FedEx Corp

Latest FedEx Corp News and Updates

XPO Logistics: A Brief Company Overview

XPO Logistics (XPO) stock closed at $98.66 on March 27, 2018, which was lower than its 52-week high of $106.20.

How FedEx’s Performance Influenced Its Outlook

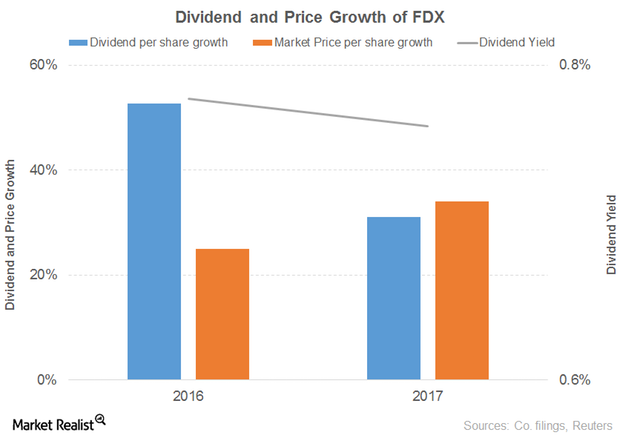

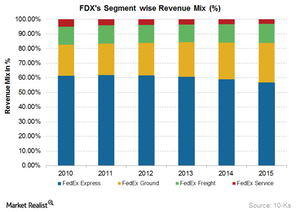

FedEx’s (FDX) revenue grew 6% and 20% in 2016 and 2017, respectively. The FedEx Ground, FedEx Freight, and FedEx Services segments drove the 2016 growth, offset by the FedEx Express segment.

FedEx Ground’s Revenues in Fiscal 2Q18: What’s behind the Growth?

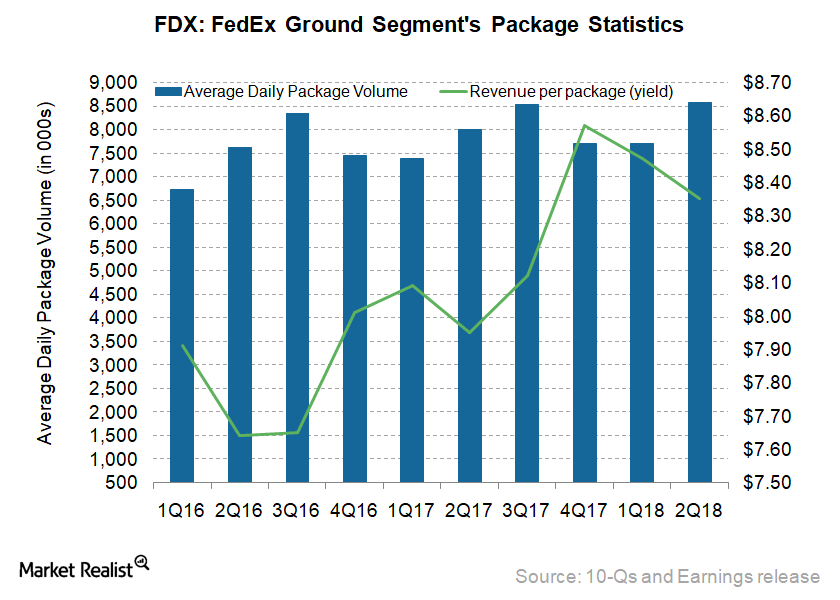

FedEx Ground’s (FDX) revenues rose 11.5% to $4.9 billion in fiscal 2Q18, from $4.4 billion in fiscal 2Q17.

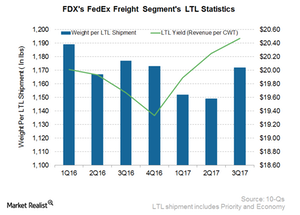

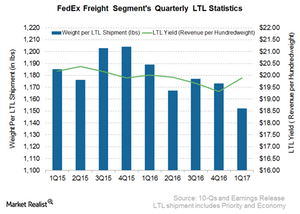

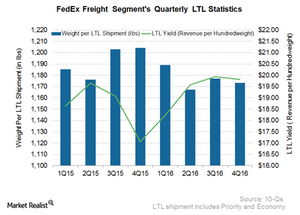

Better LTL Pricing Drove FedEx’s 3Q17 Freight Revenue

The FedEx Freight segment revenues rose 3.1% from $1.4 billion in 3Q16 to $1.5 billion in fiscal 3Q17.

Better SmartPost and Ground Yield Pushed Up FedEx Ground’s Revenue

The FedEx Ground segment’s revenues rose 6% from $4.4 billion in 3Q16 to $4.7 billion in fiscal 3Q17.

Why FedEx Sees Volume Growth in the Future of Its Freight Segment

FedEx’s (FDX) Freight segment revenues rose 4% from $1.6 billion in fiscal 1Q16 to ~$1.7 billion in fiscal 1Q17.

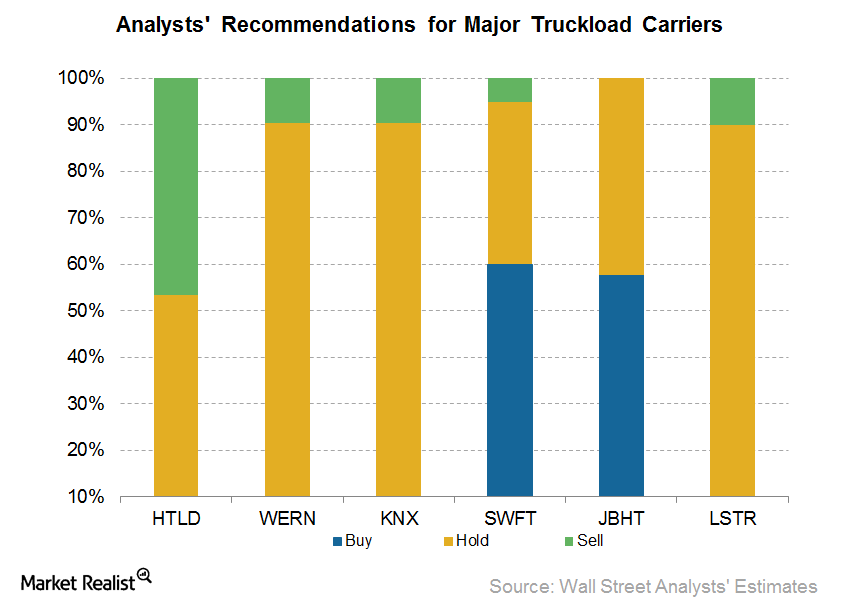

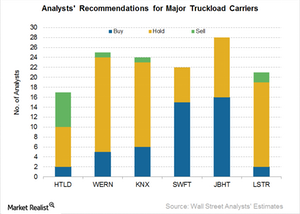

Looking at US Truckload Carriers through Analysts’ Eyes

In this part of the series, we’ll take a look at what Wall Street analysts are saying about US truckload carriers and how they’re rating the stocks.

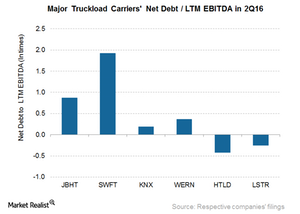

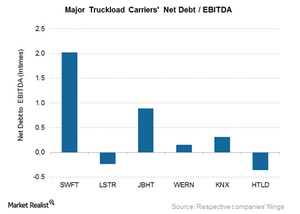

Which Truckload Carrier Posted the Most Debt in 2Q16?

Landstar System (LSTR) and Heartland Express (HTLD) have higher available cash on their balance sheets than total debt.

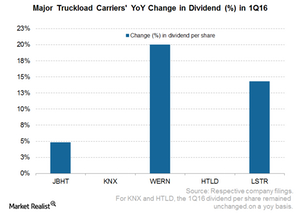

Which US Truckload Carrier Holds First Place in Dividend Growth?

Among major truckload companies, in 1Q16, Werner Enterprises (WERN) declared the highest dividend growth, at $0.06 per share, which is a 20% YoY increase.

Which Is the Least Leveraged Truckload Carrier among Major Peers?

Among truckload companies, Landstar and Heartland have a lot of available cash compared to total debt. Swift and J.B. Hunt have high net debt-to-EBITDAs.

The Word on the Street: What Analysts Are Saying about Truckload Carriers

Swift Transportation has a consensus rating of 4.36 or “strong buy” among truckload carriers. Out of 22 analysts, 15 gave it a “buy” recommendation.

FedEx Freight: Higher Demand from Large Customers

FedEx expects FedEx Freight revenues to rise in fiscal 2017.

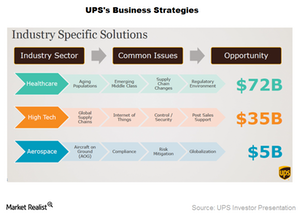

United Parcel Service: Key Growth Focus Areas

Recently, United Parcel Service has broadened the service offering of UPS My Choice to 15 more countries and territories in the Americas and Europe.

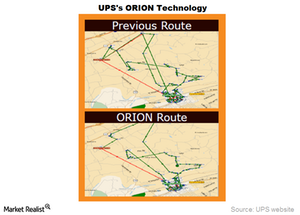

ORION: A Star in United Parcel Service’s Technology Crown

United Parcel Service, through 10,000 routes optimized with ORION, saves up to 1.5 million gallons of fuel per year.

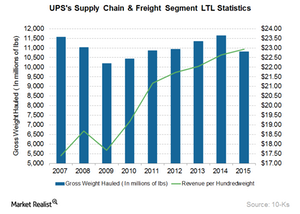

A Deep Dive into UPS’s Supply Chain and Freight Segment

United Parcel Service’s (UPS) Supply Chain and Freight segment includes forwarding and logistics services, UPS Freight, truckload freight brokerage, and financial services through UPS Capital.

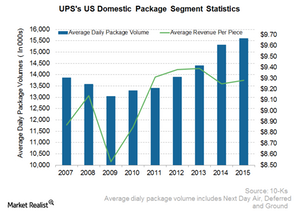

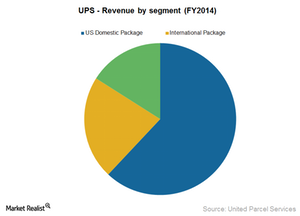

UPS Domestic Package Segment: Largest Courier Service in the US

UPS’s US Domestic Package segment consists of the time-sensitive delivery of letters, documents, and packages across the US. As the jewel in the company’s crown, this segment’s share averaged 61.1% of the total revenues in the last six years.

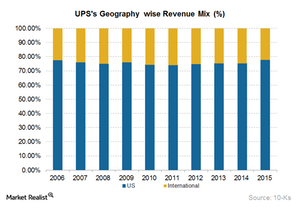

United Parcel Service: A Company Overview

In 2015, United Parcel Service reported total revenues of $58.4 billion. The company’s primary competitor in the US is the Memphis-headquartered FedEx Corporation.

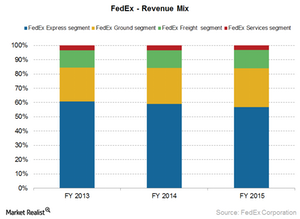

Analyzing FedEx’s Revenue Streams

In fiscal 2015, FDX increased its revenues by $1.9 billion. Its total revenue was a $47.4 billion for the year.

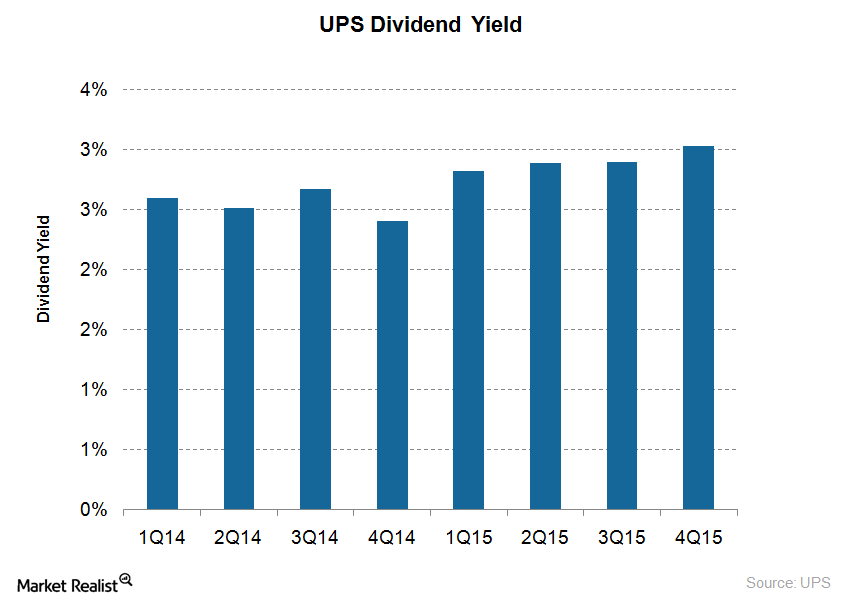

Will United Parcel Service Increase Its Dividend Payout in 2016?

United Parcel Service (UPS) has been a consistent dividend payer for the last 20 years.

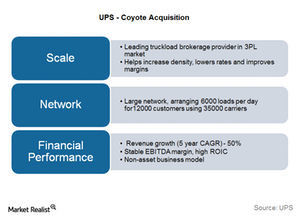

How Does UPS Benefit from Its Acquisition of Coyote Logistics?

United Parcel Services (UPS) announced its agreement to acquire Coyote Logistics. It’s a Chicago-based logistics firm with contract carrier companies.

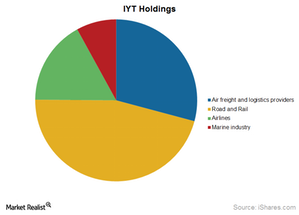

Which ETFs Give Exposure to Courier Stocks?

Smaller ETFs that provide exposure to the courier services industry include Buyback Achievers (PKW), the First Trust Capital Strength ETF (FTCS), and the MSCI Industrials Index ETF (FIDU).

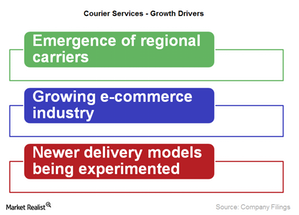

The Key Trends that Could Shape the Courier Industry in 2015

The US has witnessed the emergence of a number of regional carriers such as OnTrac and Eastern Connection, which are providing cheaper, faster delivery options.

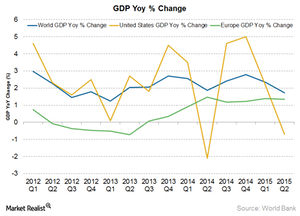

Why Is Economic Growth Important for the Courier Service Industry?

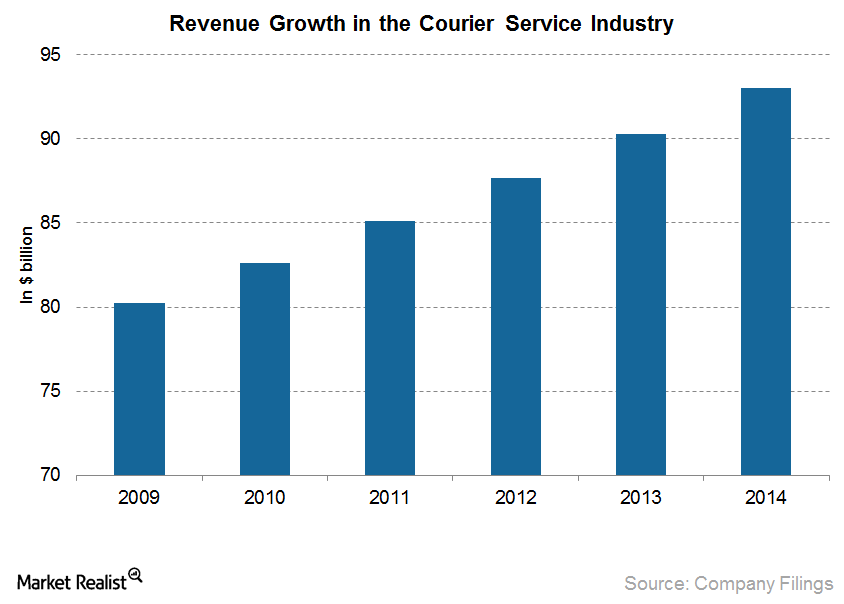

Over the past few years, the global courier services industry has managed to recover from the global economic slowdown.

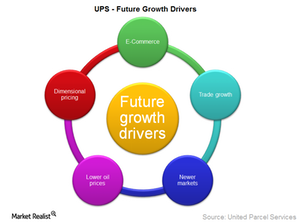

Possible Key Growth Drivers for UPS in the Near Future

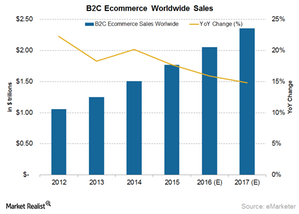

The e-commerce industry is poised to grow rapidly in the future. With this growth will come the need for package delivery.

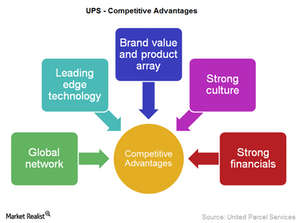

Key Strengths that Keep UPS ahead of Its Peers

Some of UPS’s key strengths that keep it ahead of its competitors include an integrated global network, leading-edge technology, a strong brand name, a strong culture, and impressive financials.

How Has E-Commerce Changed the Courier Services Industry?

In the recent past, there has been a surge in the use of e-commerce across the globe. The impact of this new form of commerce has been felt in each and every industry.

Types of Courier Services and Service Providers

Standard courier services involve collecting the parcels, sorting the parcels, and transferring the parcels to the closest depot to the delivery location.

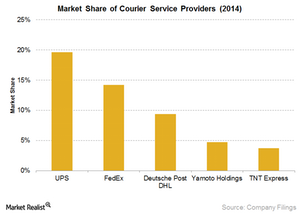

Who Are the Key Players in the US Delivery Services Industry?

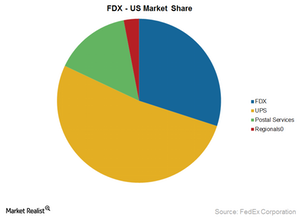

The US courier and parcel delivery services industry consists of about 7,500 companies both large and small, which have combined annual revenue of about $90 billion.

A Look at the Courier Service Industry in the United States

The growth in e-commerce among various economies across the globe has helped shape the highly competitive courier service industry that we know today.

United Parcel Service: How It Delivers Packages to the World

United Parcel Service is the world’s largest package delivery company and a leading global provider of specialized transportation and logistics services. It forms the largest holding of 7.6% in IYT.

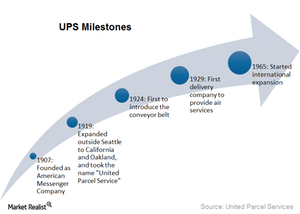

UPS: How the World’s Largest Package Delivery Service Began

United Parcel Service (UPS), originally called American Messenger Company, was founded in 1907 by 19-year-old James E. Casey with $100 borrowed from a friend.

FedEx’s Delivery Market Share Is Threatened by New Competitors

FedEx was formed with a vision to change the way delivery services worked prior to 1971. It established a new industry and it has been leading its peers since then.

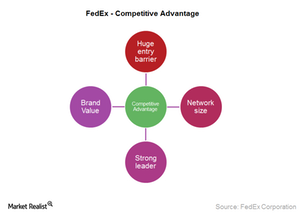

What Are FedEx’s Key Strategic Business Advantages?

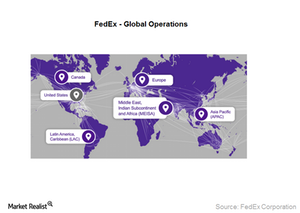

FedEx has been in the marketplace for over 40 years. It has established a huge network spread across more than 220 countries and territories worldwide.

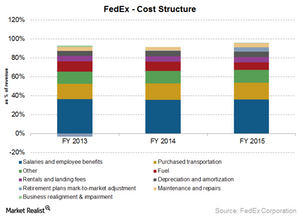

What Are FedEx’s Major Costs?

Salaries and employee benefits form the highest cost for FedEx. They account for ~36% as a percentage of revenue. Salary costs rose 6% for fiscal 2015.

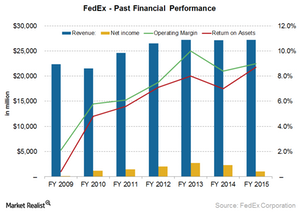

FedEx’s Financial Performance and Long-Term Goals

FedEx’s (FDX) financial performance during the last few years has been extraordinary. It successfully bounced back from the recessionary downturn.

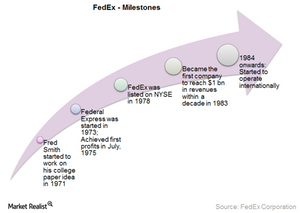

FedEx’s Growth Is Led by Acquisitions and Technology

By 1983, FedEx (FDX) had become the strongest delivery business in the nation. It started a string of acquisitions in order to grow more.

Why FedEx Is Expanding Its Global Reach

FedEx has assembled a portfolio of solutions, from express and freight forwarding to critical inventory logistics, that can solve any global commerce challenge.

FedEx: How a College Paper Idea Turned into a Delivery Giant

The idea behind FedEx (FDX) started off as a term paper by undergraduate Frederick W. Smith in 1965 at Yale University. The company started operations in 1973.

A Key Analysis of FedEx’s Business Model

Currently, FedEx is the global leader in the express delivery market. It offers delivery to and from individuals and businesses. It has various business units.