Interactive Brokers Group Inc

Latest Interactive Brokers Group Inc News and Updates

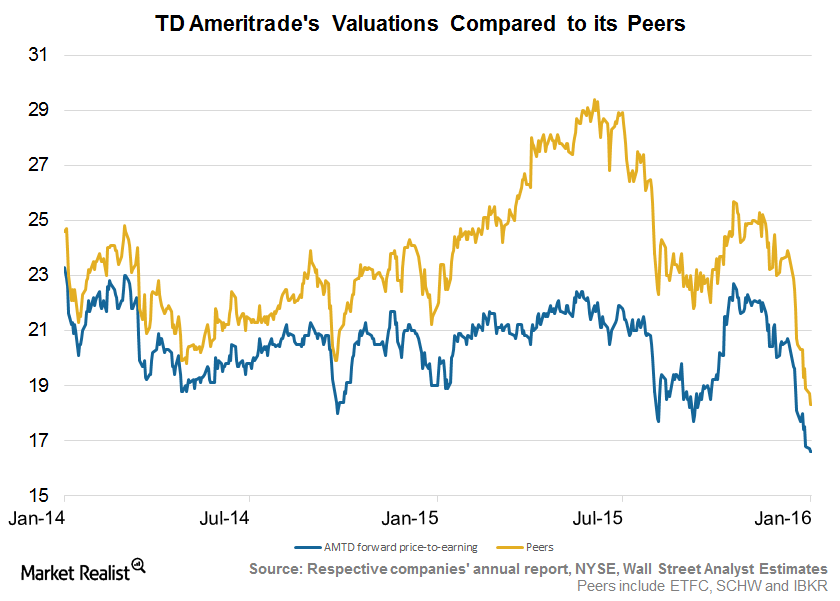

TD Ameritrade’s Valuation Falls alongside the Industry

Historically, TD Ameritrade traded at a discount to its peers because of average operating margins. The sector’s valuations fell in the recent past.

Brokerages in 2018: What to Expect

The final week of the second quarter might help brokerages, primarily because of higher client participation.

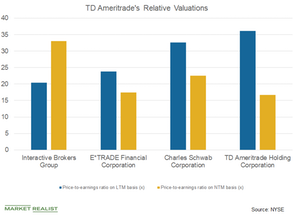

What Are TD Ameritrade’s Valuations?

TD Ameritrade’s (AMTD) PE ratio stood at 16.68x on a next 12-month basis, which implies discounted valuations.

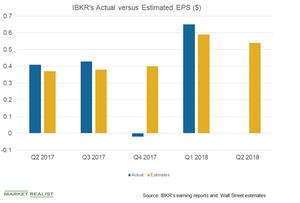

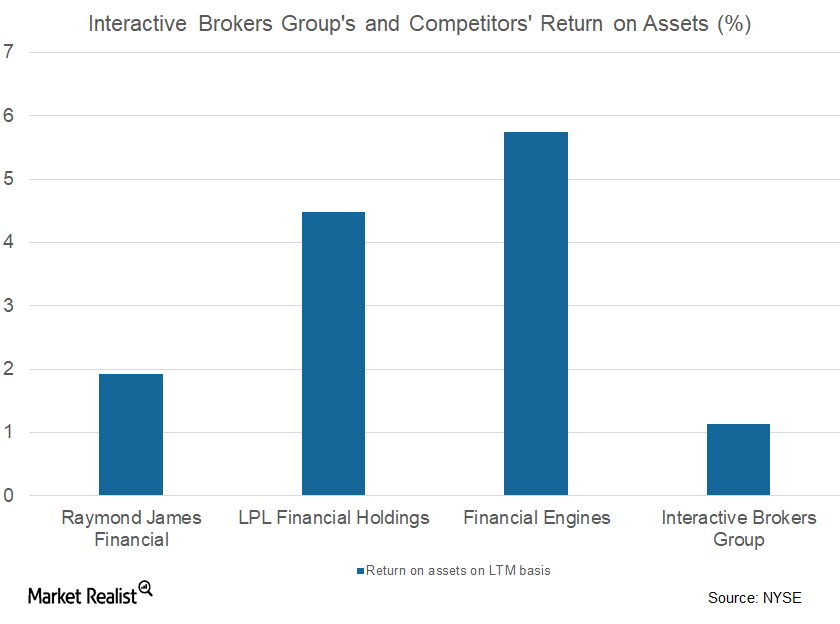

What Happened with Interactive Brokers’ Market-Making Business

Loss witnessed Interactive Brokers Group’s (IBKR) market-making business saw pre-tax income of -$35 million in the first three quarters of 2017, compared with $32 million in the same period of the prior year, primarily due to lower net revenue. Whereas the division’s trading gains fell from $124 million to $26 million, its other income rose to $14 […]

E*TRADE Bank Saw Continued Expansion, Supported Broking

E*TRADE’s bank offers its clients FDIC insurance on a certain amount of deposits. It deploys funds primarily in low-risk securities.

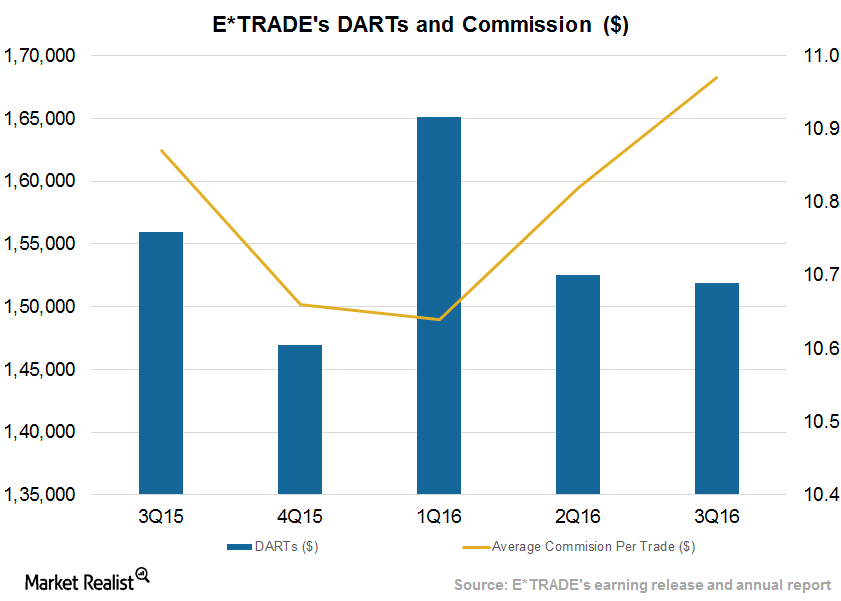

E*TRADE Saw Subdued DARTs amid Mixed Volatility in 3Q16

E*TRADE Financial reported DARTs (daily average revenue trades) of ~151,905 during 3Q16. It included 6,500 DARTs from the OptionsHouse acquisition.

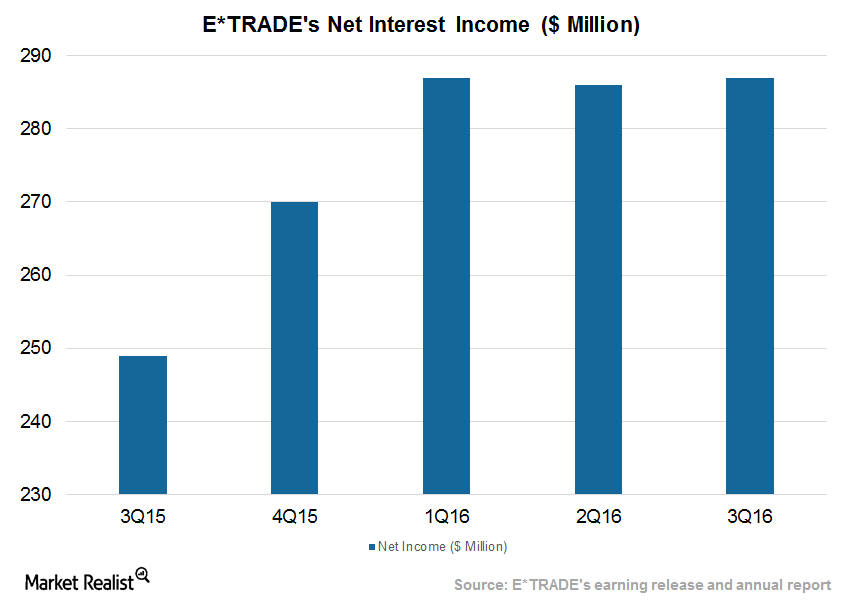

Assets, Rates to Have Pushed E*TRADE’s Bank Revenues Higher in 3Q16

E*TRADE Financial (ETFC) operates the federally chartered savings bank E*TRADE Bank. This structure has been deployed by many major brokers in the US.

How Volatility Affects E*TRADE’s DARTs

E*TRADE Financial reported DARTs (daily average revenue trades) of ~153,000 in 2Q16. The company’s DARTs fell 8% from the previous quarter and rose 2% YoY.

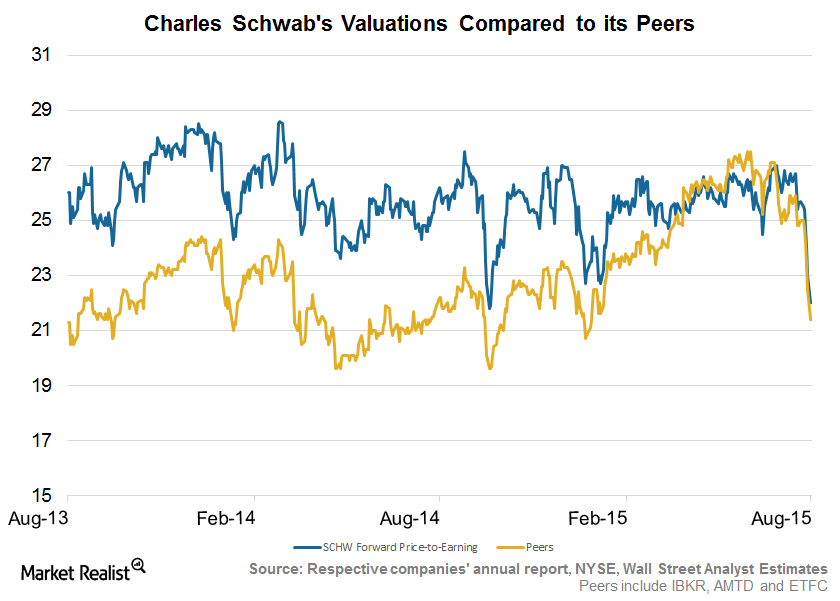

Charles Schwab Trading at Multiyear Low Valuations

Charles Schwab’s valuations declined significantly over the past month mainly due to macro factors such as China’s slowing economy and a weaker domestic economy.