Tyson Foods Inc

Latest Tyson Foods Inc News and Updates

Tyson Foods Heir and CFO Arrested for Trespassing and Public Intoxication

John R. Tyson is the great-grandson of Tyson Foods founder John W. Tyson. John's net worth of 1.2 million comes from his family's fortune.

Why Is There a Poultry Shortage? It's a Perfect Storm

A poultry shortage is causing long-term impacts in the restaurant industry. What's the root cause, and how is it impacting consumers?

Fake Fish Stocks to Buy Before Plant-Based Seafood Takes Off

Move over, fake beef. It's time for fake fish meat stocks to have their moment. Here are some stocks to buy in the fake fish sector.

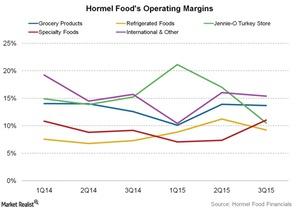

Hormel’s Specialty Food Segment Performed Well in 3Q15

Hormel Foods Corporation, based in Austin, Minnesota, is a multinational manufacturer and marketer of consumer-branded food and meat products.

BYND Leads Alt-Meat Market, Faces New Competitors

On Friday, investment bank UBS started coverage on Beyond Meat Stock (BYND). At 10:08 AM ET today, the stock was trading 4.4% lower at $76.5.

An In-Depth Overview of Panera Bread

Panera Bread is a limited-service fast-casual restaurant company. In July 2017, JAB acquired Panera in a $7.5 billion deal and took it private.

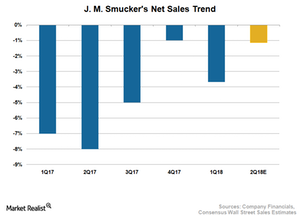

Behind J.M. Smucker’s Waning Sales

J.M. Smucker (SJM) has continued to disappoint on the sales front this year, having posted declines in sales for the past several quarters.

How McDonald’s Wages and Major Costs Stack Up

McDonald’s performance is sensitive to any changes in price levels—be it food, labor, or rent. So how much does it cost for McDonald’s to generate revenue?

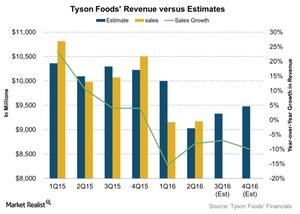

What Could Hamper Tyson Foods’ Revenue in 3Q16?

Tyson Foods is expected to report lower revenue in 3Q16. The export markets will likely be challenged moderately in 2016. This could hamper its revenue.

McDonald’s Supply Chain: A Must-Know for Investors

With over 38,000 restaurants, McDonald’s doesn’t make any of its products. Instead, it contracts with suppliers to meet its massive requirements.

Beyond Meat Stock: Goldman Sachs Turns Bearish

Beyond Meat (NASDAQ:BYND) stock fell 2.6% on March 26. Goldman Sachs downgraded its rating for the alternative-meat maker.

Why Tyson Foods Stock Is Up Despite Q4 Earnings Miss

Tyson Foods (TSN) reported lower-than-expected sales and earnings for the fourth quarter of fiscal 2019, yet the stock is in the green.

Beyond Meat Stock Plunged despite Strong Q3 Results

Beyond Meat (BYND) stock fell 10.2% in after-market trading hours on October 28, even as the company reported better-than-expected third-quarter results.

These Consumer Staples Stocks Marked Stellar Gains in Q1

The Consumer Staples Select Sector SPDR ETF (XLP) rose 10.5% in the first quarter of 2019.

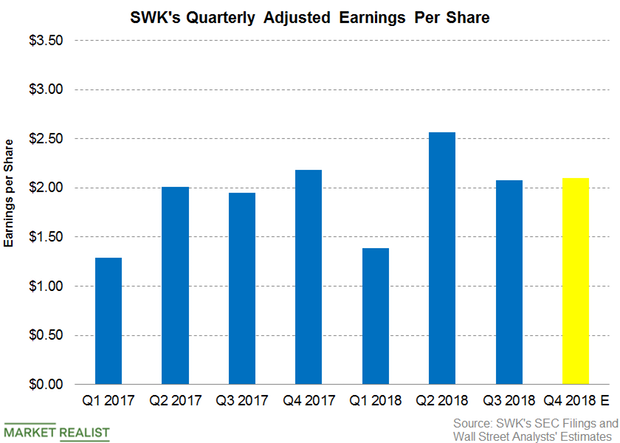

Can Stanley Black & Decker’s Q4 Earnings Beat the Estimates?

Stanley Black & Decker (SWK) is expected to post an adjusted EPS of $2.1 in the fourth quarter—a decrease of ~4.7% YoY (year-over-year).

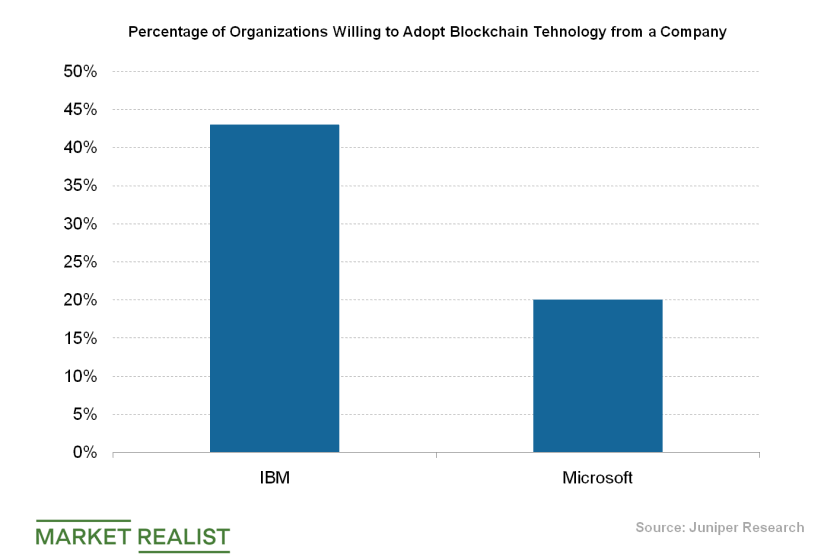

IBM Continues to Win Contracts for Its Blockchain Solutions

In July, IBM launched a blockchain solution specifically for the financial service industry, LedgerConnect.

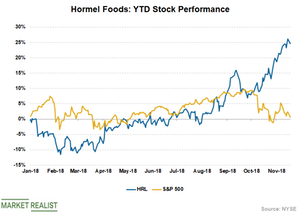

What’s Backing the Uptrend in Hormel Foods Stock?

Hormel Foods (HRL) is another company in the consumer staples industry that has outperformed the broader markets so far this year.

Why Hormel Foods’ Stock Price Has Fallen 4% in 2018

Hormel Foods (HRL) has seen its stock price fall 4% on a YTD (year-to-date) basis as of April 6, 2018.

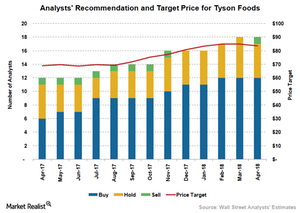

What Analysts Recommend for Tyson Foods

Of the 18 analysts covering Tyson Foods, 67.0% recommend a “buy” on its stock.

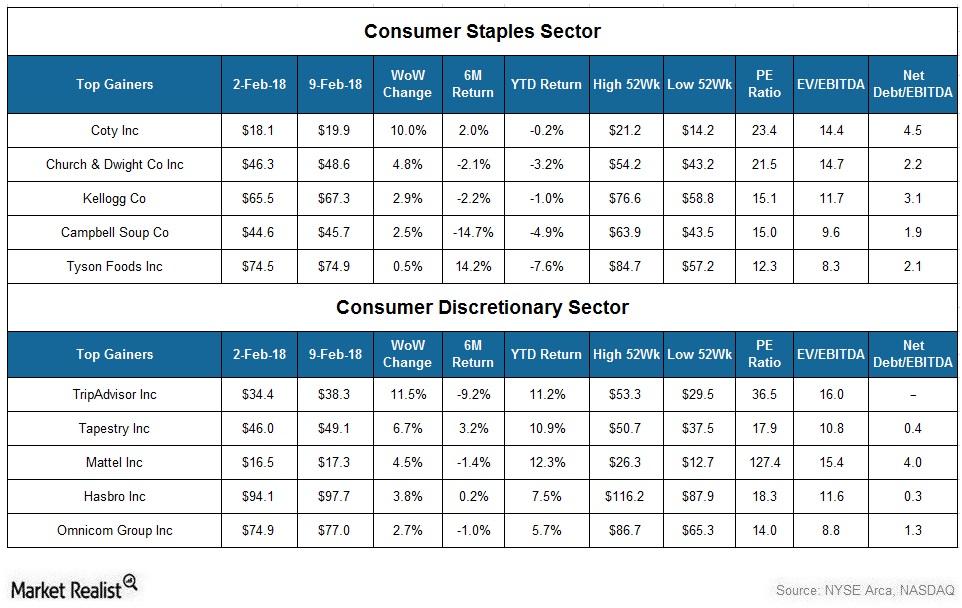

Who Gained the Most in the Consumer Sector Last Week?

Coty (COTY) released its fiscal 2Q18 results before the market opened on February 8. Its revenue increased 14.8% YoY to $2.63 billion.

What’s the Outlook for Tyson?

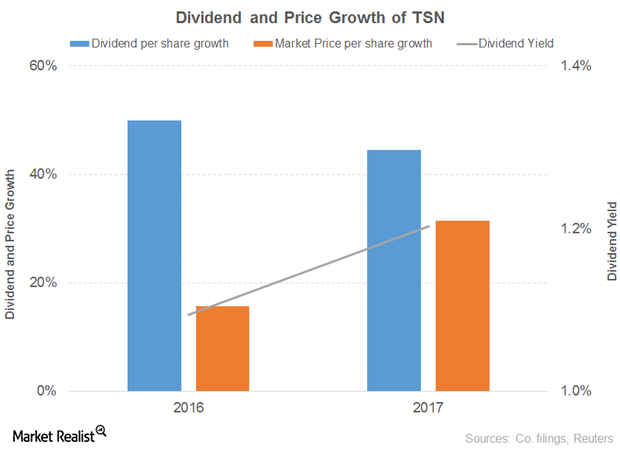

Tyson Foods’ (TSN) sales dropped 11% in 2016 before gaining 4% in 2017.

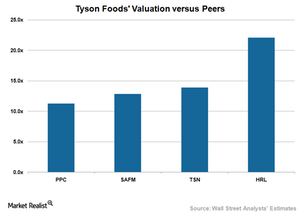

How Tyson Foods Compares with Its Peers in Valuation

As of December 22, 2017, Tyson Foods (TSN) stock was trading at a 12-month forward PE (price-to-earnings) multiple of 13.9x, which could seem attractive to investors.

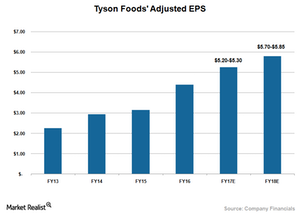

Tyson Foods Raises Fiscal 2017 Guidance

Tyson Foods (TSN) stock jumped about 8% on September 29, 2017, after the company raised its fiscal 2017 EPS (earnings per share) guidance.

Tyson Foods Forms a New Venture Capital Fund to Focus on Growth

In fiscal 2016, Tyson Foods (TSN) reported sales of $36.9 billion, a fall of 10.9% year-over-year.

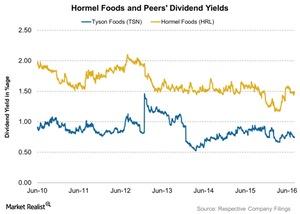

How Much Has Hormel Returned to Shareholders in Fiscal 2016?

Along with its 3Q16 results, Hormel Foods (HRL) also announced the 352nd consecutive quarterly dividend at the annual rate of $0.58 per share.

Wall Street Analysts’ Recommendations for Sanderson Farms

Stephens gave Sanderson Farm the highest target price of $108, respectively. This represents a 16% rise from the closing price of $93.17 on August 18.

How Much Has Tyson Foods Returned to Shareholders in Fiscal 2016?

Tyson Foods bought back 6.6 million shares in fiscal 3Q16 and has bought back another 5.4 million shares so far in fiscal 4Q16.

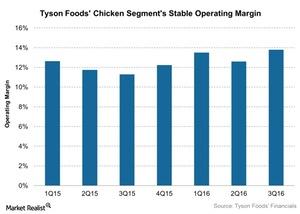

How Is Tyson Foods Improving Its Chicken Operating Margin?

In fiscal 3Q16, Tyson Foods’ Chicken segment reported an operating margin of 13.9% with an improved product mix.

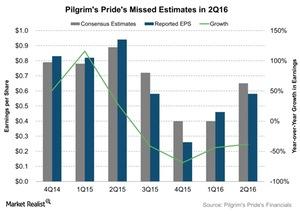

Pilgrim’s Pride in 2Q16: How Much Did Earnings Decline?

Pilgrim’s Pride’s earnings were hit hard again in the second quarter. They fell far below analysts’ expectations, missing estimates by 11%.

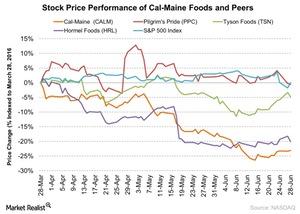

How Did Cal-Maine Foods Stock React to Its Fiscal 4Q16 Results?

Cal-Maine Foods reported its fiscal 4Q16 results on July 18. There wasn’t impact on the stock price even though the company reported a loss for the quarter.

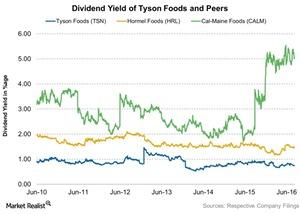

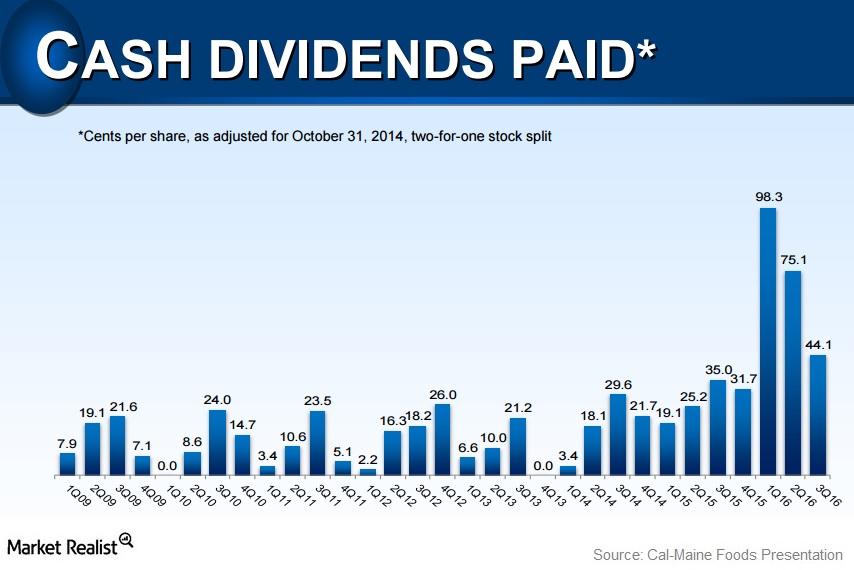

Analyzing Cal-Maine Foods’ Variable Dividend Policy

Cal-Maine has a variable dividend policy in place. It has a dividend yield of 5.8% as of June 28. Management raised the dividend at a CAGR of 15.3% over five years.

Cal-Maine Plans to Increase Its Value-Added Specialty Egg Business

Cal-Maine Foods (CALM) plans to grow its specialty egg business by meeting consumer demand in the rapidly growing segment.

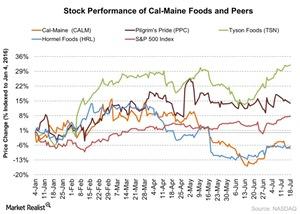

Why Did Cal-Maine Shares Fall 23% in the Last 3 Months?

Cal-Maine Foods (CALM) saw declining growth in its shares in the last three months. The company’s shares are trading close to its 52-week low.

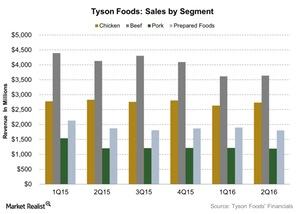

Chicken, Beef, or Pork: Which Segment Drove Tyson Foods’ Revenue?

In Tyson Foods’ Chicken segment, sales improved in 2Q16. The segment reported $2,737 million in net sales.

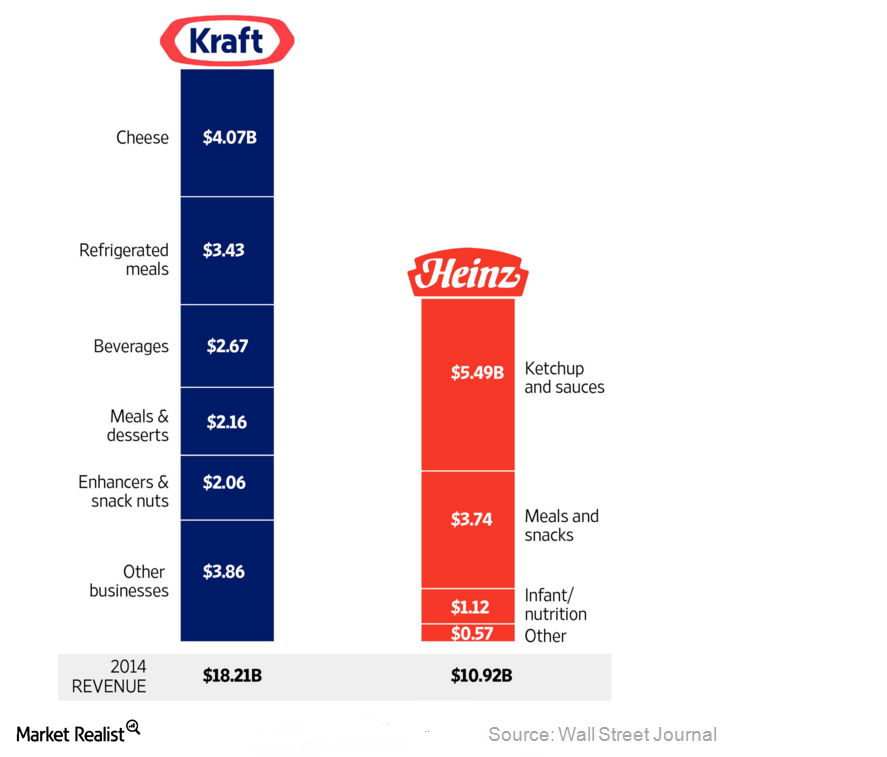

A Key Analysis of the Kraft-Heinz Merger

In early 2015, Berkshire Hathaway and 3G Capital designed the Kraft-Heinz merger by pairing the Kraft Foods Group with H. J. Heinz Company.

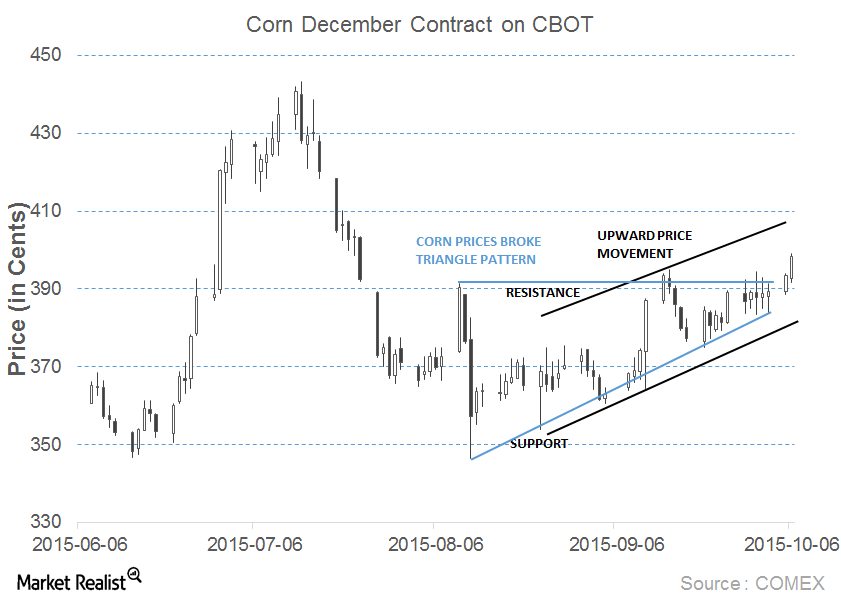

Will Corn Prices Be Range-Bound before WASDE Report Release?

On October 6, 2015, CBOT (Chicago Board of Trade) December expiry of corn futures contracts rose, breaking the resistance level.

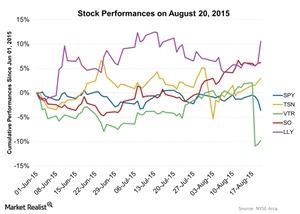

SPY’s Struggle with Wall Street Continues

Of the 502 constituent stocks of SPY, only 23 recorded positive returns on Wall Street on August 20. Only seven stocks traded at a closing price above their moving averages.

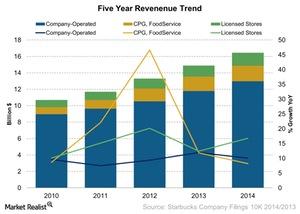

Starbucks’ Coffee Has Three Revenue Sources

Consumer packaged goods, or CPG, include the sale of SBUX’s coffee and tea-related products—like single-serve tea and coffee products. It also includes several beverages at retail stores.

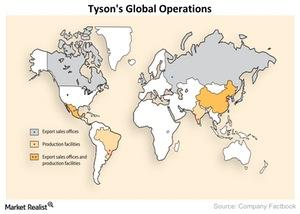

The Vast Expanse Of The Tyson Foods Product Portfolio

The Tyson Foods product portfolio includes a variety of products such as value-added chicken, beef, and pork, pepperoni, pizza crusts, and much more.

Tyson Foods Pork Biz In The Top Three

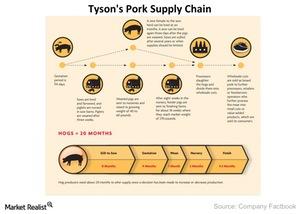

The Tyson Foods Pork segment processes live hogs into primal, sub-primal cuts, case-ready pork ready to be sold at retail stores, and fully cooked products.

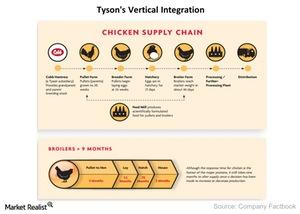

Vertical Integration Keeps Tyson Foods On Top Of Chicken Market

Vertical integration involves a single company owning and controlling all the various stages in the production chain.

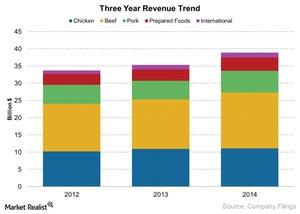

Tyson Foods Revenue Segments

Tyson Foods revenue is reported in five segments: Beef, Chicken, Pork, Processed Foods, and International. The Beef segment accounted for 43% of revenues.

Tyson Foods Commands 24% Of The Beef Market

According to Cattle Buyers Weekly, in 2014, four producers controlled 75% of the market share. Tyson Foods controls 24% of the beef market.Company & Industry Overviews Why Pilgrim’s Pride filed for bankruptcy

The primary reason why Pilgrim’s Pride filed for Chapter 11 bankruptcy was the burden of total debts in the amount of $1.9 billion.Company & Industry Overviews Pilgrim’s Pride Corporation’s three customer categories

Pilgrim’s customer base is spread across 100 countries, including the US and Mexico, which together contributed ~92% of the company’s revenues as of 2013 year-end.