Market Vectors® Coal ETF

Latest Market Vectors® Coal ETF News and Updates

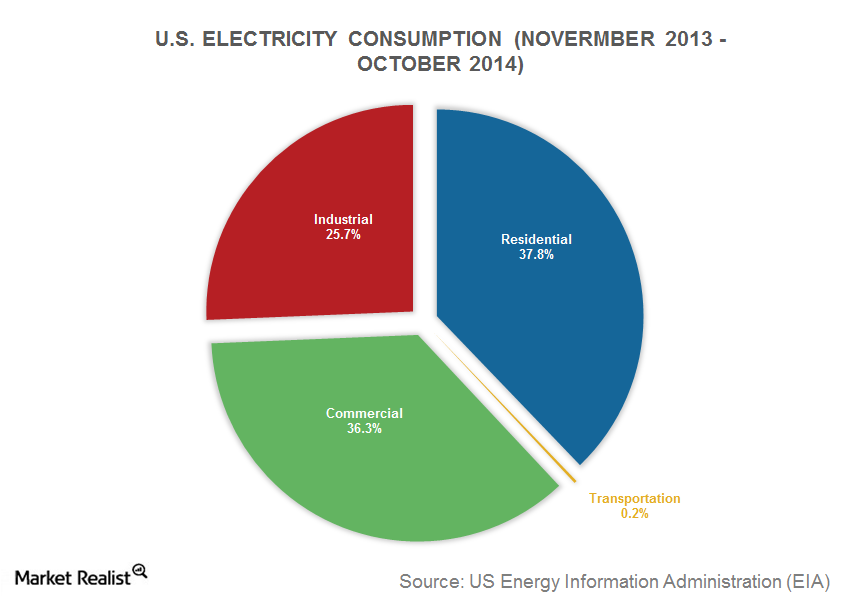

The must-know dynamics of the global power industry

In this series, we’ll look at the structure of the thermal power industry before moving on to focus on the power generation equipment sector.

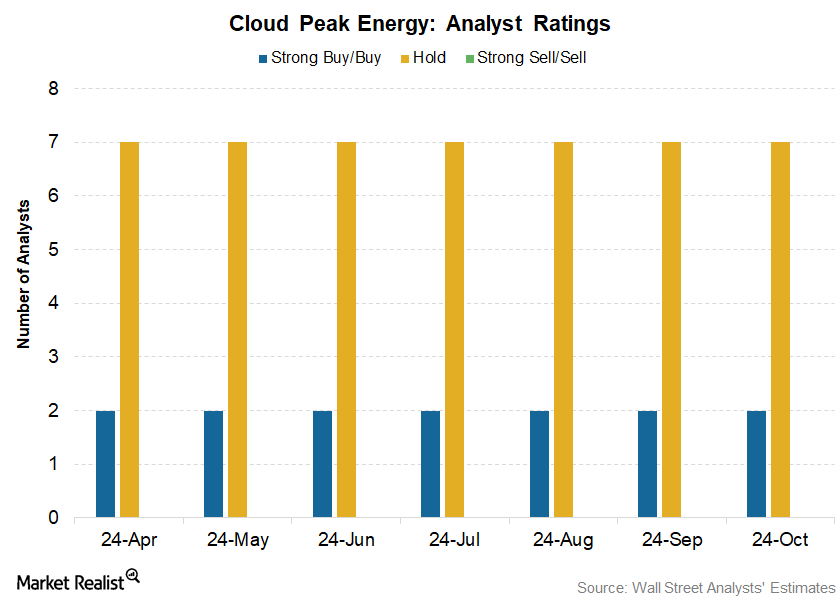

Why Most Analysts Recommend a ‘Hold’ for Cloud Peak Energy

Of the nine analysts covering Cloud Peak Energy (CLD), seven analysts rated its stock as a “hold,” and two gave CLD a “buy” or “strong buy” rating.

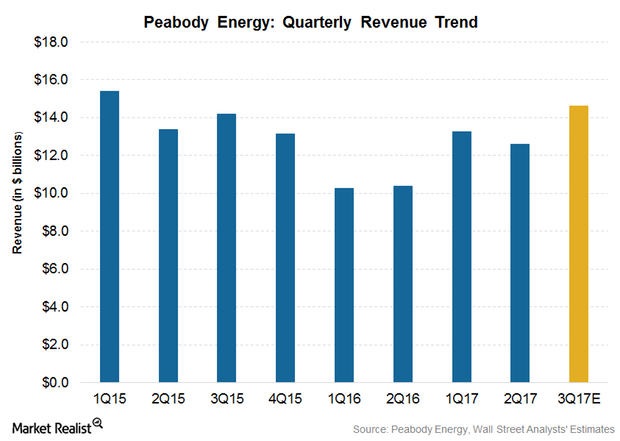

Analysts Expect Peabody Energy’s Revenues to Rise in 3Q17

In 3Q15, Peabody Energy (BTU) reported $1.42 billion in revenues. Analysts anticipate that it will post $1.46 billion in 3Q17 compared to $1.26 billion in 2Q17.

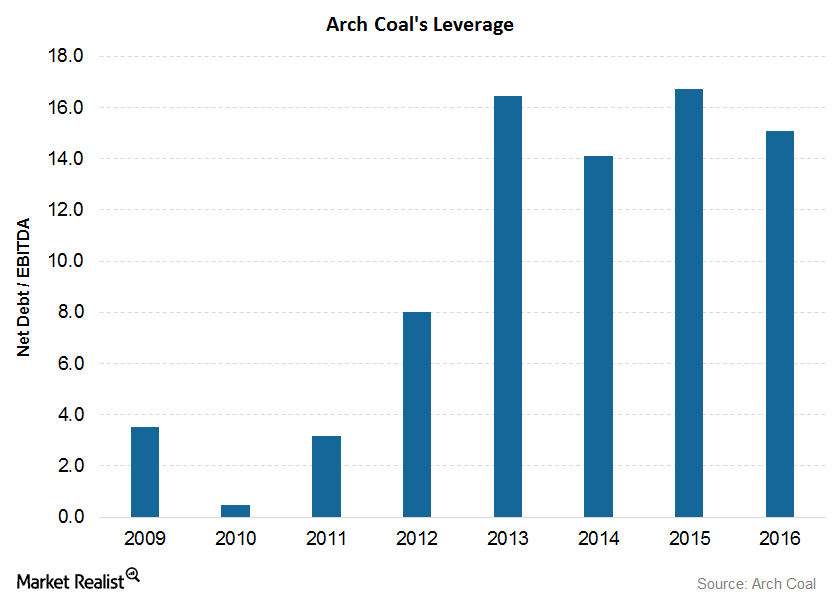

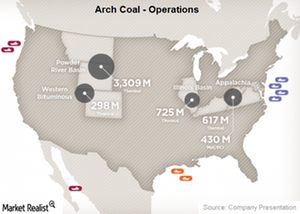

Understanding Arch Coal’s Financial Position

Arch Coal’s leverage On June 30, 2017, the book value of Arch Coal’s (ARCH) long-term debt was about $315.6 million, of which ~$297 million is due for payment in 2024. Arch Coal’s leverage, which is its net debt divided by EBITDA (earnings before interest, tax, depreciation, and amortization), has increased since the acquisition of International […]

What Could Drive Arch Coal Stock in 2017?

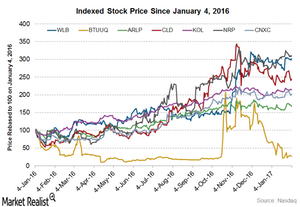

Although the majority of coal (KOL) stocks began 2016 on a weak note, they outperformed the broader market in 2016.

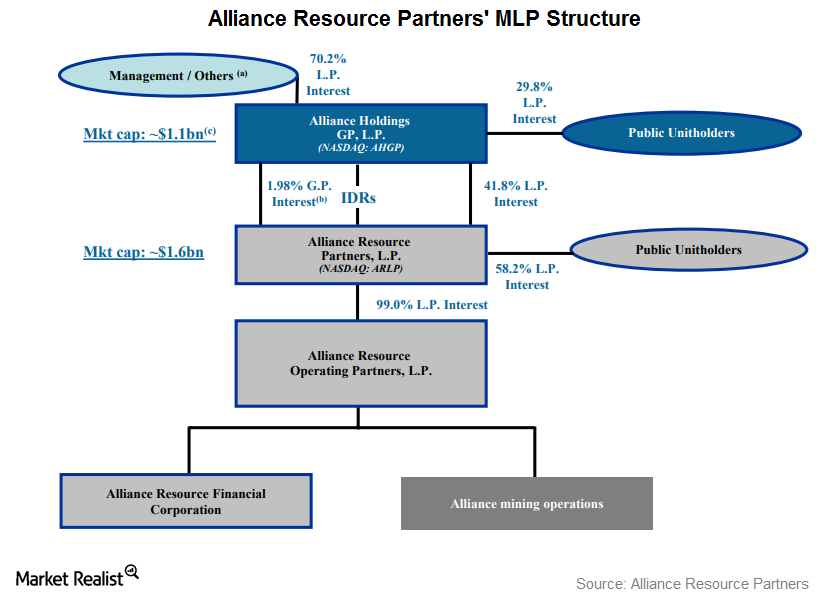

Understanding the Master Limited Partnership Structure of Alliance Resource Partners

As of December 31, 2016, Alliance Resource Partners was being managed by its MGP, which is 100% owned, directly and indirectly, by AGHP.

What Factors Could Drive Arch Coal Stock in 2H17?

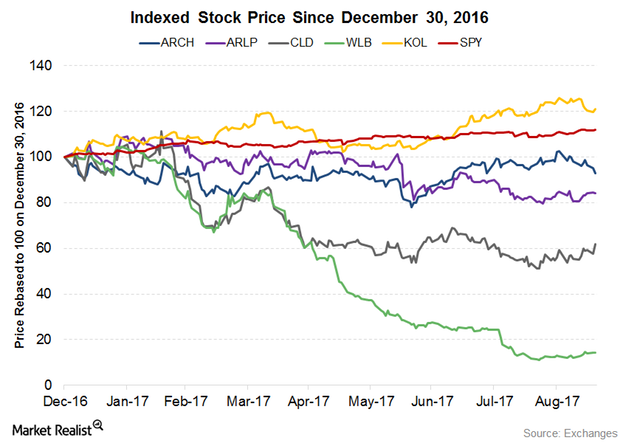

1H17 in review Majority of the coal (KOL) stocks began 2017 on a weak note. The stocks have not been able to recoup from the slump until now. They have been outperformed by the broader market and the VanEck Vectors Coal ETF so far in 2017. On September 19, 2017, Arch Coal (ARCH) has fallen […]Industrials Coal is losing its market share in China’s electricity generation

Coal is the cheapest fossil fuel, but it’s also the most polluting. With its massive electricity generation capacity—mainly coal-fired—China emits the most carbon dioxide in the world.

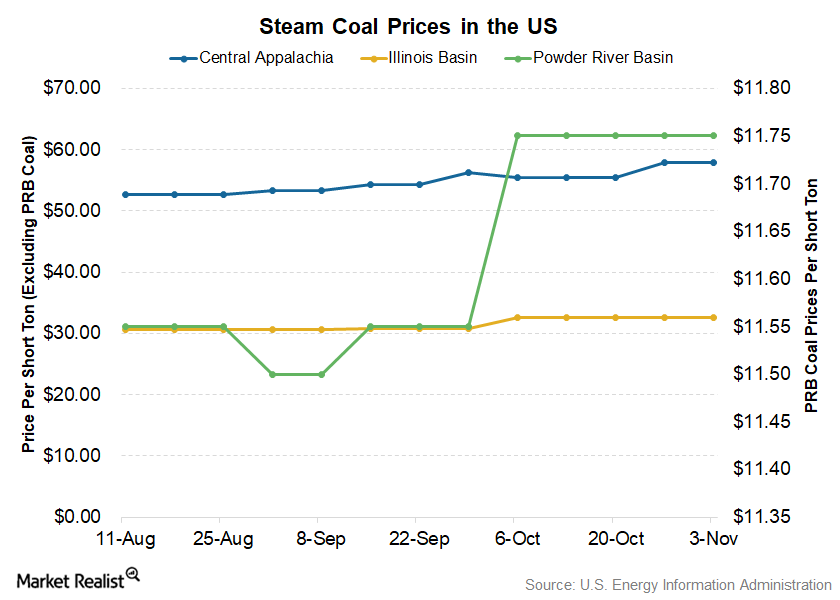

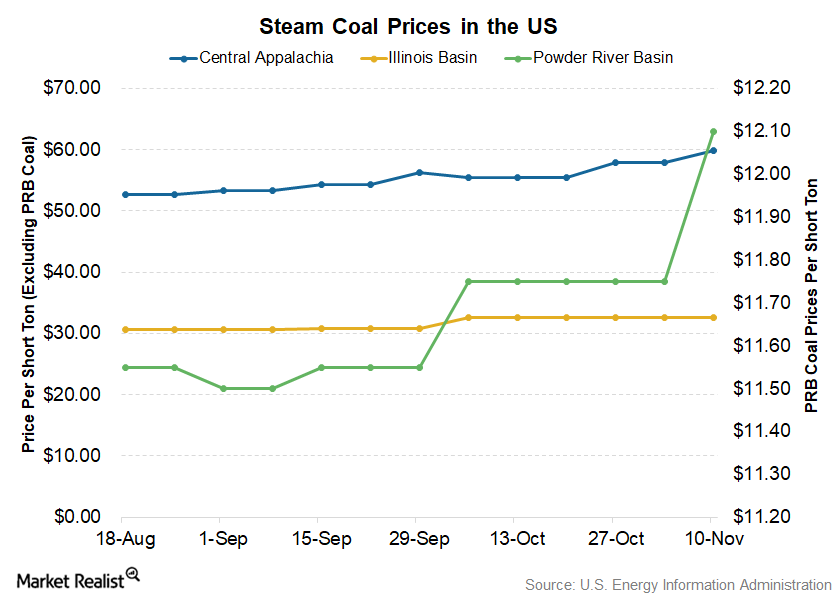

Spot Coal Prices Remained Flat in the Week Ending November 3

Powder River Basin coal settled at $11.75 per short ton, while Illinois Basin spot coal prices closed at $32.60 per short ton.

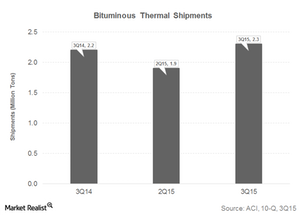

How Arch Coal’s Rise in Bituminous Thermal Coal Volumes Hurt Prices in 3Q15

Arch Coal’s Bituminous Thermal coal segment sold 2.3 million tons in 3Q15 compared to 2.2 million tons in 3Q14 and 1.9 million tons in 2Q15.

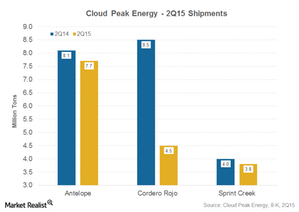

Cloud Peak Energy’s 2Q15 Shipments: Potential Risk Factors

Cloud Peak Energy (CLD) shipped 16.0 million tons of coal from its three owned and operated mines in the Powder River Basin (or PRB) in 2Q15.

Westmoreland Coal’s Canadian Operations: An Overview

Westmoreland’s Canadian operations Westmoreland Coal (WLB) acquired seven surface mines in Alberta and Saskatchewan, a stake in an activated carbon plant, and a char plant in Canada from Sherritt International in 2014. As of January 1, 2016, WLB’s Canadian operations are grouped as one entity, Prairie Mines & Royalty ULC. Its Canadian operations hold total […]

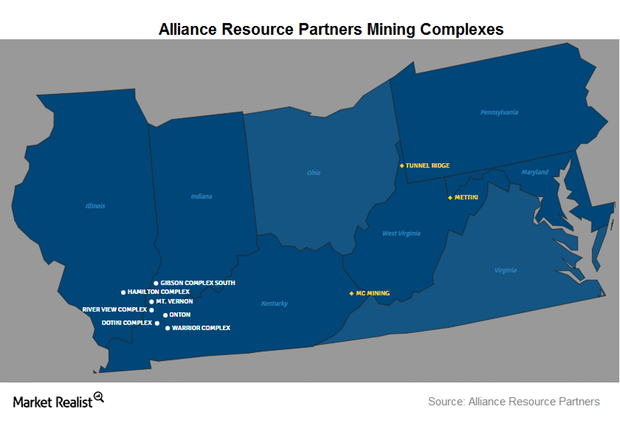

Inside Alliance Resource Partners’ Mining Operations

Alliance Resource Partners (ARLP) operates eight underground mining complexes in two regions: Illinois and Appalachia.

Powder River Basin Coal Spot Prices Recovered Sharply

During the week ended November 10, 2017, PRB coal closed at $12.10 per short ton, which was ~3% higher than $11.75 per short ton that coal maintained for the past five weeks.Materials Must-know: ANR’s thermal coal business in 3Q14

ANR produces thermal coal from its mines in the Appalachian and Powder River Basin (or PRB). The company had around three billion tons of thermal coal reserves.

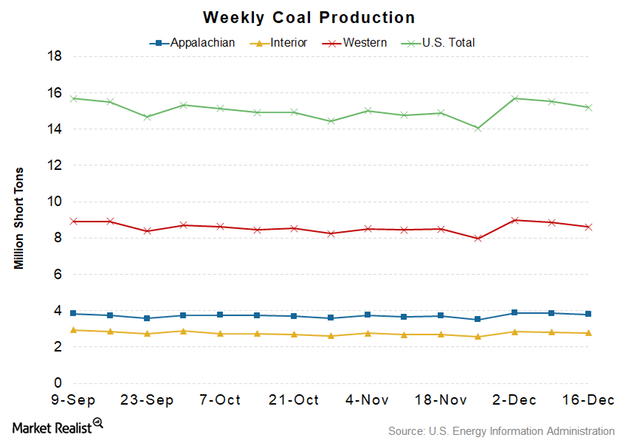

Coal Production Continues to Fall

On December 21, the EIA released the estimate of the coal volumes produced in the US for the week ending December 16.

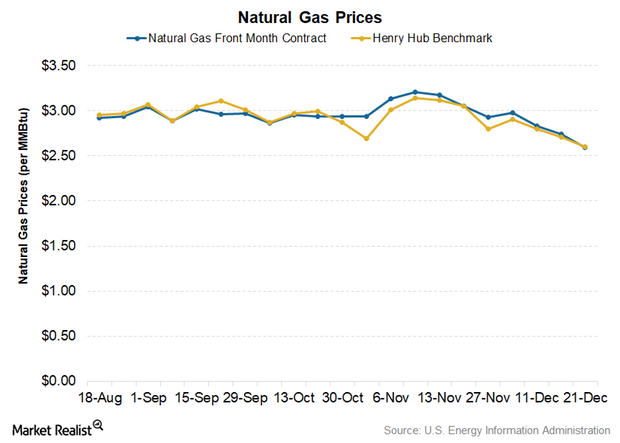

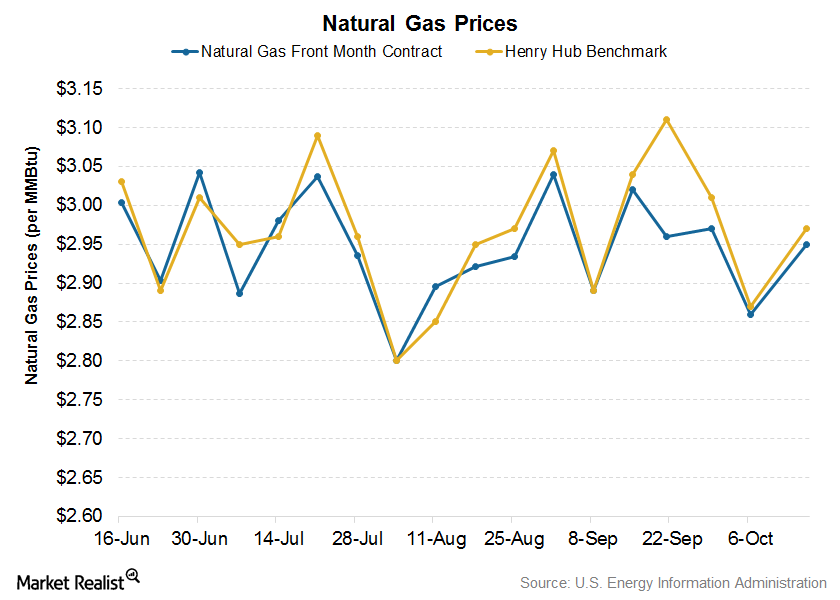

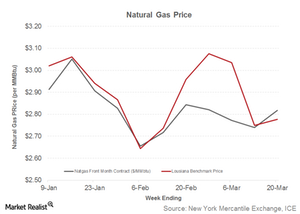

Natural Gas Prices Continue to Fall

In the EIA’s STEO report, it predicted that the Henry Hub natural gas benchmark price would average $3.12 per MMBtu in 2018.

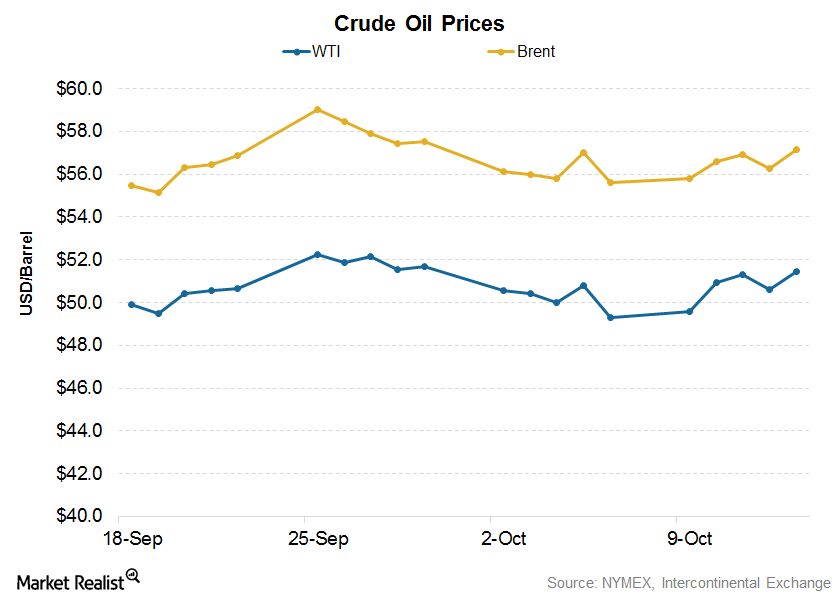

How Higher Crude Oil Prices Impact Coal Producers

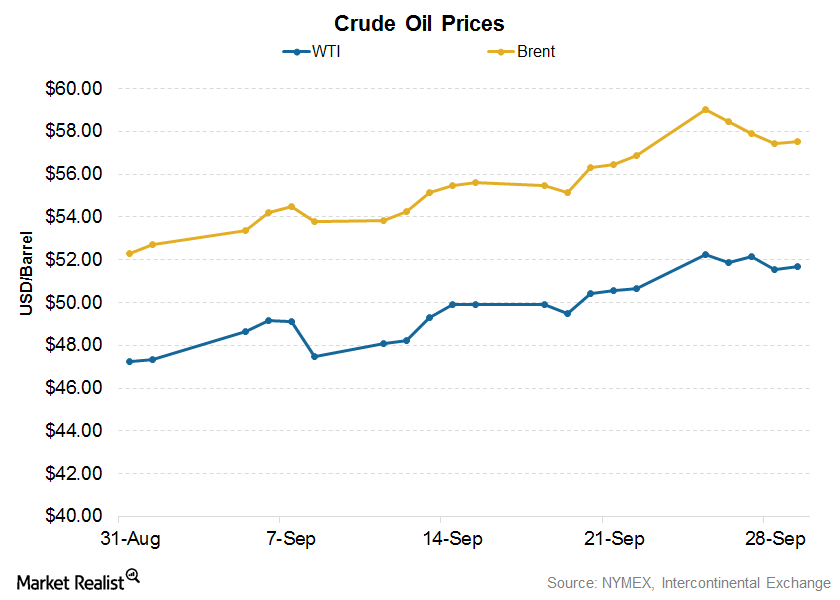

On October 13, 2017, Brent crude oil prices settled at $57.17 per barrel, 3% higher than $55.60 reported during the previous week.

How Weather Affects Natural Gas Prices

On October 16, the November US natural gas futures contract price was reported as $2.95 per MMBtu.

How Crude Oil Indirectly Impacts Coal Prices

On September 29, 2017, Brent crude oil prices closed at $57.54 per barrel compared to $56.86 the previous week.

The Key Risks Involved in Arch Coal’s Business

Commodity price risk Arch Coal (ARCH) has long-term coal supply agreements for their non-trading, thermal coal sales, hence managing commodity risk for thermal coal and also to a limited extent, through the use of derivative instruments. However, sales commitments in the metallurgical coal market are typically not long-term in nature and are subject to fluctuations […]Company & Industry Overviews An Overview of Westmoreland Coal

In this series, we’ll analyze Westmoreland Coal’s (WLB) business model. We’ll explore how the company has expanded its business, and evaluate its key operational metrics and financial position.

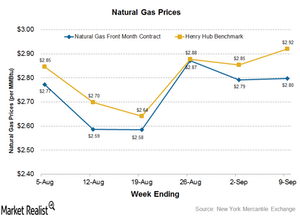

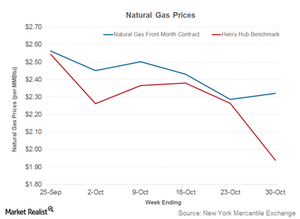

Cleaner Natural Gas Production Continuing to Hurt Coal Miners

Henry Hub benchmark natural gas prices came in at $2.92 per MMBtu for the week ended September 9, 2016, compared to $2.85 per MMBtu for the previous week.

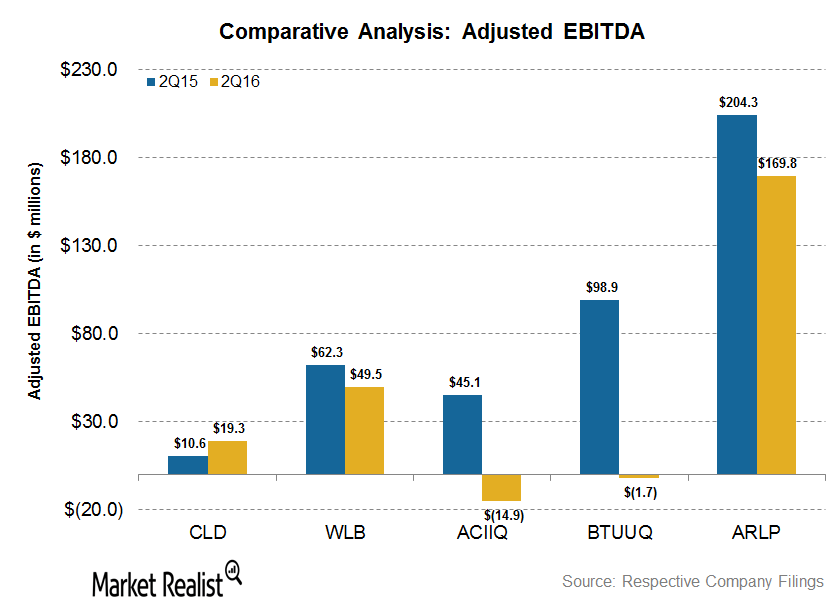

Cloud Peak Energy Topped EBITDA Margin Growth in 2Q16

Cloud Peak Energy reported positive growth in its 2Q16 EBITDA margins. Cloud Peak Energy’s EBITDA margins came in at 11.1% in 2Q16.

More Losses? Caterpillar Puts Part of Its Mining Business on Sale

Caterpillar logged four consecutive quarters of operating losses in the Resource Industries segment—it houses the mining equipment business.

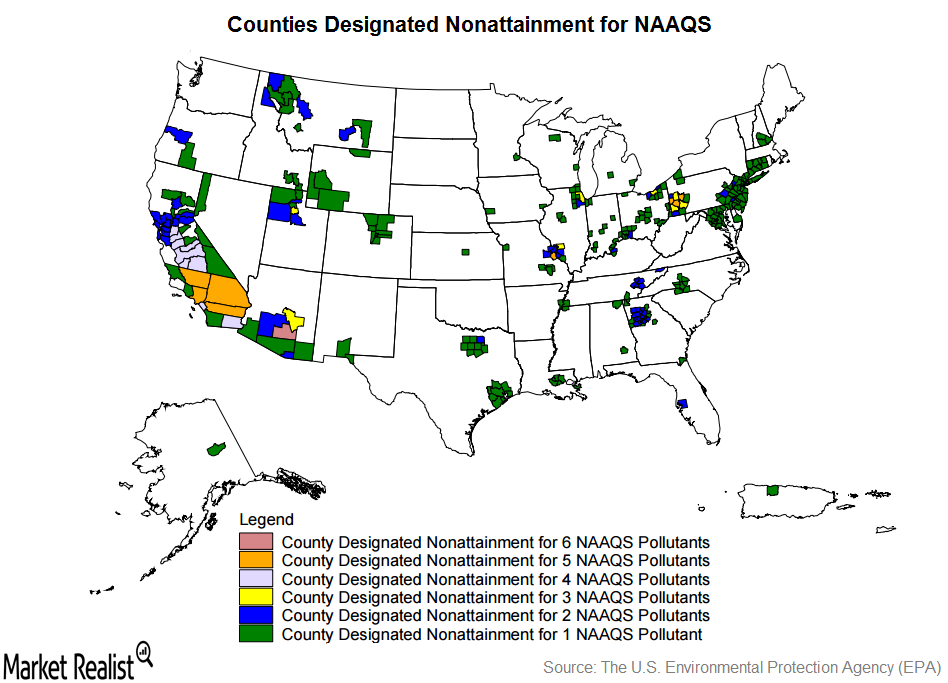

How Developments in the Clean Air Act Will Impact Coal Mining

The Clean Air Act is a national air pollution control policy that regulates the emission of hazardous pollutants from stationary and mobile sources in the United States.

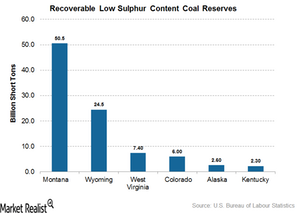

Where Are the Low Sulphur Content Coal Mines in the US?

According to the EIA, low sulphur content coal is defined as having less than 0.60 pounds of sulphur per million British thermal units.

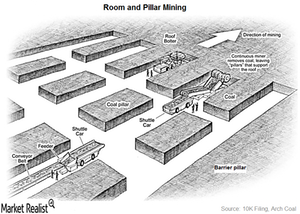

How Is Coal Mined in the US?

According to the World Coal Association, there are two main underground mining methods in the US.

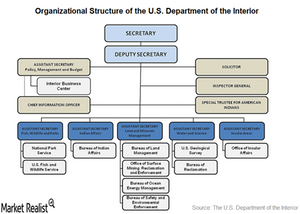

How Does the Land Ownership Pattern in the US Affect Miners?

Land ownership in the US can be broadly divided into the following categories: federally owned land, state-owned land, privately owned land, and Native American land.

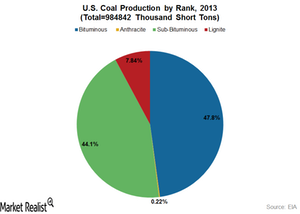

What Are the Different Types of Coal?

Coal types differ from each other as a result of the difference in their organic matter content and maturity.

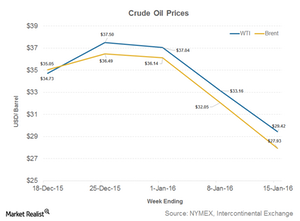

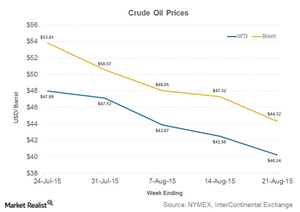

Crude Oil Fell below $30: Positive or Negative for Coal?

Crude oil prices dropped significantly during the week ended January 15, 2016. WTI (West Texas Intermediate) crude oil prices closed at $29.42 per MMBtu on January 15, 2016.

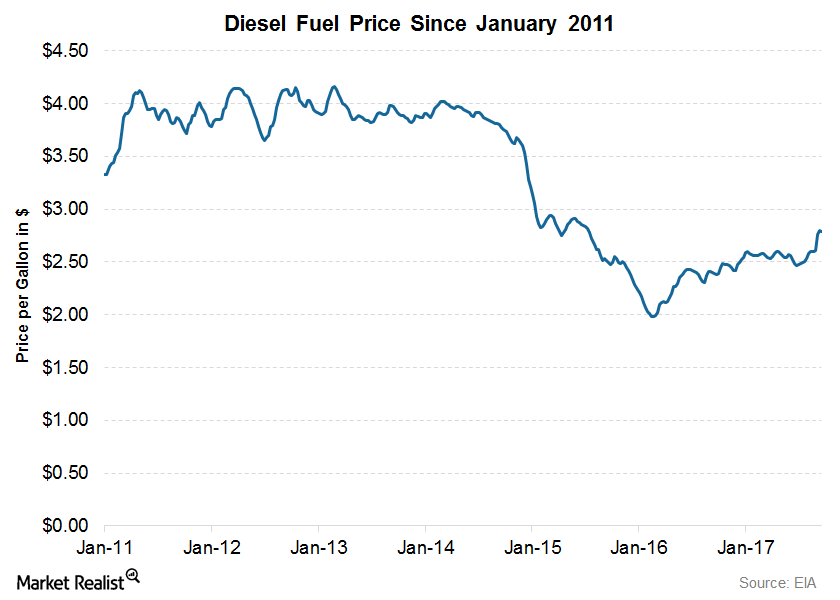

Coal under Pressure as Natural Gas Prices Remain Subdued

Natural gas prices and coal’s market share in electricity generation are related. When natural gas prices fall, coal loses market share. It becomes more economical to use natural gas for power generation.

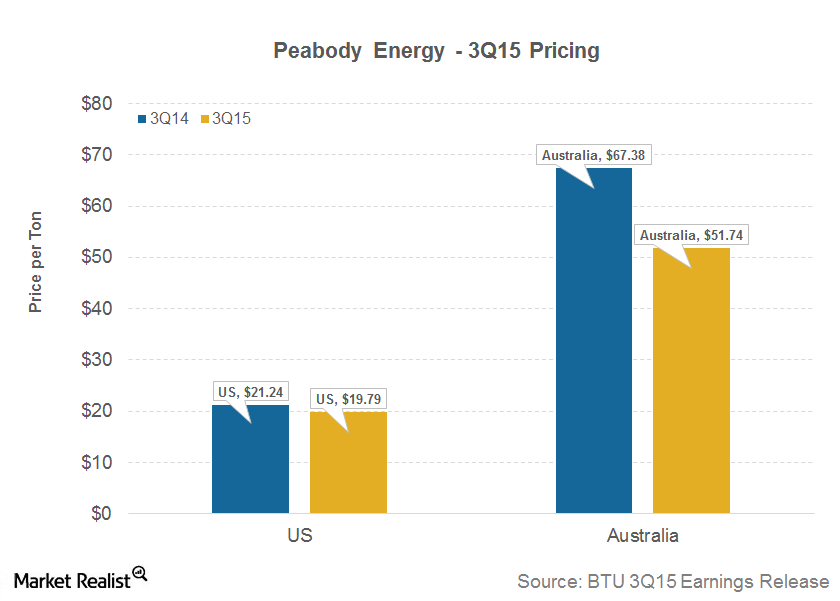

Lower Shipments and Pricing Hampered Peabody’s 3Q15 Revenues

Peabody Energy’s (BTU) US operations posted revenue per ton of $19.79 in 3Q15, down from $21.24 in 3Q14.

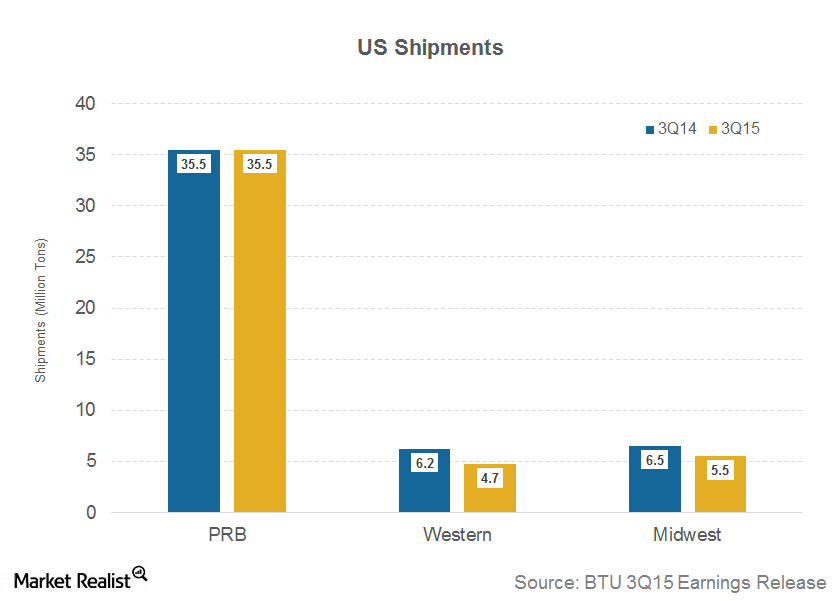

Natural Gas Weighed Heavily on Peabody Energy’s US Shipments

Peabody Energy’s (BTU) US operations sold 45.7 million tons of thermal coal (KOL) in 3Q15, 5.2% lower than 3Q14’s 48.2 million tons.

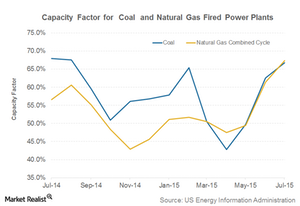

Capacity Factors Still Indicate Shift from Coal to Natural Gas

Capacity factors for coal-fired plants fell YoY and rose substantially for natural gas-fired power plants. This shows a shift from coal to natural gas as a fuel for electricity generation.

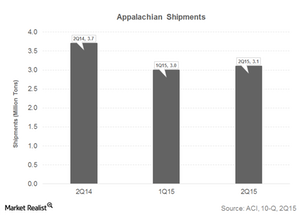

Arch Coal’s Appalachian Shipments Remain under Pressure in 2Q15

In 2Q15, Arch Coal’s (ACI) Appalachia segment shipped 3.1 million tons of coal, down from 3.7 million tons in 2Q14, but up from 1Q15’s 3.0 million.

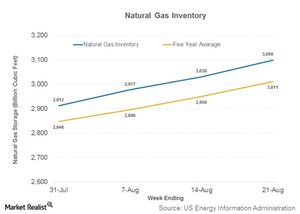

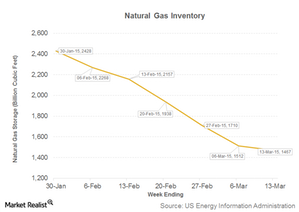

Natural Gas Inventory Figure Puts Pressure on Coal

The EIA’s natural gas inventory report for the week ended August 21 came in at 3,099 billion cubic feet, compared to 3,030 Bcf a week earlier. Natural gas is stored underground to save the fuel for peak demand during the winter.

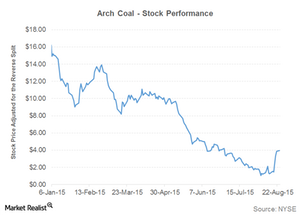

Why Arch Coal Rallied During a Bad Week for the S&P 500

Arch Coal’s (ACI) shares posted an astounding 205% rise during the week ending August 21. The stock closed at $3.85 on August 21.

Why Arch Coal Is in the News for Debt Exchange

On August 4, 2015, Arch Coal completed a reverse stock split to boost its stock price above the dollar mark and stay listed on the NYSE.

Continued Slump in Crude Oil Prices May Benefit Coal

Crude oil prices are a mixed driver for the coal industry (KOL) in the United States. On the one hand, a fall in crude oil prices results in a fall in fuel costs.

Coal Prices Dropped as Natural Gas Prices Rose

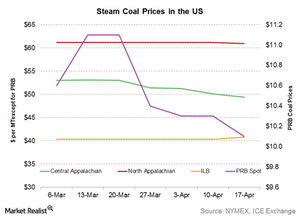

Central Appalachian thermal coal prices came in at $49.40 per ton for the week ending April 17—down from $50.10 per ton the previous week.

Why A Marginal Rise in Natural Gas Prices Helped Coal

Natural gas prices and coal’s market share in electricity generation are related. When natural gas prices rise, coal gains market share.

The Latest Natural Gas Inventory Report Proves Neutral for Coal

The EIA (US Energy Information Administration) publishes a weekly natural gas inventory and withdrawal report every Thursday.

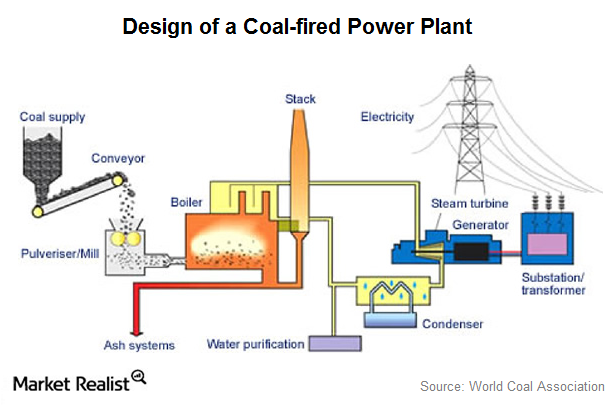

Industry structure analysis: Coal-fired power generation equipment

Coal (KOL) has fired much of the development in the US and other OECD economies in the 20th century. It’s firing growth in economies like China and India.

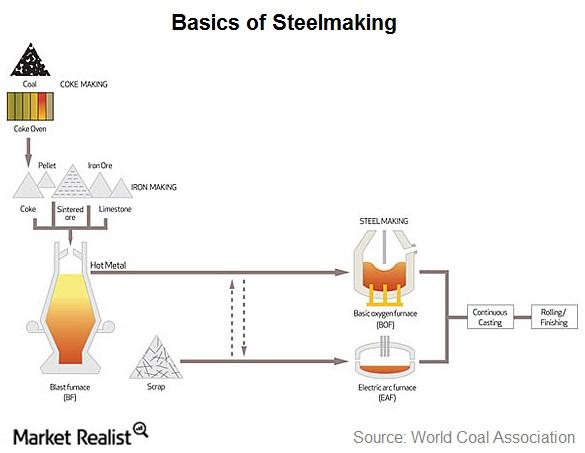

SunCoke Energy’s presence in the steelmaking process

Coke is used in the iron making process, which in turn is used in the steelmaking process. SunCoke Energy produced 4.2 million tons of coke in 2013.

How does coke fit into the steelmaking process?

Iron ore, steel scrap, and met coal are the main raw materials for steelmaking. SunCoke converts met coal to coke by driving out its impurities.

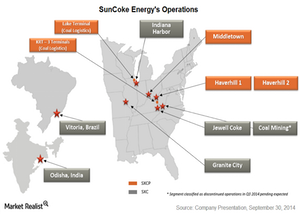

A quick look at SunCoke Energy’s US operations

SunCoke Energy (SXC) is the largest independent manufacturer of coke, which is used in steelmaking. It runs five coke making plants in the United States.

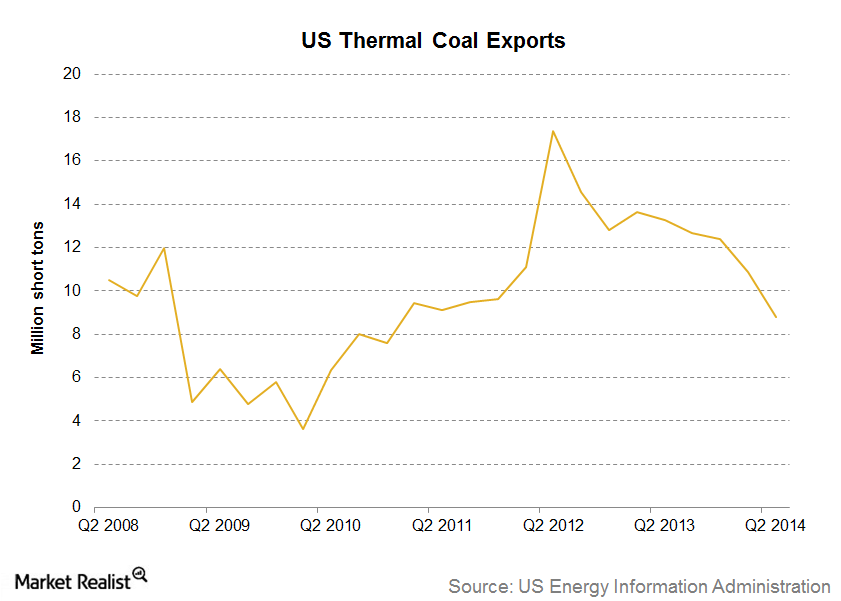

Must-know: US thermal coal exports are falling

US thermal coal exports were 19.6 million tons in the first half of 2014—down from 26.9 million tons during same period in 2013. The drop was mainly driven by falling demand from Europe.

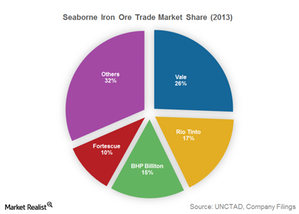

VALE, RIO, and BHP can swing the global iron ore prices

With over 65% exports going to China, China is the real swinger in global iron ore prices. A slowdown in China caused panic among all major commodity exporters.

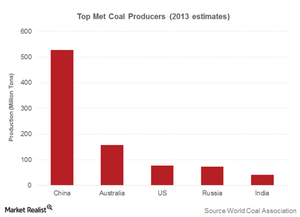

Who are the swing met coal producers in the global market?

In the seaborne met coal market, the swing producers are clearly the Australian producers. Australia is the second largest of the met coal producers. It’s the largest met coal exporter.