Deutsche Bank Rated Wabco Holdings as a ‘Hold’

Wabco Holdings (WBC) has a market cap of $6.0 billion. It rose by 0.15% to close at $107.73 per share on September 7, 2016.

Sept. 9 2016, Updated 10:04 a.m. ET

Price movement

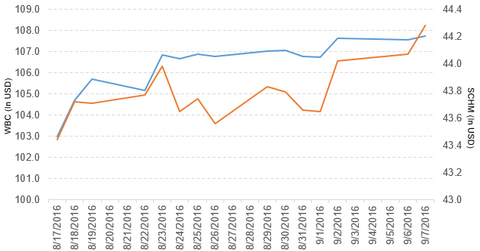

Wabco Holdings (WBC) has a market cap of $6.0 billion. It rose by 0.15% to close at $107.73 per share on September 7, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were 0.63%, 6.6%, and 5.4%, respectively, on the same day.

WBC is trading 2.6% above its 20-day moving average, 9.0% above its 50-day moving average, and 7.3% above its 200-day moving average.

Related ETF and peers

The Schwab US Mid-Cap ETF (SCHM) invests 0.22% of its holdings in Wabco. This ETF tracks a market cap–weighted index of midcap stocks in the Dow Jones US Total Stock Market Index. The YTD price movement of SCHM was 11.3% on September 7.

The market caps of WABCO’s competitors are as follows:

Wabco’s rating

Deutsche Bank has initiated the coverage of Wabco Holdings with a “hold” rating and set the stock price target at $113.00 per share.

Performance of Wabco in 2Q16

Wabco Holdings reported 2Q16 sales of $732.2 million, a rise of 10.8% compared to sales of $661.1 million in 2Q15. The company’s gross profit margin and operating income rose by 0.08% and 20.2%, respectively, in 2Q16 compared to 2Q15.

Its net income and EPS (earnings per share) rose to $75.1 million and $1.33, respectively, in 2Q16 compared to $65.8 million and $1.12, respectively, in 2Q15. It reported EPS on a performance basis of $1.43 in 2Q16, a rise of 2.1% compared to 2Q15.

WBC’s cash and cash equivalents and inventories rose by 16.3% and 14.7%, respectively, in 2Q16 compared to 4Q15. Its current ratio fell to 2.96x, and its debt-to-equity ratio rose to 2.5x in 2Q16. This compares to a current ratio and debt-to-equity ratio of 2.98x and 2.1x, respectively, in 4Q15.

During 2Q16, the company repurchased 626,200 shares worth $64.3 million. It authorized the repurchase of shares worth up to $124.0 million through December 31, 2016.

Projections

Wabco Holdings (WBC) has made the following projections for fiscal 2016:

- sales of $2.8 billion–$2.9 billion

- sales growth of 7%–10% in local currencies

- on a performance basis, operating margin of 13.5%–14.0% and diluted EPS of $5.60–$5.90

- on a reported basis, operating margin of 12.4%–12.9% and diluted EPS of $3.73–$4.03

This guidance includes the non-cash tax expense due to the European Commission’s decision in January 2016 against the Belgian tax authority.

Next, we’ll take a look at Allison Transmission Holdings (ALSN).