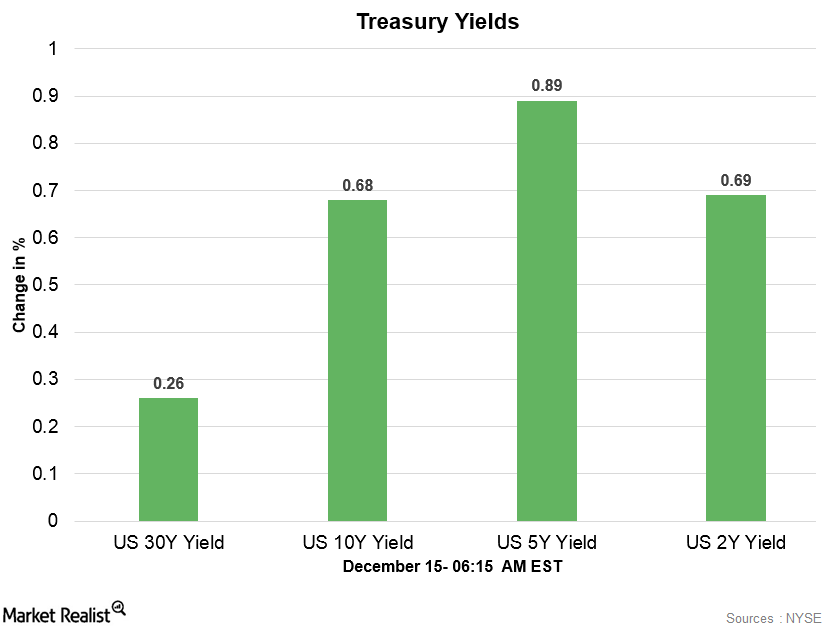

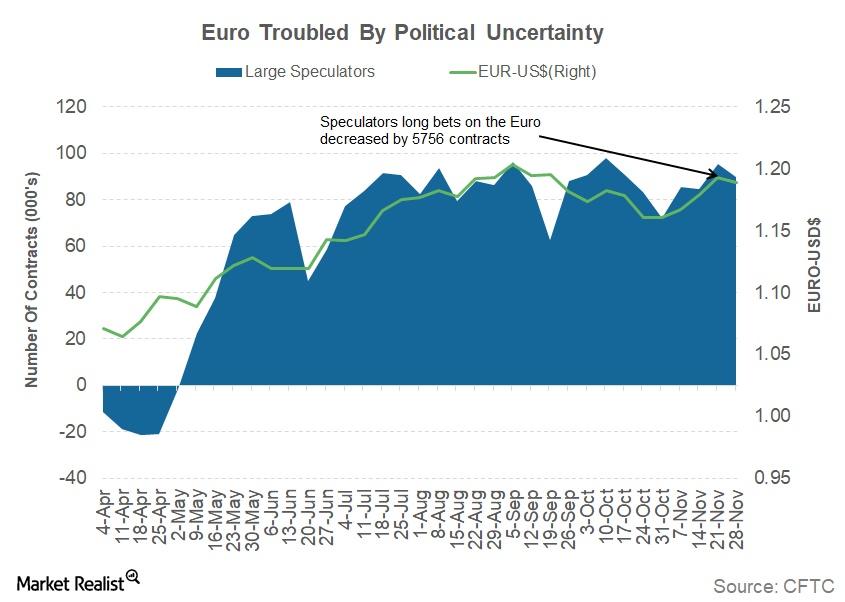

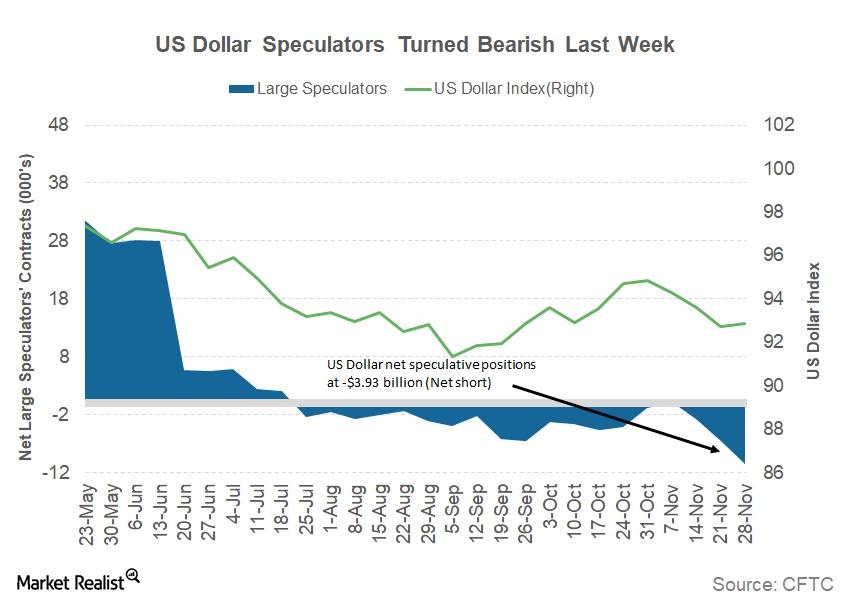

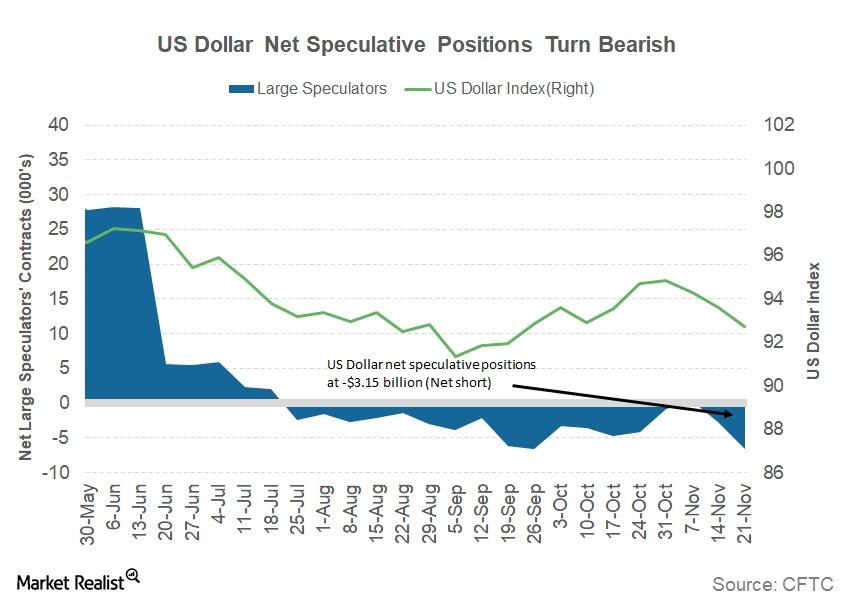

The US Dollar Index traded with strength for two weeks and started this week on a mixed note amid the dented market sentiment.

© Copyright 2026 Market Realist. Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.