Gabriel Kane

Disclosure: I am in full compliance with all ethics and other policies for Market Realist research analysts. I am not invested in securities that I cover on Market Realist.

More From Gabriel Kane

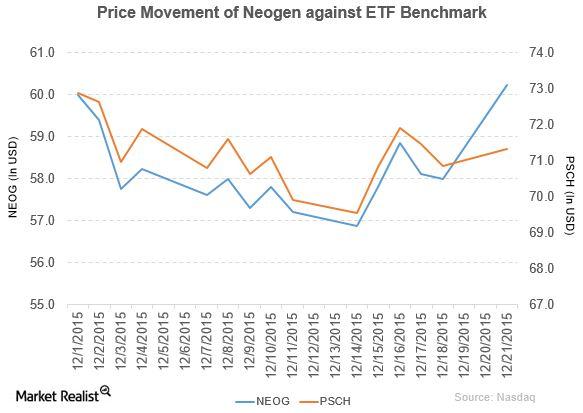

Neogen’s Revenue and Income Rose in Fiscal 2Q16

After Neogen’s (NEOG) fiscal 2Q16 earnings report, NEOG rose by 3.9% to close at $60.24 per share in yesterday’s trade.

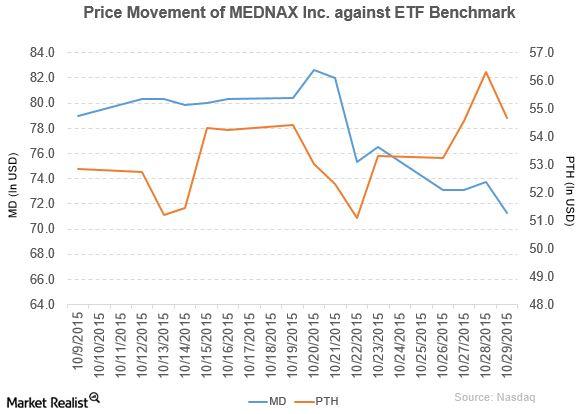

MEDNAX Revenue and Income Rose After 3Q15 Results

MEDNAX’s YTD price movement was a mix of rises and falls in 2015. After the earnings report, MEDNAX fell 3.4% to close at $71.3 per share as of October 29, 2015.

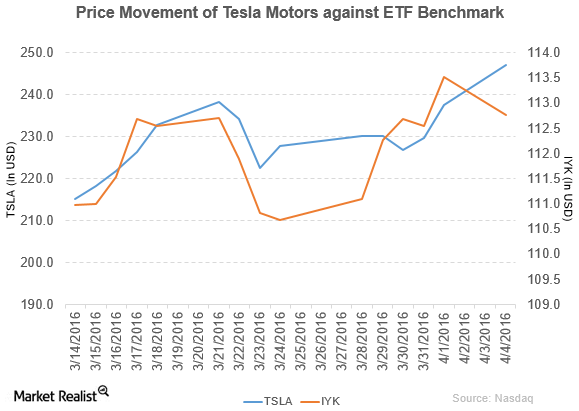

Tesla Motors Rose Due to Increased Orders for the Model 3 Sedan

Tesla Motors (TSLA) has a market cap of $31.5 billion. It rose by 4.0% and closed at $246.99 per share on April 4, 2016.

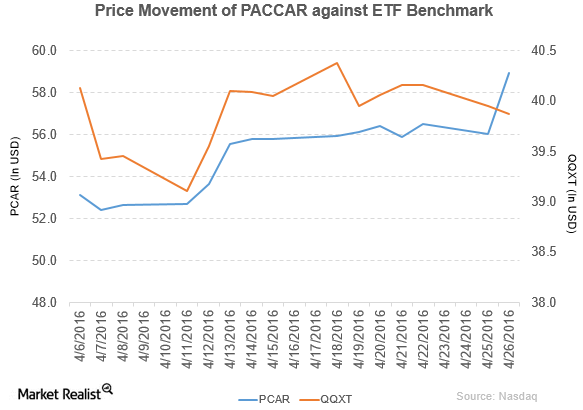

How Did PACCAR Perform in 1Q16?

PACCAR (PCAR) has a market cap of $20.5 billion. PCAR rose by 5.1% to close at $58.93 per share on April 26, 2016.

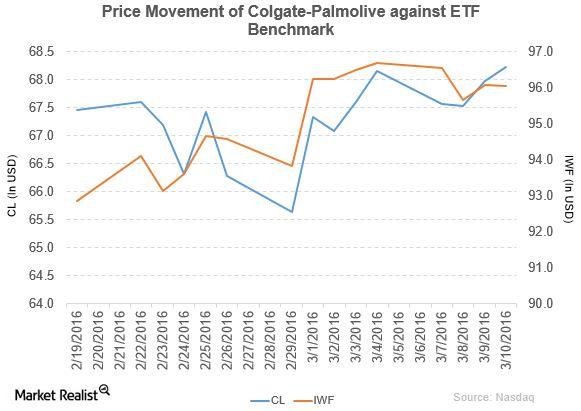

How Much Has Colgate-Palmolive Increased Its Dividend?

Colgate-Palmolive (CL) has a market capitalization of $60.9 billion. CL rose by 0.37% to close at $68.23 per share as of March 10, 2016.

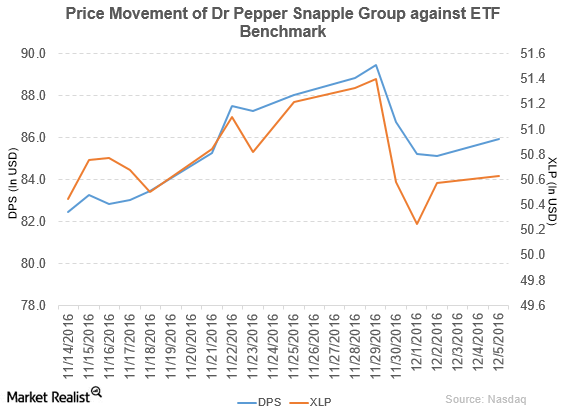

Why Did Moody’s Rate Dr Pepper Snapple Senior Notes as Baa1?

Dr Pepper Snapple Group (DPS) declared a quarterly dividend of $0.53 per share on its common stock. This dividend will be paid on January 5, 2017, to shareholders of record on December 13, 2016.

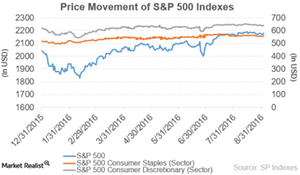

Your Outliers in the Consumer Space: 5th Week of August

By the end of August, the S&P Consumer Staples had outperformed the S&P Consumer Discretionary and SPY with respective returns of 0.89%, -0.18%, and 0.50%.

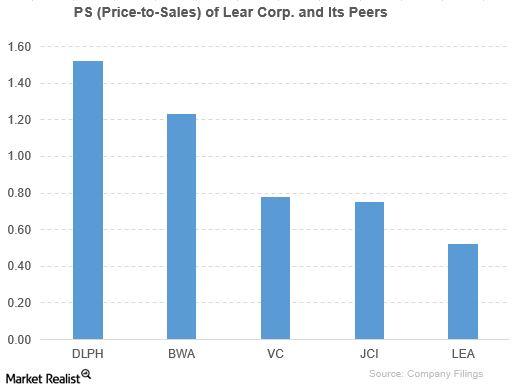

How Has Lear Performed Compared to Its Peers?

Competitors have outperformed Lear based on PE and PS. However, Lear is way ahead of its peers based on PBV. Lear is way ahead of its ETFs based on price movement.

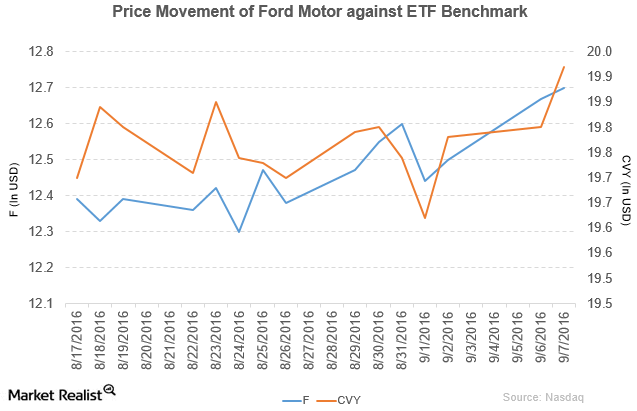

How Did Ford’s August 2016 Sales Turn Out in China?

Ford Motor Company (F) reported total vehicle sales of more than 214,000 units, which is a fall of 8.4% from August 2015.

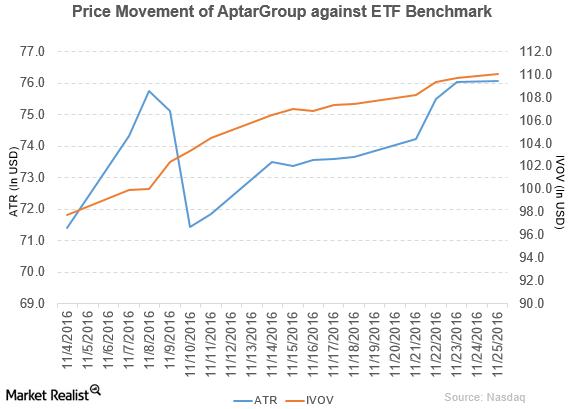

AptarGroup Appoints Stephan B. Tanda as Its President and CEO

AptarGroup (ATR) rose 3.4% to close at $76.07 per share during the fourth week of November 2016.

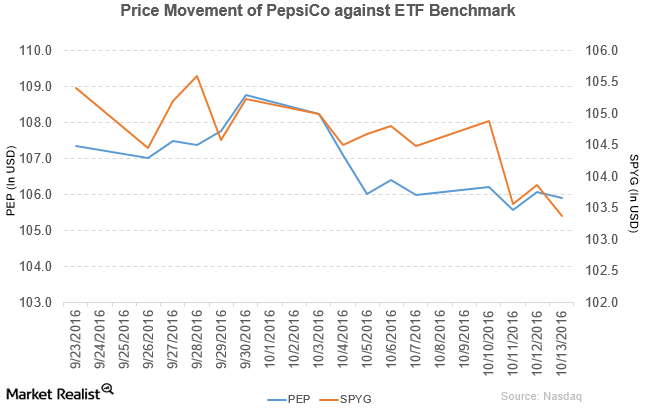

How PepsiCo Is Planning to Diversify Its Soft Drink Business

PepsiCo (PEP) has a market cap of $152.5 billion. It fell 0.15% to close at $105.92 per share on October 13, 2016.

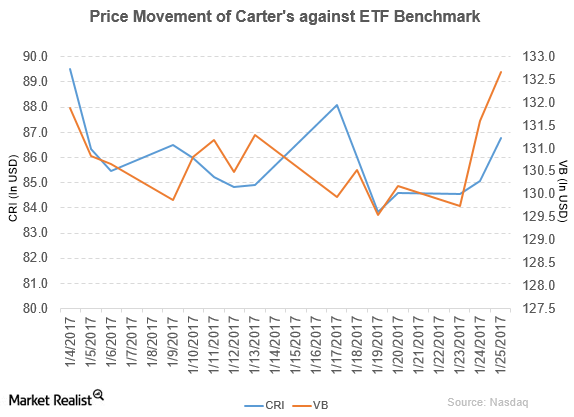

Morgan Stanley Rated Carter’s as ‘Overweight’

On January 25, 2017, Morgan Stanley initiated the coverage of Carter’s with “overweight” rating. It set the stock’s price target at $103.0 per share.

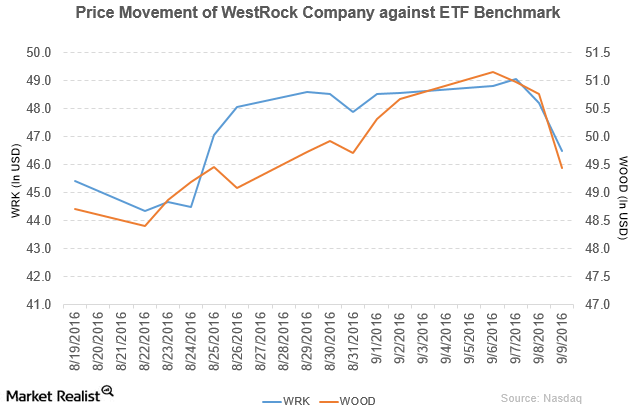

WestRock Made Key Changes to Its Management

WestRock (WRK) fell 4.2% to close at $46.49 per share during the first week of September 2016.

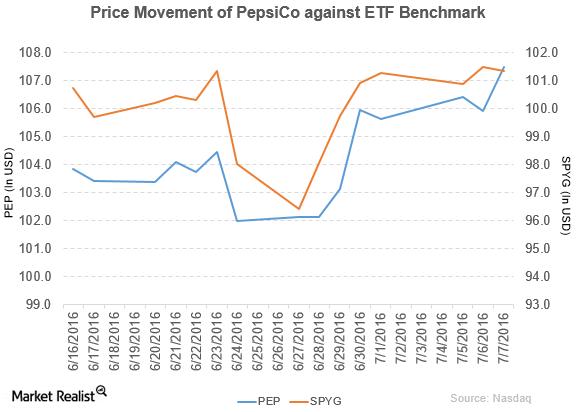

How Did PepsiCo’s 2Q16 Earnings Turn Out?

PepsiCo rose by 1.5% to close at $107.49 per share on July 7. Its weekly, monthly, and YTD price movements were 4.2%, 4.9%, and 9.2% that day.

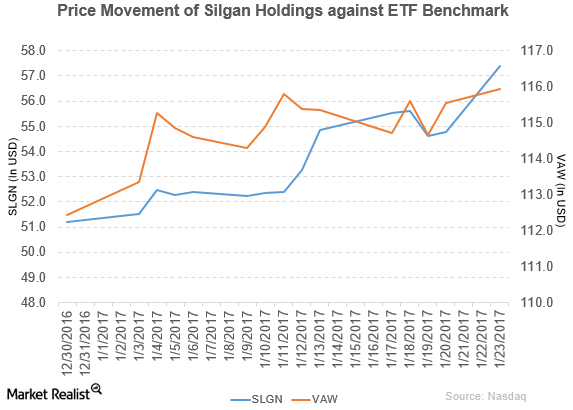

Bank of America/Merrill Lynch Upgrades Silgan Holdings to a ‘Buy’

On January 23, 2017, Bank of America/Merrill Lynch upgraded Silgan Holdings’s (SLGN) rating to a “buy” from “underperform.”

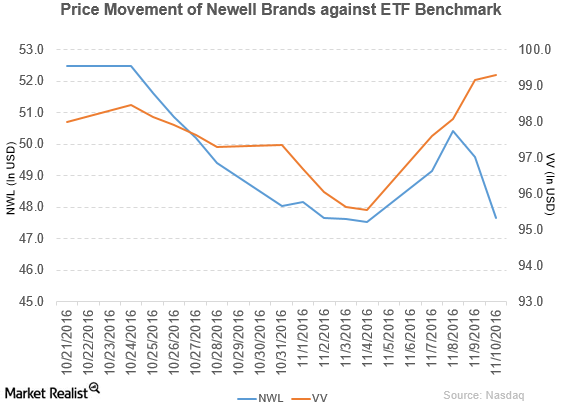

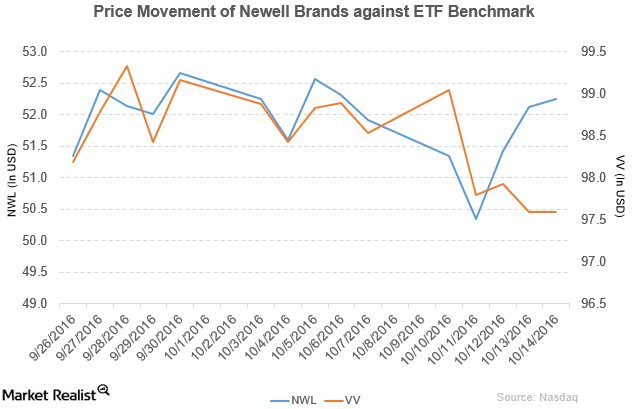

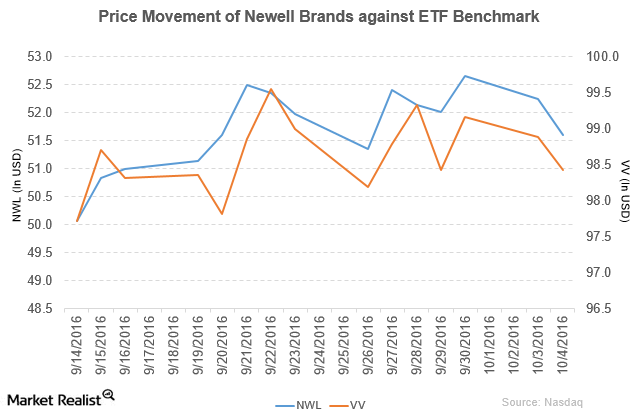

Newell Brands Declares Dividend of $0.19 per Share

Newell Brands (NWL) reported 3Q16 net sales of $4.0 billion, a rise of 158.5% over the net sales of $1.5 billion in 3Q15, due to the acquisition of Jarden.

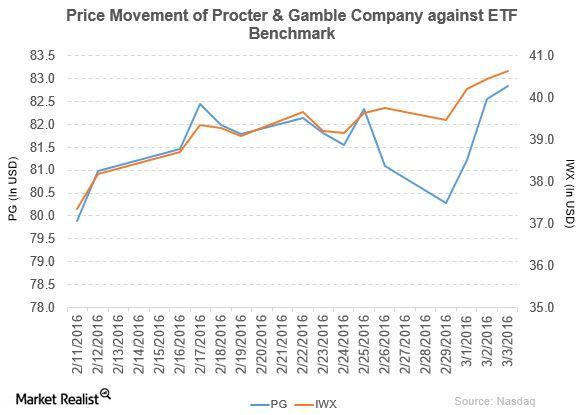

Henkel Acquired Procter & Gamble’s Haircare Brands

Procter & Gamble (PG) has a market cap of $224.1 billion. PG rose by 0.35% to close at $82.84 per share on March 3, 2016.

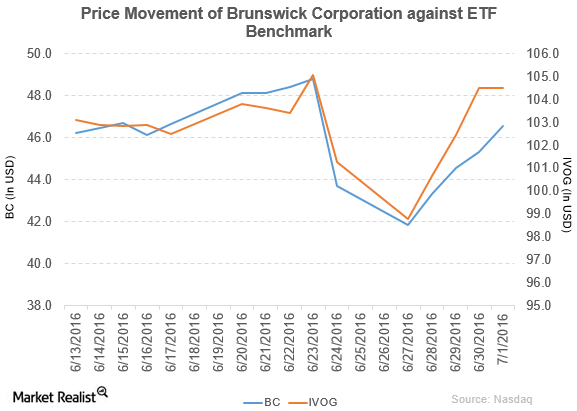

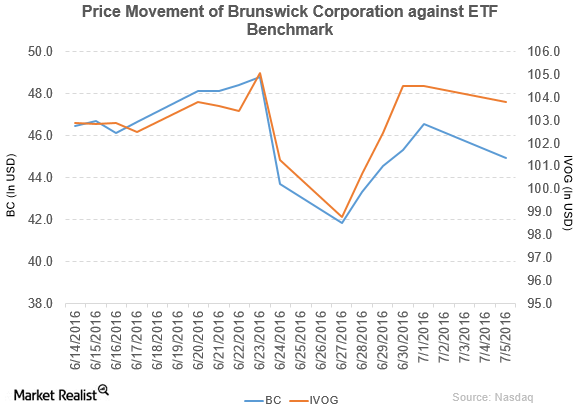

Why Did Brunswick Change Its Revolving Credit Facility?

Brunswick (BC) rose by 6.6% to close at $46.54 per share at the end of the fifth week of June 2016.

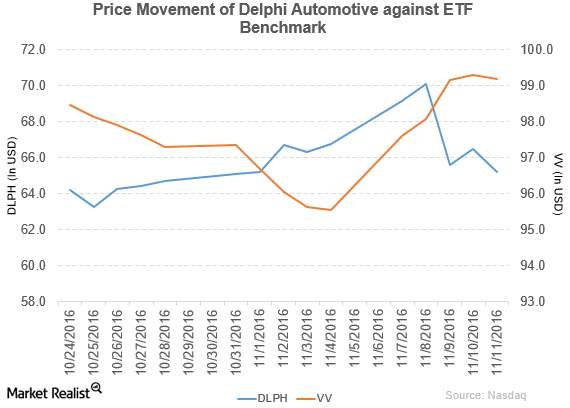

Bank of America Merrill Lynch Downgraded Delphi to ‘Underperform’

Delphi Automotive (DLPH) fell 1.9% to close at $65.23 per share during the second week of November 2016.

Why Is Newell Brands Selling Its Tool Business?

Newell Brands reported 2Q16 net sales of $3.9 billion—a rise of 143.8% compared to net sales of $1.6 billion in 2Q15.

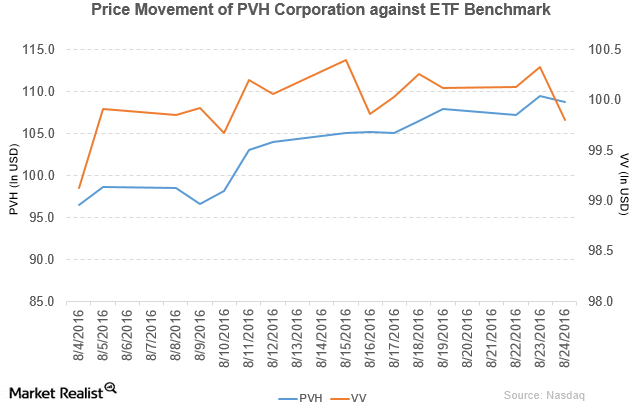

How Did PVH Corporation Perform in 2Q16?

PVH Corporation (PVH) has a market cap of $8.9 billion. It fell by 0.67% to close at $108.82 per share on August 24, 2016.

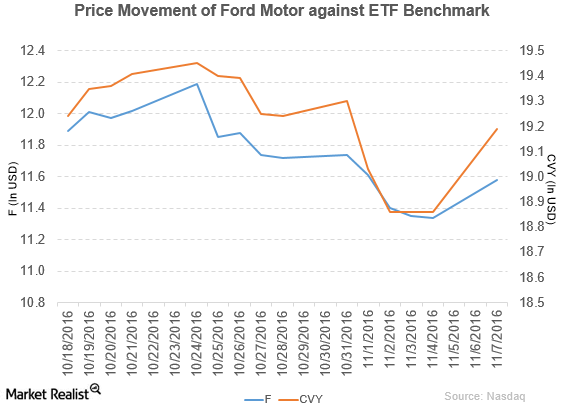

How Did Ford Motor’s Sales in China Turn Out in October 2016?

Price movement Ford Motor (F) has a market cap of $46.2 billion. It rose 2.1% to close at $11.58 per share on November 7, 2016. The stock’s weekly, monthly, and year-to-date (or YTD) price movements were -1.4%, -4.6%, and -12.1%, respectively, on the same day. Ford is trading 1.4% below its 20-day moving average, 3.4% […]

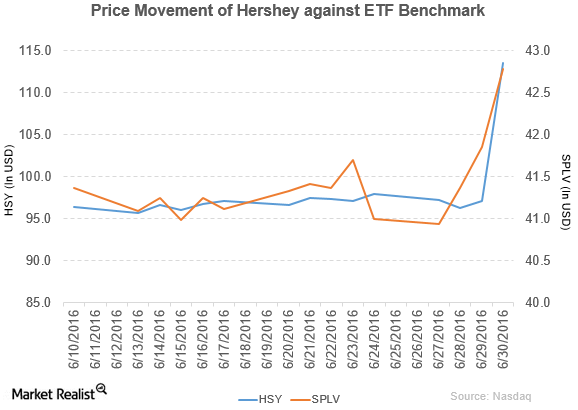

Why Did Hershey’s Stock Rise on June 30?

The Hershey Company (HSY) has a market cap of $24.2 billion. Its stock rose by 16.8% to close at $113.49 per share on June 30, 2016.

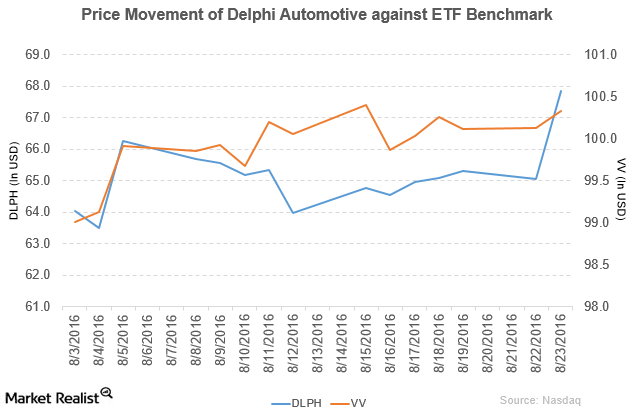

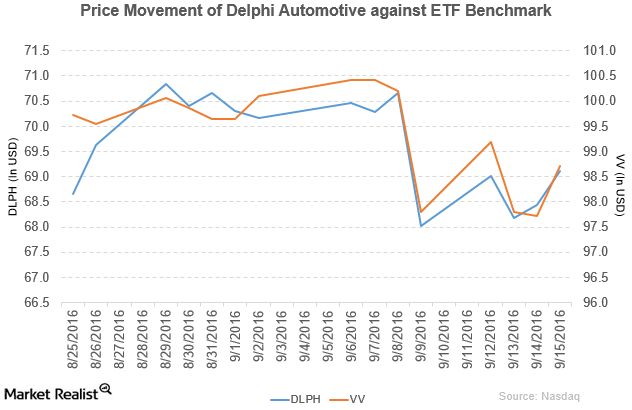

Why Did Delphi Automotive Partner with Mobileye?

Delphi Automotive (DLPH) has a market cap of $18.5 billion. It rose by 4.3% and closed at $67.86 per share on August 23, 2016.

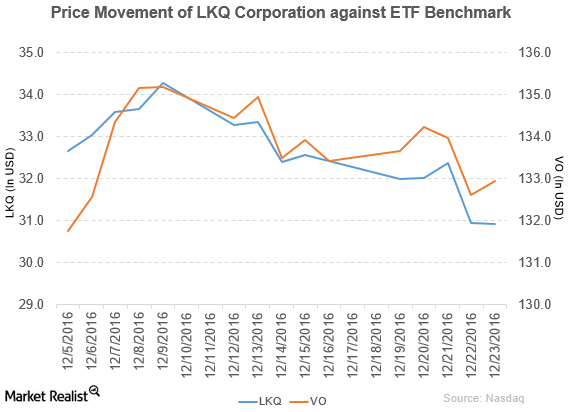

LKQ’s New Plans and Moody’s Comments

LKQ (LKQ) fell 4.6% to close at $30.93 per share during the third week of December 2016.

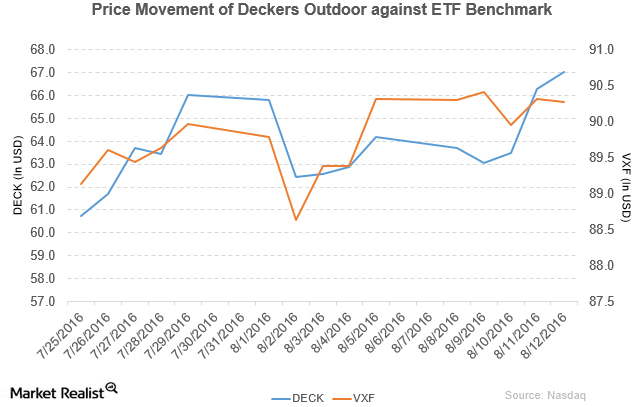

Susquehanna Rates Deckers Outdoor as ‘Neutral’

Deckers Outdoor (DECK) has a market cap of $2.1 billion. It rose by 1.1% to close at $67.01 per share on August 12, 2016.

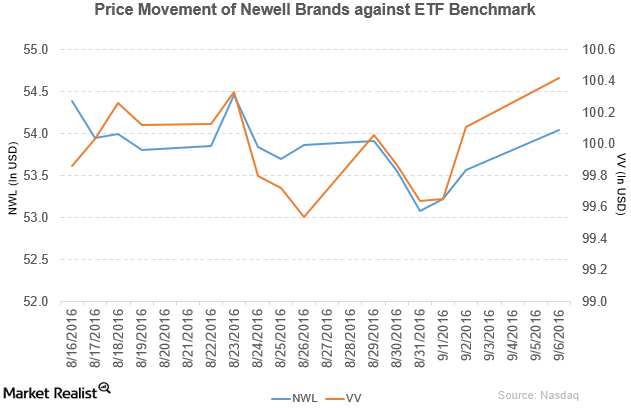

Newell Brands Reaffirms Its Fiscal 2016 Projections

Newell Brands (NWL) has a market cap of $25.9 billion. It rose by 0.88% to close at $54.04 per share on September 6, 2016.

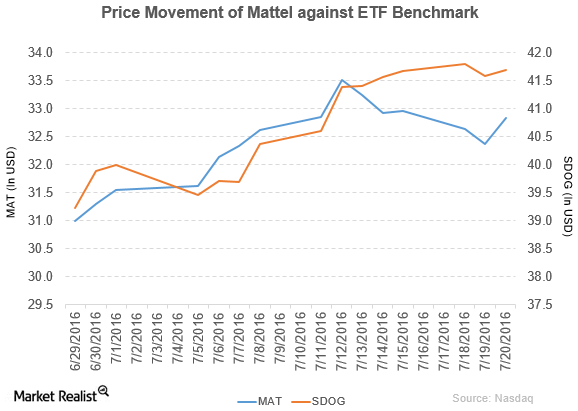

How Mattel Performed during the Second Quarter of 2016

Mattel (MAT) has a market cap of $11.2 billion. It rose by 1.4% to close at $32.83 per share on July 20, 2016.

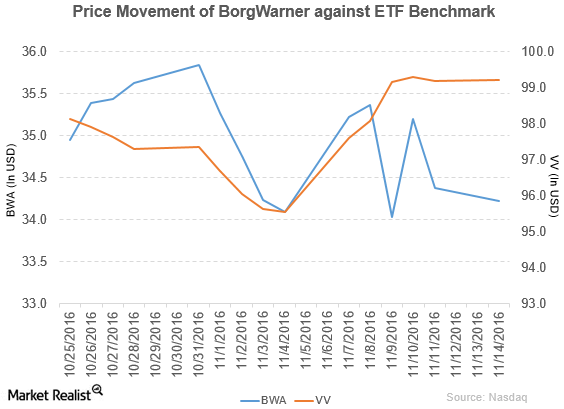

BorgWarner Announces the Appointment of Investor Relations VP

BorgWarner (BWA) reported 3Q16 net sales of $2.2 billion, a rise of 15.8% over the net sales of $1.9 billion in 3Q15.

Newell Brands Plans Its Growth Strategies

In 2Q16, Newell Brands’s net income and earnings per share fell to $135.2 million and $0.30, respectively, compared with $148.5 million and $0.55, respectively, in 2Q15.

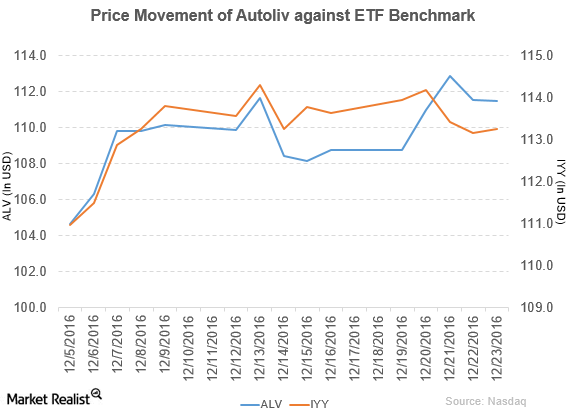

What’s the Latest News on Autoliv?

Autoliv (ALV) rose 2.5% to close at $111.46 per share during the third week of December 2016.

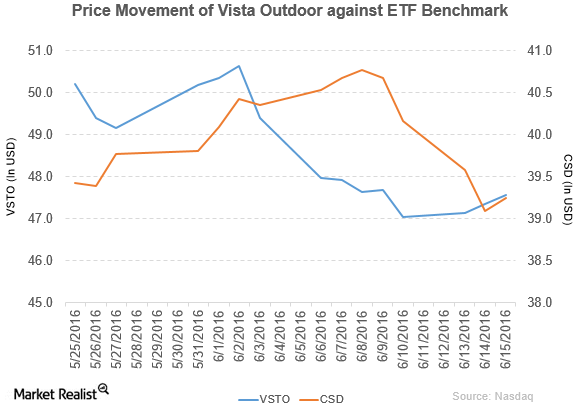

Roth Capital Rated Vista Outdoor as a ‘Buy’

Vista Outdoor (VSTO) has a market cap of $2.9 billion. It rose by 0.44% to close at $47.56 per share on June 15, 2016.

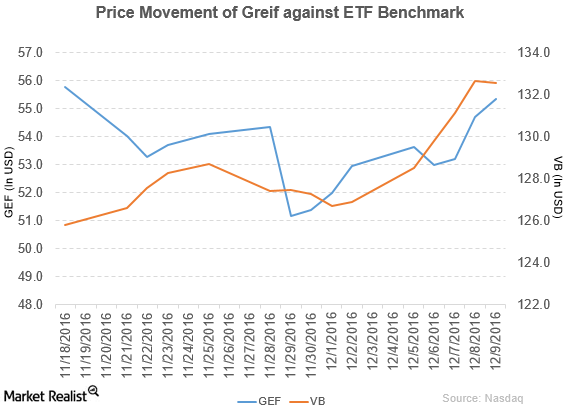

How Did Greif Perform in Fiscal 4Q16?

Greif (GEF) rose 4.6% to close at $55.35 per share during the first week of December 2016.

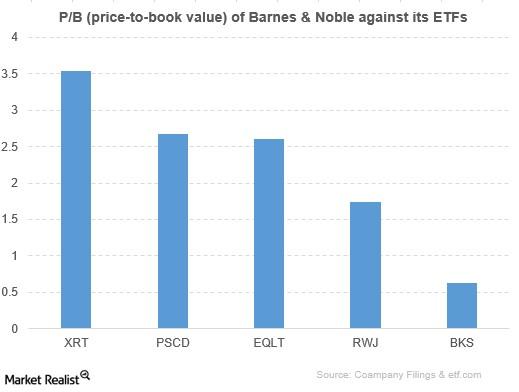

How Did Barnes & Noble Perform Compared to Its Competitors?

Barnes and Noble’s price-to-book value ratio is 0.63. Based on its price movement and PBV ratio, Barnes & Noble is performing well behind its ETFs.

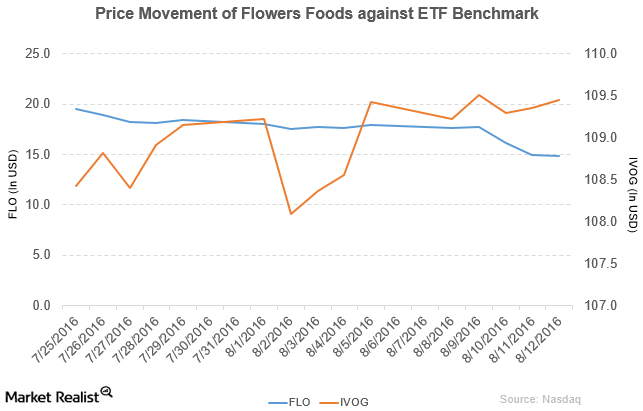

Stephens Reduces Flowers Foods’ Price Target to $14 per Share

Flowers Foods (FLO) has a market cap of $3.1 billion. It fell by 0.67% to close at $14.85 per share on August 12, 2016.

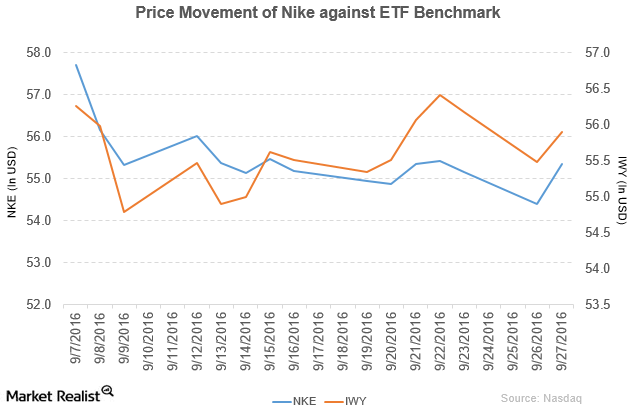

How Did Nike Perform in 1Q17?

Nike (NKE) has a market cap of $92.9 billion. It rose 1.7% to close at $55.34 per share on September 27, 2016.

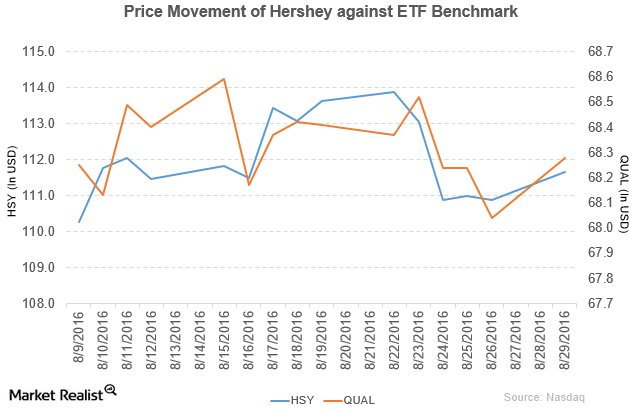

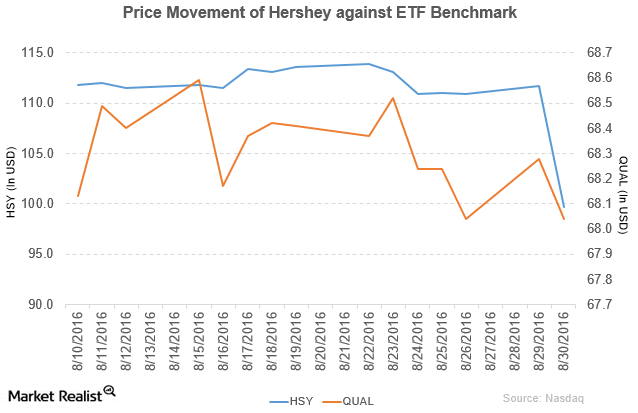

The Hershey Company Shows Mixed Price Movement on August 29

The Hershey Company (HSY) has a market cap of $23.8 billion. It rose by 0.71% to close at $111.67 per share on August 29, 2016.

Why Did Delphi Automotive Issue Senior Notes Due in 2046?

Delphi Automotive (DLPH) has a market cap of $19.6 billion. It rose 0.98% and closed at $69.11 per share on September 15, 2016.

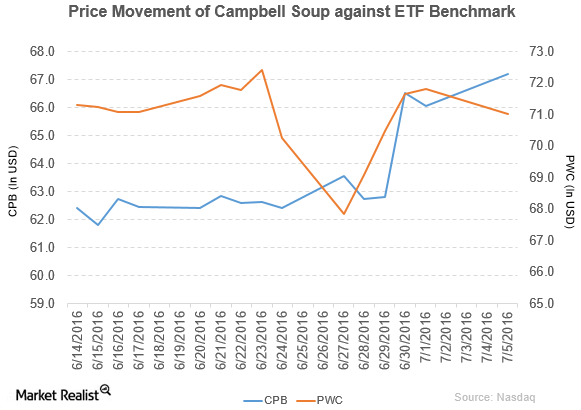

Campbell Soup’s Efforts to Make GMO Labeling Mandatory

Campbell Soup Company (CPB) has a market cap of $20.9 billion. Its stock rose by 1.7% to close at $67.19 per share on July 5, 2016.

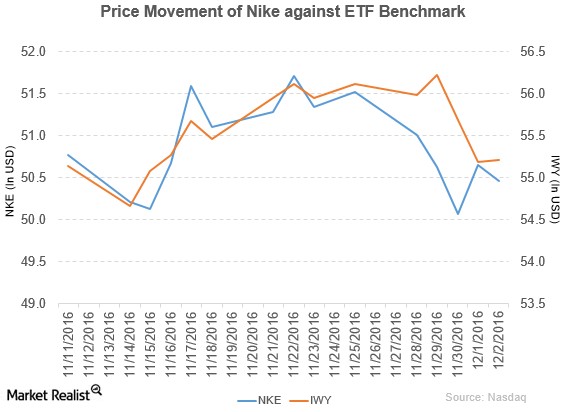

Nike Announces the Launch of New Products

Nike (NKE) fell 1.7% to close at $50.46 per share during the fifth week of November 2016.

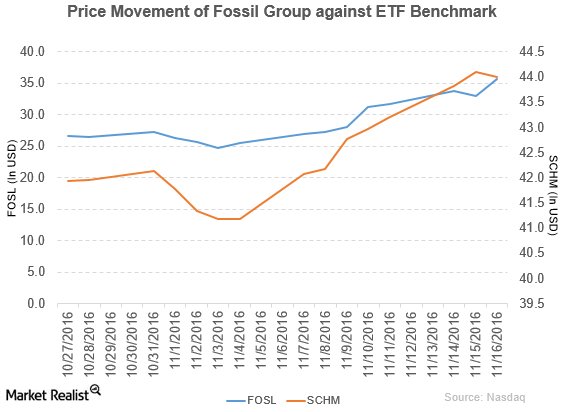

KeyBanc Capital Markets Upgrades Fossil to ‘Overweight’

Fossil Group (FOSL) has a market cap of $1.6 billion. It rose 8.4% to close at $35.70 per share on November 16, 2016.

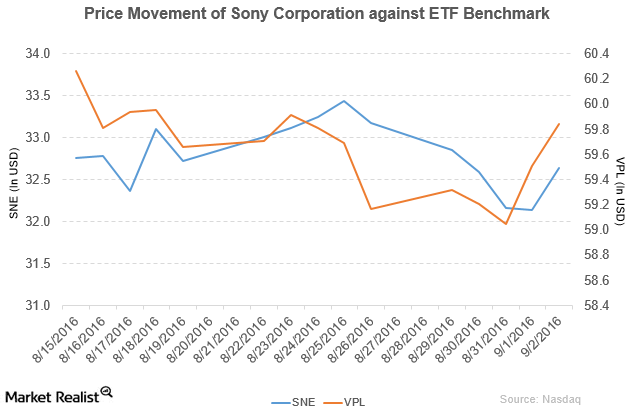

Sony Announces New Plans for Future Growth

Sony fell by 1.6% to close at $32.64 per share during the fifth week of August, with weekly, monthly, and YTD price movements of -1.6%, 0.12%, and 32.6%.

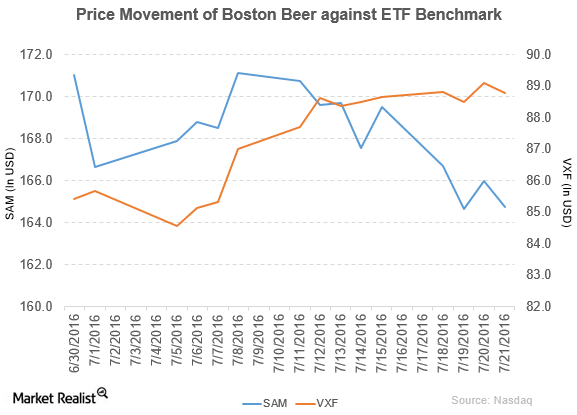

How Did Boston Beer Perform in 2Q16?

Boston Beer reported fiscal 2Q16 net revenue of $244.8 million, a fall of 2.9% compared to net revenue of $252.2 million in fiscal 2Q15.

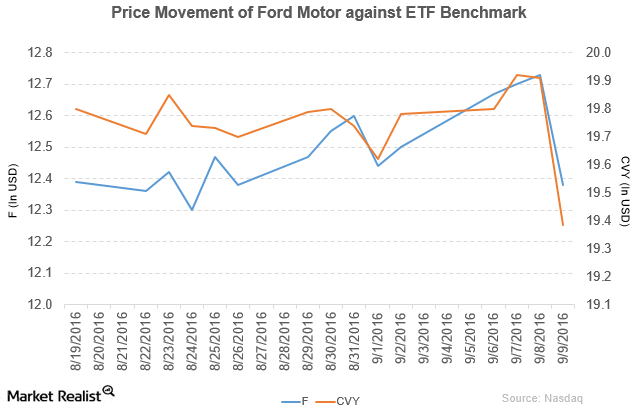

Ford Motor Elects John Weinberg to Its Board of Directors

Ford Motor (F) fell 0.96% to close at $12.38 per share during the first week of September 2016.

Why Did Brunswick Corporation Acquire Thunder Jet?

Brunswick Corporation (BC) has a market cap of $4.1 billion. Its stock fell by 3.4% to close at $44.95 per share on July 5, 2016.

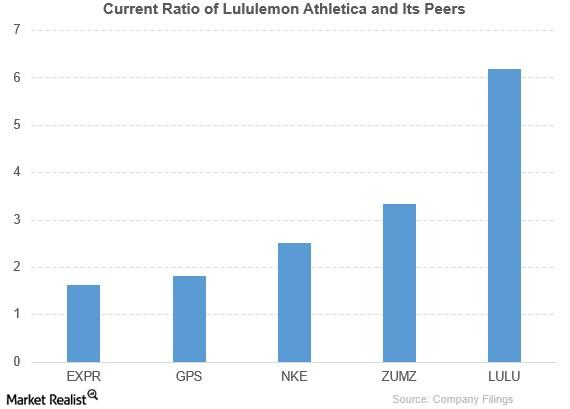

How Does Lululemon Athletica Compare with Its Peers?

Lululemon Athletica has outperformed its competitors, based on gross profit margin, current ratio, and PE in 2Q15.

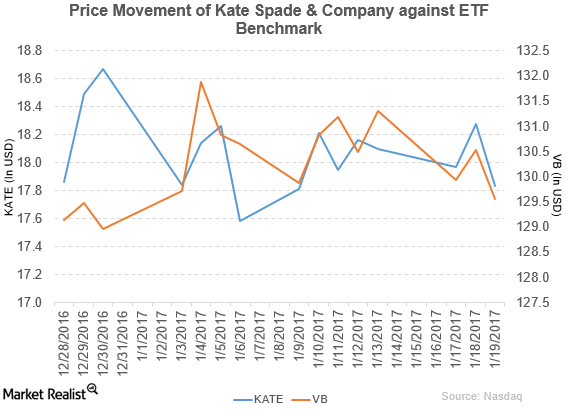

Bank of America/Merrill Lynch Downgrades Kate Spade to ‘Neutral’

Kate Spade (KATE) reported fiscal 3Q16 net sales of $316.5 million—a rise of 14.1% compared to net sales of $277.3 million in fiscal 3Q15.

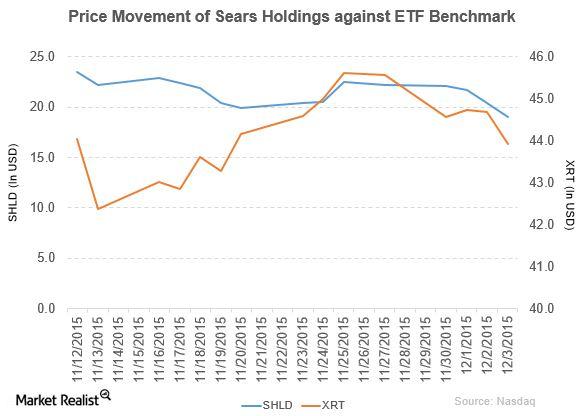

Sears Holdings’ Revenue Fell, Income Rose in Fiscal 3Q15

Sears has a market cap of $2.0 billion. Its YTD price movement both rose and fell in fiscal 2015. After it released its fiscal 3Q15 report, SHLD fell by 6.9%.

Why Did Hershey Fall by 10.8% on August 30?

The Hershey Company (HSY) has a market cap of $21.3 billion. It fell by 10.8% to close at $99.65 per share on August 30, 2016.

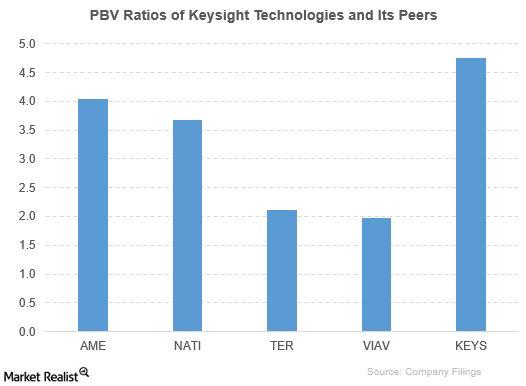

How Does Keysight Technologies Compare to Its Peers?

The Guggenheim Spin-Off ETF (CSD) invests 5.0% of its holdings in Keysight Technologies.