E*TRADE Saw Subdued DARTs amid Mixed Volatility in 3Q16

E*TRADE Financial reported DARTs (daily average revenue trades) of ~151,905 during 3Q16. It included 6,500 DARTs from the OptionsHouse acquisition.

Nov. 21 2016, Published 1:17 p.m. ET

Daily trades amid volatility

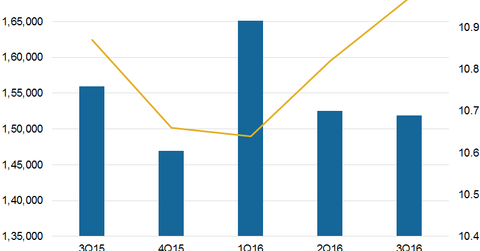

E*TRADE Financial (ETFC) reported DARTs (daily average revenue trades) of ~151,905 during 3Q16. It included 6,500 DARTs from the OptionsHouse acquisition. The company’s DARTs remained unchanged from the previous quarter and fell 3% YoY (year-over-year). The activity remained similar as the overall volatility remained average post-Brexit. Derivatives formed 26% of the company’s total options in 3Q16, including a 1.7% boost from OptionsHouse. The company targets at least 35% of its total trades in the form of derivatives over the next two years. It could boost DARTs because volumes are relatively higher in the derivatives space.

The margin balances as of September 30, 2016, fell marginally to $6.8 billion, including $300 million from OptionsHouse. It’s 14% lower than the same quarter last year and in line with 2Q16.

Here’s how a few of the company’s competitors in the industry performed in terms of revenue in the last fiscal year:

- Charles Schwab (SCHW) – $6.5 billion

- Interactive Brokers Group (IBKR) – $1.3 billion

- TD Ameritrade (AMTD) – $3.2 billion

Together, these companies account for 16.5% of the iShares US Broker-Dealers ETF (IAI).

Commissions amid competition

E*TRADE’s average commission rose continually over the past few years. In 3Q16, the company saw a rise in its average commission per trade to $10.97—compared to $10.82 in the prior quarter and $10.87 in 3Q15.

In 3Q16, the company’s commissions, service charges, fees, and other revenue totaled $185 million. It was higher than $178 million in the prior quarter. The income from commissions rose by $1 million sequentially due to an increase in commissions. However, advisory fees expanded due to client preferences towards wealth management.

The average commissions per trade grew in 3Q16. The number was partially offset by subdued DARTs, while revenues expanded on commissions.