BTC iShares MSCI Japan ETF

Latest BTC iShares MSCI Japan ETF News and Updates

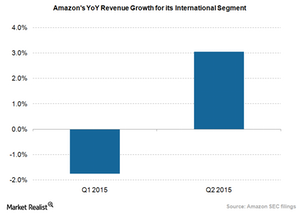

Amazon’s International Segment Saw Improvement in 2Q15

The year-over-year revenue growth trend for Amazon’s International segment was falling until last quarter.

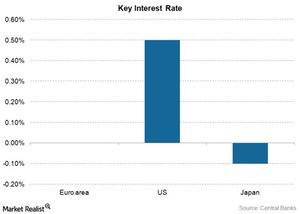

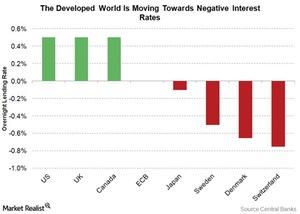

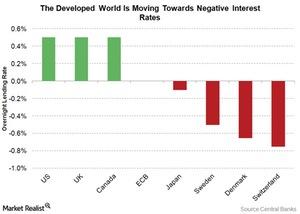

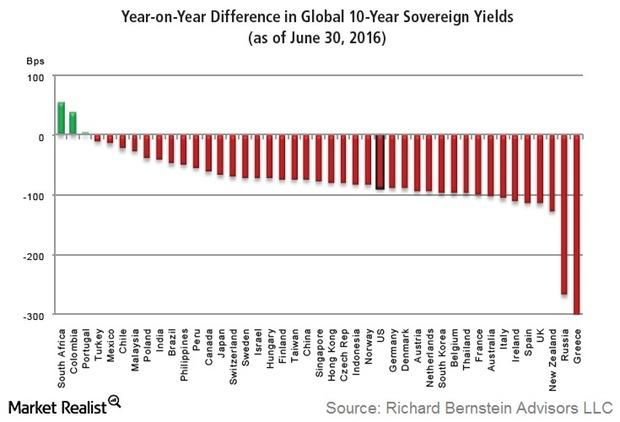

Why Do Central Bankers Continue to Surprise Bill Gross?

In his recent webcast by Janus Capital, Bill Gross expressed his surprise at the extent to which central bankers of the developed world (EFA) (VEA) have distorted the financial system.

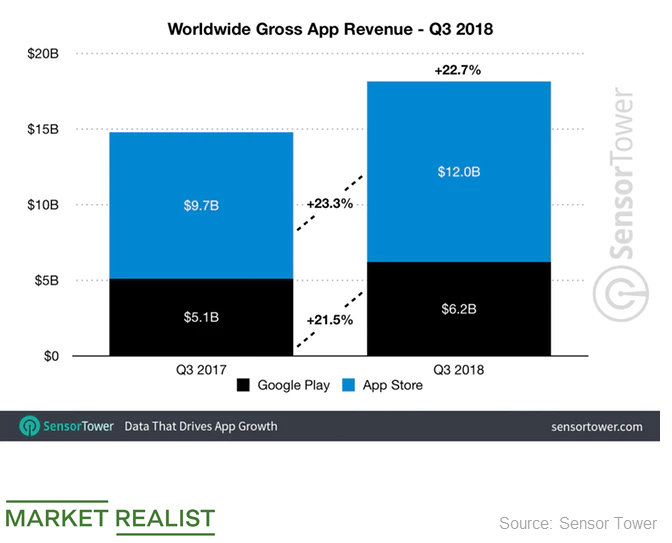

What Will Drive Services Revenue for Apple?

Emerging markets such as China and international markets such as Japan have contributed significantly to Apple’s Services segment over the years.

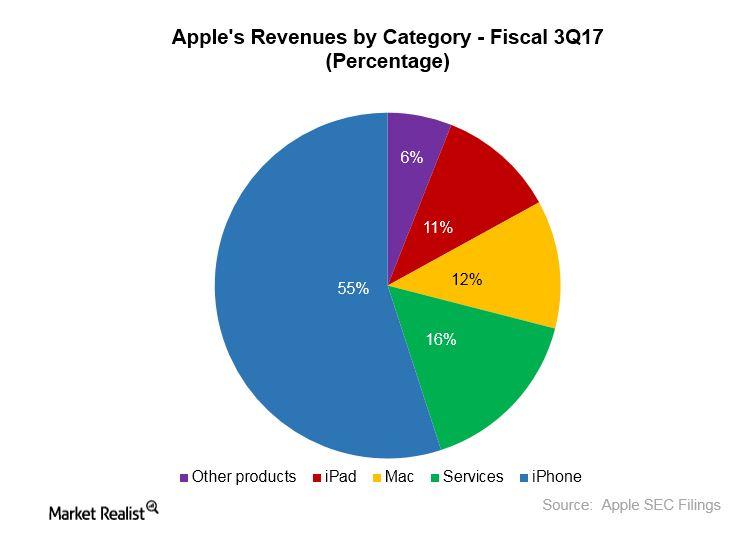

Putting Apple’s $1 Billion Content Budget into Perspective

Services contributed 16% of revenue Apple (AAPL) generated $24 billion from its Services business in fiscal 2016, and aims to double the revenue in four years. In fiscal 3Q17, Apple’s Services division contributed $7.3 billion in revenue, up 22% from a year earlier, and making up 16.1% of the quarter’s total revenue. Apple’s Services business consists of offerings […]

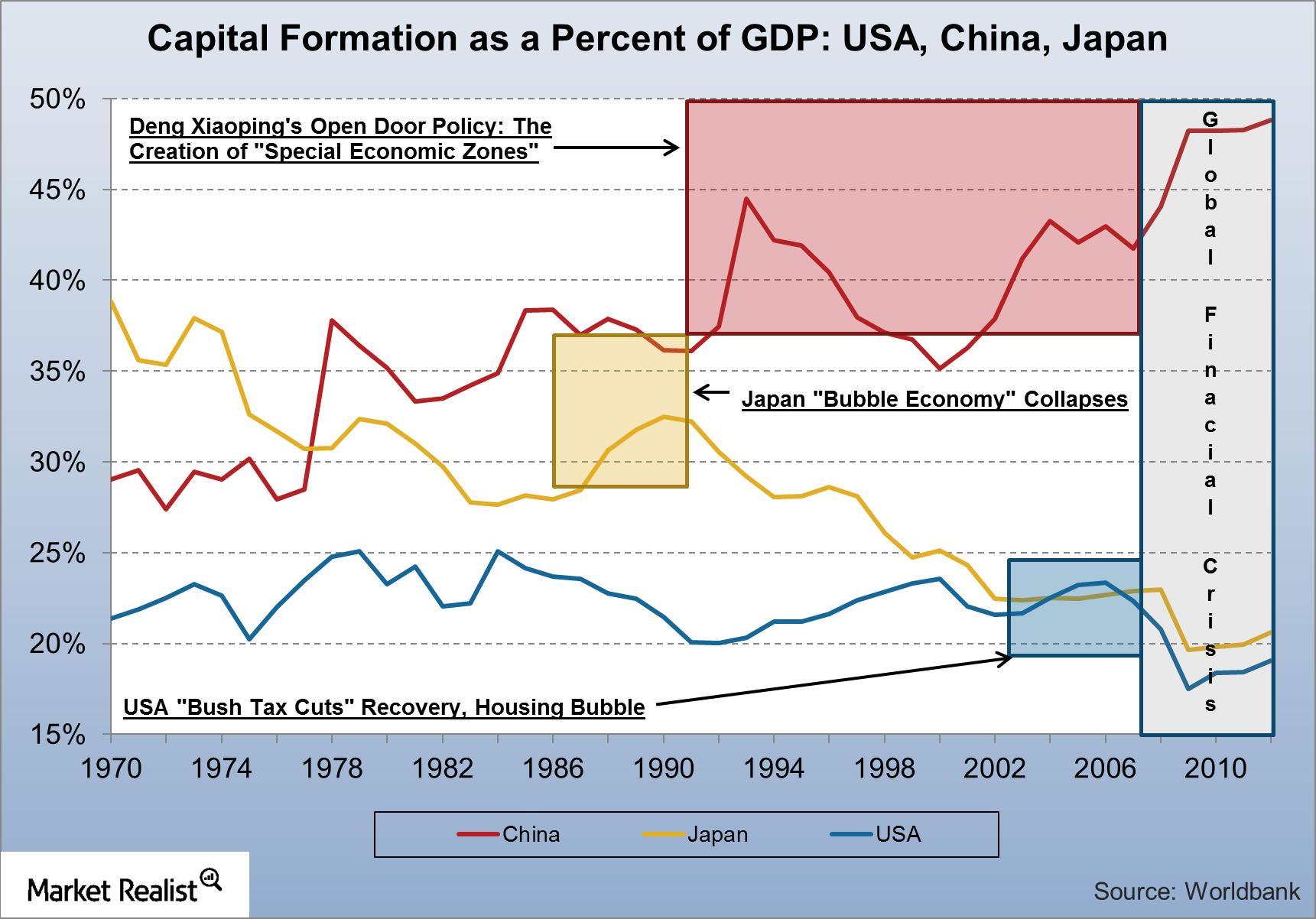

GM’s long-term competitive threat: Japan’s investment recovery

Japan is showing signs of investment recovery with its new economic policies coming into play.

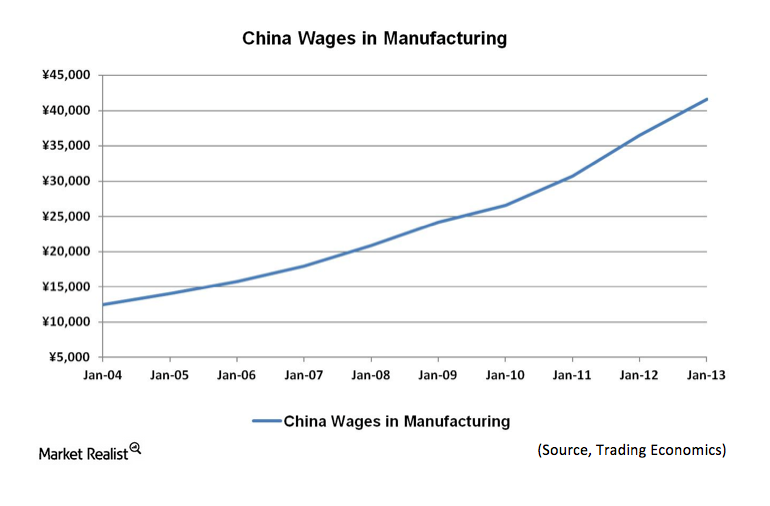

China’s wage inflation: Bad news for corporate profits and banks

Wage inflation in Chinese manufacturing With an appreciating currency and growing economy, Chinese manufacturers have experienced wage inflation. The cost of Chinese labor is simply becoming more expensive, as the below graph indicates. Private sector wage growth in China was 14% in 2012, while GDP growth is slowing to around 7.5% per annum. Wages are […]

Where Are Interest Rates Going? Ray Dalio Weighs In

Ray Dalio, and Marketplace Morning Report host David Brancaccio discussed the future of the economy and the next recession. Here’s what you need to know.

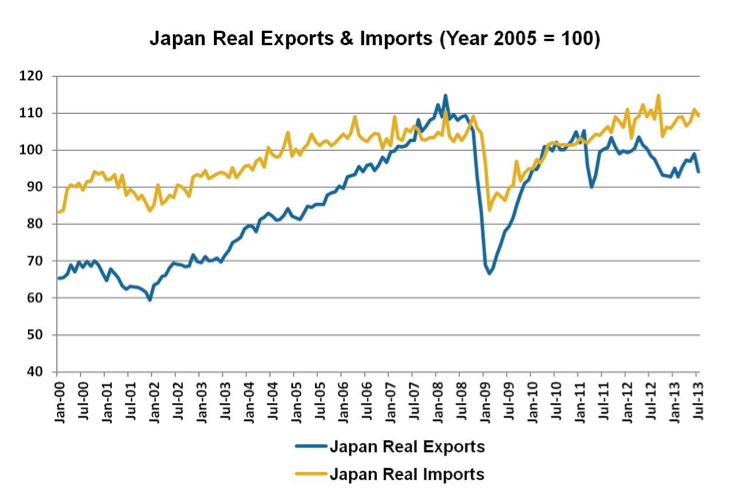

Why we could see a new trend in Japan’s exports and imports

Japan’s import and export dynamics The below graph provides a clearer picture of the import and export dynamics of the Japanese economy. By using 2005 as a base year and adjusting for inflation or deflation, the graph shows how exports and imports have changed on a “real” basis, as opposed to a “nominal” basis. Viewing […]

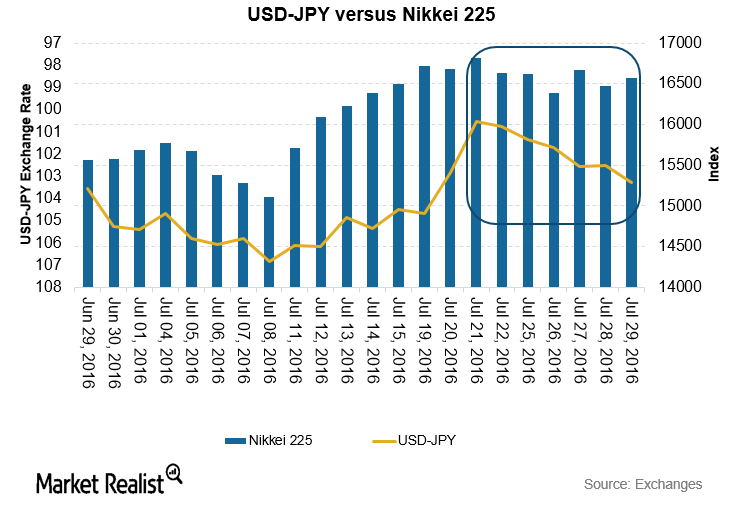

Analyzing the BoJ’s Monetary Policy Enhancement Measures

The BoJ’s monetary policy was the most awaited macro event this week. It was the first major central bank to expand its easing program after the Brexit vote.

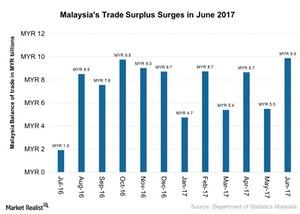

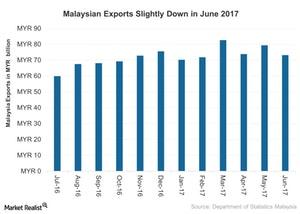

What’s behind Malaysia’s Large Trade Surplus in June 2017?

Malaysia’s trade surplus jumped to 9.9 billion Malaysian ringgit (MYR) (about $2.3 billion as of August 11, 2017) in June 2017—an 80% rise YoY.

Will the Fed Have to Use More Unconventional Measures?

Global monetary policy is unconventional. From an era of lowering interest rates to boost economic growth, central bankers are taking rates into negative territory.

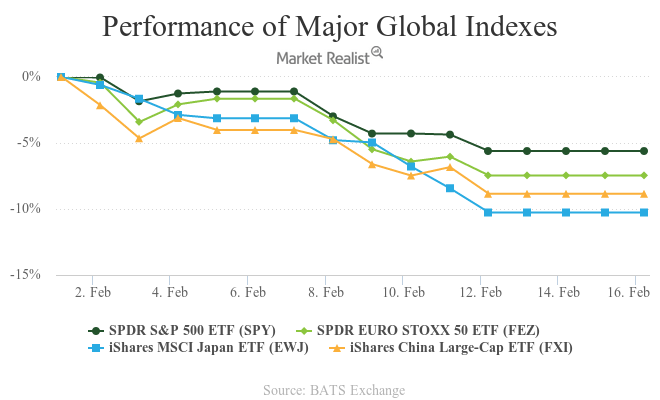

Can European Indexes Rally in the Current Global Turmoil?

In the current global scenario, the possibility of further devaluation of the Chinese yuan is a major concern for global equity markets. The Chinese PMI data released on January 31, 2016, indicated a slowdown in the Chinese economy.

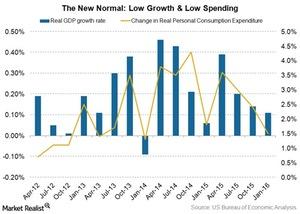

Bill Gross’s Views on Growth and Inflation

Gross believes that money has stopped generating growth and inflation. Equity prices are artificially elevated, and negative yields are guaranteeing capital losses.

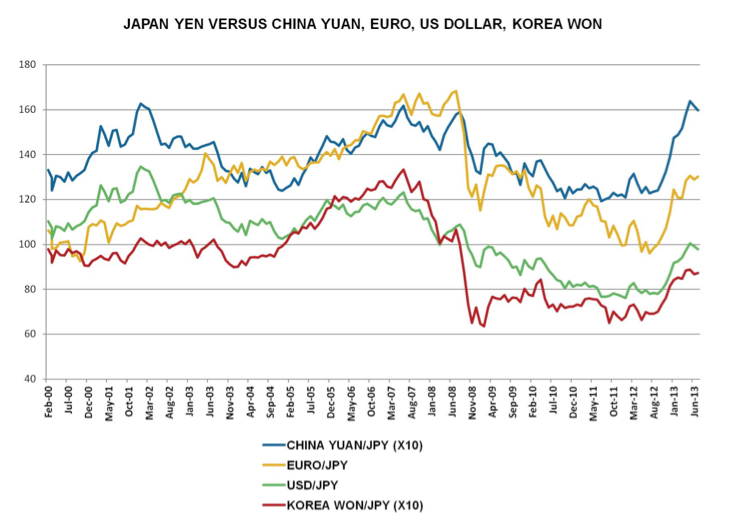

Does “Abenomics” mean a new era of yen depreciation?

A change in yen appreciation? The below graph reflects a potential big change in Japan post-2012—has yen appreciation turned the corner as a result of post-2012 “Abenomics“? In the mid 1970’s, the U.S. dollar bought 300 yen, and by the mid-1980’s, the U.S. dollar bought 250 yen. By the end of the 1980s, the dollar […]Financials Bank of Japan announces QQE2, expanded monetary stimulus

At its monetary policy meeting held on October 31, the Bank of Japan (or BOJ) announced new stimulus measures. The measures come in addition to those it announced earlier.

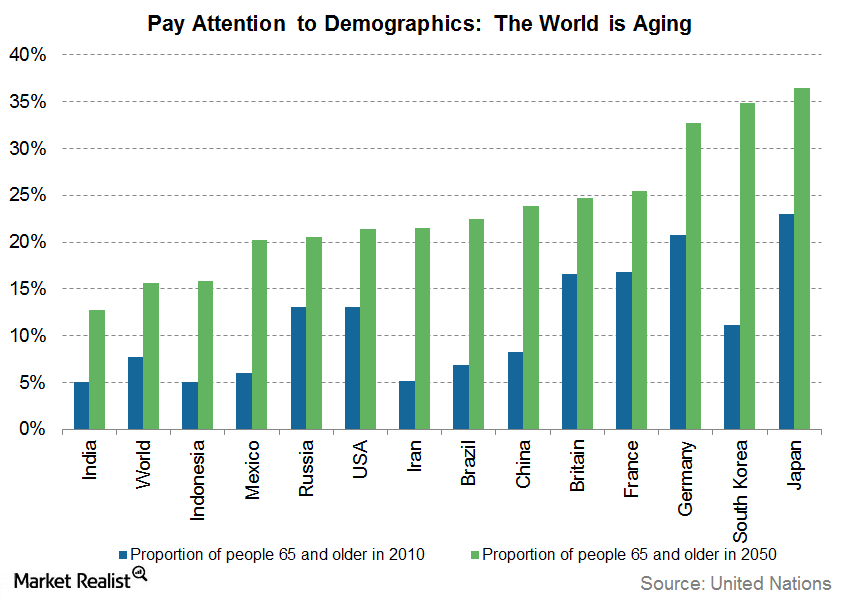

Beyond the Ephemeral: Pay Attention to Demographics

Lost in all the chatter about interest rates is a structural phenomenon that may be of far greater significance: demographics.

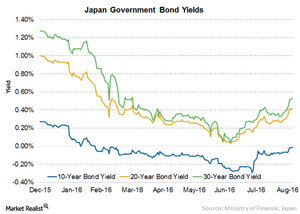

Hunting for Yield: Looking beyond Japan

Japan is the largest accessible bond market in Asia (source: Barclays Multiverse Index as of 7/29/16), but the problem is the yields for many local bonds are negative.

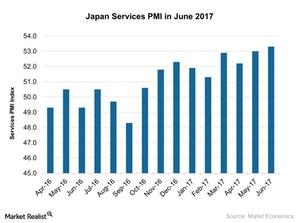

Why the Japan Services PMI Improved in June 2017

The Japan Services PMI (EWJ) (DXJ) stood at 53.3 in June 2017 compared to 53.0 in May 2017. It met the market expectation of 53.2.

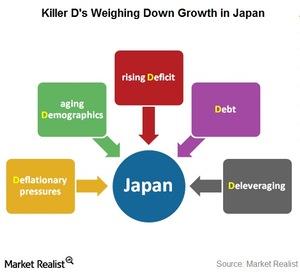

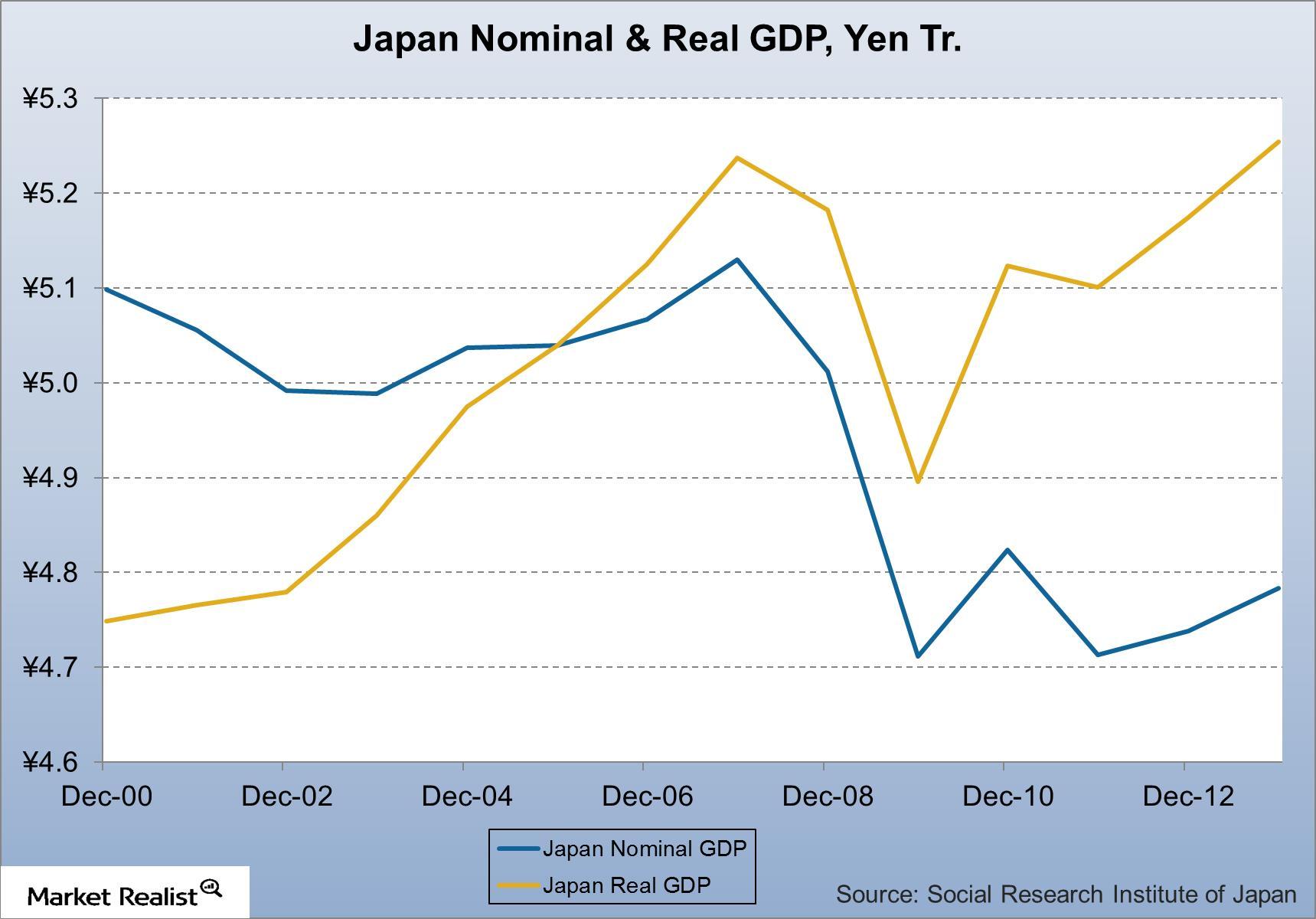

Dalio: Japan Is Undergoing an ‘Ugly Deflationary Deleveraging’

“Deleveraging” refers to reducing the debt level. With Japan’s debt burden, deleveraging the economy’s balance sheet seems more than imperative.

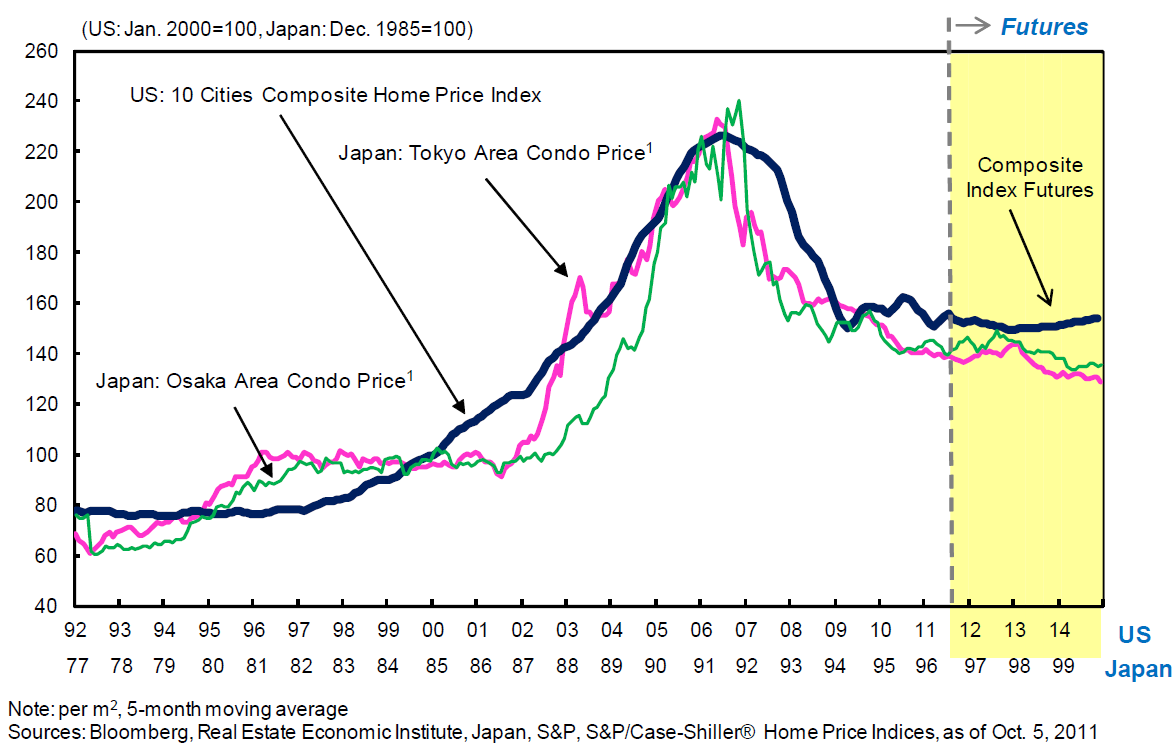

Why we’re seeing a brand new housing bubble—Japan style

Residential investments in Japan The below graph reflects the ongoing decline in the rate at which residential investments are being made in Japan. As with other forms of fixed investment noted earlier in this series, Japan has seen a long-term decline in the housing market since the peak of the economic bubble, which was accompanied […]

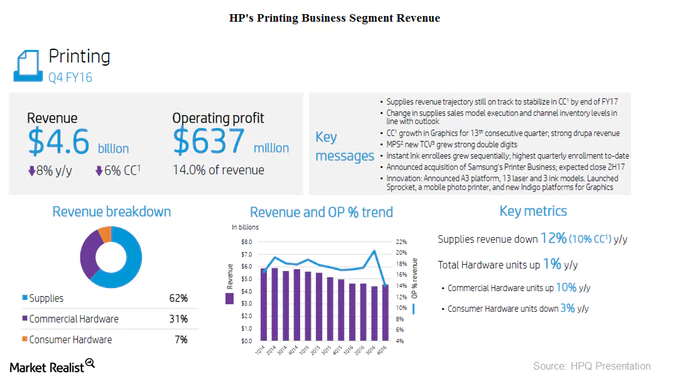

Inside HP’s Printing in Fiscal 1Q17

HP Inc.’s (HPQ) Printing business group reported revenues of $4.6 billion in fiscal 4Q16, which represents a fall of 8% YoY.

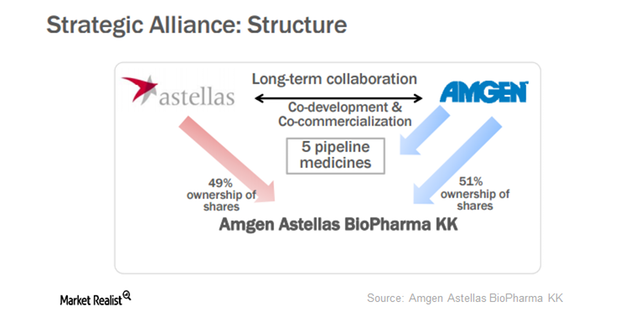

Multinational and Japanese Pharmaceuticals Should Build Alliances

The Japanese pharmaceuticals market is not very welcoming to foreign companies. Similarly, the Japanese population is quite loyal to domestic manufacturers.

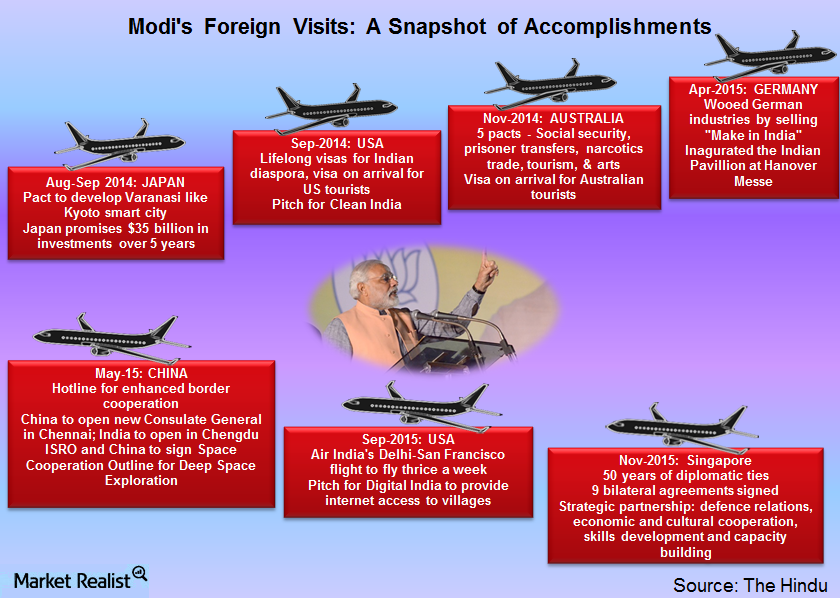

Modi’s Moment: Promises and Accomplishments

India (PIN) has strengthened its ties with Asian powerhouses (GRR) like Japan (JEQ) (EWJ) and Singapore (SGF).

Japanese Trade Surplus Rose in June, Imports Fell More than Exports

The trade surplus for Japan increased to 692.8 billion yen for June—compared to a deficit of 60.9 billion yen in the same month last year.

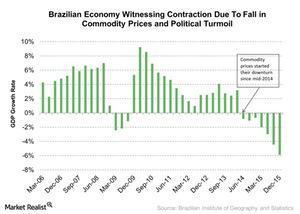

Why Is David Rubenstein Optimistic about Brazil?

The Brazilian economy is experiencing contraction due to a fall in commodity prices and the political turmoil. The commodities market is one of Brazil’s most important growth drivers.

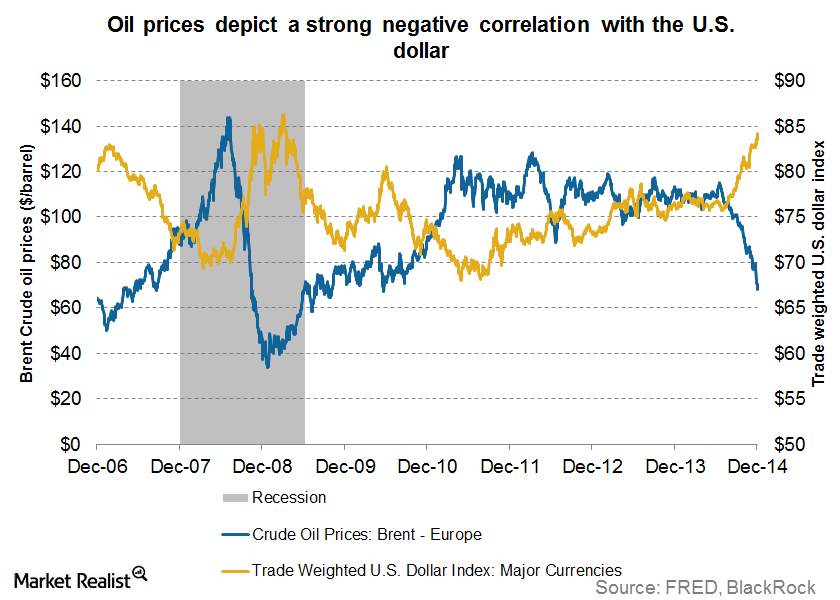

How The Rising Dollar Is Causing Oil Prices To Fall

A rising dollar has and will continue to put downward pressure on oil prices, causing trouble for the energy sector (XLE).

Understanding the Marginal Decline in Malaysian Exports in June

Exports from Malaysia in June 2017 stood at 73.1 billion Malaysian ringgit (MYR) (about $17 billion as of August 11, 2017), or 10% higher YoY.

Richard Bernstein: Falling Yields Are Testimony to Risk Aversion

Bernstein asked a rhetorical question: “Could there be anything that suggests extreme risk aversion more than the increasing proportion of global sovereign bonds that have negative yields?”

Immediate Impact of UK Election: Market Up, Volatility Down

After the announcement of the United Kingdom’s election outcome on June 9, 2017, global markets showed mixed responses.

Asian Markets Are Weak amid Trade War Concerns

The Shanghai Composite Index declined 0.84% and closed the day at 3,136.63 on April 3. The SPDR S&P China (GXC) declined 2.4% on April 2.

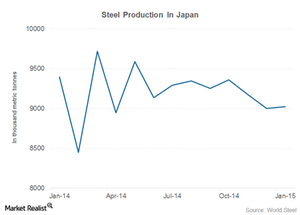

Can Abenomics Address The Japanese Steel Industry?

The Japanese steel industry also benefited from Abenomics. Steel production picked up as a result of the policies. A weaker yen also benefited Japan.Financials Overview: The must-know characteristics of frontier markets

Looking for the next frontier in emerging market investing? Del Stafford dives into these underdeveloped countries to assess the investment case.Financials Overview: What stretched valuations mean for investors

As I’ve been noting for some time, emerging markets (EEM) can offer compelling long-term value.

Japan’s GDP back to peak levels: Auto sales and Toyota benefit

This article considers the prospects for further real GDP growth acceleration and the implications for Japanese exporters like Toyota.

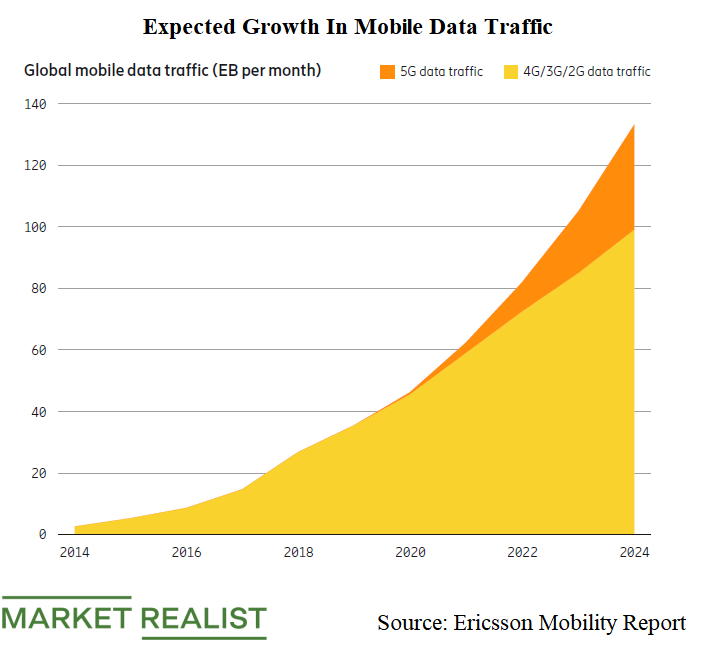

Ericsson Is Banking on 5G for Revenue Growth

Ericsson (ERIC) claims that the global 5G market is experiencing strong momentum.

Why the Yen Depreciated against the Dollar

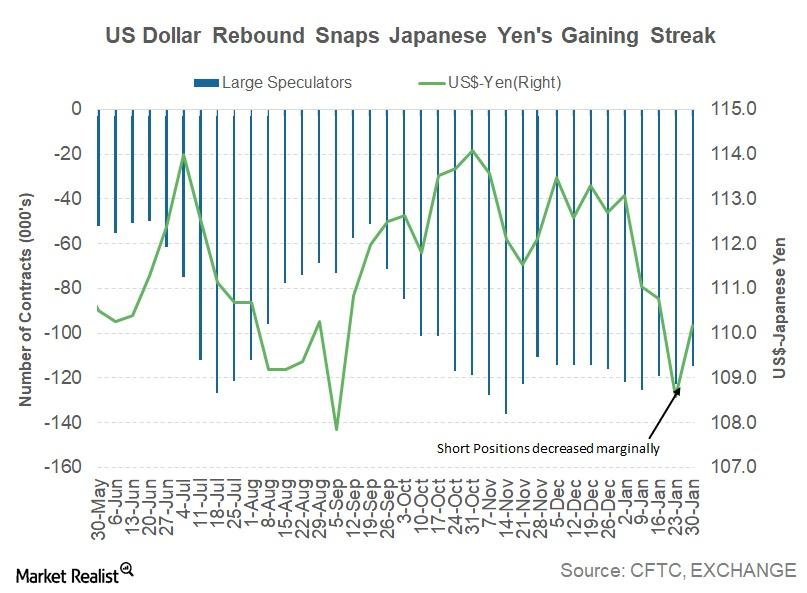

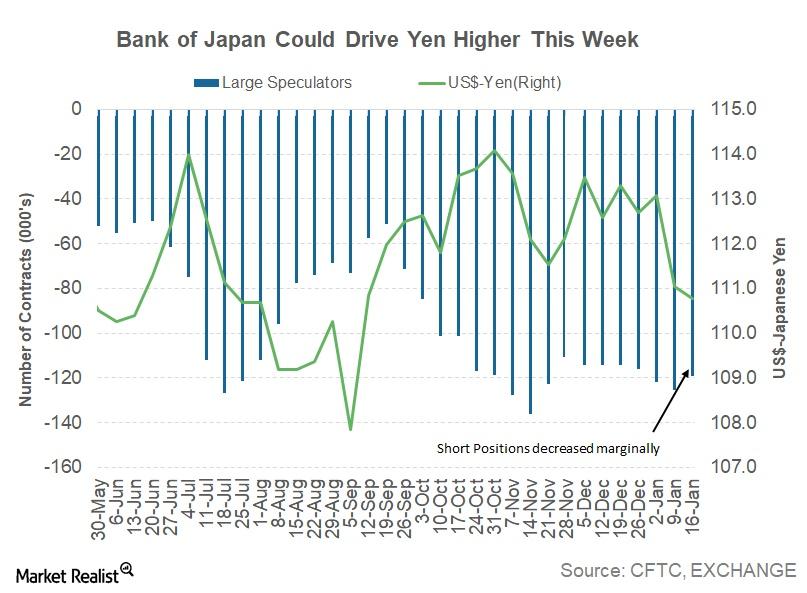

Last week, the Japanese yen (JYN) succumbed to the US dollar’s strength. The Japanese yen (FXY) closed the week at 110.67.

Why the Japanese Yen Depreciated against the Dollar Last Week

The Japanese yen (JYN) retracted against the US dollar last week as US dollar bulls tried to take control.

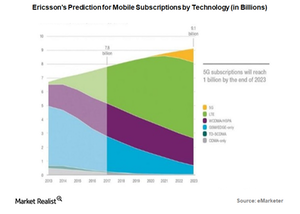

What Is Ericsson’s View on 5G Subscriptions?

Telecom gear maker Ericsson (ERIC) predicts that ~1.0 billion subscribers could have access to 5G mobile networks by 2023.

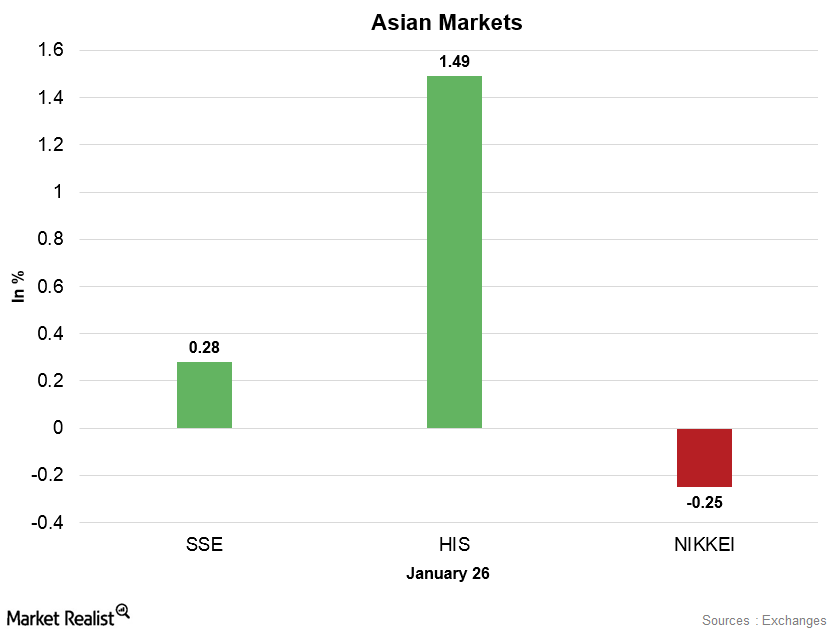

How Did Asian Markets Perform on January 26?

The Shanghai Composite Index rose 0.28% and closed the day at 3,558.13 on January 26. The SPDR S&P China (GXC) fell 0.42% on January 25.

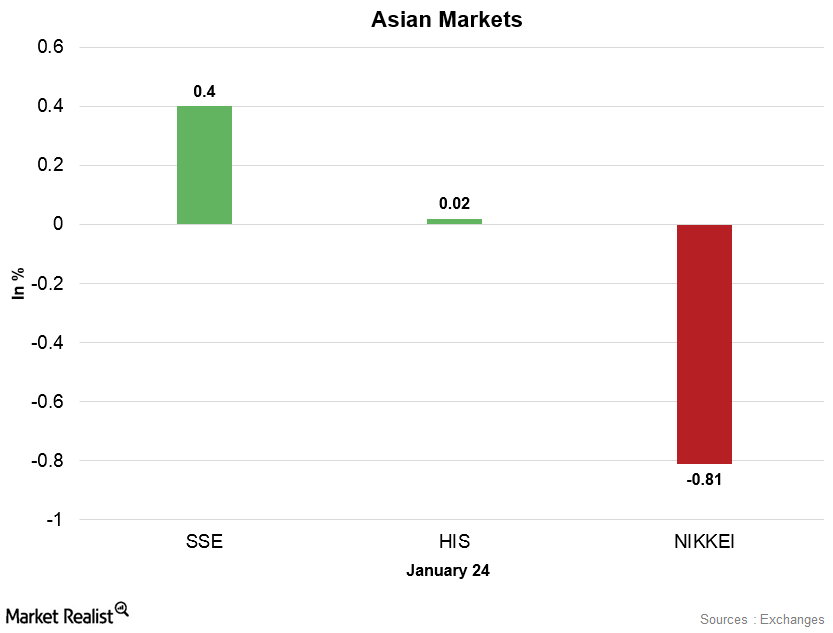

Why Are Asian Markets Mixed on January 24?

The Shanghai Composite Index rose 0.4% and closed the day at 3,560.73 on January 24. The SPDR S&P China (GXC) rose 1.3% on January 23.

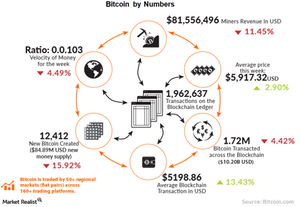

Things to Know Before You Buy Bitcoin

The sharp rise and fall in the price of bitcoin are mainly because ownership of the currency is heavily concentrated in just a few hands.

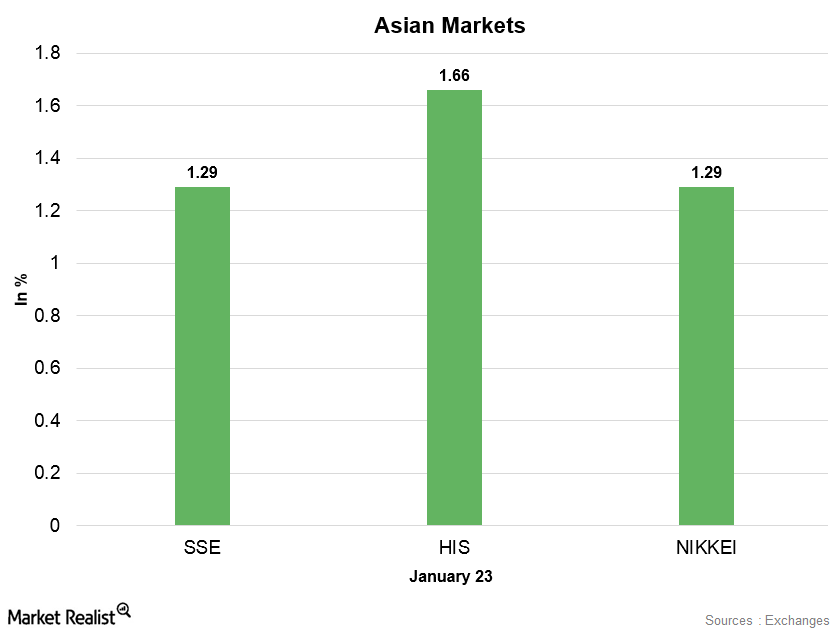

Why Did Asian Markets Increase on January 23?

On January 23, the Hang Seng Index rose 1.7% and closed the day at 32,930.70. The iShares MSCI Hong Kong (EWH) rose 0.87% on January 22.

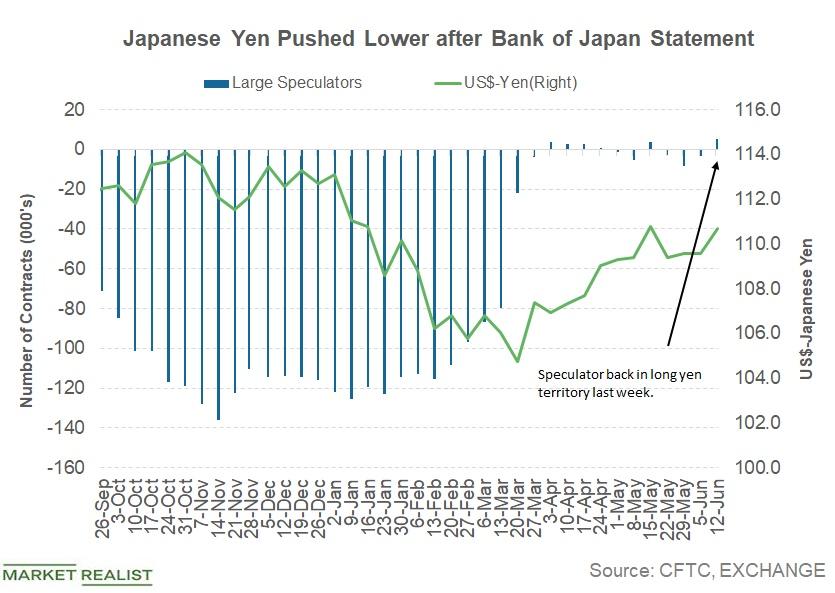

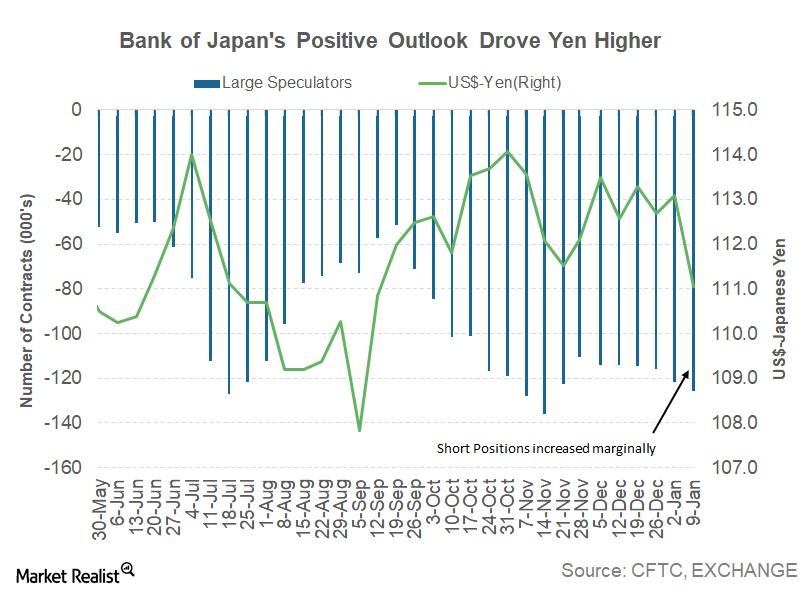

Could the Bank of Japan Drive the Yen Lower this Week?

The Japanese yen (JYN) registered its second consecutive weekly gain against the US dollar.

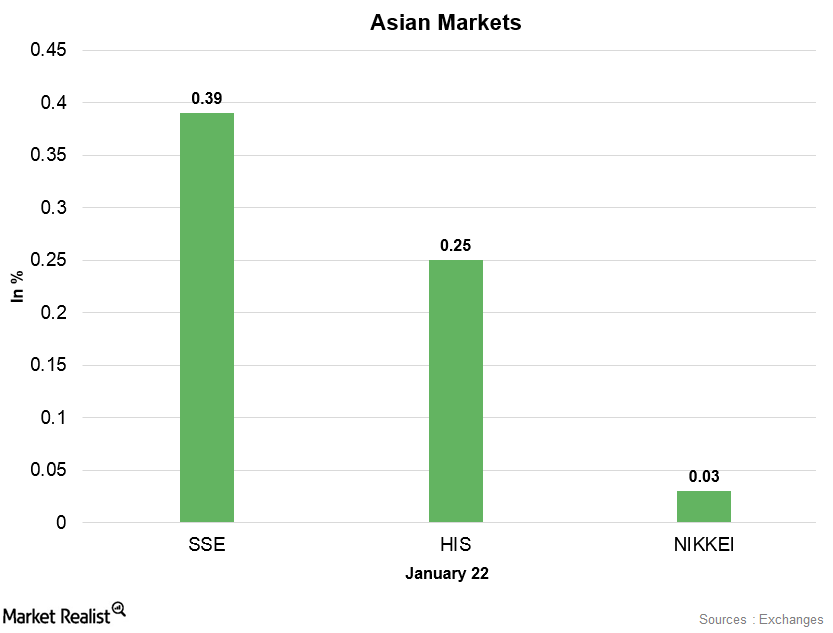

How Did Asian Markets Perform on January 22?

On January 22, the Hang Seng Index rose 0.25% and closed the day at 32,334.50. The iShares MSCI Hong Kong (EWH) rose 0.45% on January 19.

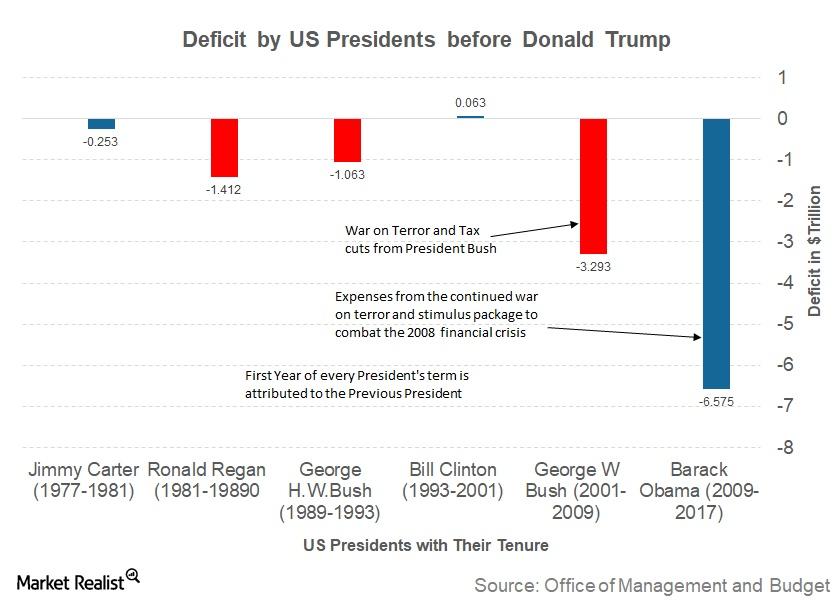

Why Is US Debt So High?

Most countries tend to issue debt to fund their deficits and keep paying interest on these borrowings. These revenues are generated through taxes from companies and individuals.

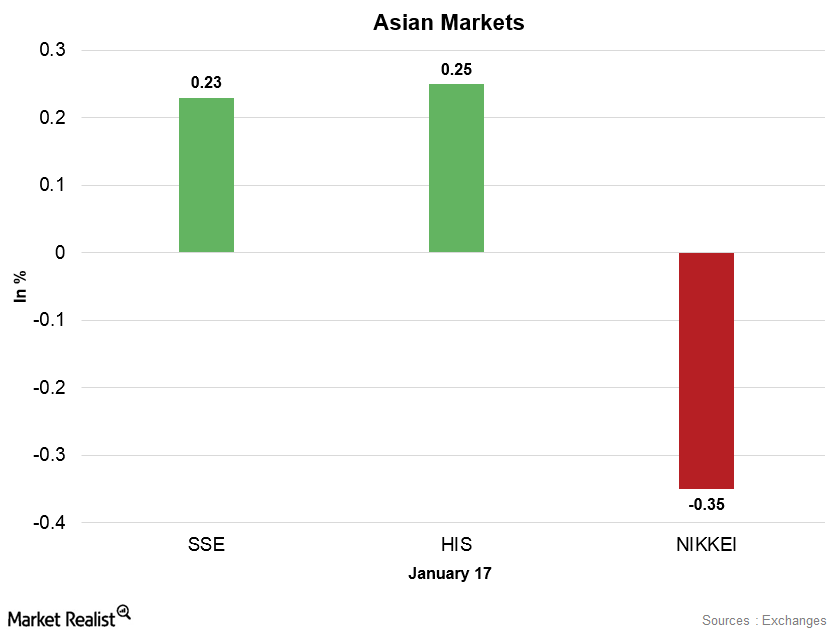

How Did Asian Markets Perform on January 17?

On January 17, the Hang Seng Index rose 0.25% and closed the day at 31,983.41. The iShares MSCI Hong Kong (EWH) rose 0.08% on January 16.

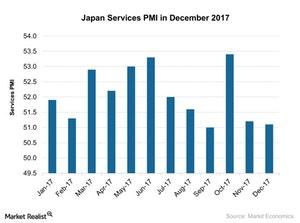

How Japan’s Services PMI Trended in December 2017

According to a report provided by Markit Economics, Japan’s services PMI (EWJ) (DXJ) remained weaker in December 2017.

Why the Japanese Yen Finally Appreciated against the US Dollar

During the week ended January 12, the yen (FXY) closed at 111.04 against the US dollar (UUP), compared to 113.08 in the week ended January 5, appreciating by 1.8%.

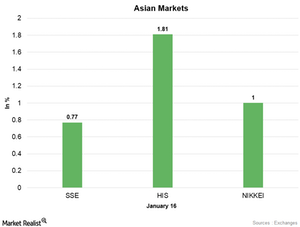

Why Did Asian Markets Rise on January 16?

On January 16, the Hang Seng Index rose 1.8% and closed the day at 31,904.75. The iShares MSCI Hong Kong (EWH) rose 0.65% on January 12.

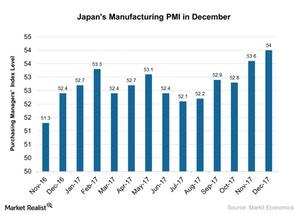

Why Japan’s Manufacturing Activity Improved in December 2017

Japan’s manufacturing activity in December Japan’s manufacturing PMI (purchasing managers’ index) improved in December 2017, rising to 54 from 53.6 in November 2017. Whereas the index was slightly below the preliminary market estimate of 54.2, it marked the strongest expansion in manufacturing activity since February 2014. The solid rise in Japan’s manufacturing PMI in December 2017 was mainly due […]