CSX Corp

Latest CSX Corp News and Updates

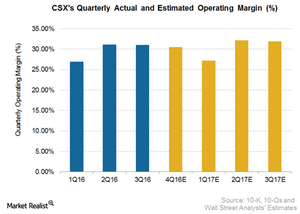

Will CSX’s 4Q16 Operating Margin Exceed Analysts’ Estimates?

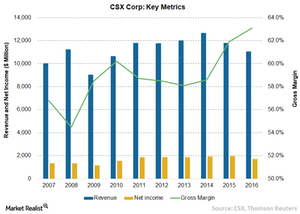

For CSX Corporation (CSX), Reuters-surveyed analysts estimate an operating margin of 30.5% for 4Q16, compared to an operating margin of 28.4% in 4Q15.

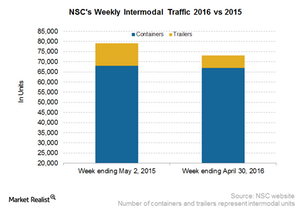

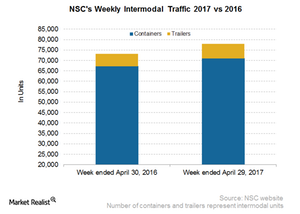

Norfolk Southern’s Intermodal Slump Equitable with Rival CSX

Norfolk Southern’s (NSC) total intermodal traffic for the week ended April 30, 2016, declined by 7.6%, at nearly 73,000 containers and trailers. This compares with 79,000-plus units in the corresponding week of 2015.

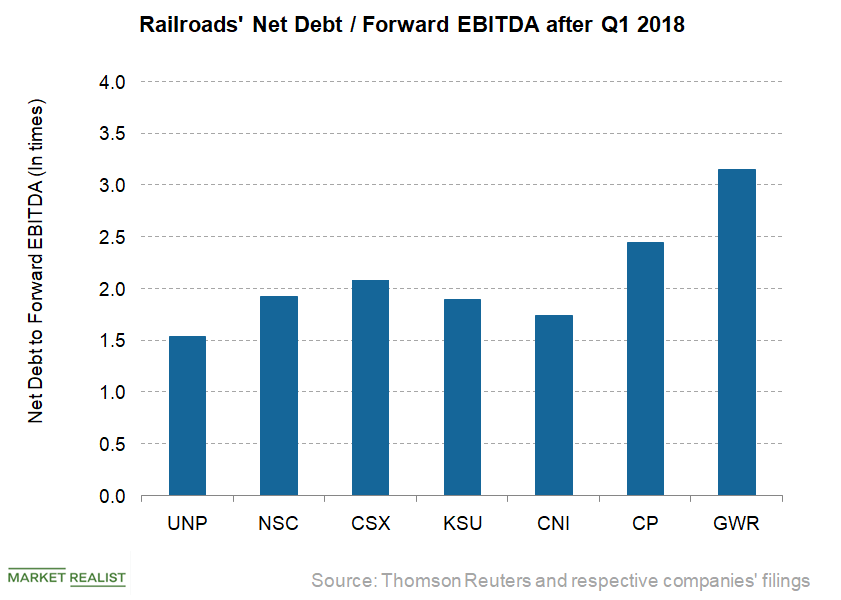

Evaluating Leverage Levels of Major Railroads after Q1 2018

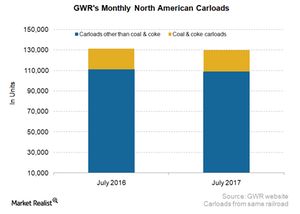

As of March 31, Genesee & Wyoming (GWR) had a net debt-to-forward-EBITDA multiple of 3.2x, which was much higher than the industry average of 2.1x.

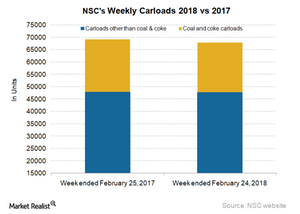

Comparing Norfolk Southern’s Freight Volumes to the Industry

For Week 8, which ended February 24, 2018, Norfolk Southern (NSC) had a 1.8% loss of carload traffic.

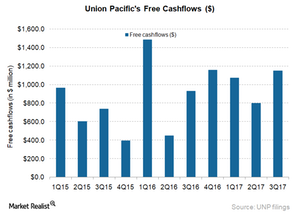

Can Union Pacific’s Free Cash Flows Support Its Higher Dividend?

Union Pacific had FCF of $3.02 billion in the first nine months of 2017, compared with $2.86 billion in the corresponding period of 2016.

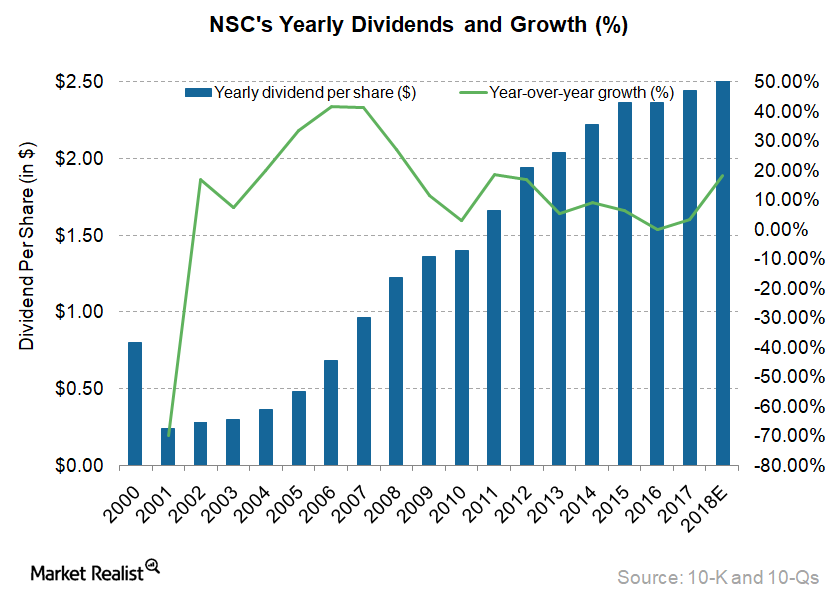

Could Norfolk Southern Increase Its Dividend in 2018?

On a long-term basis, NSC aims for a dividend payout ratio of 33.3%.

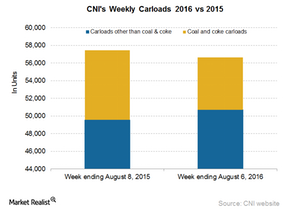

How Did Canadian National Measure up to Canadian Pacific in Carloads?

Canadian National recorded a 1.4% fall in total railcars in the week ended August 6, 2016, hauling ~57,000 railcars, compared to ~57,000 units one year ago.

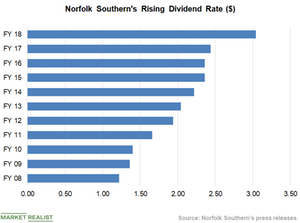

Norfolk Southern’s Aggressive Shareholder Return Plan

Norfolk Southern (NSC) has always tried to enhance shareholders’ wealth through dividend payments and share repurchases.

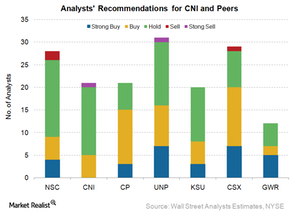

Why Analysts Have a ‘Hold’ Rating for Canadian National Railway

There are 21 analysts covering CNI. Of those, only five, or 24.0%, have a “buy” rating for the stock.

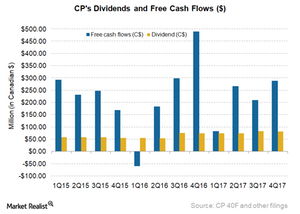

Is Canadian Pacific’s Free Cash Flow Enough for Dividend Growth?

Now let’s examine the free cash flow levels of Canadian Pacfic and compare it to its arch-rival Canadian National Railway (CNI).

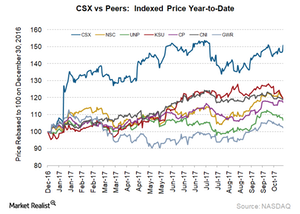

CSX’s 3Q17 Earnings Shine: Higher Freight Rates, Stock Up 2.6%

The eastern US rail freight carrier CSX (CSX) announced its 3Q17 earnings on October 17. The quarter marks the end of two full quarters under the leadership of Hunter Harrison.

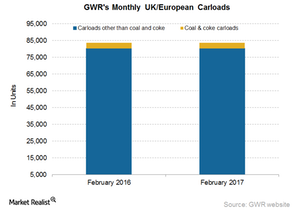

Analyzing GWR’s European Carloads in February 2017

Genesee & Wyoming’s (GWR) European carloads remained unchanged YoY (year-over-year) in February 2017.

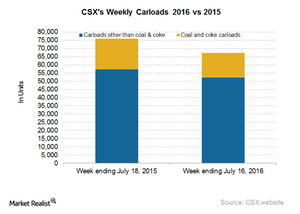

Why Did CSX’s Carloads Slump in the Week Ending July 16?

CSX (CSX) is a major operator in the Eastern US that competes with Norfolk Southern (NSC).

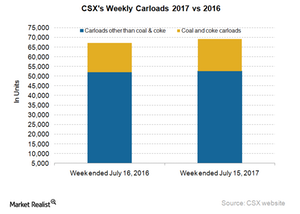

Inside Norfolk Southern’s Freight in Week 28

CSX’s (CSX) overall railcar traffic rose 3.1% in the 28th week of 2017 (ended July 15).

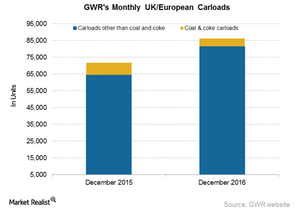

Why Did GWR’s European Carloads Rise in December?

GWR’s European carloads rose 20.3% YoY in December 2016. In the same period of 2015, GWR hauled ~72,000 railcars, as compared to ~86,000 in December 2016.

UNP Rises 1.5% on Pricing Gains, Higher Volumes in Q3 2018

Union Pacific (UNP) announced its third-quarter earnings results before the market opened on October 25.

BNSF: A Jewel in Berkshire Hathaway’s Crown

Burlington Northern Santa Fe (or BNSF) owns and operates the largest rail network in North America through its wholly owned subsidiary, BNSF Railway Company.

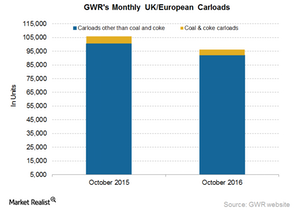

Why Genesee and Wyoming’s European Carloads Slumped in October

The decrease in the UK and European carloads in October was primarily due to the fall in coal and coke, mineral and stone, and intermodal carloads.

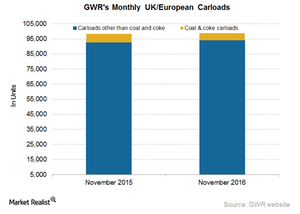

Why Genesee & Wyoming’s European Carloads Rose in November

Genesee & Wyoming’s (GWR) European carloads rose marginally 0.60% in November 2016. In the same period last year, GWR hauled 99,000 railcars.

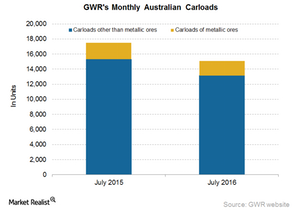

Why Did Genesee & Wyoming’s Australian Carloads Fall in July?

Genesee & Wyoming’s Australian carloads declined by 13.7% in July 2016, hauling more than 15,000 railcars, as compared to over 17,000 one year previously.

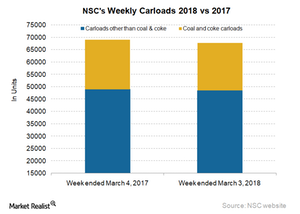

How Norfolk Southern’s Shipments Trended in Week 9

In the week ended March 3, 2018, Norfolk Southern saw a ~2% fall in carload traffic. It hauled ~67,700 carloads in the week.

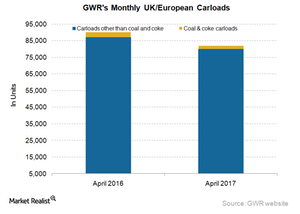

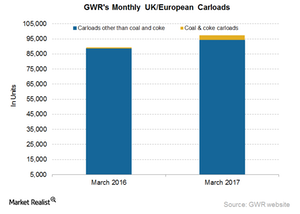

Reviewing GWR’s European Carloads in April 2017

Genesee & Wyoming’s (GWR) European carloads fell 9.1% YoY (year-over-year) in April 2017. GWR’s other-than-coal carloads fell 8.2% on a YoY basis in April 2017.

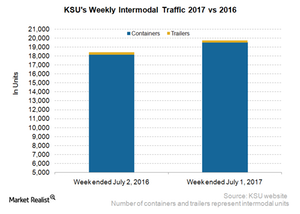

Behind Kansas City Southern’s Intermodal Growth amid Weak Trailers

Kansas City Southern (KSU) reported a 7.2% rise in its overall intermodal volumes of containers and trailers in the week ended July 1, 2017.

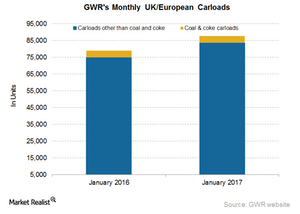

Inside GWR’s European Carload Rise in January

Genesee & Wyoming’s (GWR) European carloads rose 11.2% YoY in January 2017.

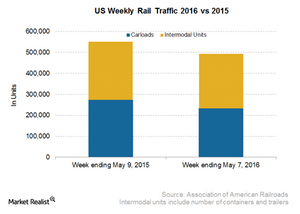

US and Canadian Rail Traffic Fell

In the week ended May 7, 2016, total US railcars went down by ~233,000, a double-digit fall of 15%.

BNSF: The Largest US Class I Railroad

Burlington Northern Santa Fe (or BNSF) owns and operates the largest rail network in North America. The company manages ~32,500 route miles of track.

Kansas City Southern Outshines Its Peers in Q2

Kansas City Southern (KSU) stock opened nearly 3% higher on Friday after reporting better-than-expected second-quarter results.

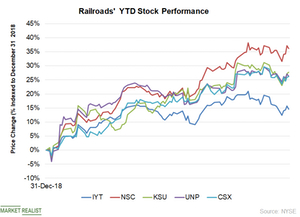

Railroad Stocks Have Outperformed in 2019

So far, railroad stocks have made a remarkable run in 2019. Most of the railroad stocks have outperformed the broader market returns.

Norfolk Southern: Investors’ Industry Favorite in 2019

Norfolk Southern (NSC) has been investors’ industry favorite since the beginning of 2019. The stock has risen 21.3% YTD.

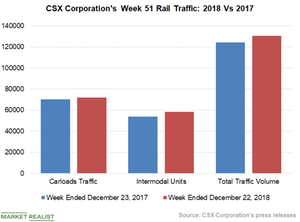

Strong Intermodal Growth Drove CSX’s Rail Traffic Higher

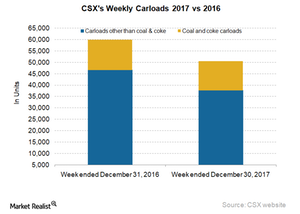

CSX reported strong rail traffic volume growth in week 51. The company’s freight rail traffic increased 5.1% YoY to 130,542 units in week 51.

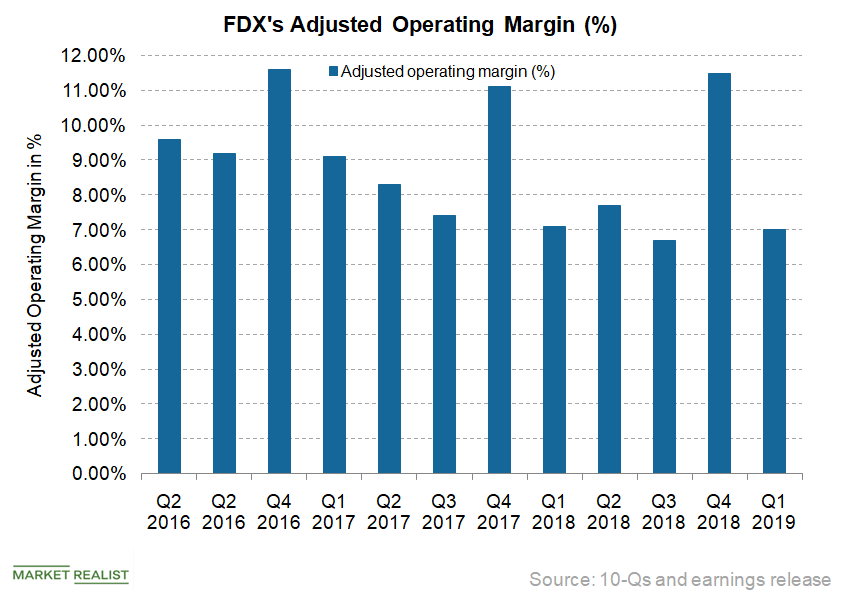

Did FedEx Deliver on Operating Margins in the First Quarter?

FedEx’s adjusted operating margin contracted by ten basis points to 7% in Q1 2019 from 7.1% in the first quarter of 2018.

How Union Pacific’s Dividend Has Varied Historically

On May 10, Western US rail freight giant Union Pacific (UNP) declared a quarterly cash dividend of $0.73 per share on its common stock.

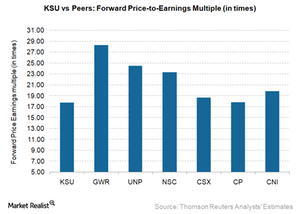

How Kansas City Southern Is Valued among Peers after 4Q17

KSU has the lowest PE ratio of 17.7x in the peer group, most likely due to the uncertainty of the NAFTA renegotiations.

Commodities that Pulled Down CSX’s Carload Traffic in Week 52

Rail giant CSX (CSX) reported double-digit carload traffic loss in the 52nd week of 2017. The company’s carload traffic slumped 15.7% that week.

CSX Corporation Has a Wide Economic Moat

To demonstrate the power of efficient scale in creating economic moats, we highlight four companies: U.S.-based wide moats CSX Corporation and UPS, and international narrow moats Telefonica SA (Spain) and CapitaLand Commercial (Singapore).

How Genesee and Wyoming’s Volumes Trended in July 2017

In July 2017, Genesee and Wyoming recorded a slight decline in its North American traffic YoY (year-over-year).

Comparing Norfolk Southern’s Intermodal Traffic with CSX’s

Norfolk Southern’s intermodal traffic Norfolk Southern’s (NSC) total intermodal traffic rose 6.5% in the week ended April 29, 2017. Its volumes reached ~78,000 containers. Norfolk’s container traffic rose 5.6%, and its trailer traffic rose 15.6% YoY (year-over-year) to nearly 6,900 units, compared with 5,900 units in the week ended April 30, 2016. Since the beginning of […]

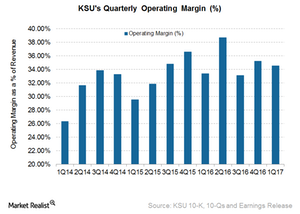

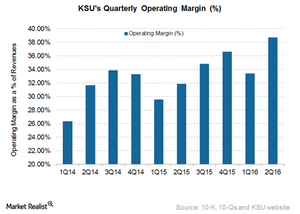

Kansas City Southern’s Operating Margin Rose in 1Q17

Kansas City Southern (KSU) reported a 120-basis-point rise in its 1Q17 operating margin. KSU recorded 34.6% operating margin in 1Q17, compared to a 33.4% in 1Q16.

Analyzing Genesee & Wyoming’s European Carloads in March 2017

Genesee & Wyoming’s (GWR) European carloads rose to 9.0% YoY (year-over-year) in March 2017.

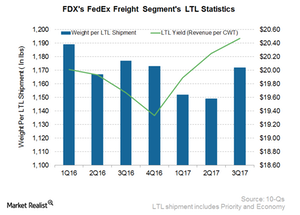

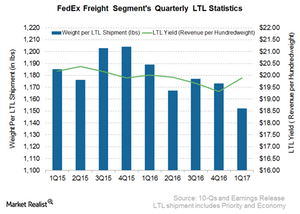

Better LTL Pricing Drove FedEx’s 3Q17 Freight Revenue

The FedEx Freight segment revenues rose 3.1% from $1.4 billion in 3Q16 to $1.5 billion in fiscal 3Q17.

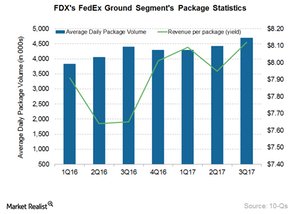

Better SmartPost and Ground Yield Pushed Up FedEx Ground’s Revenue

The FedEx Ground segment’s revenues rose 6% from $4.4 billion in 3Q16 to $4.7 billion in fiscal 3Q17.

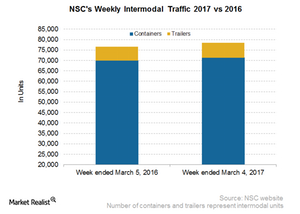

How Norfolk Southern’s Intermodal Volumes Compare to Peers

Norfolk Southern’s (NSC) total intermodal traffic rose 2.7% in the week ended March 4, 2017.

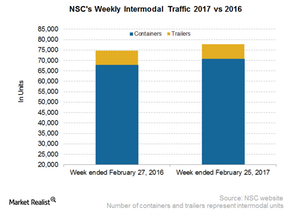

Behind Norfolk Southern’s Intermodal Volumes in the 8th Week

NSC’s total intermodal traffic rose 4.3% in the week ended February 25, 2017, reaching ~78,000 containers and trailers.

Analyzing Morningstar’s Economic Moat Rating

Morningstar first began rating companies in 2002 according to the strength and longevity of their competitive advantages.

Why FedEx Sees Volume Growth in the Future of Its Freight Segment

FedEx’s (FDX) Freight segment revenues rose 4% from $1.6 billion in fiscal 1Q16 to ~$1.7 billion in fiscal 1Q17.

How TNT Acquisition Is Driving FedEx’s European Growth

On May 25, 2016, FedEx (FDX) completed the 4.4 billion euro acquisition of the Netherlands-based TNT Express NV.

Why Kansas City Southern’s Operating Margin Rose in 2Q16

Kansas City Southern (KSU) reported a 3% decline in 2Q16 revenues to $568.5 million on a YoY (year-over-year) basis.

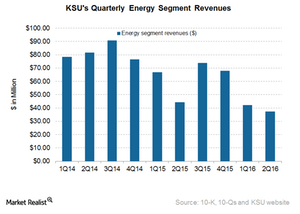

Kansas City Southern’s Energy Segment Lost Its Sheen in 2Q16

Kansas City Southern’s Energy segment Previously, we discussed the revenue of Kansas City Southern’s (KSU) Agriculture & Minerals segment in 2Q16. Now, we’ll examine KSU’s Energy freight revenues in 2Q16. In the reported quarter, KSU’s Energy freight revenues came in at $37.2 million, down by 16% from $44.2 million in the same period last year. […]

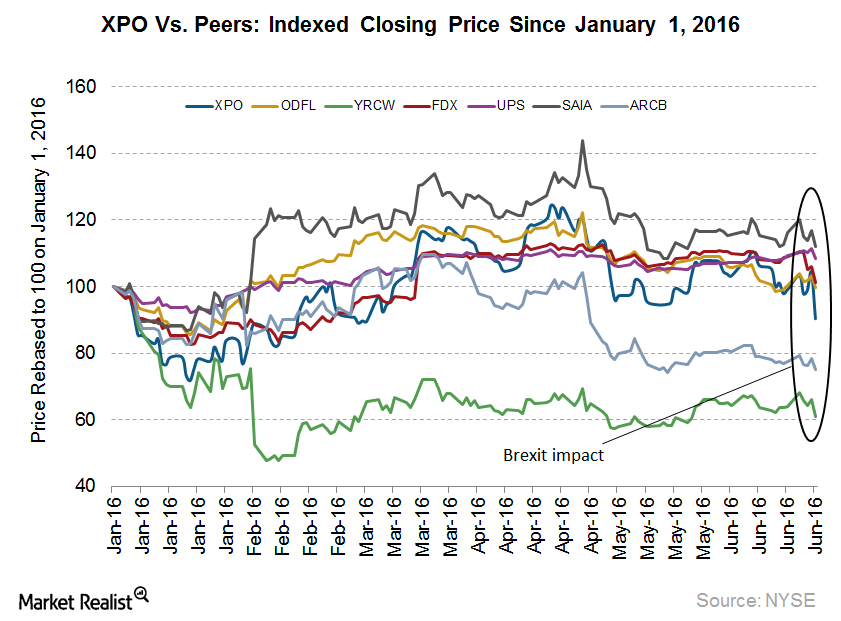

Will Brexit Continue to Impact XPO Logistics?

Following the United Kingdom’s decision to exit the European Union, XPO Logistic’s (XPO) stock fell 13.4% on June 24.

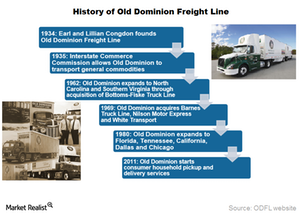

How Did Old Dominion Evolve as a Major US Trucking Company?

Old Dominion offers access, through agents or strategic alliances, to services in international locations including Canada, Mexico, Europe, and China.