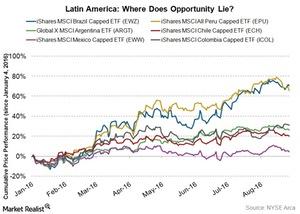

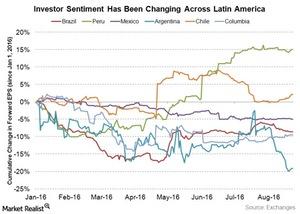

Investing in Latin America Can Bear Fruit, but Should We?

With commodity prices recovering and major developed markets (EFA) (VEA) caught in the lull, Latin America should see sunnier days ahead.

© Copyright 2026 Market Realist. Market Realist is a registered trademark. All Rights Reserved. People may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.