Tyson Foods Revenue Segments

Tyson Foods revenue is reported in five segments: Beef, Chicken, Pork, Processed Foods, and International. The Beef segment accounted for 43% of revenues.

Dec. 11 2014, Updated 5:41 p.m. ET

Tyson Foods revenue segments

In the last part of this series, we learned that Tyson Foods, Inc. (TSN) commands most of the market share in all its segments. Tyson Foods revenues are reported in five segments:

- Beef

- Chicken

- Pork

- Processed Foods

- International

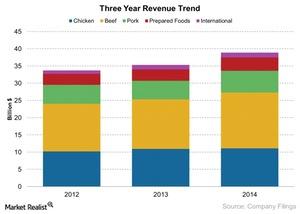

The chart below illustrates Tyson Foods revenue segments.

Segments

As of fiscal year end 2014, Tyson Foods (TSN) had total sales of $37.5 billion, which represents 9% year-over-year growth, up from $34 billion in 2013. Tyson earns the majority of its revenues from its Beef segment, which accounted for 43% or $16 billion of total revenues. This is followed by the Chicken segment at 30% or $11 billion, the Pork segment at 17% or $6 billion, the Prepared Food segment at 10% or $3 billion. The International segment, which accounted for 4% or $1 billion of 2014 revenues, was offset by $1 billion in inter-segment sales.

Competition

Tyson Foods, or Tyson, competes with big companies such as JBS USA and Cargill Meat Solutions. In 2013, revenues for other Tyson competitors were as follows:

- Pilgrim’s Pride Corporation (PPC) – $8.4 billion

- Sanderson Farms, Inc. (SAFM) – $1.5 billion

- Hormel Foods Corp. (HRL) – $11.5 billion

Some of these companies produce only one product. For example, Pilgrim’s Pride is only in the chicken business. For broader exposure to the meat processing sector, you can access some of these companies and more through the Consumer Staples Select Sector SPDR ETF (XLP).

The meat processing business is run by a few big players indicating that the industry is consolidated. JBS USA, for example, owns 75% of Pilgrim’s Pride. Read Why Pilgrim’s Pride filed for bankruptcy to learn more.

In the next few parts of this series, we’ll look at each of Tyson Foods’ segments in more details, starting with beef.