Sanderson Farms Inc

Latest Sanderson Farms Inc News and Updates

Sanderson Farms Is a Top Chicken Producer With Many U.S. Locations

Sanderson Farms has a few new owners, and they're big-time businesses. Here's where you'll find the company's locations.

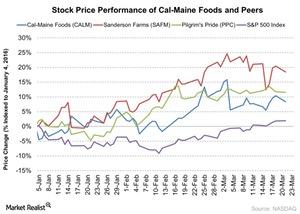

Analyzing the Expectations for Cal-Maine Foods in Fiscal 3Q16

Cal-Maine Foods will report its fiscal 3Q16 results on March 28. Cal-Maine’s stock has gained 2% since its last quarter earnings release on December 23, 2015.

Why Hormel Foods’ Stock Price Has Fallen 4% in 2018

Hormel Foods (HRL) has seen its stock price fall 4% on a YTD (year-to-date) basis as of April 6, 2018.

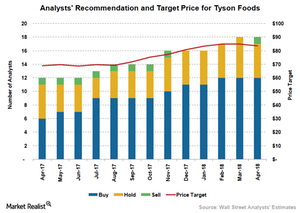

What Analysts Recommend for Tyson Foods

Of the 18 analysts covering Tyson Foods, 67.0% recommend a “buy” on its stock.

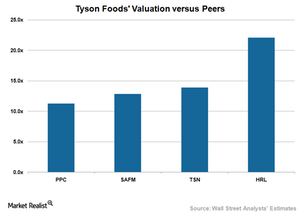

How Tyson Foods Compares with Its Peers in Valuation

As of December 22, 2017, Tyson Foods (TSN) stock was trading at a 12-month forward PE (price-to-earnings) multiple of 13.9x, which could seem attractive to investors.

What Is the Market Outlook for Underground Mining Equipment?

The global underground mining industry is expected to grow at a compound annual growth rate of approximately 7% from 2015 to 2019.

A Quick Look at Joy Global’s History and Operations

Joy Global operates in two business segments, namely its Underground Mining Machinery and Surface Mining Equipment segments.

The Vast Expanse Of The Tyson Foods Product Portfolio

The Tyson Foods product portfolio includes a variety of products such as value-added chicken, beef, and pork, pepperoni, pizza crusts, and much more.

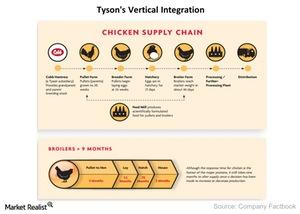

Vertical Integration Keeps Tyson Foods On Top Of Chicken Market

Vertical integration involves a single company owning and controlling all the various stages in the production chain.

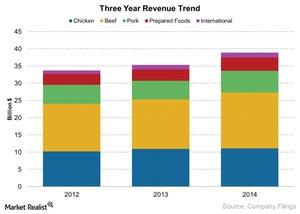

Tyson Foods Revenue Segments

Tyson Foods revenue is reported in five segments: Beef, Chicken, Pork, Processed Foods, and International. The Beef segment accounted for 43% of revenues.

Tyson Foods Commands 24% Of The Beef Market

According to Cattle Buyers Weekly, in 2014, four producers controlled 75% of the market share. Tyson Foods controls 24% of the beef market.Company & Industry Overviews Why Pilgrim’s Pride filed for bankruptcy

The primary reason why Pilgrim’s Pride filed for Chapter 11 bankruptcy was the burden of total debts in the amount of $1.9 billion.