Charles Schwab Corp

Latest Charles Schwab Corp News and Updates

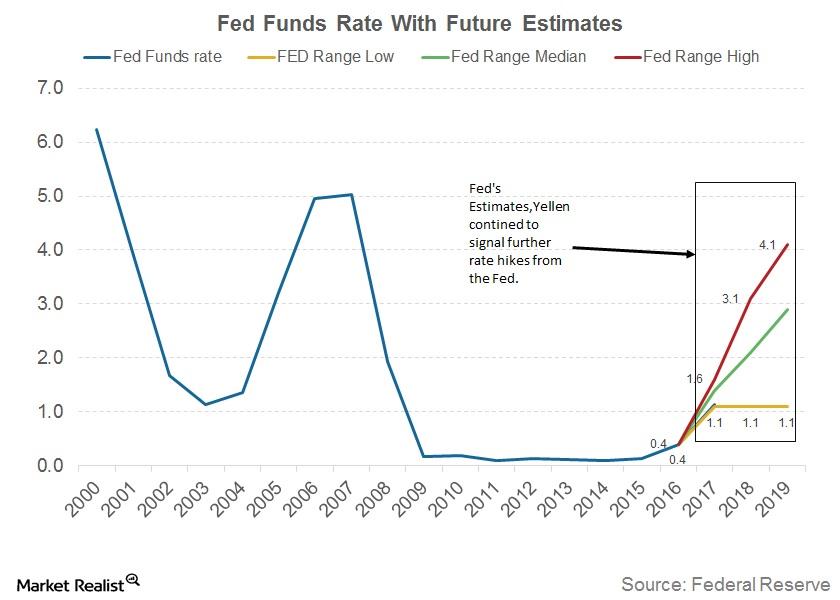

Why Fed’s Yellen Feels Gradual Rate Hikes Are Warranted

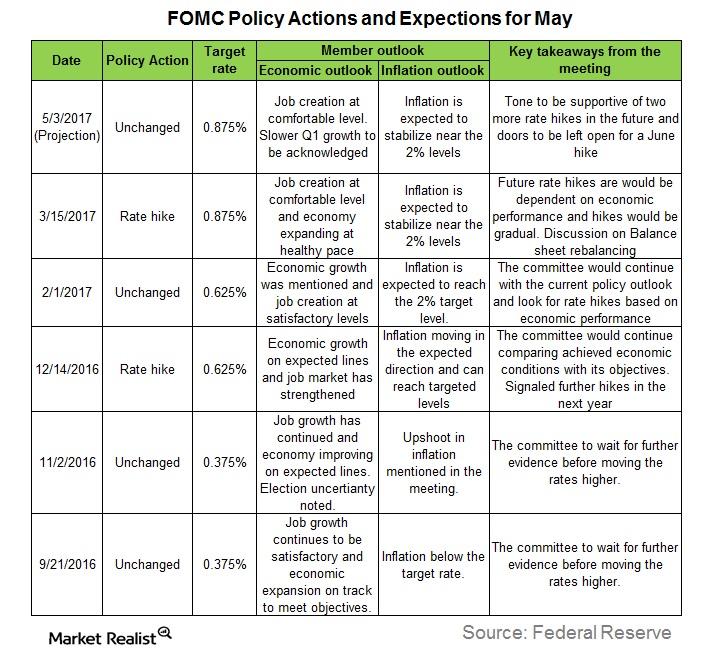

The tone of Yellen’s responses before the committee confirmed that the Fed is set to stay its course on monetary tightening, leading to policy normalization.

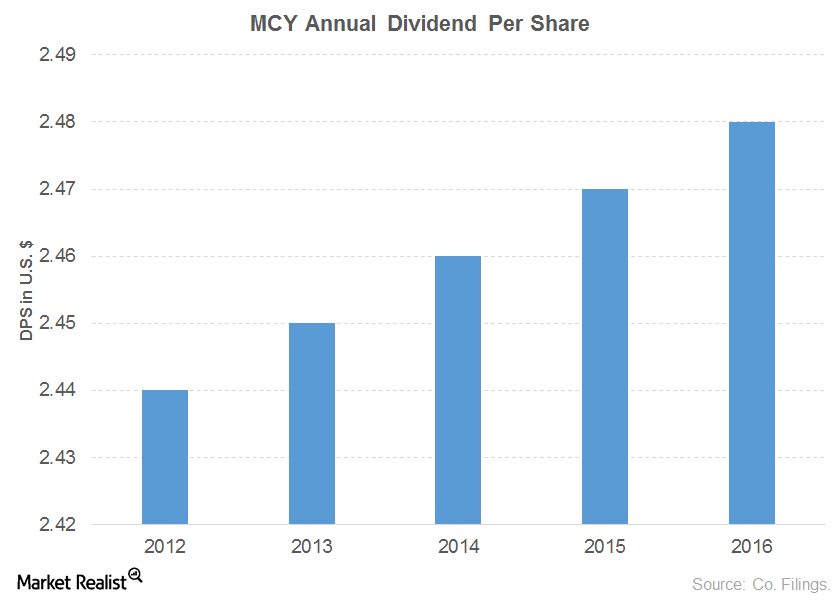

The Top Dividend-Growing Financial Sector Stocks

Mercury General (MCY) has consistently recorded revenue growth since fiscal 2011, except for a minor decline in fiscal 2015

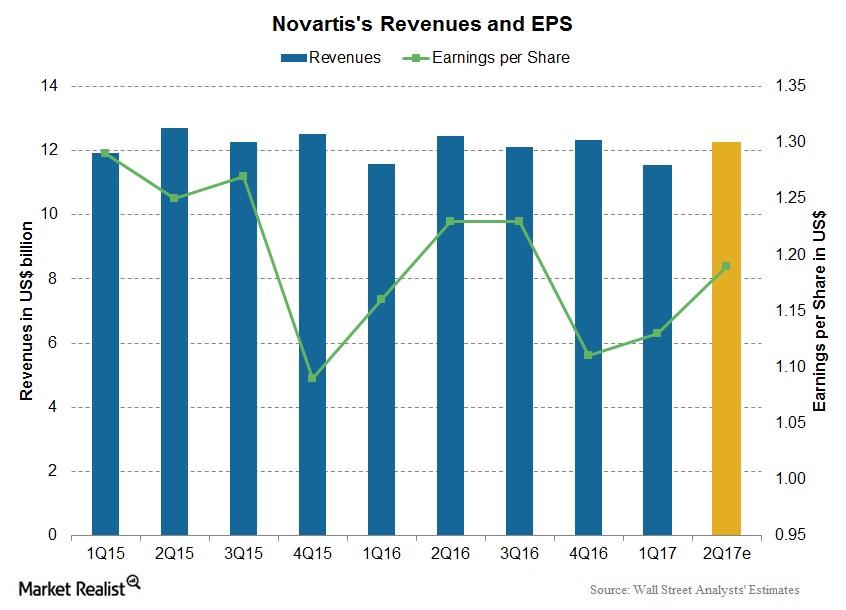

Novartis Stock in 2Q17: How Has It Performed?

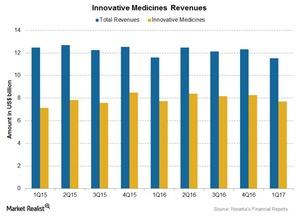

A look at Novartis Headquartered in Basel, Switzerland, Novartis (NVS) is a pharmaceutical company specializing in the research, development, manufacturing, and marketing of a broad range of healthcare products, mainly pharmaceuticals. The company has segregated its business into three segments: Innovative Medicines, Sandoz (generic), and Alcon (eye care). Stock price performance Novartis’s stock price has […]

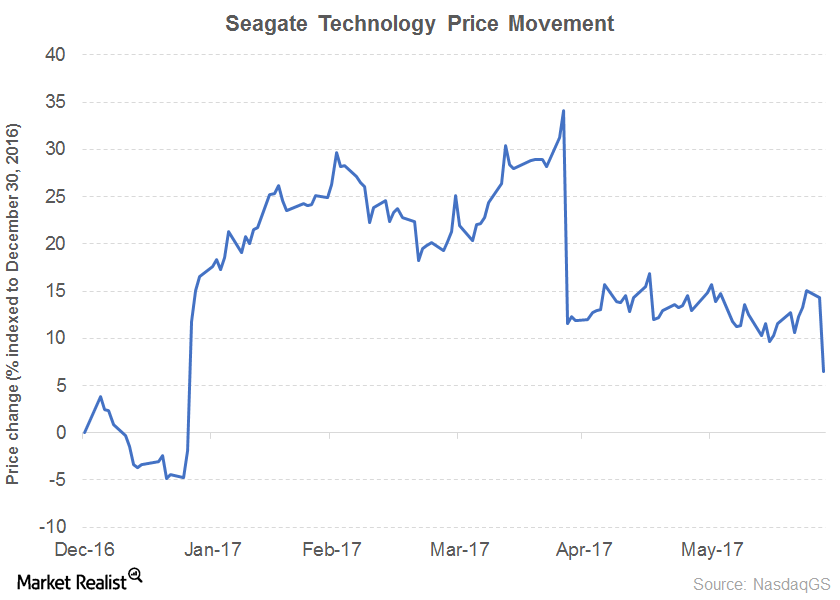

Dividend Growth of Seagate Technology and Garmin

Garmin (GRMN) recorded three-year annualized growth of 5.3%, and its five-year annualized growth fell ~1%. Its growth dipped ~24% in 2016.

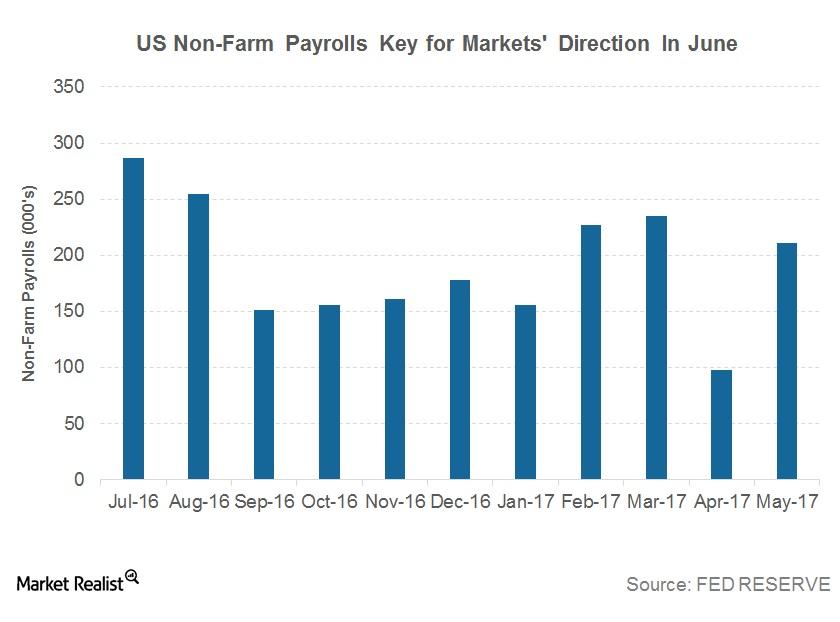

Why Minneapolis’s Fed President Voted Against a Rate Hike

In an essay published by Minneapolis’s Federal Reserve president, Neel Kashkari, after he voted against a rate hike in the Federal Open Market Committee’s (or FOMC) June 2017 meeting, he explained why he dissented.

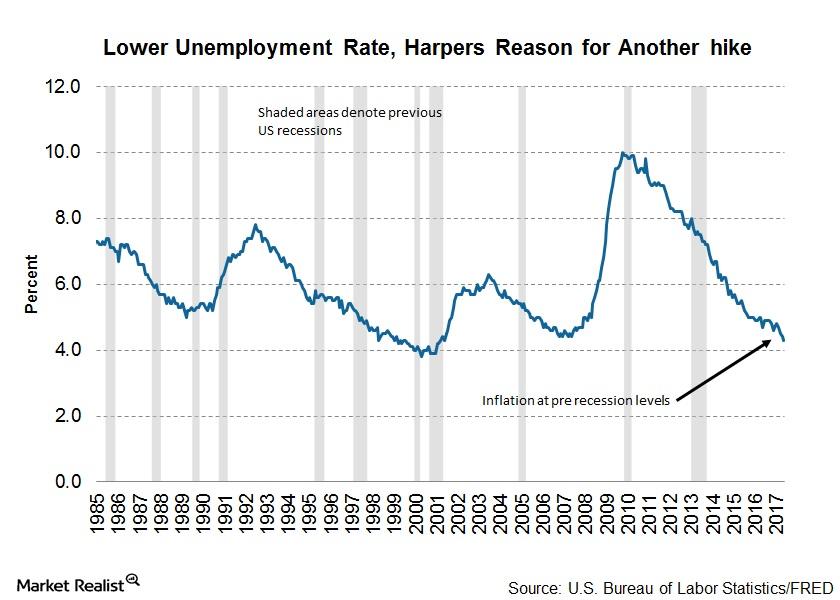

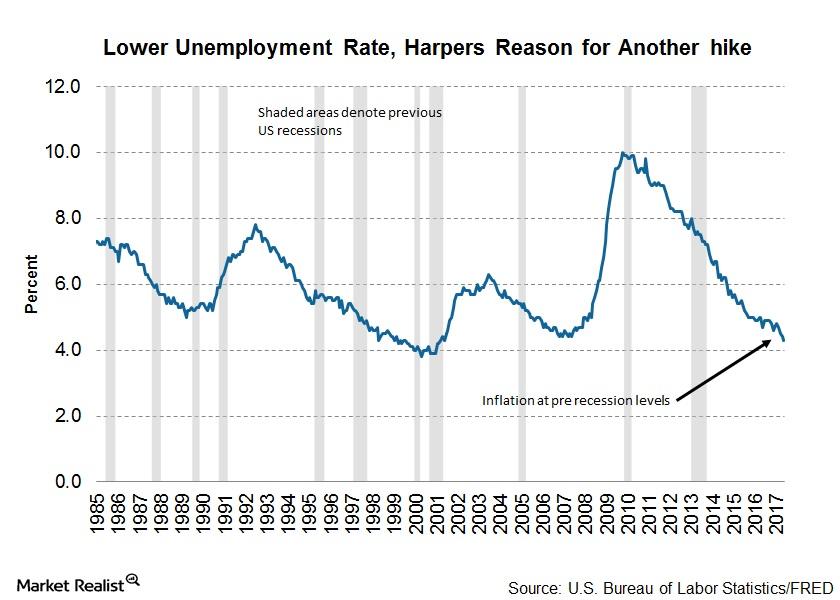

Why Philadelphia’s Fed President Supports Another Rate Hike

In a recent interview with The Financial Times, the hawkish president of the Philadelphia Federal Reserve said that the Fed’s balance sheet’s unwinding could begin in September 2017.

Why Chicago’s Evans Sees Moderate Risks to Financial Stability

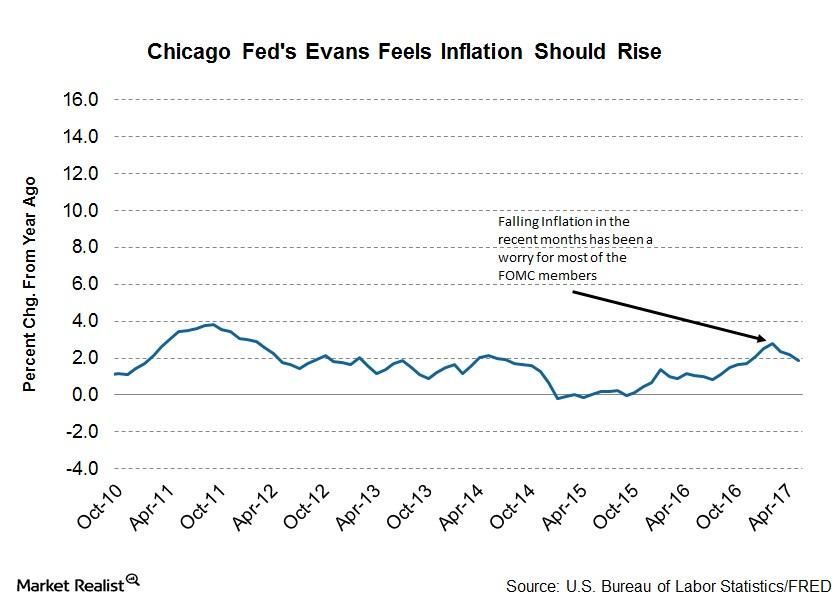

Chicago’s Federal Reserve president, Charles L. Evans, recently spoke at a Money Marketeers of New York University event about monetary policy challenges in a new inflation environment.

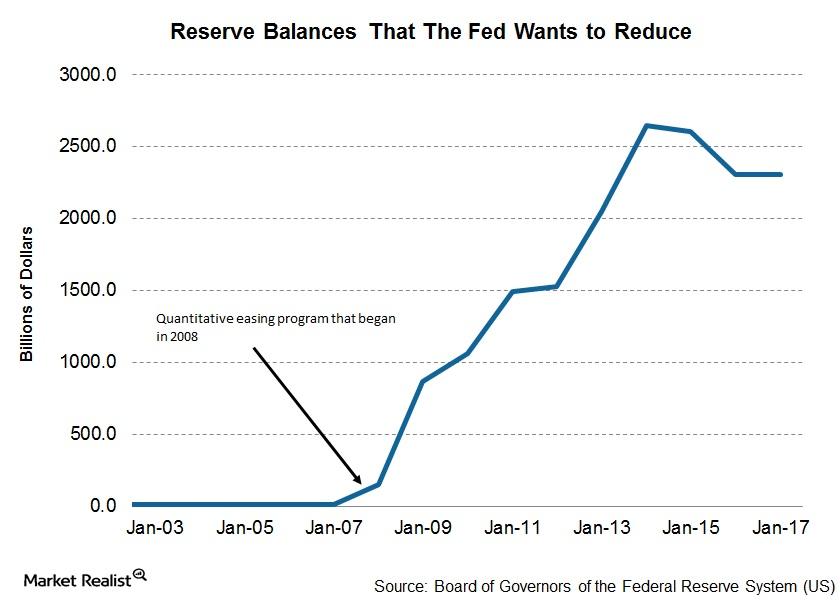

St. Louis’s Bullard Thinks Rebalancing Will Take 5 Years

At the Illinois Bankers Association’s annual conference in Nashville, organized on June 23, 2017, St. Louis’s Federal Reserve president, James Bullard, sounded dovish about the US economy.

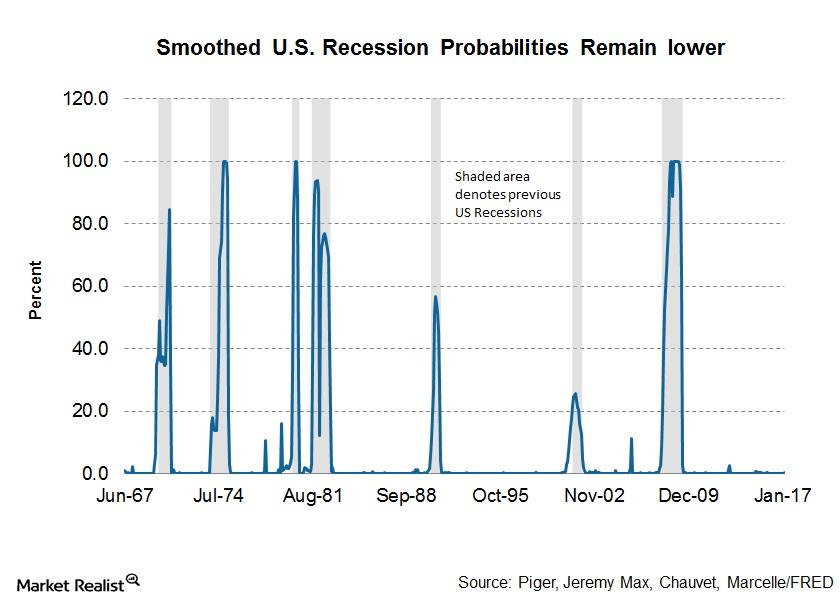

Why Cleveland’s Fed President Worries about Another Recession

Loretta J. Mester, the president and CEO of the Cleveland Federal Reserve, spoke at the 2017 Policy Summit on Housing, Human Capital, and Inequality held on June 23, 2017.

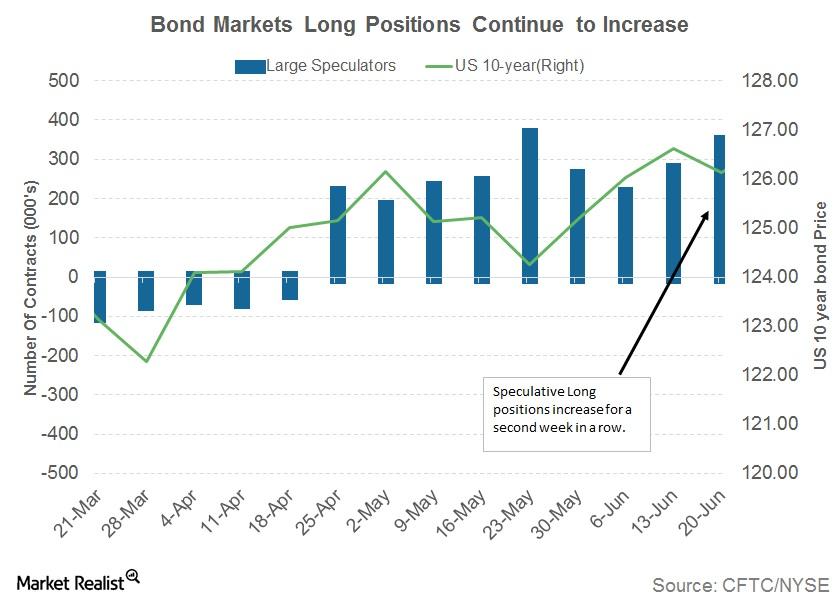

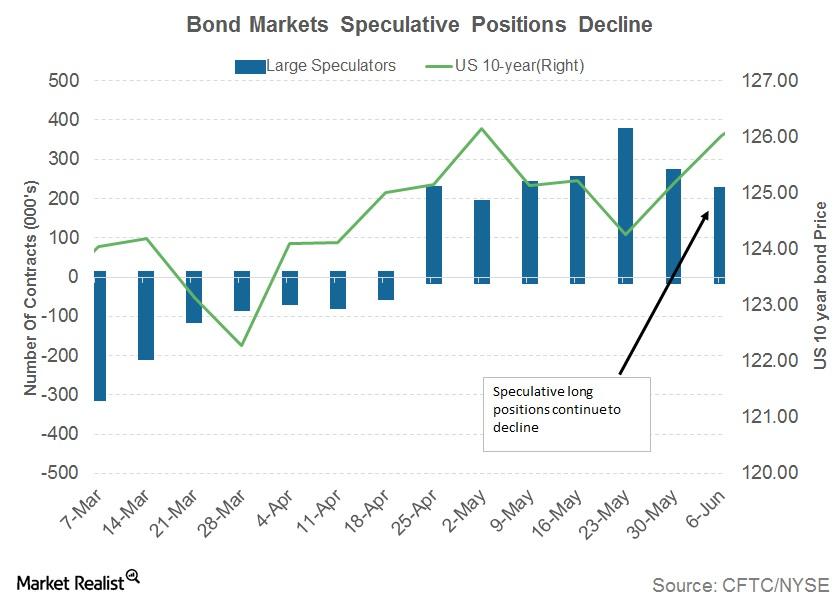

Why Bond Traders Continue to Be Confused

US Treasuries (GOVT) had another roller coaster ride this week due in part to the conflicting views from Fed members and weaker-than-expected economic data.

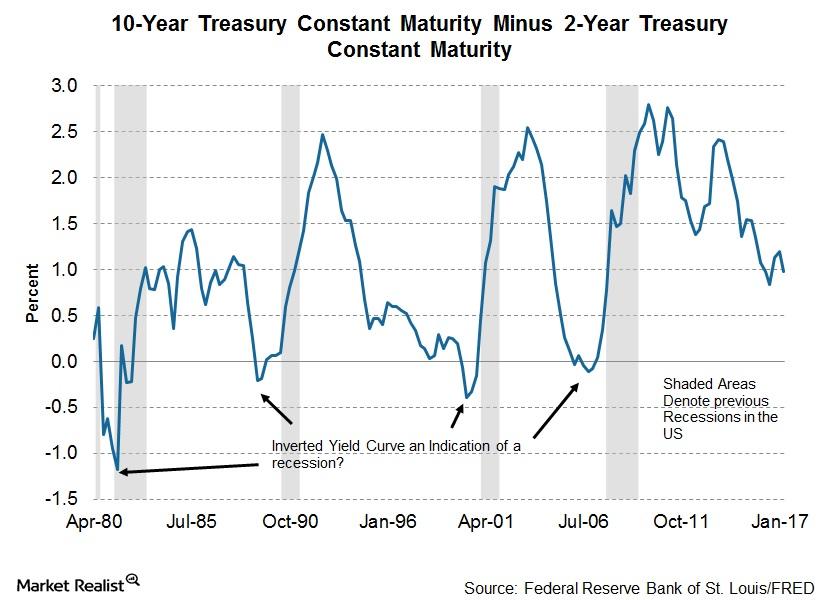

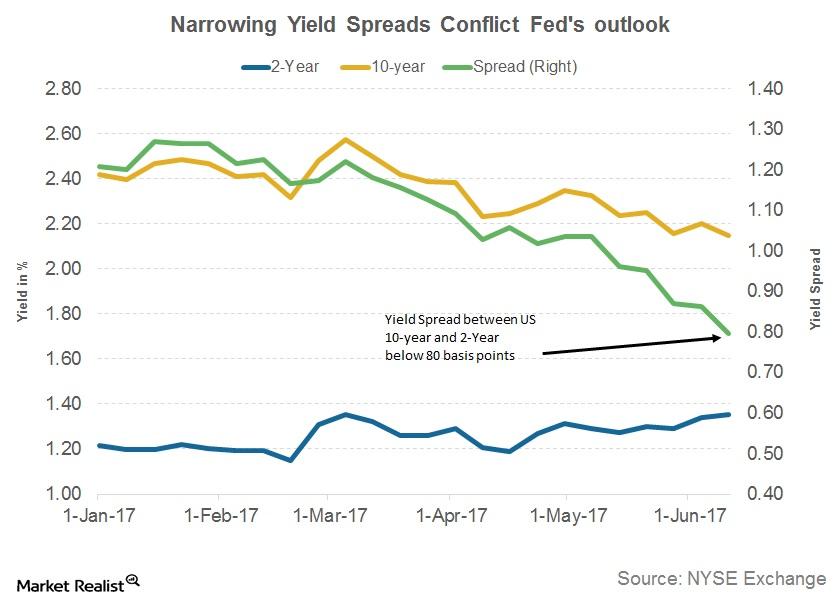

Is a Flattening Yield Curve a Sign of an Impending Recession?

Yields in the shorter timeframe such as the two-year yield (SHY) and T-notes (SCHO) are rising more than the ten-year or the 30-year (TLT) yields.

Comparing Growth and Value Stock Sectors

The SPDR S&P 500 Growth ETF (SPYG) has generated a YTD return of 13.3% versus 4.3% from the SPDR S&P 500 Value ETF (SPYV).

What Does Rise in US Interest Rates Mean for Bond Markets?

US Treasuries (GOVT) had a mixed response to the FOMC statement and the Fed’s interest rate hike.

What Narrowing Yield Spreads of US Treasuries Could Indicate

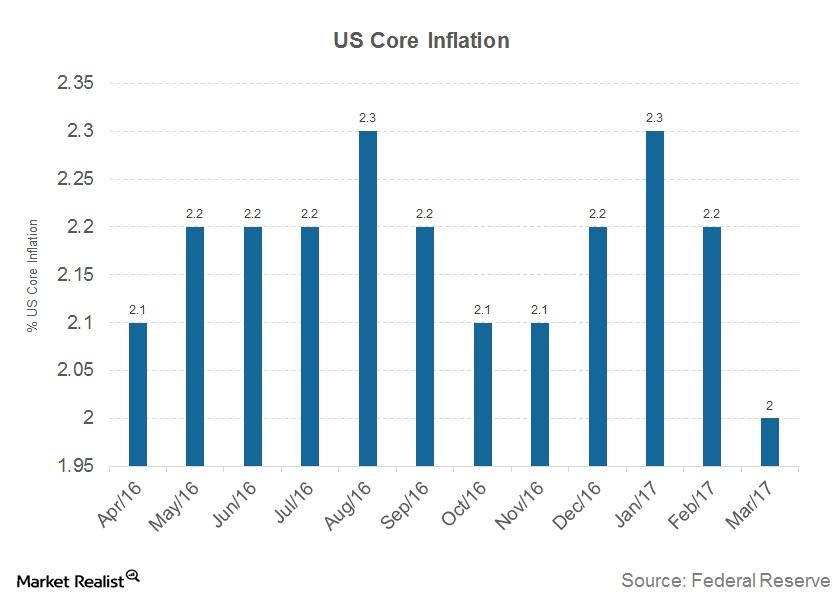

The US ten-year yield fell to 2.1% after the weak US data report, US inflation showed a decline of 0.1%, and retail sales fell by 0.3% for May 2017.

Could an FOMC Rate Hike Drive Bond Yields Higher?

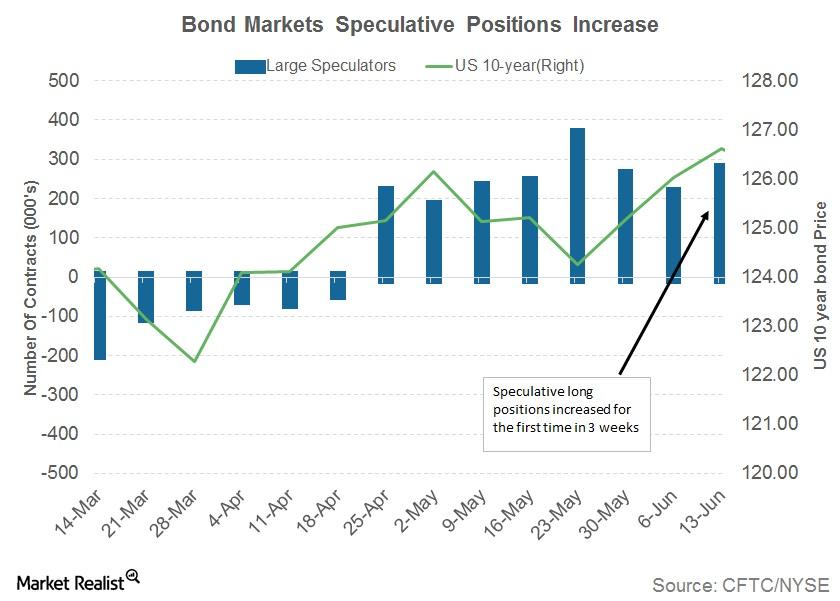

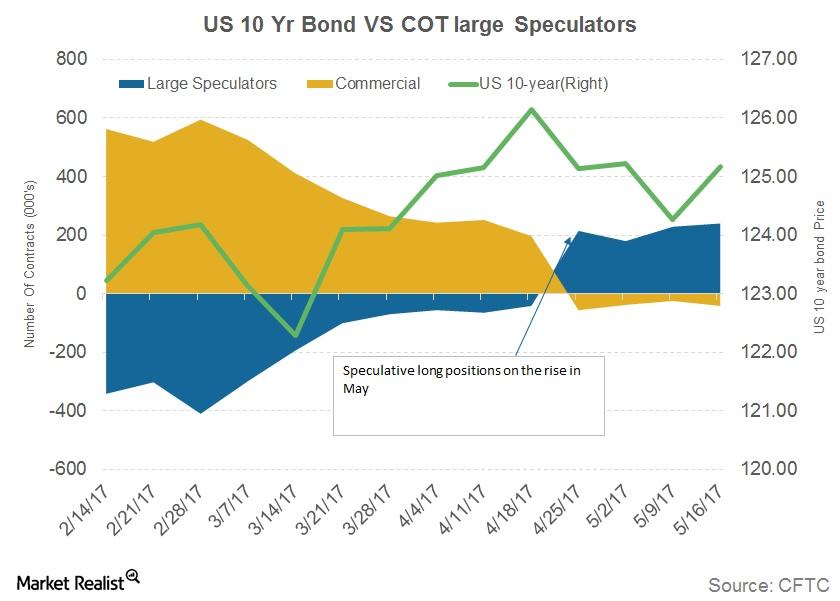

Bond yields of U.S. Treasuries managed to recover from the losses of the previous week. Demand for US bonds receded.

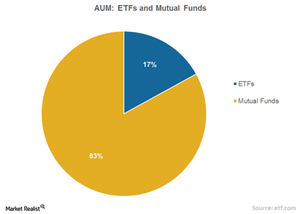

Why ETFs Are Seeing Increased Popularity

Mutual fund ownership of equities is at the lowest level in ~13 years, while ETFs (SPY) (IVV) are gradually increasing their share in the stock market.

Inside Novartis’s Innovative Medicines Segment in 1Q17

Novartis’s (NVS) Innovative Medicines segment contributed ~67% of NVS’s total revenues in 1Q17.

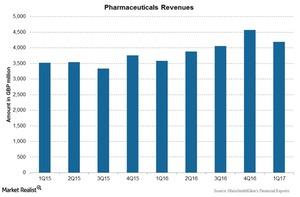

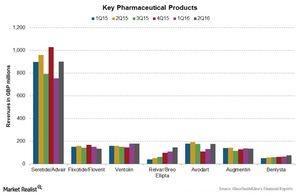

GlaxoSmithKline’s Pharmaceuticals Segment in 1Q17

The Pharmaceuticals segment reported an operational growth of 4.0% and a 13.0% positive impact of foreign exchange, resulting in a rise of 17.0% in revenues.

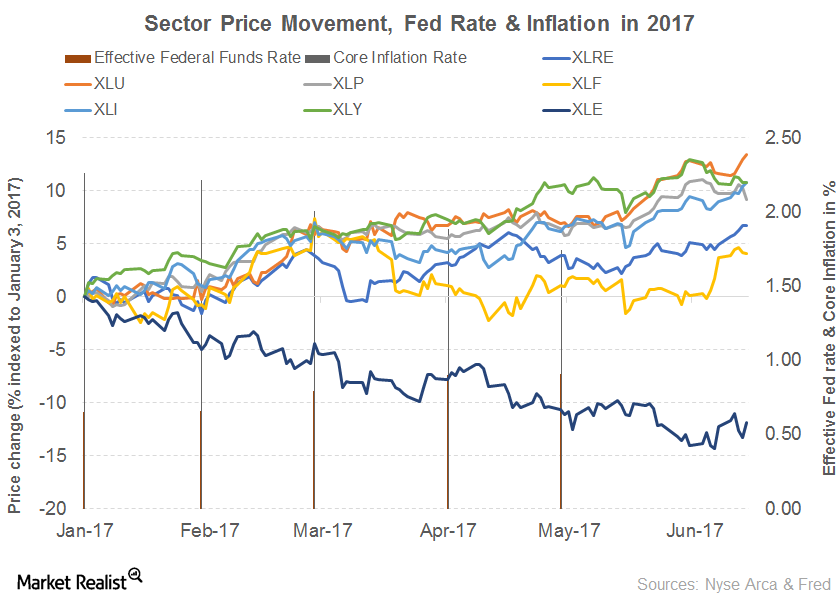

What to Look Forward to in June

In recent weeks, we’ve witnessed volatile behavior in the markets (SCHB) due to political turbulence in the United States and increased investor impatience.

How AstraZeneca’s Growth Platforms Performed in 1Q17

A few of the segments AstraZeneca identifies as growth platforms include Respiratory products, new Cardiovascular and Metabolic Diseases products, and new Oncology products.

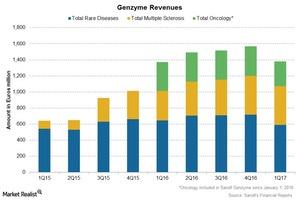

Performance of Sanofi Genzyme in 1Q17

Sanofi (SNY) reported growth of over 15% at constant exchange rates in its 1Q17 revenues from Genzyme.

Why Bond Yields Were Unaffected by Trump News

US Treasuries (SCHO) rallied all through the previous week supported by heavy safe-haven inflows into US bonds.

Why Charles Evans Thinks It’s Important to Reach Inflation Goals

Charles L. Evans, president of the Federal Reserve Bank of Chicago, said it’s extremely important that the Fed reach its inflation (VTIP) goal.

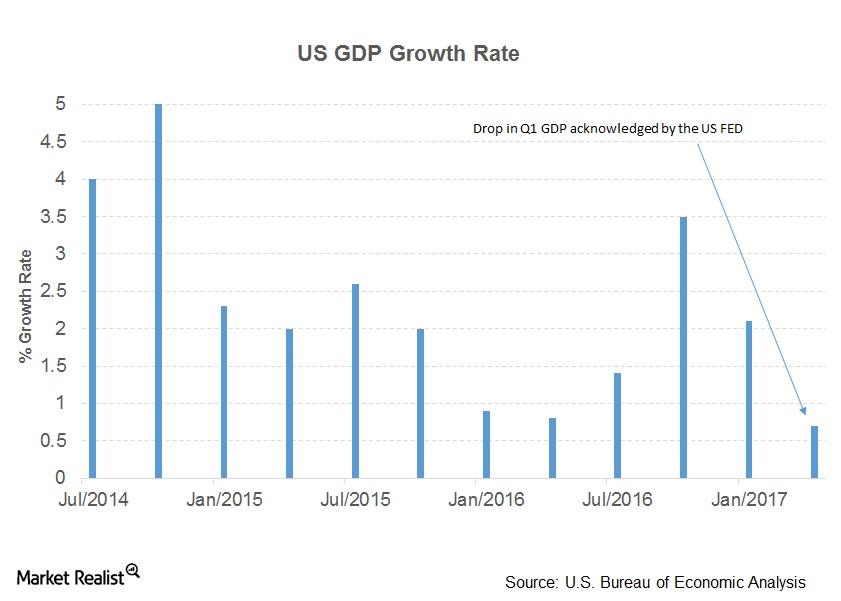

Unpacking the Fed’s Outlook on the US Market

In its May statement, the Fed seems to have gone the extra mile to explain the slowdown in the first quarter.

Will the FOMC Remain Hawkish?

In its last meeting in March, the Fed increased interest rates (SCHZ) by 0.25% and sounded hawkish about the US economy.

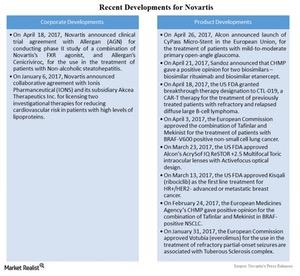

Novartis’s 1Q17 Earnings: Recent Developments

On January 6, 2017, Novartis announced the collaborative agreement with Ionis Pharmaceuticals (IONS) and its subsidiary Akcea Therapeutics.

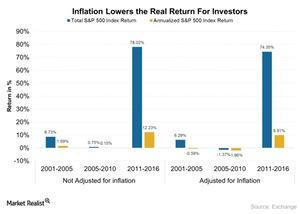

Ron Baron’s Investment Strategy to Beat Inflation in the Long Run

Inflation is expected to reduce the value of assets if the price rise of the asset doesn’t catch up with inflation. Core inflation in the United States is growing at a rate of ~2%.

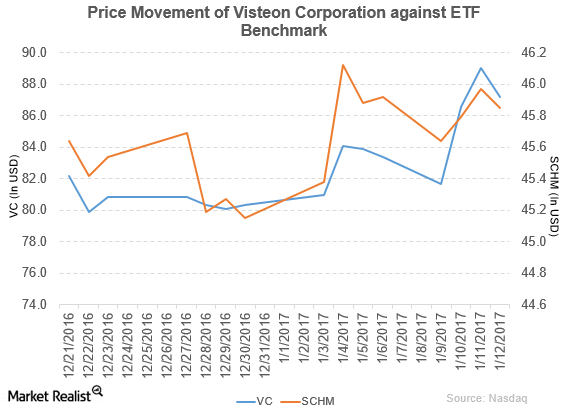

Raymond James Upgrades Visteon Corporation to ‘Outperform’

VC fell 2.1% to close at $87.19 per share on January 12. Its weekly, monthly, and YTD price movements were 3.9%, 3.9%, and 8.5%, respectively.

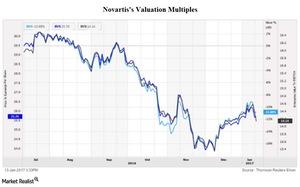

How Does Novartis’s Valuation Compare to Peers?

On January 13, 2017, Novartis was trading at a forward PE multiple of ~15.1x.

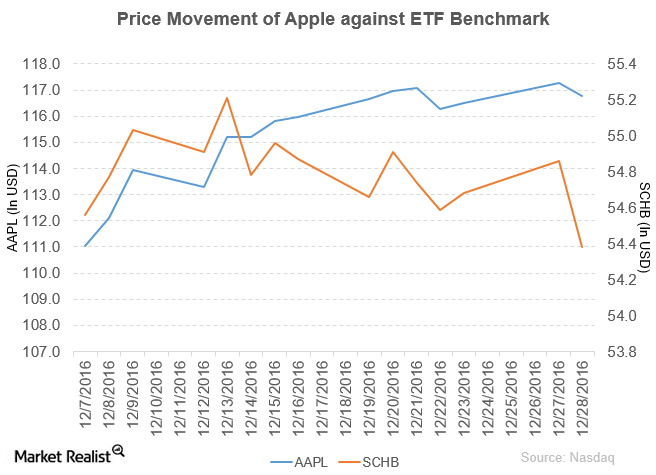

What’s the Latest News on Apple?

Apple (AAPL) reported fiscal 4Q16 net sales of $46.9 billion, which represents a YoY (year-over-year) fall of 8.9% from its net sales of $51.5 billion in fiscal 4Q15.

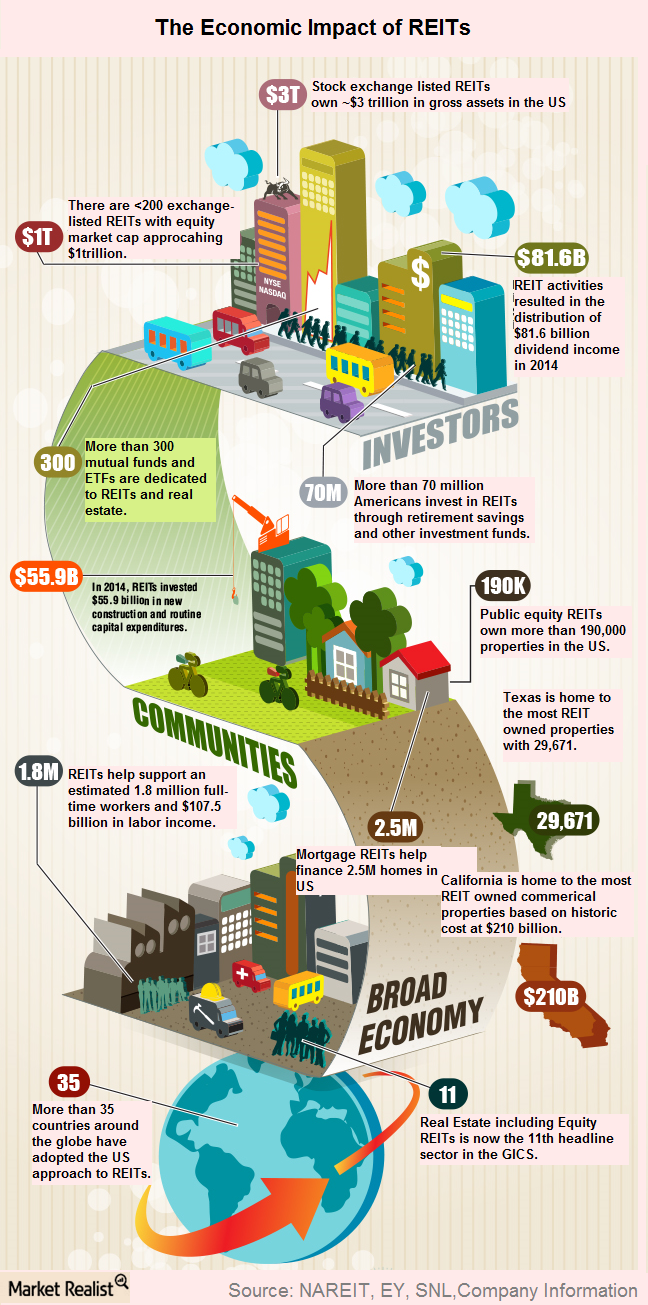

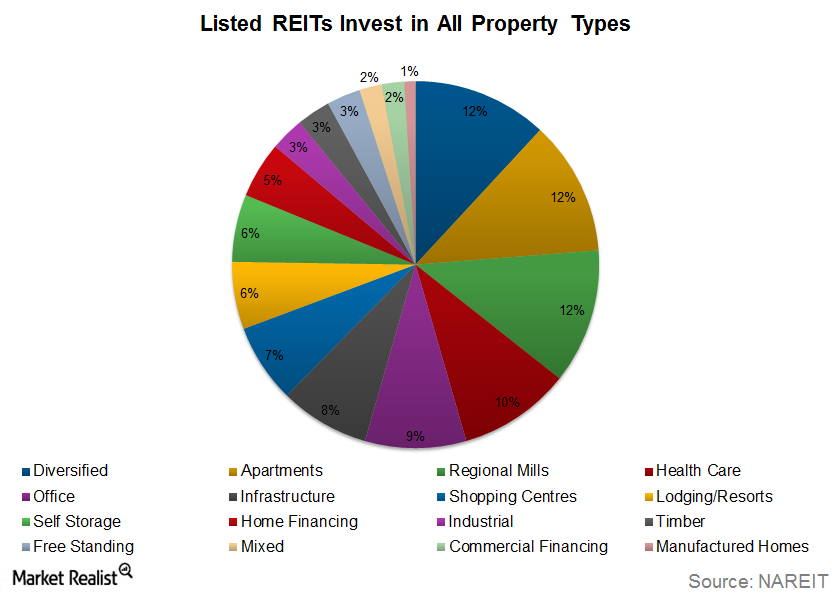

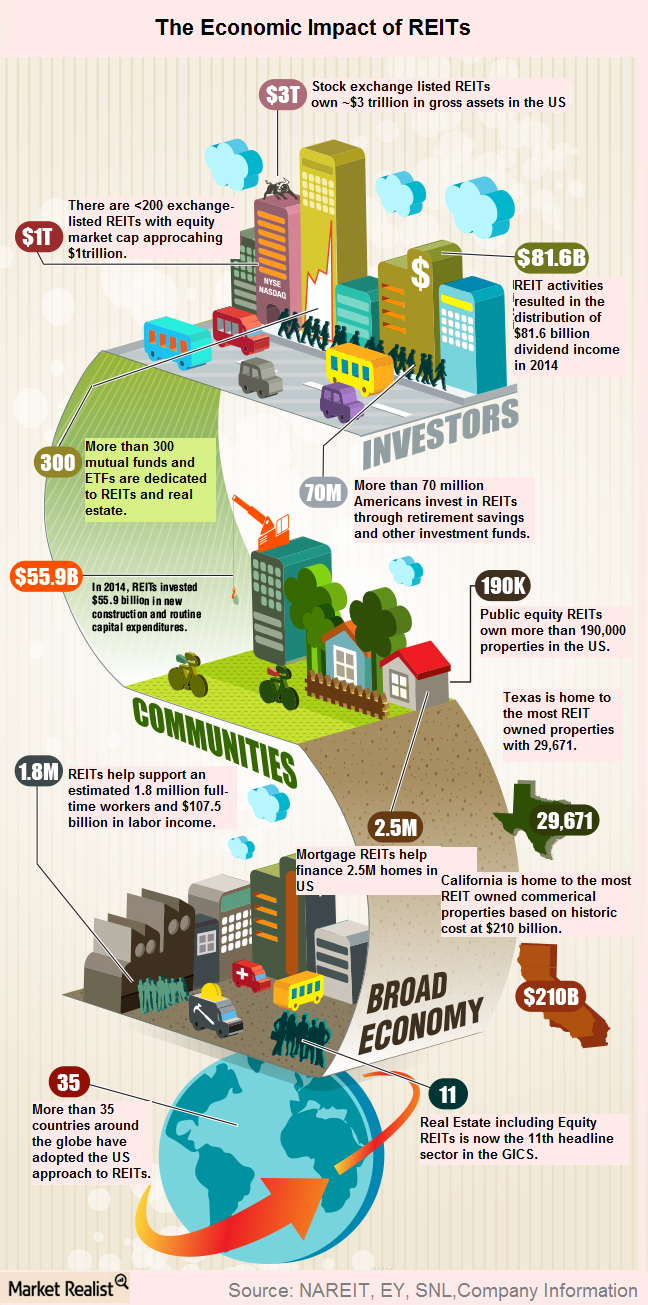

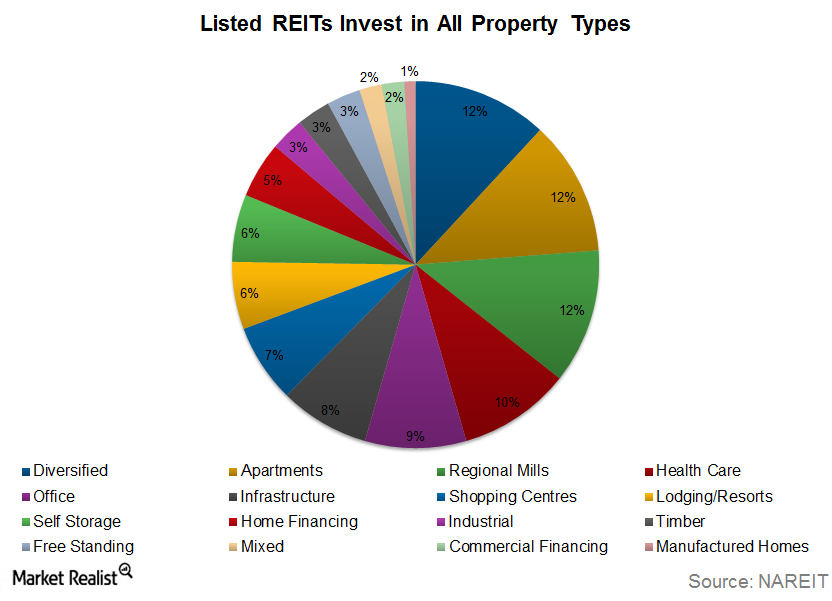

Why Look to REITs for Opportunities?

HEDGING AGAINST INFLATION Property stocks and REITs have often been viewed as inflation hedges because expected inflation will affect prices of real estate, and rental income tends to rise along with generalized inflation. However, other factors may mitigate the impact of inflationary forces. Some of these additional factors may include real estate supply and demand […]

REITs Explained: Qualifications and Types of REITs

To qualify as a REIT, a company must have most of its assets and income tied to real estate investment and must pay out almost all of its taxable income to shareholders in the form of dividends. In the U.S., a REIT must meet the following four requirements. The REIT must distribute at least 90% […]

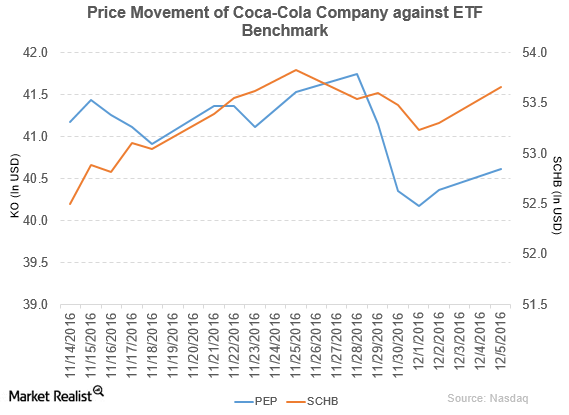

Coca-Cola Announces Its Expansion Plans

Coca-Cola’s net income and EPS fell to $1.0 million and $0.24, respectively, in 3Q16, compared to $1.4 million and $0.33 in 3Q15.

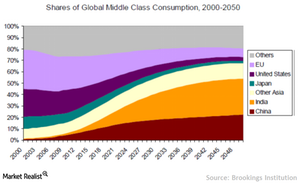

Rethink Your Emerging Market Story

In the previous articles of this series, we discussed population and economic growth as the two major drivers leading to a rise in emerging markets (EMQQ).

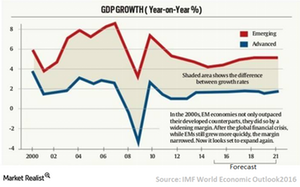

Emerging Market Economic Growth Outpaced Developed Markets

In recent years, emerging markets have experienced rapid economic growth compared to developed markets.

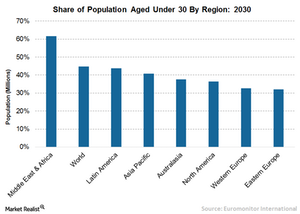

Why Emerging Markets Have Better Demographics

Achieving higher returns amid the rising market volatility, record-low interest rates, and global uncertainties is a huge challenge for investors.

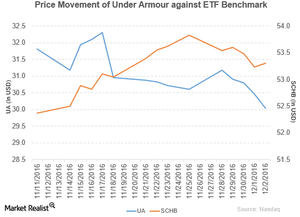

Under Armour Announces a Change in Its Ticker Symbols

Under Armour (UA) fell 1.9% to close at $30.03 per share during the fifth week of November 2016.

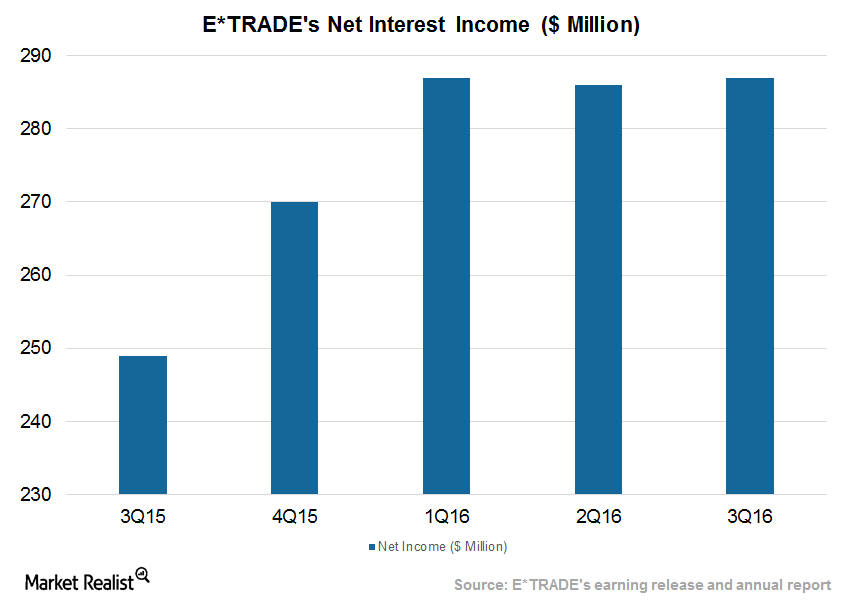

E*TRADE Bank Saw Continued Expansion, Supported Broking

E*TRADE’s bank offers its clients FDIC insurance on a certain amount of deposits. It deploys funds primarily in low-risk securities.

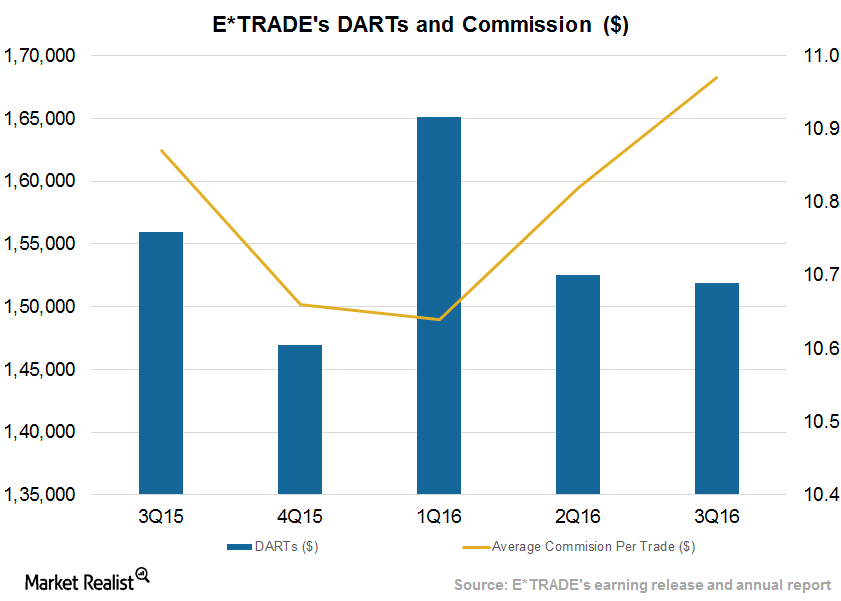

E*TRADE Saw Subdued DARTs amid Mixed Volatility in 3Q16

E*TRADE Financial reported DARTs (daily average revenue trades) of ~151,905 during 3Q16. It included 6,500 DARTs from the OptionsHouse acquisition.

Assets, Rates to Have Pushed E*TRADE’s Bank Revenues Higher in 3Q16

E*TRADE Financial (ETFC) operates the federally chartered savings bank E*TRADE Bank. This structure has been deployed by many major brokers in the US.

How Volatility Affects E*TRADE’s DARTs

E*TRADE Financial reported DARTs (daily average revenue trades) of ~153,000 in 2Q16. The company’s DARTs fell 8% from the previous quarter and rose 2% YoY.

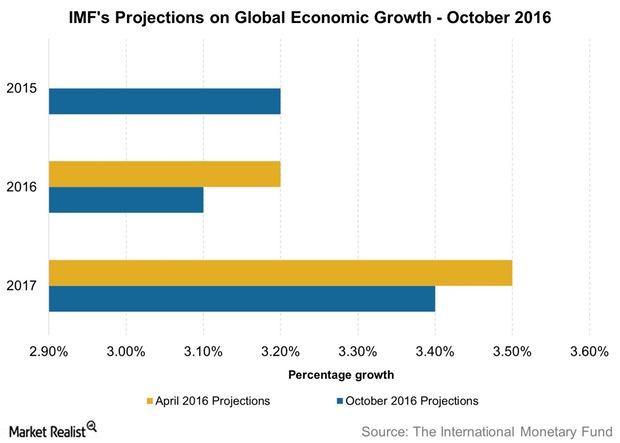

International Monetary Fund Weighs in on Slowing Global Economy

In its October World Economic Outlook report, the IMF estimated that the global economy will likely continue to slow down, reaching growth of 3.1% in 2016.

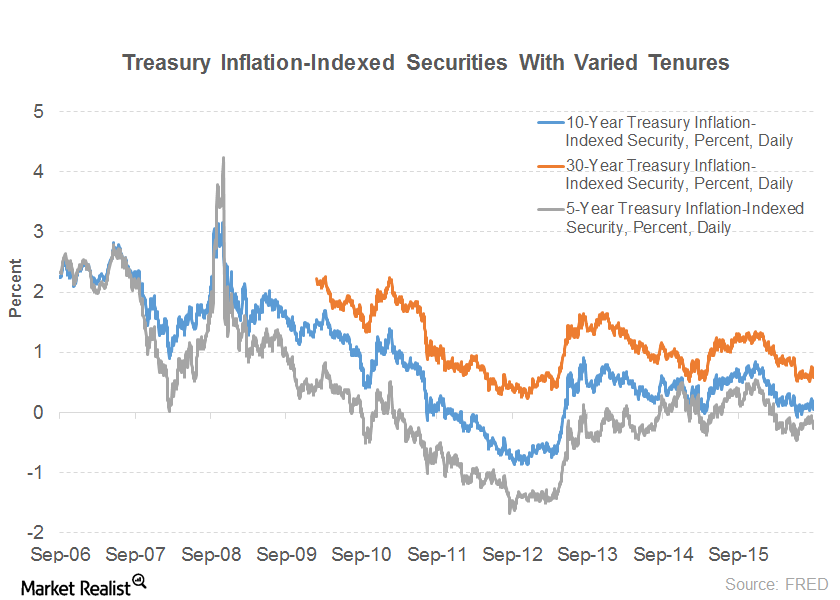

Will Treasury Inflation-Protected Securities Be a Game-Changer?

According to Bloomberg, Treasury Inflation-Protected Securities (or TIPS) have generated a year-to-date return of 6.3% compared to 4.7% by the broad Treasury market.

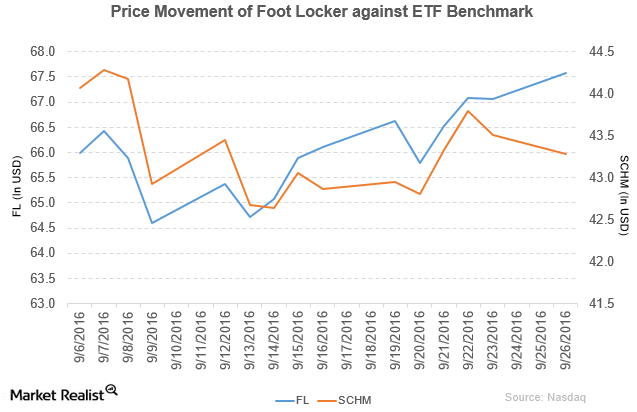

J.P. Morgan Raises Foot Locker’s Price Target, Adds to Focus List

Foot Locker (FL) has a market cap of $9.0 billion. It rose 0.76% to close at $67.58 per share on September 26.

Why Look to the REIT Sector for Opportunities?

Not only do REITs (RWR)(ICF) help diversify a portfolio, but they also bolster portfolio income with their steady dividends and their long-term capital appreciation.

REIT Explained: Qualifications and Types of REITs

Let’s talk about the two main types of REITs (ICF)—equity REITs and mortgage REITs.

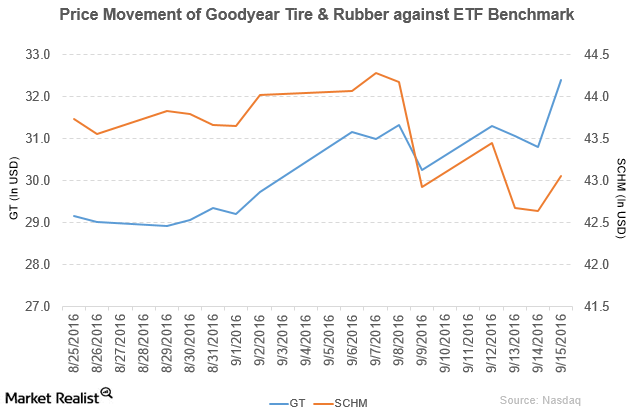

Goodyear Tire & Rubber’s Financial Targets and Quarterly Dividend

Goodyear Tire & Rubber Company (GT) has a market cap of $8.8 billion. It rose 5.1% and closed at $32.39 per share on September 15, 2016.

Performance of GSK’s Global Pharmaceuticals Franchises Mixed

The global pharmaceuticals franchise is GlaxoSmithKline’s (GSK) largest revenue contributor.

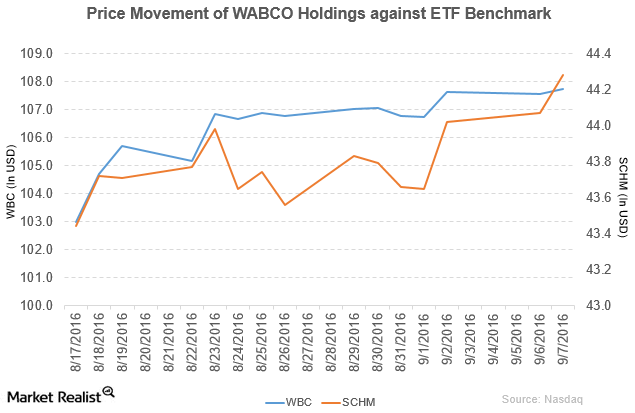

Deutsche Bank Rated Wabco Holdings as a ‘Hold’

Wabco Holdings (WBC) has a market cap of $6.0 billion. It rose by 0.15% to close at $107.73 per share on September 7, 2016.

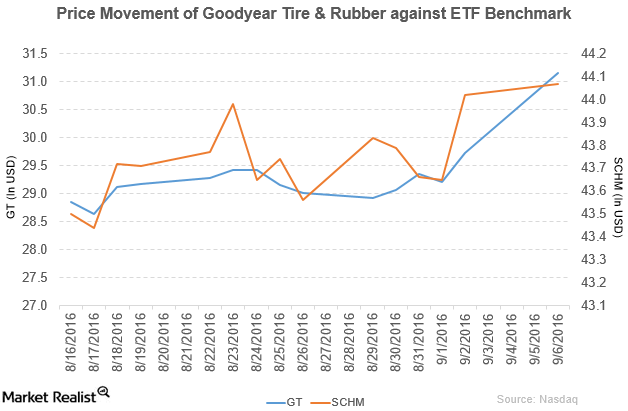

Deutsche Bank Upgrades Goodyear to ‘Buy’

The Goodyear Tire & Rubber Company (GT) has a market cap of $8.2 billion. It rose by 4.8% to close at $31.16 per share on September 6, 2016.