Nike Inc

Latest Nike Inc News and Updates

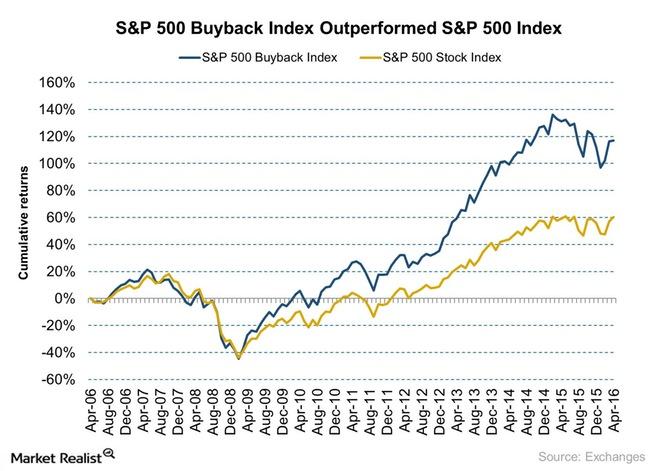

Carl Icahn’s View on Share Buybacks Is Divided

Apple (AAPL) is one of the most cash-rich companies in the US. While Carl Icahn has been talking about share buybacks artificially inflating the Market and asset values, some buybacks have occurred as a result of his push.

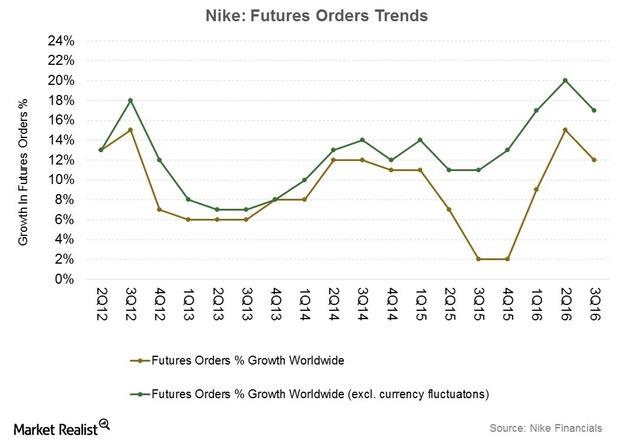

What Can We Expect from Nike’s Wholesale Channel in Fiscal 3Q16?

The wholesale channel is the largest channel for Nike’s (NKE) sales.

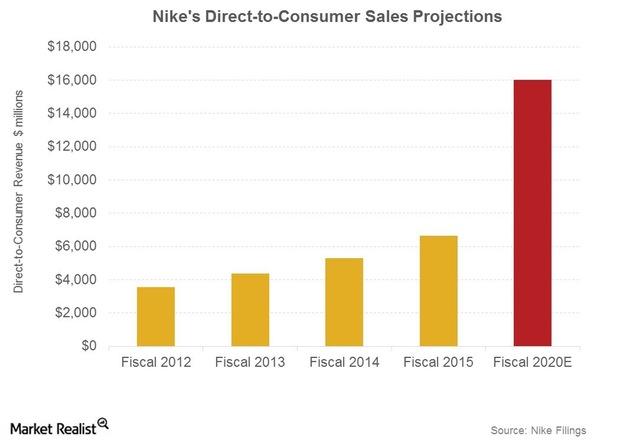

Why Is Nike Focusing on the Direct-To-Consumer Channel?

Nike’s (NKE) DTC (direct-to-consumer) (XLY) (FXD) channel includes sales made online on Nike.com and through its own retail stores.

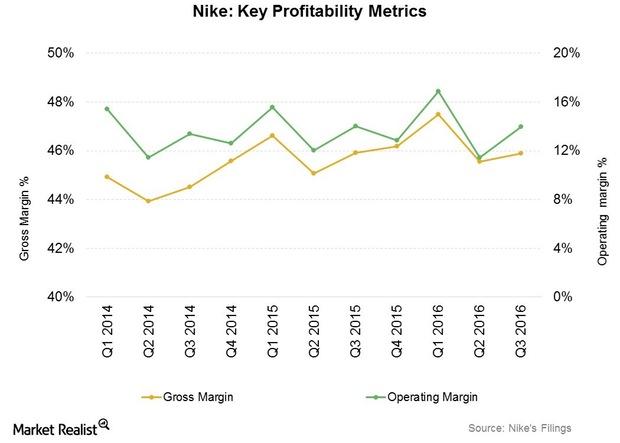

How Nike Has Sustained Profitability despite Headwinds

Nike’s profitability in fiscal 3Q16 was helped by better-than-average performance in North America and Greater China, two of its most profitable segments.

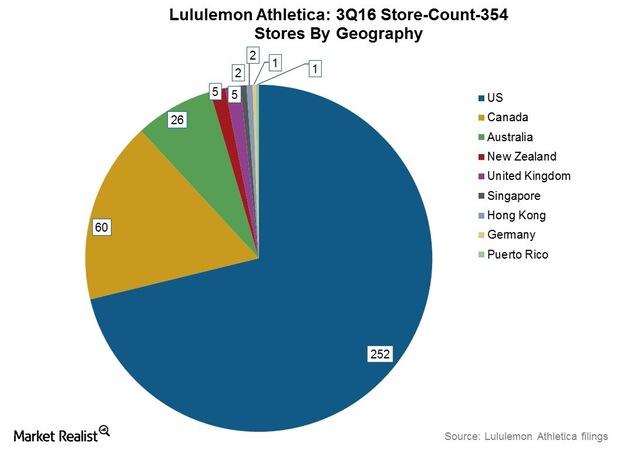

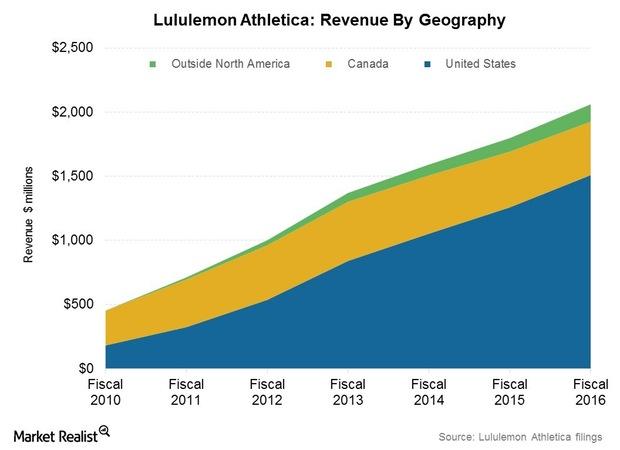

Why Lululemon Athletica Expects Stronger Sales in Fiscal 4Q16

Growth company Lululemon Athletica (LULU) has revised its fourth quarter (fiscal 4Q16) and full-year (fiscal 2016) revenue guidance upwards.

Five-Year Plan: Lululemon’s Long-Term Vision and Goals

Over the next five years, Lululemon Athletica (LULU) is aiming to double its revenue to $4 billion with an expected mid-single-digit growth rate in store comps.

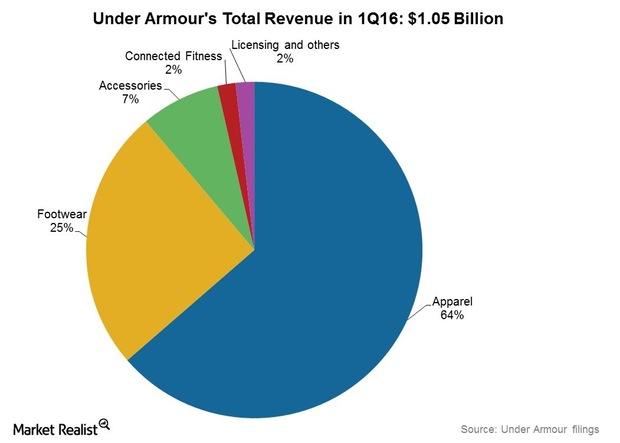

What Drove Under Armour’s 30% Revenue Jump in 1Q16?

Under Armour (UA) grew revenue by 30% to $1.05 billion in 1Q16. This was the company’s 24th straight quarter of more than 20% growth in its top line.

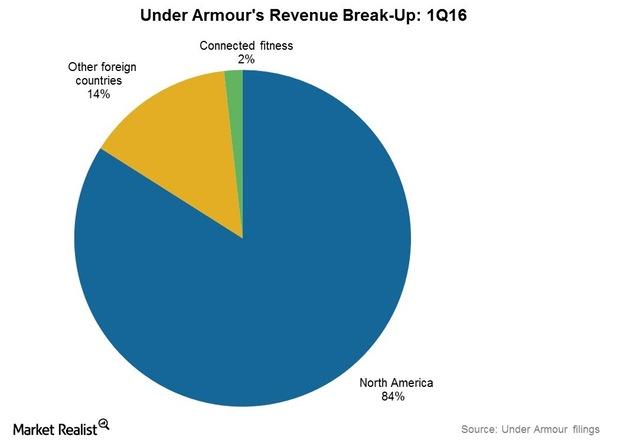

What Led to Under Armour’s Massive International Growth in 1Q16?

Under Armour’s (UA) international sales grew 55.6% to almost $150 million in 1Q16. Sales growth in overseas markets came in at 64.6% in currency-neutral terms.

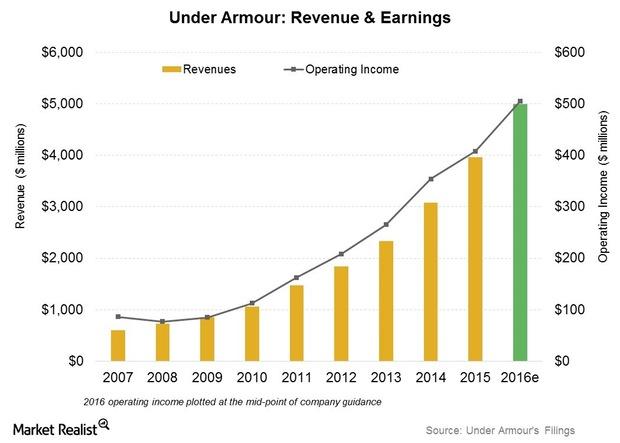

How Much Has Under Armour Increased Revenue Guidance?

Under Armour raised the higher end of its 2016 operating income estimate to $503 million–$507 million, implying a growth rate of 23.1%–24.1% over 2015.

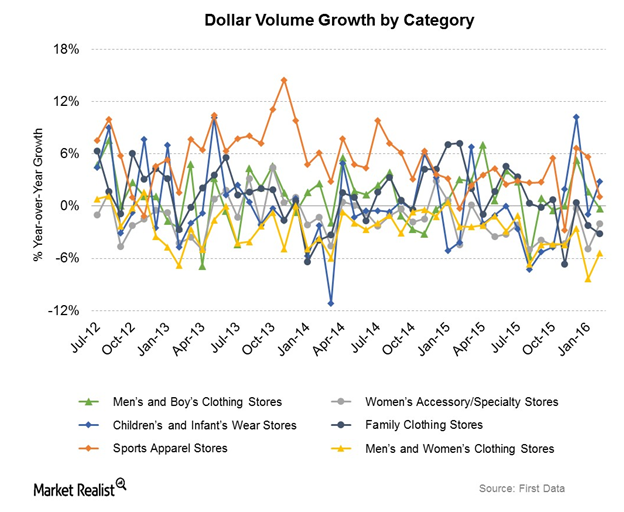

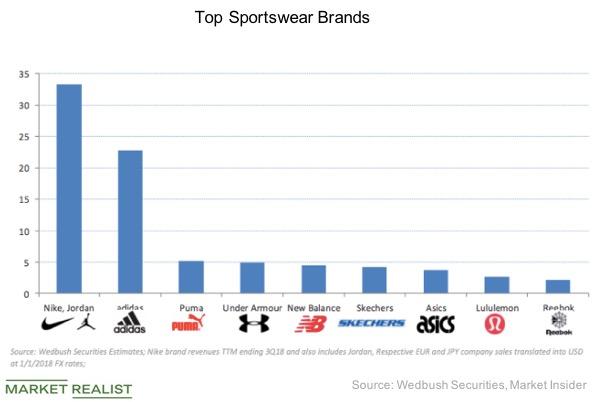

Athleisurewear Giants: Which Companies Dominate Activewear?

The athleisurewear category has had a boost from higher interest in physical well-being globally and by increased participation by women in sports and other fitness activities.

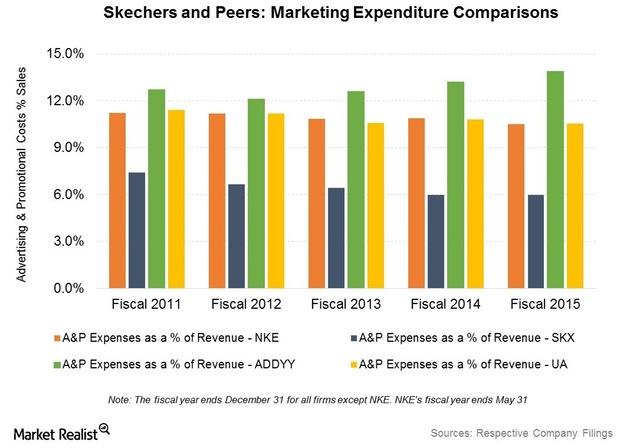

Marketing and Branding: How Skechers Sells Its Footwear Products

To maintain its market share and drive sales, Skechers spends considerable time and effort in marketing activities to promote its footwear globally.

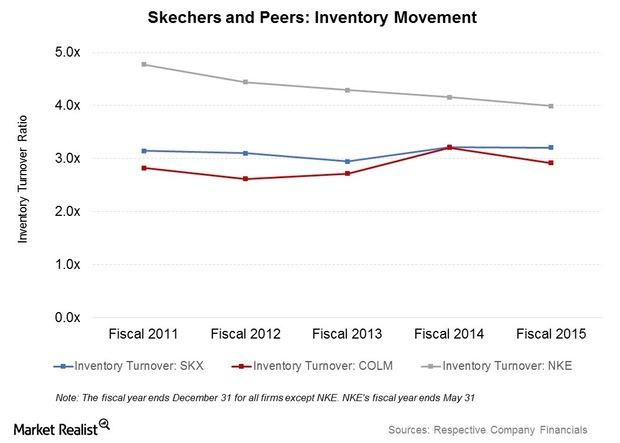

How Does Skechers Manage Its Inventory and Distribution?

In recent years, Skechers has reported improved working capital metrics. The company’s inventory turnover (or ITR) rose from 2.9x in 2013 to 3.2x in 2015.

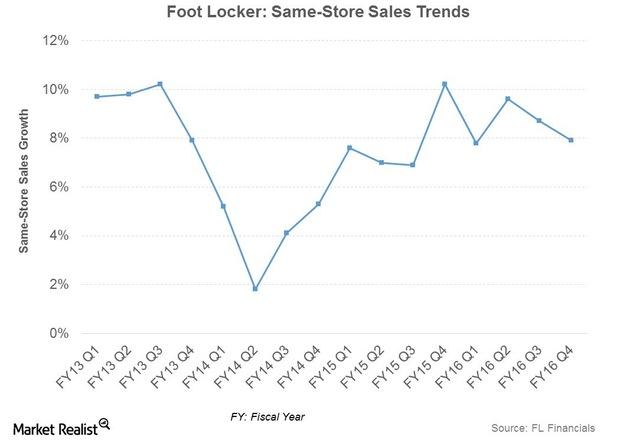

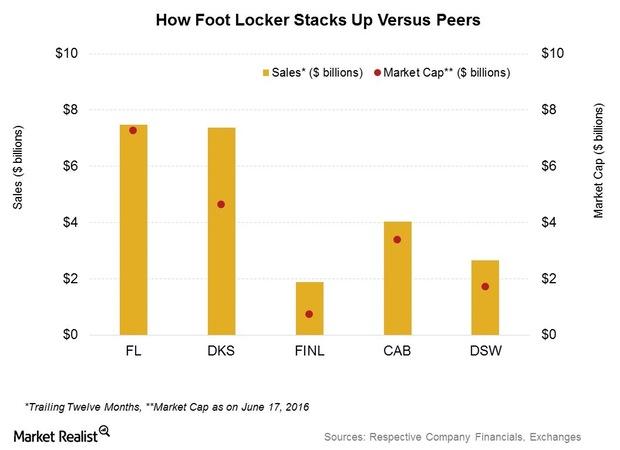

Porter’s Five Forces: What’s Foot Locker’s Industry Position?

In this part, we’ll look at industry forces affecting sporting goods retailers. We’ll also look at Foot Locker’s competitive positioning based on Porter’s Five Forces

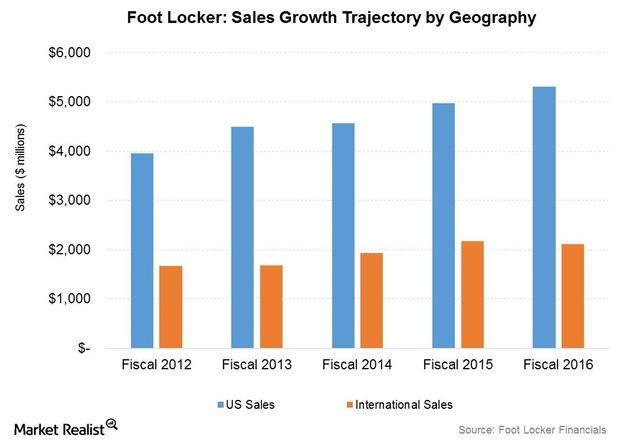

Fleet of Foot? Foot Locker’s Fastest-Growing Sales Segments

In fiscal 2016, Foot Locker made $5.3 billion in US sales, representing 71.6% of its total revenue. In contrast, international revenue came in at $2.1 billion.

Foot Locker’s e-Commerce Sales Growth: Potential and Prospects

Foot Locker (FL) operates several e-commerce websites under the Foot Locker and other store banners. It reports e-commerce sales under the direct-to-customer segment.

Why Is Foot Locker Eyeing Higher Growth in Europe?

Foot Locker (FL) made about 28.4% of its sales, or $2.1 billion, from outside the United States in fiscal 2016.

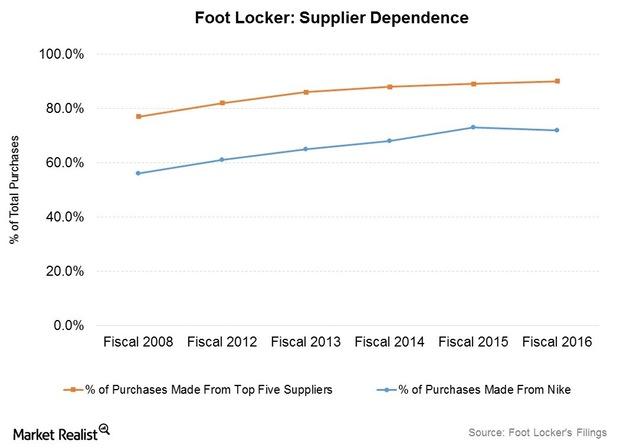

Analyzing the Cogs in Foot Locker’s Supply Chain

Foot Locker’s distribution and supply chain includes five distribution centers around the world. It owns two of them and leases three.

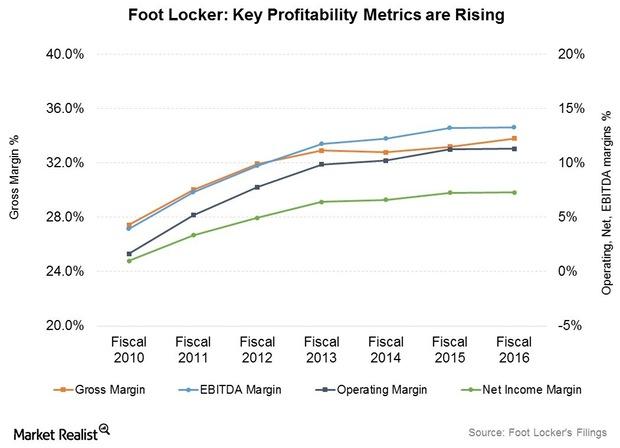

A Look at Foot Locker’s Cost Structure, Expanding Profitability

As part of its long-term plan, Foot Locker (FL) has been concentrating on enhancing its profitability margins and focusing on store remodels and improved service and product assortment.

The Catalysts Powering Nike’s Growth Performance in Fiscal 2016

Nike (NKE) is expected to post sales of $8.3 billion in fiscal 4Q16, an increase of 6.4% year-over-year, according to the Wall Street analysts’ consensus.

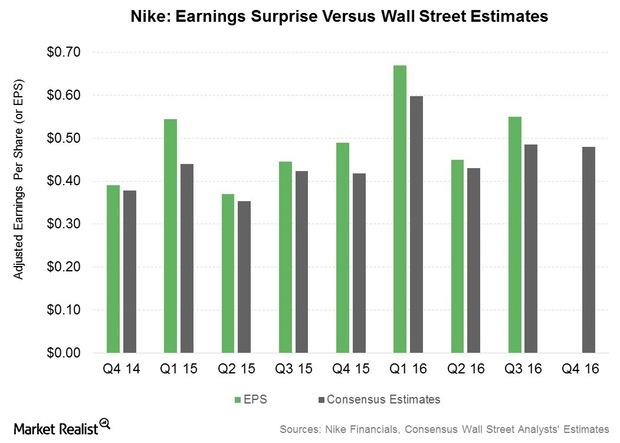

The Earnings Outlook for Nike in Fiscal 4Q16

After posting adjusted EPS growth rates exceeding 20% in the first three quarters of fiscal 2016, the earnings expectations for Nike (NKE) in the fourth quarter are modest.

Skechers Stock Falls on Mixed Third-Quarter Results

Skechers (SKX) stock was down 4.2% today in reaction to the footwear maker’s mixed third-quarter results. Find out what went wrong for the company.

Under Armour Stock Rises on CEO Succession Plan

Under Armour (UAA) stock was up 5.0% today after the company announced its CEO succession Founder Kevin Plank will step down as chairman and CEO

Nike Manufacturing and Supply Chain Strategies

Nike’s manufacturing network has over 525 factories. Products move from several distribution centers across a network of thousands of retail accounts.

Nike’s Pricing Power and Brand Drive Its Economic Moat

Giving it a competitive advantage, Nike’s pricing power is supported through premium innovation and a shift toward the direct-to-consumer business.

Why Nike Stock’s Uptrend Could Persist

Bank of America Merrill Lynch upgraded Nike stock (NKE) to “neutral” from “underperform” yesterday and raised its target price to $98 from $70.

Buying Nike Stock: Should You ‘Just Do It’?

Talk about a turnaround! After a swing and a miss in its July earnings report, Nike (NKE) is now the comeback kid. But is NKE stock still a buy?

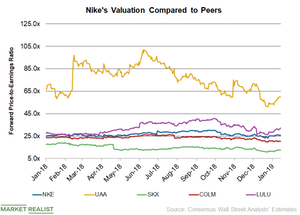

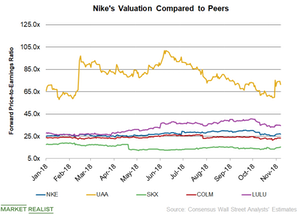

Comparing Nike’s PE Ratio with Its Peers

On January 14, Nike’s 12-month forward PE ratio was 25.8x. For fiscal 2019, analysts expect Nike’s adjusted EPS to increase 10.9% YoY to $2.65.

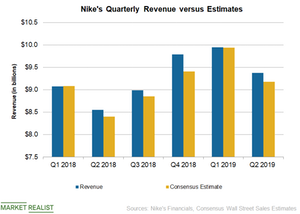

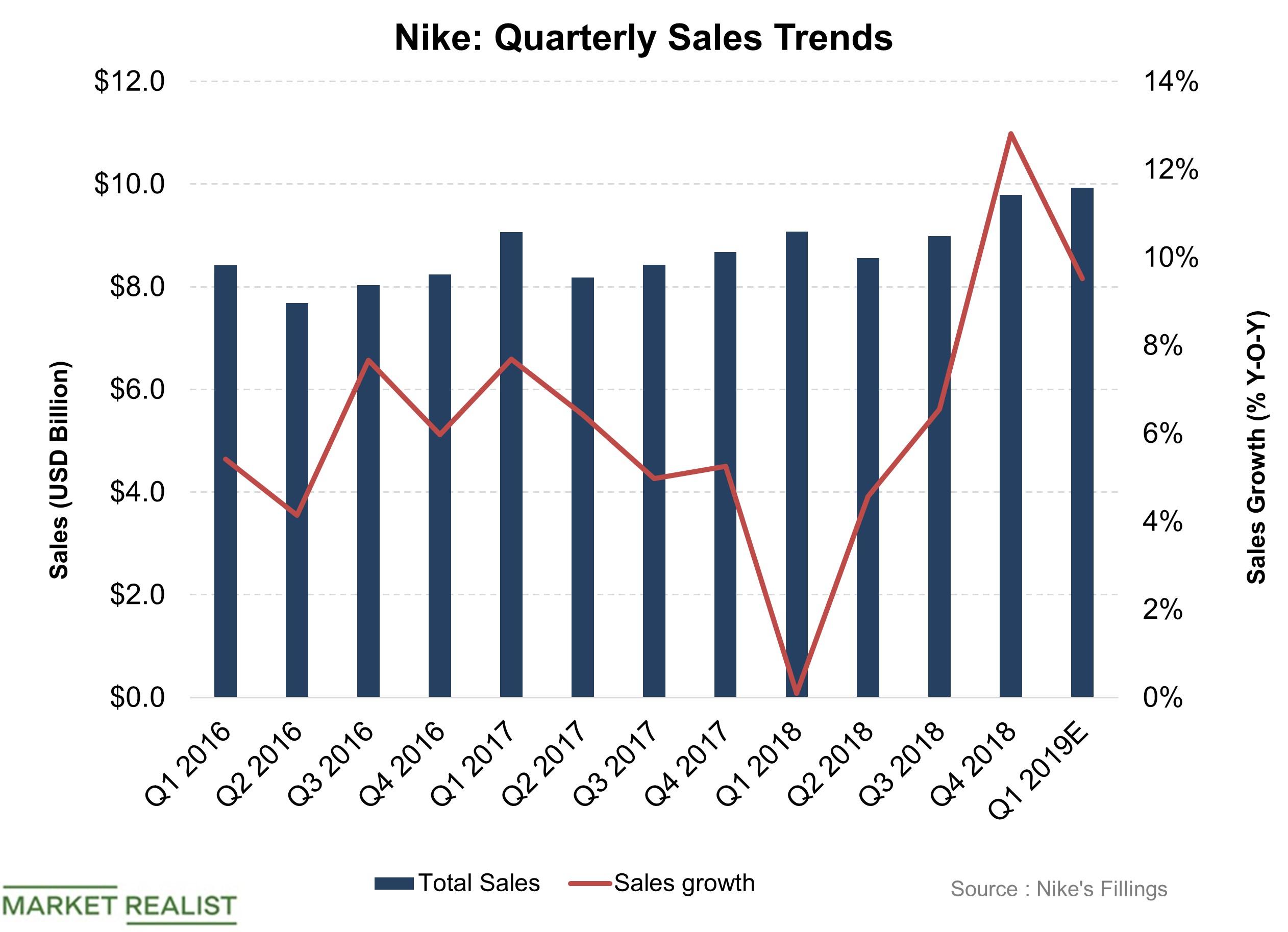

What Drove Nike’s Fiscal 2019 Second-Quarter Revenue

In the second quarter of fiscal 2019, Nike’s (NKE) revenue rose ~10% YoY (year-over-year) to $9.37 billion.

Nike Stock Rose 7.9% Due to Strong Q2 2019 Numbers

On December 20, Nike stock was trading 7.9% higher in after-market trading following its results for the second quarter of fiscal 2019.

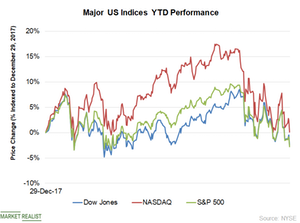

What Triggered the Broader Market Sell-Off in December?

The broader market sell-off started on December 1 when Huawei Technologies’ CFO Meng Wanzhou was arrested by Canadian authorities.

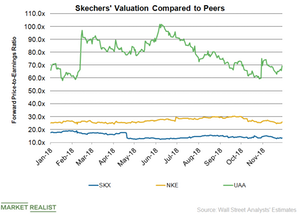

Skechers’ Valuation Compared to Its Peers

As of November 28, Skechers (SKX) was trading at a 12-month forward PE multiple of 13.6x.

How Nike’s Valuation Compares to Those of Its Peers

In fiscal 2019, analysts expect Nike’s sales to rise 7.6% to $39.2 billion and its EPS to surge ~11.0% to $2.65.

What Are Nike’s Key Growth Drivers in Fiscal 2019?

Nike’s total sales for fiscal 2018 increased 6% YoY to $34.5 billion. Its brand wholesale revenue increased 2%, and its DTC sales grew 12%.

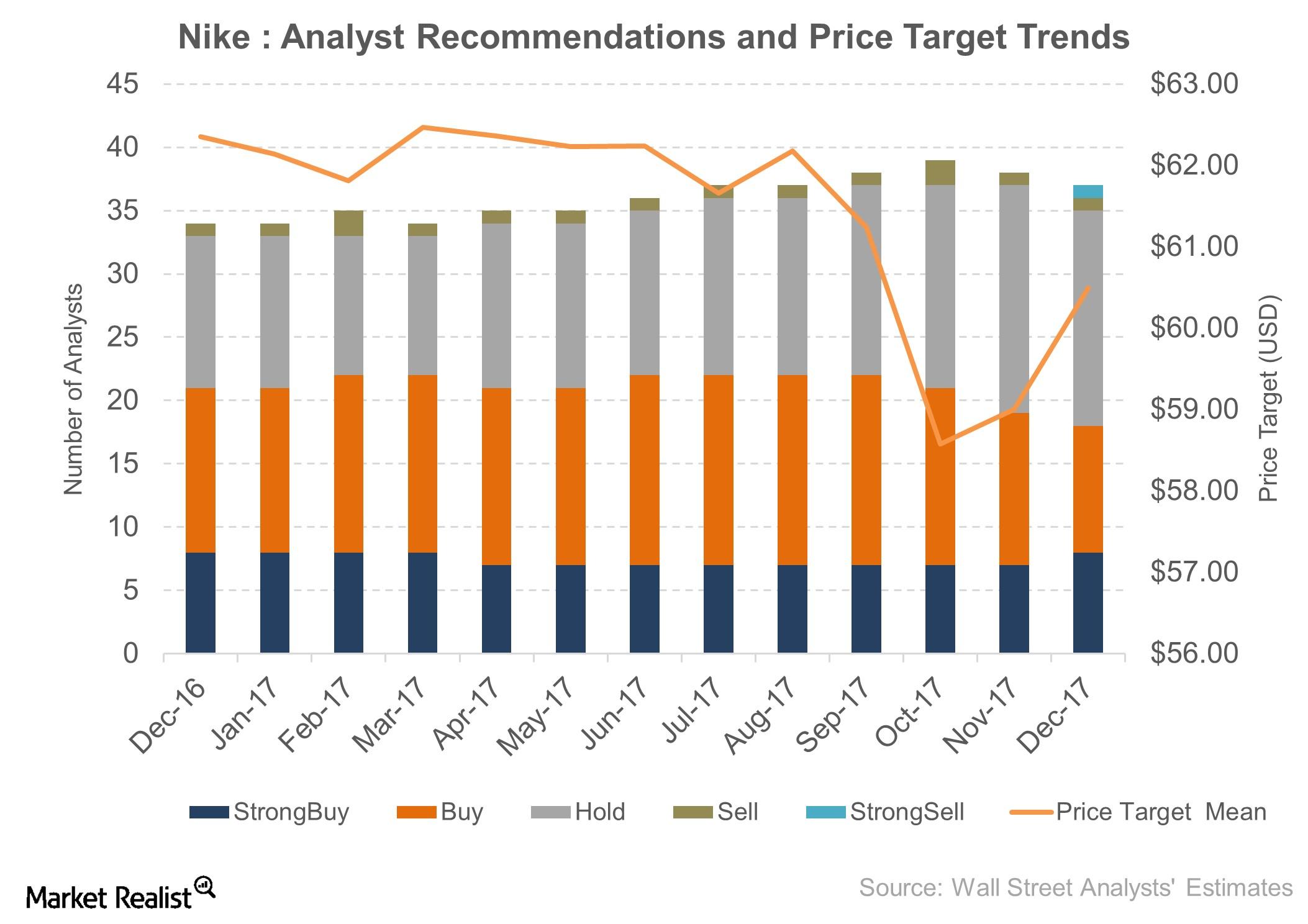

Nike: Top Dow Stock in 2018

Currently, 37 analysts track Nike stock. Of these analysts, ~59% recommended a “buy,” 35% recommended a “hold,” and 5% recommended a “sell.”

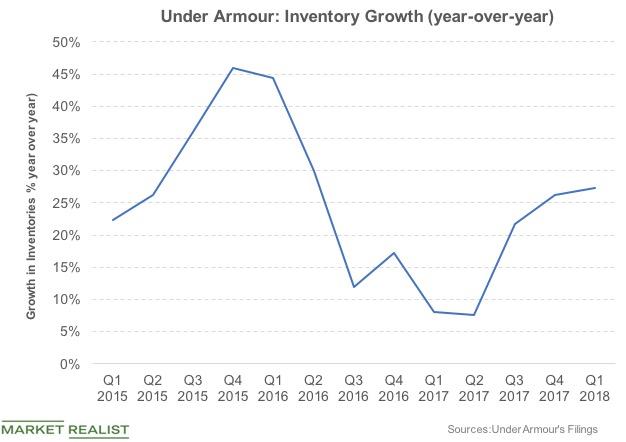

Under Armour: Inventory Management in Focus

Inventory backlog has been a critical pressing issue for Under Armour (UAA) for some time.

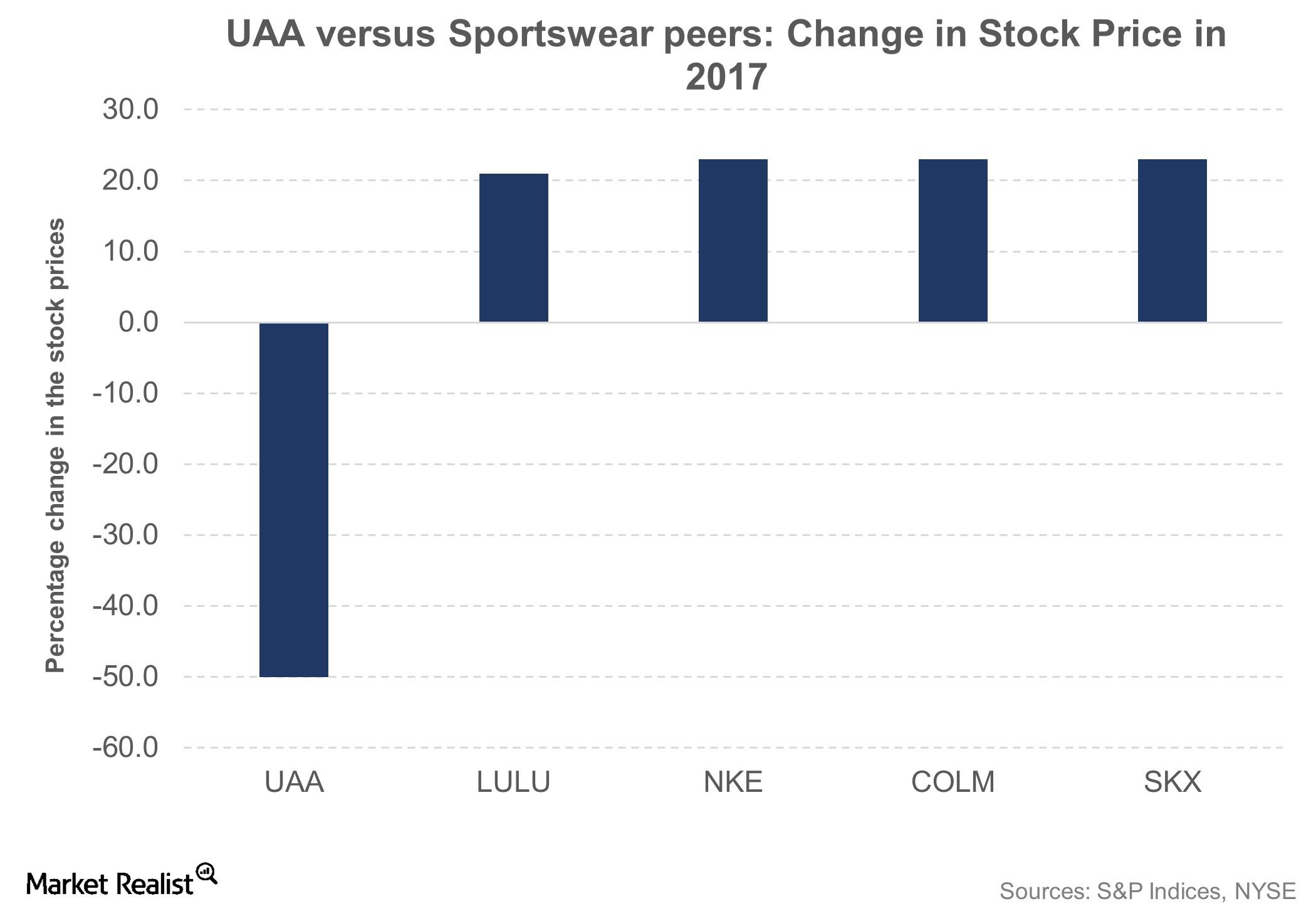

Under Armour: How It’s Placed among the Competition

Not long ago, Under Armour (UAA) challenged Nike’s (NKE) dominance in the sneaker market with the success of its Curry series.

What Are Kohl’s Other Growth Strategies?

Under its Greatness Agenda strategy, Kohl’s is revamping its merchandise offerings, emphasizing the omnichannel experience, and optimizing its marketing spending.

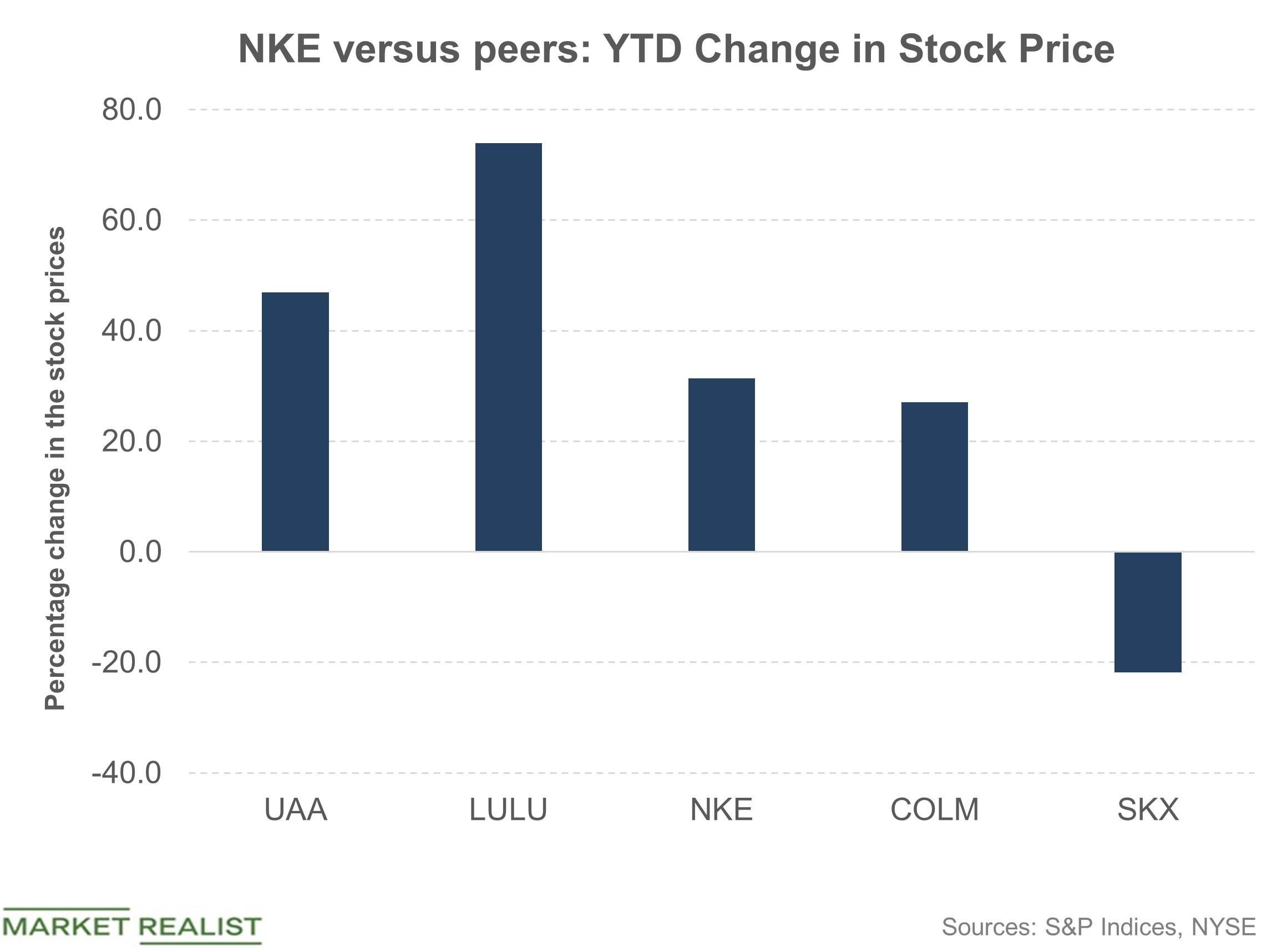

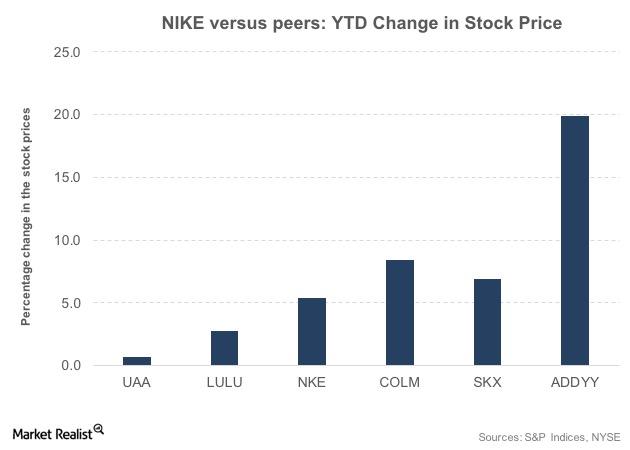

How Nike Stock Has Performed in 2018

Nike (NKE) delivered a strong performance in the stock market during 2017 with a 23% rise during the year.

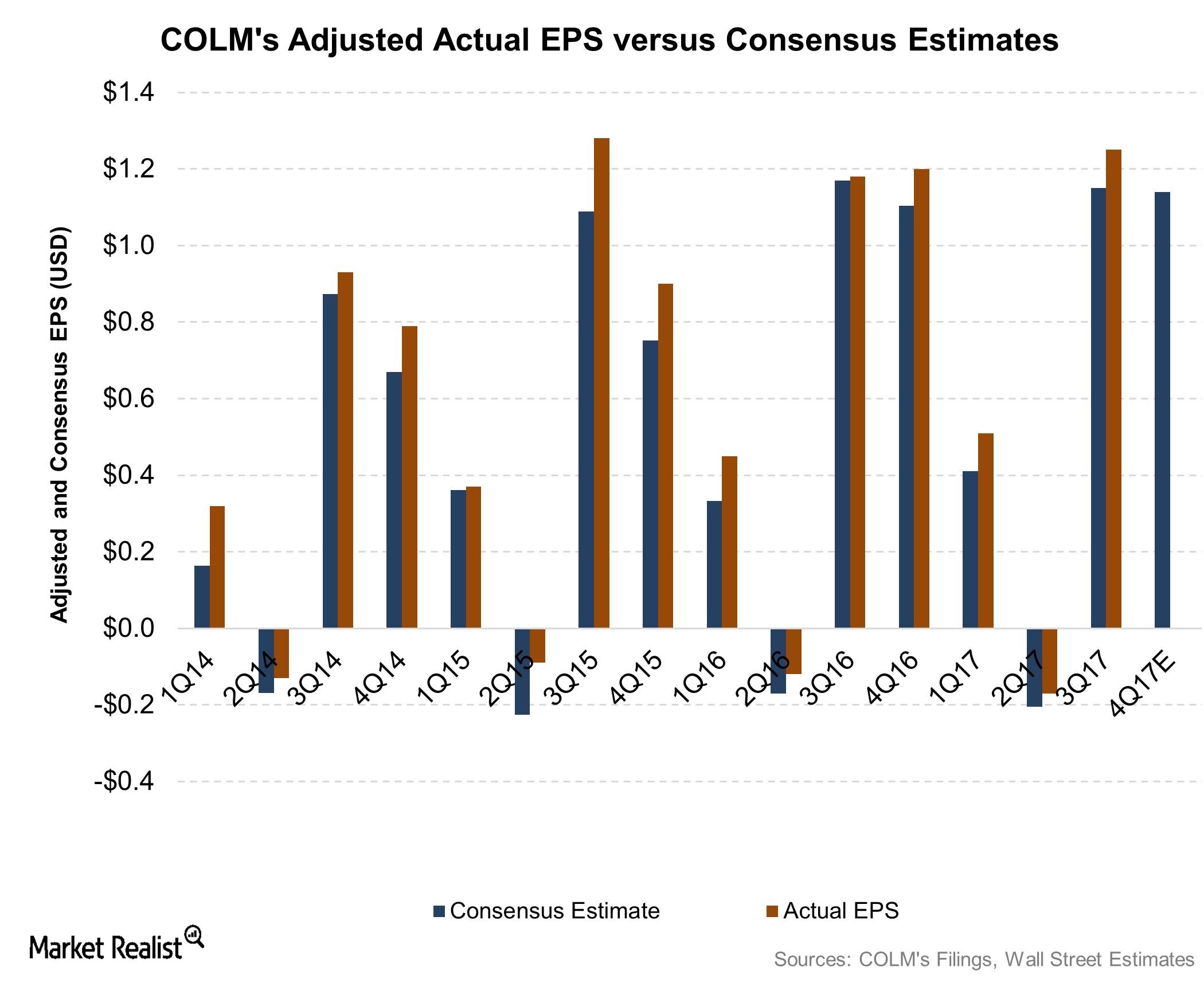

Columbia’s 4Q17 Preview: Can COLM Post Solid Results Again?

Portland-based Columbia Sportswear (COLM) plans to release its 4Q17 financial results on Thursday, February 8, 2018.

Under Armour Stock Slides after Macquarie Downgrade

Under Armour (UAA) started 2018 on a positive note and surged more than 10.0% in the first three trading days of the new year.

Recent Recommendation Changes for Nike

Nike (NKE) is a well-covered stock, tracked by 37 Wall Street analysts. The company is rated a “buy” by 49% of analysts, a “hold” by 46%, and a “sell” by 5%.

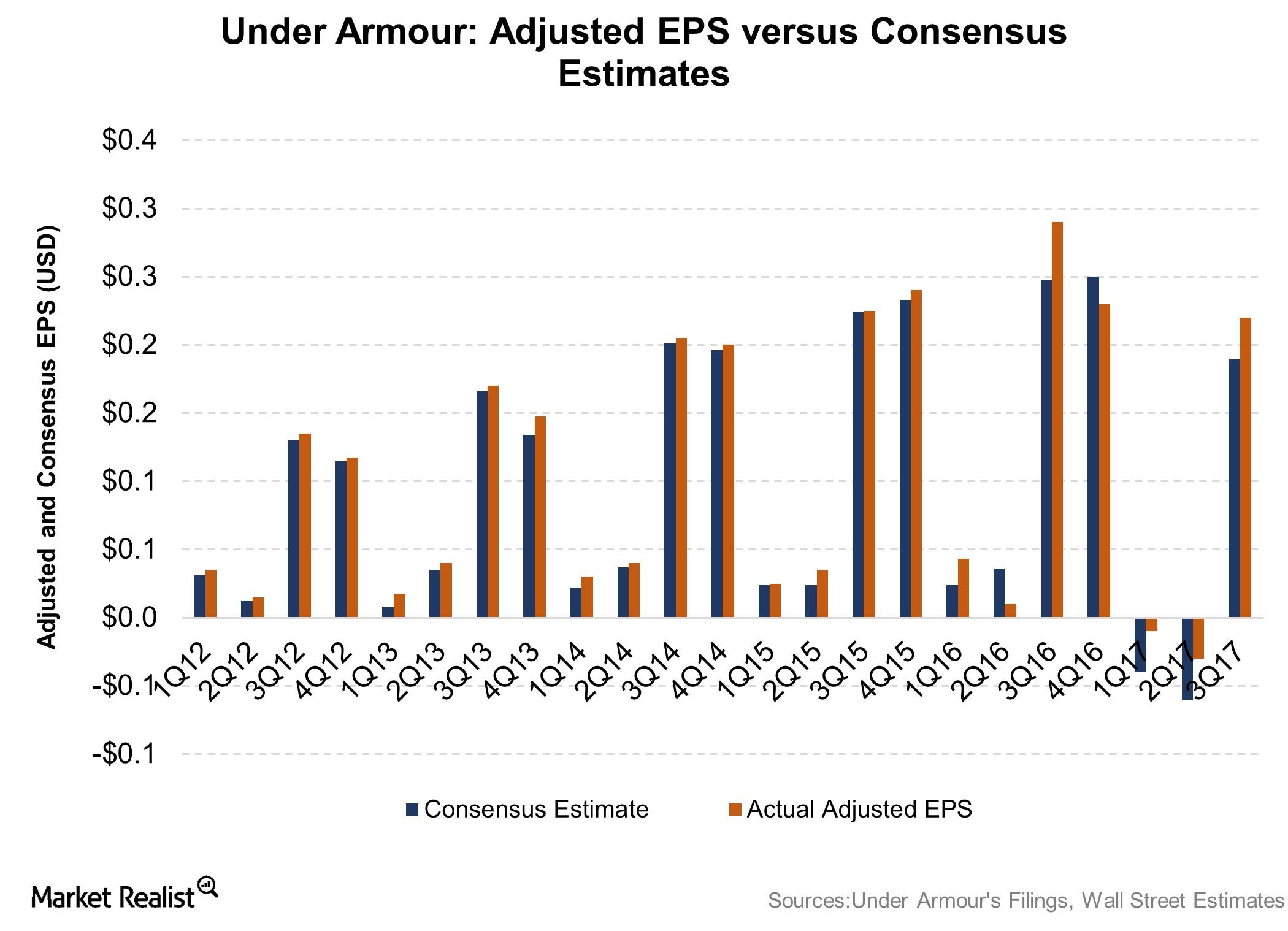

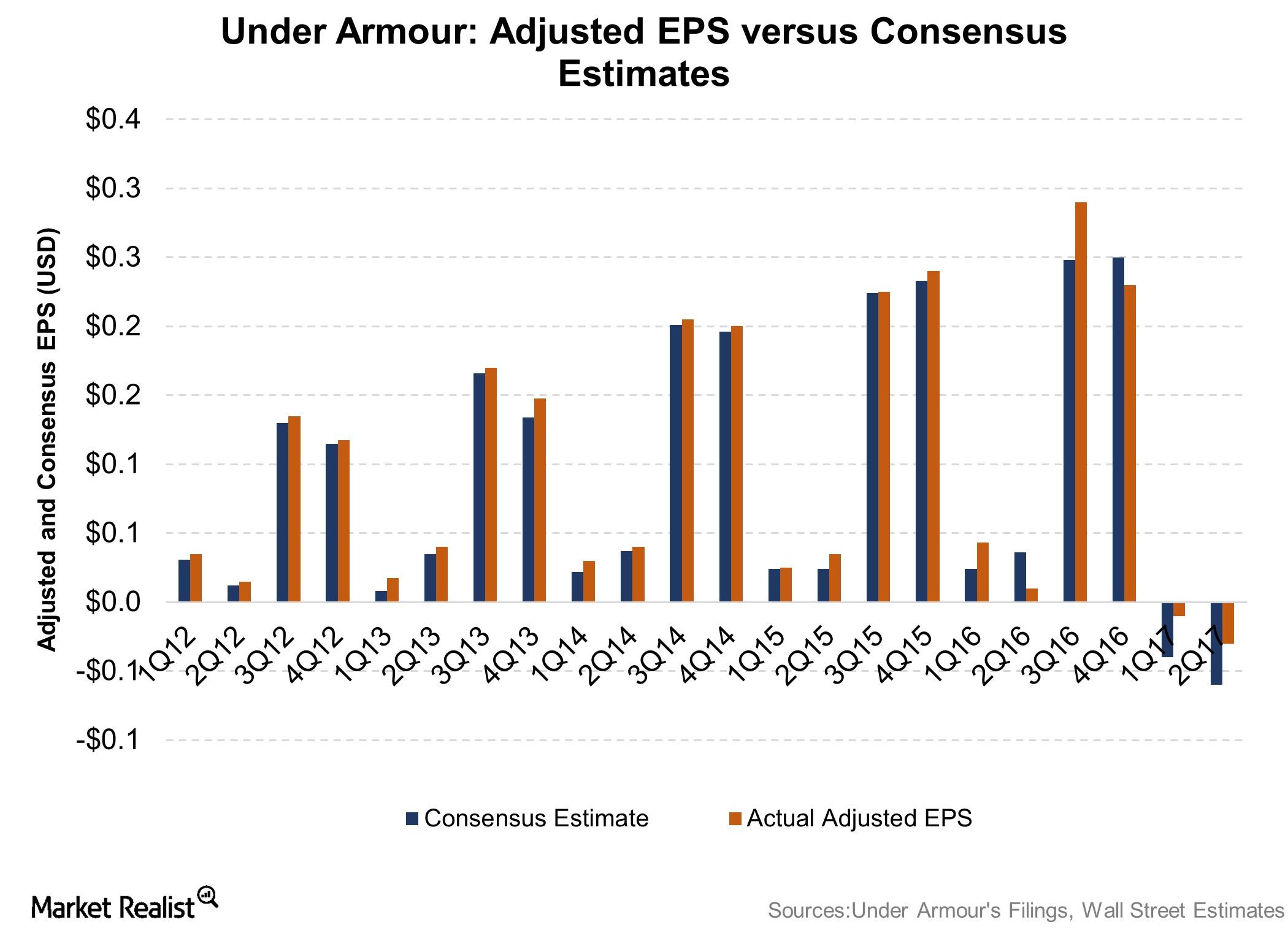

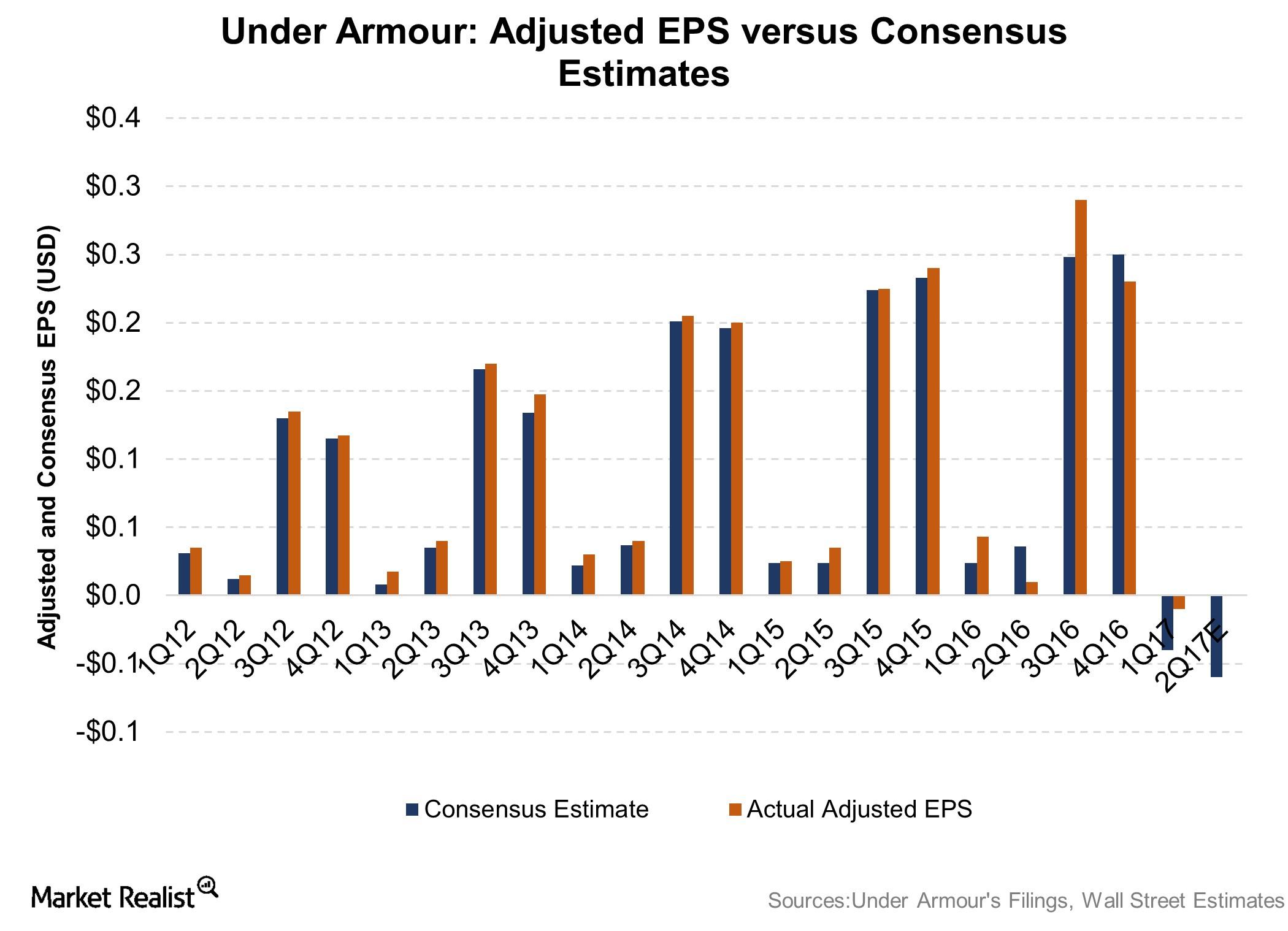

Under Armour Beats Earnings per Share Estimate by $0.03

Baltimore-based Under Armour (UAA) reported its 3Q17 results on October 31.

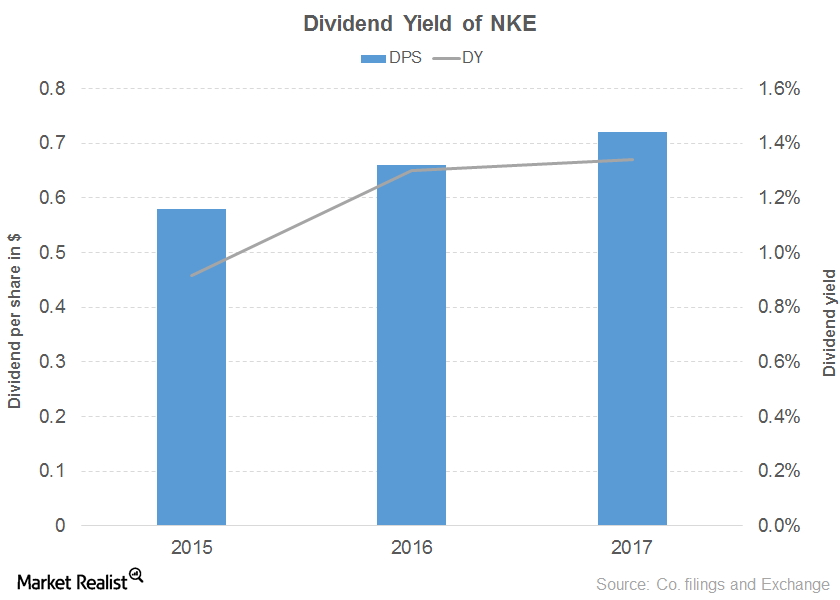

A Look at Nike’s Dividend Yield Curve

Nike’s (NKE) operating income rose 5.0% in 2017 compared to 8.0% in 2016 due to higher expenses and lower gross margins.

Under Armour Faces Target Price Cuts

Wall Street’s reaction to 2Q17 earnings Under Armour’s (UAA) 2Q17 results were followed by a host of analyst actions, ranging from target price cuts to downward revisions. The stock’s target price was revised by UBS (from $21 to $19), Canaccord Genuity (from $21 to $18), Stifel (from $19 to $18), Wedbush (from $18 to $17), […]

Under Armour Beats Top- and Bottom-Line Expectations

Baltimore-based Under Armour (UAA) reported its 2Q17 results on Tuesday, August 1. This series is an overview of Under Armour’s 2Q17 results.

Under Armour Reports a Loss Once Again in 2Q17

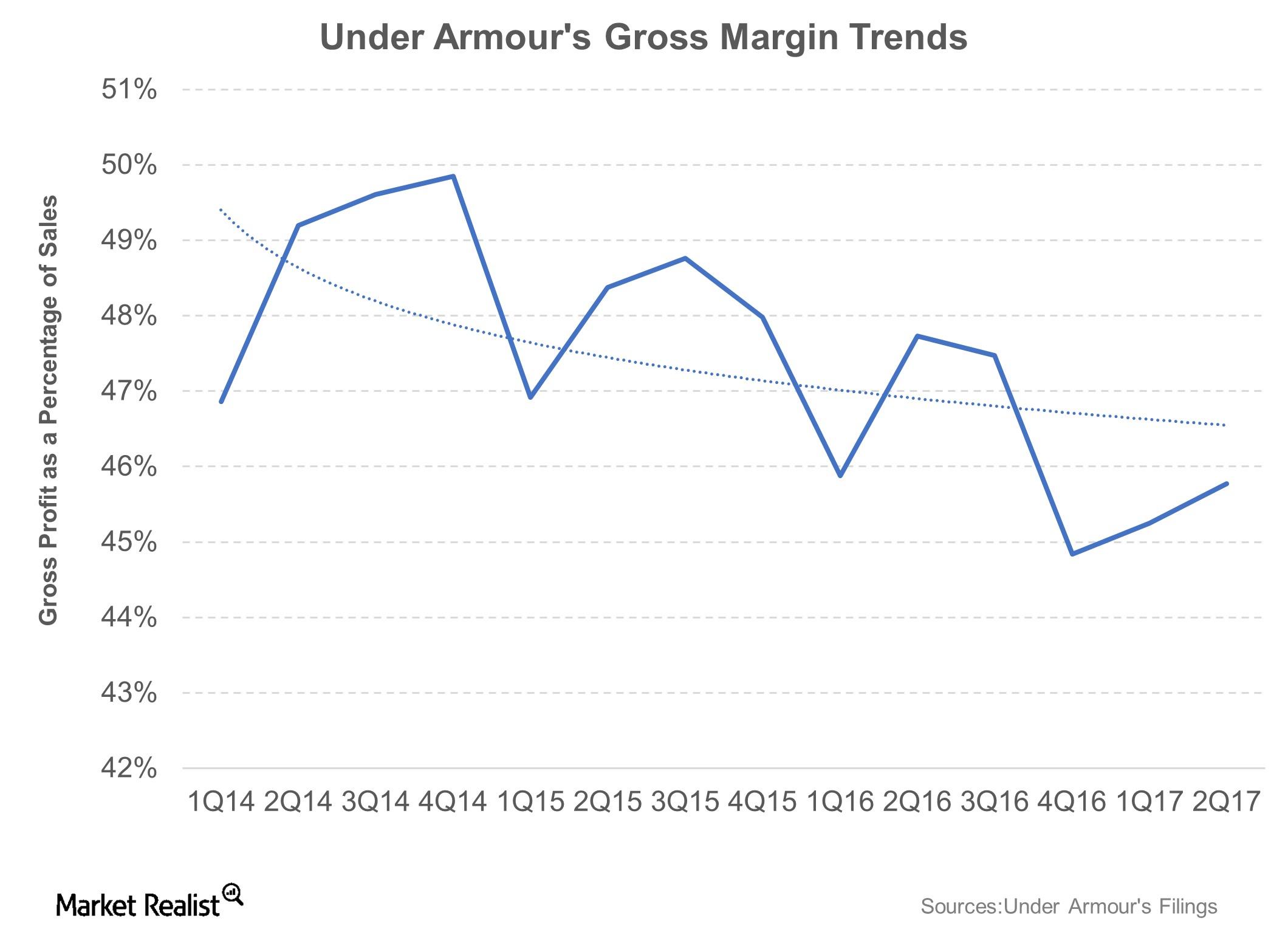

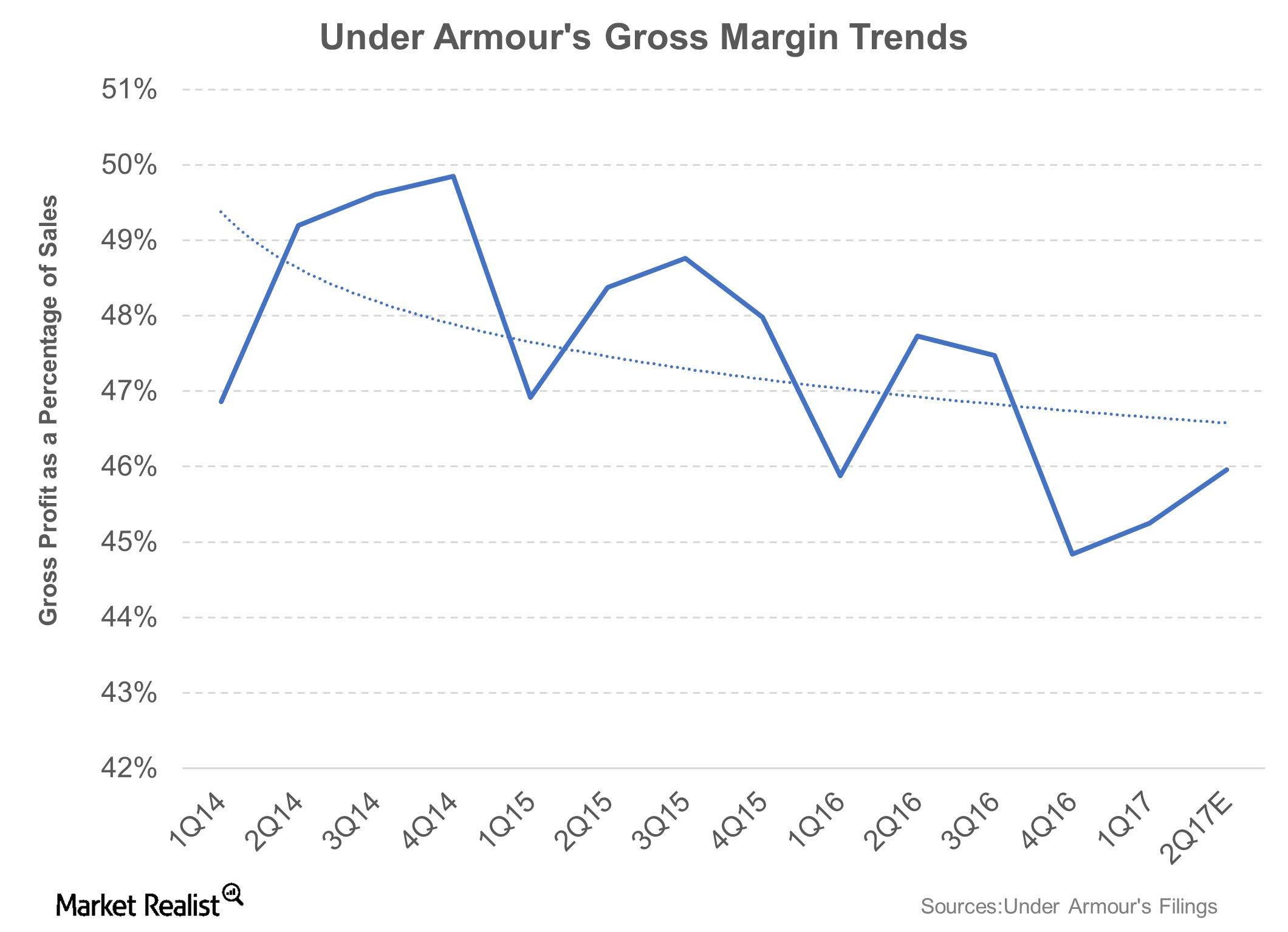

A look at Under Armour’s 2Q17 bottom line Under Armour (UAA), which released its 2Q17 results on August 1, reported net earnings of -$12 million, or EPS (earnings per share) of -$0.03. The company reported a weaker gross margin and a rise in SG&A (selling, general, and administrative) expenses. In comparison, it reported earnings of $19 […]

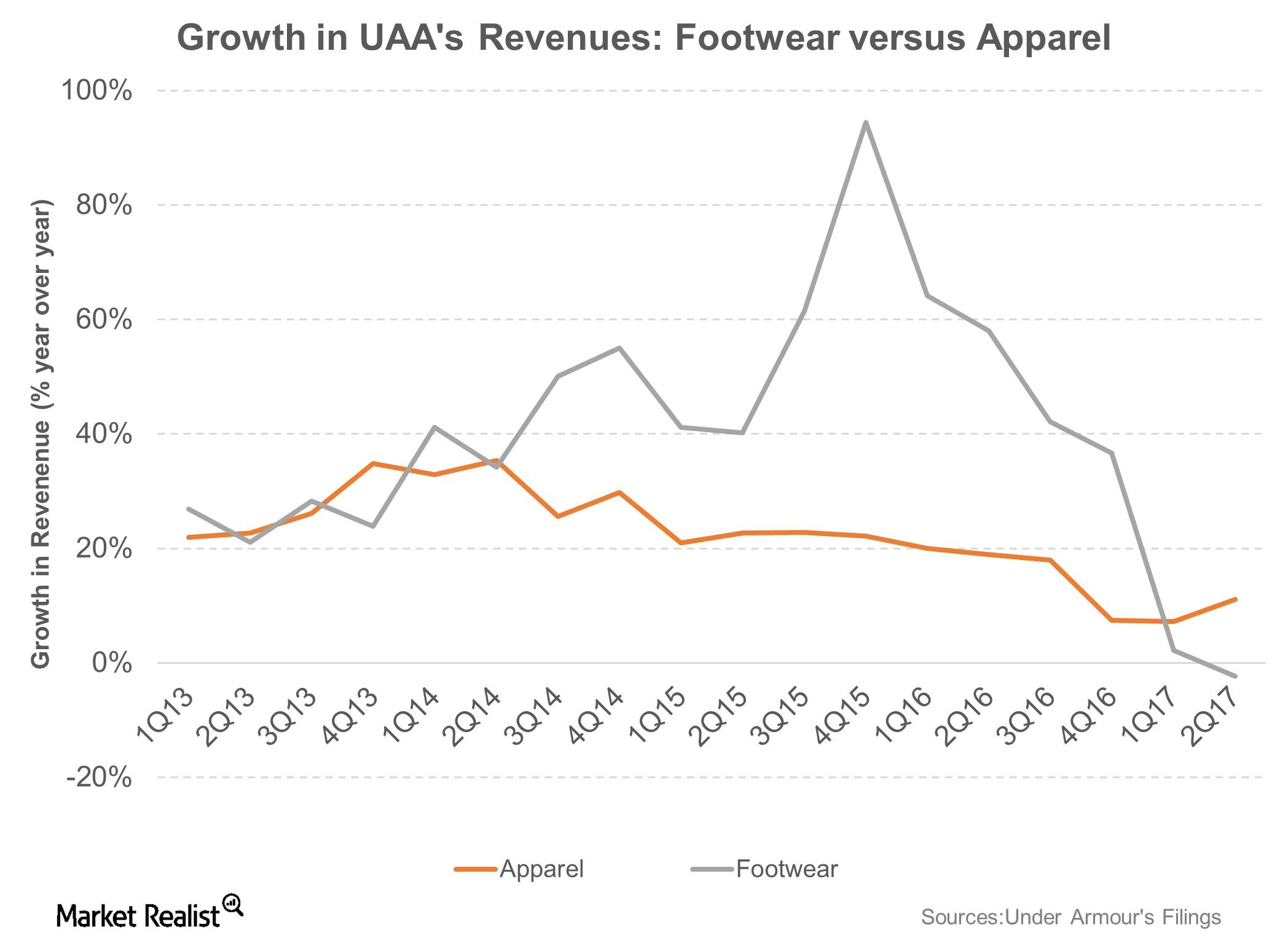

Under Armour’s 2Q17 Footwear Sales Lose Traction

Footwear growth turns negative Under Armour’s (UAA) footwear business was considered the company’s growth engine until recently. The company recorded average quarterly growth of 52% between fiscal 2014 and 2016. However, 2Q17 was a complete letdown. Sales were down 2% YoY (year-over-year) as the company coped with tough comparisons with the year prior. Also impacting sales […]

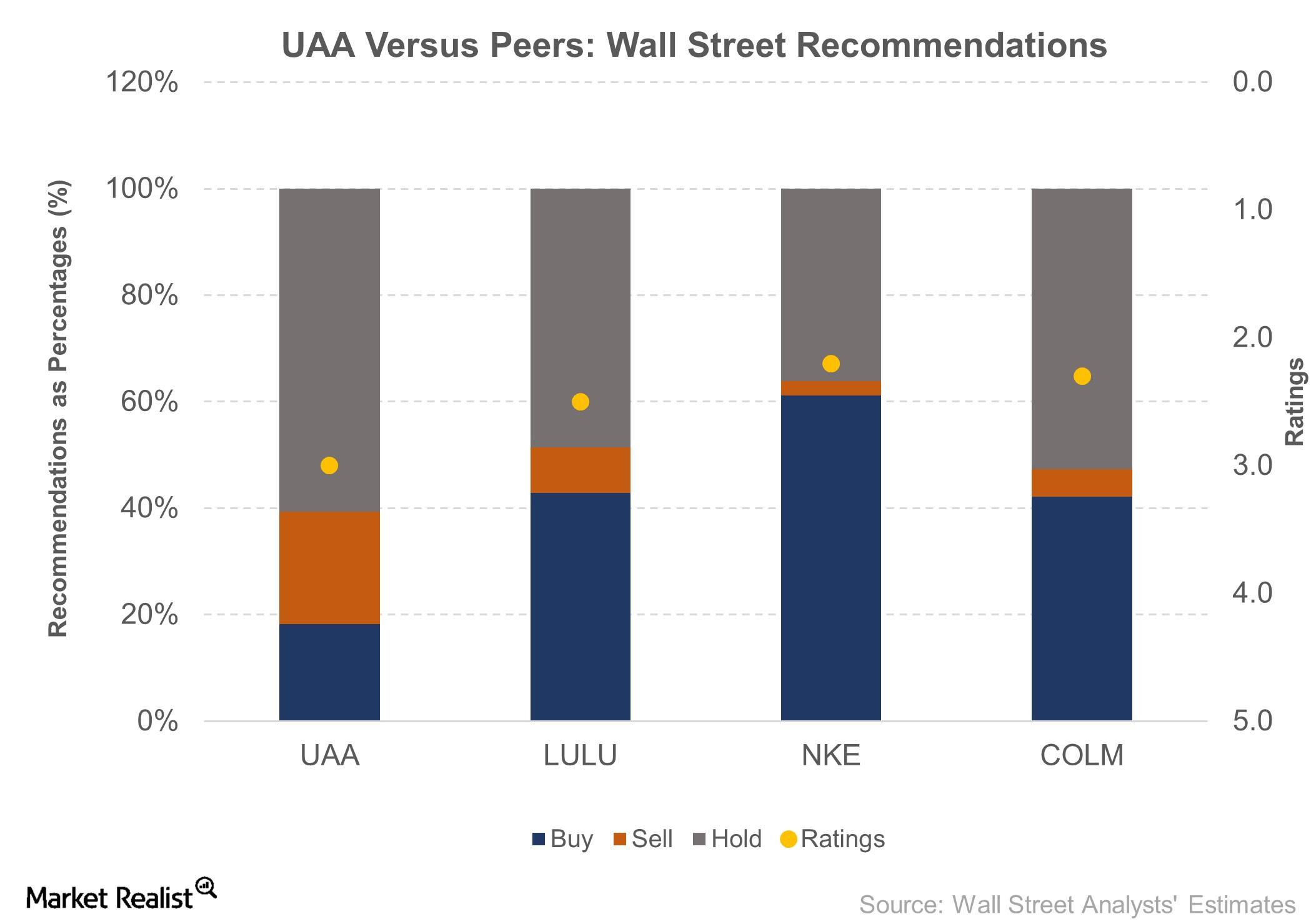

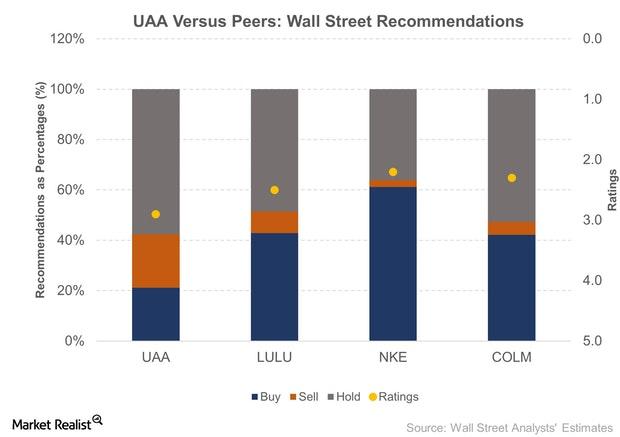

What Wall Street Thinks of Under Armour

Under Armour has a 2.8 rating on a scale where one is a “strong buy” and five is a “strong sell.”

Operating Loss Could Be in the Cards for Under Armour in 2Q17

Under Armour is expected to report a loss of six cents per share in 2Q17, which follows a loss per share of one cent during the first quarter.

Under Armour’s 2Q17 Earnings: What to Expect

Under Armour (UAA) is expected to report results for 2Q17 on Tuesday, August 1, 2017.