BTC iShares MSCI Japan ETF

Latest BTC iShares MSCI Japan ETF News and Updates

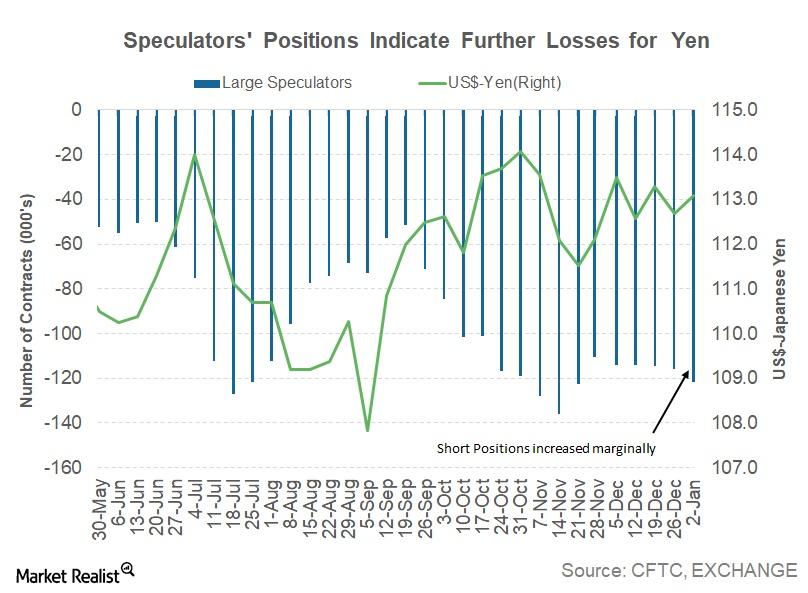

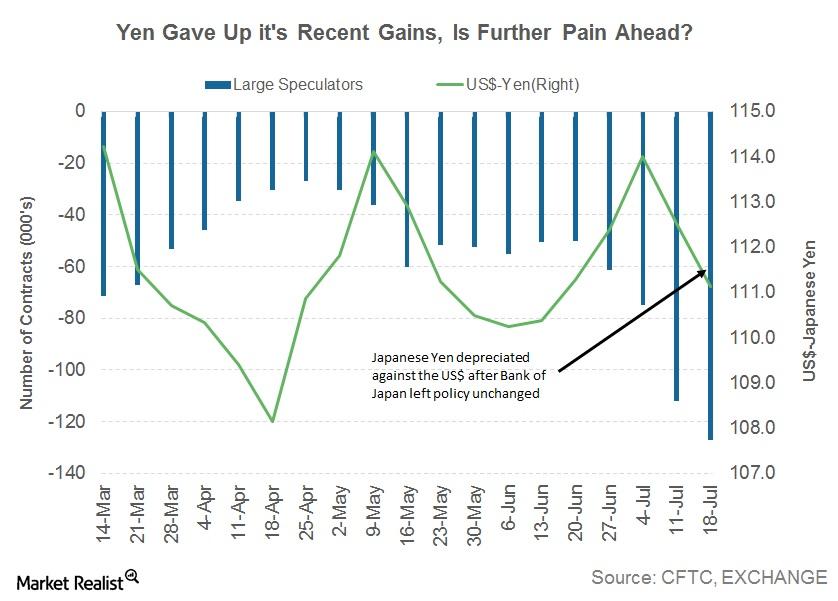

Can the Japanese Yen Rise against the US Dollar?

The Japanese yen (JYN) is the only currency that is unable to capture the weakness in the US dollar (UUP).

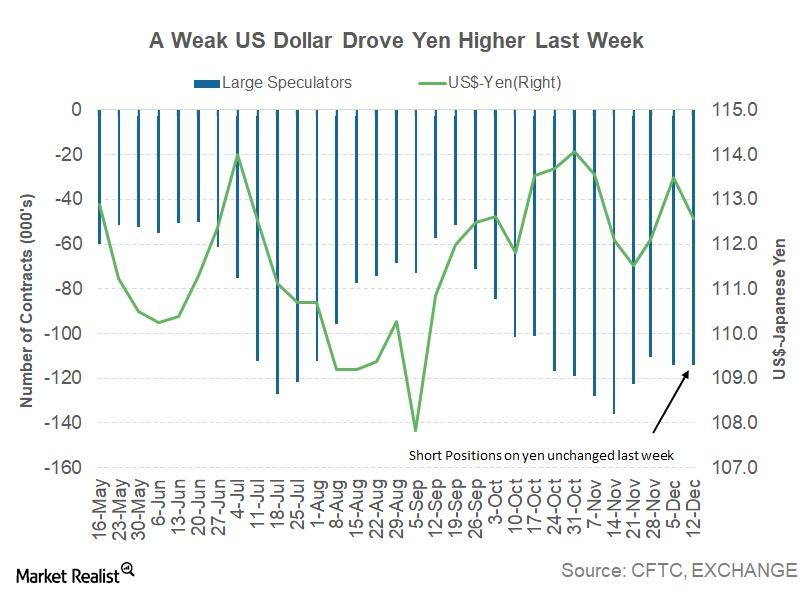

How the Bank of Japan Could Have an Impact on the Yen This Week

For the week ended December 15, the Japanese yen (FXY) closed at 112.58 against the US dollar (UUP), appreciating by 0.79%.

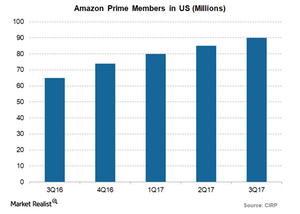

Amazon Unveils Amazon Prime in Southeast Asia

Amazon (AMZN) has finally launched its Prime membership in Singapore, thus expanding its reach in the fastest growing region of Southeast Asia.

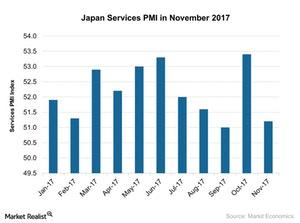

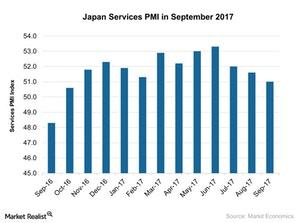

Why Japan Services PMI Didn’t Meet Expectations in November

The Japan Services PMI fell in November 2017. It came in at 51.2 compared to 53.4 in October. It didn’t meet the market expectation of 52.0.

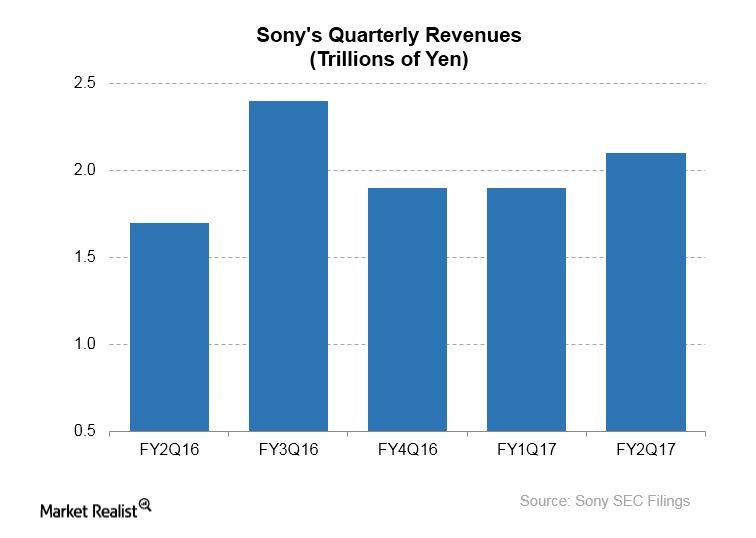

Tracing Sony’s Return to Its Aibo Robot Dog Business

Sony’s original Aibo sold for between $600 and over $2,000. The new Aibo starts at $1,700, a price that puts the product in the range of competitors.

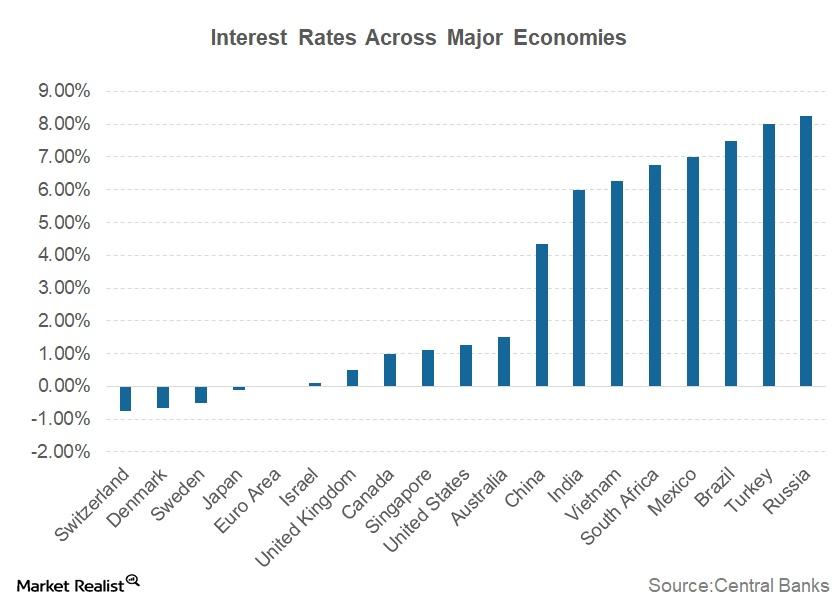

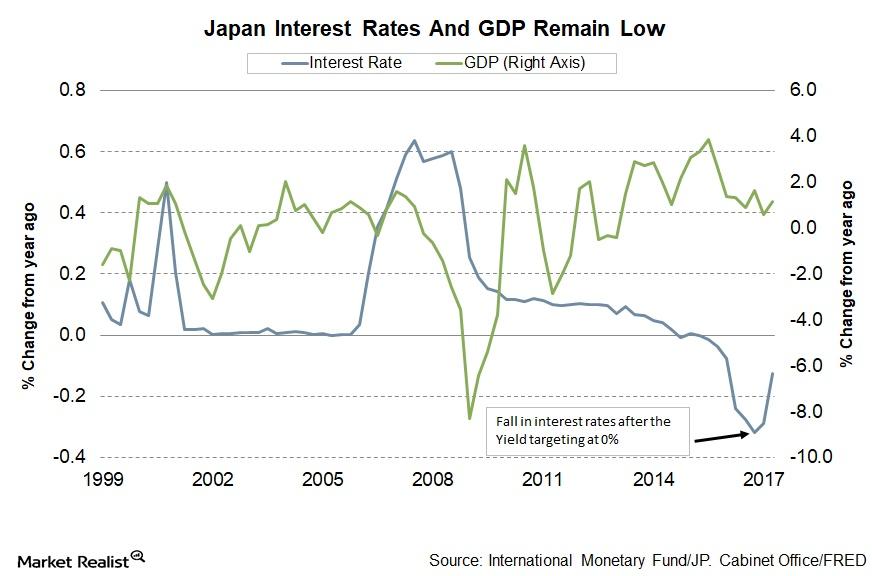

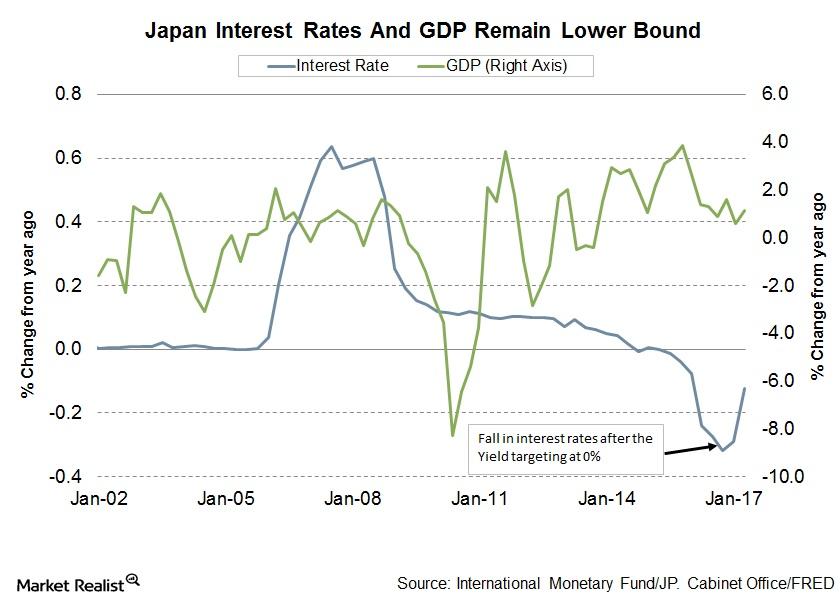

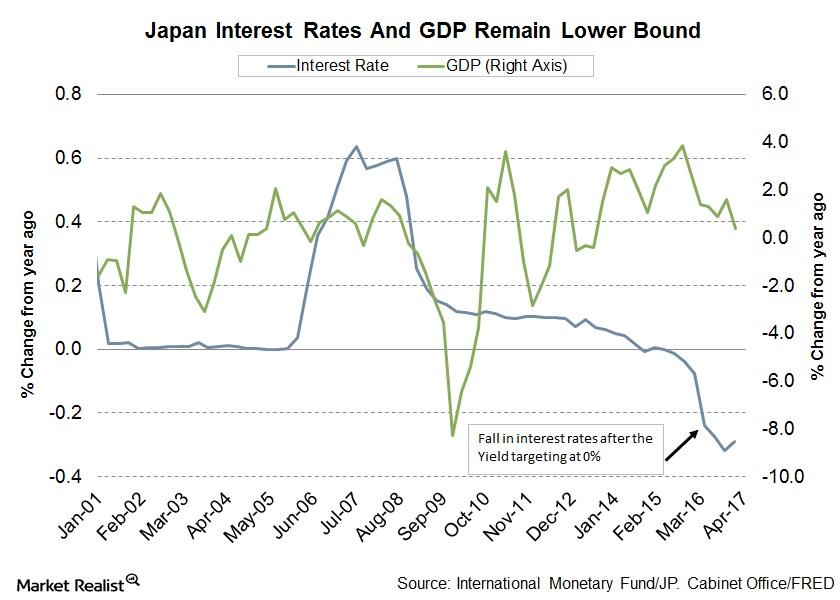

The Problem with the Current Interest Rates

With global economies progressing toward normalcy or the “new normal,” as Williams called it, central banks are moving toward normalizing policy by signaling interest rate hikes.

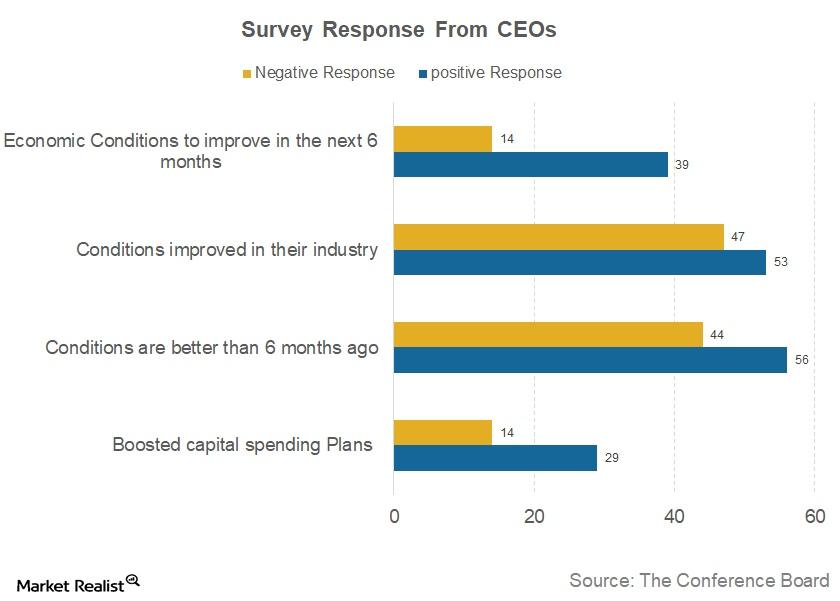

How Does CEO Confidence Index Assess US and Global Economies?

The Conference Board CEO Confidence Survey is a quarterly report based on a survey that collects responses from approximately 100 CEOs who represent a variety of industries.

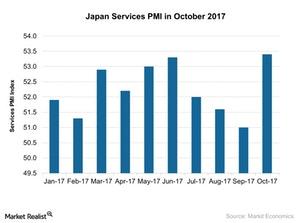

Why Japan’s Services PMI Improved Solidly in October 2017

Japan’s services PMI (EWJ) (DXJ) rose solidly in October 2017. It stood at 53.4 in October 2017 compared to 51.0 in September 2017.

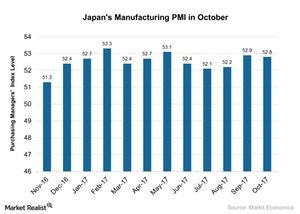

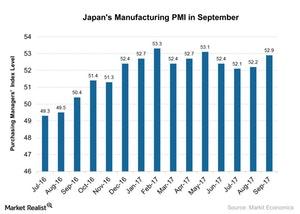

Key Insight into Japan’s Manufacturing PMI in October

Japan’s manufacturing PMI stood at 52.8 in October 2017, compared with 52.90 in September 2017, and beat the preliminary market estimation of 52.5.

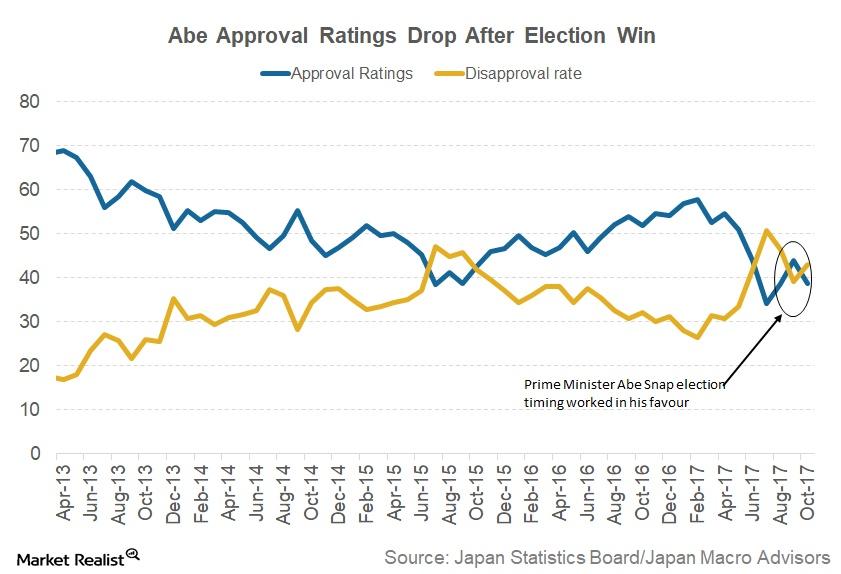

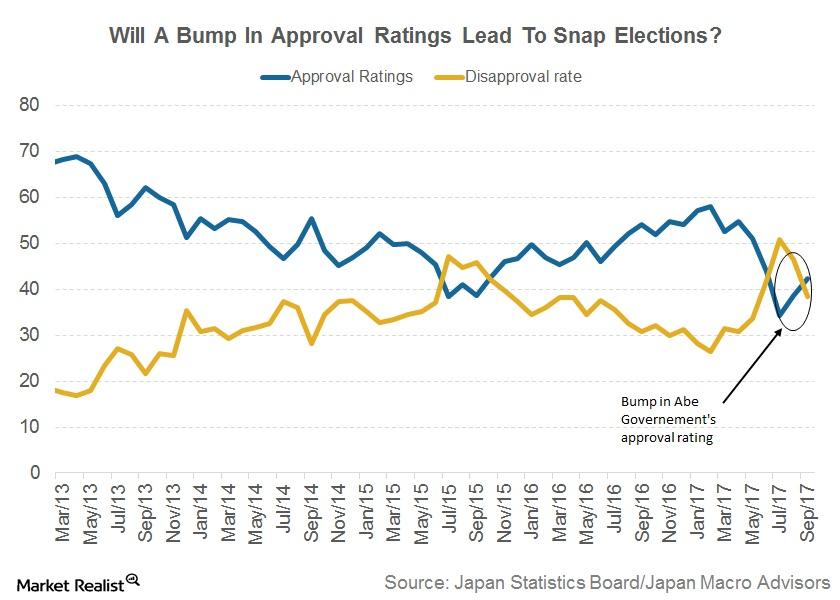

Why the Recent Election Results Are Positive for Japan

Japanese Prime Minister Shinzo Abe’s call for an early election worked in his favor. He called for a snap election to take advantage of his high ratings.

Bank of Japan: No Changes in the October Policy Meeting

At its October policy meeting, the Bank of Japan left its ultra-loose monetary policy unchanged. The decision was made by an 8-1 majority vote.

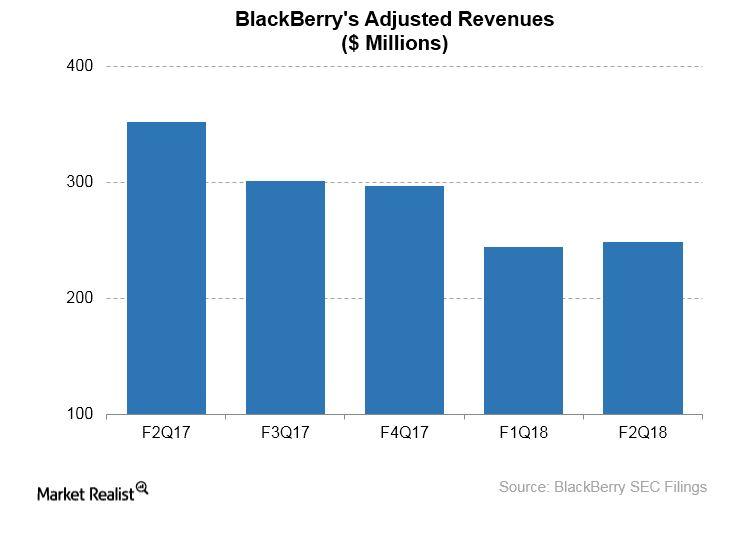

How the Tokyo Electron Device Deal Fits in Blackberry’s Strategy

Providing Japan with access to Blackberry’s QNX BlackBerry (BB) recently announced that it had entered into a sales and distribution agreement with Japanese semiconductor company Tokyo Electron Device. Under the agreement, Tokyo Electron Device will provide manufacturers in Japan (EWJ) with access to BlackBerry’s QNX Software Development Platform (QNX SDP 7.0). According to BlackBerry, QNX SDP […]

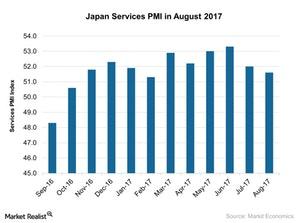

Why Japan’s Services PMI Has Been Falling Gradually

According to the report provided by Markit Economics, Japan’s services PMI (EWJ) (DXJ) stood at 51.0 in September 2017 compared to 51.6 in August 2017.

Insight into Japan’s Manufacturing in September 2017

Japan’s manufacturing PMI stood at 52.90 in September 2017, compared to 52.20 in August 2017. The PMI figure beat the preliminary market estimation of 52.5.

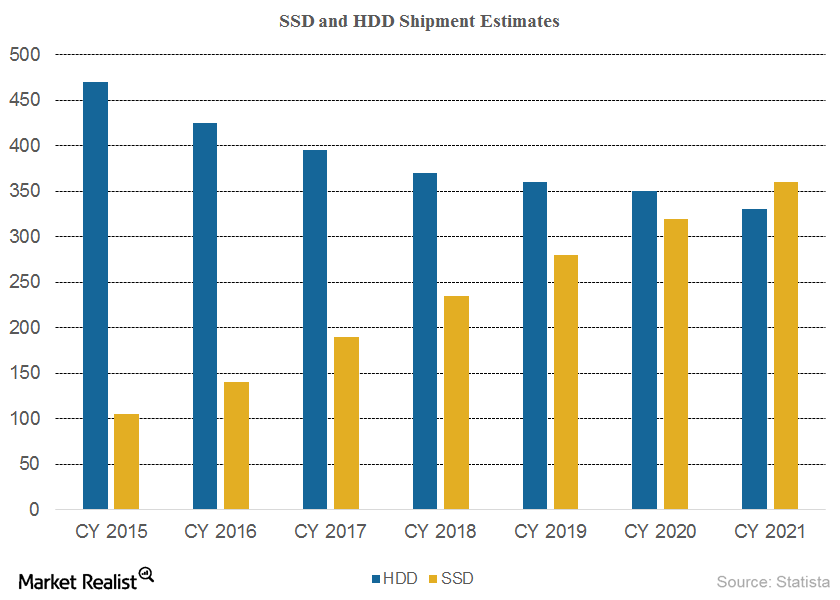

What Analysts Project for Global HDD and SSD Shipments

According to Statista, HDD (hard disk drive) shipments are expected to fall 7% YoY (year-over-year) in 2017 to 395 million units from 425 million units in 2016.

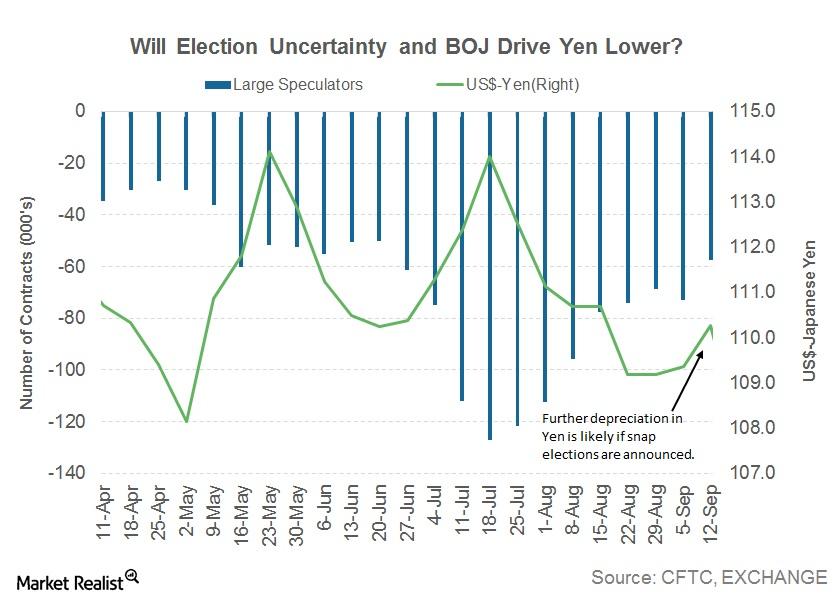

Bank of Japan Sees Rising Political Uncertainty as a Risk

According to news reports, Japanese Prime Minister Shinzo Abe could be calling for a snap election next month to capitalize on the increased approval ratings in August.

Update on the Bank of Japan’s September Policy Meeting

The Bank of Japan left its policy unchanged at its September meeting. By an 8–1 majority vote, the policy board decided to leave its policy and its QQE with a yield curve control unchanged.

How Japan’s Service Activity Trended in August 2017

According to the latest report by Markit Economics, the Japan Services PMI (EWJ) (DXJ) stood at 51.6 in August 2017, compared with 52 in July 2017.

Will Election Uncertainty Drive the Japanese Yen Lower?

The Japanese yen (JYN) continued to depreciate against the US dollar last week.

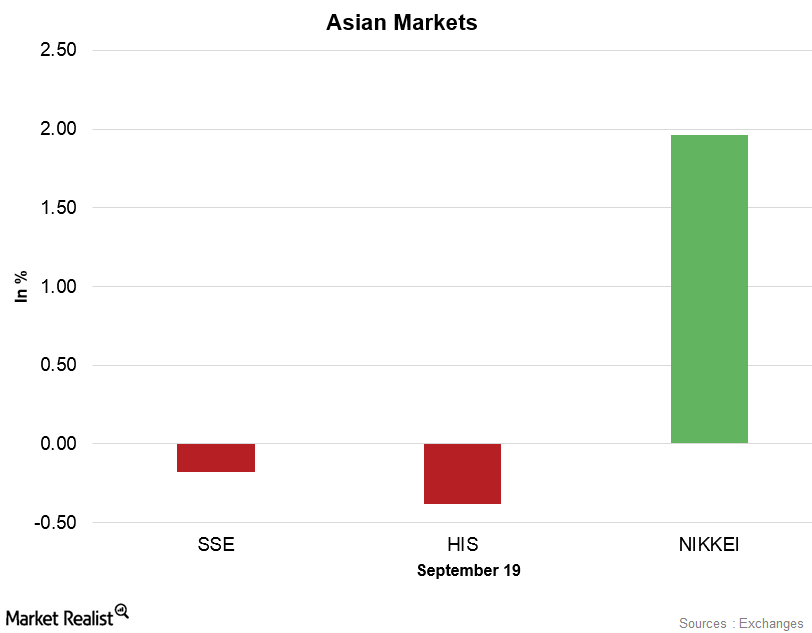

Asian Markets Are Mixed on September 19, Decreased Risk Appetite

On September 19, 2017, the Shanghai Composite Index fell 0.18% and ended at 3,356.84. The SPDR S&P China ETF (GXC) rose 1.1% and closed at 104.38.

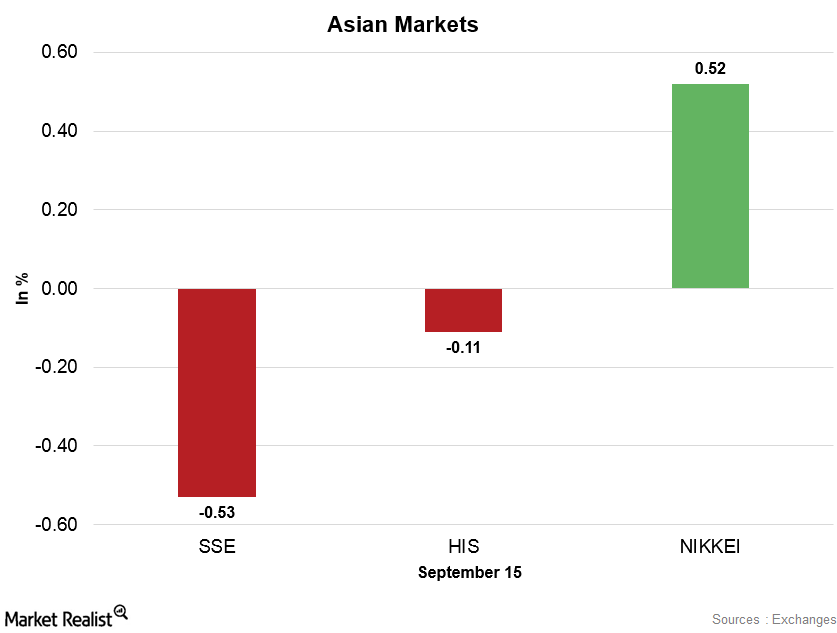

Asian Markets Are Mixed amid North Korea Tensions

On September 15, 2017, the Shanghai Composite Index fell 0.53% and ended at 3,353.62. The SPDR S&P China ETF (GXC) fell 0.1% and closed at 102.65.

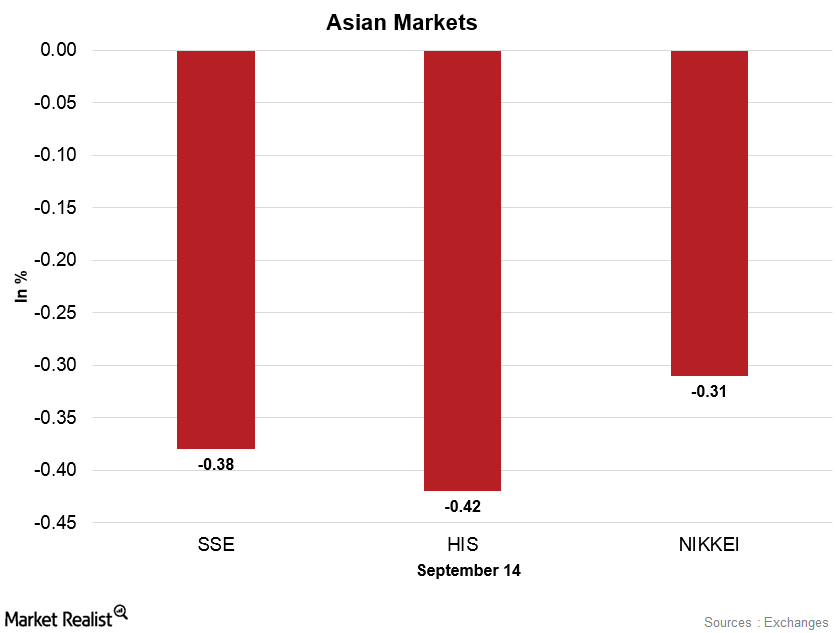

Asian Markets Pulled Back amid China’s Weak Economic Data

On September 14, 2017, the Shanghai Composite Index fell 0.38% and ended at 3,371.43. The SPDR S&P China ETF (GXC) rose 0.33% and closed at 102.75.

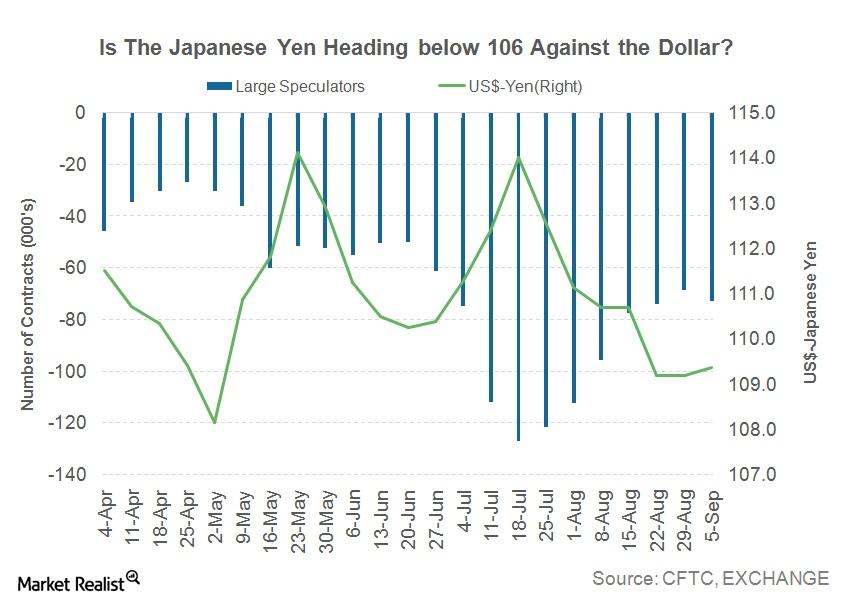

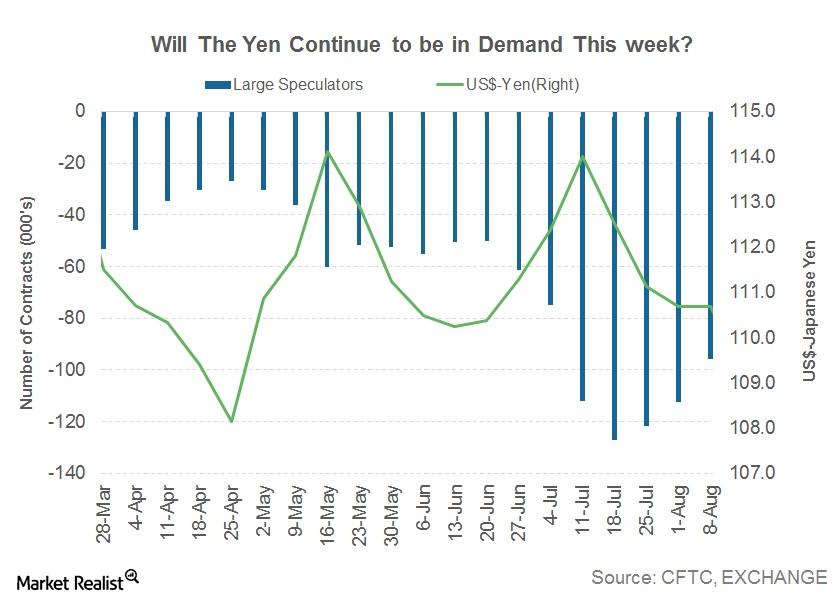

What Drove the Japanese Yen below 108 Last Week?

The Japanese yen gained ground against the US dollar last week, closing at 107.8 against the US dollar, which appreciated 0.56%.

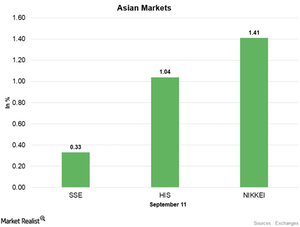

Asian Markets Started the Week on a Stable Note

On September 11, 2017, the Shanghai Composite Index rose 0.33% and ended at 3,376.42. The SPDR S&P China ETF (GXC) fell 0.53% and closed at 100.30.

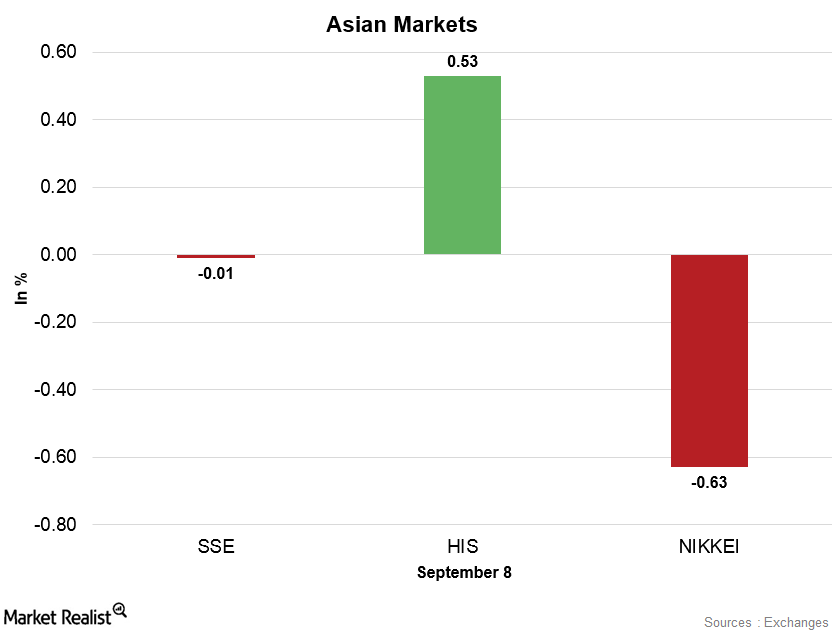

Asian Markets Were Mixed on September 8

On September 8, 2017, the Shanghai Composite Index fell 0.01% and ended at 3,365.24. The SPDR S&P China ETF (GXC) rose 0.78% and closed at 100.83.

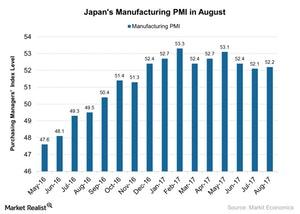

How Japan’s Manufacturing Activity Trended in August 2017

Japan’s manufacturing PMI stood at 52.2 in August 2017 as compared to 52.1 in July 2017.

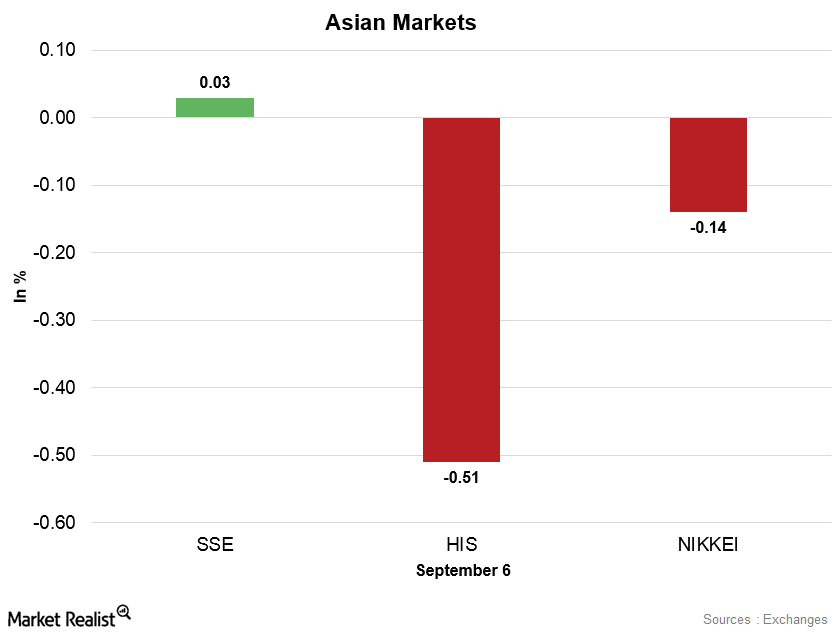

Asian Markets Lost Strength amid North Korea Tensions

On Tuesday, the Shanghai Composite started the day on a weaker note by opening lower. However, the market gained strength as the day progressed.

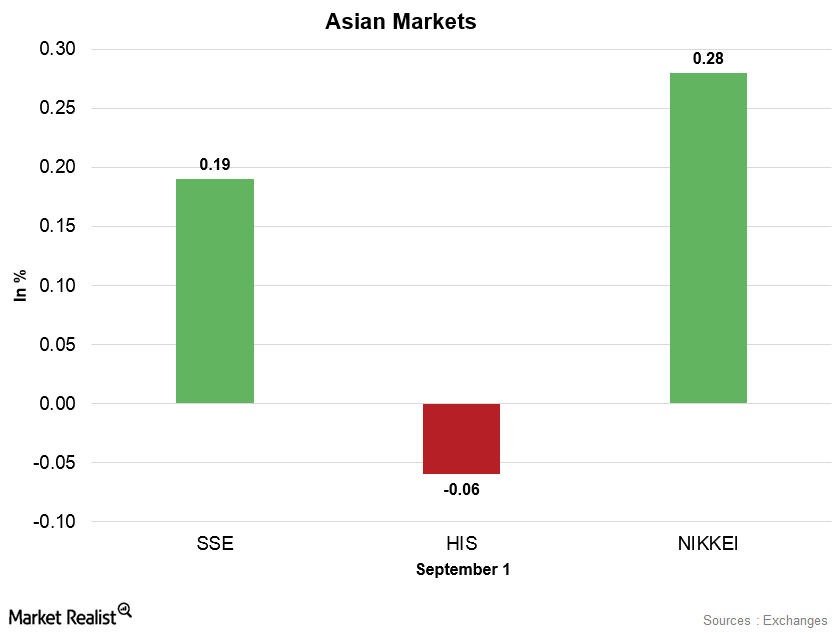

Asian Markets Are Stable on September 1

On September 1, 2017, the Shanghai Composite Index rose 0.19% and ended at 3,367.12. The SPDR S&P China ETF (GXC) rose 0.32% and closed at 100.65.

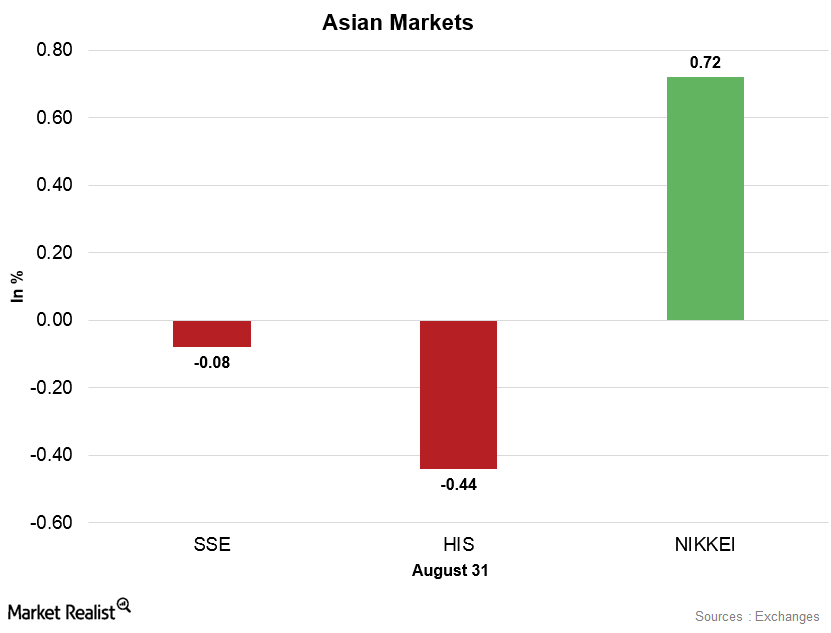

Asian Markets Are Mixed on August 31

On August 31, 2017, the Shanghai Composite Index fell 0.08% and ended at 3,360.81. The SPDR S&P China ETF (GXC) rose 0.83% and closed at 100.33.

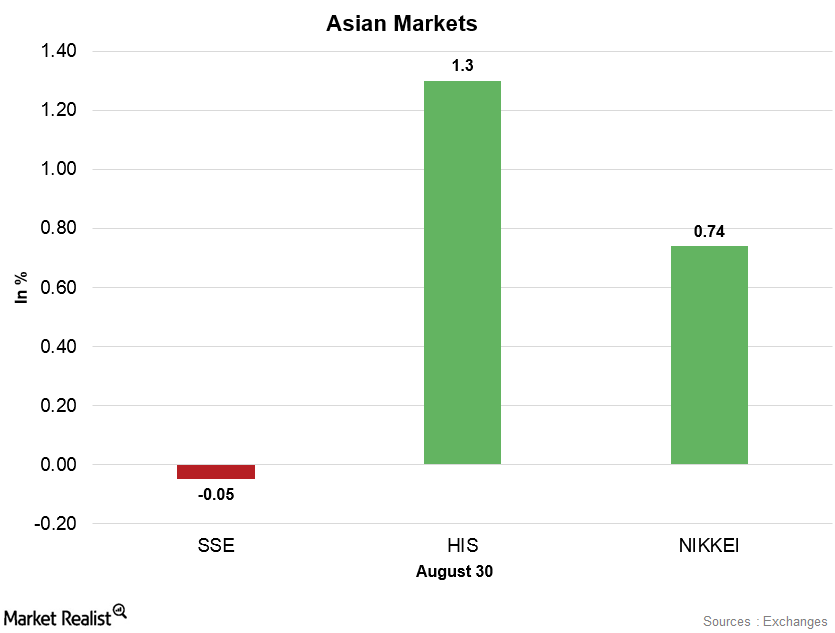

Asian Markets Are Mixed amid Improved Market Sentiment

On August 30, 2017, the Shanghai Composite Index fell 0.05% and ended at 3,363.63. The SPDR S&P China ETF (GXC) rose 0.02% and closed at 99.50.

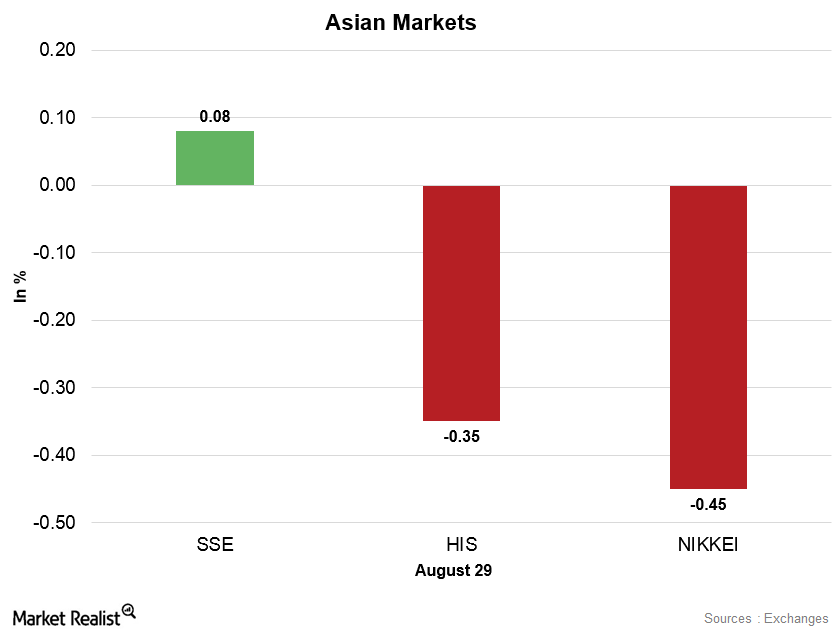

Asian Markets Are Weak on August 29 amid Geopolitical Tension

On August 29, 2017, the Shanghai Composite Index rose 0.08% and ended at 3,365.23. The SPDR S&P China ETF (GXC) fell 0.71% and closed at 99.48.

Why Were Asian Markets Mixed on August 28?

On August 28, the Shanghai Composite opened the day above the important resistance of 3,300 and rose to fresh 20-month high price levels.

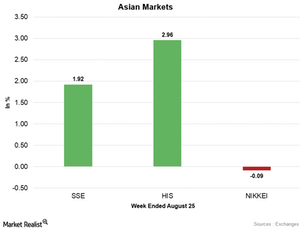

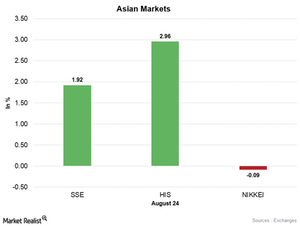

Asian Markets Rose in the Week Ending on August 25

After regaining strength last week, China’s Shanghai Composite Index continued to gain in the week ending on August 25.

The Latest Key Economic Indicators from Developed Nations

In this series, we’ll analyze the services PMIs for major developed nations including the US, France, Germany, Spain, the Eurozone, Japan, and the UK.

Will the Japanese Yen Appreciate Further This Week?

The Japanese yen (JYN) was back in demand as geopolitical tensions took center stage last week.

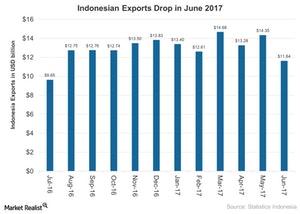

Indonesia’s Exports Fell in June 2017

Exports from Indonesia (EIDO) in June 2017 stood at $11.6 billion, a fall of 11.8% on a year-over-year basis and 19% on a month-over-month basis.

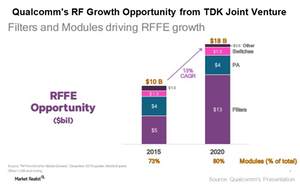

What’s Qualcomm’s Growth Strategy in the Radio Frequency Market?

Qualcomm (QCOM) is not only expanding its end markets, it’s also expanding in related technologies in order to increase its semiconductor content per device.

The Japanese Yen Could Keep the US Dollar Company

Another week of appreciation The Japanese yen (JYN) had another positive week, posting gains of 1.3% and closing at 111.12 against the US dollar (UUP). The previous week’s close for the currency pair was 112.53. This strength was primarily driven by the US dollar, rather than positive news from the Japanese economy. Most of the […]

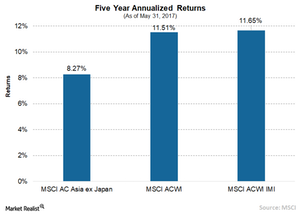

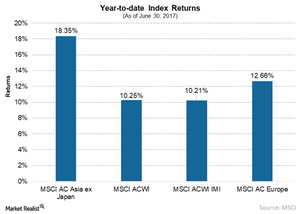

An Asian Rally Will Likely Hinge on This

Although Asian markets have outperformed most of the other regions this year, their performance over the past few years has remained sluggish overall.

Will North Korea Undermine Broader Asian Markets?

Under Kim Jong-Un, North Korea has adopted a more aggressive stance toward its regional adversaries, fueling unprecedented tension in the region.

Is It Time to Focus on Asian Markets?

Asian nations (AAXJ) are experiencing a continuation of the economic recovery that has been going on for a couple of quarters now.

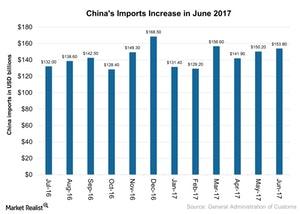

Did China’s Imports Rise on Its Structural Shift in June 2017?

China’s (FXI) imports rose to $153.8 billion in June 2017, a 17.2% rise year-over-year (or YoY) and a 2% rise month-over-month.

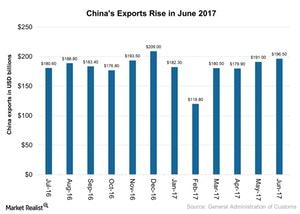

Chinese Exports Rose in June 2017 on Improving Global Demand

Chinese (FXI) exports stood at $196.6 billion in June 2017, a rise of 11.3% year-over-year basis and a rise of 8.7% month-over-month.

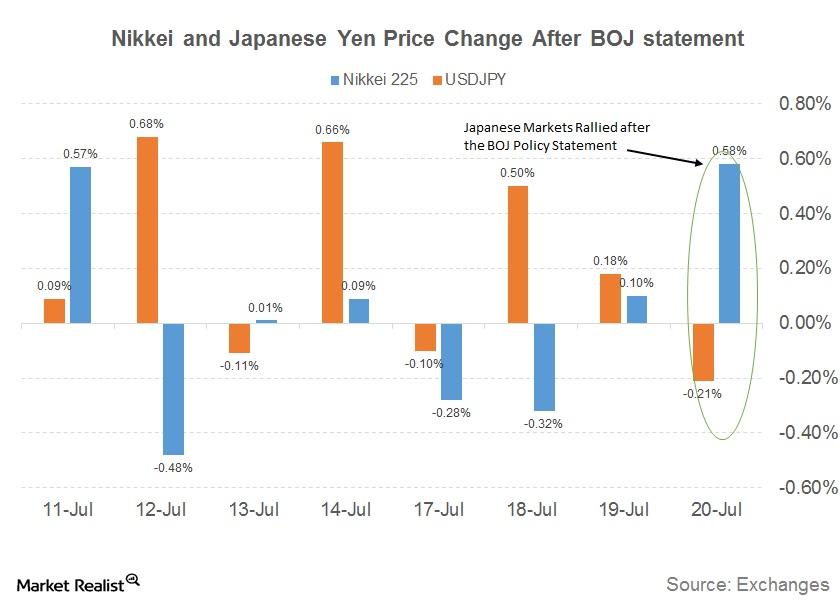

Why Japanese Markets Surged after the Bank of Japan’s Inaction

In its July 2017 monetary policy statement on July 20, 2017, the Bank of Japan reported that it had left interest rates unchanged at -0.1%.

The Bank of Japan Cuts Its Inflation Forecast

According to the statement it released at the end of its two-day meeting on July 20, 2017, the Bank of Japan has left its monetary policy unchanged.Macroeconomic Analysis What Japan’s Manufacturing Suggests for Its Economy

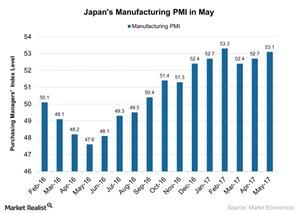

Japan’s manufacturing PMI (purchasing managers’ index) stood at 52.4 in June 2017 compared to 53.1 in May.

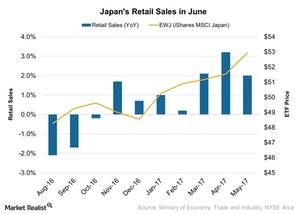

What Japan’s Falling Retail Sales Indicate for the Economy

According to the data provided by Japan’s Ministry of Economy, Trade and Industry, Japan’s retail sales rose to 2% in May 2017 on a yearly basis.

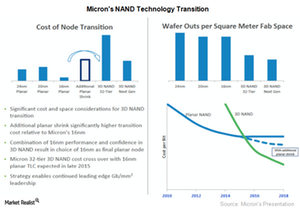

Micron’s Strategy to Become Cost-Competitive

For the last two years, Micron reduced its DRAM production cost 15.0%–25.0% by transitioning to a 20 nm node and starting mass production of the 1X node.

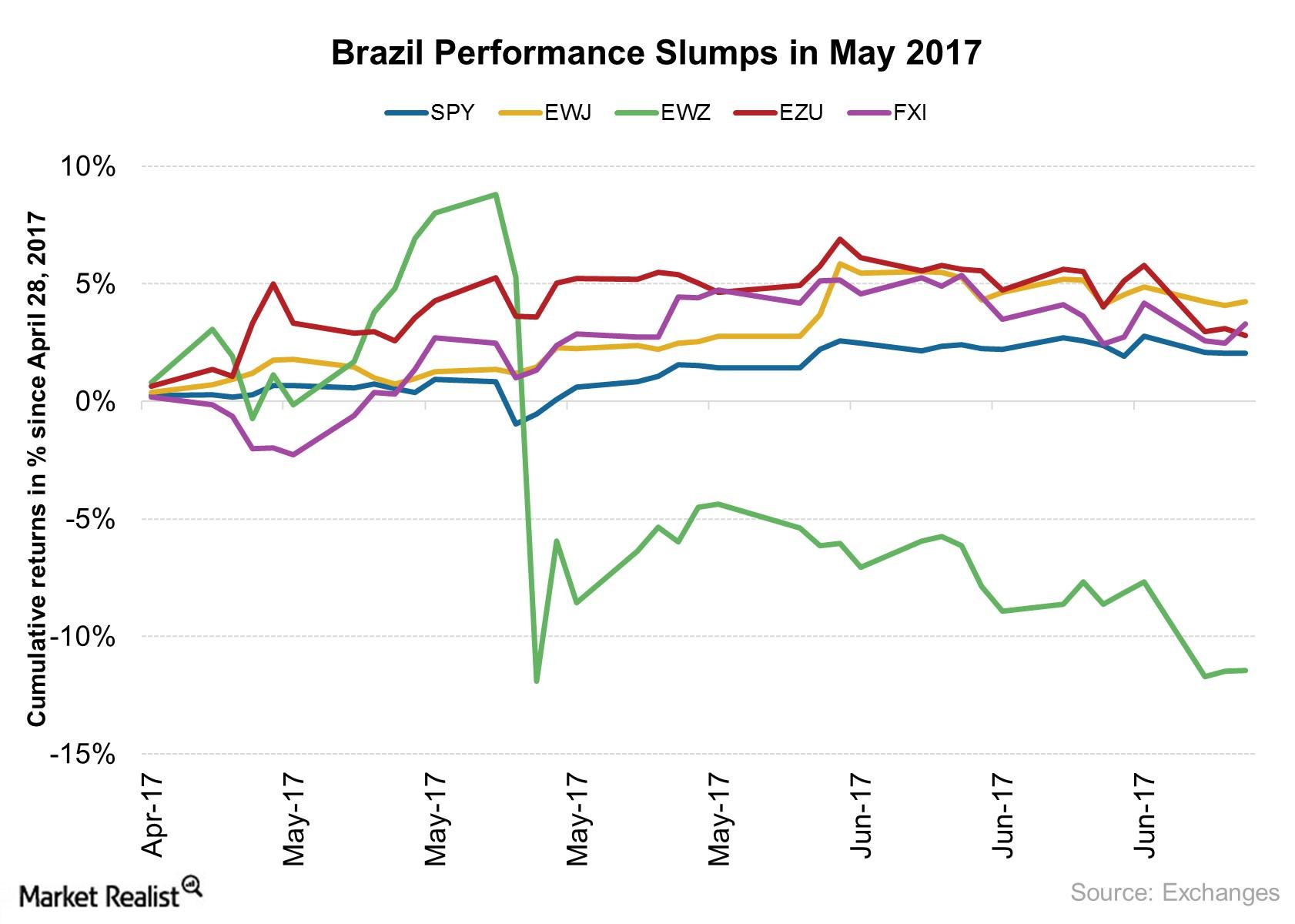

How Political Instability Affected Brazil’s Stock Performance in May 2017

The International Monetary Fund is projecting 0.5% growth in Brazil’s GDP output in 2017, according to its April 2017 outlook report.

Japan’s Manufacturing PMI in May, and What to Make of It

The Japan Manufacturing PMI stood at 53.1 in May 2017, as compared to 52.7 in April, outperforming the preliminary market estimation of 52.0.