Recent Recommendation Changes for Nike

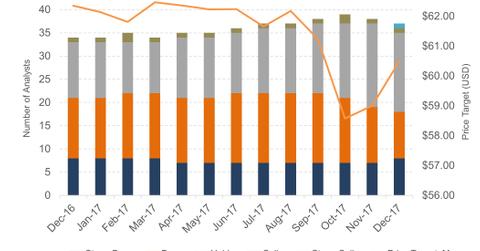

Nike (NKE) is a well-covered stock, tracked by 37 Wall Street analysts. The company is rated a “buy” by 49% of analysts, a “hold” by 46%, and a “sell” by 5%.

Dec. 19 2017, Updated 7:32 a.m. ET

What Wall Street thinks about Nike

Nike (NKE) is a well-covered stock, tracked by 37 Wall Street analysts. The company is rated a “buy” by 49% of analysts, a “hold” by 46%, and a “sell” by 5%.

Seema [7:41 AM

At least four brokerage firms have revised their recommendations for Nike over the past three months.

Goldman downgrades Nike to ‘neutral’

On October 19, 2017, Goldman Sachs downgraded Nike to “neutral” from “buy.” Analyst Lindsay Drucker Mann cited excess inventory and intense competition as the reasons for the downgrade.

Mann wrote in a client note, “The drivers of domestic pressure will take some time to work through, exacerbated by persistent excess inventory sitting at Nike’s brick and mortar retail partners and the high visibility this markdown product gets as it is funneled online via amazon.com and other platforms.” Mann added, “Near-term dynamics are challenging … with an inventory overhang in the US hampering Nike’s ability to ‘reset’ the market.”

HSBC lowers Nike to ‘hold’

On November 28, 2017, HSBC lowered Nike to a “hold” from a “buy” rating. Analyst Erwan Rambourg downgraded the stock on concerns of valuations.

Rambourg believes Nike has what he calls a “compelling future.” He’s not that confident about Nike’s “valuation relative to growth (and to Adidas).”

Argus upgrades Nike to a ‘buy’

On December 14, 2017, Argus Research upgraded Nike from a “hold” to a “buy” recommendation. Analyst John Staszak said, “Although the industry remains fiercely competitive, we expect the company to build on its dominant position through its globally recognized brand, innovative products, economies of scale and rapid growth in emerging markets.”

He added, “In the near term, we expect an accelerating U.S. economy and solid results in China to benefit earnings.”

In the next part, we’ll look at the views of analysts who are positive on the company.