Leverage and mortgage REITs – Part 2

Leverage and Mortgage REITs – Part 1 How a mortgage REIT typically does it Most mortgage REITs use repurchase agreements to fund their balance sheet. A repurchase agreement (repo) is basically a secured loan. The REIT will pledge the mortgage backed securities they just bought as collateral for a loan. It is actually an agreement […]

Nov. 20 2020, Updated 1:18 p.m. ET

Leverage and Mortgage REITs – Part 1

How a mortgage REIT typically does it

Most mortgage REITs use repurchase agreements to fund their balance sheet. A repurchase agreement (repo) is basically a secured loan. The REIT will pledge the mortgage backed securities they just bought as collateral for a loan. It is actually an agreement to sell a mortgage backed security to the bank and agreeing to buy it back at a future date at a specified price. REITs will also use longer-term financing (like a bond issue) to raise capital for levering the portfolio as well.

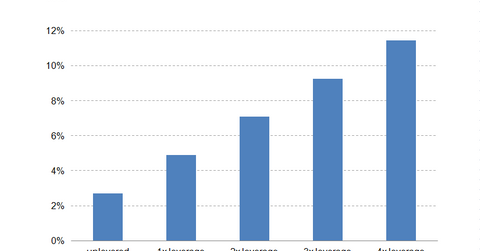

In the returns graphed above, it shows what the return on equity (ROE) would be for differing levels of leverage; in practice, mortgage REITs would hedge interest rate risk, which would cut into returns. But for the purposes of our example, we won’t get into that too deeply.

Mortgage REITs usually pay a spread to the London Interbank Offered Rate (LIBOR) of 25 to 75 basis points. In the example above, we’ve assumed L + 25 (which means LIBOR plus 25 basis points, or about 0.52%). REITs will often use swaps to hedge their borrowing costs. The yield on the TBA may move around a bit, but when the Fed starts tightening, short-term borrowing rates will increase.

Finally, a REIT that issues its own mortgage backed securities, like Redwood Trust (RWT), uses the securitization process to lever their book. They will raise permanent capital, use that to fund loans, and then issue mortgage backed securities against it. This will have the effect of cutting the amount of money they have on their books.

Leverage and Mortgage REITs – Part 3