Pilgrims Pride Corp

Latest Pilgrims Pride Corp News and Updates

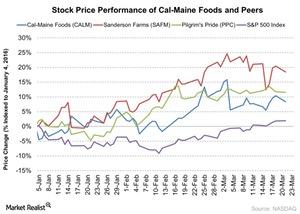

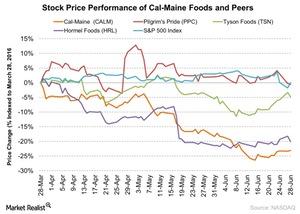

Analyzing the Expectations for Cal-Maine Foods in Fiscal 3Q16

Cal-Maine Foods will report its fiscal 3Q16 results on March 28. Cal-Maine’s stock has gained 2% since its last quarter earnings release on December 23, 2015.

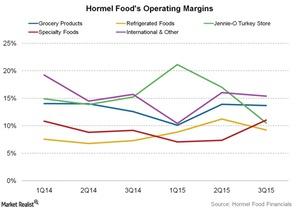

Hormel’s Specialty Food Segment Performed Well in 3Q15

Hormel Foods Corporation, based in Austin, Minnesota, is a multinational manufacturer and marketer of consumer-branded food and meat products.

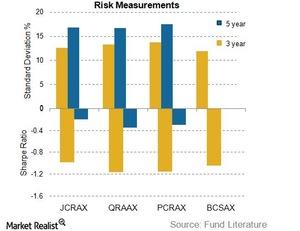

Volatility: Risks and Rewards Go Hand in Hand

The Sharpe ratio is calculated using standard deviation as its volatility measure.

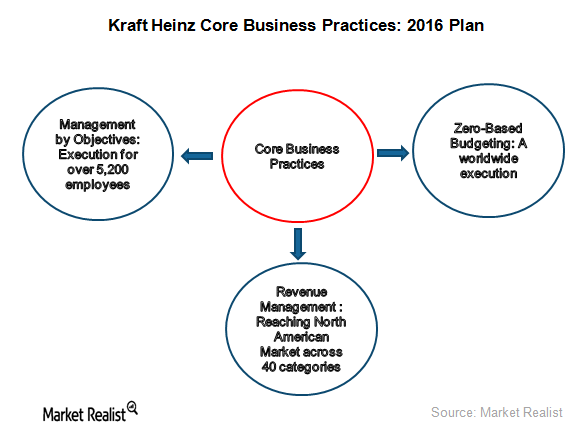

Evaluating Kraft Heinz’s Core Business Strategies

Kraft Heinz is focusing on core business practices, including ZBB (zero-based budgeting), revenue management, and MBO (management by objectives).

An Investor’s Guide to Chipotle and Its Customers

Chipotle Mexican Grill (CMG) operates more than 1,700 fast-casual restaurants. Here’s everything you need to know about the business.

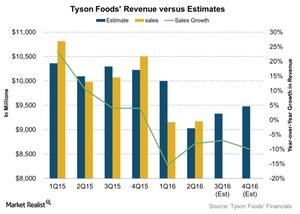

What Could Hamper Tyson Foods’ Revenue in 3Q16?

Tyson Foods is expected to report lower revenue in 3Q16. The export markets will likely be challenged moderately in 2016. This could hamper its revenue.

Why Hormel Foods’ Stock Price Has Fallen 4% in 2018

Hormel Foods (HRL) has seen its stock price fall 4% on a YTD (year-to-date) basis as of April 6, 2018.

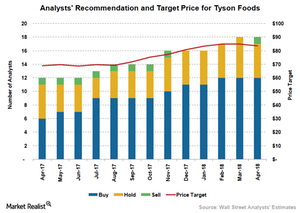

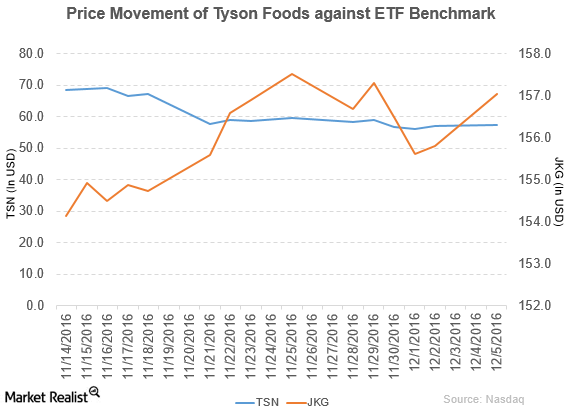

What Analysts Recommend for Tyson Foods

Of the 18 analysts covering Tyson Foods, 67.0% recommend a “buy” on its stock.

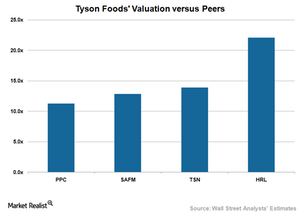

How Tyson Foods Compares with Its Peers in Valuation

As of December 22, 2017, Tyson Foods (TSN) stock was trading at a 12-month forward PE (price-to-earnings) multiple of 13.9x, which could seem attractive to investors.

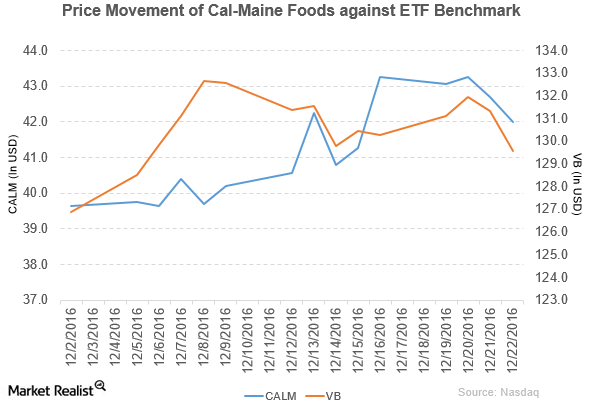

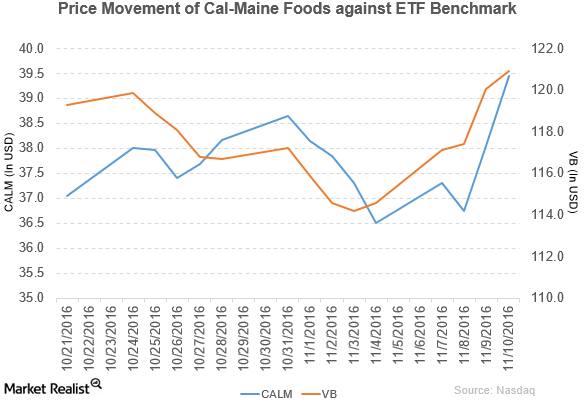

Understanding Cal-Maine Foods’ Performance in Fiscal 2Q17

Cal-Maine Foods (CALM) has a market cap of $1.9 billion. It fell 1.6% to close at $42.00 per share on December 22, 2016.

Tyson Foods Forms a New Venture Capital Fund to Focus on Growth

In fiscal 2016, Tyson Foods (TSN) reported sales of $36.9 billion, a fall of 10.9% year-over-year.

Goldman Sachs Rated Cal-Maine Foods as ‘Neutral’

Cal-Maine Foods (CALM) reported fiscal 1Q17 net sales of $239.8 million, a fall of 60.7% compared to its net sales of $609.9 million in fiscal 1Q16.

Wall Street Analysts’ Recommendations for Sanderson Farms

Stephens gave Sanderson Farm the highest target price of $108, respectively. This represents a 16% rise from the closing price of $93.17 on August 18.

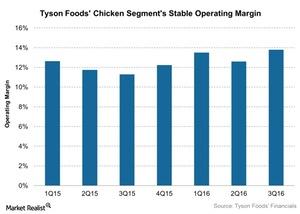

How Is Tyson Foods Improving Its Chicken Operating Margin?

In fiscal 3Q16, Tyson Foods’ Chicken segment reported an operating margin of 13.9% with an improved product mix.

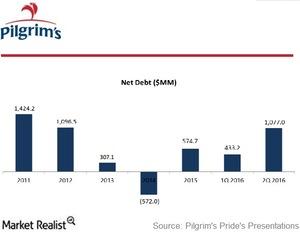

How Has Pilgrim’s Pride Made Room for Strategic Investments?

Consistent with its strategy to improve capital structure and generate shareholder value, Pilgrim’s Pride (PPC) paid $700 million, or $2.75 per share, in special dividends.

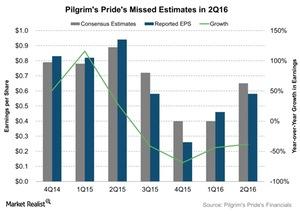

Pilgrim’s Pride in 2Q16: How Much Did Earnings Decline?

Pilgrim’s Pride’s earnings were hit hard again in the second quarter. They fell far below analysts’ expectations, missing estimates by 11%.

Cal-Maine Plans to Increase Its Value-Added Specialty Egg Business

Cal-Maine Foods (CALM) plans to grow its specialty egg business by meeting consumer demand in the rapidly growing segment.

Why Did Cal-Maine Shares Fall 23% in the Last 3 Months?

Cal-Maine Foods (CALM) saw declining growth in its shares in the last three months. The company’s shares are trading close to its 52-week low.

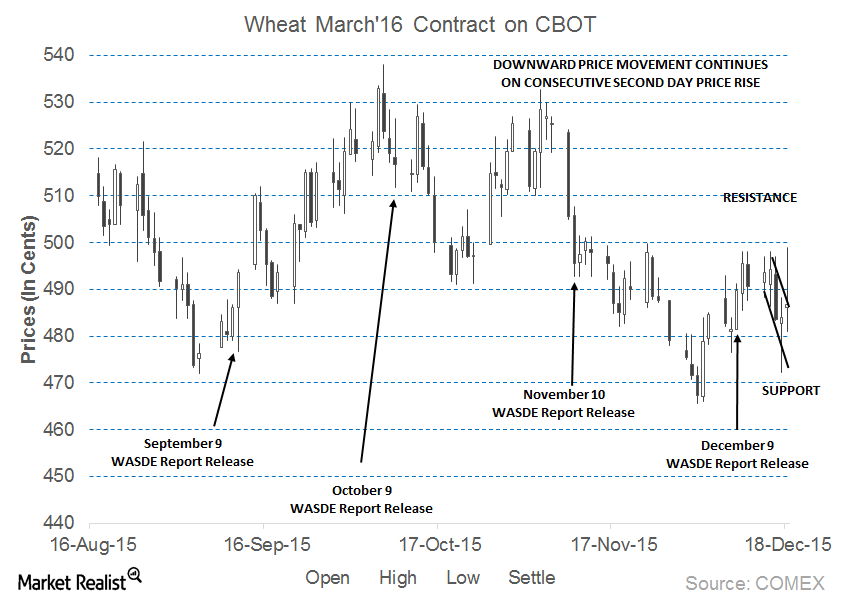

Wheat Prices Trade above 20-Day Moving Average

Wheat futures contracts for March expiry were trading above the key support level of 485 cents per bushel on December 18, 2015.

The Vast Expanse Of The Tyson Foods Product Portfolio

The Tyson Foods product portfolio includes a variety of products such as value-added chicken, beef, and pork, pepperoni, pizza crusts, and much more.

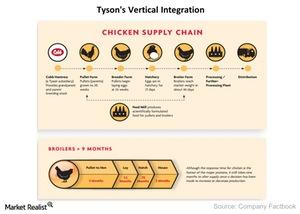

Vertical Integration Keeps Tyson Foods On Top Of Chicken Market

Vertical integration involves a single company owning and controlling all the various stages in the production chain.

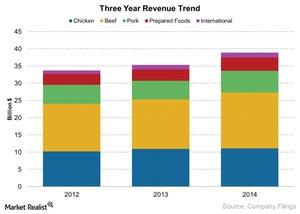

Tyson Foods Revenue Segments

Tyson Foods revenue is reported in five segments: Beef, Chicken, Pork, Processed Foods, and International. The Beef segment accounted for 43% of revenues.

Tyson Foods Commands 24% Of The Beef Market

According to Cattle Buyers Weekly, in 2014, four producers controlled 75% of the market share. Tyson Foods controls 24% of the beef market.Company & Industry Overviews Why Pilgrim’s Pride filed for bankruptcy

The primary reason why Pilgrim’s Pride filed for Chapter 11 bankruptcy was the burden of total debts in the amount of $1.9 billion.Company & Industry Overviews Pilgrim’s Pride Corporation’s three customer categories

Pilgrim’s customer base is spread across 100 countries, including the US and Mexico, which together contributed ~92% of the company’s revenues as of 2013 year-end.