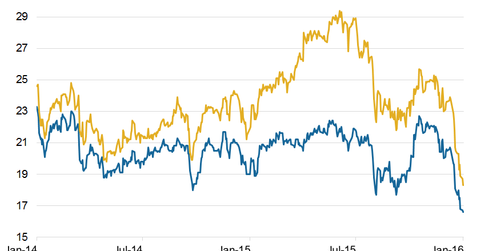

TD Ameritrade’s Valuation Falls alongside the Industry

Historically, TD Ameritrade traded at a discount to its peers because of average operating margins. The sector’s valuations fell in the recent past.

Dec. 4 2020, Updated 10:53 a.m. ET

Macro concerns

TD Ameritrade’s (AMTD) stock has returned 15% over the past one year. The company has registered nominal growth in client assets, trades, and commissions. However, the global slowdown led by China resulted in a sell-off across asset classes, and that led to a fall in broker and financial stocks.

TD Ameritrade’s first quarter net income rose by $1 million to $212 million as compared to the prior year’s quarter. The company rewards its shareholders through dividend and share repurchases. For 1Q16, TD Ameritrade declared a dividend of $0.17 per share, a rise of 13% compared to the previous quarter as well as the prior year’s quarter.

TD Ameritrade’s peers in the brokerage industry have the following dividend yields:

- Interactive Brokers Group (IBKR) – 1.1%

- E*TRADE Financial Corporation (ETFC) – 0%

- Charles Schwab Corporation (SCHW) – 0.74%

Together, these companies form 1.3% of the Financial Select Sector SPDR Fund (XLF).

In the first quarter of 2016, TD Ameritrade repurchased 1 million shares of its common stock.

Falling valuations

Currently, TD Ameritrade is trading at 16.6x on a one-year forward earnings basis. Its peers are trading at 18.3x. Historically, the company has traded at a discount to its peers because of average operating margins. Overall, the sector’s valuations fell in the recent past on macro issues and lower interest rates.

On a trailing-12-month basis, TD Ameritrade is valued at a price-to-earnings ratio of 19x compared to the industry average of 34x.

The trading activity in the US market is expected to be lower in the next few quarters as economic growth is slowing. The contraction of yields is having a negative impact on TD Ameritrade’s earnings. The rise in interest rates is expected to be lower and slower due to falling commodity prices, slowing emerging and markets like China, and major economies like Japan. Brokers might have to focus on expanding client assets to boost their returns.