Market Vectors® Mortgage REIT Income ETF

Latest Market Vectors® Mortgage REIT Income ETF News and Updates

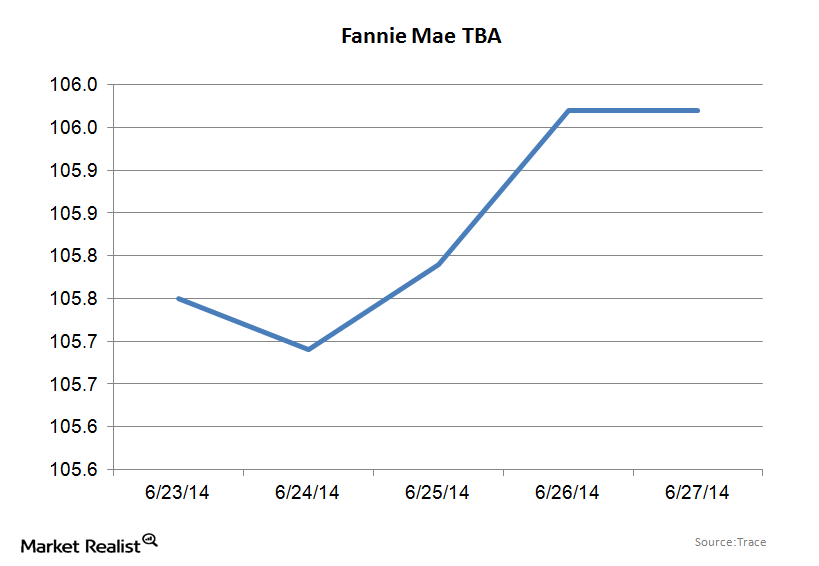

Why Fannie Mae securities rallied with bonds about 1/4

The main action driving TBAs specifically seems to be out of Washington, between the Fed purchases and the government’s policies to drive origination.

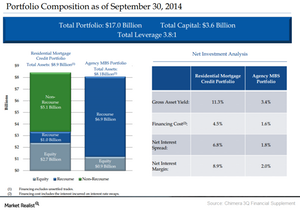

Chimera posts growth in third quarter profit and interest income

Chimera’s core earnings grew to $116 million compared to $93 million in the year-ago period. Growth was mainly due to an increase in net interest income.

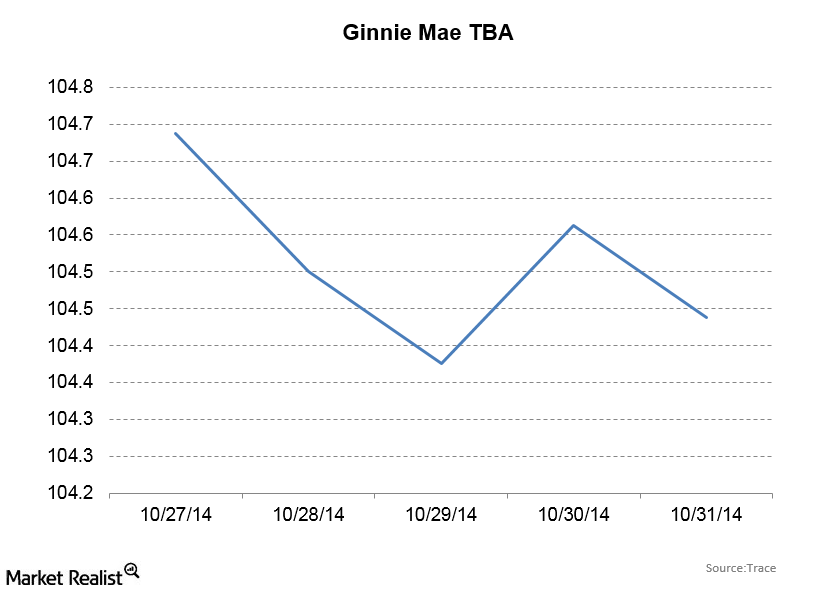

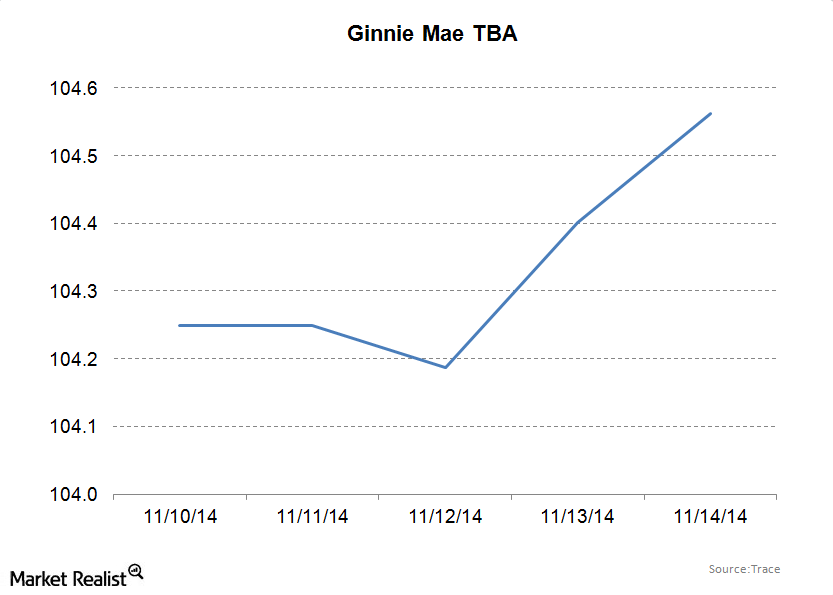

Ginnie Mae securities shake off the end of quantitative easing

The ten-year bond sold off, with yields increasing from 2.27% to 2.34%. Ginnie Mae TBAs bucked the trend, rising from 104 20/32 to 104 25/32.

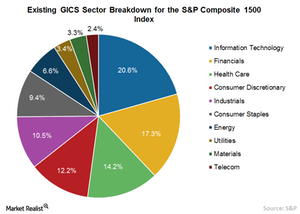

How REIT Classification Benefits Preferred Securities

S&P Dow Jones Indices and MSCI (MSCI) have decided to shift stock exchange-listed equity REITs and other listed real estate companies from the financial sector (XLF) to a new real estate sector.

Ginnie Mae Securities Buck The Recent Trend And Rally

Ginnie Mae and the to-be-announced market The Fannie Mae to-be-announced (or TBA) market represents the usual conforming loan—the plain Fannie Mae 30-year mortgage. Meanwhile, Ginnie Mae TBAs are where government loans go—such as the federal housing administration (or FHA) and veterans affairs (or VA) loans. The biggest difference between a Fannie Mae mortgage-backed security (or […]

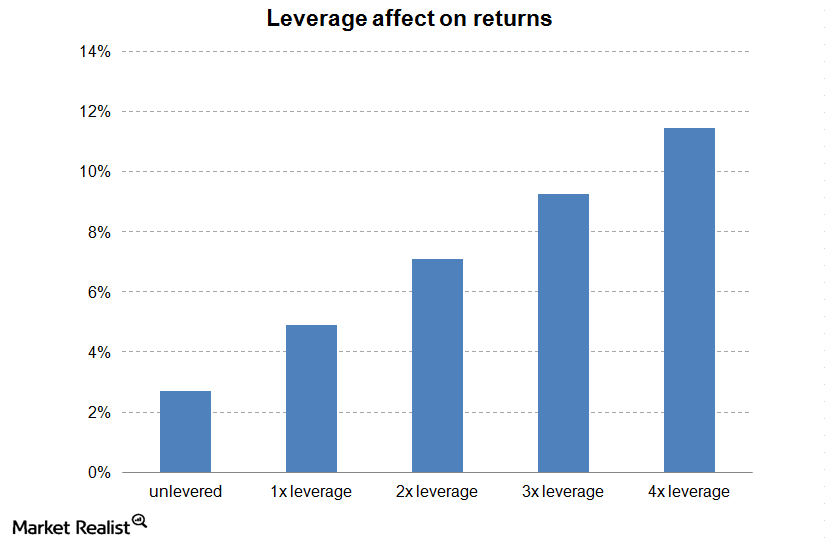

Leverage and mortgage REITs – Part 2

Leverage and Mortgage REITs – Part 1 How a mortgage REIT typically does it Most mortgage REITs use repurchase agreements to fund their balance sheet. A repurchase agreement (repo) is basically a secured loan. The REIT will pledge the mortgage backed securities they just bought as collateral for a loan. It is actually an agreement […]

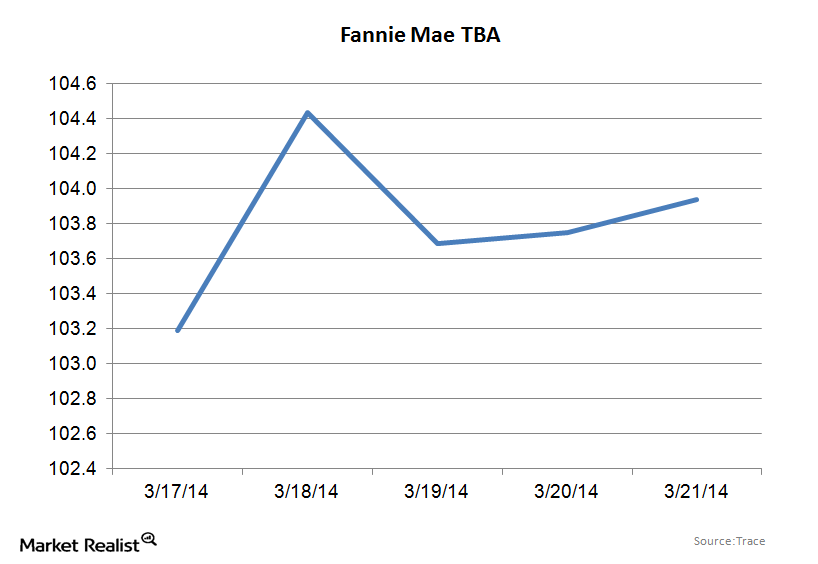

Fannie Mae TBA securities shrug off the March FOMC meeting

Given that another $10 billion in tapering was already priced in, TBAs didn’t react to the FOMC meeting. MBS spreads tightened as MBS rallied in the face of a bond market sell-off.