Wabco Holdings Inc

Latest Wabco Holdings Inc News and Updates

Deutsche Bank Rated Wabco Holdings as a ‘Hold’

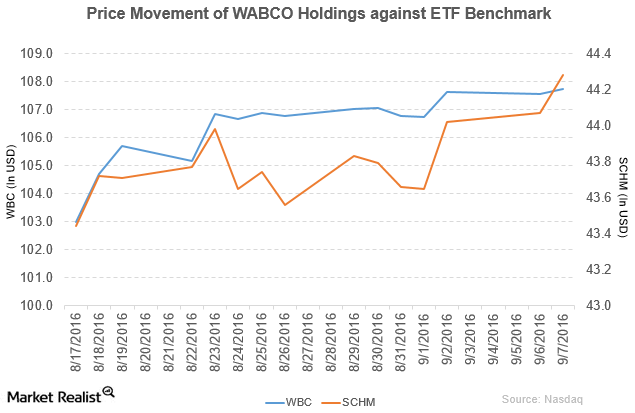

Wabco Holdings (WBC) has a market cap of $6.0 billion. It rose by 0.15% to close at $107.73 per share on September 7, 2016.

Wabco Holdings Enjoyed Top and Bottom Line Growth in 2Q16

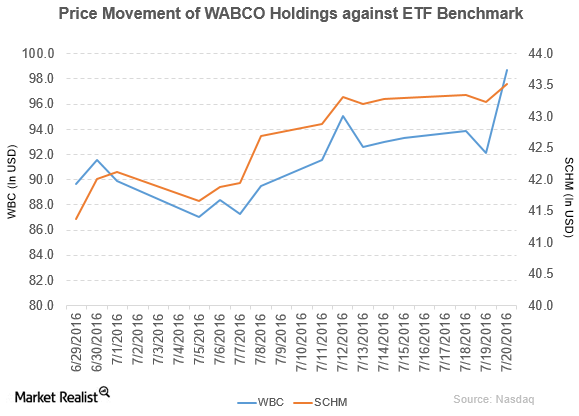

Wabco Holdings (WBC) has a market cap of $5.5 billion. It rose by 7.2% to close at $98.72 per share on July 20, 2016.

Bank of America-Merrill Lynch Downgrades WABCO to ‘Neutral’

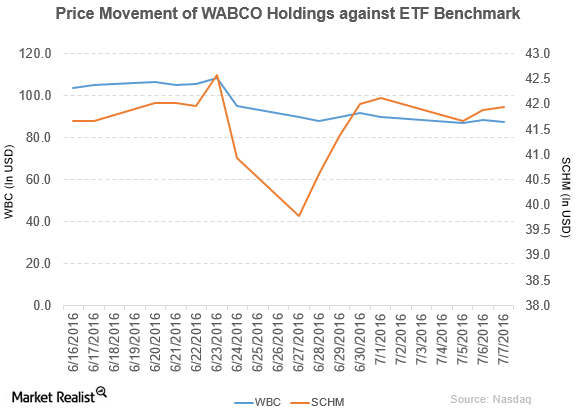

WABCO Holdings fell by 1.3% to close at $87.26 per share on July 7. The stock’s weekly, monthly, and YTD price movements were -2.7%, -20.3%, and -14.7%.

Why Goldman Sachs and Piper Jaffray Downgraded WABCO to ‘Neutral’

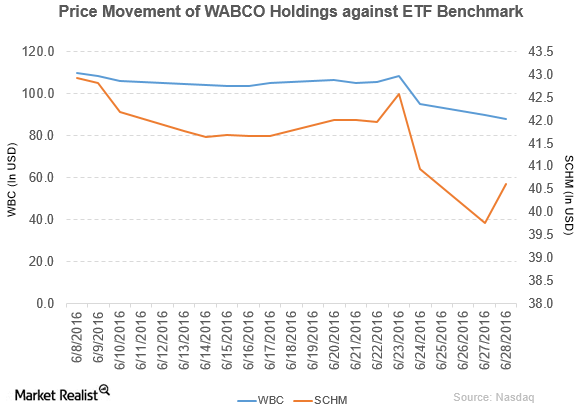

WABCO Holdings (WBC) has a market cap of $5.0 billion. It fell 2.0% to close at $88.07 per share on June 28.